- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

In-Depth Analysis of U.S. Stock Brokerage Features and Comparison of Chinese User Experience

Image Source: pexels

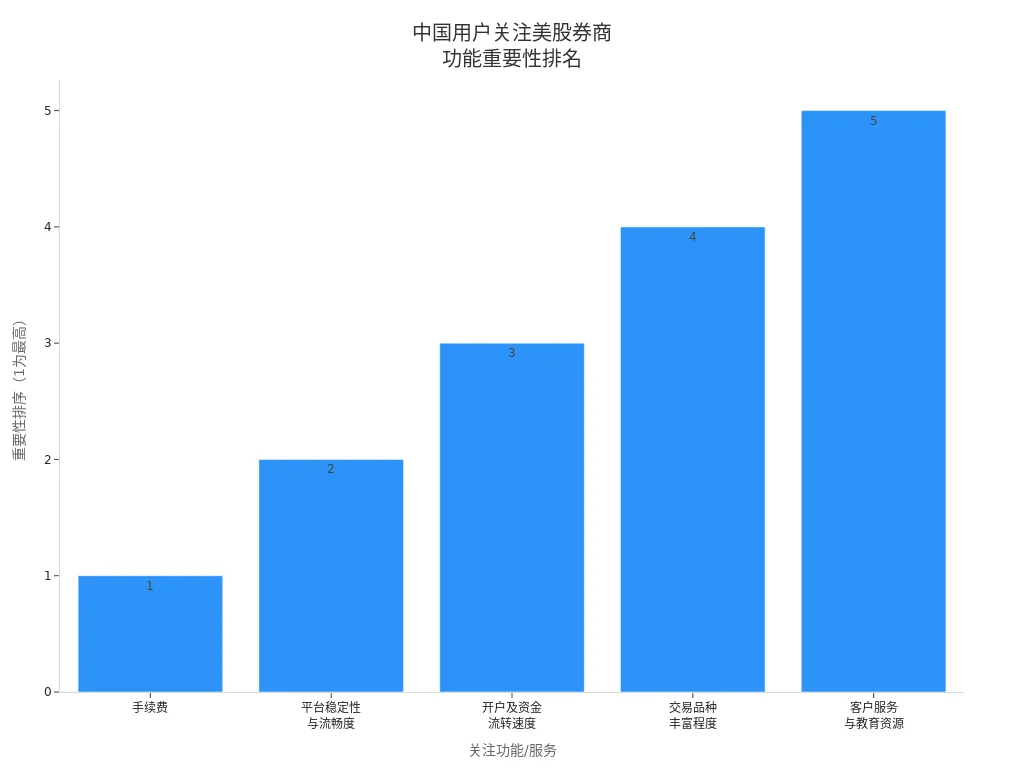

When choosing a U.S. stock brokerage, Chinese users typically focus on fees, platform stability, account opening and fund transfer speed, diversity of trading products, and customer service. Data shows that investors born in the 1980s and 1990s account for over 80%, with investment activity continuously increasing. The chart below displays the ranking of user priorities for brokerage features:

Brokerage evaluations focus on actual user experience to help investors efficiently select a suitable platform.

Key Points

- Choosing a brokerage that supports fully online account opening, fast verification, and no minimum funding requirements can significantly enhance account setup efficiency and experience.

- Brokerages with zero commissions and transparent fee structures are ideal for frequent traders, saving on investment costs.

- Brokerages like Futu, Tiger Brokers, Webull, and moomoo offer high-quality Chinese language services, facilitating operation and communication for Chinese users.

- Fractional share trading and diverse trading products meet various investment needs, enhancing fund flexibility and investment diversity.

- Pay attention to brokerage fund security measures and regulatory compliance to ensure worry-free investment safety.

Brokerage Feature Comparison

Image Source: pexels

Account Opening Convenience

The account opening process for mainstream U.S. stock brokerages generally includes registration, filling out personal information, uploading ID photos, risk disclosure, and awaiting verification. Most brokerages support fully online document submission, with verification typically taking 1-2 business days. Some traditional brokerages may require in-person witnessing, making the process more complex. Regarding funding thresholds, some emerging internet brokerages like moomoo, Webull, and Robinhood have no minimum funding requirements, suitable for users new to U.S. stock investing. For example, Futu moomoo allows users to complete the entire account opening process via its app, with verification taking about 1-2 business days and no minimum funding requirement. In contrast, traditional brokerages like Interactive Brokers may require higher funding, with some accounts needing up to $50,000.

Tip: Choosing a platform with fully online account opening, fast verification, and no funding threshold can enhance the account setup experience.

Trading Products

Different brokerages show significant differences in supported trading products. The table below compares the trading markets and products of major brokerages:

| Brokerage Name | Supported Trading Markets | Trading Product Overview | Fee Structure |

|---|---|---|---|

| Futu Securities | U.S. Stocks, Hong Kong Stocks | U.S. and Hong Kong stocks, warrants, funds, bonds, etc. | U.S. stocks: $3/250 shares, Hong Kong stocks: 0.03% + HK$15 |

| Interactive Brokers | U.S. Stocks, Hong Kong Stocks | U.S. and Hong Kong stocks, ETFs, options, etc. | U.S. stocks: $1/200 shares, Hong Kong stocks: 0.08% |

| Tiger Brokers | U.S. Stocks, Hong Kong Stocks | U.S. and Hong Kong stocks, ETFs, etc. | Approx. $1.99/trade |

| Webull | U.S. Stocks | U.S. stocks, ETFs, options, cryptocurrencies | Zero commission |

| moomoo | U.S. Stocks, Hong Kong Stocks | U.S. and Hong Kong stocks, ETFs, options | Zero commission |

| Robinhood | U.S. Stocks | U.S. stocks, ETFs, options, cryptocurrencies | Zero commission |

| Mitrade | U.S. Stock CFDs | U.S. stock CFDs, forex, commodities | Zero commission |

Brokerages like Futu, Tiger Brokers, and moomoo support both U.S. and Hong Kong stock markets, ideal for diversified asset allocation. Webull and Robinhood focus on U.S. stocks, ETFs, and cryptocurrencies, catering to different investor needs.

Fee Structure

U.S. stock investors commonly focus on trading commissions, platform fees, and deposit/withdrawal fees. The table below compares the fee structures of major brokerages:

| Brokerage Name | Trading Type | Commission Rate & Minimum Fee | Platform Fee & Minimum Fee | Minimum Total Fee per Trade |

|---|---|---|---|---|

| Futu Securities | U.S. Stocks/ETFs | Zero commission | $0.99/trade | $0.99 |

| Tiger Brokers | U.S. Stocks/ETFs | $0.005/share, min. $0.99 | $0.005/share, min. $1 | Approx. $1.99 |

| Robinhood | U.S. Stocks/ETFs | 0 | 0 | 0 |

| Charles Schwab | U.S. Stocks/ETFs | 0 | 0 | 0 |

| Webull | U.S. Stocks/ETFs | 0 | 0 | 0 |

Brokerages like Robinhood, Webull, and Charles Schwab offer zero commissions and no account management fees, ideal for frequent traders. Futu and Tiger Brokers charge approximately $1 to $2 per trade in commissions and platform fees. Some brokerages like E*TRADE and Fidelity may incur additional fees for account transfers. Cross-border wire transfers may involve bank fees, and investors should consider fund transfer costs.

Chinese Language Support

Mainstream brokerages like Futu Securities, Tiger Brokers, Webull, and moomoo support Chinese interfaces and customer service. Futu Securities offers 24/7 Chinese customer service, a stable platform, and rich features, ideal for Chinese investors. Tiger Brokers also supports Chinese services, with low trading fees and robust research tools, though customer service response times are slightly slower than Futu. Webull and moomoo also provide Chinese interfaces, with user-friendly operations suitable for beginners. Interactive Brokers’ platform is more complex and does not explicitly support Chinese services.

| Brokerage Name | Chinese Interface Support | Chinese Customer Service Support | Details |

|---|---|---|---|

| Futu Securities | Supported | 24/7 Chinese customer service | Stable platform, rich features |

| Tiger Brokers | Supported | Supported | Average customer service response time |

| Webull | Supported | Supported | Free real-time market data |

| moomoo | Supported | Supported | User-friendly operation |

| Interactive Brokers | Not explicitly supported | Not explicitly supported | Complex platform |

Platform Experience

Futu moomoo’s desktop version is feature-rich, supporting Level 2 market data, options depth order book, and extensive research data, ideal for U.S. stock investors with technical analysis needs. Webull and Robinhood have clean, smooth interfaces, suitable for new users. Tiger Brokers offers multi-market investment products and robust research tools with a stable platform. moomoo and Webull support fractional share trading, while Robinhood and Webull also support cryptocurrency trading, meeting diverse investment needs. Mitrade focuses on CFD trading, suitable for users seeking leverage and diversified asset allocation.

Fund Deposits and Withdrawals

When Chinese users deposit or withdraw funds through U.S. stock brokerages, common channels include personal bank card cross-border transfers and Hong Kong bank cards. Personal bank card transfers require converting RMB to USD and transferring via online banking to the brokerage account, with funds arriving in 1-3 business days. Banks charge transfer fees, telegraph fees, and intermediary bank fees, while brokerages typically do not charge. Hong Kong bank cards, such as those from Wing Lung Bank or CMBC Hong Kong, take about two weeks to set up, with transfer speed depending on the method. The minimum deposit threshold is typically $3,000, and currency exchange and cross-border transfers must comply with China’s foreign exchange regulations, with an annual exchange quota of $50,000.

Note: Ensure accurate recipient information and remarks are provided during transfers to avoid failures.

Customer Support

Futu Securities and Tiger Brokers offer Chinese customer service, with Futu providing 24/7 WeChat support and fast response times. Webull and moomoo also have Chinese customer service, suitable for Chinese users. Robinhood’s customer service experience is poorer, primarily relying on email responses with slow turnaround. Interactive Brokers supports Mandarin and Cantonese but has a complex platform. Overall, Futu and Tiger Brokers excel in customer support, promptly addressing account opening, trading, and fund issues.

Feature Comparison

| Feature/Brokerage | Futu/Futu moomoo | Tiger Brokers/TradeUP | Interactive Brokers (TD Ameritrade) | Webull | Robinhood | moomoo |

|---|---|---|---|---|---|---|

| Fractional Share Trading Fees | $0.0049/share, min. $0.99; platform fee $0.005/share, min. $1 | $0.0039/share, min. $0.99; platform fee $0.004/share, min. $1 | Lifetime free stock and options trading | Zero commission, zero platform fee | Zero commission | Zero fees |

| Cryptocurrency Support | Not supported | Not supported | Supports forex, futures, etc., no clear cryptocurrency trading | Supports Bitcoin, Ethereum, etc., no fees | Supports cryptocurrency trading | Does not support cryptocurrency trading |

| IPO Subscription Support | Supports Chinese concept stock IPOs, high allocation rates | Supports U.S. stock IPOs, broad coverage, high returns | Requires asset or trading volume conditions, high threshold | Supports U.S. stock IPOs, zero commission, zero fees | No clear IPO subscription support | Supports U.S. stock IPOs |

| Pre-Market/After-Hours Trading Hours | 4 AM–8 PM (ET) | 7 AM–8 PM (ET) | 7 AM–8 PM (ET) | 4 AM–8 PM (ET) | Non-Gold: 9 AM–6 PM, Gold: 4 AM–8 PM (ET) | 4 AM–8 PM (ET) |

| Customer Service | WeChat Chinese customer service | Chinese customer service | Mandarin and Cantonese support | App or phone customer service | No phone support, slow email response | N/A |

| Software Features | Powerful desktop version, Level 2 data, options depth order book | N/A | Professional technical analysis software thinkorswim | Supports limit order placement, Level 2 requires payment | Level 2 requires Gold membership, basic features | N/A |

Overall, Futu, Tiger Brokers, Webull, and moomoo stand out in account opening convenience, Chinese language support, fractional share trading, and IPO subscriptions, meeting the diverse needs of Chinese users. Robinhood and Webull have clear advantages in cryptocurrency trading and zero commissions. Investors can choose a brokerage based on their needs to enhance their U.S. stock investment experience.

U.S. Stock Investment Feature Analysis

Trading Experience

Mainstream U.S. stock brokerages offer distinct trading experiences. Futu moomoo and Tiger Brokers provide clean, intuitive interfaces, supporting one-click trading, conditional orders, take-profit, and stop-loss instructions. Webull and Robinhood are known for their minimalist style, ideal for users new to U.S. stock investing. Interactive Brokers, while feature-rich, has a more complex interface, better suited for experienced investors. Fractional share trading is widely available on platforms like Webull and moomoo, allowing investors to participate in high-priced stocks with smaller funds, enhancing flexibility. For fund deposits and withdrawals, Futu and Tiger Brokers support USD transfers via Hong Kong bank accounts, with fast processing and transparent fees. Overall, platforms with user-friendly interfaces and smooth operations better meet the needs of Chinese users for U.S. stock investing.

Fee Transparency

Fee structures directly impact investment returns. Brokerages like Robinhood, Webull, and moomoo offer zero-commission trading, eliminating extra costs per trade. Futu and Tiger Brokers charge approximately $1–2 per trade in commissions and platform fees. Interactive Brokers has varying fee rates based on account types, with some requiring high funding thresholds. Some brokerages may incur additional fees for deposits, withdrawals, or currency conversion. Investors should note bank fees for cross-border transfers, such as those via Hong Kong banks. Platforms generally display detailed fee breakdowns on their apps or websites, allowing users to check costs easily. High fee transparency helps investors plan U.S. stock investment costs effectively.

Technical Tools

Technical analysis tools and data services are critical for improving U.S. stock investment decision-making efficiency. Major brokerages and third-party platforms offer diverse technical analysis support:

| Platform Name | Technical Analysis Tools and Data Services |

|---|---|

| Yahoo Finance | Real-time market data, financial news, portfolio tracking, supports fundamental and technical analysis. |

| Cailianshe | Big data analysis, identifying market trends, fund flows, and market sentiment. |

| TradingView | Rich charting and indicator tools, supports custom technical analysis and data comparison, with a professional community. |

| U.S. Stock Home | Real-time market data, news, financial reports, technical analysis, integrated with smart data analysis tools. |

| DaZhihui | Real-time market data, financial reports, smart stock selection, and fund flow analysis. |

Some brokerages, like Firstrade, offer AI-driven FirstradeGPT, combining professional analyst data to provide company analysis, financial data, data visualization, and market insights. Investors can access accurate investment recommendations through advanced financial language processing. Platforms like Tiger Brokers and Interactive Brokers also integrate rich real-time market data, research reports, and smart stock selection tools. Chinese users can select appropriate technical tools based on their needs to enhance the professionalism and efficiency of U.S. stock investing.

Pre-Market and After-Hours Trading

The U.S. stock market supports pre-market, regular, and after-hours trading to meet diverse investor needs. The specific trading sessions are as follows:

| Trading Session | Time (ET) | Time (Beijing Time) | Trading Activity | Liquidity | Trading Features | Supported Brokerages & Stock Range |

|---|---|---|---|---|---|---|

| Pre-Market Trading | 4:00 AM–9:30 AM | 4:00 PM–9:30 PM | Low | Poor | Limit orders only, high price volatility, limited software features | Most U.S. stock brokerages support |

| Regular Trading | 9:30 AM–4:00 PM | 9:30 PM–4:00 AM | Highest | Best | Strong liquidity, high trading volume, relatively stable prices | All mainstream brokerages support |

| After-Hours Trading | 4:00 PM–8:00 PM | 4:00 AM–8:00 AM | Low | Poor | Limit orders only, high price volatility | Most U.S. stock brokerages support |

| Overnight Trading | After-hours continuation | After-hours continuation | Lower | Poorer | Limited to 600+ active stocks and mainstream ETFs, higher price volatility | Chinese internet brokerages like Futu, Tiger, Longbridge support |

Pre-market and after-hours trading have lower trading volumes, poorer liquidity, and higher price volatility, requiring cautious operation. Overnight trading, primarily developed by brokerages like Futu and Tiger, supports select active stocks and ETFs, suitable for Chinese investors with specific needs. Regular trading hours offer the best liquidity, ideal for most U.S. stock investors.

Margin Trading

Margin trading services provide leverage and short-selling opportunities. Mainstream brokerages like Interactive Brokers, Futu, and Tiger Brokers support margin trading. Investors can apply for margin based on account funds, with interest rates varying by brokerage and market conditions. For example, Interactive Brokers typically offers lower-than-average margin rates, suitable for high-frequency traders and large-fund users. Futu and Tiger Brokers provide Chinese-language guidance and risk warnings, lowering the entry barrier. Margin trading carries high risks, and investors should fully understand the rules and manage leverage ratios to ensure safe U.S. stock investing.

IPO Subscriptions and Protections

U.S. stock IPO subscriptions have become a focus for Chinese investors. Brokerages like Futu, Tiger Brokers, and Webull support U.S. stock IPOs, with some offering high allocation rates and broad coverage. Investors can subscribe via apps with a simple process. Some brokerages require specific funding for IPO subscriptions, so investors should prepare USD funds in advance. U.S. stock investment platforms are generally regulated by the Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC), with SIPC providing up to $500,000 in account protection (including $250,000 in cash), enhancing fund security. Investors should focus on platform compliance and fund protection measures to ensure safe U.S. stock investing.

User Experience Comparison

Image Source: pexels

Identity Verification

Major U.S. stock brokerages have strict identity verification processes. Chinese users typically need to upload passport or ID photos and provide detailed personal information. Platforms like Webull and moomoo support account opening without a Social Security Number (SSN), suitable for international students and new investors. Brokerages like Firstrade offer Chinese interfaces and guidance, reducing the complexity of identity verification. User feedback indicates that Chinese customer service can effectively address questions during document verification, improving account opening efficiency.

Deposit Challenges

Chinese users often face the following deposit challenges in U.S. stock investing:

- Some foreign brokerages like Robinhood lack Chinese customer service, causing communication difficulties.

- Deposit channels are limited, with users preferring trusted Hong Kong banks like Bank of China (Hong Kong), HSBC, and Standard Chartered.

- Product designs may not align with Chinese user habits, leading to suboptimal mobile experiences.

To address these, mainstream brokerages have implemented:

- Full Chinese interfaces and multilingual customer service.

- Support for deposits via Hong Kong bank accounts, covering RMB, HKD, and USD.

- Optimized mobile product designs to simplify trading processes.

- Localized brokerages like Futu and Tiger improve service quality through local customer support and product adaptation.

Tip: Choosing platforms with Hong Kong bank deposit support and Chinese services can significantly enhance fund transfer efficiency and experience.

Customer Service Response

Customer service directly impacts user experience. Firstrade, Futu, and Tiger Brokers offer Chinese customer service through phone, WeChat, and online chat. Firstrade provides 7×21-hour service, with plans to upgrade to 24/7. Users report that Chinese customer service quickly resolves account opening, trading, and fund issues, with minimal time zone impact. Robinhood relies primarily on email responses, with slower turnaround and lower user satisfaction.

Tax Handling

Tax issues are a key concern for Chinese users in U.S. stock investing. Common issues include capital gains tax and dividend tax, with rates varying based on holding periods and income levels. Some states, like New York, also impose state taxes. Brokerages like Webull and Fidelity support tax software, simplifying tax filing. Webull supports SSN-free account opening, ideal for Chinese students. Some investors use a combination of Interactive Brokers, East West Bank, and ITIN to reduce dividend withholding tax rates and isolate asset information. East West Bank accounts are not subject to CRS information exchange, enhancing fund security.

- Tax-saving strategies include using IRA accounts and tax loss harvesting.

- Brokerage support services include diverse account types, tax-friendly features, and tax software assistance.

User Feedback

Chinese users generally report high satisfaction with U.S. stock brokerages. Firstrade is praised for its low, transparent commissions ($6.95 per trade), diverse investment products, and fund security assurances. Key user concerns include:

- Language barriers, addressed by Firstrade’s full Chinese platform and customer service.

- Time zone inconveniences, mitigated by extended customer service hours.

- Fund security, bolstered by SIPC protection mechanisms.

Diverse order types and margin trading services also meet various investment strategy needs. Users generally believe that choosing brokerages with robust localized services and fund security enhances the U.S. stock investment experience.

Scenario Recommendations

New Users

New investors typically prioritize platform usability, service quality, and fund security. The following brokerages stand out:

- Webull is favored for its simple, user-friendly trading platform and high-quality customer service.

- Tiger Brokers offers a robust trading system, low commissions, and diverse investment products, suitable for all investor types.

- Futu Securities, Tiger Brokers, Webull, and Meitiancha emphasize reputation and service quality, ensuring investment safety.

- Choosing large, reputable brokerages like Interactive Brokers, Charles Schwab, TD Ameritrade, E*Trade, and Fidelity reduces risks.

Recommendation: New users should prioritize platforms with high safety and comprehensive services, aligning with their risk tolerance.

Chinese Language Priority

For investors prioritizing Chinese language services, the following brokerages are suitable:

- Futu Securities, backed by Tencent, offers a simple, intuitive product design and excellent Chinese services, ideal for users accustomed to Chinese interfaces.

- Tiger Brokers has a mature product system, stable services, and Chinese interface support.

- BIYAPAY, a Hong Kong-based platform, offers low account opening thresholds, a simple process, Chinese support, and competitive fees.

Frequent Trading

Frequent traders should focus on trading fees, platform stability, and customer service. The table below compares key considerations:

| Concern | Description |

|---|---|

| Trading Fees | Futu Securities, Charles Schwab, TD Ameritrade, and E*TRADE offer zero-commission trading. Interactive Brokers has low but complex fees. |

| Platform Features | TD Ameritrade’s ThinkorSwim, Interactive Brokers, and Futu Securities offer robust research tools and demo accounts. |

| Customer Service | Futu Securities and Charles Schwab excel in educational resources and customer service. |

| Security | Choose brokerages with strong regulatory backgrounds to ensure fund and data safety. |

Technical Analysis

Users with high technical analysis needs should choose brokerages with in-house technical teams and licenses:

- BBAE Securities holds a U.S. brokerage license, ensuring compliant operations and account safety.

- Its technical team has experience developing 24/7 online trading systems, ensuring safety and stability.

- BBAE Securities supports complex needs of high-net-worth clients with full-process personalized services.

- Compared to internet brokerages relying on third-party systems, in-house technical platforms better meet the personalized needs of technical analysis users.

Fund Security

In 2024, multiple brokerages continued to strengthen network and information system security. Regulatory requirements mandate that system performance capacity reaches three times the historical peak, with network bandwidth at twice the past year’s peak. Brokerages generally establish IT risk management systems, adopting encrypted storage, disaster recovery systems, and contingency plans to enhance emergency response capabilities. Historical security incidents, such as the 2010 Nasdaq technical failure and the 2012 Knight Capital software error, remind investors to choose stable financial institutions and diversify investments to reduce risks.

Mainstream U.S. stock brokerages each have unique strengths. Futu Securities performs strongly in the Canadian market, while Tiger Brokers covers the UK and parts of Europe. Chinese users should assess platforms based on their financial situation and risk tolerance. Recent policies promoting the integration of digital assets and U.S. stock investing mean investors should focus on service details and fund security and stay updated on brokerage services and policy changes.

FAQ

What materials are required to open a U.S. stock brokerage account?

Investors need a valid ID (e.g., passport), proof of address, and bank card information. Some platforms support SSN-free account opening, suitable for Chinese users.

How do Chinese users deposit funds into a U.S. stock brokerage account?

Users can transfer USD via Hong Kong bank accounts. Some brokerages support RMB exchange transfers. Ensure accurate recipient information to avoid delays.

What are the main fees for U.S. stock brokerages?

Fees include trading commissions, platform fees, and deposit/withdrawal fees. Some platforms offer zero-commission trading. Cross-border transfers may incur bank fees, which should be reviewed in advance.

What taxes apply to U.S. stock investments?

Investors must pay capital gains tax and dividend tax. Some brokerages offer tax software to simplify filing. Consult professionals for guidance.

How do U.S. stock brokerages ensure fund security?

Mainstream brokerages are regulated by U.S. authorities, with accounts protected by SIPC up to $500,000. Investors can verify safety measures on brokerage websites.

This article provides a comprehensive analysis of the features Chinese users look for when choosing a US stock investment brokerage. It covers key aspects like account opening, fees, tradable products, customer service, and technical tools. The article gives a detailed comparison of the pros and cons of brokers like Futu, Tiger, Webull, and moomoo, offering valuable insights for different types of investors.

However, while the article provides a wealth of information, it doesn’t fully address a core issue many Chinese investors face: the efficiency and cost of cross-border fund transfers. Traditional funding methods, such as international bank wire transfers, are not only complex and time-consuming but also come with high fees and opaque exchange rate spreads. These factors can directly impact investment returns and increase transaction costs.

BiyaPay was created to solve these cross-border financial pain points. We offer a smoother, more cost-effective channel for your investments. We support the conversion between various fiat and digital currencies, allowing you to easily manage global assets, and provide a real-time exchange rate query feature to ensure you always get the best rates. What’s more, our remittance fees are as low as 0.5% with same-day delivery, significantly cutting down your transaction costs and time. Now, you don’t need a complex overseas account to invest in both U.S. and Hong Kong stocks on one platform. Say goodbye to the hassle of cross-border payments and start your efficient financial journey. Register with BiyaPay today to make fund management as smooth as trading.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.