- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Futu vs. Interactive Brokers for U.S. Stock Trading? Answers to Common Questions for Chinese Users

Image Source: pexels

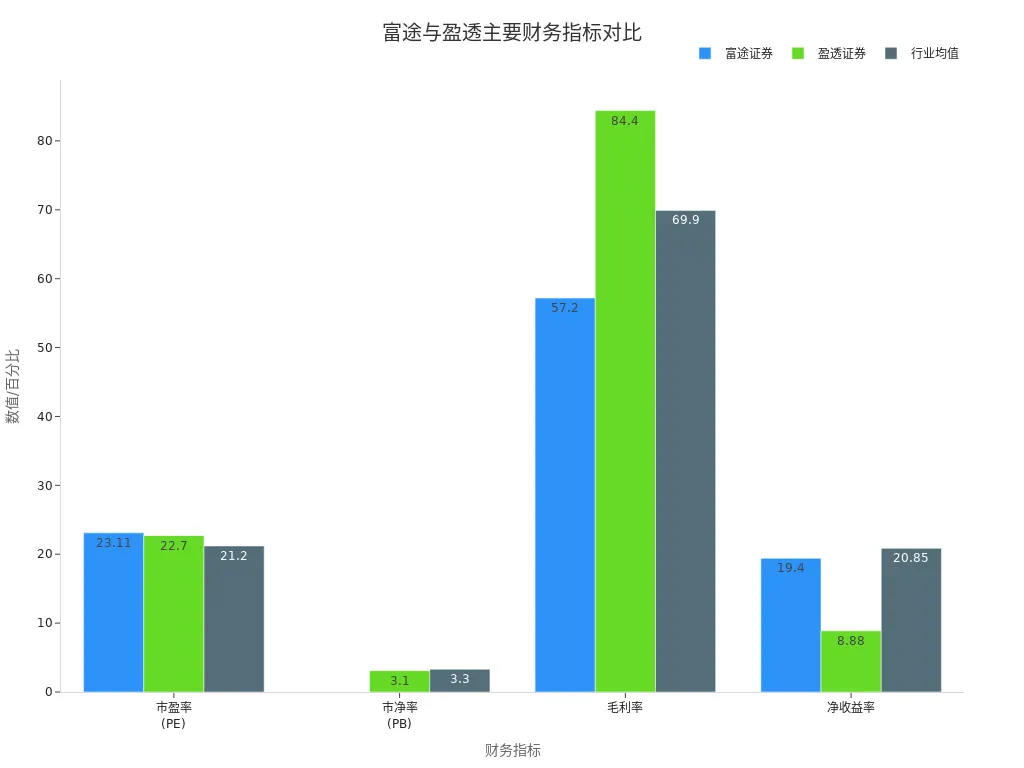

Investors often hesitate between Futu Securities and Interactive Brokers when choosing a U.S. stock broker. Futu Securities is suitable for users seeking simple operations and multi-market trading, with a user-friendly interface and rich educational resources. Interactive Brokers attracts professional investors with low transaction fees and a wide range of investment options. The table below shows the key financial metric differences:

| Metric | Futu Securities | Interactive Brokers | Industry Average |

|---|---|---|---|

| Price-to-Earnings (PE) | 23.11 | 22.7 | 21.2 |

| Price-to-Book (PB) | Negative (not meaningful) | 3.1 | 3.3 |

| Gross Margin | 57.2% | 84.4% | 69.9% |

| Net Profit Margin | 19.4% | 8.88% | 20.85% |

Key Points

- Futu Securities is ideal for beginners and small-to-medium investors, offering a simple interface, Chinese-language support, low account opening thresholds, and rich investment education and community support.

- Interactive Brokers suits experienced professional investors, supporting over 150 global markets, with low commissions and powerful features for diversified and high-frequency trading.

- Both brokers support online account opening, with Futu taking 1-3 business days for review and Interactive Brokers 1-2 business days; funding speed and fees vary, so choose based on fund size and frequency.

- Both Futu Securities and Interactive Brokers are strictly regulated, with Interactive Brokers offering more robust fund protection; prioritize platform compliance and fund safety.

- Futu’s moomoo app is simple to use, ideal for users seeking convenience and social interaction; Interactive Brokers’ TWS is feature-rich, suited for investors needing professional tools and global asset allocation.

Suitable Audiences

Beginners and Individual Investors

Futu Securities is more suitable for investors new to the U.S. stock market. The platform has a simple interface and clear operation process, allowing users to get started quickly. The moomoo app provides real-time market data, in-depth research reports, and rich educational content. Many Chinese users choose Futu for its Chinese-language support and 24-hour customer service, which promptly address queries. The low account opening threshold makes it ideal for individual investors with smaller funds. Futu also has an active investment community where users can exchange experiences and gain investment advice.

Futu Securities is suitable for individual investors seeking a convenient trading environment, rich information, and community support, especially small-to-medium investors and those valuing investment support services.

Advanced and Professional Users

Interactive Brokers (IBKR) is better suited for advanced users and professional investors with some investment experience. The platform supports over 150 global markets, covering stocks, options, futures, bonds, and funds. Interactive Brokers is known for low commissions and financing rates, helping investors reduce trading costs. Its highly automated trading platform, with a robust risk management system, suits users needing efficient trading and global asset allocation. Professional investors can leverage Interactive Brokers’ extensive tools to implement diversified investment strategies.

- Interactive Brokers supports trading in stocks, options, futures, bonds, and funds across over 150 global markets.

- Low commissions and financing rates help investors maximize returns.

- The highly automated trading platform is ideal for professional investors needing efficient trading.

- It features a robust risk management system and strong capital backing, ensuring client fund safety.

- It suits investors seeking global asset allocation and diversified investments.

The table below compares the two brokers on account opening thresholds, operational complexity, and feature depth:

| Aspect | Interactive Brokers | Futu Securities |

|---|---|---|

| Account Opening Threshold | Suits experienced investors, complex process | Suits beginners and Chinese investors, low threshold |

| Operational Complexity | Complex interface, higher learning curve, limited Chinese support, slower customer service | Simple, user-friendly interface, low complexity, Chinese support, 24-hour customer service |

| Feature Depth | Comprehensive, covers multiple global markets, supports stocks, options, futures, forex, ideal for professional and high-frequency traders | Rich features, some advanced functions require extra fees, funding delays, no direct RMB deposits, suits general and beginner investors |

| Fees | Trading fees as low as 0.08%, cost-effective | Low fees, especially friendly for small trades |

| User Experience | Less intuitive interface, suits experienced users | User-friendly design tailored to Chinese users, rich educational content, frequent promotions |

Through this comparison, investors can choose the U.S. stock broker best suited to their experience level and investment needs.

Futu Securities Account Opening Process

Steps and Requirements

Investors opening an account with Futu Securities can choose online account opening, in-person witnessed account opening, or third-party witnessed account opening. Online account opening is simple and suitable for most Chinese users. The main steps are as follows:

- Download the moomoo app, register, and log in.

- Enter the account opening interface, fill in personal information, and upload ID photos.

- Provide a residential address and upload valid proof of address within the last three months.

- Complete occupational, financial status, investment experience, and tax information.

- Select account type and complete phone SMS verification.

- Confirm all information and complete electronic signing.

- Link a Hong Kong bank account in the same name and initiate an online transfer to complete account opening.

In-person witnessed account opening suits users needing on-site processing. Investors must book a witnessing site and time via the app and attend as scheduled. Third-party witnessed account opening requires preparing ID copies, proof of address, application forms, and a witness’s license copy, signed by the witness.

Futu Securities’ account opening requirements are simple, mainly including ID, proof of address, and Hong Kong bank account details. The process supports Chinese guidance, lowering the entry barrier.

Review and Experience

Futu Securities’ review process is fast. After submitting materials, investors typically receive results within 1-3 business days. The online account opening process is fully self-service, with the system automatically prompting required materials and notes for each step. Once approved, investors can fund the account and start U.S. stock trading.

Many users report that Futu’s account opening experience is user-friendly, with a clear interface and detailed instructions. Even first-time U.S. stock investors can complete the process smoothly. The platform offers online customer service to address issues during account opening.

Futu Securities’ convenient account opening process and fast review speed help Chinese investors quickly enter the U.S. stock market.

Interactive Brokers Account Opening Process

Steps and Requirements

Investors opening an account with Interactive Brokers need to prepare personal information and relevant documents in advance. The account opening process includes the following steps:

- Visit the Interactive Brokers website, click “Open Account,” and select account type (e.g., individual, joint).

- Create an account, set a username and password, and verify the registered email.

- Fill in detailed personal information, including name, ID number, passport number, phone number, residential address, and company details.

- Upload identity proof, such as a Chinese ID (front and back), passport, driver’s license, or Hong Kong/Macau pass.

- Upload proof of address, such as utility bills, bank statements, household registry, property deeds, phone bills, credit card statements, or lease agreements. Identity and address proofs must be different documents.

- Read and sign relevant agreements.

- Submit a funding intent notice to receive Interactive Brokers’ designated bank account details (e.g., Hong Kong bank account).

- Await review; once approved, fund the account to start trading.

Investors are advised to use a compatible browser like Firefox for a smooth account opening process.

Review and Experience

Interactive Brokers’ review process is highly efficient. After submitting all materials, investors typically receive results within 1-2 business days. Upon approval, Interactive Brokers sends account details via email. Investors must use an overseas bank card (e.g., Hong Kong bank account) to fund the account. Once funds arrive, the account is activated, and investors can log in to the trading platform.

Interactive Brokers mails a security card to each user, requiring a security code for trading and login. If the card isn’t received promptly, contact customer service for a temporary code. For account opening or review issues, investors can consult the Shanghai or Hong Kong customer service teams for Chinese-language support.

Although Interactive Brokers’ account opening process involves more steps, the review is fast, and requirements are clear, making it suitable for experienced investors.

Funding and Withdrawals

Image Source: unsplash

Futu Securities Funding and Withdrawals

Futu Securities offers multiple funding and withdrawal methods, convenient for Chinese users. Users can complete transfers through three main methods:

- Check Transfer: Operated within the Futu app, banks typically process funds within one business day. No withdrawal fees apply.

- Broker-to-Bank Transfer: Initiated in the Futu app, supporting HKD and USD withdrawals. Users need to enable relevant services at designated Hong Kong banks. Withdrawals are fee-free, but non-initial or large withdrawals require manual approval.

- Overseas Bank Wire: Users can wire funds via banks like Bank of China (Hong Kong). After linking a bank card, funds can be withdrawn directly. Fees vary by currency, e.g., approximately $38 USD per transaction for HKD (at 1 USD = 7.8 HKD) and $45 USD for USD. Additional fees may apply for some transfers.

Futu Securities supports funding via multiple Hong Kong banks and Chinese bank cards. Users need a second-generation ID and a Chinese savings card. Funding channels include China Minsheng Bank, Bank of China, etc., with Hong Kong cards supporting transfers, FPS, and V card/SIB funding. Pay attention to processing times and fees; funds require broker settlement and approval after arrival.

Interactive Brokers Funding and Withdrawals

Interactive Brokers offers diverse funding and withdrawal channels. Users can transfer funds via Hong Kong bank accounts, wire transfers, or checks. Interactive Brokers supports multi-currency accounts, allowing operations in USD, HKD, and other major currencies. After opening an account, users must link a Hong Kong bank account or other overseas bank card in the same name. For funding, users wire funds to Interactive Brokers’ designated account, with automatic crediting upon arrival. For withdrawals, users submit requests on the platform, and funds transfer to the linked bank account.

Interactive Brokers has strict fund security requirements. Users must ensure funding and withdrawal accounts match the account holder’s name. The platform reviews large transactions to ensure security. Note bank fee standards and exchange rate fluctuations during operations.

Speed and Fees

The two brokers differ in funding and withdrawal speed and fees. Futu’s check and broker-to-bank transfers typically take 1-4 business days, while overseas bank wires take 3-5 business days. Interactive Brokers’ wire funding generally takes 1-3 business days, with faster withdrawals. Actual processing times depend on Hong Kong bank speeds.

Fee-wise, Futu’s check and broker-to-bank withdrawals are fee-free, ideal for frequent small transactions. Overseas bank wires incur higher fees, around $38 USD for HKD and $45 USD for USD. Interactive Brokers’ wire funding and withdrawals also incur bank fees, varying by bank standards. Choose funding methods based on fund size and transaction frequency to optimize costs.

Chinese users should note: Banks charge handling, email, and intermediary fees, subject to bank standards. Conduct face recognition for account opening in well-lit, stable network conditions. Some promotions require funds to remain for 30 days; early withdrawals may affect eligibility. Funds require broker settlement and approval, with actual arrival times depending on bank processing.

| Broker | Funding Methods | Withdrawal Methods | Processing Time (Business Days) | Main Fees (USD) | Convenience |

|---|---|---|---|---|---|

| Futu Securities | Check transfer, broker-to-bank, wire | Check transfer, broker-to-bank, wire | 1-5 | Check/broker-to-bank fee-free, wire $38-45/transaction | User-friendly, supports multiple banks |

| Interactive Brokers | Wire, check, Hong Kong bank transfer | Wire, Hong Kong bank transfer | 1-3 | Bank wire fees, vary by standard | Multi-currency support, globally compatible |

When choosing a broker, consider funding method convenience, processing speed, and fees. For frequent or large fund movements, prioritize platforms with lower fees and faster processing.

Trading Fees

Futu Securities Fees

Futu Securities offers a clear commission structure. U.S. stock trading commissions follow two models: fixed, at $3 per 250 shares, or tiered, with lower rates based on traded shares. Hong Kong stock commissions are 0.03% of the transaction amount, plus a HK$15 service fee. Investors can choose the model based on trading volume.

Futu Securities’ commission structure is straightforward, ideal for small-to-medium investors. The platform offers fee waivers or cashback promotions based on market activities, helping users reduce trading costs.

Interactive Brokers Fees

Interactive Brokers is known for low commissions. U.S. stock trading commissions are fixed at 0.5 cents per share or tiered at 0.35 cents per share, plus/minus exchange fees. Hong Kong stock commissions are 0.08% of the transaction amount. Interactive Brokers supports multi-market trading, allowing cost-effective global asset allocation.

- Interactive Brokers’ U.S. stock commission standard is $1 per 200 shares, with Hong Kong stock commissions at 0.08%.

- Flexible commission structures suit high-frequency and large-volume investors.

- Exchange and platform fees are transparent, allowing investors to understand total costs upfront.

Commissions and Hidden Costs

Beyond explicit commissions, investors should consider hidden trading costs. While Interactive Brokers advertises zero commissions for some U.S. ETFs and stocks, it charges 0.0035-0.005 USD per share in exchange fees. Options trading fees are lower than Futu’s but include contract and other platform fees. Collaboration with Bank of America reduces funding and withdrawal costs, ideal for frequent fund movers.

Futu Securities promotes zero commissions but may charge fees for remittances or fund transfers. Investors should also note bid-ask spreads and fund management fees as hidden costs. The overall fee structure reflects actual expenses more than commissions alone.

| Broker | U.S. Stock Commission Structure | Hong Kong Stock Commission Structure | Other Fee Notes |

|---|---|---|---|

| Futu Securities | $3/250 shares or tiered | 0.03% + HK$15 | Potential remittance, management fees |

| Interactive Brokers | 0.5 or 0.35 cents/share | 0.08% | Exchange, contract, funding fees |

Investors should consider commissions, platform fees, and hidden costs to choose the broker best suited to their trading habits.

Platform Safety

Image Source: pexels

Futu Securities Regulation

Futu Securities holds a securities license in Hong Kong, subject to strict oversight by Hong Kong financial regulators. Since its establishment, Futu has operated compliantly, primarily offering U.S. and Hong Kong stock trading services.

- Hong Kong financial regulators oversee Futu Securities’ daily operations to ensure compliance.

- The Macau Monetary Authority announced that Futu Securities is not licensed to conduct financial activities in Macau. Futu stated it has not authorized anyone to solicit clients in Macau on its behalf.

The China Securities Regulatory Commission announced that Futu Holdings conducted cross-border securities business for Chinese investors without approval, constituting illegal operations. Regulators required Futu to stop soliciting new clients and rectify existing operations. Futu committed to complying with regulatory requirements and standardizing its business.

Interactive Brokers Regulation

Interactive Brokers holds a legitimate license in the U.S., regulated by the Securities and Exchange Commission (SEC) and the Financial Industry Regulatory Authority (FINRA). Regulators enforce strict requirements on compliance, fund safety, and client rights protection. Interactive Brokers offers securities trading services globally.

- The SEC and FINRA regularly inspect Interactive Brokers’ operations to ensure compliance with laws.

- Its legitimate credentials allow investors to trade confidently on the platform.

Fund Protection

Interactive Brokers provides multiple fund protection measures. Each investor is covered by SIPC (Securities Investor Protection Corporation) insurance, with a maximum coverage of $500,000, including $250,000 for cash. Interactive Brokers also purchases additional Lloyd’s of London insurance, covering up to $30 million beyond SIPC limits, with a total cap of $150 million (excluding futures and options).

- These measures significantly enhance investor fund safety.

- Futu Securities’ public information lacks specific fund protection details; investors should focus on platform compliance and fund safety management.

When choosing a broker, prioritize regulatory credentials and fund protection mechanisms. Compliant operations and robust safeguards reduce investment risks and protect investor rights.

Service Experience

Futu Securities Chinese-Language Support

Futu Securities offers a fully Chinese interface. Users see all functions and instructions in Chinese on the moomoo app. The platform provides extensive Chinese educational content, including video courses, tutorials, and real-time news. Many investors note the active Chinese community, allowing experience sharing. Futu offers 24-hour online Chinese customer service, enabling users to resolve issues anytime. The platform’s FAQ section details account opening, trading, and funding processes in Chinese.

Interactive Brokers Chinese-Language Support

Interactive Brokers also supports Chinese services. Investors can select a Chinese interface on the website and TWS software. The platform offers Chinese manuals and help documents. Chinese phone and email support are available, with customer service teams in Hong Kong and Shanghai, operating weekdays from 9:00 to 18:00. Some users report fast response times, though wait times may occur during peak periods.

Customer Service and Support

Both brokers prioritize customer service. Futu Securities offers 24-hour online support via app chat, phone, or email, with a dedicated advisory team for investment queries. Interactive Brokers provides multi-channel support, including phone, email, and online tickets, with options tailored to issue types. The table below compares their customer service channels and hours:

| Broker | Support Channels | Service Hours | Features |

|---|---|---|---|

| Futu Securities | Online chat, phone, email | 24 hours | Active Chinese community |

| Interactive Brokers | Phone, email, tickets | Weekdays 9:00-18:00 | Multi-region support teams |

When choosing a broker, consider customer service response speed and quality. High-quality Chinese support and timely assistance enhance the investment experience.

Investment Products

Futu Securities Products

Futu Securities offers diverse trading options. Users can trade the following via the moomoo app:

- U.S. stocks: Including major companies like Apple, Amazon, Tesla.

- ETFs: Such as VTI, VOO, SPY index funds.

- ADRs: Trade overseas companies like TSMC, Foxconn, China Telecom listed in the U.S.

- OTC stocks: Support for over-the-counter market stocks.

- Options: U.S. stock options trading.

- Futures: Select mainstream futures.

- IPO subscriptions: Participate in U.S. and Hong Kong IPOs.

- Hong Kong and Chinese A-shares: Multi-market investments.

Futu does not currently support mutual funds or bonds. The moomoo app’s Chinese interface allows one-stop multi-market asset management with near-24/7 trading.

Interactive Brokers Products

Interactive Brokers offers a wide range of investment products, including stocks, ETFs, options, futures, bonds, forex, and funds, across over 150 global markets. It provides advanced charting, complex order types, and real-time market data for professional users. The platform emphasizes tool diversity for diversified asset allocation and offers rich educational resources to enhance investment skills.

Product Variety

Both brokers have unique strengths in product variety.

- Interactive Brokers covers global markets with a more comprehensive product line, ideal for users needing international asset allocation and diversified investments. Its professional tools and data support in-depth analysis.

- Futu’s moomoo focuses on user experience, with a simple interface and rich information, suitable for investors seeking convenience and comprehensive services.

Choose a platform based on your needs. Interactive Brokers is ideal for global markets and diverse assets, while Futu suits those valuing Chinese support and ease of use.

Trading Software

Futu Moomoo App

The moomoo app offers rich functional modules. Users can view market indices and gain/loss distributions on the homepage to gauge trends. The stock screener supports multi-dimensional real-time filtering for efficient stock selection. Investors can review shareholder activity data to track major shareholders’ moves. The app includes simulated trading with a points reward system to help beginners improve skills. The trading journal, like a memo, supports manual and auto-recording for trade reviews. The moomoo community acts as an investment social platform, allowing users to share insights like on social media, fostering knowledge exchange.

Futu simplifies account opening and provides detailed account analysis, lowering the entry barrier. The app balances usability and feature depth, meeting diverse investor needs. Its 16 million users reflect wide recognition among Chinese investors.

Interactive Brokers TWS

Interactive Brokers’ TWS software supports trading in stocks, options, futures, bonds, and funds across over 150 global markets. Key features include portfolio management, watchlists, account management, and real-time monitoring. TWS supports advanced order types, algorithmic trading, and automated strategies for professional investors. Its clean interface supports multi-platform syncing and cloud services. Security includes two-factor authentication and automated risk controls. The mobile app introduces options spread grids and order entry wheels for enhanced efficiency. TWS offers online courses and market analysis to boost skills. Some users note that TWS’s localization and Chinese support need improvement, with incomplete translations and weaker news features, posing challenges for users with limited English.

Operational Experience

Both platforms offer distinct operational experiences. The moomoo app is user-friendly with clear processes, ideal for users with limited internet product experience. Investors can easily handle account opening, stock selection, trading, and reviews. The community enhances user engagement with an active investment atmosphere. TWS excels in comprehensive features and professionalism, suiting active investors needing multi-market, multi-product trading. Its advanced orders and automation provide efficient trading.

Choose based on your needs and habits: moomoo for ease and community, TWS for global assets and professional tools.

Financing Rates

Futu Securities Rates

Futu Securities offers margin trading services, charging an annualized interest rate. Public data indicates Futu’s financing rate is around 6.8%, mid-to-high among U.S. stock brokers used by Chinese investors. Investors should monitor rate changes, as financing rates impact costs, especially in leveraged trading, directly affecting returns.

When applying for margin trading with Futu, rates adjust based on market rates and funding costs. Rates may fluctuate with market conditions. Review terms carefully and assess funding needs and risk tolerance before financing.

The table below compares the brokers’ financing rates:

| Broker | Financing Rate |

|---|---|

| Futu Securities | ~6.8% |

| Interactive Brokers | Not specified |

Interactive Brokers Rates

Interactive Brokers offers global margin trading services with rates varying by currency and market. While specific rates for Chinese users aren’t publicly listed, industry feedback suggests USD financing rates are typically below average. Investors can check the latest rates in the TWS software. Low rates reduce leveraged investment costs, ideal for large-fund professional investors.

Interactive Brokers advises understanding rate structures and fees before using margin services. Leveraging low-rate advantages boosts efficiency but requires caution with leverage risks.

Promotional Offers

Futu Securities Offers

Futu Securities has launched several promotions to attract Chinese investors. New users completing their first deposit may receive NVIDIA (NVDA) or Alibaba (BABA) stock rewards. Some promotions offer HK$200 cash vouchers, worth about $25 USD (at 1 USD = 7.8 HKD). These encourage new account openings and reward existing clients. Note deposit requirements and promotion validity periods. The app provides updates on the latest offers.

Futu’s promotions cover new and existing users with diverse rewards like popular U.S. stocks and cash vouchers, boosting account opening and trading enthusiasm.

Interactive Brokers Offers

Interactive Brokers currently has no specific promotions for Chinese users. The platform focuses on enhancing trading experiences and product offerings. No additional bonuses or stock rewards are reported during account opening or trading. Interactive Brokers emphasizes long-term service and low-cost advantages to attract professional investors. Check the platform’s announcements for future promotions.

| Broker | Current Main Promotions | Target Audience |

|---|---|---|

| Futu Securities | Deposit rewards with NVDA/BABA stocks, HK$200 cash vouchers | New and existing users |

| Interactive Brokers | No specific promotions | All users |

Consider your account opening needs and interest in promotions when choosing a broker.

Investors can select a U.S. stock broker based on their needs. Futu Securities suits individual users seeking easy account opening and Chinese support. Interactive Brokers is ideal for professional investors needing global asset allocation and low fees. Each platform has unique strengths. Evaluate based on your investment goals and habits for an informed choice.

FAQ

How long does it take to open an account with Futu Securities and Interactive Brokers?

Futu Securities’ review typically takes 1-3 business days. Interactive Brokers’ review generally takes 1-2 business days. Both support online material submission with high review efficiency.

Can Chinese users directly deposit RMB?

Neither broker supports direct RMB deposits. Investors must convert funds to USD via a Hong Kong bank account for transfers.

What are the minimum deposit requirements for Futu Securities and Interactive Brokers?

Futu Securities has no mandatory minimum deposit. Interactive Brokers recommends at least $2,000 USD (at 1 USD = 7.8 HKD), with some account types requiring more.

How long does it take to withdraw to a Chinese bank card?

Withdrawals to a Hong Kong bank account take 1-3 business days. Transfers to a Chinese bank card depend on bank processing, typically 3-5 business days.

Which devices do the brokers’ trading software support?

Futu’s moomoo app supports iOS, Android, and PC. Interactive Brokers’ TWS supports Windows, Mac, iOS, and Android. Choose software based on your device.

While Wise’s new policy offers a more convenient way to manage multi-currency accounts, the restriction on direct RMB deposits remains a major pain point for mainland users. Traditional cross-border remittance processes are complex, expensive, and often involve hidden exchange rate losses. A tool that simplifies your funding process and transfers your funds securely at an extremely low cost would make your cross-border journey much more convenient.

BiyaPay is committed to providing you with a more efficient and cost-effective cross-border financial solution. We support the conversion between various fiat and digital currencies, allowing you to easily manage your global assets. Our real-time exchange rate query ensures you always get the best rates for your transactions. With BiyaPay, you can enjoy remittance fees as low as 0.5%, with same-day delivery for your funds, significantly reducing waiting times. This not only solves the funding problem for your Wise account but also makes every cross-border transfer more affordable. Say goodbye to the complexities of traditional remittances and start your convenient financial journey now. Register with BiyaPay and make fund management as simple as opening your Wise account.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.