- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Comparison of Mobile Experience and Services of Mainstream U.S. Stock Trading Apps

Image Source: pexels

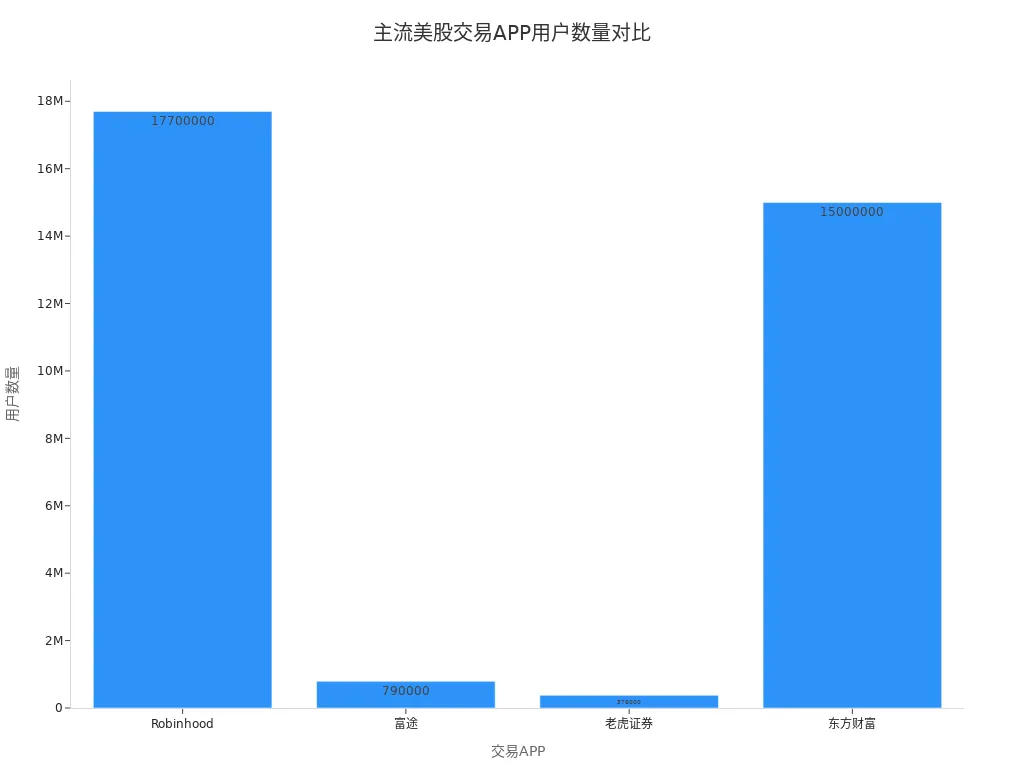

Which U.S. stock trading app offers the best mobile experience and services for different types of investors? Data shows that Chinese investors in U.S. stocks are primarily young, highly educated, and high-income individuals, with 80% being born in the 1980s and 1990s, and 30% earning over $300,000 annually. The performance of major apps in the global market also varies significantly. Robinhood has approximately 17.7 million monthly active users, while Futu and Tiger Brokers are growing rapidly in cross-border markets. The table below shows the user base and market coverage of major platforms:

| Trading App | User Type | Number of Users (Q1 2021) | Client Asset Size | Main Market Coverage |

|---|---|---|---|---|

| Robinhood | Monthly Active Users | ~17.7 million | $80.9 billion | U.S. domestic market |

| Futu | Paid Users | ~790,000 | HK$462.2 billion | Cross-border and international markets (including Hong Kong) |

| Tiger Brokers | Paid Users | ~376,000 | $21.4 billion | Cross-border and international markets (including Hong Kong) |

| East Money | Paid Users | ~15 million (estimated) | N/A | Chinese mainland market |

When choosing a U.S. stock trading app, actual experience and service quality are key considerations. Different platforms have unique strengths in interface, features, fees, and security, and users need to make efficient choices based on their specific needs.

Key Points

- When selecting a U.S. stock trading app, focus on a clean interface, ease of operation, and feature richness to ensure a smooth trading experience.

- Zero-commission trading platforms are suitable for frequent traders and those with smaller funds, but attention should be paid to withdrawal fees and other hidden costs.

- Apps with Chinese language support and active communities help investors access information and resolve issues, boosting investment confidence.

- Professional investors should choose platforms supporting multi-market, multi-asset trading, and advanced analytical tools to meet in-depth research and quantitative needs.

- Beginner investors should prioritize platforms with easy account opening, simple operations, and learning resources to quickly master U.S. stock trading skills.

Evaluation Dimensions

Interface Experience

Interface experience directly impacts operational efficiency. Many investors prefer clean and clear interface designs. Beginner investors often focus on app startup speed, page layout, and operational flow. For example, Youyu Stock App has fast startup speeds and low memory usage, ideal for users needing efficient operations. Mainstream U.S. stock trading apps generally support iOS and Android systems, ensuring smooth use across different devices.

Feature Comparison

Feature-rich apps can meet the needs of different investors. Some platforms provide real-time market data, financial information, and technical indicators to help users make more accurate investment decisions. For instance, East Money and Xueqiu integrate community interaction and news functions, suitable for users who enjoy engagement and information access. Youyu Stock has innovatively introduced a “photo stock recognition” feature, enhancing information retrieval convenience.

Fee Structure

Fee structure is a critical consideration when choosing a U.S. stock trading app. Investors focus on trading commissions, account management fees, and remittance fees. Some platforms offer zero-commission trading but may charge for other services. Investors need to select the most suitable fee plan based on their trading frequency and fund size. All fees are typically denominated in U.S. dollars (USD), and investors should consider exchange rate fluctuations affecting costs.

Service Support

High-quality service support enhances user experience. Some apps offer 24/7 online customer service with multilingual support. Investors can seek help via phone, online chat, or email when encountering issues. Platforms like East Money and Xueqiu also have active communities where users can share experiences and gain investment advice.

Security

Fund and data security is a core concern for all investors. Mainstream U.S. stock trading apps typically hold financial licenses from authoritative bodies like the Hong Kong Securities and Futures Commission, with client funds strictly regulated by law. Platforms also employ two-factor authentication and dual transaction verification to ensure account and transaction security.

Target Audience

Evaluation dimensions of concern for different investor types vary. The table below summarizes the main investor types and their priorities:

| Investor Type | Evaluation Dimensions of Concern | Representative Apps and Features |

|---|---|---|

| Beginner Investors | Clean interface, ease of operation, rich educational resources | Tonghuashun, East Money: user-friendly interface, simple operation, provides educational resources |

| Experienced Investors | In-depth market analysis, diverse investment tools | Guotai Junan Junhong, ZhangLe Wealth: smart trading, in-depth analysis |

| Investors Focused on Specific Markets | Specialized trading services, community interaction | Tiger Brokers: focused on U.S. and Hong Kong stocks, strong community and news functions |

| All Investors | Fund security, technological innovation, performance stability, compatibility | Youyu Stock App: fund security assurance, innovative features, multi-system compatibility |

Investors should select the U.S. stock trading app that best fits their needs.

Firstrade Experience

Image Source: pexels

Interface and Operation

Firstrade’s mobile interface is clean and clear. Users can quickly access commonly used functions. The main page displays account balance, holdings, and market data. The operation process is straightforward, suitable for beginners. The app supports iOS and Android systems with good compatibility.

Main Features

Firstrade provides real-time market data, stock trading, ETF trading, and options trading. Users can view detailed company financial reports and historical data. The platform supports various order types for U.S. stock trading. Investors can set price alerts for timely operations.

Fees

Firstrade implements a zero-commission policy. Users pay no trading commissions for U.S. stocks, ETFs, and options. The platform does not charge account management fees. Some special services, such as wire withdrawals, incur additional fees. Based on 2024 exchange rates, wire withdrawal fees are approximately $30 (USD).

Customer Service and Support

Firstrade offers multi-channel customer service. Users can seek help via phone, email, or online chat. The platform supports Chinese language services, convenient for Chinese investors. Common issues can be quickly resolved in the Help Center.

Security

Firstrade holds licenses from the U.S. Financial Industry Regulatory Authority (FINRA) and the Securities Investor Protection Corporation (SIPC). Client funds are protected by law. The platform uses two-factor authentication and encryption technology to ensure account security.

Target Audience

Firstrade is suitable for investors seeking low fees and simple operations. Both beginners and somewhat experienced investors can get started quickly. Users needing Chinese language services can also enjoy a good experience.

Pros and Cons

Pros

- Zero-commission trading, low fees

- Clean interface, easy operation

- Chinese language support

- Assured fund security

Cons

- Limited advanced market data and research tools

- Withdrawal speeds can sometimes be slow

Webull Experience

Interface and Operation

Webull’s mobile interface offers both dark and light themes, allowing users to switch based on preference. The main page layout is clear, with distinct sections for market data, holdings, and news. Users can swipe to view real-time data from different markets. Operation buttons are large, suitable for finger taps. New users can quickly familiarize themselves with features through guided tutorials.

Main Features

Webull provides real-time market data for U.S., Hong Kong, and A-share stocks. The platform supports trading in stocks, ETFs, options, and more. Users can utilize candlestick charts, technical indicators, and custom alerts. Webull also offers a simulated trading feature to help beginners practice. The community section allows users to exchange investment ideas and access market news.

Fees

Webull implements a zero-commission policy for U.S. stock trading. Users pay no trading commissions for stocks or ETFs. Options trading is also commission-free, but a fixed fee per contract applies. The platform does not charge account management fees. Withdrawals to Hong Kong bank accounts incur a wire transfer fee of approximately $25 (USD), subject to exchange rate fluctuations.

Customer Service and Support

Webull offers online customer service and email support. Users can submit issues within the app, with the support team typically responding within 24 hours. The platform supports Chinese language services, convenient for Chinese investors. Common issues can be addressed in the Help Center.

Security

Webull holds licenses from FINRA and SIPC. Client funds are legally protected. The platform uses multi-factor authentication and data encryption to ensure account and transaction security.

Target Audience

Webull is suitable for investors who prefer using multiple analytical tools. Beginners can gain experience through simulated trading. Experienced investors can leverage rich technical indicators for in-depth analysis. Users needing Chinese language services also receive good support.

Pros and Cons

Pros

- Zero-commission U.S. stock trading, low fees

- Feature-rich, supports multi-market data

- Offers simulated trading and community interaction

- Chinese language support

Cons

- Some advanced data requires paid subscriptions

- Withdrawal speeds depend on bank processing times

Futu Niuniu Experience

Interface and Operation

Futu Niuniu’s mobile interface uses a modular design. Users can customize the homepage layout, placing frequently used functions in prominent positions. Operation buttons are large, with smooth swiping. New users can quickly learn main functions through guided pages. The interface supports dark and light themes to suit different visual preferences.

Main Features

Futu Niuniu provides real-time market data, stock trading, ETF trading, and options trading. The platform includes robust technical analysis tools, such as candlestick charts, moving averages, and various indicators. Users can set price alerts to stay updated on market trends. The active community section allows investors to exchange ideas and access the latest news.

Fees

Futu Niuniu’s fee structure is tiered.

- The platform sets different fee standards based on monthly trading order volume and share count.

- The fee structure is relatively complex compared to Tiger Brokers’ single low-fee rate.

- Users should consider actual trading volume to select the optimal fee plan.

- Based on 2024 exchange rates, some service fees are settled in U.S. dollars (USD), with specific amounts subject to exchange rate fluctuations.

Customer Service and Support

Futu Niuniu provides 24/7 online customer service. Users can seek help via in-app chat, phone, or email. The platform supports Chinese language services, with common issues quickly resolved in the Help Center. The community section also offers experience sharing and investment advice.

Security

Futu Niuniu holds financial licenses from authoritative bodies like the Hong Kong Securities and Futures Commission. The platform employs transaction unlock passwords, secondary order confirmation, and real-time market alerts for security. Client funds are legally protected, ensuring account safety.

Target Audience

Futu Niuniu is suitable for investors seeking diverse investment tools and active community interaction. Beginners can learn through guides and the community. Experienced investors can use robust analytical tools for in-depth research. Users needing Chinese language services also enjoy a good experience.

Pros and Cons

Pros

- Feature-rich, supports multiple investment products

- Flexible fee structure, suitable for varying trading volumes

- Active community, convenient information access

- Robust security measures

Cons

- Complex fee structure requires careful selection

- Some advanced features require paid subscriptions

IBKR Experience

Interface and Operation

IBKR’s mobile interface leans toward a professional style. The main page displays account information, market data, and trading entries. Users can customize frequently used function modules. The operation process is clear, suitable for those with some investment experience. The app supports iOS and Android systems with strong compatibility. The navigation bar is clearly segmented, helping users quickly locate needed functions.

Main Features

IBKR supports trading in stocks, ETFs, options, futures, and more across global markets, including U.S., Hong Kong, and A-shares. The platform includes rich market analysis tools, such as candlestick charts, technical indicators, and real-time news. Users can utilize the SmartRoutingSM system to improve trading execution efficiency. IBKR also offers an API interface to meet quantitative trading and automation needs.

Fees

IBKR uses a tiered commission structure. For standard accounts, U.S. stock trading commissions start at $0.005 per share (USD), with a minimum of $1 per trade (USD), subject to exchange rate changes. The platform does not charge account management fees. Some special services, like wire withdrawals, incur additional fees. High-volume traders can benefit from lower rates.

Customer Service and Support

IBKR offers multi-channel customer service, including phone, email, and online chat. The platform supports multilingual services for global investors. The Help Center includes frequently asked questions. Users can quickly resolve technical or trading issues.

Security

IBKR boasts strong capital strength and a conservative balance sheet, coupled with automated risk management measures to effectively mitigate major financial market risks, ensuring platform and client fund safety.

- IBKR is strictly regulated by the U.S. SEC, FINRA, and SIPC, ensuring compliant operations.

- Client funds are held in designated custodial bank accounts, with up to $500,000 in SIPC protection and an additional $30 million in excess insurance.

- The platform uses data encryption and firewalls to prevent information leaks and unauthorized access.

- The insured bank deposit sweep program provides clients with up to $2.75 million in insurance coverage, with excess amounts backed by IBKR’s strong equity capital.

- The smart routing system and mature trading technology ensure efficient and secure trade execution.

Target Audience

IBKR is suitable for investors with some experience seeking global asset allocation. Professional users, quantitative traders, and fee-sensitive high-volume traders can fully leverage the platform’s advantages. Users needing multi-market, multi-asset trading will also benefit.

Pros and Cons

Pros

- Broad global market coverage, supports multiple asset types

- Transparent fees, suitable for high-volume trading

- Industry-leading security, strict regulation

- API interface for quantitative trading

Cons

- Professional interface, may be challenging for beginners

- Customer service response times can occasionally lag

Charles Schwab Experience

Interface and Operation

Charles Schwab’s mobile app interface is clean, with a blue-white color scheme. Users can quickly view account balance, holdings, and market data on the homepage. The navigation bar is clearly segmented, with common functions like stock trading, transfers, and market news easily accessible. The operation process is intuitive, suitable for investors of varying experience levels. The app supports iOS and Android systems with good compatibility.

Main Features

The Schwab app supports trading in stocks, ETFs, options, and more. Users can access real-time market data, candlestick charts, and various technical indicators. The platform offers automated investment plans, robo-advisors, and retirement account management. Investors can set price alerts to stay updated on market trends. The app includes rich market news and educational resources to help users improve their investment skills.

Fees

Charles Schwab implements a zero-commission policy for U.S. stocks and ETFs. Options trading incurs a $0.65 per contract (USD) fee. The platform does not charge account management fees. Some special services, such as wire withdrawals, cost approximately $25 (USD), subject to exchange rate fluctuations. Investors should review the fee standards for different services.

Customer Service and Support

Schwab provides 24/7 phone and online chat support. Users can seek help via the app, phone, or email. The platform primarily supports English, with some pages offering Chinese guidance. Common issues can be quickly resolved in the Help Center.

Security

Charles Schwab holds SEC and FINRA regulatory licenses. Client funds are protected by SIPC, up to $500,000 (USD). The platform uses multi-factor authentication and data encryption to ensure account and transaction security.

Target Audience

Schwab is suitable for investors seeking low fees, high security, and diverse investment products. Both beginners and experienced investors can enjoy a good experience. Users comfortable with English services will find it easier to navigate.

Pros and Cons

Pros

- Zero-commission U.S. stock trading, transparent fees

- Comprehensive features, supports multiple investment products

- High security, assured fund protection

Cons

- Limited Chinese language support

- Some advanced features require web platform access

Robinhood Experience

Interface and Operation

Robinhood’s mobile interface is extremely clean. Upon opening the app, the homepage directly displays account balance and holdings. The bottom navigation bar makes common functions like stock trading, market data, and account settings easily accessible. The operation process is smooth, with large, easy-to-tap buttons. New users can quickly learn through built-in guides. The interface has a youthful, vibrant color scheme, ideal for investors who prefer an intuitive experience.

Main Features

Robinhood supports trading in stocks, ETFs, options, and more. Users can view real-time market data and set price alerts. The platform offers automated investment plans and fractional share trading. Investors can browse concise company financial reports and market news within the app. Robinhood avoids complex analytical tools, focusing on lightweight and convenient operations.

Fees

Robinhood implements a zero-commission policy. Users pay no trading commissions for U.S. stocks, ETFs, and options. The platform does not charge account management fees. Some special services, like wire withdrawals, cost approximately $25 (USD), subject to exchange rate fluctuations. Investors should consider actual costs for fund withdrawals.

Customer Service and Support

Robinhood offers online customer service and email support. Users can submit issues through the app, with the support team typically responding within 1-2 business days. The platform primarily supports English, with no Chinese customer service. Common issues can be addressed in the Help Center.

Security

Robinhood holds SEC and FINRA regulatory licenses. Client funds are protected by SIPC, up to $500,000 (USD). The platform uses multi-factor authentication and data encryption to ensure account security. Users can enable fingerprint or face recognition for added login security.

Target Audience

Robinhood is suitable for investors seeking low fees and simple operations. Beginners and younger users can get started quickly. Investors with minimal need for advanced analytical tools will find the platform practical. Users requiring Chinese language services may find it less suitable.

Pros and Cons

Pros

- Zero-commission trading, low fees

- Clean interface, easy operation

- Supports fractional share trading, low entry barrier

Cons

- No Chinese language support

- Limited advanced analytical tools

- Customer service response speed needs improvement

TD Ameritrade Experience

Interface and Operation

TD Ameritrade’s mobile app interface uses green and white as primary colors. Users can quickly view account balance, holdings, and market data on the homepage. The navigation bar is clearly segmented, with common functions like stock trading, transfers, and market news easily accessible. The operation process is intuitive, suitable for investors of varying experience levels. The app supports iOS and Android systems with good compatibility.

Main Features

The TD Ameritrade app supports trading in stocks, ETFs, options, and more. Users can access real-time market data, candlestick charts, and various technical indicators. The platform offers automated investment plans, robo-advisors, and retirement account management. Investors can set price alerts to stay updated on market trends. The app includes rich market news and educational resources to help users improve their investment skills.

Fees

TD Ameritrade implements a zero-commission policy for U.S. stocks and ETFs. Options trading incurs a $0.65 per contract (USD) fee. The platform does not charge account management fees. Some special services, such as wire withdrawals, cost approximately $25 (USD), subject to exchange rate fluctuations. Investors should review the fee standards for different services.

Customer Service and Support

TD Ameritrade provides 24/7 phone and online chat support. Users can seek help via the app, phone, or email. The platform primarily supports English, with some pages offering Chinese guidance. Common issues can be quickly resolved in the Help Center.

Security

TD Ameritrade holds SEC and FINRA regulatory licenses. Client funds are protected by SIPC, up to $500,000 (USD). The platform uses multi-factor authentication and data encryption to ensure account and transaction security.

Target Audience

TD Ameritrade is suitable for investors seeking low fees, high security, and diverse investment products. Both beginners and experienced investors can enjoy a good experience. Users comfortable with English services will find it easier to navigate.

Pros and Cons

Pros

- Zero-commission U.S. stock trading, transparent fees

- Comprehensive features, supports multiple investment products

- High security, assured fund protection

Cons

- Limited Chinese language support

- Some advanced features require web platform access

eToro Experience

Interface and Operation

eToro’s mobile interface adopts a clean style. The main page displays account balance, holdings, and market data. Users can quickly switch functions via the bottom navigation bar. Operation buttons are large, suitable for finger taps. New users can learn basic operations through guided tutorials. The app supports iOS and Android systems with good compatibility. The interface uses vibrant colors and clear information hierarchy.

Main Features

eToro supports trading in stocks, ETFs, cryptocurrencies, and more. Users can view real-time market data, historical prices, and company financial reports. The platform’s standout feature is “copy trading,” allowing users to replicate the portfolios of top global investors with one click. The active community enables investors to exchange ideas and access market news. eToro also offers a demo account to help beginners practice trading.

Fees

eToro implements a zero-commission policy for U.S. stock trading. Users pay no trading commissions for stocks. The platform does not charge account management fees. Withdrawals incur a $5 (USD) fee per transaction, subject to exchange rate fluctuations. Some special services, like currency conversion, incur additional fees. Investors should review the fee standards for different services.

Customer Service and Support

eToro offers online customer service and email support. Users can submit issues within the app, with the support team typically responding within 1-2 business days. The platform supports multiple languages, including Chinese. Common issues can be addressed in the Help Center. The community section also provides experience sharing and investment advice.

Security

eToro holds licenses from the UK FCA, Australian ASIC, and other financial regulators. Client funds are held in segregated accounts, protected by law. The platform uses multi-factor authentication and data encryption to ensure account and transaction security. Users can enable two-factor authentication for enhanced login security.

Target Audience

eToro is suitable for users who enjoy social investing and copy trading. Beginners can learn through demo accounts and the community. Experienced investors can leverage the platform’s diverse products for global asset allocation. Users needing Chinese language services will also enjoy a good experience.

Pros and Cons

Pros

- Zero-commission U.S. stock trading, low fees

- Unique copy trading feature, ideal for beginners

- Active community, convenient information access

- Supports multiple languages, including Chinese

Cons

- Fixed withdrawal fees

- Additional fees for some products like cryptocurrencies

- Relatively limited advanced analytical tools

moomoo Experience

Interface and Operation

moomoo’s mobile interface uses a modular layout, displaying account information, market data, and news on the main page. Users can customize frequently used functions, with the homepage supporting quick-add entries. Swiping is smooth, and button placement is intuitive. Dark and light theme switching is convenient, accommodating different visual preferences. New users can quickly learn main functions through guided pages. The interface is clean with a clear information hierarchy.

Main Features

moomoo supports trading in U.S., Hong Kong, and A-share markets. Users can trade stocks, ETFs, options, and more. The platform includes rich market analysis tools, such as candlestick charts, technical indicators, and real-time news. The active community allows investors to exchange ideas. moomoo also offers simulated trading to help beginners gain experience. Users can set price alerts to stay updated on market trends.

Fees

moomoo implements a zero-commission policy for U.S. stock trading. Users pay no trading commissions for stocks and ETFs. Options trading incurs a fixed per-contract fee, denominated in U.S. dollars (USD) and subject to exchange rate fluctuations. The platform does not charge account management fees. Withdrawals to Hong Kong bank accounts incur a wire transfer fee of approximately $25 (USD). Investors should review the fee standards for different services.

Customer Service and Support

moomoo provides 24/7 online customer service. Users can seek help via in-app chat, phone, or email. The platform supports Chinese language services, with common issues quickly resolved in the Help Center. The community section also offers experience sharing and investment advice.

Security

moomoo holds financial licenses from authoritative bodies like the Hong Kong Securities and Futures Commission. The platform uses multi-factor authentication and data encryption to ensure account and transaction security. Client funds are held in regulated banks, protected by law. The platform conducts regular security audits to enhance overall safety.

Target Audience

moomoo is suitable for investors seeking diverse investment tools and active community interaction. Beginners can learn through simulated trading and the community. Experienced investors can use robust analytical tools for in-depth research. Users needing Chinese language services will also enjoy a good experience.

Pros and Cons

Pros

- Zero-commission U.S. stock trading, low fees

- Feature-rich, supports multi-market products

- Active community, convenient information access

- Chinese language support

Cons

- Some advanced data requires paid subscriptions

- Fee structure requires attention to service details

TradeStation Mobile Experience

Interface and Operation

TradeStation Mobile’s interface adopts a professional style. The main page displays account balance, holdings, and market data. Users can customize frequently used function modules. The navigation bar is clearly segmented, with large operation buttons suitable for finger taps. The app supports iOS and Android systems with good compatibility. New users can quickly learn main functions through guided pages. The layout is clean with a clear information hierarchy.

Main Features

TradeStation Mobile supports trading in stocks, ETFs, options, and more. The platform includes rich technical analysis tools, such as candlestick charts, moving averages, and various indicators. Users can set price alerts to stay updated on market trends. The app also supports simulated trading to help beginners gain experience. Investors can access real-time news and market information through the app.

Fees

TradeStation implements a zero-commission policy for U.S. stock trading. Users pay no trading commissions for stocks and ETFs. Options trading incurs a $0.60 per contract (USD) fee. The platform does not charge account management fees. Withdrawals to Hong Kong bank accounts incur a wire transfer fee of approximately $25 (USD), subject to exchange rate fluctuations. Investors should review the fee standards for different services.

Customer Service and Support

TradeStation offers multi-channel customer service, including phone, email, and online chat. The platform primarily supports English services. Common issues can be resolved in the Help Center. Users can quickly address technical or trading issues.

Security

TradeStation holds SEC and FINRA regulatory licenses. Client funds are protected by SIPC, up to $500,000 (USD). The platform uses multi-factor authentication and data encryption to ensure account and transaction security.

Target Audience

TradeStation is suitable for investors with some experience seeking professional analytical tools. Users who prefer multiple technical indicators and in-depth analysis will benefit. Beginners can gain experience through simulated trading.

Pros and Cons

Pros

- Zero-commission U.S. stock trading, low fees

- Rich technical analysis tools

- Supports simulated trading

- High security

Cons

- Limited Chinese language support

- Professional interface, may require adaptation for beginners

- Some advanced features require paid subscriptions

U.S. Stock Pass Experience

Interface and Operation

U.S. Stock Pass’s mobile interface adopts a clean style. The main page displays account balance, holdings, and market data. Users can quickly switch functions via the bottom navigation bar. Operation buttons are large, suitable for finger taps. New users can learn basic operations through guided pages. The layout is clear with a distinct information hierarchy. The app supports iOS and Android systems with good compatibility.

Main Features

U.S. Stock Pass supports trading in stocks, ETFs, options, and more. Users can view real-time market data, historical prices, and company financial reports. The platform includes various technical analysis tools, such as candlestick charts and moving averages. Investors can set price alerts to stay updated on market trends. U.S. Stock Pass also offers simulated trading to help beginners gain experience. The community function allows users to exchange investment ideas and access market news.

Fees

U.S. Stock Pass implements a zero-commission policy for U.S. stock trading. Users pay no trading commissions for stocks and ETFs. Options trading incurs a fixed per-contract fee, denominated in U.S. dollars (USD) and subject to exchange rate fluctuations. The platform does not charge account management fees. Withdrawals to Hong Kong bank accounts incur a wire transfer fee of approximately $25 (USD). Investors should review the fee standards for different services.

Customer Service and Support

U.S. Stock Pass provides 24/7 online customer service. Users can seek help via in-app chat, phone, or email. The platform supports Chinese language services, with common issues quickly resolved in the Help Center. The community section also offers experience sharing and investment advice.

Security

U.S. Stock Pass holds financial licenses from authoritative bodies like the Hong Kong Securities and Futures Commission. The platform uses multi-factor authentication and data encryption to ensure account and transaction security. Client funds are held in regulated banks, protected by law. The platform conducts regular security audits to enhance overall safety.

Target Audience

U.S. Stock Pass is suitable for investors seeking diverse investment tools and active community interaction. Beginners can learn through simulated trading and the community. Experienced investors can use robust analytical tools for in-depth research. Users needing Chinese language services will also enjoy a good experience.

Pros and Cons

Pros

- Zero-commission U.S. stock trading, low fees

- Feature-rich, supports multi-market products

- Active community, convenient information access

- Chinese language support

Cons

- Some advanced data requires paid subscriptions

- Fee structure requires attention to service details

Horizontal Comparison of U.S. Stock Trading Apps

Image Source: pexels

Main Dimension Comparison

When choosing a U.S. stock trading app, investors typically focus on interface usability, feature richness, fee structure, service support, and security. The table below provides a horizontal comparison of mainstream platforms to help users quickly understand their strengths:

| App Name | Interface Experience | Feature Richness | Fee Structure | Service Support | Security |

|---|---|---|---|---|---|

| Futu Niuniu | Modular interface, smooth operation, customizable | Supports U.S., Hong Kong, A-shares, rich technical analysis tools | Tiered fees, some services require payment, relatively high | 24/7 Chinese customer service, active community | Hong Kong SFC license, multiple security measures |

| Webull | Dark/light theme switching, clear layout | Multi-market data, simulated trading, many technical indicators | Zero-commission, some advanced data requires payment | Online customer service, supports Chinese | U.S. regulation, data encryption |

| Robinhood | Minimalist design, easy operation | Supports stocks, ETFs, options, cryptocurrencies | Zero-commission, withdrawal fees apply | English customer service, average response | U.S. regulation, SIPC protection |

| IBKR | Professional style, clear navigation | Global markets, API interface, quantitative support | Tiered commissions, suitable for high-volume trading | Multilingual customer service, fast response | Multi-country regulation, excess insurance |

| Charles Schwab | Clean blue-white design, clear segmentation | Multiple products, automated investing, rich educational resources | Zero-commission, options contract fees | 24/7 phone customer service, mainly English | U.S. regulation, SIPC protection |

| TD Ameritrade | Green-white design, intuitive operation | Multiple products, robo-advisors, educational resources | Zero-commission, options contract fees | 24/7 phone customer service, mainly English | U.S. regulation, SIPC protection |

| eToro | Clean and vibrant, clear information hierarchy | Copy trading, active community, demo account | Zero-commission, fixed withdrawal fees | Multilingual customer service, including Chinese | Multi-country regulation, segregated accounts |

| moomoo | Modular layout, smooth swiping | Multi-market, simulated trading, active community | Zero-commission, some services require payment | 24/7 Chinese customer service | Hong Kong SFC license, multi-factor authentication |

| TradeStation | Professional style, clean layout | Rich technical analysis tools, simulated trading | Zero-commission, options contract fees | English customer service, fast response | U.S. regulation, SIPC protection |

| U.S. Stock Pass | Clean style, smooth operation | Multi-market, simulated trading, community interaction | Zero-commission, some services require payment | 24/7 Chinese customer service | Hong Kong SFC license, security audits |

Tip: Users generally find East Money Securities’ interface user-friendly and smooth. Some platforms, like Galaxy Securities, have slower interface responses, affecting operational smoothness. In terms of features, Huasheng Tong, Webull, moomoo, etc., support multi-market and multi-asset trading with active community interaction. Robinhood is known for zero commissions and beginner-friendliness, while IBKR excels in professionalism and global reach. Regarding fees, Tiger Brokers has the lowest fees, while Futu Niuniu’s fees are relatively high. Most platforms do not disclose detailed fee data, so investors should choose based on actual trading volume and service needs.

Recommended Platforms for Different Audiences

Different investors prioritize different factors when choosing a U.S. stock trading app. Below are recommendations for common investor types:

- Beginner Investors

Platforms like Robinhood, Webull, moomoo, and U.S. Stock Pass have clean interfaces, easy operations, and simulated trading, ideal for new users. Robinhood’s zero-commission and lightweight features help beginners get started quickly. Webull and moomoo offer rich learning resources and community interaction, facilitating skill-building. - Users Seeking Chinese Language Support

Futu Niuniu, moomoo, U.S. Stock Pass, and Webull provide full Chinese language services. Users benefit from 24/7 Chinese customer support, ensuring seamless communication. Active community features also provide investment advice and market information. - Fee-Sensitive Investors

Tiger Brokers, Webull, Robinhood, and eToro offer zero-commission policies, ideal for frequent traders or those with smaller funds. Platforms like Futu Niuniu have complex fee structures, requiring attention to trading volume and service details. - Professional/Advanced Investors

IBKR, TradeStation, Charles Schwab, and TD Ameritrade offer comprehensive features, supporting global markets and multiple asset types. IBKR provides an API interface for quantitative and automated trading. TradeStation’s rich technical analysis tools meet in-depth research needs. Charles Schwab and TD Ameritrade offer extensive educational resources and robo-advisors, ideal for long-term investors. - Users Valuing Community and Information Exchange

moomoo, Futu Niuniu, and eToro have active communities where users can discuss and share insights. eToro’s unique copy trading feature allows beginners to follow successful investors’ strategies.

Investors should choose a U.S. stock trading app based on their needs, considering interface experience, feature richness, fee structure, service support, and security. Actual experience and service quality often outweigh individual features.

Selection Recommendations

Beginner Users

Beginner investors typically focus on easy account opening, simple operations, and access to guides and learning resources. Many platforms offer beginner-friendly onboarding and operational guidance:

- Tiger Brokers and Futu Securities support fully online account opening, requiring only ID card uploads, no specific bank card binding, and completion within minutes.

- These platforms support various trading products, including U.S. and Hong Kong IPO subscriptions, U.S. and Hong Kong stock trading, and global futures, meeting diverse beginner needs.

- Moomoo (Futu) and Tiger Brokers offer Chinese customer service, with smooth operational experiences, suitable for Chinese users.

- Webull (Weiniu) has no fees and often offers stock giveaways, ideal for beginners.

- Robinhood has a clean interface, suitable for beginners, but its features are relatively limited.

Beginners should prioritize platforms with low commissions and trading fees to reduce costs. Platforms offering beginner learning resources and operational guides are also crucial for understanding U.S. stock trading and enhancing the investment experience.

Tip: Beginners can prioritize platforms like Moomoo (Futu), Tiger Brokers, Webull, and Robinhood. These offer fast account opening, simple operations, low fees, and often include Chinese customer service and beginner guides.

Chinese Language Support Needs

Many investors prefer U.S. stock trading apps with Chinese interfaces, which lower the operational barrier and enhance the overall experience. Platforms with Chinese support excel in detailed services:

- User-friendly interface design, suitable for beginners and those seeking intuitive operations.

- Offer a wide range of investment products and diverse trading tools to meet various needs.

- Innovative trading models effectively reduce trading costs.

- High-quality customer service, focused on improving user experience.

- Robust fund security measures and excellent trading efficiency.

- Online currency conversion and remittance operations with low fees and support for global instant transfers.

Investors needing Chinese language services can prioritize Futu Niuniu, moomoo, U.S. Stock Pass, and Webull. These platforms offer full Chinese interfaces and 24/7 Chinese customer service, ensuring seamless communication.

Low-Fee Needs

For fee-sensitive investors, choosing zero-commission or low-fee platforms is crucial. Many mainstream U.S. stock trading apps offer zero-commission trading, and some provide signup bonuses or stock giveaways. Investors should consider:

- Robinhood, Webull, eToro, and Tiger Brokers offer zero-commission policies, ideal for frequent traders or those with smaller funds.

- Moomoo (Futu) and U.S. Stock Pass also provide zero-commission U.S. stock trading with rich signup bonuses.

- Platforms like Futu Niuniu have complex fee structures, requiring attention to trading volume and service details.

- Withdrawals may incur wire transfer fees (e.g., $25 USD), and investors should consider exchange rate impacts on costs.

Recommendation: Investors can prioritize Robinhood, Webull, eToro, and Tiger Brokers for zero-commission trading, balancing trading frequency and fund size to control costs effectively.

Advanced/Professional Users

Advanced or professional investors prioritize market data, analytical support, smart tools, and service quality. Their typical needs include:

- Real-time and comprehensive market data updates, covering global markets.

- Rich professional financial news and data support for in-depth analysis.

- Smart stock selection and AI-assisted decision-making to enhance efficiency.

- Stable and smooth trading experience with multi-market support (e.g., Shanghai, Shenzhen, Hong Kong, U.S.).

- Professional investment advisory services and high-quality customer support, including dedicated agents.

East Money is known for its comprehensive database and professionalism, ideal for advanced investors. Tonghuashun emphasizes rich financial news and real-time data updates. Zhiliao Stock offers AI stock selection and smart monitoring. Tencent Zixuan Stock supports multi-market trading with a smooth interactive experience. IBKR, TradeStation, and Charles Schwab also provide global market access, API interfaces, and quantitative trading support.

Professional investors should prioritize platforms with comprehensive features, rich data, and professional services to enhance decision-making efficiency and trading experience.

Other Needs

Some investors have specific needs, such as U.S. IPO subscriptions, ETF investments, or cryptocurrency trading. Mainstream U.S. stock trading apps offer varying support for these:

- Robinhood supports zero-threshold IPO subscriptions, with no fund freezes and deductions only upon allocation, with a simple process.

- Tiger Brokers’ TradeUP supports U.S. IPO subscriptions, securing allocation shares as an underwriter, offering retail investors access, zero-commission trading, and rich IPO projects and signup bonuses.

- Futu Moomoo supports U.S. IPO subscriptions, particularly for Chinese concept stocks, with high allocation rates, pure zero-commission trading, and signup bonuses.

- Robinhood, Webull, and others support zero-commission trading for stocks, ETFs, options, and cryptocurrencies, meeting diverse investment needs.

Investors with needs like U.S. IPO subscriptions or ETF investments should prioritize platforms supporting these functions to enhance flexibility and return opportunities.

Reminder: Investors should align their investment goals and risk preferences with the platform’s unique features and services to choose the most suitable U.S. stock trading app.

Different U.S. stock trading apps have distinct mobile experiences and services. The table below summarizes the main platforms’ pros, cons, and suitable audiences:

| App Name | Main Advantages | Suitable Audience |

|---|---|---|

| Firstrade | Low fees, Chinese support | Beginners, long-term investors |

| Futu Niuniu | Active community, feature-rich | Users needing interaction |

| IBKR | Global markets, professional tools | Experienced and professional investors |

| Webull | Modern interface, simulated trading | Young and multi-asset users |

Investors should consider their trading habits, language needs, and fee sensitivity to rationally choose a U.S. stock trading platform. Hands-on experience and comparisons can improve trading efficiency and security.

FAQ

What materials are required to open an account with a U.S. stock trading app?

Investors typically need a valid ID, proof of residence, and contact information. Some platforms also require tax information. The account opening process is mostly online, with materials uploaded for review.

Is the withdrawal process for U.S. stock trading apps complicated?

Most platforms support online withdrawals. Users need to link a Hong Kong bank account and provide withdrawal amount and account details. Funds typically arrive within 1-3 business days after platform review, depending on exchange rates and bank processing.

Do zero-commission platforms truly have no other fees?

Zero-commission platforms do not charge trading commissions but may impose fees for withdrawals, wire transfers, or advanced data subscriptions. Investors should carefully review the platform’s fee disclosures and choose based on their trading needs.

How can account and fund security be ensured?

Mainstream U.S. stock trading apps use multi-factor authentication and data encryption. Client funds are held in regulated banks and protected by law. Investors can enable two-factor authentication to enhance account security.

Which languages do U.S. stock trading apps support?

Many platforms support multiple languages, including Chinese and English. Investors can choose platforms with Chinese customer service for easier communication and issue resolution. Some platforms also offer multilingual help centers and operational guides.

This article provides a comprehensive comparison of the mobile experience and services of mainstream U.S. stock trading apps for Chinese investors. It offers a detailed analysis of the pros and cons of platforms like Futu, Interactive Brokers, and Webull, and provides practical selection advice based on different investor needs (e.g., beginners, those requiring Chinese support, or those sensitive to costs).

However, despite the detailed content of the article, a core challenge for many Chinese investors remains: the flow of cross-border funds. Traditional funding methods, such as international bank wire transfers, are not only complex and time-consuming but also come with high fees and opaque exchange rate spreads. These issues can directly impact investment returns and increase transaction costs.

BiyaPay was created to solve these cross-border financial pain points. We offer a smoother, more cost-effective channel for your investments. We support the conversion between various fiat and digital currencies, allowing you to easily manage global assets, and provide a real-time exchange rate query feature to ensure you always get the best rates. What’s more, our remittance fees are as low as 0.5% with same-day delivery, significantly cutting down your transaction costs and time. Now, you don’t need a complex overseas account to invest in both U.S. and Hong Kong stocks on one platform. Say goodbye to the hassle of cross-border payments and start your efficient financial journey. Register with BiyaPay today to make fund management as smooth as trading.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.