- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

A Complete Guide to Getting Started with Hong Kong Stock Trading for Chinese Investors

Image Source: unsplash

If you want to learn about getting started with Hong Kong stock trading, in fact, approximately 39,000 Chinese investors have participated in northbound trading over the past three years. You only need to master a few key steps to take your first step. Whether you are a beginner or an average investor, as long as you operate carefully, each step can become clear and easy to understand. You will find that getting started with Hong Kong stock trading is not difficult, and with careful preparation, you can smoothly embark on your investment journey.

Key Points

- To get started with Hong Kong stock trading, first understand the market structure, major indices, and investment products; mastering basic knowledge helps make informed investment decisions.

- The account opening process includes selecting a broker, submitting identity and financial proof, completing identity verification, and depositing funds; it’s recommended to choose a licensed broker to ensure account security.

- Hong Kong stock trading follows a T+0 trading mechanism, with fund and stock settlement on T+2; you need to plan funds carefully to avoid settlement risks.

- When investing in Hong Kong stocks, pay attention to market volatility and the risks of “pump-and-dump” stocks; diversify investments and stay rational, avoiding blind trend-following and frequent trading.

- Choosing the right broker and trading tools, focusing on fee structures and trading hours, can effectively improve investment efficiency and returns.

Market Basics

Image Source: unsplash

Market Structure

When learning to get started with Hong Kong stock trading, you first need to understand the structure of the Hong Kong stock market. The Hong Kong stock market is composed of various participants, mainly including:

- Institutional investors: Such as pension funds, insurance companies, and hedge funds, which have large capital and strong analytical capabilities.

- Individual investors: You can participate in Hong Kong stock trading through brokers or Hong Kong banks, including both local Hong Kong investors and Chinese investors via Stock Connect.

- Listed companies: These companies are listed on the Main Board or GEM of the Hong Kong Stock Exchange, raising funds through stock issuance.

- Brokers and financial institutions: They provide brokerage services, margin financing, and some act as market makers.

- Market makers: Large financial institutions provide liquidity through two-way quotes.

- Exchange and regulators: The Hong Kong Stock Exchange manages trading operations, while the Securities and Futures Commission oversees regulation to ensure market fairness.

You can refer to the table below to understand the scale of the Hong Kong stock market:

| Time Point | Number of Listed Companies | Total Market Value (HKD Trillion) |

|---|---|---|

| February 14, 2025 | 2,645 | 59 |

| April 2025 | 2,627 | 39.95 |

| Overall Range | Approx. 2,600 | 40–59 |

Currently, the Hong Kong stock market has around 2,600 listed companies, with a total market value ranging from 40 trillion to 59 trillion HKD. Calculated at 1 HKD ≈ 0.13 USD, the total market value is approximately 5.2 trillion to 7.7 trillion USD.

Major Indices

When getting started with Hong Kong stock trading, you often focus on several key indices. The Hang Seng Index, Hang Seng China Enterprises Index, and Hang Seng Tech Index are the three most representative indices, reflecting the overall market and performance of different sectors. Below is the performance of these indices as of March 18, 2025:

| Index Name | Daily Gain | Year-to-Date Cumulative Gain |

|---|---|---|

| Hang Seng Tech Index | Approx. 3.96% | 36.65% |

| Hang Seng China Enterprises Index | Approx. 2.79% | 25.90% |

| Hang Seng Index | Approx. 2.46% | 23.33% |

The Hang Seng Tech Index has performed strongly, driven by AI and capital inflows, showing significant gains. When investing, you can track these indices to gauge market sentiment and opportunities.

Investment Products

The Hong Kong stock market offers you a variety of investment products. You can trade securities listed on the Hong Kong Stock Exchange through the Stock Connect mechanism. Common investment products include:

- Main Board and GEM stocks

- ETFs (Exchange-Traded Funds)

- Stock options

- Bonds

- Preferred shares

You can also engage in margin financing, IPO subscriptions, and other investment methods. Stock Connect allows you to trade eligible Hong Kong stocks through the Shanghai and Shenzhen Stock Exchanges, further enriching your investment options.

Hong Kong Stock Trading Process

Image Source: unsplash

Account Opening Preparation

When getting started with Hong Kong stock trading, the first step is account opening. You can choose online or in-person account opening. Online account opening suits most investors, being convenient and completed via the broker’s website or mobile app using facial recognition and video verification. In-person account opening requires you to book an appointment, bring original and copied documents, and have a client manager guide you through filling out forms.

| Main Channels | Description |

|---|---|

| Online Account Opening | Broker’s website or app, supports facial recognition and video verification, no need to visit a branch |

| In-Person Account Opening | Requires appointment, bring original and copied documents, verified on-site with paper forms |

When opening an account, you need to prepare the following documents:

| Required Documents | Description |

|---|---|

| Identity Documents | Resident ID, Hong Kong/Macau Pass, or passport, requiring original verification |

| Proof of Address | Utility bill or Hong Kong bank statement from the past three months |

| Proof of Funds | Hong Kong bank passbook or credit card statement; some brokers may require asset or income proof |

| Others | Sign a risk disclosure statement to understand Hong Kong stock market risks |

You need to follow these steps to complete account opening:

- Choose a suitable broker, comparing services, fees, and reputation.

- Fill out the account opening application and upload or submit required documents.

- Complete identity verification, online via video or in-person at the counter.

- Sign relevant agreements, including the risk disclosure statement.

- Deposit initial funds to activate the account.

You should note that some brokers have capital and experience requirements for Stock Connect accounts. Generally, you need approximately USD 50,000 (at 1 USD ≈ 7.2 HKD) in funds and over two years of securities trading experience. The review process typically takes 1–3 business days, with some brokers having stricter reviews. After submitting documents, you need to wait patiently for the results.

Tip: Choose a licensed broker to ensure account security. Ensure account opening documents are accurate and complete to avoid review failures due to discrepancies.

Fund Deposit

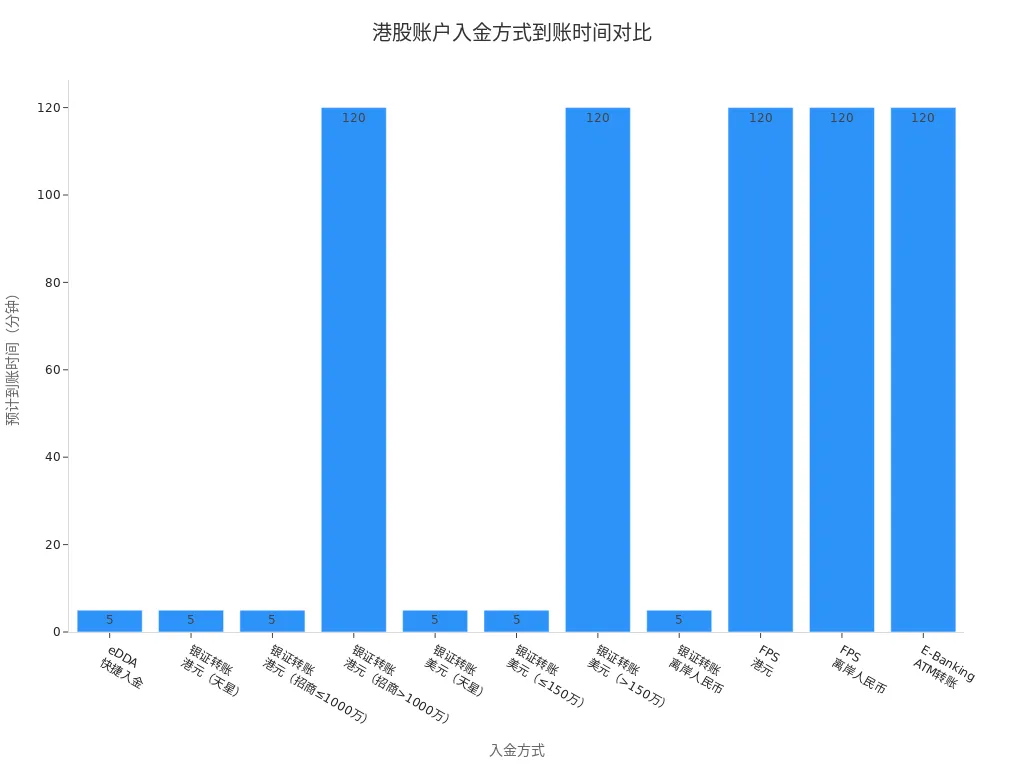

After opening an account, you need to deposit funds into your Hong Kong stock account. You can choose various funding methods, such as Hong Kong bank eDDA quick deposit, bank-securities transfer, FPS (Fast Payment System), or E-Banking/ATM transfer. Processing times vary slightly, typically ranging from 5 minutes to 2 hours. You can select the appropriate method based on your funding needs.

| Funding Method | Specific Method | Initiation Time Range | Estimated Processing Time | Supported Currencies |

|---|---|---|---|---|

| Hong Kong Bank eDDA Quick Deposit | Via Hong Kong bank account | Monday 08:00–Saturday 09:55 | Within 5 minutes | HKD |

| Bank-Securities Transfer | HKD, USD, offshore RMB | Trading days 08:00–18:55 | 5 minutes–2 hours | HKD, USD, offshore RMB |

| FPS (Fast Payment System) | Deposit HKD/offshore RMB | Monday 08:00–Friday 15:00 | Within 2 hours | HKD, offshore RMB |

| E-Banking/ATM Transfer | Same-bank online banking/counter transfer | Hong Kong trading days 09:00–15:00 | Within 2 hours | HKD, USD, offshore RMB, JPY |

When depositing funds, note that some brokers have minimum requirements for initial deposits. Once funds are credited, the account is activated, entering the practical stage of Hong Kong stock trading. Deposits during holidays or non-trading hours may be delayed.

Reminder: Prioritize Hong Kong bank account deposits for fast processing and low fees. For cross-border transfers, monitor exchange rates and fees to avoid unnecessary losses.

Placing Orders

Once funds are credited, you can start placing orders for Hong Kong stock trading. You need to understand the order types and precautions. Hong Kong stock orders are divided into board lot and odd lot trading. Board lot trading is executed via the Hong Kong Stock Exchange’s automatic matching system, while odd lots can only be sold through a semi-automatic matching system, not bought.

You should choose different order types based on trading sessions:

- Pre-opening and closing auction sessions: Use “at-auction limit orders.”

- Continuous trading session: Use “enhanced limit orders.”

After placing an order, the price and quantity cannot be modified, but unexecuted orders can be canceled during permitted cancellation periods: 9:00–9:15, 9:30–12:00, 12:30–16:00, and 16:01–16:06. Hong Kong stocks follow a T+0 trading mechanism, allowing you to sell stocks bought on the same day, but settlement is T+2. You should watch out for settlement risks to avoid defaults due to improper fund planning.

Note: Before placing orders, carefully verify the stock code, price, and quantity. In case of market volatility, suspensions, or delistings, stay updated with broker notifications and Hong Kong Stock Exchange announcements.

Settlement and Delivery

The final step in Hong Kong stock trading is settlement and delivery. Hong Kong stocks use a T+2 settlement system, meaning funds and stocks are settled on the second trading day after the transaction. When you buy stocks on T day, you officially own them on T+2. When selling, funds are credited on T+2.

You need to ensure sufficient funds and stocks in your account to avoid additional fees from settlement failures. Some brokers may freeze funds required for purchases in advance, and funds from sales cannot be reused until credited. You can check settlement status and fund changes anytime via the broker’s trading software.

Summary: The Hong Kong stock settlement process is clear, and the T+2 system helps you plan funds effectively. For settlement issues, contact the broker’s customer service promptly to ensure trading safety.

By following these four steps, you can smoothly complete the full process of getting started with Hong Kong stock trading. Each step requires careful attention to detail to effectively mitigate risks and enhance your investment experience.

Trading Rules

Trading Hours

When trading Hong Kong stocks, you need to understand the specific trading hours. Trading days are divided into multiple sessions:

- Auction Session: 9:00–9:30 a.m.

- Morning Trading: 9:30 a.m.–12:00 p.m.

- Afternoon Trading: 1:00 p.m.–4:00 p.m.

- Closing Auction Session: 4:00 p.m.–4:08 p.m., with random closing before 4:10 p.m.

Hong Kong stocks are closed on Western holidays like Easter and Christmas, with specific dates varying yearly. During extreme weather like typhoons or heavy rain, the Hong Kong Stock Exchange may adjust trading hours. You should check the exchange’s holiday calendar and plan trading accordingly.

Trading Mechanism

Hong Kong stocks use a T+0 trading mechanism. You can sell stocks bought on the same day, offering high liquidity suitable for short-term trading. In contrast, A-shares use a T+1 system, requiring you to wait until the next trading day to sell. Hong Kong stocks have no price change limits and no restrictions on trading frequency. You can flexibly adjust positions based on market changes but must also manage risks.

The T+0 mechanism allows you to lock in profits or stop losses quickly, but risks increase during high market volatility.

Trading Units

The minimum trading unit for each Hong Kong stock is determined by the listed company. You need to check the board lot size when placing orders to avoid transaction failures due to incorrect units. Below are examples of minimum trading units for common stocks:

| Stock Name | Minimum Trading Unit (Board Lot) |

|---|---|

| Tencent Holdings | 100 shares |

| HSBC Holdings | 400 shares |

Common units include 100, 200, 400, 500, or 1,000 shares. You should verify the board lot size of your target stock before placing orders.

Order Types

You can choose different order types. Common ones include:

- Limit Order: You set a specific buy or sell price, and the order executes only when the market price meets or exceeds it. Suitable for price-sensitive, non-urgent trades.

- Market Order: Executes immediately at the current market price, offering speed but with potential price fluctuations. Ideal for urgent trades.

Limit orders help control costs but may not execute if the price is set too high or low. Market orders execute quickly but may deviate during volatile markets. Choose the order type based on your needs and market conditions.

Investment Methods

Individual Stocks

You can directly trade stocks listed on the Hong Kong Stock Exchange. When selecting stocks, focus on the company’s fundamentals, industry outlook, and financial health. Each stock has a different minimum trading unit, such as 100 or 200 shares. You can monitor real-time quotes via broker platforms and adjust holdings flexibly. Investing in individual stocks carries higher risk due to price volatility, requiring some analytical skills.

ETFs

ETFs (Exchange-Traded Funds) offer you diversified investment options. Hong Kong ETFs mainly track the Hang Seng Index, such as ChinaAMC Hang Seng ETF (159920), which has the best liquidity, suitable for frequent trading. The Hang Seng Index covers finance, technology, and other sectors with high-quality constituent stocks and attractive dividend yields. You can also explore thematic ETFs, like the ICBC CSOP Stock Connect Innovation Drug ETF, which uses long-short hedging strategies and invests in bonds for liquidity. Overall, Hong Kong ETFs offer broad coverage and good liquidity, ideal for risk diversification.

IPO Subscriptions

You can participate in Hong Kong IPO subscriptions to aim for listing-day gains. In 2018, Hong Kong IPO subscription success rates reached 61%, with some IPOs achieving 100% success, yielding about USD 700 per lot (at 1 USD ≈ 7.8 HKD). However, from 2023 to 2024, the Hong Kong market was sluggish, with some IPOs dropping over 20% on debut, significantly lowering returns. You should monitor market conditions, control subscription funds, and avoid losses from blind participation.

Derivatives

You can also trade Hong Kong stock derivatives, such as warrants and callable bull/bear contracts (CBBCs). Warrants and CBBCs both offer leverage, amplifying returns. For example, Tencent bull contracts surged 208% in June, far outpacing the underlying stock’s 18% gain. However, CBBCs have a mandatory call mechanism, and if the underlying price hits the call price, you could face significant losses. Warrants can hedge risks but carry high uncertainty. Derivatives are risky and suit investors with high risk tolerance. You must fully understand product rules and risks before investing and proceed cautiously.

Fee Structure

Main Fees

When trading Hong Kong stocks, you need to understand the fees involved in each transaction. Common fees include commissions, stamp duty, trading levy, trading fee, settlement fee, and securities management fee. The table below lists fee standards, converted at 1 USD ≈ 7.8 HKD:

| Fee Item | Fee Standard (HKD) | Converted (USD) |

|---|---|---|

| Commission | 0.03%–0.25% | 0.03%–0.25% |

| Stamp Duty | 0.1% | 0.1% |

| Trading Levy | 0.0027% | 0.0027% |

| Trading Fee | 0.005% | 0.005% |

| Settlement Fee | 0.002%, min 2 HKD, max 100 HKD | 0.002%, min 0.26 USD, max 12.82 USD |

| Securities Management Fee | 0.008%–0.003% (annual) | 0.008%–0.003% (annual) |

You may also encounter custody fees, dividend collection fees, and transfer fees. Some brokers charge monthly custody fees of 0.5–2 USD. Dividend collection fees are typically 0.5%–1% of the dividend amount. Transfer fees are charged per transfer, around 5–10 USD.

Tip: Read the broker’s fee disclosure carefully before trading to avoid impacting returns due to overlooked small fees.

Fee Comparison

When choosing a broker, the fee structure is a key consideration. Mainstream online brokers like Futu Securities, Tiger Brokers, Longbridge Securities, and Vantage Securities have commission rates typically between 0.025%–0.03%, with a fixed platform fee of 12–15 HKD (approx. 1.54–1.92 USD) per trade. Traditional brokers have higher commission rates, usually 0.03%, but can be negotiated down to 0.0085% with a client manager, with a minimum fee of about 0.64 USD. The table below compares mainstream brokers’ fees:

| Broker | Commission Rate | Platform Fee (Per Trade) | Minimum Fee (USD) | Funding Convenience |

|---|---|---|---|---|

| Futu Securities | 0.03% | 1.92 USD | 1.92 USD | High |

| Tiger Brokers | 0.029% | 1.92 USD | 1.92 USD | High |

| Longbridge Securities | 0.025%–0.03% | 1.92 USD | 1.54 USD | High |

| Vantage Securities | 0.03% | 1.54 USD | 1.54 USD | High |

| Traditional Brokers | 0.03% (negotiable) | None/Low | 0.64 USD | Moderate |

Online brokers excel in retail services and innovative features. If you trade frequently with large capital, online brokers are preferable. Traditional brokers are more robust in compliance and institutional services, suitable for those prioritizing security.

Recommendation: Choose a broker based on your trading habits and capital size to optimize transaction costs.

Risks and Pitfalls

Market Risks

When investing in Hong Kong stocks, you first face market risks. The Hong Kong market is highly volatile, significantly affected by global economics, policy changes, and exchange rates. You may encounter sudden events causing sharp price fluctuations. The T+0 trading mechanism allows same-day buying and selling but can amplify losses from frequent trading. You should diversify investments and avoid concentrating on a single stock. During sharp market fluctuations, consider stopping losses promptly to protect capital.

Tip: You can set stop-loss orders to automatically sell during market downturns, reducing losses.

Pump-and-Dump Stocks

The Hong Kong market has “pump-and-dump” stocks, which pose high risks. You should be particularly cautious of the following cases and warning signs:

- Stock 81** has harmed investors through consolidation, capital restructuring, and similar tactics.

- WYT stock caused significant investor losses due to frequent capital maneuvers.

- Willie International (273.HK) has long-term losses, frequent name and code changes, with stock prices consistently below 1 USD (at 1 USD ≈ 7.8 HKD).

- Mongolia Mining (1166.HK) conducted a 10-to-1 consolidation and large-scale rights issues, typical of “pump-and-dump” tactics.

Common warning signs include:

- Frequent company name and management changes.

- Abnormal performance fluctuations or CFO resignations.

- Frequent buying or selling by major shareholders.

- Unstable cash flow or delayed annual results.

Before investing, carefully review company announcements and financial reports, steering clear of these high-risk stocks.

Investment Pitfalls

When investing in Hong Kong stocks, you may fall into common pitfalls. For example, you might focus only on short-term price movements, ignoring company fundamentals. You may also blindly follow hot sectors, neglecting risk management. Some investors frequently switch stocks, increasing fees and reducing returns. You should stay rational, develop an investment plan, and avoid emotional trading.

Recommendation: Learn fundamental analysis, focus on long-term company value, and avoid being swayed by market sentiment.

Practical Tips and Common Questions

Information Sources

During Hong Kong stock investing, obtaining authoritative and timely information is crucial. You can follow the Hong Kong Stock Exchange’s official website for real-time company announcements, trading rules, and market updates. Mainstream financial platforms like Vantage, East Money, and Tonghuashun provide real-time quotes, company news, and in-depth analysis. You can also join investor communities to share experiences and stay updated on market trends.

Recommendation: Regularly review company financial reports and announcements, follow analyst ratings and institutional reports to seize investment opportunities and avoid risks.

Tool Recommendations

You can use various analysis and trading tools to boost investment efficiency. Below are commonly used tools for Hong Kong stock investing:

- Vantage App: Supports global real-time quotes, technical analysis, and smart advisory, suitable for beginners and experienced investors.

- Tonghuashun: Comprehensive features, supports simulated trading, rich information, and user-friendly interface.

- East Money: Fast updates, comprehensive data, active community, great for interaction.

- Tiger Brokers: Focuses on Hong Kong and US stock trading, with robust community and information features, ideal for younger users.

- Interactive Brokers: Globally recognized, supports multi-market trading, offers in-depth research and personalized advice.

- US-HK Connect Securities: Focuses on real-time Hong Kong and US stock quotes, providing key metrics and investor communities.

- Qianlong HK Stock Connect Series: Offers premium services like direct institutional access, VIP insights, and trading seat data, suitable for those needing in-depth information.

You can also try social investment platforms like Xueqiu and Huihuang Youpei for more investment ideas.

Common Questions

When investing in Hong Kong stocks, you often encounter these questions:

- Do you need a new securities account? You can use an existing Shanghai A-share account for Stock Connect trading without opening a new one.

- What currency is used for Stock Connect trading? You settle with brokers in RMB, and settlement is also in RMB.

- Does Stock Connect trading affect designated securities account trading? Stock Connect uses a strict designated trading system, and you cannot casually cancel designations.

- When do you gain securities rights after buying Stock Connect stocks? Hong Kong uses T+2 settlement, so you gain rights after settlement is complete.

- When do you lose securities rights after selling Stock Connect stocks? The loss of rights aligns with the timing of gaining rights for purchases.

- How do you check Stock Connect holdings and print proof of holdings? You can use the China Securities Depository and Clearing Corporation platform to check and print, similar to A-shares, with legally valid records.

If you have other questions, consult your broker’s customer service or review official guidelines from the Hong Kong Stock Exchange and China Securities Depository for compliant and safe operations.

During Hong Kong stock trading, you need to focus on details and risks at every step. The table below summarizes common risks and mitigation strategies:

| Risk Point | Description and Manifestation | Mitigation Strategy |

|---|---|---|

| Market Risk | Hong Kong stocks are volatile, heavily influenced by global economics and politics. | Conduct market research, diversify investments to reduce single-stock risk. |

| Exchange Rate Risk | HKD-RMB exchange rate fluctuations may impact returns. | Monitor exchange rate trends and use hedging when appropriate. |

| Policy Risk | Policy changes may significantly affect specific industries or companies. | Stay updated on policy changes and adjust portfolios accordingly. |

| Corporate Governance Risk | Some listed companies have poor governance and inadequate disclosure, affecting investment safety. | Choose companies with strong governance and transparent information. |

You should invest rationally and beware of false information and abnormal trading behaviors. Cases show that some investors faced penalties for market manipulation, false declarations, or irregular trading. You can practice on simulated platforms like DaZhiHui or Tonghuashun to gain experience before trading with small amounts. Choose reputable brokers, stay updated on market trends, select suitable investment methods based on your needs, and avoid blindly following trends.

FAQ

What currencies can you use for Hong Kong stock trading?

You can trade Hong Kong stocks using USD or HKD. When depositing via a Hong Kong bank account, the system automatically converts at the daily exchange rate (e.g., 1 USD ≈ 7.8 HKD) conversion.

Recommendation: Monitor exchange rate changes and choose optimal times for deposits.

What is the minimum deposit for a Hong Kong stock trading account?

Most brokers require a minimum initial deposit, typically USD 500 (at 1 USD ≈ 7.8 HKD), though some may require more. Check the broker’s requirements before opening an account.

How do you check Hong Kong stock holdings and fund changes?

You can log into the broker’s app or web platform to view holdings, funds, and transaction history. Some brokers offer SMS alerts via Hong Kong banks.

What to do if a system failure occurs during Hong Kong stock trading?

If you encounter a system failure, contact the broker’s customer service immediately. You can also use Hong Kong bank phone banking or in-person services for urgent orders to ensure trading safety.

How are Hong Kong stock dividends credited?

After a company issues dividends, the broker automatically credits the amount (in USD or HKD) to your account, typically within 3–5 business days after the announcement.

This article provides a detailed guide to Hong Kong stock trading for Chinese investors, comprehensively analyzing every key aspect from fundamental market knowledge and account opening procedures to trading rules, fee structures, and risk management. The article clearly outlines the differences between Hong Kong and mainland China A-share markets and emphasizes the importance of T+0 trading and T+2 settlement, offering valuable practical advice for new investors.

However, despite the rich content of the article, a core challenge for many Chinese investors remains: the flow of cross-border funds. Traditional funding methods, such as bank wire transfers, are not only complex and time-consuming but also come with high fees and opaque exchange rate spreads. These issues can directly impact investment returns and increase transaction costs.

BiyaPay was created to solve these cross-border financial pain points. We offer a smoother, more cost-effective channel for your investments. We support the conversion between various fiat and digital currencies, allowing you to easily manage global assets, and provide a real-time exchange rate query feature to ensure you always get the best rates. What’s more, our remittance fees are as low as 0.5% with same-day delivery, significantly cutting down your transaction costs and time. Now, you don’t need a complex overseas account to invest in both U.S. and Hong Kong stocks on one platform. Say goodbye to the hassle of cross-border payments and start your efficient financial journey. Register with BiyaPay today to make fund management as smooth as trading.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.