- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Practical Guide to Choosing a Hong Kong Stock Trading Platform for Chinese Investors

Image Source: pexels

When choosing a Hong Kong stock trading platform, you should focus on safety and compliance, fee structures, product types, account opening processes, operational experience, service quality, and promotional offers. It’s recommended to prioritize platforms regulated by the Hong Kong Securities and Futures Commission (SFC). As of June 2024, 11 virtual asset trading platforms have received SFC approval, offering higher compliance. The number of users for securities apps continues to grow, with industry resources concentrating on leading platforms. By combining your needs and investment style, you can more efficiently select a Hong Kong stock trading platform that suits you.

Key Points

- When choosing a Hong Kong stock trading platform, prioritize those regulated by the SFC to ensure fund safety and compliant operations.

- Pay attention to trading commissions and deposit/withdrawal fees to control investment costs reasonably and leverage platform promotions to reduce expenses.

- Choose platforms supporting multiple markets and products to meet diverse investment needs and achieve diversified asset allocation.

- Opt for platforms with simple and convenient account opening processes, prepare ID documents and a Hong Kong bank account, and prioritize fast deposit methods.

- Value platform usability and Chinese customer service, selecting platforms with quick responses and good service to enhance investment efficiency and experience.

Safety and Regulation

Regulatory Bodies

When selecting a Hong Kong stock trading platform, you should first check whether the platform is regulated by the Hong Kong Securities and Futures Commission (SFC). As the core regulatory body for Hong Kong’s financial markets, the SFC imposes strict licensing requirements. Only platforms that have obtained an SFC license can operate compliantly. You can verify a platform’s licensing status on the SFC’s official website. Licensed platforms must meet high standards for cybersecurity and technical infrastructure, establishing robust risk management systems. These measures effectively mitigate potential risks, ensuring the safety of your investments.

Tip: The SFC’s regulatory philosophy emphasizes “same business, same risks, same rules,” scrutinizing the underlying assets and fund flows beyond the surface structure of financial products to further protect investor interests.

Fund Safety

When using a Hong Kong stock trading platform, fund safety is one of the most critical considerations. Platforms regulated by the SFC adopt multiple safety measures:

- The vast majority of user assets are stored in offline cold wallets, isolating them from cyberattack risks.

- Multi-signature and military-grade encryption technologies are used to enhance the security of asset operations and storage.

- Platforms must establish comprehensive risk management and internal oversight mechanisms to ensure compliant and transparent fund flows.

- Regulatory oversight of fiat-pegged stablecoin issuers includes reserve asset management, anti-money laundering, counter-terrorism financing, and know-your-customer (AML/CFT/KYC) measures to enhance market stability.

When choosing licensed brokers like Futu Securities or Longbridge Securities, you can enjoy higher fund safety assurances. Futu Securities, backed by Tencent, has a strong brand reputation and excellent customer service. Longbridge Securities holds SFC licenses for Types 1, 4, and 9, as well as licenses in the US, Singapore, and New Zealand, offering enhanced safety. Longbridge Securities processes withdrawals through the edda channel, which is free and fast, ensuring convenient fund flows without additional fees. These advantages make you feel more secure when investing in Hong Kong stocks.

Fee Structure

Image Source: unsplash

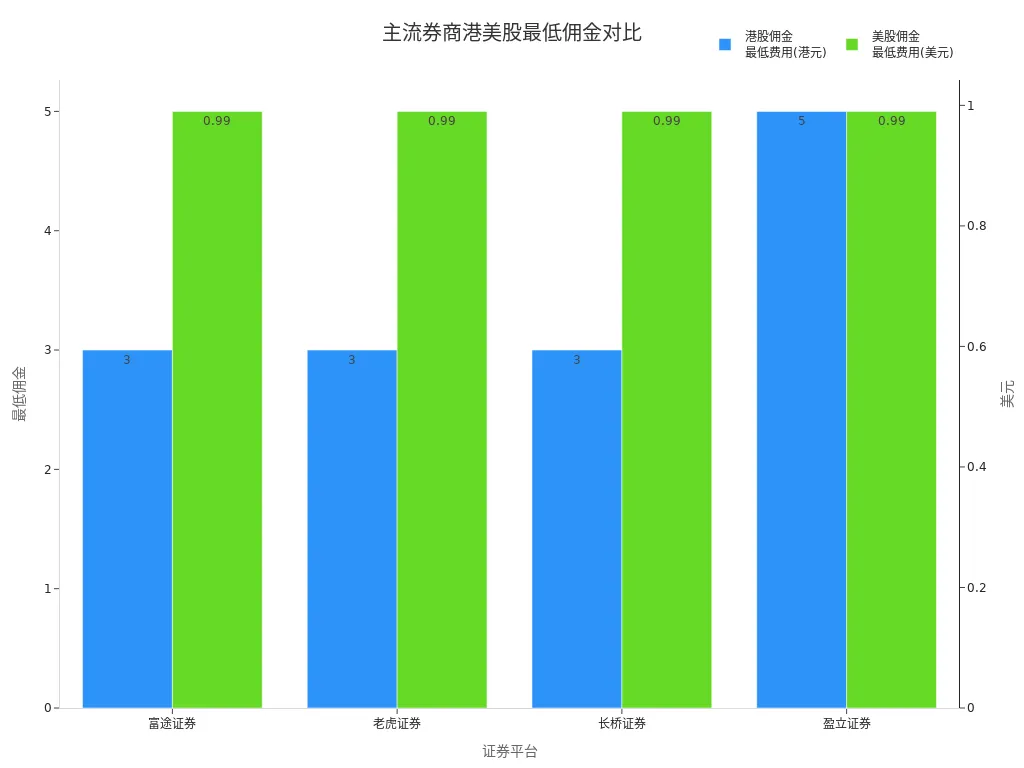

Trading Commissions

When selecting a Hong Kong stock trading platform, trading commissions are the most direct factor affecting investment costs. The average commission rate for Hong Kong stock trading is about 0.03% (3 basis points), with slight variations among brokers. You can consider the following points:

- Mainstream brokers like Futu Securities, Longbridge Securities, and Tiger Brokers typically charge 0.03% for Hong Kong stock commissions, with a minimum of 3 HKD (approximately 0.38 USD, based on 1 USD = 7.8 HKD).

- Smaller brokers may charge higher commissions, reaching 0.06% or even 0.1%.

- You also need to pay stamp duty, trading system usage fees, and other charges, totaling about 0.11% of the transaction amount.

You can negotiate lower commission rates by increasing trading frequency or discussing with the broker. Some platforms offer VIP discounts based on account fund size.

Platform Fees

Platform fees include usage fees, account management fees, and more. The fee structures of mainstream online brokers are as follows:

| Broker Platform | Hong Kong Stock Commission Rate & Minimum Fee | US Stock Commission Rate & Minimum Fee | Feature Description |

|---|---|---|---|

| Futu Securities | 0.03%, minimum 3 HKD | 0.0049 USD/share, minimum 0.99 USD | User-friendly interface, rich research resources |

| Tiger Brokers | 0.03%, minimum 3 HKD | 0.0039 USD/share, minimum 0.99 USD | Supports fractional share trading, good US stock options experience |

| Longbridge Securities | 0.03%, minimum 3 HKD | 0.0049 USD/share, minimum 0.99 USD | Strong social investing features, suitable for beginners |

| Wide Easy Securities | 0.025%, minimum 5 HKD | 0.0049 USD/share, minimum 0.99 USD | Low commission strategy, suitable for high-frequency traders |

When opening an account, you can also check for new user rewards. For example, some platforms offer 180 days of commission-free Hong Kong stock trading for new users, and a first deposit of at least 2,600 USD may grant lucky draw opportunities and fund income vouchers. Inviting friends to open accounts can also yield additional rewards.

Deposit and Withdrawal Costs

When using a Hong Kong stock trading platform, deposit and withdrawal costs mainly include account opening fees, deposit fees, and withdrawal fees:

- Account opening fees: Some brokers charge about 13–65 USD, while others offer free account opening.

- Deposit fees: Some brokers do not charge deposit fees, but Hong Kong banks or intermediary banks may charge around 38 USD.

- Withdrawal fees: Withdrawals to Hong Kong bank cards are usually free, but withdrawals to overseas bank cards may incur a 45 USD service fee, and receiving banks may charge additional fees.

- Fund requirements: Some brokers require a minimum account balance of about 130–650 USD to activate trading permissions.

You need to complete deposit and withdrawal operations via a Hong Kong bank account, with common methods including bank-securities transfers, online banking remittances, and EDDA fast deposits. When choosing a platform, it’s advisable to thoroughly understand all fees to control trading costs effectively.

Product Types

Markets Supported by Hong Kong Stock Trading Platforms

When choosing a Hong Kong stock trading platform, you should consider which markets the platform supports. Mainstream platforms typically cover multiple markets, helping you achieve diversified asset allocation. You can trade Hong Kong, US, and A-shares on these platforms. For example, Longbridge Securities’ trading system supports stocks, ETFs, warrants, and options in the US and Hong Kong markets. Platforms like Futu Niuniu and Tiger Brokers also provide trading services for US and Hong Kong stocks. This allows you to flexibly select high-quality assets from different markets based on your investment goals.

Tip: Multi-market support enables you to diversify risks and seize global investment opportunities.

US Stocks, A-Shares, ETFs, and More

On Hong Kong stock trading platforms, you can not only trade Hong Kong stocks but also invest in US stocks, A-shares, ETFs, options, and other products. Longbridge Securities supports securities products across Hong Kong, US, and A-share markets, offering additional options like warrants, callable bull/bear contracts, REITs, money market funds, and off-exchange funds. Futu Niuniu and Tiger Brokers also provide diverse investment tools like ETFs and options. You can participate in the growth of globally renowned companies or choose index funds to diversify investment risks.

- Products you can trade on mainstream platforms include:

- Hong Kong stocks

- US stocks

- A-shares

- ETFs

- Options

- Warrants, callable bull/bear contracts

- REITs, money market funds, off-exchange funds

Choosing a Hong Kong stock trading platform with multi-market and multi-product support can meet investment needs at different stages, enhancing asset allocation flexibility.

Account Opening and Deposits

Image Source: pexels

Account Opening Process

When selecting a Hong Kong stock trading platform, the account opening process is typically very convenient. You only need to prepare your ID, Hong Kong/Macau pass, or passport, along with Hong Kong bank account details. Most platforms support fully online account opening. You can submit documents via the app or website, upload photos of your ID, and fill in personal information as prompted. Some platforms may require video verification to confirm your identity. Upon approval, you’ll receive a notification of successful account opening. The entire process generally takes 1–2 business days. When opening an account, ensure your information is accurate. Some platforms have minimum deposit requirements for new users, typically 130–650 USD (based on 1 USD = 7.8 HKD), so you should prepare funds in advance.

Tip: Prepare all materials in advance to significantly improve account opening efficiency.

Deposit Methods

After opening an account, you need to transfer funds into your securities account. Hong Kong stock trading platforms support multiple deposit methods. You can choose the most suitable method based on your needs:

- Bank-securities transfer: You can directly transfer funds between your Hong Kong bank account and securities account, which is convenient and fast. However, not all banks and brokers support this, and some banks may charge fees.

- eDDA fast deposit: By linking your Hong Kong bank account and authorizing it in the broker’s app, funds can arrive in as fast as 5 minutes without uploading transfer proof. Most mainstream brokers and banks support this, making it simple and ideal for frequent traders.

- FPS (Fast Payment System): Launched by the Hong Kong Monetary Authority, this supports 24/7 transfers with no fees. You need to upload transfer proof, and funds typically arrive on the same day or the next trading day.

- Traditional online banking transfer: You can transfer via Hong Kong bank online banking, uploading transfer proof. The arrival time is similar to FPS, but the process is more cumbersome.

When choosing a deposit method, prioritize eDDA and FPS for their fast processing and convenience, enhancing fund usage efficiency.

Operational Experience

App and Web Platform

When selecting a Hong Kong stock trading platform, operational experience is crucial. Mainstream platforms like Futu Niuniu, Tiger Brokers, and Snowball Securities offer both app and web platforms. You can check market data and trade on your phone anytime or perform in-depth analysis on the web platform. The app interface is clean, supporting personalized settings and multi-language switching. The web platform is ideal for users needing large screens and multi-window operations. You can receive real-time market push notifications and set price alerts via the app to seize market opportunities. Account management, fund transfers, and transaction history queries are all readily available. Whether you’re a beginner or experienced investor, you can quickly get started.

Tip: Use both the app and web platform simultaneously for flexible switching and improved trading efficiency.

Market Data and Tools

On Hong Kong stock trading platforms, you can access rich market data and investment tools. Mainstream platforms provide the following features:

- After registering and logging in, you can set up a watchlist to easily track Hong Kong stock real-time market data.

- You can view detailed data like price, percentage change, trading volume, intraday charts, and candlestick charts.

- Technical analysis tools like moving averages, MACD, and KDJ help you make investment decisions.

- Platforms push financial news, policy interpretations, and company announcements to keep you updated on market dynamics.

- You can use simulated trading to gain experience and reduce real trading risks.

- Smart stock selection features allow screening for potential stocks based on financial metrics.

The table below compares market data and tool experiences of mainstream platforms:

| Platform Name | Market Data Features | Investment Tool Features | User Experience |

|---|---|---|---|

| Futu Niuniu | Real-time Hong Kong, US, A-share market data | Smart stock selection, quantitative trading | Clean and smooth interface |

| Snowball Securities | Real-time global multi-market data | Smart advisory, quantitative trading | User-friendly operations |

| Tiger Brokers | Multi-market data and trading products | News, market data | Multi-language switching |

| Washington Securities | Real-time Hong Kong, US market data | New share subscriptions, Hong Kong IPOs | Personalized analysis |

You can choose a platform based on your needs, leveraging rich tools to enhance investment efficiency.

Customer Service

Chinese Support

When choosing a Hong Kong stock trading platform, Chinese customer support is crucial. Many platforms offer multiple Chinese service channels to help you resolve trading and account issues. You can get assistance through:

- Online customer service: You can consult directly via the platform’s app or website for instant answers.

- Customer hotline: For example, Guoyuan Securities provides the 95578 hotline for convenient phone communication.

- Diverse electronic channels: You can contact customer service via SMS, WeChat, QQ, or the company website.

- Comprehensive services: The support team offers trading assistance, business inquiries, information services, complaint handling, and follow-up visits. You can also provide feedback and participate in satisfaction surveys to help platforms improve.

These services cater to individual clients, aiming to enhance service quality and meet diverse investor needs. When facing issues, you can choose the most convenient communication method for quick assistance.

Tip: Prioritize platforms with robust Chinese services and diverse communication channels to significantly improve your investment experience.

Response Speed

During investing, customer service response speed directly impacts your experience. Many Hong Kong stock trading platforms use smart customer service systems for second-level responses. You can get answers almost instantly when encountering issues. For example, Northeast Securities’ smart customer service system has strong semantic recognition and analysis, typically responding within one second. GF Securities offers 24/7 service, ensuring timely answers anytime. Guoxin Securities’ “Xiaoxin Smart Customer Service” supports 24/7 online assistance with a 95% issue recognition rate and over 80% response accuracy.

- When consulting on the platform, smart customer service typically responds within one second.

- For complex issues, the system intelligently assigns human customer service to ensure professional answers.

- Many platforms offer 24/7 support, providing help anytime, day or night.

Choosing a platform with fast response times allows you to resolve trading issues efficiently, reducing wait times and improving overall investment efficiency.

Promotional Offers

New User Rewards

When choosing a Hong Kong stock trading platform, you can look into rewards offered to new users. Many platforms use cash, stocks, or combined rewards to attract you to open accounts and deposit funds. By completing account opening and making your first deposit, you can qualify for these rewards. Rewards typically range from 100 HKD to 299 CNY, equivalent to approximately 13 USD to 38 USD (based on 1 USD = 7.8 HKD). Refer to the table below for common new user reward types and amounts:

| Reward Type | Details | Amount Range (USD) |

|---|---|---|

| Cash Reward | Account opening gift of 299 CNY IPO package | Approx. 38 USD |

| Stock Reward | Net deposit ≥2,564 USD in the first month, receive 3 Xiaomi shares | Approx. 22 USD |

| Stock Reward | Net deposit ≥12,820 USD in the first month, receive 5 Xiaomi shares | Approx. 37 USD |

| Cash + Stock | 5 HSBC shares + 13 USD cash | Approx. 13 USD + stocks |

When opening an account, prioritize platforms with generous rewards to effectively reduce initial investment costs.

Transfer Incentives

If you already hold Hong Kong stocks on another platform, you can look into transfer incentives. Many Hong Kong stock trading platforms offer rewards to encourage you to transfer stocks to their platform. After completing the transfer, you may receive cash, stocks, or commission-free vouchers. Some platforms provide tiered rewards based on the market value of transferred stocks. For example, transferring stocks worth 2,564 USD may earn a 10 USD cash voucher; transferring over 12,820 USD may yield higher rewards. Before transferring, thoroughly review each platform’s policies to choose the most suitable reward plan.

- You can obtain transfer incentives through:

- Applying for a transfer online and uploading relevant proof.

- Waiting for platform review and stock transfer completion.

- Receiving cash, stocks, or commission-free vouchers.

During the transfer process, consult platform customer service in advance to understand procedures and reward details to ensure you receive all incentives smoothly.

Investor Type Recommendations

Beginners

When starting to invest in Hong Kong stocks, choosing the right platform is crucial. You should prioritize platforms with simple interfaces, user-friendly operations, and rich information. These platforms help you get started quickly and reduce operational errors. When choosing, consider:

- Whether the platform provides detailed investor service guides, such as account opening, stock trading, and position queries.

- Support for multiple account opening methods, including online, witnessed, and in-person account opening, to suit your circumstances.

- Comparing brokers’ scale, trading fees, software features, customer service, and research capabilities to match your needs.

- Fast market data and rich information content with a clear and simple interface.

- Platforms supporting multi-bank custody, ETF subscriptions, money market funds, and wealth management to meet basic investment needs.

For early-stage investing, consider platforms like Tencent Zixuan Gu, which offer simple interfaces and smooth operations. Platforms like Dazhihui provide AI-driven full-chain alerts and professional analyst insights to enhance safety and research capabilities.

Intermediate

With some investment experience, your requirements for Hong Kong stock trading platforms increase. You’ll focus on professional databases, in-depth financial news, and diverse investment tools. Consider these features:

- Platforms supporting Hong Kong Stock Connect ETF trading, margin trading, and stock options.

- PC or app-based trading systems with automatic stop-loss/profit, options strategy trading, and portfolio orders.

- Using cross-border asset allocation tools like “Ganggu Bao” for one-click global asset strategy configuration, lowering investment barriers.

- ETF investment tool matrices to capture market sentiment in real time, intelligently screening high-quality ETFs for tech sectors and cross-border Hong Kong stock assets.

- Smart monitoring features for 24/7 ETF tracking, automatically extracting core insights to help you seize investment opportunities.

- Participating in “Follow Me” sections for premium advisory services to establish investment discipline and avoid irrational decisions.

Choose platforms like Eastmoney with comprehensive databases and strong professionalism to meet higher data and information needs.

Professional

As a professional investor, your requirements for Hong Kong stock trading platforms are the most stringent. You’ll prioritize:

- All transaction-related fees, including commissions, platform fees, settlement fees, and stamp duties, which directly impact investment returns.

- Platforms with access to local and international markets, supporting stocks, bonds, ETFs, options, futures, mutual funds, and cryptocurrencies to meet diverse strategy needs.

- Support for extended trading hours to seize international market opportunities.

- Flexible account types and minimum deposit requirements to suit different fund sizes.

- Availability and interest rates of margin accounts, affecting trading costs.

- Platform security and stability to ensure fund safety and smooth trading.

- IPO participation opportunities and smart investment services to enhance convenience and potential.

Refer to the table below for a quick overview of investor type needs and typical platforms:

| Investor Type | Main Needs and Preferences | Typical Platforms and Features |

|---|---|---|

| Beginner | Simple interface, user-friendly, rich but not complex information | Tencent Zixuan Gu: Simple interface, smooth operation, beginner-friendly |

| Intermediate | Professional databases, in-depth financial news | Eastmoney: Comprehensive database, strong professionalism for experienced investors |

| Professional | Comprehensive features, AI stock selection, smart monitoring, professional analysis | Zhiliao Xuangu: Offers AI stock selection, smart monitoring, professional analysis |

For a higher-tier investment experience, choose platforms with comprehensive features, AI stock selection, and smart monitoring, like Zhiliao Xuangu, which provide professional analysis and all-around tools.

When choosing a Hong Kong stock trading platform, combine your investment stage and needs, prioritizing suitable features and services. This ensures you can efficiently achieve your investment goals and enhance your overall experience.

Hong Kong Stock Trading Platform Comparison

Key Differences

When selecting a Hong Kong stock trading platform, compare aspects like fees, product support, service experience, and account security. The table below summarizes the main differences between Futu Securities, Tiger Brokers, and Webull Securities (for reference):

| Dimension | Futu Securities | Tiger Brokers | Webull Securities (Reference) |

|---|---|---|---|

| Fees | US stocks ~$0.013/share, min $2.99/trade; HK stocks 0.03% + ~$1.92; margin rate 6.8% | US stocks $0.012/share, min $2.99/trade; HK stocks 0.029% + ~$1.92; margin rate 4.6%-5.6% | US stocks commission-free; HK stocks commission-free but ~$1.28 platform fee; margin rate 5%+ |

| Product Support | US and HK stocks, supports US clients opening HK stock accounts | US and HK stocks, supports US IPOs for Chinese companies | US and HK stocks, supports US IPOs for US companies |

| Service Experience | Stable trading system, rich investment community | Tech innovation, smart advisory, quantitative trading | Flexible user experience and customer service |

| Account Opening & Deposits | ID + phone number, first deposit >~$1,282 | ID + phone number, first deposit >~$1,282 | ID + phone number, first deposit >$1,100 |

| Account Security | $500,000/~$19,230 account insurance | $500,000/~$19,230 account insurance | $500,000/~$19,230 account insurance |

You can see that different platforms emphasize different fee structures and product features. Futu Securities and Tiger Brokers are licensed for both US and Hong Kong stocks, with stable trading systems and good service experiences. Webull Securities attracts users with commission-free trading but charges platform fees. When choosing, ensure the platform transparently displays all fees and rules on its homepage to avoid unreasonable charges.

Tip: According to the Guidelines for Compliant Fee Practices of Online Trading Platforms, all Hong Kong stock trading platforms must transparently display fee standards, and any fee adjustments must be announced in advance to protect your right to know and choose.

Suitable Audiences

Different investor types suit different Hong Kong stock trading platforms. Based on your investment experience and needs, refer to the table below:

| Investor Type | Suitable Platform | Main Reasons and Features |

|---|---|---|

| Beginner | Futu Niuniu | Simple operations, low fees, user-friendly interface, beginner-friendly |

| Needs Global Real-Time Market Data & Easy Operations | Futu Niuniu | Global real-time market data, rich technical analysis tools, smooth operations |

| Enjoys Social Interaction & Personalized Advice | Tiger Brokers | Strong community and information features, supports multi-market trading |

| Needs Professional Research Tools & Technical Analysis | Huatai Securities, CITIC Securities | Rich investment products, smart trading assistance, meets professional needs |

| Values Trading Safety & One-Stop Wealth Management | Guotai Junan Junhong | Secure and efficient, diverse wealth management tools, ideal for safety-focused users |

If you’re a beginner, choose Futu Niuniu for its simple operations and rich investment guides. If you enjoy community interaction and diverse investment channels, Tiger Brokers is more suitable. Professional investors can opt for Huatai Securities for comprehensive research tools and data support.

Recommendation: When choosing a Hong Kong stock trading platform, consider your investment habits and goals, prioritizing platforms with transparent fees, rich products, and high-quality services to enhance your investment experience and efficiency.

When selecting a Hong Kong stock trading platform, prioritize safety and compliance, transparent fees, rich products, and quality services. The Hong Kong market continues to introduce innovative policies and tech applications, improving trading transparency and risk management. You can leverage smart trading systems and diverse products to flexibly respond to market changes. Combine your investment experience and needs, regularly monitor platform policies and market dynamics, and adjust strategies to ensure the platform aligns with your goals.

FAQ

What documents are needed to open an account with a Hong Kong stock trading platform?

You need to prepare an ID, Hong Kong/Macau pass, or passport, along with Hong Kong bank account details. Some platforms also require proof of address. The account opening process is generally completed online.

What are the minimum deposit requirements for Hong Kong stock trading platforms?

Most platforms require a first deposit of approximately 130 to 650 USD (based on 1 USD = 7.8 HKD). Check the platform’s specific requirements before opening an account and prepare funds accordingly.

How can I transfer funds from mainland China to a Hong Kong stock trading platform?

You can use a Hong Kong bank account for bank-securities transfers, eDDA fast deposits, or FPS transfers. Prioritize eDDA and FPS for fast processing and convenience.

What are the trading hours for Hong Kong stock trading platforms?

You can trade Hong Kong stocks during the Hong Kong Exchange’s regular trading hours, typically Monday to Friday, 9:30 AM–12:00 PM and 1:00 PM–4:00 PM (Hong Kong time).

Are funds safe on Hong Kong stock trading platforms?

Choosing a platform regulated by the SFC ensures funds are segregated. Platforms use multiple encryption and risk control measures to safeguard your funds.

This article serves as a practical guide for Chinese investors on how to choose a Hong Kong stock trading platform. It provides a detailed analysis of key factors such as security and compliance, fee structure, product variety, account opening procedures, user experience, customer service, and promotional offers. The article clearly contrasts the strengths and weaknesses of mainstream platforms like Futu, Tiger Brokers, and Longbridge, offering tailored advice for different types of investors.

However, while the article is comprehensive, a major challenge for many Chinese investors remains: the flow of cross-border funds. Traditional funding methods, such as international bank wire transfers, are not only complex and time-consuming but also come with high fees and opaque exchange rate spreads. These issues can directly impact investment returns and increase transaction costs.

BiyaPay was created to solve these cross-border financial pain points. We offer a smoother, more cost-effective channel for your investments. We support the conversion between various fiat and digital currencies, allowing you to easily manage global assets, and provide a real-time exchange rate query feature to ensure you always get the best rates. What’s more, our remittance fees are as low as 0.5% with same-day delivery, significantly cutting down your transaction costs and time. Now, you don’t need a complex overseas account to invest in both U.S. and Hong Kong stocks on one platform. Say goodbye to the hassle of cross-border payments and start your efficient financial journey. Register with BiyaPay today to make fund management as smooth as trading.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.