- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

What Requirements Must Chinese Users Meet to Invest in US Stocks? A Comprehensive Walkthrough of the Process

Image Source: pexels

To invest in U.S. stocks, Chinese investors must meet specific requirements. You need to be 18+, provide a passport or ID, address proof, tax documents, and an overseas bank card, such as a Hong Kong account. Some brokers require a $2,000 initial deposit. In 2013, about 300,000 Chinese investors participated in U.S. markets (source).

Key Points

- Be 18+, provide passport, address proof, and overseas bank card.

- Choose a regulated broker, meet funding thresholds, and complete risk assessments with accurate information.

- Use Hong Kong bank accounts for efficient funding and withdrawals, ensuring secure transfers.

- Understand U.S. stock trading hours, fees, and rules to plan strategies and avoid impulsive trades.

- Comply with U.S. and Chinese tax regulations, declaring income to avoid legal issues.

Requirements for Chinese Investors

Image Source: pexels

Age and Identity

You must be at least 18 with full legal capacity to open a U.S. securities account and bear investment risks. Minors are prohibited due to risk concerns. Brokers verify age to ensure compliance.

Passport and ID Proof

A valid passport is typically required (source). Some brokers accept Chinese IDs or driver’s licenses. Upload clear passport photos and use English transliteration for name and email. Complete the W-8BEN form to confirm non-U.S. resident status, exempting capital gains tax. Provide accurate employment details—avoid “unemployed” or “freelancer” to improve approval odds. Net worth details help brokers assess suitability.

Tip: Prepare scanned copies of passport, ID, or license for quick uploads.

Address Proof

Submit address proof, such as:

- Utility bills

- Bank statements

- Property invoices

Documents must show your name and address, issued within three months. Hong Kong bank statements or household utility bills work. Provide clear scans or photos.

Funding Thresholds and Risk Assessment

Brokers vary in funding requirements. TD Ameritrade and Firstrade allow zero minimum deposits, needing only a Hong Kong bank card. Schwab International requires $25,000. Some mandate a $2,000 initial deposit. Choose based on your budget.

Brokers assess risk tolerance via questionnaires covering education, occupation, income, net worth, funding source, investment knowledge, goals, trading frequency, risk capacity, and experience. Face verification confirms identity. Sign agreements to finalize compliance. Accurate responses ensure suitable product recommendations and lower risks.

Note: Truthful risk assessment answers help brokers match you with appropriate investments.

Broker Selection and Signup Process

Image Source: pexels

Broker Types

Consider these broker types (source):

| Broker Type | Examples | Key Features |

|---|---|---|

| Chinese | CITIC, China Merchants, Huatai | Easy signup/funding, higher commissions, varying stability. |

| International | Futu, Tiger, Interactive Brokers | Low/zero commissions, robust platforms, diverse products. |

| U.S.-Based | TD Ameritrade, Schwab, Firstrade | Non-U.S. resident signup, SIPC protection, Chinese support. |

| Hong Kong | UP Fintech, TradeUP | HK SFC-licensed, secure, supports U.S./HK stocks. |

Hong Kong brokers like UP Fintech hold SFC licenses, ensuring safety. International brokers offer low fees, while U.S.-based ones provide SIPC coverage and Chinese support.

Document Preparation

Prepare (source):

- Valid ID (passport or Chinese ID).

- Hong Kong bank account details for smooth funding.

- Address proof (recent utility bill or bank statement).

- W-8BEN form for tax compliance.

Ensure consistency and authenticity across documents.

Online Signup Steps

Complete signup via broker website or app (source):

- Compare brokers for regulation, fees, and services.

- Submit application with ID and address proof.

- Sign electronic agreements and W-8BEN.

- Set account password and select account type (cash/margin).

- Fund via Hong Kong bank or wire transfer.

Verify all information for accuracy.

Review and Activation

Applications are reviewed in 1–3 days, some in 1–2 days. You’ll receive approval notification. Fund the account to activate and start trading. Remote signup enhances efficiency.

Tip: Monitor app/email for updates and respond to document requests promptly.

Funding and Withdrawals

Funding Channels

Funding options include:

- Convert CNY to USD via Chinese bank cards, transferring to broker accounts (source). Annual forex limit: $50,000 (source).

- Direct USD transfers from Hong Kong bank accounts, low fees (source).

- Bank wire transfers for quick, secure funding.

- Cross-border platforms for low-cost transfers (ensure compliance).

- Hong Kong brokers’ sub-delegation services.

Tip: Verify broker bank details before transferring.

Withdrawal Process

To withdraw:

- Submit a request via the broker platform, specifying your Hong Kong bank account.

- Funds arrive in 1–3 days, depending on bank processing.

- Retain USD in Hong Kong accounts or convert to CNY.

Note: Check fees and exchange rates to minimize losses.

Overseas Bank Cards and USD Accounts

Open a dual-currency (CNY/USD) account (source):

- Visit a Hong Kong bank with ID/passport.

- Specify use for U.S. stock broker transfers.

- Some require video verification and $2,500 deposit.

- Withdrawals via ATMs incur 1%–3% fees.

Tip: Hong Kong or U.S.-based banks (e.g., Velocity Clearing) streamline funding.

U.S. Stock Trading Rules and Taxes

Trading Hours and Rules

U.S. markets (NYSE, NASDAQ, AMEX) operate 9:30 AM–4:00 PM ET (10:30 PM–5:00 AM Beijing time, adjusted for DST) (source). Pre-market (4:00–9:30 AM) and after-hours (4:00–8:00 PM) have lower liquidity and higher volatility. T+2 settlement applies, with no minimum share purchase or price movement caps. Short selling is allowed but risky. Use market, limit, or stop orders for flexibility.

Tip: Pre/after-hours trading via ECNs may face delays; trade cautiously.

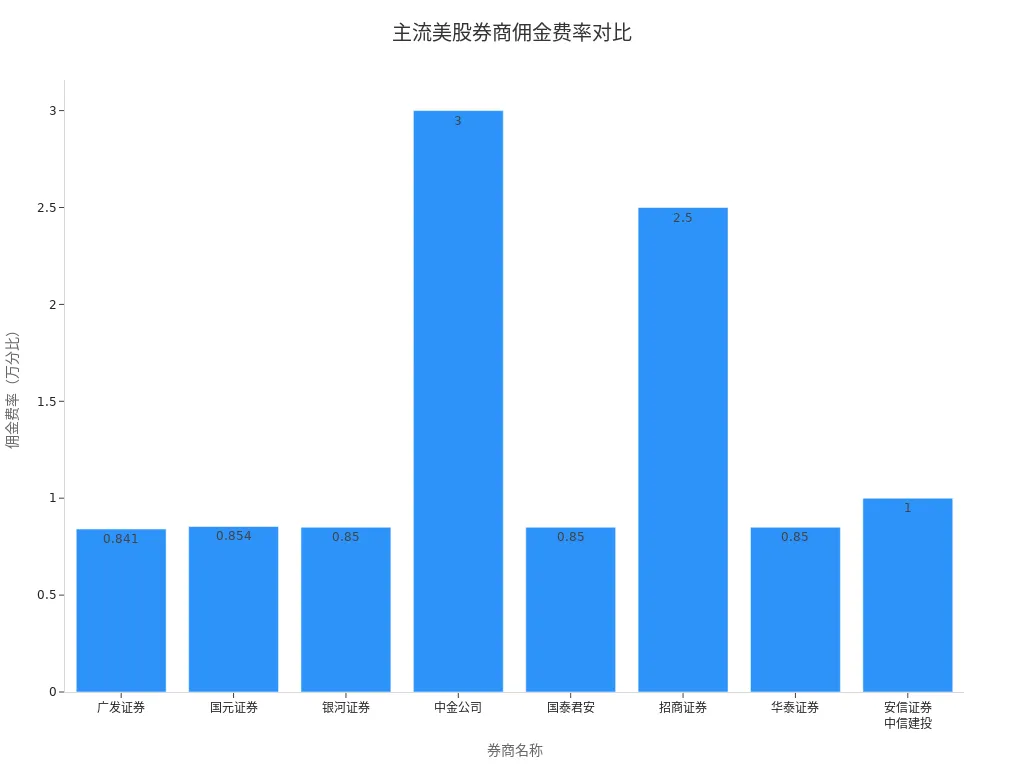

Fees and Commissions

Broker fees vary (source):

| Broker | Account Fee | Trade Commission | Forex Fee | Withdrawal Fee |

|---|---|---|---|---|

| Robinhood | $0 | $0 | High | $0 |

| Webull | $0 | $0 | High | $0 |

| TD Ameritrade | $0 | ~$6.95 | Medium | $25 |

| Charles Schwab | $0 | ~$4.95 | Medium | $25 |

| Fidelity | $0 | ~$4.95 | Medium | $0 |

U.S. brokers often charge zero commissions, but forex or withdrawal fees apply. Chinese brokers may negotiate down to $5/trade. Confirm fee details with brokers.

Tax Compliance

Non-U.S. residents pay 10% dividend withholding tax, auto-deducted by brokers. Capital gains are exempt with W-8BEN. In China, declare global income (March–June) (source), including U.S. stock gains, via CRS/FATCA. Offset U.S. taxes to avoid double taxation. Undeclared income risks penalties. Consult tax advisors for compliance.

Note: Frequent trading or large repatriations increase tax scrutiny; declare proactively.

For U.S. stock investments, prepare ID, address proof, and an overseas bank card. Choose SIPC-protected brokers for up to $500,000 coverage. Verify credentials via SEC/FINRA. Complete risk assessments based on age, investment horizon, and goals. Use robo-advisors for tailored strategies. Learn basics, diversify, and avoid emotional trading for stable returns.

FAQ

Can I use a Chinese ID for signup?

Passports are preferred; some brokers accept Chinese IDs, but most U.S. brokers require passports.

What’s the minimum investment?

Some brokers allow zero-minimum signup; plan for ~$2,000 USD based on requirements and rates.

Are accounts safe?

SIPC-protected brokers offer up to $500,000 coverage. Verify broker legitimacy.

Can I invest without a Hong Kong bank card?

Yes, but funding/withdrawals are limited. Hong Kong accounts enhance efficiency.

Do I need to report taxes?

U.S. dividends face 10% withholding; declare global income in China. Consult advisors for compliance.

The article provides a detailed analysis of the requirements and procedures for Chinese users to invest in U.S. stocks. A key pain point is clearly highlighted: you must open an overseas bank account and face an annual foreign exchange quota of $50,000, along with the high fees and opaque exchange rates of traditional bank wire transfers. These steps not only complicate the process but also subject every transaction to unnecessary costs and time delays.

BiyaPay was created to solve these very pain points, offering you a smoother and more cost-effective investment channel. We support the conversion between various fiat and digital currencies, allowing you to easily manage global assets. Our real-time exchange rate query feature ensures you always get the best rates for your conversions. Most importantly, we provide remittance fees as low as 0.5% with same-day delivery, significantly reducing your transaction costs and time. Now, you can invest in both U.S. and Hong Kong stocks on a single platform without needing a complex overseas account. Say goodbye to cross-border payment hassles and start your efficient financial journey now. Register with BiyaPay and make your fund management as smooth as your trading.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.