- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

2025 Wise vs. PayPal/Xoom Cross-border Remittance: In-depth Analysis of Pros and Cons

Image Source: unsplash

If you want to complete cross-border remittances with lower fees, better exchange rates, and faster speeds, Wise is usually your top choice. In urgent situations, you can choose Xoom, which delivers funds in minutes. PayPal is suitable for balance transfers within its ecosystem. When choosing, you should focus on fees, exchange rates, receipt speed, security, ease of use, supported currencies, and usage thresholds, as these factors directly impact your experience and costs.

Core Points

- Wise offers low remittance fees, transparent exchange rates, and fast receipt, making it suitable for users seeking low costs and high efficiency.

- Xoom is ideal for urgent remittances with fast receipt speeds, but fees and exchange rate costs are higher, making it suitable for occasional use.

- PayPal is suitable for balance transfers within its ecosystem, offering instant and convenient transfers, but withdrawals take longer and incur higher fees.

- When choosing a cross-border remittance tool, you should focus on fees, exchange rates, receipt speed, security, and ease of use, selecting flexibly based on your needs.

- Regularly monitor remittance policies and security measures, enable two-factor authentication, protect account and fund security, and avoid unnecessary risks.

Comparison Dimensions

When choosing a cross-border remittance tool, you need to focus on several key dimensions. Fees, exchange rates, and receipt speed directly affect your actual costs and experience. Security, ease of use, supported currencies, and usage thresholds also influence your choice. Below, we analyze the importance of these dimensions one by one.

Fees

When you conduct cross-border remittances, fees are the most direct cost. Major Chinese banks, such as Bank of China and ICBC, typically charge fees of 0.10%, plus additional telegraph and intermediary bank fees.

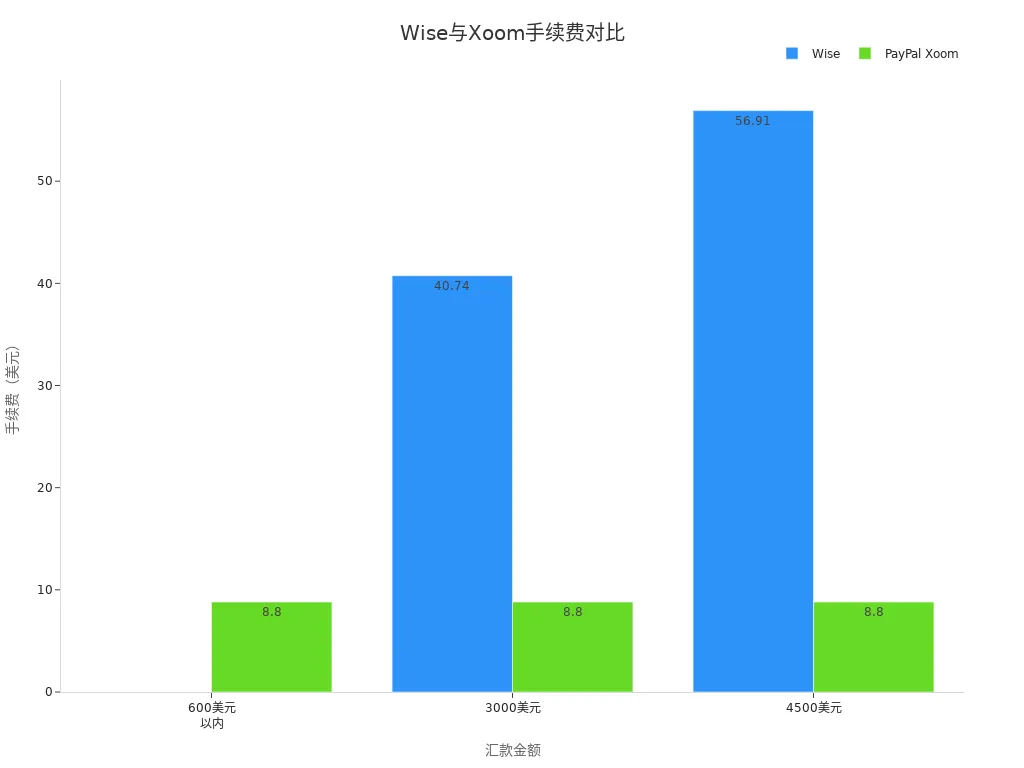

When you choose Wise, fees are lower, with a $3,000 remittance costing about $40.74 (1.358%) and a $4,500 remittance costing about $56.91 (1.26%), and the first small-amount remittance is fee-free. PayPal Xoom charges about $8.8 in fees, but its exchange rates are less transparent, resulting in higher actual costs.

Exchange Rates

Exchange rate fluctuations significantly impact your remittance costs. Wise uses the market mid-rate, transparent with no markup. PayPal Xoom’s exchange rates are below the market mid-rate, reducing the actual received amount. The table below compares exchange rates and fees across major platforms:

| Remittance Platform | Exchange Rate (USD to CNY) | Remittance Fee (USD) | Receipt Time | Remarks |

|---|---|---|---|---|

| Wise | 6.954858 | 12.34 | Within seconds | Optimal exchange rate, transparent fees |

| Xoom | 6.77906 | 30 | 30 minutes | Lower exchange rate, higher fees |

| Western Union | 6.88897 | 0-25 | Instant | Traditional channel, higher fees |

You can reduce remittance costs by regularly comparing platform exchange rates and using rate alert tools.

Receipt Speed

Receipt speed directly affects your fund usage efficiency. Swift surveys show that 79% of Chinese users want funds to arrive within one hour, but only 24% experience instant receipt. Wise can deliver funds in seconds, Xoom processes credit/debit card payments in minutes, while bank account transfers take 1-3 days. Traditional banks typically require 1-3 business days, with longer delays during holidays.

Security

When choosing a cross-border remittance tool, security is a fundamental concern. Wise and PayPal hold regulatory licenses in Hong Kong and other regions, using TLS encryption, 2FA, and real-time risk control systems. Chinese users particularly focus on personal information protection, compliance risks, and anti-money laundering requirements. Payment institutions must establish risk monitoring mechanisms to prevent illegal fund flows and ensure transaction security.

Ease of Use

You can easily operate Wise, PayPal, and Xoom via mobile apps or websites. The registration process is simple, with user-friendly interfaces and support for multiple payment methods. PayPal requires only an email to register, while Wise and Xoom require identity verification, but the process is relatively straightforward.

Supported Currencies

If you need to remit to different countries, supported currencies and coverage are crucial. Wise supports over 40 currencies across 50 countries, including major economies like the US, UK, Australia, and Japan. PayPal and Xoom also support multiple currencies, but their coverage is less transparent than Wise.

Usage Thresholds

Wise and Xoom require users to be at least 18 years old, with registration needing email and identity verification. PayPal has the lowest entry threshold, requiring only an email to register. All three support mobile operations and multiple payment methods, catering to diverse user needs.

Wise vs. Other Tools Comparison

Image Source: unsplash

Wise Advantages

When choosing a cross-border remittance tool, Wise offers significant cost and experience advantages. Wise uses the real market mid-rate with no hidden markups, and fees are charged proportionally, typically as low as 0.41%. For a $3,000 remittance, the fee is about $12.34, far lower than Hong Kong banks and traditional channels. Wise supports multiple receipt methods, including bank accounts and Alipay, with fast receipt—about 45% of remittances are instant, and 80% arrive within 24 hours. You can transfer funds directly to Chinese bank cards or Alipay accounts via Wise, with receipt as fast as 30 minutes, and no longer than 2 days.

Wise also enjoys high user satisfaction. It has over 15 million registered users globally, with a service satisfaction rate above 92%. Its Trustpilot rating is as high as 4.6 out of 5, with users praising its transparent exchange rates, low fees, and fast receipt. Wise holds financial regulatory licenses from multiple countries, including the Hong Kong Monetary Authority, ensuring your fund security.

The table below clearly compares Wise and PayPal across key dimensions:

| Item | Wise Performance | PayPal Performance |

|---|---|---|

| Fees | Low, proportional fees, ~0.41% for major currencies, no high fixed fees | Fixed fee of $38.99, ~4% exchange rate markup, additional fees for credit card payments, overall higher costs |

| Exchange Rate | Real market mid-rate, no markup | 4% exchange rate markup, reducing actual received amount |

| Receipt Speed | ~45% instant, 80% within 24 hours, direct to bank accounts | Instant to PayPal accounts, withdrawals to banks take days or incur extra fees |

| Receipt Methods | Supports multiple currency accounts, similar to bank accounts, supports bank transfers, Alipay, and more | Primarily via PayPal accounts, bank withdrawals require waiting |

| User Reputation | Trustpilot rating 4.5, high user satisfaction | Trustpilot rating 1.3, lower user satisfaction |

If you prioritize low costs, transparent exchange rates, and fast receipt, Wise is a highly recommended choice.

Xoom Features

Xoom is PayPal’s cross-border remittance service. When you need urgent remittances, Xoom is a viable option. Xoom supports credit/debit card and bank account payments, with some remittances arriving in minutes. You can transfer funds directly to Chinese bank cards, suitable for urgent needs.

However, Xoom’s main drawback is its high cost. Starting at $799.99, its fees and exchange rate markups are higher than Wise. Market feedback indicates poor product sales, with vendors discontinuing it within six months, reflecting low market acceptance. Analysts note that Xoom fails to address users’ key concerns, with deficiencies in user experience and functionality. You should consider costs and service experience when choosing.

Tip: If you only occasionally need urgent remittances, Xoom is a viable backup, but long-term use is costly.

PayPal Features

PayPal is suitable for balance transfers within its ecosystem. If you have a balance in your PayPal account, you can transfer it instantly to other PayPal users. When buying, selling, or transferring its stablecoin PYUSD, PayPal charges no fees, requiring only Ethereum protocol Gas fees. This significantly reduces transfer costs for ecosystem users. PayPal also excels in B2B payments and digital goods transactions, supporting instant settlements to enhance receipt speed.

PayPal has over 169 million active accounts globally, covering 203 countries and regions, supporting multiple currency transactions. You can securely access international markets through PayPal with risk management services. However, withdrawing to bank accounts requires waiting and may incur additional fees. Public data does not disclose specific usage rates or satisfaction among Chinese users, but its global active users are nearly 400 million, indicating widespread use.

Reminder: If you frequently send or receive payments within the PayPal ecosystem, balance transfers are efficient and low-cost.

Comparison of Pros and Cons

| Dimension | Wise | Xoom | PayPal |

|---|---|---|---|

| Fees | Low, proportional | High, significant fees and rate markups | Free for ecosystem balance transfers, fees for withdrawals |

| Exchange Rate | Market mid-rate, no markup | Rate markup, reduced received amount | Rate markup, additional withdrawal fees |

| Receipt Speed | Most within 2 hours | Credit/debit card in minutes | Instant for balance transfers |

| Receipt Methods | Bank accounts, Alipay, etc. | Bank accounts | PayPal accounts only |

| User Reputation | High satisfaction, 4.5-4.6 rating | Low market acceptance | Many global users, average satisfaction |

| Applicable Scenarios | Daily remittances, regular amounts | Urgent large-amount fast receipt | Ecosystem transfers, digital goods settlements |

You can flexibly choose the most suitable cross-border remittance tool based on your actual needs.

Scenario Recommendations

Image Source: unsplash

Study Abroad Remittances

If you need to remit for study abroad expenses, prioritize fees, receipt speed, and security. Chinese students typically focus on the following when choosing cross-border remittance tools:

- Fee transparency and exchange rate markups

- Receipt speed to meet urgent needs like tuition and living expenses

- Fund security and provider compliance

- Ease of operation and Chinese language support

- Simplicity of document preparation

- Exchange rate fluctuation risks

- User experience and interface friendliness

According to Reade Education’s blog, Wise performs best in study abroad remittance scenarios. When you use Wise, fees are transparent and low, exchange rates are close to the market mid-rate, and receipt typically takes 1-2 business days. Xoom, while faster, has higher fees and noticeable rate markups, leading to higher costs. PayPal’s specific fees and receipt speeds for study abroad remittances are not detailed, with an overall recommendation rating lower than Wise.

| Platform | Fees (USD) | Exchange Rate Advantage | Receipt Time | Recommendation Rating |

|---|---|---|---|---|

| Wise | Low and transparent | Close to mid-rate | 1-2 business days | ★★★★★ |

| Xoom | High | Noticeable rate markup | Slower | ★★ |

| PayPal | Not detailed | Rate markup | Not detailed | ★★★ |

If you prioritize low costs and high transparency, Wise is the top choice for study abroad remittances. You can also monitor exchange rate fluctuations and remit in batches at optimal times to further reduce costs.

Family Remittances

When remitting to family, you typically focus on receipt speed, fees, and receipt methods. User feedback shows that Wise and Xoom each have advantages in receipt speed and methods. You can refer to the table below for a quick overview of their performance in family remittance scenarios:

| Platform | Receipt Speed | Exchange Rate Advantage | Fees (USD) | Supported Receipt Methods | Applicable Scenarios |

|---|---|---|---|---|---|

| Xoom | ~30 minutes | ~1.8% rate markup | ~30 | UnionPay card, Alipay | Urgent or large transfers |

| Wise | Seconds | Market mid-rate, no markup | ~12.34 | Wise account, UnionPay card, Alipay, WeChat | Low-fee, optimal rate needs |

| PayPal | Fast | Slightly worse than Wise | Higher | Multiple payment methods | Urgent and large transfers |

If you need to quickly send funds to family, Xoom and PayPal offer fast receipt, suitable for emergencies. If you prioritize fees and exchange rates, Wise allows you to complete remittances at lower costs. You can also choose receipt methods like Alipay or WeChat to enhance convenience for recipients.

Recommendation: Choose flexibly based on remittance amount and urgency. For frequent small remittances, Wise is ideal for daily use. For occasional large, urgent transfers, Xoom and PayPal are viable backups.

Business Payments and Collections

As a cross-border e-commerce or business user, you typically focus on fund flow efficiency, compliance, and costs. Traditional Hong Kong bank wire transfers are slow and costly, while third-party collection tools are favored for their convenience and compliance. You can consider the following when choosing:

- High fund flow efficiency and fast receipt

- Low fees and transparent exchange rates

- Support for multi-currency and multi-region collections

- Strong compliance to reduce fraud risks

- Convenient operation with support for batch payments

- Suitable for small, high-frequency transactions

| Remittance Tool | Main Advantages | Main Disadvantages | Applicable Scope |

|---|---|---|---|

| Wise | Low fees, transparent rates, fast receipt | Requires real-name verification, limited for some currencies | Cross-border e-commerce, B2B, freelancers |

| Hong Kong Offshore Bank Account | No amount limits, free currency conversion | Complex account opening, inconvenient transfers to China | Traditional trade, large enterprises |

| Credit Card Collections | Large user base, popular in Europe/US | Complex integration, high fees, chargeback risks | Cross-border e-commerce retail platforms |

If you need efficient, compliant international payments and collections, Wise can help reduce costs and speed up receipt. You can also select appropriate receipt methods and currencies based on business needs to enhance fund flow efficiency.

Cross-border e-commerce businesses increasingly prefer third-party collection tools, with market share exceeding 80%. You can focus on innovative digital payment services to meet small, high-frequency transaction needs.

Other Needs

If you have small, frequent, or niche currency remittance needs, you can explore PayPal’s Venmo and Xoom products. You can use PayPal’s stablecoin PYUSD for international remittances, suitable for individuals needing frequent small transfers. Companies like ScaleAI and SpaceX also use stablecoins to reduce cross-border transaction costs and forex risks, demonstrating strong practical results in niche scenarios.

If you need support for niche currencies or want to reduce forex risks, choose tools supporting stablecoins or multiple currencies. You can also flexibly combine tools to optimize remittance paths and costs based on your needs.

Recommendation: Regularly monitor remittance policies and fee changes, adjust strategies promptly, and ensure fund safety and compliance.

Considerations

Fee Details

When conducting cross-border remittances, you must carefully review all fees. Handling fees, exchange rate differences, and receipt times affect your actual costs. Different platforms have varying fee structures—some charge proportional fees, others have fixed fees. You can compare platforms’ fee details to choose the most suitable option. Receipt time is also critical; some platforms have low fees but slow receipt, which may impact fund usage. Before remitting, use the platform’s fee calculator to simulate the actual received amount to avoid increased costs from hidden fees.

Policy Changes

You need to stay updated on platform policy changes. Remittance policies may adjust due to national regulatory requirements, anti-money laundering rules, or forex management changes. For example, some platforms may adjust remittance limits or receipt methods based on China’s forex policies. You should regularly check platform announcements to stay informed about the latest policies and avoid remittance failures or delays due to policy changes. Compliant operations ensure fund safety and reduce unnecessary issues.

Security Risks

When using cross-border remittance tools, security risks cannot be ignored. PayPal explicitly prohibits fraud, account abuse, information leaks, dispute resolution abuse, and password security violations. You must not use others’ information to register accounts or disclose passwords. PayPal takes measures against non-compliant accounts to protect user interests. Cybercrime causes significant economic losses, and PayPal uses risk management tools and machine learning to help businesses reduce fraud risks and enhance payment security. You should regularly update passwords, enable two-factor authentication, and protect account and fund security.

When choosing a cross-border remittance tool, you should consider core factors like fees, exchange rates, and receipt speed. PayPal is suitable for ecosystem balance transfers, Xoom for urgent fast receipt. If you prioritize low costs and transparent exchange rates, Wise is a top choice. Always stay informed about policy changes, fee details, and security risks to rationally select the most suitable remittance method.

FAQ

How long does it take for Wise to remit to a Chinese bank card?

When you use Wise to remit to a Chinese bank card, funds can arrive in seconds. Most remittances complete within 24 hours. In rare cases, it may take up to 2 days.

How long does it take to withdraw from PayPal to a Hong Kong bank account?

Withdrawing from a PayPal account to a Hong Kong bank account typically takes 2 to 5 business days. Actual receipt time varies based on bank processing speeds.

What receipt methods does Xoom support?

You can use Xoom to remit to Chinese UnionPay cards or Alipay accounts. In some cases, recipients can also choose WeChat for receipt.

Are there limits on remittance amounts?

When using Wise, PayPal, or Xoom, platforms set single-transaction and daily maximum limits. Specific limits vary based on account verification levels and policy changes.

How to ensure remittance security?

You should enable two-factor authentication and regularly update passwords. Avoid disclosing account information. Choosing platforms with financial regulatory licenses, like Wise and PayPal, enhances fund security.

This article provides a detailed analysis of the pros and cons of two major cross-border remittance tools, Wise and PayPal/Xoom, for Chinese users in 2025. It compares them across multiple dimensions, including fees, exchange rates, transfer speed, security, and ease of use. The article also offers practical advice for different scenarios, such as student remittances, family transfers, and business payments. It clearly highlights that Wise is the top choice for those seeking cost-effectiveness due to its low fees and transparent exchange rates, while Xoom is a reliable option for emergencies due to its rapid transfer speed. PayPal, on the other hand, is best suited for instant transfers within its own ecosystem.

However, despite the detailed content of the article, a core challenge for many Chinese investors remains: the flow of cross-border funds. Traditional funding methods, such as international bank wire transfers, are not only complex and time-consuming but also come with high fees and opaque exchange rate spreads. These issues can directly impact investment returns and increase transaction costs.

BiyaPay was created to solve these cross-border financial pain points. We offer a smoother, more cost-effective channel for your investments. We support the conversion between various fiat and digital currencies, allowing you to easily manage global assets, and provide a real-time exchange rate query feature to ensure you always get the best rates. What’s more, our remittance fees are as low as 0.5% with same-day delivery, significantly cutting down your transaction costs and time.

Now, you don’t need a complex overseas account to invest in both U.S. and Hong Kong stocks on one platform. Say goodbye to the hassle of cross-border payments and start your efficient financial journey. Register with BiyaPay today to make fund management as smooth as trading.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.