- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Overview of Hong Kong Stock Connect Trading Rules to Help Chinese Investors Seize Opportunities

Image Source: pexels

When participating in Hong Kong Stock Connect investments, you often focus on key points such as account opening conditions, trading mechanisms, settlement systems, trading day arrangements, price restrictions, fee structures, and risk management. Since the launch of Shanghai-Hong Kong Stock Connect, the cumulative transaction volume has reached approximately $3.7 trillion USD (calculated at 1 USD = 7.3 HKD), with daily average transaction amounts significantly increasing. Compared to A-shares, Hong Kong Stock Connect trading rules have notable differences, such as no daily price limits, T+0 trading, T+2 settlement, and unique odd-lot handling. You need to understand these core differences to better seize Hong Kong stock investment opportunities.

Key Points

- Hong Kong Stock Connect implements T+0 trading, allowing you to sell stocks bought on the same day, offering trading flexibility, but funds are available only on T+2, requiring careful fund allocation.

- Hong Kong Stock Connect has no daily price fluctuation limits, leading to greater price volatility, so you should closely monitor market risks and set stop-losses to protect funds.

- Account opening requires meeting capital and account duration requirements, completing a risk assessment, and choosing a reputable broker to ensure accurate documentation for smooth trading.

- Hong Kong Stock Connect trades are quoted in HKD and settled in RMB, with exchange rate fluctuations affecting returns, so you should monitor exchange rate changes and convert funds strategically.

- Hong Kong Stock Connect trading fees include stamp duty and commissions, differing from A-shares, so you should understand fee details before investing to control costs.

Overview of Hong Kong Stock Connect Trading Rules

Image Source: unsplash

Main Rules

When participating in Hong Kong Stock Connect investments, you need to understand the following core rules:

- T+0 Trading System: After buying Hong Kong Stock Connect stocks, you can sell them on the same day. This flexible trading method allows you to quickly adjust positions based on market changes.

- T+2 Settlement System: After buying stocks, the actual settlement of stocks and funds occurs on the second trading day after the transaction. You can still sell stocks on T or T+1, but the proceeds are available for other investments or wealth management only on T+2.

- No Price Limits: Hong Kong Stock Connect has no daily price fluctuation limits, resulting in greater price movement potential. You need to closely monitor market risks.

- Odd-Lot Handling: During trading, you may generate odd lots. Odd lots can only be sold through the Hong Kong Stock Exchange’s semi-automatic odd-lot trading system, unlike A-shares, which can be sold via continuous auctions.

- Trading Day Arrangements: Hong Kong Stock Connect trading days follow the Hong Kong Stock Exchange’s schedule. Trading may be suspended during statutory holidays in China or Hong Kong.

Hong Kong Stock Connect trading rules are based on the Hong Kong market, with all trades quoted in HKD and settled in RMB. You need to monitor the impact of exchange rate changes on investment returns.

Comparison with A-Shares

When understanding Hong Kong Stock Connect trading rules, you should focus on the main differences from A-shares. The table below helps you quickly grasp these differences:

| Rule Point | Hong Kong Stock Connect | A-Shares |

|---|---|---|

| Trading System | T+0, same-day buying and selling | T+1, selling only the next day |

| Settlement System | T+2, funds and stocks settle in two days | T+1, funds and stocks settle the next day |

| Price Limits | No daily price limits | Generally 10% (some 20%) |

| Trading Currency | Quoted in HKD, settled in RMB | Quoted and settled in RMB |

| Odd-Lot Handling | Sold only via odd-lot system | Freely tradable in the market |

| Trading Day Arrangements | Based on Hong Kong Stock Exchange | Based on Chinese exchanges |

You’ll notice that Hong Kong Stock Connect’s T+0 trading allows you to buy and sell the same stock on the same day, while A-shares require T+1 trading. Hong Kong Stock Connect uses T+2 settlement, meaning you wait two trading days to receive stocks and funds. Hong Kong Stock Connect has no price limits, leading to greater price volatility and higher risks. Odd-lot handling also differs significantly, as Hong Kong Stock Connect requires selling odd lots through a dedicated system. For trading days, Hong Kong Stock Connect follows the Hong Kong Stock Exchange, with potential suspensions during holidays in either market.

During actual operations, you should plan funds and positions based on these Hong Kong Stock Connect trading rule characteristics to avoid unnecessary risks due to rule differences.

Account Opening Requirements

Investor Eligibility

When opening a Hong Kong Stock Connect account, you must first meet specific capital and account requirements. You need an existing Shanghai or Shenzhen A-share account, and the account must have been open for at least 6 months. Your account assets (including securities market value and available balance) must average no less than 500,000 RMB over the past 20 trading days. Based on the current exchange rate (1 USD ≈ 7.1 RMB), 500,000 RMB is approximately $70,000 USD. You also need to complete a risk assessment questionnaire and pass the Hong Kong Stock Connect business knowledge test. If you have a severe bad faith record or legal restrictions, you cannot open Hong Kong Stock Connect permissions. Some investors may use short-term “borrowing” to temporarily meet capital requirements, but you should be cautious of the risks.

Friendly Reminder: The capital threshold is only checked at account opening; funds can be withdrawn after activation, but you should plan funds carefully to avoid impacting investment plans due to insufficient capital.

Account Opening Process

You can complete the Hong Kong Stock Connect account opening through the following steps:

- Choose a reputable securities company with quality service and reasonable fees, supporting online or offline applications.

- Fill in personal information online and upload ID photos. If you choose a Hong Kong securities company, you also need to prepare a Hong Kong/Macau pass or passport and proof of address (e.g., utility bills or bank statements).

- The securities company will review your eligibility, including capital, account duration, and risk assessment.

- After passing the review, you need to conduct simulated trading to familiarize yourself with Hong Kong Stock Connect trading rules.

- Sign relevant agreements, complete real-name verification, and link a bank account (e.g., a Hong Kong bank account).

- Once the account is officially activated, you can transfer funds to the Hong Kong stock account and start trading.

During the account opening process, ensure all documents are authentic and valid to avoid review failures due to incorrect information. Each step is critical to the smooth progress of subsequent investments.

Trading Mechanism

Trading Hours

When participating in Hong Kong Stock Connect trading, you need to understand its unique trading hours. Hong Kong Stock Connect trading days are divided into three main phases: 9:30 AM to 12:00 PM for the morning session, 1:00 PM to 4:00 PM for the afternoon session, and 4:00 PM to 4:10 PM for the closing auction session. The closing auction session allows for final price adjustments and confirmations, helping you better seize trading opportunities before the market closes. In contrast, A-share trading hours include a 9:15 AM to 9:25 AM call auction, continuous trading from 9:30 AM to 11:30 AM and 1:00 PM to 3:00 PM, with no closing auction. This is a key difference in Hong Kong Stock Connect trading rules. During actual operations, pay special attention to the closing auction session, plan buying and selling times wisely, and avoid missing critical trading windows.

Tip: Hong Kong Stock Connect trading hours follow the Hong Kong Stock Exchange, and trading may be suspended during statutory holidays in China or Hong Kong. Check whether a day is a trading day before trading.

Trading Units

When buying or selling Hong Kong Stock Connect stocks, you must trade in “lots.” The number of shares per lot is determined by the listed company, typically ranging from 100 to 5,000 shares, with no uniform standard. The minimum trading unit is one lot, and the specific number of shares depends on the stock’s rules. For example, some stocks have 100 shares per lot, while others may have 1,000 shares per lot. Unlike A-shares, where all stocks are standardized at 100 shares per lot, the maximum order quantity per trade is 3,000 lots, and the maximum number of shares per trade cannot exceed 99,999,999. Before placing an order, check the target stock’s lot size to avoid trade failures due to incorrect quantities.

- Hong Kong Stock Connect trading units are “lots,” with shares per lot determined by the listed company, ranging from 100 to 5,000 shares.

- The minimum trading unit is one lot, with share counts varying by stock.

- The maximum order quantity per trade is 3,000 lots.

- The system caps the maximum shares per trade at 99,999,999.

Friendly Reminder: When trading, check the lot size to avoid order errors. Some popular stocks have high per-lot values, so with the current exchange rate (1 USD = 7.3 HKD), prepare sufficient USD funds in advance.

T+0 and T+2

Hong Kong Stock Connect adopts a T+0 round-trip trading system, allowing you to sell stocks bought on the same day. This mechanism lets you adjust positions quickly based on market changes, enabling timely stop-loss or profit-taking. T+0 trading significantly enhances market liquidity and pricing efficiency, especially during volatile market conditions, allowing you to respond flexibly. However, T+0 can also increase market volatility risks, as frequent trading by some investors may raise transaction costs.

Hong Kong Stock Connect’s settlement system is T+2. After buying stocks, funds and stocks settle on the second trading day after the transaction. You can sell stocks on T or T+1, but the proceeds are available for other investments or wealth management only on T+2. The T+2 settlement system means your funds are tied up for two days, unlike A-shares’ T+1 settlement. A shorter settlement cycle can accelerate fund turnover and improve capital efficiency, but you should plan funds carefully to avoid impacts from delayed availability.

During actual operations, combine Hong Kong Stock Connect trading rules to plan trading pace and fund allocation wisely. T+0 offers trading flexibility, while T+2 settlement requires proactive fund planning.

Order Placement and Matching

Order Placement Methods

When trading Hong Kong Stock Connect, you can only use limit orders. Specifically, Hong Kong Stock Connect supports two types: call auction limit orders and enhanced limit orders. Unlike A-shares, market orders are not allowed. When placing an order, you need to specify the buy or sell price and quantity. The system queues orders based on your input price for matching. You can place orders through a securities company’s trading software, with a process similar to A-shares but differing in order types.

Tip: When placing orders, ensure only compliant limit orders are submitted, as market orders are automatically rejected.

Matching Rules

Hong Kong Stock Connect’s matching rules differ significantly from A-shares. Refer to the table below for a quick comparison of key differences:

| Rule Item | A-Share Matching Features | Hong Kong Stock Connect Matching Features |

|---|---|---|

| Order Types | Supports limit and market orders | Only supports call auction limit orders and enhanced limit orders, no market orders |

| Trading Hours | Call auction 9:15-9:25, continuous trading 9:30-11:30, 13:00-14:57, closing auction 14:57-15:00 | Pre-open call auction 9:00-9:15, continuous trading 9:30-12:00, 13:00-16:00, closing auction 16:00-16:10 |

| Trading Units | Main Board, GEM: 100 shares or multiples; STAR Market: minimum 200 shares; Beijing Exchange: minimum 100 shares | Determined by listed company, variable lot sizes, e.g., 100, 200, 500 shares |

| Minimum Price Increment | 0.01 RMB | Minimum quote unit varies with stock price; higher prices have larger increments |

| Price Limits | Clear price fluctuation limits | No price limits, but with Volatility Control Mechanism (VCM) |

| Trading Currency | RMB | Quoted in HKD, settled in RMB |

When trading, note that Hong Kong Stock Connect has no daily price limits, potentially leading to greater price volatility. The system matches orders based on price priority and time priority.

Order Cancellation Rules

After placing an order in Hong Kong Stock Connect, you can cancel it at any time before it’s executed. As long as the order hasn’t been matched, the system processes cancellation requests immediately. If the order is partially executed, you can cancel the unexecuted portion. You need to use the securities company’s trading system to cancel orders. Cancellation is available during trading hours, but some orders may not be cancellable during the closing auction session.

Friendly Reminder: When canceling orders during high-volatility periods, check system feedback to avoid failures due to network delays.

Price and Fluctuation Limits

Price Restrictions

When trading Hong Kong Stock Connect, pay close attention to the Hong Kong Stock Exchange’s quoting rules. The closing auction session has strict price restrictions. You can follow this process:

- Reference Price Setting Period (16:00-16:01, half-day market 12:00-12:01): The system does not accept any buy or sell orders.

- Order Input Period (16:01-16:06, half-day market 12:01-12:06): You can input or cancel call auction limit orders. Prices must be within ±5% of the reference price. Orders exceeding this range are automatically canceled or rejected.

- Non-Cancelable Period (16:06-16:08, half-day market 12:06-12:08): You can only input new call auction limit orders, not modify or cancel existing ones. Prices must still be within ±5% of the reference price and between the best bid and ask prices.

- Random Closing Period (16:08-16:10, half-day market 12:08-12:10): Order input and price restrictions are the same as the previous period, with the closing price determined via call auction.

You must strictly follow these quoting rules to ensure smooth trading. In special cases, such as typhoon warnings, the Hong Kong Stock Exchange may adjust the closing auction session.

Tip: Before placing orders, check the target stock’s reference price and best bid/ask prices to avoid order rejections due to price violations.

Price Fluctuation Rules

When trading Hong Kong Stock Connect, you’ll notice no daily price fluctuation limits. Stock prices can fluctuate significantly within a single day, unlike A-shares. You need to closely monitor market trends and adjust strategies promptly. The Hong Kong Stock Connect market has higher price volatility risks, with some popular stocks potentially exceeding 20% fluctuations in a day. Conduct a risk assessment before investing and control positions appropriately.

Although the Hong Kong Stock Exchange has no price limits, it has a Volatility Control Mechanism (VCM). When individual stock prices fluctuate excessively in a short period, the system triggers a cooling-off period to restrict further sharp price movements. You should note that this mechanism mainly applies to Hang Seng Index constituent stocks and some large-cap stocks.

Friendly Reminder: When investing in Hong Kong Stock Connect, set stop-loss levels to prevent significant losses from sharp price fluctuations. Leveraging the Hong Kong Stock Exchange’s quoting rules helps you better time trades.

Settlement and Clearing

Settlement Cycle

When trading Hong Kong Stock Connect, you need to understand the T+2 settlement system. T+2 means that after buying stocks, settlement occurs two trading days later. For example, if you buy Hong Kong Stock Connect stocks on day T, you gain stock rights after trading ends on T+2. If you sell stocks, funds are available on T+2. Although you can buy and sell on the same day, funds still take two days to settle. During these two days, your funds can only be used for Hong Kong Stock Connect trading, not transferred out or used for A-shares. Dividend payments typically take three trading days. The T+2 settlement system affects your fund allocation and trading plans.

Tip: When planning funds, account for the T+2 settlement delay to avoid impacts from unavailable funds.

Fund Transfers

After selling Hong Kong Stock Connect stocks, funds are credited to your account on T+2. You can transfer funds out via a Hong Kong bank or continue using them for Hong Kong Stock Connect trading. Before funds are credited, you cannot transfer them to Chinese accounts or use them for A-share investments. During fund transfers, note exchange rate changes. At 1 USD = 7.3 HKD, currency conversions may result in exchange gains or losses. You can convert and transfer funds promptly after they are credited to reduce exchange rate risks.

- Funds are credited on T+2 after selling stocks.

- Before funds are credited, they can only be used for Hong Kong Stock Connect trading.

- After crediting, funds can be transferred out via a Hong Kong bank.

Odd-Lot Handling

During Hong Kong Stock Connect trading, you may generate odd lots due to rights issues, bonus shares, or non-integer trading quantities. Odd lots are stocks less than one lot. Unlike A-shares, you cannot freely trade odd lots in the market. Hong Kong Stock Connect odd lots can only be sold through the Hong Kong Stock Exchange’s semi-automatic odd-lot trading system. You need to submit an odd-lot sell request to your securities company, and the system automatically matches the transaction. Odd-lot transaction prices may be lower than market prices, and the process is slower. Understand odd-lot handling rules in advance to avoid impacts on fund recovery.

Friendly Reminder: Trade in integer lots to minimize odd lots and streamline fund management.

Quotas and Funds

Total Quota

When participating in Hong Kong Stock Connect investments, you need to understand daily quota settings. Hong Kong Stock Connect implements a daily quota management, with a daily limit of 42 billion RMB. At the current exchange rate (1 USD ≈ 7.1 RMB), this equals approximately $5.9 billion USD. There is no total quota limit, meaning you can continue investing in Hong Kong stocks without worrying about long-term quota exhaustion. The daily quota exists to mitigate risks from large-scale cross-border fund flows, ensuring market stability.

Tip: Before trading, check the remaining daily quota via your broker’s platform or the Hong Kong Stock Exchange website to avoid trading disruptions due to quota exhaustion.

Quota Usage

During actual operations, quota usage rules directly affect your buying activities. Note the following:

- The daily quota is 10.5 billion RMB (approximately $1.48 billion USD), and when exhausted, the system suspends buy orders, but sell orders remain unaffected.

- If the quota is used up before the market opens, subsequent buy orders are paused for the day, but you can still sell held stocks.

- After a sell transaction, if the quota balance is restored, buy orders may resume during continuous trading.

- If the quota is exhausted during continuous trading or the closing auction, subsequent buy orders are halted, but sell orders remain valid.

- Shanghai-Hong Kong and Shenzhen-Hong Kong Stock Connect quotas are independent, each at 10.5 billion RMB (approximately $1.48 billion USD), and cannot be combined.

- Quota restrictions primarily affect buying, while selling remains unrestricted.

- You need to closely monitor quota changes during trading hours to avoid buy order suspensions.

Recommendation: During peak trading periods, monitor quota changes and plan buy timings to minimize inconvenience from quota exhaustion.

Fund Management

When investing in Hong Kong Stock Connect, fund management is critical. You need to prepare USD funds in advance and transfer them via a Hong Kong bank account. After funds are credited, you can flexibly arrange buy or sell operations. Under the T+2 settlement system, funds from stock sales take two trading days to arrive. You can use funds for further Hong Kong Stock Connect trading or transfer them out via a Hong Kong bank to other investment channels. Exchange rate fluctuations affect actual returns, so monitor USD, HKD, and RMB exchange rates and choose optimal conversion times. Proper fund flow planning enhances investment efficiency and reduces exchange rate risks.

Tip: Use a Hong Kong bank’s foreign currency account for convenient fund transfers and conversions, improving capital flexibility.

Fees and Taxes

Main Fees

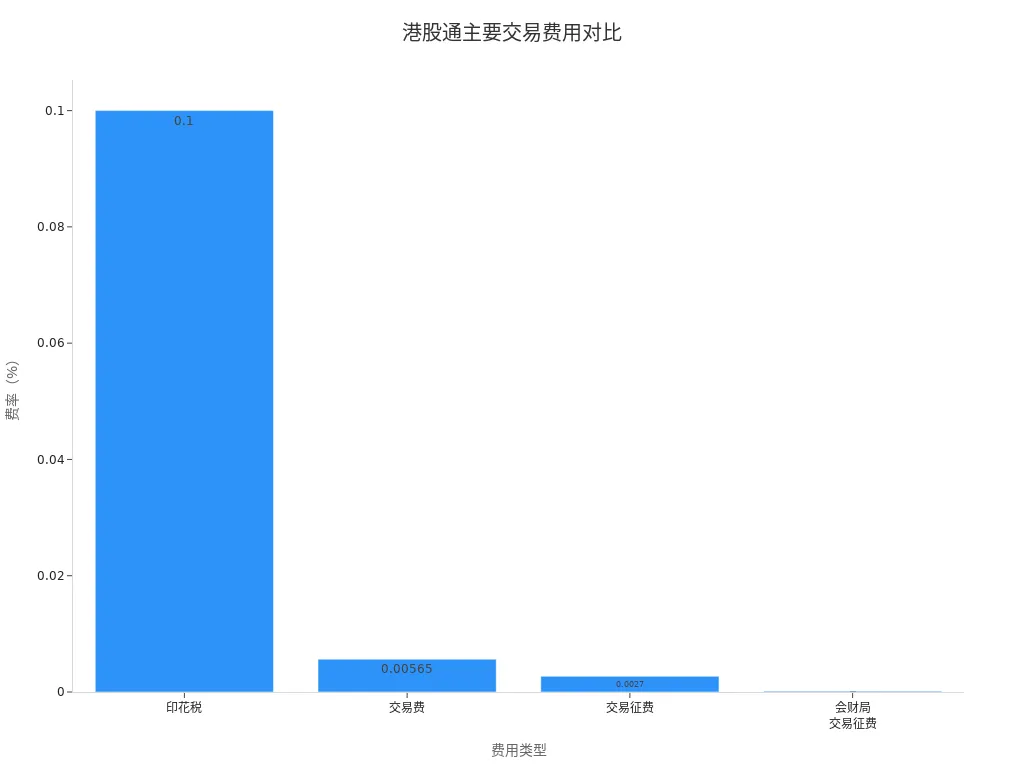

When investing in Hong Kong Stock Connect, you’ll encounter several fees. The primary fees include stamp duty and broker commissions. Stamp duty is 0.1% of the transaction amount, charged on both sides. At 1 USD = 7.3 HKD, for a $10,000 stock trade, stamp duty is approximately $10 USD. Broker commissions vary by company, and some may exceed stamp duty. You should actively check commission rates, ideally keeping them below one-tenth of stamp duty. If commissions exceed 0.02%, consider switching brokers. Additional fees like trading levies, transaction fees, and settlement fees, though low individually, can impact returns when combined.

| Fee Name | Recipient | Rate Standard | Charging Method |

|---|---|---|---|

| Trading Commission | Broker | Varies by broker, consult the branch | Charged on both sides |

| Stamp Duty | Hong Kong Stamp Office | 0.1% of transaction amount (1‰), minimum $1 USD if less | Charged on both sides |

| Trading Levy | Hong Kong SFC | 0.0027% of transaction amount (0.027‰) | Charged on both sides |

| FRC Levy | Financial Reporting Council | 0.00015% of transaction amount (0.0015‰) | Charged on both sides |

| Transaction Fee | Hong Kong Stock Exchange | 0.00565% of transaction amount (0.0565‰) | Charged on both sides |

| Share Settlement Fee | Hong Kong Clearing | 0.0042% of transaction amount (0.042‰) | Charged on both sides |

| Securities Portfolio Fee | Hong Kong Clearing Agent | Tiered based on holding value, 0.03‰-0.08‰ | Charged based on holding value |

Refer to the fee comparison chart below for a visual breakdown of main fee proportions:

Friendly Reminder: All fees are quoted in HKD, so monitor USD-to-HKD exchange rate changes during actual payments.

Tax Policies

When investing in Hong Kong Stock Connect, tax policies are also important. Key taxes include:

- Stock Transfer Capital Gains Tax: As an individual investor, capital gains from buying and selling Hong Kong Stock Connect stocks are currently exempt from personal income tax. Corporate investors must pay corporate income tax as required.

- Dividend Income Tax: When receiving dividends from H-share companies, a 20% personal income tax is withheld by the company. If you’ve paid withholding tax abroad, you can apply for a tax credit. Corporate investors holding H-shares for 12 consecutive months are exempt from corporate income tax.

- Securities Trading Stamp Duty: 0.1% of the transaction amount, paid by both buyers and sellers.

- Other Fees: Include trading commissions, trading levies, transaction fees, system usage fees, and settlement fees.

- Double Taxation Issue: H-share dividends are subject to a 10% pre-withheld tax, and Hong Kong Stock Connect investors pay an additional 20% personal income tax, totaling up to 28%. You can apply for a partial refund of the withholding tax.

During operations, stay informed about tax policy changes and plan investment strategies accordingly.

Comparison with A-Shares

When investing in Hong Kong Stock Connect, you’ll notice significant differences in fee structures compared to A-shares:

- Hong Kong Stock Connect fund settlement takes two trading days, one day longer than A-shares, increasing capital holding costs.

- Each trade involves automatic USD-to-HKD conversion, incurring exchange rate differences and bank fees. You bear conversion costs per trade, especially noticeable during high exchange rate volatility.

- HKD is pegged to USD, and international market fluctuations affect HKD rates, increasing your exchange risk.

- Hong Kong Stock Connect uses T+0 trading with no price limits, differing from A-shares’ T+1 and limited price fluctuation rules.

- A-share trading has no cross-border conversion issues, with faster fund arrivals and simpler tax structures.

Before investing, thoroughly understand the fee and tax differences between Hong Kong Stock Connect and A-shares, and plan funds and trades accordingly.

Risk Warnings

Image Source: unsplash

Main Risks

When investing in Hong Kong Stock Connect, you must prioritize market risks. Although Hong Kong Stock Connect has no daily price limits, actual price fluctuations are not significantly larger than A-shares. Refer to the table below for differences:

| Metric | Hong Kong Stock Connect (Hang Seng Composite Index) | A-Share Market (Shanghai Composite Index) |

|---|---|---|

| Volatility | Approx. 1.34% | Approx. 2.87% |

| P/E Ratio | Hang Seng Composite Index P/E within 15 | Shanghai Composite Index peaks at 23 |

| Turnover Rate | Approx. 0.2% | Approx. 0.65% |

Experts note that the Hong Kong Stock Connect market is dominated by institutional investors, with different market rules, more rational valuations, and relatively stable price fluctuations. You should also note that Hong Kong Stock Connect is heavily influenced by global fund flows, and international market volatility may cause significant price changes in Hong Kong stocks. Before investing, carefully read the risk disclosure statement, control positions rationally, and avoid losses due to market fluctuations.

Operational Pitfalls

During actual operations, you may overlook settlement system differences. The T+2 settlement system introduces the following risks:

- After buying stocks, you must hold them until two trading days before the dividend record date to receive dividends or bonus shares. Stocks bought on the record date or the previous trading day do not qualify for these benefits.

- The longer settlement period means unsettled stocks cannot be pledged, affecting your fund flexibility.

- You may encounter issues like settlement participants failing to complete centralized settlements, settlement defaults, or incorrect transfer instructions, leading to delays in funds or stock arrivals.

- Force majeure factors like severe weather may delay settlements, affecting your fund planning and trading decisions.

During operations, closely monitor announcements and ex-dividend dates, plan trading times wisely, and avoid misjudgments due to settlement differences.

Investor Protection

As an investor, you can protect your rights through various measures. Choose compliant securities companies to ensure trading safety. In case of disputes, you can file complaints with the Hong Kong Stock Exchange or Chinese securities regulators. Stay updated on the latest Hong Kong Stock Connect trading rule changes and adjust strategies promptly. Regularly review the risk disclosure statement to maintain market risk awareness. Diversifying investments and avoiding heavy positions in single stocks are effective ways to reduce risks.

Friendly Reminder: When investing in Hong Kong Stock Connect, stay rational, fully understand market rules and settlement systems, and manage funds scientifically to better seize Hong Kong stock opportunities.

You must prioritize compliant operations and understand each trading rule to navigate the Hong Kong stock market steadily. Hong Kong Stock Connect rules continue to evolve with market developments, with adjustments involving investment quotas, eligible stocks, and disclosure mechanisms. Consider these recommendations:

- Stay informed about rule changes. Hong Kong Stock Connect rules have no fixed adjustment cycle and are implemented in phases, so prepare in advance.

- Access authoritative information promptly. Use the “Securities Times” official app and WeChat account to stay updated on policies and market dynamics.

- Plan funds rationally. T+2 settlement and exchange rate fluctuations affect fund usage efficiency.

- Prioritize risk management. Diversify investments, set stop-losses, and avoid losses from market volatility.

By continuously learning and monitoring policy updates, you can better seize Hong Kong stock investment opportunities.

FAQ

Which currencies can be used for Hong Kong Stock Connect trading settlements?

You can only settle Hong Kong Stock Connect trades in RMB. During trading, the system automatically converts RMB to HKD. Monitor the USD-to-HKD exchange rate (e.g., 1 USD = 7.3 HKD) to avoid return impacts from rate fluctuations.

How long does it take to transfer funds out from a Hong Kong Stock Connect account?

After selling stocks, funds are credited on T+2. Once credited, you can transfer funds out via a Hong Kong bank account. Plan fund allocations to avoid impacts from the settlement cycle.

What are the main fees for Hong Kong Stock Connect trading?

You need to pay stamp duty (0.1% of transaction amount), broker commissions, trading levies, transaction fees, and settlement fees. All fees are quoted in HKD. Monitor the USD-to-HKD exchange rate to control trading costs.

Which stocks can be traded via Hong Kong Stock Connect?

You can only trade select stocks listed on the Hong Kong Stock Exchange’s Main Board. The list is periodically updated. Check the latest eligible stocks on your broker’s platform or the Hong Kong Stock Exchange website.

What are the risks of Hong Kong Stock Connect investments?

You should note risks like high price volatility, T+2 settlement, exchange rate changes, and odd-lot handling. Diversify investments, set stop-losses, and review the risk disclosure statement to protect your interests.

You’ve provided a very detailed guide on the trading rules of Stock Connect, covering all aspects from account opening to risk management. The article clearly contrasts the differences in trading mechanisms between Stock Connect and A-shares, and highlights key points like T+2 settlement, RMB settlement, and exchange rate fluctuations. For mainland investors, these rules often point to a central pain point: the complexity of cross-border fund transfers. Traditional bank wire transfers are time-consuming and costly, and non-transparent exchange rate spreads can also erode investment returns. These issues often detract from the investment experience on Stock Connect.

BiyaPay is built to solve these cross-border financial pain points, providing you with a smoother and more cost-effective investment channel, so you no longer have to worry about cumbersome fund transfers. We support the conversion between various fiat and digital currencies, allowing you to easily manage global assets, and offer a real-time exchange rate query feature to ensure you always get the best rates. Most importantly, we provide remittance fees as low as 0.5% with same-day delivery, significantly reducing your transaction costs and time. Now, you can invest in both U.S. and Hong Kong stocks on a single platform without needing a complex overseas account. Say goodbye to cross-border payment hassles and start your efficient financial journey now. Register with BiyaPay and make your fund management as smooth as your trading.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.