- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

A Detailed Tutorial on Opening an Account and Trading US Stocks with Robinhood Securities

Image Source: pexels

You can start trading U.S. stocks on Robinhood in a few steps: prepare your passport or ID, download the app, fill in details, upload documents, link a Hong Kong bank account, and deposit funds. The fully digital process has no minimum funding requirement. Robinhood offers zero-commission and fractional share trading, allowing you to buy popular stocks with as little as $1. With 24-hour trading and free stock rewards upon signup, it’s no surprise that over 25.8 million users choose Robinhood for its convenience.

Key Points

- Robinhood’s simple signup requires only an ID, U.S. address, and phone number, with no minimum deposit, ideal for beginners and small investors.

- Zero-commission and fractional share trading (as low as $1) lowers barriers, saving costs on popular U.S. stocks.

- 24-hour trading supports stocks, ETFs, options, and cryptocurrencies, offering flexible investment options.

- New users receive free stock rewards, with additional bonuses for inviting friends, enhancing returns.

- The user-friendly mobile app enables anytime, anywhere trading, perfect for young investors seeking convenience.

Platform Features

Zero-Commission Trading

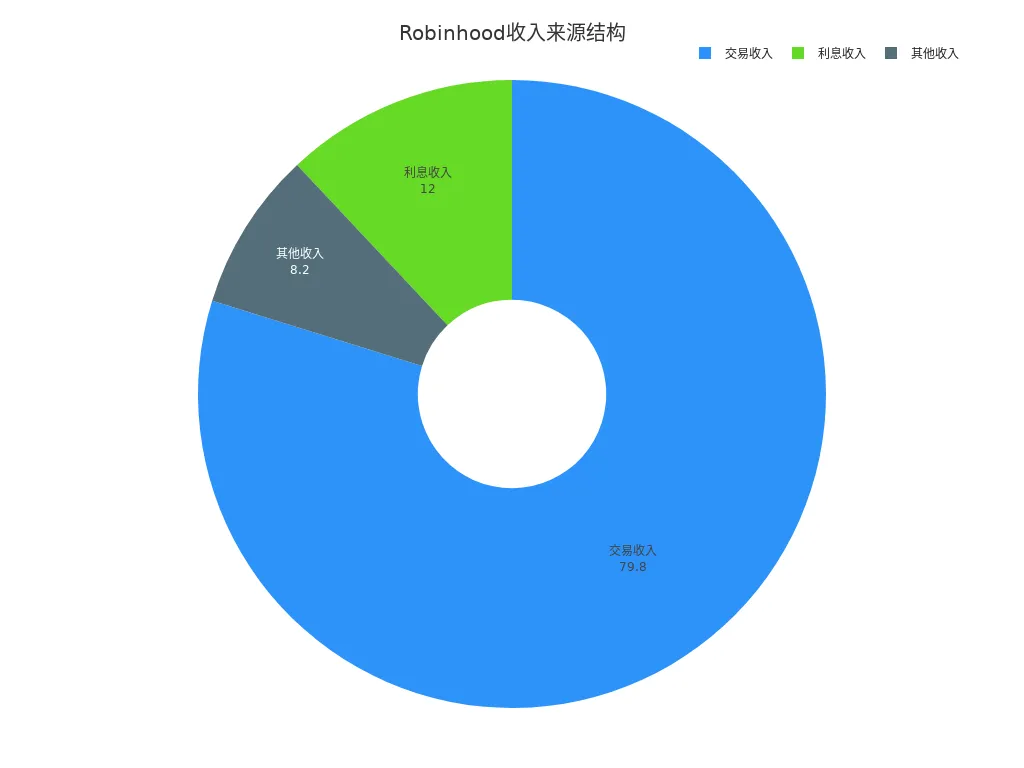

Robinhood eliminates trading commissions, leveraging payment for order flow (PFOF) by selling order data to market makers, offsetting traditional brokerage fees. Additional revenue comes from low margin rates, stock lending, and Gold subscriptions. Here’s a breakdown of Robinhood’s revenue sources (Q2 2021):

| Revenue Source | Description | Share (Q2 2021) |

|---|---|---|

| Trading Income | Order flow, options, crypto, stock trading | 79.8% |

| Interest Income | Interest from user cash balances | 12% |

| Other Income | Robinhood Gold subscriptions, etc. | 8.2% |

Your funds are secure with Robinhood, a licensed U.S. broker regulated by the SEC, allowing seamless asset transfers to other brokers.

Fractional Share Trading

Robinhood’s fractional share feature lets you buy U.S. stocks with as little as $1 (approx. ¥7.2, 1:7.2 exchange rate), down to 1/1,000,000 of a share. This enables investment in high-priced stocks like Tesla or Apple, diversifying portfolios with minimal funds.

24-Hour Trading

Robinhood offers 24-hour U.S. stock trading from Sunday 8 PM to Friday 8 PM ET, initially covering 43 popular stocks and ETFs (e.g., Apple, Tesla, Amazon). Plans are underway to expand to more assets and potentially 24/7 trading, ensuring you never miss market opportunities.

Multi-Asset Support

Robinhood supports diverse assets:

- Trade 200+ tokenized stocks and ETFs from 0.01 shares, with dividend and voting rights.

- Invest in pre-IPO companies like OpenAI or SpaceX.

- Future offerings include bonds, REITs, crypto perpetual contracts, and staking for a comprehensive “stocks + crypto” experience.

One account manages all assets, simplifying your investment strategy.

Account Opening Process

Image Source: pexels

Robinhood’s fully digital account opening has no minimum deposit, making it ideal for beginners and young investors with limited funds.

Required Documents

Prepare these for signup:

- Valid passport or ID (passport preferred for faster approval).

- U.S. address (use a friend’s or forwarding service).

- U.S. phone number (virtual number services work).

- Hong Kong bank account details for funding.

- Email address.

Tip: No U.S. citizenship or green card is required, just accurate documents.

Registration Steps

Follow these steps to register:

- Download the Robinhood app from the App Store or Google Play.

- Click “Sign Up” in the app.

- Enter your email, set a password, and provide personal details (name, birthdate, address).

- Upload clear passport or ID photos.

- Complete tax information (SSN or ITIN optional; consult support if unavailable).

- Await approval, typically within minutes to 1 business day.

Robinhood’s zero-commission and $1 minimum for fractional shares lowers barriers compared to traditional brokers like E*TRADE ($500 minimum). It’s designed for retail investors, especially those with limited funds.

| Aspect | Details |

|---|---|

| Signup Threshold | $0, no minimum required |

| Trading Threshold | As low as 0.000001 shares |

| Traditional Brokers | E.g., E*TRADE requires $500 minimum |

| Target Audience | Young investors with limited funds |

| Design Philosophy | Zero-commission and fractional shares to democratize trading |

Identity Verification

For account security, verify your identity:

- Upload clear passport or ID photos (front and back).

- Submit a selfie holding your ID.

- Provide tax details (SSN/ITIN optional; check with support).

Approval takes 1–3 business days. If rejected, Robinhood notifies you via app or email to resubmit documents.

Note: Ensure documents are clear and accurate to avoid delays.

Bank Linking and Funding

After verification, link a bank account:

- Select “Link Bank Account” in the app.

- Choose a U.S. bank (e.g., Chase, Bank of America) and enter details for automatic verification. Manual verification is available if needed.

- Fund via ACH for 1–3 business day transfers or wire transfer from a Hong Kong bank (select “Deposit Funds” > “Wire Transfer”).

- No minimum deposit is required, enabling trades with $1.

Tip: Use a Hong Kong bank to wire funds to a U.S. bank for smoother Robinhood deposits.

Signup Rewards

Free Stock

Upon completing signup and verification, you receive a free stock valued between $2.5 and $225 (approx. ¥18–1,620, 1:7.2 rate), though most get $2.5–$10. Inviting friends earns both you and them a random stock, up to a $500 total reward.

Tip: High-value stocks like Tesla are rare, but rewards add fun to investing.

Reward Claim Process

To claim free stock:

- Complete signup and verification.

- Navigate to “Free Stock” in the app.

- Follow prompts to receive your random stock, credited to your portfolio.

- Earn additional stocks by inviting friends who complete signup.

- Check reward details in the app; stocks may have a 30-day lockup before trading.

U.S. Stock Trading Process

Image Source: pexels

Finding Stocks

Search for stocks by entering the company name or ticker (e.g., “Apple” or “AAPL”) in the app’s top search bar. Browse via popular lists, sectors, or ETF categories. Each stock page shows real-time quotes, historical charts, company profiles, and news. Add stocks to your watchlist for easy tracking.

Tip: 24-hour trading for select stocks and ETFs ensures flexibility.

Buying and Selling

Trade stocks easily:

- On the stock’s page, click “Buy” or “Sell.”

- Enter share quantity (e.g., 0.5 for fractional shares).

- Choose “Market Order” or “Limit Order” (set a specific price via “Order Types” > “Limit”).

- Swipe up to confirm the order.

Robinhood charges no commissions but passes on mandatory exchange fees, disclosed in order details. PFOF ensures profitability, and SEC rules guarantee best execution prices.

Note: Exchange fees are standard across brokers; review them before trading.

Fractional Share Trading

Fractional shares make high-priced stocks accessible:

- Click “Buy” on the trading screen.

- Enter a fractional amount (e.g., 0.01 or 0.5 shares).

- Swipe up to execute.

For limit orders:

- Select “Buy” or “Sell,” then “Order Types” > “Limit.”

- Set your desired price and quantity (fractional supported).

- Swipe up to submit.

Fractional shares let you invest in Apple or Tesla with minimal funds, enhancing diversification.

Fund Withdrawal

Stock sales settle in T+2 days, after which funds are withdrawable. Reward stocks have a 30-day lockup. To withdraw:

- Go to the funds management section and select “Transfer” or “Withdraw.”

- Enter the amount and choose your linked bank (e.g., Hong Kong account).

- Submit; funds arrive in 2–5 business days, depending on bank processing and holidays.

- Use Robinhood’s debit card for instant withdrawals (30–60 minutes, 1.5% fee). Daily limits: $50,000 for bank transfers, $5,000 for debit.

Reminder: Verify bank details to avoid withdrawal delays.

Other Asset Trading

ETFs and Options

Robinhood supports trading mainstream ETFs and options, including index options and futures contracts. Search by ticker to view quotes and place orders. Options trading suits diversification or hedging, with active user engagement.

Cryptocurrencies

Trade 20+ cryptocurrencies like Bitcoin (BTC), Ethereum (ETH), and Solana (SOL) commission-free. Features include multi-chain wallets and cross-chain trading. With over 4 million crypto users across all U.S. states, Robinhood offers robust crypto services.

IPO Participation

Join IPO offerings like Figma or CoreWeave with no minimum or frozen funds. Apply via the app and view allocation results instantly, ideal for new stock investors.

ADR Trading

Trade American Depositary Receipts (ADRs) of international firms (e.g., Chinese or European companies) by searching their names or tickers, diversifying your portfolio within one account.

Pros and Cons

Key Advantages

Robinhood’s zero-commission trading saves costs on stocks and crypto. Fractional shares start at $1 (¥7.2), enabling investment in high-priced stocks. The intuitive mobile app supports 24-hour trading, ideal for young investors. Multi-asset support (stocks, ETFs, options, crypto) and no minimum deposit attract beginners.

Robinhood’s innovations make global markets accessible with low costs and high efficiency.

Key Drawbacks

Consider these risks:

- Limited customer support with slow response times.

- System instability during high volatility, with potential trading restrictions.

- PFOF may lead to suboptimal execution prices.

- Encourages frequent trading, increasing speculative risks.

- High-risk options and margin products lack prominent warnings.

- Past regulatory fines for outages and restrictions raise compliance concerns.

PFOF and data sales may create information asymmetry, and extreme market conditions could delay withdrawals.

Target Audience

Robinhood suits beginners and small investors testing U.S. stocks or crypto with minimal funds. Its simple interface requires little expertise. However, high-frequency traders or those needing advanced tools may find it lacking. It’s ideal for mobile-savvy users with Hong Kong bank accounts seeking stocks, ETFs, options, and crypto.

Evaluate your goals and risk tolerance before choosing Robinhood.

Robinhood simplifies U.S. stock trading with no minimum deposit and easy signup:

- Zero-commission saves costs.

- Multi-asset trading via mobile is convenient.

- 24-hour trading and rewards enhance engagement.

Assess risks and start your trading journey!

FAQ

Which countries can open Robinhood accounts?

Chinese residents can sign up with a passport, U.S. address, and phone number. Hong Kong bank accounts are commonly used for funding, but mainland Chinese cards are not directly supported.

What if I lack a U.S. phone number?

Use a virtual U.S. phone number from third-party services to complete verification.

What’s the minimum deposit?

No minimum; start trading with $1 (¥7.2, 1:7.2 rate) via Hong Kong bank transfers.

How long do withdrawals to Hong Kong banks take?

Funds arrive in 2–5 business days, depending on bank processing and holidays.

Are there hidden fees?

Robinhood is commission-free but charges standard exchange fees, disclosed in order details. No hidden broker fees apply.

Robinhood’s zero-commission and user-friendly interface have undoubtedly opened a new door for your U.S. stock investment journey. However, while enjoying these conveniences, have you ever been troubled by the complex funding process? Whether it’s transferring funds through a Hong Kong bank account or facing high wire fees and long settlement times, these can become obstacles on your path to U.S. stock trading.

Now, you can choose a simpler and more efficient financial channel. BiyaPay is built for global investors, offering a one-stop, seamless cross-border financial solution. We support the convenient exchange between various fiat and digital currencies, allowing you to easily manage your global assets. Our real-time exchange rate query feature helps you seize the best conversion opportunities. What’s more, we offer remittance fees as low as 0.5% with same-day delivery, significantly reducing your transaction costs and time. Now, you can invest in both U.S. and Hong Kong stocks from a single platform without needing a complex overseas account. Say goodbye to cross-border payment hassles and start your efficient financial journey now. Register with BiyaPay and make your financial management as smooth and worry-free as your trading.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.