- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

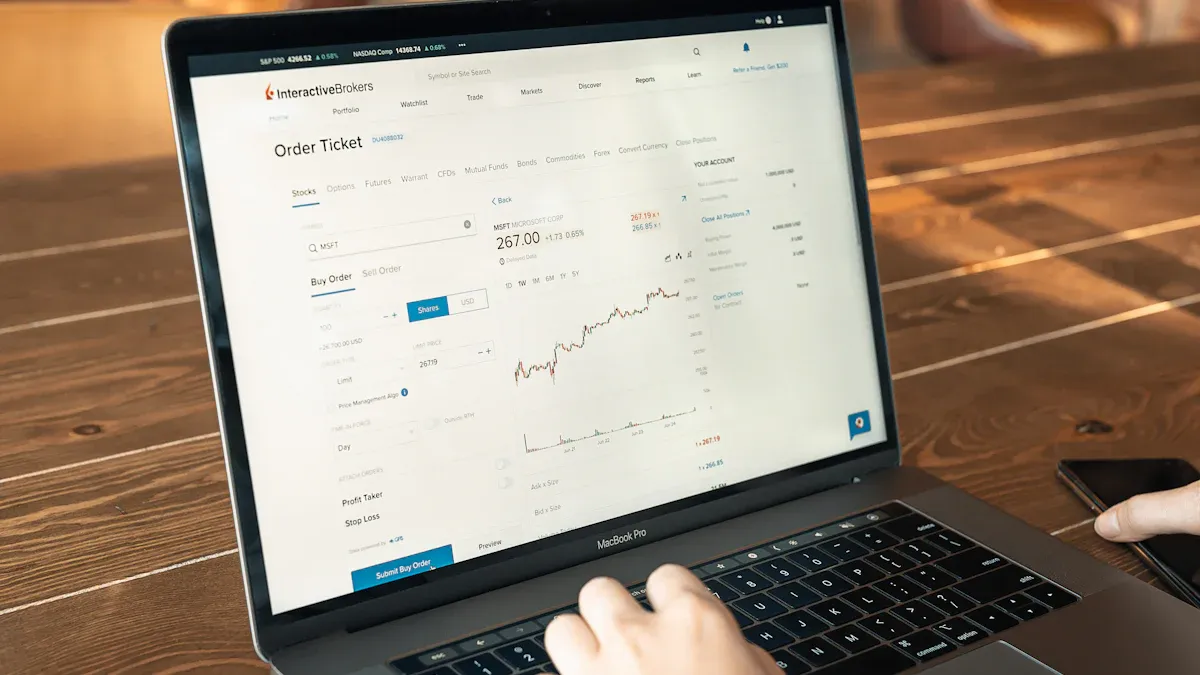

US Stock Brokerage Fee Comparison: Tiger Brokers vs. Interactive Brokers, Which Is More Suitable for Chinese Investors

Image Source: pexels

If you are interested in US stock investments, Tiger Brokers and Interactive Brokers are often top choices. Interactive Brokers offers lower US stock trading fees, making it suitable for investors with large capital and diverse product needs. Tiger Brokers has a user-friendly interface and fast account opening, ideal for beginners and small to medium-sized investors. Data shows that Tiger Brokers leads in market share among Chinese investors and has rapid user growth. How should you choose? Which is more cost-effective? The main text will provide detailed answers.

Key Points

- Interactive Brokers offers lower fees, suitable for large-capital and high-frequency traders, helping you save more costs.

- Tiger Brokers has a simple account opening process and a user-friendly interface, ideal for beginners and small to medium-sized investors, with Chinese-language services.

- Interactive Brokers has strict regulation and robust fund security, suitable for users prioritizing compliance and safety.

- Tiger Brokers supports multi-market trading and investor communities, ideal for those seeking diversified investments and learning exchanges.

- When choosing a brokerage, consider your capital size, trading frequency, and service needs to make a rational decision and find the most suitable platform.

Fees

Image Source: unsplash

US Stock Trading Fee Structure

When choosing a US stock brokerage, your primary concern is likely the trading fees. The fee structure directly impacts your investment costs. The US stock trading fees for Tiger Brokers and Interactive Brokers include the following components:

- Tiger Brokers’ US stock trading commission is $0.01 per share, with a minimum fee of $2.99 per trade.

- Interactive Brokers’ US stock trading commission is $0.005 per share, with a minimum fee of $1 per trade.

- Tiger Brokers’ commission is slightly higher than Interactive Brokers’ because Tiger Brokers’ accounts are executed and cleared through Interactive Brokers.

- Tiger Brokers supports margin trading, with annualized margin rates ranging from 3.66% to 4.91%.

- Short-selling fees are based on floating rates, varying depending on stock risk and liquidity.

You can see that both brokers have clear US stock trading fee structures, but Interactive Brokers has an advantage in commissions and minimum fees.

Commissions and Platform Fees

When trading, in addition to basic commissions, you should also consider platform fees and other hidden costs. The fee standards for Tiger Brokers and Interactive Brokers are as follows:

- Tiger Brokers: Charges $0.01 per share commission, with a minimum of $2.99 per trade. Additionally, a $0.003 per share exchange fee is charged. In some cases, the platform may also charge small account management or data service fees.

- Interactive Brokers: Uses a fixed commission model, $0.005 per share, with a minimum of $1 per trade. Interactive Brokers also offers a tiered commission plan, where the per-share rate decreases with higher trading volume. Exchange fees are 0.000207% of the trade value. Interactive Brokers waives platform monthly fees for most accounts, with data service fees optional based on needs.

Tip: If you trade frequently or have large trade amounts, Interactive Brokers’ US stock trading fee advantage becomes more apparent.

Fee Comparison

You may wonder how much the actual cost difference is between the two brokers for different trade amounts. The table below compares the US stock trading fees for Tiger Brokers and Interactive Brokers at $1,000, $10,000, and $100,000 trade amounts (assuming a per-share price of $10, ignoring exchange rate fluctuations for simplicity):

| Trade Amount | Shares Traded | Tiger Brokers Commission | Tiger Brokers Exchange Fee | Tiger Brokers Total Fee | Interactive Brokers Commission | Interactive Brokers Exchange Fee | Interactive Brokers Total Fee |

|---|---|---|---|---|---|---|---|

| $1,000 | 100 | $2.99 (minimum) | $0.30 | $3.29 | $1.00 (minimum) | $0.21 | $1.21 |

| $10,000 | 1,000 | $10.00 | $3.00 | $13.00 | $5.00 | $2.07 | $7.07 |

| $100,000 | 10,000 | $100.00 | $30.00 | $130.00 | $50.00 | $20.70 | $70.70 |

You can see that as trade amounts increase, Interactive Brokers’ US stock trading fee advantage becomes more significant. For investors with larger capital, Interactive Brokers can save more costs. While Tiger Brokers has a lower threshold for small trades, its total fees are higher than Interactive Brokers’ in the long run.

Summary: If you prioritize US stock trading fees, especially for large or frequent trades, Interactive Brokers is more suitable. If you value ease of use and Chinese-language services, Tiger Brokers can meet your needs.

Account Opening and Funding

Account Opening Process

When choosing a brokerage for account opening, the process’s convenience and required materials directly affect your experience. Tiger Brokers and Interactive Brokers have distinct account opening steps:

- If you choose Interactive Brokers, you need to visit its official website, register an account, and provide personal information, including identity proof, contact details, and financial status. You then upload relevant documents and submit for review. Once approved, you can fund your account and start trading.

- Tiger Brokers’ account opening is more suited for mobile operations. You can register with a phone number via a dedicated link or invitation code, download the Tiger Brokers app, log in with your phone, and follow the instructions to prepare an ID, Hong Kong bank card, or overseas card for identity verification and document submission. Once approved, you can fund your account.

Typically, Tiger Brokers’ review takes 1-3 business days, while Interactive Brokers’ review is often conducted on Fridays, Eastern Time. You need to prepare an ID and signature, and in some cases, confirm your identity via email.

Deposit Methods

When depositing funds into Tiger Brokers or Interactive Brokers, you primarily use bank wire transfers. Both brokers require you to use a bank account in your name, supporting USD and HKD transfers. You can use Hong Kong banks such as China Merchants Bank Hong Kong One Card, Bank of China (Hong Kong), or CITIC Bank for wire transfers. Obtain dedicated transfer details from the brokerage platform. Note that RMB cannot be directly transferred cross-border; you must use foreign currency spot exchange. Both brokers’ deposit channels are essentially the same, with funds ultimately transferred to Interactive Brokers accounts.

Tip: When transferring, use “IB” or a more personal-like name for the recipient to ensure smooth processing.

Withdrawal Fees

When withdrawing funds, the fee differences are noticeable. Tiger Brokers charges about $1.3 (10 HKD) per withdrawal, and banks may charge around $38 (300 HKD) in handling fees. Interactive Brokers offers one free withdrawal per month, with fees applied for subsequent withdrawals. If you withdraw frequently, Interactive Brokers can save significant costs. User feedback suggests Tiger Brokers’ withdrawal fees and transparency are less favorable than Interactive Brokers’.

Summary: If you value convenient account opening and Chinese guidance, Tiger Brokers is more user-friendly. If you prioritize low deposit and withdrawal costs, Interactive Brokers’ free withdrawal advantage is more significant.

Security and Regulation

Image Source: pexels

Regulatory Bodies

When choosing a US stock brokerage, the authority of regulatory bodies directly impacts your fund security. Interactive Brokers, headquartered in the US, is regulated by multiple authoritative bodies, including the SEC, FINRA, and NYSE. It is also supervised by foreign regulators like the UK’s FCA. You can rest assured that Interactive Brokers’ compliance and transparency are industry-leading.

Tiger Brokers is registered in New Zealand with offices in Hong Kong but lacks a formal license from Hong Kong’s SFC. China’s Securities Regulatory Commission has stated that cross-border client solicitation by internet brokers like Tiger Brokers is illegal, leading to a crackdown in 2023. Tiger Brokers has acquired financial licenses in the US and Australia, but specific regulators are not detailed. You should note that Tiger Brokers has stopped offering new account openings for Chinese investors, with its app removed from stores, only providing limited customer service for existing clients.

If you prioritize regulatory compliance and transparency, Interactive Brokers’ regulatory framework is more robust, with no major compliance risks historically.

Fund Security

Your primary concern about fund security is addressed by both brokers with multiple safeguards:

- Tiger Brokers stores client funds in segregated accounts at Citibank in the US, preventing the brokerage from misusing assets. Withdrawals are restricted to your same-name account, complying with SEC regulations. Your account also enjoys high commercial insurance coverage, up to $30 million per account (including $900,000 for cash). This insurance applies only in case of brokerage bankruptcy, not investment losses.

- Early on, Tiger Brokers partnered with Interactive Brokers, using its fully disclosed accounts, with Interactive Brokers handling trade clearing, fund and asset custody, and deposits/withdrawals. Tiger Brokers holds SEC, FINRA, and SIPC regulatory and protection qualifications.

- Interactive Brokers, a well-established US brokerage, offers SIPC (up to $250,000) and FDIC (up to $2.5 million) dual insurance, totaling up to $2.75 million. It has over $12.2 billion in capital strength, with client assets valued daily at market prices. Cash balances exceeding insurance limits are protected by SEC Rule 15c3-3.

You can see that Interactive Brokers offers a more comprehensive insurance and regulatory system for fund security. It has no history of fund security issues. Tiger Brokers faced penalties from New Zealand regulators for inadequate anti-money laundering measures and client fund management issues. If you seek maximum fund security and compliance, Interactive Brokers is more trustworthy.

Platform Experience

User Interface

When using a brokerage platform, the user interface’s friendliness directly affects your investment experience.

- Tiger Brokers’ interface prioritizes user experience, with a clear process ideal for beginners to quickly get started. You can easily find common functions, with a simple and intuitive layout.

- Interactive Brokers’ interface is feature-rich but relatively complex. If you’re a first-time user, you may need time to adapt. Interactive Brokers is better suited for experienced investors with high-net-worth or complex trading needs.

- Tiger Brokers continuously optimizes user experience, lowering the barrier for complex operations. If you value convenience and efficiency, Tiger Brokers will feel more effortless.

Tip: If you prefer customizable features and professional tools, Interactive Brokers’ robust platform offers more options.

Investment Products

When choosing a brokerage, the variety of investment products is crucial. Founded in 1977, Interactive Brokers covers over 150 market centers globally, managing $541.5 billion in client net assets. You can trade over 10,000 US stocks, ETFs, options, and bonds, with 24/7 overnight trading covering major Asian and European market hours. Interactive Brokers supports stocks, options, futures, and more, meeting your diverse global investment needs. In contrast, Tiger Brokers’ product coverage is more limited, focusing primarily on US stocks and some Hong Kong stocks.

Customer Service

When you encounter issues, the brokerage’s customer service response speed and professionalism are critical. Tiger Brokers offers Chinese-language support, with common issues resolved quickly via in-app customer service. You can also get prompt responses via phone or email. Interactive Brokers provides multilingual support, primarily in English. If you prefer Chinese communication, Tiger Brokers offers a more tailored experience. Interactive Brokers is better suited for English-fluent investors with international service needs.

Suitable Investors

Who Tiger Brokers Is Suitable For

If you want quick access to overseas markets like US and Hong Kong stocks, Tiger Brokers is a friendly choice. Its account opening process is simple, supports mobile operations, and has fast reviews. You can easily deposit funds using a Hong Kong or overseas bank card, making it suitable for those new to cross-border investing.

Tiger Brokers is ideal for the following Chinese investors:

- You have overseas asset allocation needs, focusing on US and Hong Kong stock markets.

- You want to save on trading costs, with low commission rates, such as Hong Kong stock commission rate of 0.029% + $15 platform fee, lower than traditional brokers’ 0.1%-0.2%.

- You care about margin rates, with Tiger Brokers’ USD margin rates at 3.25%-4.07% and HKD at 4.0%-5.0%, offering some cost advantages.

- You want to participate in IPO subscriptions for high-quality Chinese concept stocks. Tiger Brokers has covered popular IPOs like Pinduoduo, Bilibili, and Kingsoft Cloud, meeting your IPO needs.

- You want to trade US stocks, Hong Kong stocks, A-shares (via Shanghai-Hong Kong Stock Connect/Shenzhen-Hong Kong Stock Connect), Singapore stocks, Australian stocks, futures, and funds through one platform for diversified asset allocation.

- You value investor communities and educational resources. Tiger Brokers offers an investor community and Tiger Academy to help you get started and interact with other investors.

- Your capital size is below $10,000, or you trade infrequently, prioritizing convenient account opening and Chinese-language service experience.

Tiger Brokers enhances service quality and profitability through self-clearing capabilities and diversified revenue streams. If you value ease of use, Chinese-language services, and community interaction, Tiger Brokers is easier to get started with.

Who Interactive Brokers Is Suitable For

If you seek global investment opportunities and optimal trading cost control, Interactive Brokers is more suitable. It supports trading in 33 countries and 135 markets, covering stocks, bonds, futures, forex, and more. You can fund and settle in 23 currencies, including USD and HKD, facilitating global asset allocation.

Interactive Brokers is ideal for the following Chinese investors:

- You have global asset allocation needs, targeting US, Hong Kong, European, and Asian markets.

- Your capital is large (e.g., $10,000 or more), or you trade frequently, valuing low commissions and tiered fee structures. Interactive Brokers’ commissions are as low as $0.005 per share, with a $1 minimum per trade, significantly reducing costs for long-term trading.

- You need multi-currency operations, with Interactive Brokers’ currency exchange rates close to interbank levels with minimal spreads, ideal for large forex transactions.

- You have investment experience and prefer a powerful professional trading platform (e.g., TWS) supporting complex orders and algorithmic trading.

- You prioritize fund security and regulatory compliance. Interactive Brokers offers up to $30 million in account insurance, with a robust regulatory system and no major compliance risks historically.

- You want to invest in multiple markets and asset types through one account, with diverse account types for individuals, joint accounts, and institutional investors.

- You can adapt to the account opening process and English interface, accepting a higher minimum deposit of $10,000 and a more complex account opening process.

| Advantages | Details |

|---|---|

| Diverse Trading Products | Covers 24 countries and over 100 market centers, supporting multi-currency trading (stocks, futures, bonds, forex, ETFs, etc.) |

| Advanced Trading Platform | Offers the most advanced algorithmic trading platform in the US, providing fully electronic, high-speed trading services |

| High Account Insurance | Up to $30 million per securities account, with $500,000 per user account |

| Strong Profitability | Gross margin above industry average, with an 8.88% net profit margin |

| Disadvantages | Details |

|---|---|

| Complex Account Opening | Requires extensive form-filling, with a review period of about two weeks |

| High Deposit Threshold | Minimum deposit of nearly $10,000, less friendly for new investors |

| Account Maintenance Fee | Charges $10 monthly maintenance fee, against the trend of fee-free accounts |

If you have large capital, trade frequently, seek global asset allocation, and prioritize cost control, Interactive Brokers is more suitable. If you value fund security and regulatory compliance, Interactive Brokers is also a top choice.

Choosing Advice

When choosing a US stock brokerage, consider your capital size, trading frequency, investment experience, and service needs for a comprehensive decision. Common concerns for Chinese investors include trading fees, account opening convenience, Chinese-language services, trading software usability, fund security, product variety, deposit methods and costs, and the brokerage’s regulatory background and reputation.

- If your capital is small (e.g., under $10,000), you trade infrequently, and value Chinese-language services and easy account opening, prioritize Tiger Brokers. Its user-friendly interface and multi-market trading suit beginners and small to medium-sized investors.

- If your capital is large (e.g., $10,000 or more), you trade frequently, and seek low commissions and global asset allocation, choose Interactive Brokers. Its lower fees and diverse products suit experienced investors with professional needs.

- If you want to participate in US and Hong Kong IPOs or value investor communities and educational resources, Tiger Brokers has an edge.

- If you prioritize fund security, regulatory compliance, and high account insurance, Interactive Brokers is more trustworthy.

You can first review commission rates and service levels of various brokers, assessing potential savings based on your trading frequency and capital size. You can also consider commission differences for different products, choosing lower-cost options. Regularly evaluate your user experience and adjust your brokerage choice if needed to ensure investment safety and cost optimization.

When choosing a brokerage, there is no absolute best or worst—only the one most suitable for you. Make a rational decision based on your needs for a better investment experience and returns in global markets.

When selecting a brokerage, you need to weigh multiple factors. Tiger Brokers focuses on user experience, with convenient account opening, active communities, and rich educational content, suitable for beginners and small to medium-sized investors. Interactive Brokers offers strong compliance, robust fund security, and diverse products, ideal for large capital and diversified needs.

In practice, common issues include compliance risks, restricted fund flows, and inadequate legal protections. The table below summarizes the key features of both brokers:

| Aspect | Tiger Brokers | Interactive Brokers |

|---|---|---|

| Compliance | Applying for Hong Kong license, compliance risks to note | Regulated by SEC, FINRA, and others, high security |

| Fund Flow | Deposits and withdrawals may use different banks, some risks | Efficient deposits and withdrawals via East West Bank, low fees |

| User Experience | Excellent Chinese services, active community, beginner-friendly | Powerful platform, global market coverage, suits professional investors |

You can choose the brokerage that best fits your capital size, trading frequency, and investment habits. There’s no absolute good or bad—only the most suitable choice for you.

FAQ

What documents are needed to open an account with Tiger Brokers or Interactive Brokers?

You need to prepare an ID and a Hong Kong or overseas bank card. Interactive Brokers also requires proof of address. Ensure all documents are valid during account opening.

How long do deposits and withdrawals take?

Deposits via Hong Kong bank wire transfers typically take 1-2 business days to arrive. Withdrawals to Hong Kong bank accounts take as little as 1 business day, though some cases may take 3-5 business days.

Is there a minimum deposit requirement for US stock trading?

Interactive Brokers requires a minimum deposit of $10,000. Tiger Brokers has no strict minimum deposit requirement, allowing you to operate based on your financial situation.

Which currencies do the brokers support for deposits?

You can deposit in USD or HKD. Using a Hong Kong bank account for wire transfers is recommended to reduce costs and time.

What taxes apply when investing in US stocks?

You need to pay a US dividend tax, typically 10%. Both Tiger Brokers and Interactive Brokers automatically withhold this tax. You don’t need to file it yourself but should monitor tax policy changes.

This article provides a detailed comparison of Tiger Brokers and Interactive Brokers, with an in-depth analysis from various perspectives, including fees, account opening processes, fund security, and platform experience. Tiger Brokers has become a popular choice for beginners and retail investors due to its user-friendly interface, Chinese-language services, and convenient account opening process. Interactive Brokers, on the other hand, has won over professional investors with its extremely low transaction costs, powerful features, and global asset allocation capabilities.

However, no matter which broker you choose, the secure and efficient flow of funds remains a core challenge for successful U.S. stock investing. The high fees, cumbersome procedures, and long transfer times of traditional bank wire transfers can become a major obstacle to seizing fleeting investment opportunities in the U.S. stock market.

Now, you can choose a simpler and more efficient financial channel. BiyaPay is designed for global investors, offering a one-stop, seamless cross-border financial service. We support the convenient exchange between various fiat and digital currencies and provide a real-time exchange rate query, allowing you to catch the best conversion times. Our service, with remittance fees as low as 0.5% and same-day delivery, significantly reduces your transaction costs and time. What’s more, we enable you to invest in both the U.S. and Hong Kong stock markets from a single platform, all without the need for a complex overseas bank account. Say goodbye to complexity and embrace efficiency. Register with BiyaPay today to easily begin your global investment journey.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.