- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

PayPal Xoom vs. Western Union: Which Platform Suits Chinese Users Better?

Image Source: unsplash

If you frequently need to send small, fast remittances to China, PayPal Xoom is suitable for you. Western Union is better for scenarios requiring cash pickup or urgent funds. Many Chinese users focus on compliance risks, delivery speed, exchange rate fluctuations, and security. When choosing a low-cost remittance platform, you should also consider delivery experience and localized services, as these factors directly impact your fund security and ease of use.

Key Points

- PayPal Xoom is ideal for small, fast remittances with quick delivery but higher fees, suitable for users needing urgent funds.

- Western Union supports cash pickup, ideal for cash collection or urgent needs, but fees are higher and delivery takes longer.

- Low-cost platforms like Wise and CurrencyFair offer low fees, transparent exchange rates, and multi-currency management, suitable for cost-conscious users.

- When choosing a remittance platform, consider fees, delivery speed, exchange rate transparency, and collection methods to make the best choice based on your needs.

- All major platforms are highly secure, but beware of online scams; user-friendly platforms enhance the experience.

Quick Conclusions

Small-Value Remittances

If you need to send small amounts to China, PayPal Xoom and low-cost remittance platforms are viable options. PayPal Xoom offers very fast delivery, often achieving “instant arrival,” but fees are relatively high. For example, when sending $100 (USD), the fee is noticeably higher than some low-cost platforms. If you care about fees and exchange rate transparency, consider Wise or CurrencyFair.

- Wise uses a peer-to-peer model, avoiding intermediary profits, with transparent fees, typically delivering within 8 hours, sometimes in 1-2 hours. You can check fees and delivery time in real-time before sending.

- CurrencyFair charges a small exchange rate margin and fixed fees, ideal for currency exchange needs. You can pre-deposit multiple currencies, set a desired rate, and send once matched.

If you prioritize delivery speed, Xoom excels. If cost matters more, low-cost platforms have the edge.

Urgent Remittances

In urgent situations, delivery speed is the top priority. PayPal Xoom supports “instant arrival,” ideal for quick transfers to China. You can operate via your PayPal account, with funds arriving almost instantly.

Western Union also supports urgent remittances, especially for cash pickup scenarios. You can have the recipient collect cash directly at a Western Union outlet in China without a bank card.

However, Xoom may face PayPal account transfer failures in some cases, with certain service limitations. Western Union’s fees and delivery speed information are less transparent, so you should inquire beforehand.

If you want to save on fees during urgent situations, low-cost platforms like Wise are worth considering. Wise typically delivers in 8 hours, as fast as 1-2 hours, with transparent fees, ideal when balancing time and cost.

Multi-Currency Needs

If you have multi-currency collection or exchange needs, low-cost platforms are more flexible. Wise supports over 50 countries and 40+ currencies, allowing you to hold and exchange multiple currencies directly on the platform. When receiving funds in a Hong Kong bank account, you can choose USD, EUR, and other currencies, facilitating global fund management.

CurrencyFair lets you hold multiple currencies and set desired exchange rates, sending funds after matching, ideal for flexible exchange needs.

PayPal Xoom and Western Union mainly support major currencies, suitable for single-currency remittances. For multi-currency management and flexible exchanges, low-cost platforms better meet your needs.

Tip: When choosing a remittance platform, consider your specific needs, focusing on delivery speed, fees, exchange rate transparency, and supported currencies. Low-cost platforms excel in fees and delivery speed, ideal for cost-effectiveness and multi-currency management.

Low-Cost Remittance Platform Comparison

Image Source: unsplash

Fees

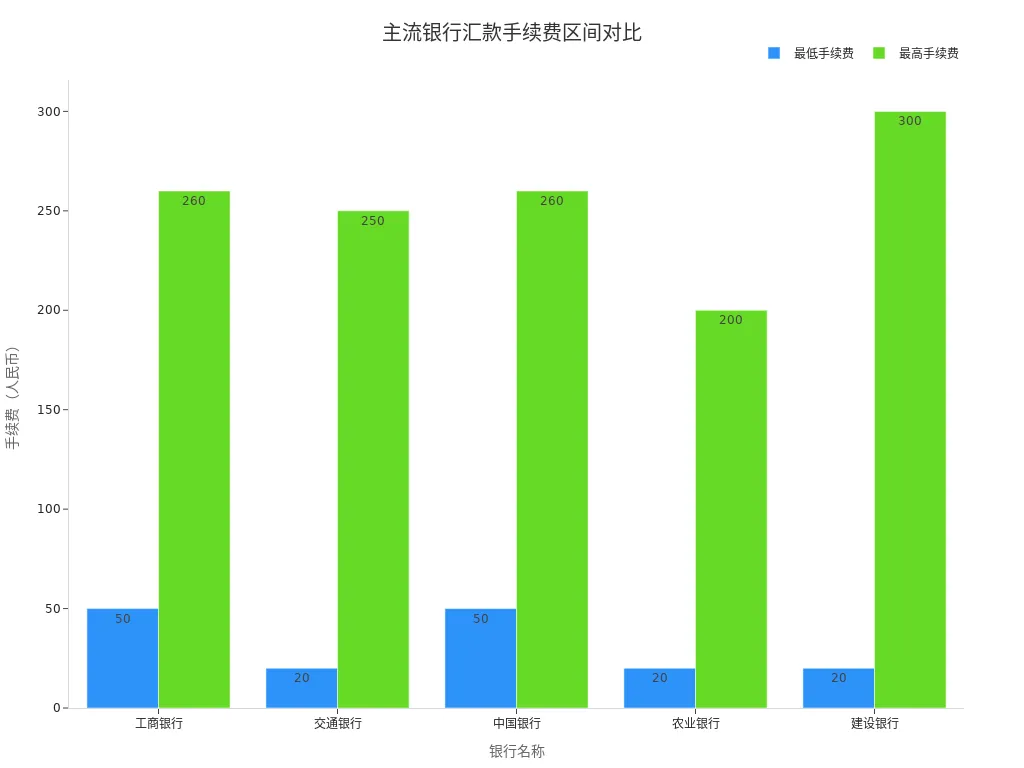

When choosing a remittance platform, fees are the most direct cost. Fee structures vary significantly across platforms. Refer to the table below for fee ranges of major banks and low-cost platforms:

| Institution Type | Institution Name | Fee Rate | Minimum Fee (USD) | Maximum Fee (USD) |

|---|---|---|---|---|

| Hong Kong Bank | ICBC | 0.10% of transfer amount | ~7 USD | ~36 USD |

| Hong Kong Bank | Bank of Communications | 0.10% of transfer amount | ~3 USD | ~35 USD |

| Hong Kong Bank | Bank of China | 0.10% of transfer amount | ~7 USD | ~36 USD |

| Hong Kong Bank | Agricultural Bank | 0.10% of transfer amount | ~3 USD | ~28 USD |

| Hong Kong Bank | China Construction Bank | 0.10% of transfer amount | ~3 USD | ~42 USD |

| Third-Party Platform | Wise, Remitly, Panda Remit, etc. | 0.5%-3% (some fixed fees) | N/A | N/A |

| Third-Party Platform | Western Union | 3.9% + 0.3 USD | Free (if paid by overseas relatives) | N/A |

| Third-Party Platform | KoalaPay | Fixed fee of 5.99 USD | N/A | N/A |

You can see that low-cost platforms generally have lower fees than traditional banks. Wise, Remitly, and similar platforms charge 0.5%-3%, with some using fixed fee models. Western Union’s remittance fees are higher, but certain promotions may waive some fees.

Delivery Speed

In urgent situations, delivery speed is critical. PayPal Xoom supports “instant arrival,” ideal for fast transfers. Wise typically delivers within 8 hours, sometimes 1-2 hours. Remitly offers expedited delivery. Western Union generally takes 1 business day, with no processing on holidays. Hong Kong bank cross-border transfers may take 1-3 business days. For maximum speed, prioritize PayPal Xoom or Wise.

Exchange Rate Transparency

When remitting, exchange rate transparency directly affects the received amount. Wise uses real-time mid-market rates, updated every second, with all fees transparent before the transaction. You can use Wise’s calculator to see all fees and expected delivery amounts upfront. Low-cost platforms generally offer transparent rates with no hidden markups. In contrast, Hong Kong banks and Western Union often include rate markups that aren’t disclosed, resulting in lower-than-expected delivery amounts.

| Platform | Exchange Rate Transparency | Fee Structure | Hidden Fees |

|---|---|---|---|

| Wise | Real-time mid-market rate, transparent, no markup | Fixed fee + <1% proportional fee | No hidden fees |

| Hong Kong Bank | Rate includes markup, not disclosed | Complex fee structure | Possible intermediary bank fees |

| Western Union | Rate includes markup, partially disclosed | 3.9% + 0.3 USD | Possible hidden fees |

If you want predictable costs, prioritize low-cost platforms with transparent rates.

Supported Currencies and Countries

When remitting globally, the number of supported countries and currencies determines flexibility. The table below shows the coverage of major platforms:

| Remittance Platform | Countries Covered | Supported Currencies | Notes |

|---|---|---|---|

| Xoom | 131 | 32 | Does not support transfers to mainland China |

| Western Union | 200+ | 130 | Supports cash pickup in emerging markets |

| Wise | 80+ | 50+ | Does not support some Asian currencies |

| CurrencyFair | N/A | N/A | Information unavailable |

For multi-currency needs, Wise and Western Union offer broader coverage. Western Union supports cash pickup, ideal for recipients without bank cards in certain countries. PayPal Xoom does not support transfers to mainland China, so take note.

Convenience

In terms of operation process, low-cost platforms are generally more convenient. PayPal Xoom supports fully online operations with a Chinese interface, ideal for anytime transfers. Wise and Remitly support mobile apps and web platforms with simple processes. Western Union relies heavily on offline outlets, with more complex procedures and time restrictions. Hong Kong bank transfers require extensive information and complex procedures. For convenience, prioritize online low-cost platforms.

| Remittance Method | Operation Process | Supported Channels | Delivery Time | Convenience Features | Other Notes |

|---|---|---|---|---|---|

| Western Union | Mostly offline, complex process | Limited bank support | ~1 business day | Inconvenient, heavily time-restricted | Higher fees |

| PayPal Xoom | Fully online, supports Chinese interface | Online platform | Faster | Convenient online operation, but high fees and unstable rates | Strict account management |

Security

When choosing a platform, security is paramount. Low-cost platforms like Wise, Remitly, and Paysend are regulated by the UK FCA or EU authorities, using multiple encryption and risk control measures. PayPal Xoom leverages PayPal’s secure system. Western Union, with a long history and global outlets, is reliable. Hong Kong bank transfers have robust compliance systems. You can trust these platforms but stay vigilant against phishing and scams.

Promotions

To save costs, check for platform promotions. PayPal Xoom currently has no promotions. Western Union waives fees during major holidays like Chinese New Year and offers referral rewards: invite friends to register and transfer $100 USD or more to earn a $20 USD Amazon gift card per referral, up to $500 USD. Wise and Remitly occasionally offer first-transfer fee waivers or referral bonuses. Monitor platform websites or apps for the latest offers.

Tip: When choosing a low-cost platform, consider fees, delivery speed, rate transparency, and convenience. Wise and Paysend excel in fees, transparency, and speed, ideal for cost-effectiveness and ease of use.

Detailed Analysis

Image Source: pexels

Fee Structure

When choosing a platform, the fee structure directly impacts your costs. Different platforms have distinct fee models. See the table below:

| Platform | Fee Structure Features | Payment Method Impact on Fees | Other Fees and Features |

|---|---|---|---|

| PayPal Xoom | Tiered fees by payment method and amount: PayPal balance/bank account $4.99 for $1,000 or less, free above $1,000; debit/credit card fees increase | Debit/credit card fees high, PayPal balance/bank account low | Additional currency conversion fees, delivery speed varies by payment method |

| Wise | Percentage-based fees, varies by payment method, credit/debit card fees high with fast delivery, bank account fees low with slower delivery | Payment method affects fees and speed | Transparent fees, ideal for cost-conscious users |

| Western Union | Fees vary widely by country, payment, and collection method, $3.5-$100, credit card and cash pickup cost more | Payment and collection method affect fees, rate fluctuations impact costs | Wide global network, suits diverse needs |

Low-cost platforms like Wise have more transparent fee structures, ideal for clear and predictable costs.

Exchange Rates and Costs

When remitting, exchange rate differences directly affect the received amount. Note the following:

- Real-time rates and fixed rates impact your actual received amount.

- Platforms differ in rate margins; some are close to interbank rates, others have higher spreads.

- Larger transfers often get better rates.

- Some platforms offer rate-locking to mitigate fluctuation risks.

- Multi-currency accounts allow flexible conversions to leverage rate advantages.

Low-cost platforms typically offer rates closer to the market, minimizing losses.

Delivery Experience

During actual remittances, delivery speed and experience matter. User feedback shows:

| Experience Aspect | PayPal Xoom Feedback | Western Union Feedback |

|---|---|---|

| Fast Delivery | Minutes to hours, covers 200+ countries | Minutes to hours, funds reach recipients quickly |

| Security | Multiple security measures, US-regulated | Multiple security measures, trusted globally |

| Convenience | User-friendly website and app | Website, app, or agent outlets, flexible |

| Collection Methods | Bank accounts, mobile wallets, cash pickup | Cash pickup, bank transfers, mobile wallets |

For fast delivery and convenience, prioritize online low-cost platforms.

Security Measures

Security is critical when remitting. PayPal Xoom, Wise, and Western Union use multi-factor authentication, encryption, and anti-fraud measures. Wise and Paysend are FCA-regulated, PayPal Xoom is FinCEN-regulated, and Western Union has a 160-year global reputation. You can use these platforms confidently but stay cautious of scams.

Operation Process

Operating on low-cost platforms is straightforward. Register an account, enter recipient details, choose a payment method, confirm rates and fees, and submit. PayPal Xoom and Wise offer Chinese interfaces with clear processes. Western Union supports online and offline operations for varied needs. Choose the platform that suits your habits.

Payment and Collection Methods

Consider flexibility when choosing payment and collection methods. PayPal Xoom and Wise support bank accounts, credit/debit cards, and more. Western Union also offers cash payments and pickups. You can choose bank deposits, mobile wallets, or cash collection to meet different needs.

Promotions

To save costs, monitor platform promotions. Western Union offers holiday fee waivers and referral rewards. Wise and Paysend provide occasional first-transfer or referral bonuses. Check apps and websites for the latest offers.

Selection Recommendations

Small Family Remittances

For small family transfers, focus on fees and delivery speed. PayPal Xoom may waive fees for PayPal balance payments, but exchange rate losses are ~3%. Western Union advertises “zero fees” but charges ~4.5% through rate margins. Refer to the table below for a quick comparison in small family remittance scenarios:

| Factor | PayPal Xoom | Western Union |

|---|---|---|

| Fees | Some PayPal balance payments fee-free | ~4.5% hidden cost via rate margin |

| Exchange Rate Loss | ~3% | ~4.5% |

| Delivery Speed | Debit card instant in some countries | Instant cash pickup in 55 countries |

| Security | Low fund freeze risk, fast dispute resolution | Higher freeze risk, slower disputes |

For transparent fees and delivery experience, consider low-cost platforms like Wise, with clear fees and fast delivery.

Urgent Needs

For urgent funds, delivery speed is key. Western Union supports instant cash pickup in 55 countries, ideal for quick cash needs. PayPal Xoom offers “lightning delivery” to debit cards in 31 countries. Western Union’s fees are higher, especially for large amounts, but VIP rates are available. PayPal Xoom may waive fees for certain conditions (e.g., first $5,000 transfer), with ~2.75% rate loss. Choose based on recipient country and amount.

PayPal Account Integration

If you have a PayPal account, PayPal Xoom is more convenient. You can pay with PayPal balance or linked bank cards, sometimes fee-free. Xoom is ideal for transfers within the PayPal ecosystem. Without a PayPal account, other low-cost platforms are equally convenient.

Multi-Currency Collection

For multi-currency needs, choose platforms supporting multi-currency management. Wise supports 50+ currencies, allowing free exchanges and holding. Some low-cost platforms support Alipay and WeChat for receiving foreign currencies in China. CurrencyFair is great for setting desired rates and waiting for matches, offering high flexibility.

Cash and Bank Card Collection

For cash pickup, Western Union’s global outlets allow recipients to collect cash with ID. PayPal Xoom supports instant bank account deposits and some cash pickups. Refer to the table below for collection methods and fee differences:

| Item | PayPal Xoom | Western Union |

|---|---|---|

| Collection Methods | Instant bank deposits, some cash pickups | Agent outlet cash pickup, bank deposits, mobile wallets |

| Fees | $4.99 for transfers below $2,999, $7.99 for USD billing | $8-10 for $100 transfer, varies by amount |

| Delivery Time | 2-4 business days | Instant or up to 3 days |

| Target Users | Bank account holders, low fees, fast delivery | Cash pickup users, simple process but high fees |

For fast delivery and low fees, prioritize low-cost platforms. For cash pickup, Western Union is better.

Tip: When choosing a platform, consider your needs, focusing on fees, delivery speed, and collection methods. Low-cost platforms excel in transparency and flexibility, ideal for cost-effectiveness and multi-currency management.

When selecting a cross-border remittance platform, focus on fees, rates, and delivery speed. The table below summarizes the core advantages of PayPal Xoom and Western Union:

| Dimension | PayPal Xoom Advantages | Western Union Advantages |

|---|---|---|

| Fees | Fee-free with PayPal balance, low rate loss | VIP rates for large transfers |

| Exchange Rate | ~2.75% loss, transparent | VIP rate loss as low as 1.8% |

| Delivery Speed | Minutes for many countries, debit card instant | Instant cash pickup in 55 countries |

Choose flexibly based on your needs, ensuring platform compliance and data security for efficient and secure fund delivery.

FAQ

Can PayPal Xoom transfer directly to Chinese bank cards?

You cannot transfer directly to mainland China bank cards via PayPal Xoom. You can send to Hong Kong bank accounts or use low-cost platforms like Wise.

What documents does a Western Union recipient need?

Your recipient needs a valid ID and transfer reference number to collect cash at a Western Union outlet. No bank card is required.

What collection methods does Wise support?

You can transfer funds to Hong Kong bank accounts via Wise. You can also choose Alipay or WeChat for simple, fast delivery.

How do I calculate the actual received amount?

You can input the amount on the platform, and the system will display all fees and the expected received amount clearly, including rates.

What if a transfer fails?

If a transfer fails, contact platform customer service. Provide the order number and relevant details. The platform will assist with refunds or resending.

This article provides an in-depth analysis for Chinese users on the pros and cons of PayPal Xoom versus Western Union for cross-border remittances. The article details a comparison between the two platforms across various aspects, including fees, transfer speed, exchange rate transparency, supported currencies, and convenience. It clearly points out that PayPal Xoom, with its “instant” transfer speed, is the top choice for small, urgent remittances. In contrast, Western Union, with its extensive global cash pickup network, is ideal for users who need to receive cash or who do not have a bank card. The article also highlights that low-cost remittance platforms like Wise and CurrencyFair excel in transparent fees and favorable exchange rates, making them the perfect choice for users seeking high cost-effectiveness.

However, despite the detailed content of the article, a core challenge for many Chinese investors remains: the flow of cross-border funds. Traditional funding methods, such as international bank wire transfers, are not only complex and time-consuming but also come with high fees and opaque exchange rate spreads. These issues can directly impact investment returns and increase transaction costs.

BiyaPay was created to solve these cross-border financial pain points. We offer a smoother, more cost-effective channel for your investments. We support the conversion between various fiat and digital currencies, allowing you to easily manage global assets, and provide a real-time exchange rate query feature to ensure you always get the best rates. What’s more, our remittance fees are as low as 0.5% with same-day delivery, significantly cutting down your transaction costs and time. Now, you don’t need a complex overseas account to invest in both U.S. and Hong Kong stocks on one platform. Say goodbye to the hassle of cross-border payments and start your efficient financial journey. Register with BiyaPay today to make fund management as smooth as trading.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.