- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

An Overview of Features and Fees for Zero-Commission US Stock Platforms

Image Source: pexels

When selecting a platform for U.S. stock trading, zero-commission brokers like Webull, moomoo, Firstrade, Charles Schwab, Robinhood, and Futu Securities stand out. With over 25 million users, Robinhood leads in accessibility, while Webull offers rapid signup and multi-asset trading, Firstrade has no maintenance fees, and Schwab excels in customer service. However, zero-commission platforms often charge for options, data subscriptions, or transfers, so understanding total costs is key.

| Platform | User Accounts | Annual Trading Volume | Notes |

|---|---|---|---|

| Futu | Over 26M | ~$1T | Multi-market expansion |

| Robinhood | Over 25M | Hundreds of billions | High payment for order flow |

| Schwab | Not specified | Not specified | Growing market share |

Key Points

- Zero-commission platforms waive trading fees but may charge platform, options, or transfer fees; evaluate total costs.

- Platforms vary in trading options and features; align your choice with investment goals.

- Online signup is streamlined; prepare a passport and W-8BEN form for faster approval.

- Chinese-language support is critical for Chinese users, with Futu and Tiger offering robust services.

- Prioritize fund safety and regulatory compliance to avoid hidden costs and policy risks.

Zero-Commission Platform Overview

Image Source: pexels

Webull

Webull offers zero-commission trading but charges a platform fee of $1 minimum or 0.5% of trade value. Referral-based free trades are available but complex. Suits users comfortable with platform fees and seeking rewards.

moomoo

moomoo provides permanent zero commissions and platform fees, with free Level 2 data (40 order depths) and pre/after-hours trading. Signup takes 5 minutes, and 24/7 support enhances usability. Ideal for cost-conscious investors wanting efficiency. Rich features include quotes, options, and quant tools.

Firstrade

Since 1985, Firstrade has offered zero-commission trading with no minimum deposit, supporting stocks, ETFs, options, and mutual funds. Its Chinese-language interface is perfect for Chinese users seeking simplicity.

Charles Schwab

Since 2019, Schwab offers zero commissions on U.S. stocks, ETFs, and options, with no minimum balance and a satisfaction guarantee (refunds fees if dissatisfied). Extensive ETFs and robo-advisory services, plus banking integration, suit research-focused investors.

| Platform | Zero-Commission Policy | Ideal Users & Highlights |

|---|---|---|

| Webull | Zero commissions, $1 min/0.5% platform fee | Referral reward seekers, platform fee-tolerant |

| moomoo | Zero commissions, zero platform fees, free Level 2 | Cost-conscious, efficiency-driven investors |

| Firstrade | Zero commissions, no minimum deposit, Chinese support | Chinese users, diverse products |

| Schwab | Zero commissions, no minimum, satisfaction guarantee | Research-focused, full-service investors |

Choose based on your investment needs and preferences.

Fee Comparison

Image Source: pexels

Zero-commission platforms aren’t fully free; hidden costs like platform, options, and transfer fees impact returns. Below, we compare trading commissions, options fees, platform/service fees, transfer fees, and hidden costs.

Trading Commissions

Most platforms now offer zero commissions for U.S. stocks and ETFs, unlike past fees (e.g., TD Ameritrade/E*TRADE at $6.95, Schwab at $4.95). JPMorgan charges $2.95 per trade, and Interactive Brokers uses $0.005 per share (min $1). Some, like Tiger, claim zero commissions but charge platform fees ($0.005/share, min $1).

| Broker | Commission Structure | Scope |

|---|---|---|

| TD Ameritrade | Previously $6.95/trade, now zero | Stocks, ETFs |

| E*TRADE | Previously $6.95/trade, now zero | Stocks, ETFs |

| Schwab | Previously $4.95/trade, now zero | Stocks, ETFs |

| JPMorgan | $2.95/trade | Stocks |

| Interactive Brokers | $0.005/share, min $1, tiered $0.0035/share ± fees | Stocks |

| Tiger Brokers | Zero commissions, $0.005/share platform fee, min $1 | Stocks |

| moomoo | Zero commissions, zero platform fees (promotional) | Stocks, ETFs |

Tip: Check for platform or regulatory fees even with zero commissions.

Options Contract Fees

For options, Firstrade and Webull offer zero commissions but charge SEC fees (0.000013%–0.00231%). Saxo Bank charges $0.75 minimum per contract. Some platforms add FINRA fees ($0.01–$5.95) for sell orders.

| Platform | Options Commission | Fee Details | Exchange Coverage | Additional Fees |

|---|---|---|---|---|

| Saxo Bank | Min $0.75/contract | Clear commission structure | 20+ exchanges, 3,100+ options | None specified |

| Firstrade | Zero commission | SEC fee 0.000013% | N/A | No FINRA fees specified |

| Webull | Zero commission | SEC fee 0.00231% | N/A | FINRA fees $0.01–$5.95 for sells |

Monitor regulatory and additional fees for options trading.

Platform and Service Fees

Platforms may charge platform or service fees. Webull has a $1 minimum/0.5% platform fee. Robinhood charges $10 monthly for accounts with fewer than 5 trades. Premium data or quant tools often require subscriptions.

Transfer Fees

International wire transfers incur fees: Schwab and TD Ameritrade charge $25, Firstrade $35, Interactive Brokers $10 after the first free withdrawal monthly. Crypto transfers (e.g., USDT) avoid bank fees but charge 1 USDT on-chain. Schwab adds ~1% forex conversion fees.

| Platform | Transfer Fee Details | Forex Conversion Fees |

|---|---|---|

| Schwab | $25/international wire | ~1% via payment processor |

| Interactive Brokers | 1st withdrawal free, then $10 | Not specified |

| TD Ameritrade | $25/international wire | Not specified |

| Firstrade | $35/international wire | Not specified |

| Crypto (USDT) | No bank fees, 1 USDT on-chain | None (crypto-based) |

| Robinhood | No transfer fees specified, $10 for <5 trades/month | Not specified |

Hidden Fees

Hidden costs include:

- Platform Fees: Charges for premium data or tools.

- Slippage: Difference between expected and actual trade prices (e.g., $100 vs. $100.5).

- Forex Conversion: Fees for non-USD accounts.

- Inactivity/Withdrawal Fees: Charges for low activity or cancellations.

- Bid-Ask Spreads/Market Impact: Higher in low-liquidity markets.

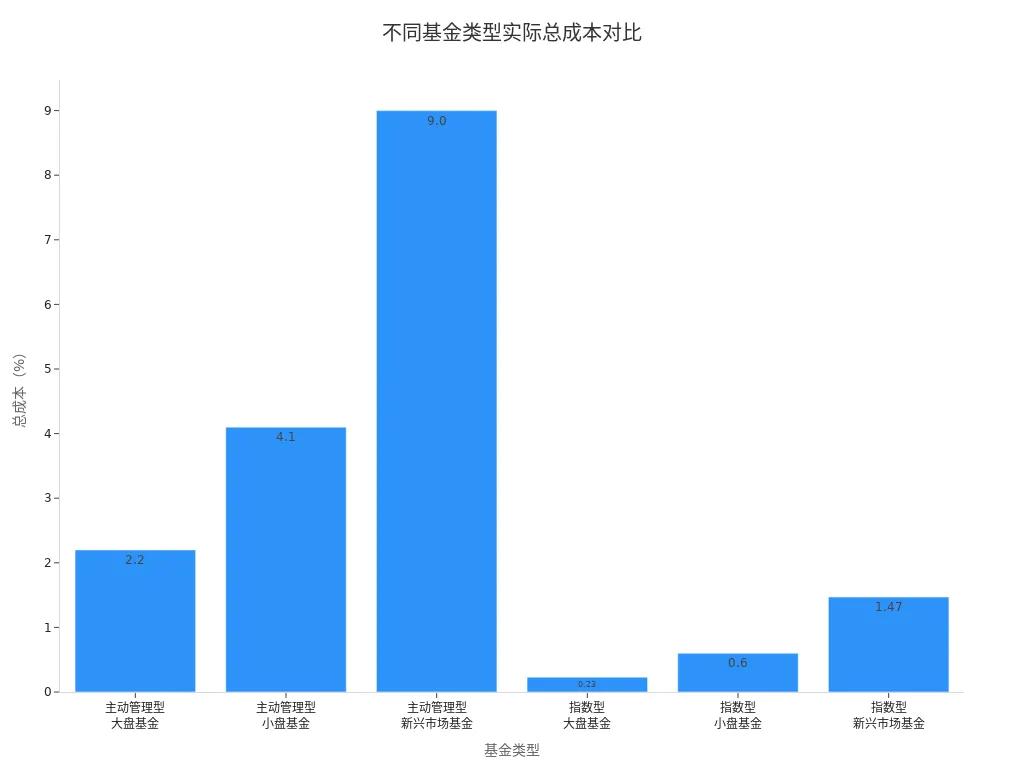

| Fund Type | TER (Management) | Commission | Bid-Ask Spread | Market Impact | Total Trading Cost | Total Cost (Incl. Hidden) |

|---|---|---|---|---|---|---|

| Active Large-Cap | 1.30% | 0.30% | 0.30% | 0.30% | 0.90% | 2.20% |

| Active Small-Cap | 1.60% | 0.50% | 1.00% | 1.00% | 2.50% | 4.10% |

| Active Emerging Markets | 2.00% | 1.00% | 3.00% | 3.00% | 7.00% | 9.00% |

| Index Large-Cap | 0.18% | 0.01% | 0.02% | 0.02% | 0.05% | 0.23% |

| Index Small-Cap | 0.20% | 0.10% | 0.15% | 0.15% | 0.40% | 0.60% |

| Index Emerging Markets | 0.57% | 0.10% | 0.40% | 0.40% | 0.90% | 1.47% |

Zero commissions don’t ensure low costs. Hidden fees like spreads and slippage can significantly raise expenses. Use USD accounts and limit frequent trades to minimize costs.

Feature Comparison

Trading Options

Platforms differ in asset coverage. Webull supports U.S./HK stocks, ETFs, and options across 220 regions. Futu covers U.S., Hong Kong, London, and Singapore markets with 17 licenses. Tiger focuses on U.S./HK stocks with strong compliance. Binance offers Tesla stock tokens, tradable with USD stablecoins, blending crypto and stocks.

| Platform | Trading Options | Markets Covered | Notes |

|---|---|---|---|

| Webull | Stocks, ETFs, options | U.S., Hong Kong | Zero commissions, long/short |

| Futu | Stocks, ETFs, multi-market | U.S., HK, London, Singapore | Diverse products, global reach |

| Tiger | U.S./HK stocks | U.S., Hong Kong | Compliant, U.S./HK-focused |

| Binance | Tesla stock tokens | U.S. (tokenized) | Stablecoin trading, innovative |

Market Data and Tools

Data and tools enhance decision-making. Meituan offers real-time U.S. stock data, smart stock selection, and risk assessment. Tiger and Futu provide multi-market quotes and robust interfaces. Xueqiu combines data with social investing. Orient Wealth and DaZhiHui offer research reports, while Tonghuashun and Xintong provide technical analysis and backtesting.

| Platform | Data Features | Tools | Ideal Users |

|---|---|---|---|

| Meituan | Real-time U.S. data | Smart selection, risk tools | Fundamental analysts |

| Tiger | Multi-market quotes | Robust, simple interface | All experience levels |

| Futu | Multi-market quotes | Diverse trading options | All experience levels |

| Xueqiu | Data + social features | Investor community | Social investors |

| Orient Wealth | Quotes, research integration | Comprehensive tools | Full-service investors |

| DaZhiHui | Real-time, in-depth data | Research reports | Research-driven investors |

| Tonghuashun | Stable system, rich data | Extensive data resources | Data-focused investors |

| Xintong | Technical analysis data | Strategy backtesting | Technical traders |

Mobile Experience

Mobile apps are vital for modern trading. Investing.com’s app covers 200,000+ global products with a sleek interface. Zixuan offers simple, smooth multi-market access. Orient Wealth provides professional data and live updates. Xueqiu’s active community suits discussion-driven traders. Tonghuashun’s rich alerts and multi-broker support ensure fast trades.

| Platform | User Experience | Feature Completeness | Notes |

|---|---|---|---|

| Investing.com | Unique design, rich data | Global 200,000+ products | Ideal for global investors |

| Tonghuashun | Modern, data-rich | Multi-broker, fast trades | Strong data, non-trading platform |

| Orient Wealth | Traditional, professional | Complete database, live | Data/community-focused, older UI |

| Zixuan | Simple, smooth interaction | Multi-market quotes | Stable, user-friendly |

| Xueqiu | Social, active community | U.S./HK trading | Great for discussion and research |

Chinese-Language Support

For Chinese users, Chinese support is critical. Futu offers 24/7 Chinese support, stable platforms, and rich features. Tiger provides Chinese interfaces but less consistent support. Xueying is user-friendly for Chinese users. Interactive Brokers and Schwab lack robust Chinese support, favoring English users.

| Platform | Chinese Interface | Chinese Support | Notes |

|---|---|---|---|

| Futu | Yes | 24/7 Chinese support | Stable, feature-rich, ideal for Chinese users |

| Tiger | Yes | Non-24/7 Chinese support | Lower fees, flexible accounts |

| Xueying | Yes | Chinese support | Simple, user-friendly for Chinese users |

| Interactive Brokers | No | English only | Long response times, professional platform |

| Webull | Limited | Weak Chinese support | Primarily English-focused |

| Schwab | No | Unclear Chinese support | Comprehensive but complex |

Account Opening Convenience

Online signup takes ~5 minutes, requiring phone, email, work details, investment goals, passport scans, E-signature, and W-8BEN forms. Approval takes 3 business days. Upload documents via platform dashboards or email.

Tip: Ensure accurate, complete documents to avoid delays.

Ideal User Profiles

Beginner Investors

Robinhood and SoFi Active Investing suit beginners with zero commissions, fractional shares, and simple interfaces. Robinhood offers signup bonuses, SoFi free financial advice.

| Investor Type | Recommended Platforms | Reasons |

|---|---|---|

| Beginners | Robinhood, SoFi Active Investing | Zero commissions, fractional shares, bonuses |

Consider low fees, real-time data, simple UI, security, and Chinese support.

Frequent Traders

Interactive Brokers and Ally Invest offer low fees and diverse products for active traders. Focus on commissions, quant tools, and technical support.

Long-Term Investors

Fidelity provides research reports, zero-fee index funds, and robust services for long-term holdings. Evaluate research, product range, and fees.

| Asset Type | Fee Types | Fee Range |

|---|---|---|

| Stocks | Commissions, stamp duty, transfer | Commissions: 0.01%–0.3%; Stamp: 0.1%; Transfer: 0.002% |

| Funds | Subscription, redemption, management, custody | Subscription/Redemption: 0–1.5%; Management: 0.5%–2%; Custody: 0.1%–0.25% |

International Users

Interactive Brokers supports global signup with strong compliance but requires passports, address proof, and fund source documents. Hong Kong banks may need in-person visits and notarized English documents. W-8BEN forms ensure tax compliance. Non-residents face 30%–50% longer signup times.

Considerations

Costs Behind Zero Commissions

Zero-commission platforms may have hidden costs:

- High-frequency traders profit from bid-ask spread arbitrage.

- Payment for order flow (PFOF) sells orders to market makers for rebates.

- Frequent trading amplifies hidden costs.

- “Negative exchange fees” divert orders for rebates.

- Focus on commissions overlooks execution price and speed.

Evaluate total costs, including execution quality.

Fund Safety

Fund safety varies by platform:

- China Securities Regulatory Commission tightened oversight on Futu and Tiger, banning new Chinese clients and restricting fund inflows.

- Domestic platforms lack legal protections for overseas trading.

- Platforms like VSTAR segregate funds, backed by banks and compensation funds.

- Regulators: CSRC, MiFID, CySEC, BaFin, FSC.

| Platform | Safety Measures | Regulators |

|---|---|---|

| VSTAR | Segregated funds, bank/compensation protection | MiFID, CySEC, BaFin, FSC |

| Futu | CSRC compliance, under rectification | CSRC |

| Tiger | CSRC compliance, under rectification | CSRC |

Service Quality

Prioritize 24/7 support, Chinese-language options, responsive service, and educational resources to reduce risks.

Policy Changes

Regulatory shifts impact platforms:

- Firstrade, Schwab adopted zero commissions, streamlined signups.

- 2025 GENIUS Act regulates stablecoins, requiring USD cash/Treasury reserves and audits.

- Platforms delisted non-compliant stablecoins.

- Decentralized platforms like XBIT enhance transparency with smart contracts.

- Fed and global regulators tighten stablecoin and cross-border rules.

| Broker | Advantages | Disadvantages |

|---|---|---|

| Futu | Low-latency, multi-market, great UX | Premium feature fees, high virtual asset fees |

| Tiger | Low fees, broad markets, fast signup | Limited HK products, inconsistent support |

| Xueying | Zero commissions, stable, fast trades | Higher inactive fees, basic support |

Choose based on needs:

- Ensure regulatory compliance.

- Compare fees with trading frequency and capital.

- Test platform tools and support.

FAQ

Are zero-commission platforms free?

No, they may charge platform, subscription, or transfer fees. Review fee schedules.

What documents are needed for signup?

Passport scans, English name, email, phone, W-8BEN form; some require address proof.

What are the transfer options?

Hong Kong bank wires, SWIFT, or crypto (USDT). Fees and speed vary.

Are platforms safe?

Regulated platforms (e.g., Futu/Tiger under CSRC, Interactive Brokers under SEC) segregate funds. Check licenses.

Can non-U.S. residents trade U.S. stocks?

Yes, with W-8BEN form for non-U.S. tax residency. Most platforms support Chinese users.

When choosing a zero-commission U.S. stock platform, you’ll find that despite their “zero-commission” claims, they still have various hidden fees and complex fund transfer processes. The article lists these pain points in detail, including platform fees, deposit and withdrawal fees (like wire transfer fees), currency conversion fees, and the hassle of using a Hong Kong bank account for remittances. These issues not only increase your investment costs but also make fund management inefficient and unpredictable.

BiyaPay is built to solve these cross-border financial pain points, providing you with a smoother and more cost-effective investment channel. We support the conversion between various fiat and digital currencies, allowing you to easily manage global assets, and offer a real-time exchange rate query feature to ensure you always get the best rates. Most importantly, we provide remittance fees as low as 0.5% with same-day delivery, significantly reducing your transaction costs and time. Now, you can invest in both U.S. and Hong Kong stocks on a single platform without needing a complex overseas account. Say goodbye to cross-border payment hassles and start your efficient financial journey now. Register with BiyaPay and make your fund management as smooth as your trading.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.