- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

2025 Hong Kong Stock Trading Selection Guide: Global vs. Local Brokers Analysis

Image Source: unsplash

When choosing a Hong Kong stock trading broker, you must consider your own needs. Global brokers like Futu and Tiger Brokers support online account opening, which can be completed in minutes, with reviews taking only 1-3 business days. Traditional local brokers have complex account opening processes, require numerous documents, and have review periods lasting weeks. Global brokers offer commissions as low as 0.00029 USD per share (approximately 0.0029%), while local brokers typically charge 0.1%-0.3% commissions. You can also experience rich trading interfaces and diverse product coverage, enjoying convenient fund transfer methods and a flexible Hong Kong stock trading experience.

Key Points

- The Hong Kong stock market is highly internationalized, with strong liquidity and valuations lower than the U.S. stock market, making it suitable for diversified investments.

- Global brokers offer fast account opening, low commissions, and support multi-market trading, ideal for high-frequency and cross-market investors.

- Local brokers provide detailed services, suitable for investors who prefer offline support and localized services.

- When choosing a broker, consider your trading frequency, capital size, and investment needs to rationally select the most suitable platform.

- Licensed brokers ensure fund safety, requiring identity and address proof for account opening, with low entry barriers suitable for most investors.

Hong Kong Stock Trading Basics

Image Source: pexels

Market Characteristics

You will find that the Hong Kong stock market is highly internationalized. It hosts listed companies from around the world, including China, the U.S., and Southeast Asia. The market has strong liquidity, with average daily trading volume reaching about 31.9 billion USD in 2025 (calculated at 1 USD = 7.8 HKD), more than double that of 2018. The investor structure has also changed, with increasing Chinese capital flowing in through the “Southbound Connect,” boosting the market share of technology and consumer sectors to 44%. Now, the Hong Kong stock market includes not only large institutional investors but also a growing number of retail investors, maintaining high market activity.

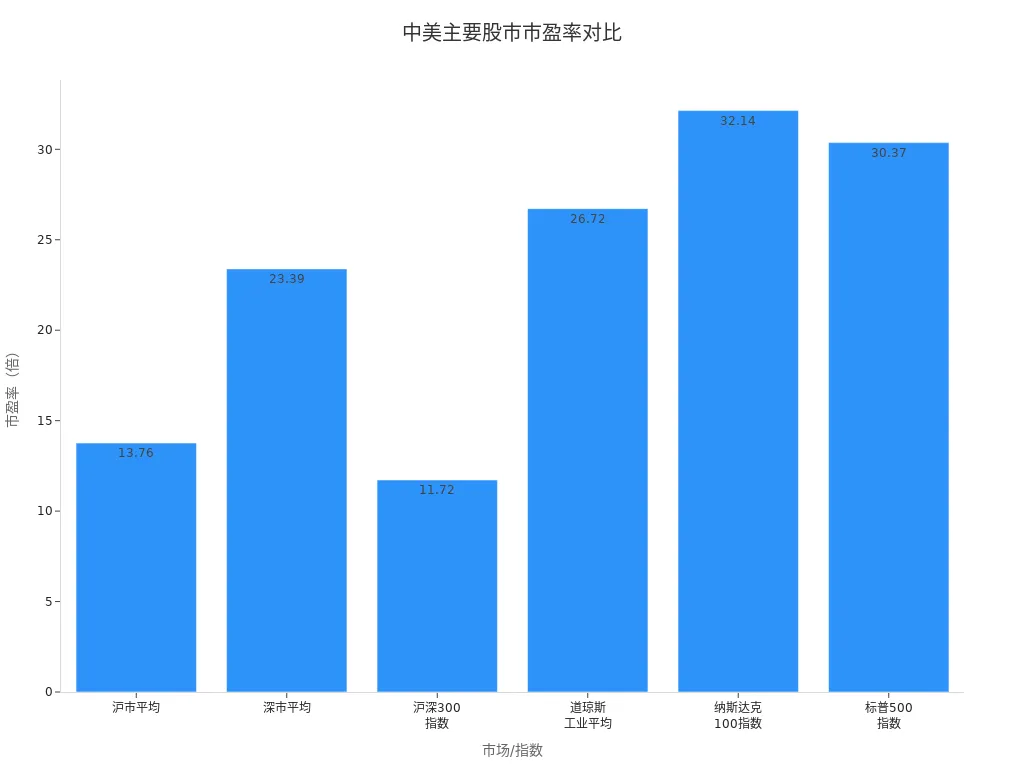

- The overall valuation of Hong Kong stocks is lower than the U.S. market. The Hang Seng Index has a P/E ratio of about 10.8, a P/B ratio of 1.3, and a dividend yield of up to 3.2%, with some high-dividend sectors exceeding 5%. In contrast, major U.S. indices have P/E ratios around 30, indicating room for recovery in Hong Kong’s technology sector.

- The Hong Kong stock market has attracted significant overseas capital inflows, with the Hang Seng Index rising 13.4% in February 2025, leading global markets, and the Hang Seng Tech Index rising 17.9%.

Trading Rules

When trading Hong Kong stocks, you can experience the T+0 trading mechanism. This allows you to buy and sell the same stock multiple times within the same day, flexibly seizing market opportunities. The Hong Kong market has no price limit restrictions but has volatility control mechanisms, so individual stock prices may fluctuate significantly within a day. All trades are quoted in HKD, and you can convert to USD or RMB automatically via the broker’s platform during settlement. The Stock Connect has daily quota limits, suspending purchases when exhausted, but sales can continue. Note that the Hong Kong market has no delisting grace period, and some stocks may delist directly, so you should monitor risks when investing.

Entry Threshold

To participate in Hong Kong stock trading, the entry threshold is low. As long as you are 18 or older, have full civil capacity, and prepare valid identity and address proof, you can apply for an account. Account opening methods include online and offline; online account opening requires uploading documents and video verification via a broker’s app, completable in minutes. You also need to link a real-name bank card for fund transfers. The minimum trading unit in Hong Kong stocks is one lot, typically 100 shares. For example, if a stock is priced at 5 USD per share, you need 500 USD (excluding fees) to buy one lot. After opening an account, the broker will store your funds in a segregated trust account to ensure safety.

Tip: Choose a licensed broker for account opening to ensure it holds relevant licenses from the Hong Kong SFC, providing greater fund security.

Broker Type Comparison

Image Source: pexels

Fee Comparison

When choosing a broker, fees are a key consideration. Global brokers like Futu Securities and Tiger Brokers use a floating commission model, with commissions as low as 0.0029% (about 0.00029 USD per share), ideal for high-frequency traders and those with larger capital. Local brokers often use fixed commissions, typically ranging from 0.1% to 0.3%, with more comprehensive services. You also need to consider additional fees like handling and regulatory fees. Internet brokers, with lower operational costs, offer lower trading fees, especially suitable for young investors and beginners.

| Broker Type | Commission Model | Fee Components | Commission Characteristics & Strategies |

|---|---|---|---|

| Large Comprehensive Brokers | Mainly fixed commissions, some floating | Commissions include handling and regulatory fees | Higher commission rates, comprehensive services, preferential policies for large clients |

| Small-Medium Brokers | Flexible commission strategies | Commissions may be charged separately | Lower commission rates, basic services, personalized investment advice |

| Internet Brokers | Mainly floating commissions | Low commissions, low operational costs | Generally low commissions, convenient trading, suitable for young investors |

Tip: For long-term high-frequency trading, global brokers with low commissions are more suitable, while local brokers are worth considering if you value comprehensive services and personalized advice.

Product Coverage

On global broker platforms, you can easily invest in markets like Hong Kong, U.S., Singapore, and Australia. Futu Securities and Tiger Brokers support stocks, ETFs, options, warrants, CBBCs, and IPO subscriptions, meeting your diversified asset allocation needs. Local brokers primarily focus on the Hong Kong market, with some supporting A-share channels, but offer fewer cross-market products. If you plan global asset allocation, global brokers provide broader product coverage and more options.

| Trading Market | Futu Securities Support | Tiger Brokers Support | Notes & Advantages |

|---|---|---|---|

| U.S. Stocks | Supported | Supported | Competitive commissions, rich products |

| Hong Kong Stocks | Supported | Supported | Includes stocks, warrants, CBBCs, IPO subscriptions |

| Chinese A-Shares | Supported | Supported | Via Shanghai-Hong Kong and Shenzhen-Hong Kong Connect |

| Singapore Stocks | Supported | Supported | Holds Singapore market license |

| Australian Stocks | Supported | Supported | Covers ASX stocks |

| Japanese Stocks | Supported | Supported | Added Japanese market |

| Canadian Stocks | Supported | Not Supported | Futu’s unique advantage |

| UK & European Markets | Not Supported | Supported | Tiger’s unique advantage |

Platform Features

On global broker platforms, you can experience efficient trading systems. Futu Securities and Tiger Brokers use Kubernetes elastic clusters, supporting tens of thousands of orders per second with fast system responses, ideal for high-frequency Hong Kong stock trading. You also get direct official data connections with low latency and accurate information. Global brokers support one-stop multi-market access, making it easy to manage assets across markets.

Local brokers excel in localized customization, quickly responding to Hong Kong market demands with flexible risk control rules, suitable for investors with specific trading strategies. However, they may lag in global data coverage and high-concurrency processing.

Financial technology innovations continue to enhance broker platform features. For example, TRS (Total Return Swap), OTC (Over-the-Counter), and ESOP (Employee Stock Ownership Plan) tools help you implement complex investment strategies, particularly in block trading and customized needs.

Service Experience

On global broker platforms, you typically get 24/7 online customer support, user-friendly app interfaces, and clear operational processes. Platforms like Futu Securities and Tiger Brokers also offer community interactions, investment courses, and real-time news as value-added services to help you quickly improve your investment skills.

Local brokers focus more on offline services, with some offering dedicated account managers, phone consultations, and in-person support. If you prefer traditional service methods, local brokers are more suitable. If you seek efficiency and a digital experience, global brokers will satisfy you more.

Regulatory Safety

When choosing a broker, safety is paramount. Global brokers like Futu Securities and Tiger Brokers hold licenses from the Hong Kong Securities and Futures Commission (SFC), are subject to strict regulation, and store funds in segregated trust accounts to ensure your asset safety. Local brokers are also regulated by the SFC, with some established brokers boasting long histories and strong reputations. As long as you choose a licensed broker, your funds are well-protected.

Account Opening Convenience

On global broker platforms, the account opening process is highly convenient. You only need to upload identity and address proof via the app, completing the application in minutes, with reviews typically done within 1-3 business days. You don’t need to visit a branch, saving significant time. Local brokers often require in-person account opening with physical document submission, and reviews can take weeks. For efficiency-focused investors, global brokers offer a superior account opening experience.

Fund Transfers

On global broker platforms, you can transfer funds via Hong Kong banks, wire transfers, or FPS, with fast processing and low fees. Some platforms support multi-currency accounts in USD, HKD, and RMB, allowing flexible fund management. Withdrawals are also efficient, typically processed within 1-2 business days. Local brokers mainly rely on Hong Kong bank transfers, with some supporting checks or cash deposits, but processing speed and convenience are slightly inferior. For frequent fund transfers, global brokers’ flexibility and efficiency better meet your needs.

Reminder: For Hong Kong stock trading, prioritize brokers supporting multi-currency and fast transfers to enhance fund usage efficiency.

Hong Kong Stock Trading Data Comparison

Global Broker Data

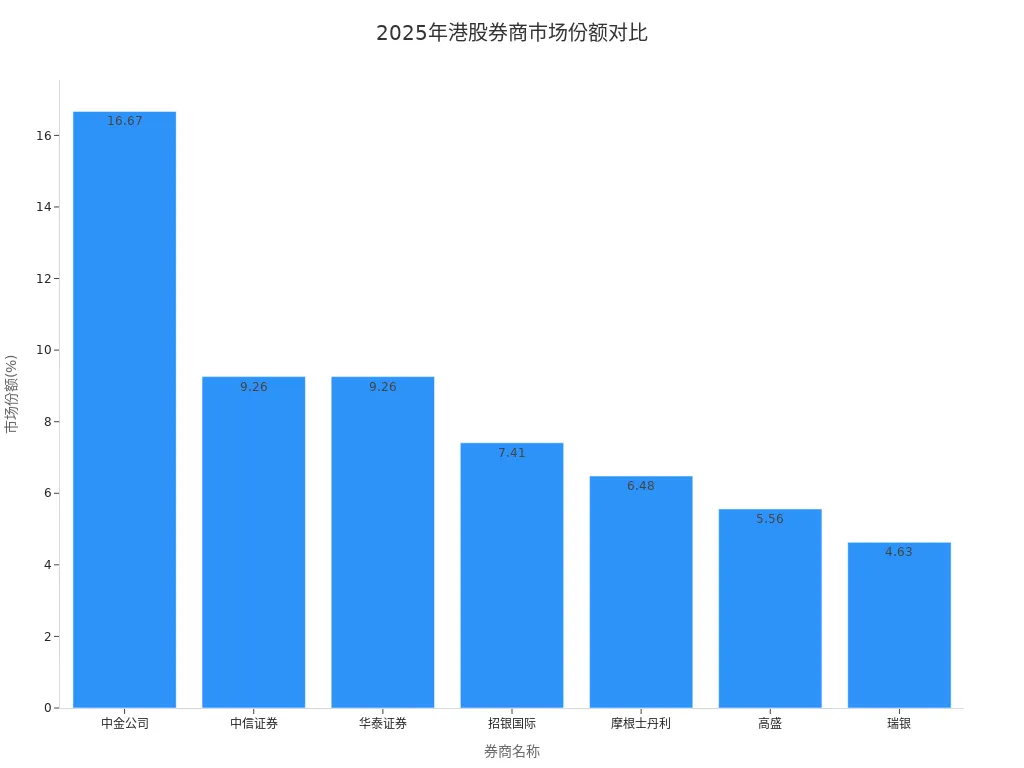

When choosing global brokers, you can see their significant role in the Hong Kong stock market. In Q1 2025, Hong Kong’s primary market equity financing reached about 16.744 billion USD (calculated at 1 USD = 7.8 HKD), up over 400% year-on-year. The HKEX reported 32% revenue growth and 37% profit growth, reflecting sustained market activity and profitability. Global brokers like CICC, CITIC Securities, and Morgan Stanley excel in project sponsorship and market share. You can refer to the table below for major brokers’ market shares:

| Broker Name | Number of Sponsored Projects | Market Share (%) |

|---|---|---|

| CICC | 18 | 16.67 |

| CITIC Securities | 10 | 9.26 |

| Huatai Securities | 10 | 9.26 |

| CMB International | 8 | 7.41 |

| Morgan Stanley | 7 | 6.48 |

| Goldman Sachs | 6 | 5.56 |

| UBS | 5 | 4.63 |

Local Broker Data

On local broker platforms, you can experience services tailored to the Hong Kong market. Some local brokers have unique advantages in brokerage services and customer support. While they lag behind global brokers in sponsored project numbers, they maintain stability in serving local investors, offering offline support and localized products. You’ll find local brokers invest more in risk management and client relationship maintenance, ideal for investors prioritizing local service experiences.

Tip: If you focus on local market dynamics and offline services, local brokers can provide more detailed support.

Dimension Comparison Table

When choosing a broker, you can compare based on the following key dimensions:

| Dimension | Global Broker Advantages | Local Broker Advantages |

|---|---|---|

| Business Scale & Market Share | High market concentration, strong internationalization | Stable local client base, detailed services |

| Investment Banking Revenue | Leading investment banking revenue, rich project reserves | Focus on brokerage, less investment banking |

| Asset Management Scale | Large-scale, diverse asset management products | Stable asset management, low risk preference |

| Risk Management Capability | International-standard risk control systems, advanced technology | Rich local compliance experience, fast response |

| International Development | Multi-market presence, strong cross-border services | Focused on Hong Kong market, familiar with local policies |

| Business Structure | Diverse: brokerage, investment banking, asset management, proprietary trading | Mainly brokerage, serving local investors |

You can quickly select the most suitable broker type based on your Hong Kong stock trading needs and the dimensions above.

Investor Recommendations

Frequent Traders

If you trade Hong Kong stocks frequently, focus on the following when choosing a broker:

- Commission rates and preferential policies. Commission rates vary significantly among brokers. Some offer tiered commission discounts based on your capital (e.g., 500,000 USD or 1 million USD). New clients may also enjoy low-commission packages for a period, reducing your trading costs.

- Service quality. Professional investment advisors can provide personalized advice, helping you adjust portfolios and reduce risks. Responsive customer service can quickly resolve trading issues, minimizing losses and stress.

- Trading software functionality and stability. You need software supporting real-time market data, fast order placement, cancellation, and fund queries. Software stability is crucial to avoid delays or crashes during peak times, ensuring you don’t miss trading opportunities.

Tip: Prioritize global brokers for lower commissions and more efficient trading experiences.

Long-Term Holders

If you prefer long-term stock holding, data and tools impact your investment outcomes. Many quantitative investment teams use iTick Hong Kong and U.S. stock data API for historical data backtesting to optimize strategies and verify profitability under different market conditions. You can access price changes quickly via real-time data interfaces to adjust holdings. Fintech companies also provide investment analysis reports, including stock recommendations and risk assessments, for more informed decisions.

- Brokers like Huatai Securities and Guotai Junan offer conditional order functions, including price change buy/sell, time triggers, and dynamic strategies. You can also use tools like Wave Master, moving average strategies, and break-even condition orders to automate investment management.

- Grid trading tools help capture short-term price differences, reducing monitoring costs. Some brokers offer AI smart grids and T0 algorithm services, supporting multiple intraday trades to boost returns.

Choose brokers with robust data services and tools to enhance long-term investment efficiency and returns.

Cross-Market Investors

If you aim to allocate assets across markets, global brokers’ international advantages suit you better. By October 2024, over 120,000 individual investors participated in the Greater Bay Area’s “Cross-Border Wealth Connect” pilot, with cross-border fund flows exceeding 95 billion RMB (about 12.2 billion USD, at 1 USD = 7.8 HKD). Fourteen brokers, including local and global ones with overseas presence, were among the first pilot participants.

- Brokers with overseas presence offer global asset allocation services to meet varied risk preferences.

- “Southbound Connect” and “Northbound Connect” allow you to freely invest in Chinese or Hong Kong/Macau markets, seizing global opportunities.

Prioritize brokers with multi-market trading capabilities and cross-border service experience for convenient fund flows and asset allocation.

Other Needs

If you have specific needs, such as premium services or one-stop wealth management, focus on the following:

- Convenient online account opening and trading systems, supporting real-time market data and basic information.

- Dedicated account managers for daily consultations and trading support.

- Professional research services, including daily market updates, investment strategies, and in-depth reports delivered via WeChat, SMS, or email.

- High-net-worth clients can access “1+1” advisory services, listed company visits, dedicated trading channels, and margin trading.

- Integrated group resources offering “investment banking + commercial banking” and “domestic + overseas” one-stop financial services.

When choosing a broker, focus on cross-border service capabilities, research depth, and convenient account opening channels based on your needs.

When choosing a broker, consider your investment habits, capital size, and trading frequency. Global brokers offer advanced systems and diverse product services, ideal for those seeking efficiency and diversified allocation. Local brokers excel in local services and regulatory coordination but may lag in technical platforms and innovation. Many investors overlook commission fees or blindly follow trends, leading to suboptimal trading experiences. Rationally analyze your needs, understand trading processes, and choose the broker type that best aligns with your goals.

FAQ

What documents are needed for Hong Kong stock account opening?

You need to prepare valid identity proof, address proof, and Hong Kong bank account information. Some global brokers support online document uploads, with reviews typically completed in 1-3 business days.

What is the minimum fund threshold for Hong Kong stock trading?

You only need to be 18 or older, with one lot typically being 100 shares. For example, a stock at 5 USD per share requires 500 USD (calculated at 1 USD = 7.8 HKD).

Is it safe to transfer funds to a Hong Kong stock account?

Choosing a licensed broker ensures funds are stored in segregated trust accounts. The Hong Kong SFC strictly regulates, ensuring fund safety.

What are the main fees for Hong Kong stock trading?

You need to pay commissions, handling fees, and regulatory fees. Global brokers charge as low as 0.0029%, while local brokers typically charge 0.1%-0.3%. Refer to the broker’s announcement for specific fees.

Can you invest in Hong Kong stocks directly with RMB?

You can convert RMB to HKD or USD through brokers supporting multi-currency accounts for Hong Kong stock investments. Some brokers offer automatic conversion for convenience.

This article provides a comprehensive guide for Chinese investors on how to choose a Hong Kong stock trading platform in 2025, with an in-depth analysis of the pros and cons of global versus local brokerage firms. The article offers a detailed comparison across multiple dimensions, including fees, product coverage, platform features, service experience, regulatory security, and account opening convenience. It also provides personalized recommendations for different types of investors, such as high-frequency traders, long-term holders, and cross-market investors. The article clearly states that global brokerages, with their low commissions, convenient account opening processes, and diversified product offerings, are the top choice for Chinese investors seeking efficiency and portfolio diversification.

However, despite the detailed content of the article, a core challenge for many Chinese investors remains: the flow of cross-border funds. Traditional funding methods, such as international bank wire transfers, are not only complex and time-consuming but also come with high fees and opaque exchange rate spreads. These issues can directly impact investment returns and increase transaction costs.

BiyaPay was created to solve these cross-border financial pain points. We offer a smoother, more cost-effective channel for your investments. We support the conversion between various fiat and digital currencies, allowing you to easily manage global assets, and provide a real-time exchange rate query feature to ensure you always get the best rates. What’s more, our remittance fees are as low as 0.5% with same-day delivery, significantly cutting down your transaction costs and time.

Now, you don’t need a complex overseas account to invest in both U.S. and Hong Kong stocks on one platform. Say goodbye to the hassle of cross-border payments and start your efficient financial journey. Register with BiyaPay today to make fund management as smooth as trading.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.