- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Common Channels and Latest Policy Insights for Remittances from China to the USA

Image Source: pexels

You can process remittances from China to the USA through various methods, such as bank wire transfers, third-party platforms, and cash remittances. Since 2023, policies stipulate that each individual can remit up to $50,000 (USD) annually, requiring valid identification and supporting documents. You must accurately declare the purpose of the remittance, as banks conduct strict reviews and prohibit uses like overseas property purchases or fund investments. In the USA, remittances exceeding $10,000 (USD) must be reported to the IRS, making compliance crucial.

Core Points

- Remittances from China to the USA primarily involve bank wire transfers, third-party platforms, and cash remittances, each with its pros and cons, suitable for different needs.

- The annual remittance limit per person is $50,000, requiring authentic documents and accurate declaration of purpose to ensure compliance and safety.

- Third-party platforms like Wise offer transparent fees, favorable exchange rates, and fast receipt, ideal for small, frequent remittances; bank wire transfers are secure and formal, suitable for large and long-term purposes.

- Cash remittances are fast but have high fees, suitable for urgent small-amount needs, not for large transfers.

- When choosing a remittance channel, consider fees, receipt speed, security, and policy changes, and retain all receipts to mitigate risks.

Remittance Channels

Image Source: unsplash

Bank Wire Transfers

You can choose bank wire transfers as a traditional method for remittances from China to the USA. Many major banks, such as Bank of China and China Merchants Bank, support this service. Bank wire transfers are suitable for scenarios like tuition, living expenses, and family support. You need to prepare the recipient’s name, account number, detailed address, receiving bank name, and SWIFT code. As a SWIFT member bank, China Merchants Bank supports multi-currency and multi-region remittances, with the following process:

- Fill out a remittance application form, specifying the recipient’s information and remittance amount.

- Provide identification and relevant documents, explaining the remittance purpose.

- After bank review, the remittance is processed through the SWIFT system, typically arriving in 3-5 business days.

- You can choose whether the sender or recipient bears overseas bank fees; if unspecified, the recipient bears them by default.

- China Merchants Bank supports automatic opening of multi-currency accounts for easy receipt of foreign currency remittances.

Bank wire transfers are suitable for large amounts requiring formal receipts. You can process them through Bank of China, which offers lower fees and faster receipt, typically within 24 hours.

Tip: Bank wire transfers are highly secure, ideal for long-term uses like study abroad or business transactions, but require more documentation and a relatively complex process.

Third-party Platforms

If you prioritize convenience and fee transparency, you can choose third-party platforms for remittances from China to the USA. Common platforms include Wise and Alipay International Remittance. Wise supports instant low-cost transfers in over 50 currencies, emphasizing speed, affordability, and transparency. Alipay International Remittance, via its “Cross-border Remittance” mini-program, supports Wise as a remittance tool, with the following process:

- Open Alipay and access the “Cross-border Remittance” mini-program.

- Select “Instant Receipt,” fill in the remittance amount and recipient information.

- Create or log into a Wise account, choose the funding currency and amount.

- Enter the recipient’s Alipay account number and name, then confirm the information.

- Select a payment method and complete the payment.

| Platform | Features | Target Users |

|---|---|---|

| Wise | Multi-currency low-cost transfers, transparent fees, fast receipt, no hidden exchange rate fees | Individuals and businesses with cross-border living, working, travel, or family support needs |

| Alipay International Remittance | Easy operation, suitable for USD-to-CNY conversions received via Alipay | Users needing USD-to-CNY conversion and Alipay receipt |

Third-party platforms are suitable for smaller, frequent remittances with demands for fast receipt. You can operate anytime, anywhere, with a simple process, ideal for daily living expenses or family remittances.

Cash Remittances

You can also choose cash remittances. Western Union is a globally recognized cash remittance provider. You only need to bring identification and cash to a Western Union outlet, fill in the recipient’s information and amount, and receive a reference code to notify the recipient. The recipient can withdraw cash at designated US outlets with ID and the reference code. Cash remittances are fast, suitable for urgent funding needs, but have high fees and amount limits.

Note: Cash remittances are not suitable for large fund transfers due to loss risks; use them only in emergencies.

Other Methods

In addition to the main channels, you can consider the following methods for remittances from China to the USA:

| Remittance Method | Applicable Scenarios | Fees and Features |

|---|---|---|

| Mailing Personal Checks | Cost-saving for senders with ample time | Fees around 0.2% of the amount, takes 1-2 months, risk of check loss |

| UnionPay Remittance | Fast small-amount remittances | Fee of $8.8, single transaction limit of $2,999, monthly limit of $9,999, instant receipt |

| Traveler’s Checks | Used by travelers themselves | Fees around 0.75% of the amount, purchased at banks, redeemed at US banks |

| Foreign Currency Drafts | Bank-issued drafts | Fees around 0.1% of the amount, additional cash conversion fees for cash remittances, recipients withdraw with the draft |

These methods suit specific needs, such as non-urgent, small-amount, or travel-related remittances. You can choose the most suitable channel based on your situation.

Fees and Speed for Remittances from China to the USA

When choosing a remittance channel from China to the USA, you are likely most concerned about fees, exchange rates, receipt speed, and the actual received amount. Different channels have significant variations in fee structures and receipt times. Below, we break down the costs and efficiency of bank wire transfers, third-party platforms, and cash remittances to help you understand each option comprehensively.

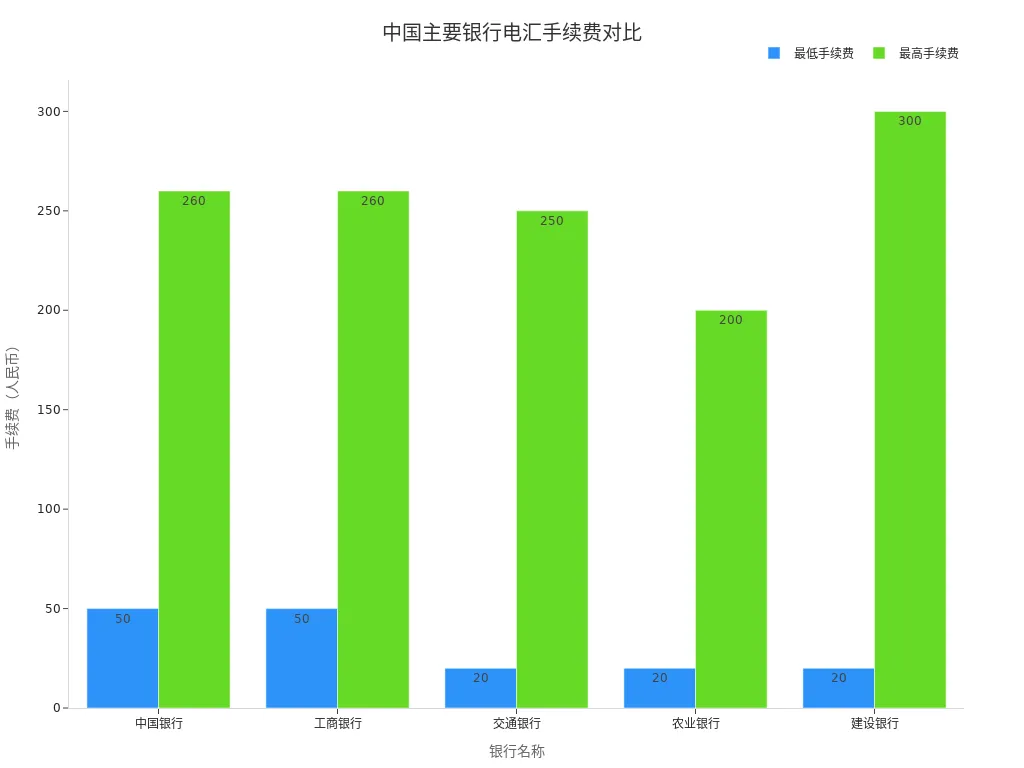

Bank Wire Transfer Fees

Bank wire transfers are a common choice for remittances from China to the USA. You need to consider handling fees, exchange rate differences, and potential intermediary bank fees. Major Chinese banks charge similar wire transfer fees, typically 0.1% of the remittance amount, with minimum and maximum limits. You also need to pay telegraph fees, and some banks offer full-amount receipt services, but intermediary bank fees are variable and may reduce the actual received amount.

| Bank Name | Fee Rate | Minimum Fee (USD) | Maximum Fee (USD) | Telegraph Fee (USD) | Exchange Rate Notes | Full-amount Receipt Service Fees |

|---|---|---|---|---|---|---|

| Bank of China | 0.1% | 7 | 37 | 22 | Based on real-time forex rates, includes cash-to-transfer spread | No clear fee, may be deducted by intermediary banks |

| ICBC | 0.1% | 7 | 37 | - | - | - |

| Bank of Communications | 0.1% | 3 | 36 | - | - | - |

| Agricultural Bank of China | 0.1% | 3 | 29 | - | - | - |

| China Construction Bank | 0.1% | 3 | 44 | - | - | - |

Tip: Bank wire transfer exchange rates are typically less favorable than third-party platforms. You should also note that intermediary banks may charge additional fees, reducing the received amount.

Third-party Platform Fees

Third-party platforms like Wise and Alipay International Remittance are increasingly popular due to transparent fees and favorable exchange rates. When using Wise, fees consist of fixed and variable components. For example, a $1,000 remittance to the USA incurs about $14.81 (including a $4.78 fixed fee and a 1.01% variable fee). Wise uses the market mid-rate with no hidden markups, offering better rates than banks. You don’t need to worry about account opening or maintenance fees, keeping overall costs lower.

| Platform | Fee for $1,000 Remittance (USD) | Exchange Rate Markup | Account Maintenance Fee | Receipt Speed | Other Advantages |

|---|---|---|---|---|---|

| Wise | 14.81 | None | Free | Instant for most currencies | Transparent rates, predictable received amount |

| Bank | 7-44 + telegraph fee 22 | Yes | Possible | 1-3 business days | Possible intermediary bank deductions |

When you remit via Wise, $1,000 can be converted to about 7,137 CNY, compared to about 6,793 CNY via banks, allowing you to receive more.

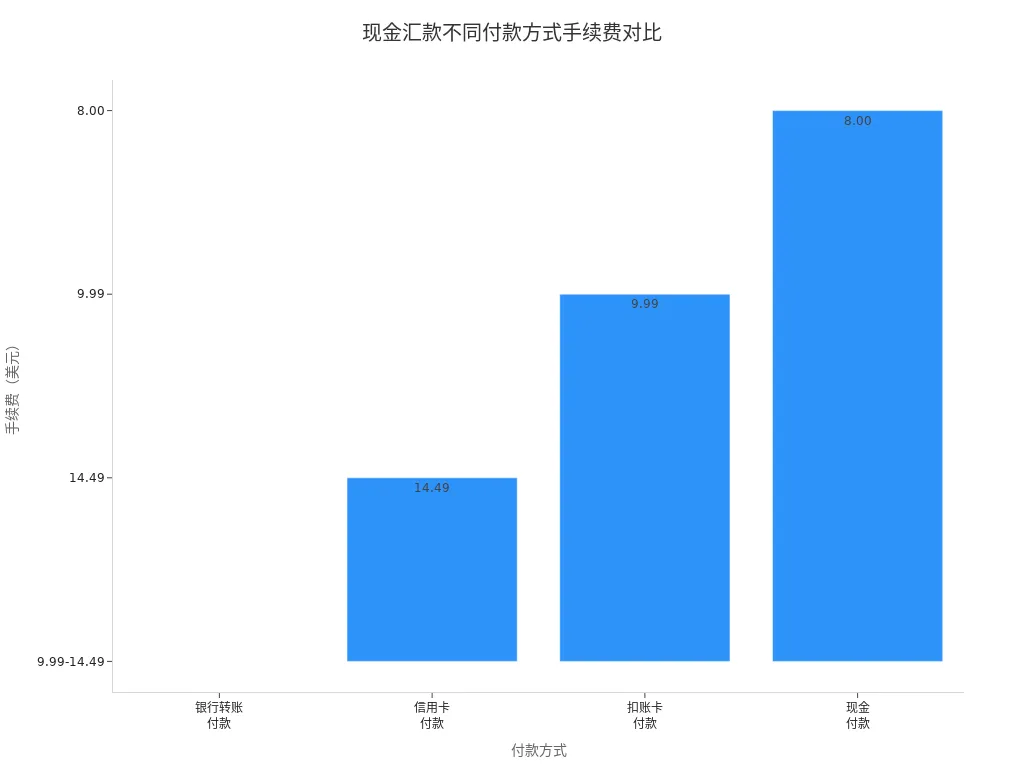

Cash Remittance Fees

Cash remittances, such as Western Union, are suitable for urgent small-amount transfers. When processing at a Western Union outlet, fees vary by payment method. Bank transfer payments incur fees of $9.99-$14.49, credit card payments $14.49, and cash payments $8. Western Union’s exchange rate spread is significant, around 1.16%-2.3%, representing a hidden cost. You should note that, despite fast receipt, the actual received amount is reduced due to rate markups.

| Payment Method | Fee (USD) | Exchange Rate Spread Range |

|---|---|---|

| Bank Transfer | 9.99-14.49 | 1.16%-2.3% |

| Credit Card | 14.49 | 1.16%-2.3% |

| Debit Card | 9.99 | 1.16%-2.3% |

| Cash | 8.00 | 1.16%-2.3% |

Cash remittance fees are high, and exchange rates are less favorable, suitable for emergencies. You should calculate the actual received amount in advance.

Receipt Time Comparison

When choosing a remittance channel from China to the USA, receipt speed is a key consideration. Bank wire transfers typically take about 3 business days, with some banks faster. Third-party platforms like Wise can achieve instant receipt for some currencies, with most completed within 1 business day. Cash remittances like Western Union arrive in minutes, ideal for urgent needs.

- Bank wire transfers: ~3 business days

- Third-party platforms like Wise: Instant for most currencies, fastest in minutes, slowest within 1 business day

- Cash remittances: Within minutes

If you prioritize receipt speed, third-party platforms and cash remittances are more advantageous. If you value fund security and formal receipts, bank wire transfers are more suitable.

You can choose the most suitable remittance method from China to the USA based on your needs, considering fees, exchange rates, and receipt times.

Safety and Compliance

Fund Safety

When choosing a remittance channel from China to the USA, fund safety is a top priority. Bank wire transfers and third-party platforms implement multiple measures to ensure your funds’ safety:

- You can choose remittance companies with strong reputations and extensive experience to ensure professional and secure fund transfers.

- Banks and third-party platforms generally use bank-grade encryption to protect your personal and transaction data from leaks.

- Hong Kong banks, when processing wire transfers, verify both parties’ account information before proceeding, further reducing risks.

- Third-party platforms like Wise use digital encryption and fast processing to enhance fund safety and receipt efficiency.

- You can review user feedback on remittance companies to assess service reliability.

Reminder: Before remitting, verify the platform’s credentials to avoid fund losses due to poor choices.

Compliance Requirements

Cross-border remittances must strictly adhere to Chinese and US laws and regulations. You need to note the following compliance requirements:

- You must comply with US economic sanctions regulations, particularly OFAC’s sanctions list, ensuring the transaction counterparty is not restricted.

- Banks and third-party platforms verify your identity to prevent money laundering and terrorist financing.

- You must accurately provide the recipient’s name, address, bank information, remittance amount, and purpose; incomplete information may lead to frozen funds.

- Financial institutions monitor suspicious transactions and take action if risks are detected.

- If funds are frozen, you should proactively communicate with the bank and regulators, providing proof to facilitate unfreezing.

Risk Warnings

During the remittance process, you should be aware of the following risks:

- Banks and payment platforms monitor suspicious transactions and may freeze funds to ensure account safety.

- Risk control measures protect your funds but may occasionally disrupt normal transactions due to misjudgments.

- You should conduct due diligence before large or sensitive transactions to ensure no sanctions risks in the transaction chain.

- Retain all remittance receipts and communication records for quick resolution of issues.

Summary: Only by choosing compliant channels and accurately declaring information can you maximize fund safety and avoid unnecessary legal and financial risks.

Remittance Limits and Documents

Annual Limits

You can remit up to $50,000 (USD) annually from China to the USA per person, per purpose. This limit is non-cumulative and cannot be carried over to the next year. When remitting, banks require authentic and valid documents to verify the purpose. Banks ensure your funds’ use is compliant, such as for tuition or living expenses. You should note that single transactions exceeding $10,000 (USD) attract close scrutiny from banks and US regulators.

Reminder: If you plan multiple remittances, allocate amounts in advance to avoid exceeding the annual limit.

Required Documents

When processing bank wire transfers, you need to prepare the following documents:

- Recipient’s name, address, and account number.

- Receiving bank’s SWIFT code or IBAN code.

- Remittance amount and currency (e.g., USD).

- Your identification documents, such as a passport copy.

When visiting a bank, you fill out forms and submit documents for verification. For third-party platforms like Wise, you register an account, verify your identity, input recipient and payment details, and confirm the transaction. You can track remittance progress anytime via the platform. Hong Kong banks also support online and mobile banking for self-service remittances, offering convenience and speed.

Authentic Proof

When remitting, you must provide authentic transaction proof. Banks and third-party platforms require you to specify the remittance purpose, such as tuition, medical expenses, or family support. You need to retain all remittance receipts and electronic confirmations, which help resolve issues quickly. Personal and commercial remittances require different documents: personal remittances need identity proof and purpose statements, while commercial remittances require contracts, invoices, etc.

Recommendation: Retain all receipts after each remittance to effectively address bank or regulator inquiries.

Remittance Process

Bank Process

When processing remittances from China to the USA via a bank, you can choose online or offline methods. Online processes are typically completed through Hong Kong banks’ online or mobile banking. You need to prepare detailed recipient information, including bank name, address, account number, and SWIFT code. After logging into online banking, add the recipient, input the remittance amount, and set up security authentication. Online operations are convenient for remote processing but require accurate information. Offline processes involve visiting a bank branch, filling out a wire transfer application, and submitting identification and documents. Branch staff provide guidance, suitable for first-time or complex remittances. Regardless of the method, banks charge wire transfer fees (e.g., $45), and intermediary bank fees may apply. You can choose who bears the fees (OUR, SHA, BEN), and exchange rate fluctuations affect the received amount.

Third-party Platform Process

If you choose third-party platforms like Wise or Alipay International Remittance, the process is simplified. You register an account, complete identity verification, and input recipient information and remittance amount. The platform displays real-time exchange rates and fees, helping you lock in costs. You can pay via bank card, credit card, or balance. After submission, the platform completes the transfer within 1 business day, with most currencies arriving instantly. You can track progress anytime on the platform. Third-party platforms are ideal for smaller, frequent daily remittances, offering flexible operations and transparent fees.

Cash Remittance Process

When processing cash remittances like Western Union, you can submit applications via bank counters, online banking, or mobile banking. You need to provide complete recipient information, valid identification, and pay the remittance and fees. Counter remittances can go up to $10,000 (USD), electronic channels up to $5,000 (USD). Upon completion, you receive a Money Transfer Control Number (MTCN), which you must promptly share with the recipient. The recipient withdraws cash at US outlets with the MTCN and ID. You should note that the remittance currency is USD, with recipients choosing USD or EUR. Fees follow Western Union standards, with no additional bank charges. Verify all information to avoid delays due to errors.

Considerations

Before remitting, carefully verify recipient information, ensuring the name, account number, and bank codes are correct. Identity verification is mandatory for all channels, with banks and platforms strictly enforcing anti-money laundering checks. Monitor exchange rate changes and lock rates if necessary to reduce losses. Intermediary bank fees may affect the received amount, so consult banks or platforms in advance. Online remittances are convenient but require attention to daily cut-off times and information accuracy. Offline remittances are suitable for cases needing staff assistance. Retain all remittance receipts and confirmations for quick issue resolution.

Reminder: Regardless of the method, comply with relevant laws and regulations, cooperate with bank and platform compliance requirements, and ensure secure and smooth remittances.

Policies and Latest Changes

Image Source: pexels

Foreign Exchange Management

When processing remittances from China to the USA, you need to stay informed about the latest policies from China’s State Administration of Foreign Exchange. The annual foreign exchange purchase limit per person is $50,000 (USD), with banks strictly reviewing remittance purposes. You must provide authentic identity information and proof of fund sources. Hong Kong banks and other financial institutions verify your documents to ensure compliant fund flows. Starting January 1, 2026, the USA will impose a 1% tax on remittances via non-bank channels (e.g., cash, Western Union, drafts, promissory notes). Remittances through formal bank accounts are exempt from this tax. This change will influence your choice of remittance channels, with more people likely opting for banks and formal institutions.

Declaration Requirements

When remitting, you must accurately declare the remittance amount and purpose. Banks and third-party platforms require detailed recipient information and purpose statements. Single remittances exceeding $10,000 (USD) are automatically reported to China’s State Administration of Foreign Exchange and US authorities. You need to retain all remittance receipts for future audits. With policy changes, compliance risks have increased, and banks strengthen monitoring of large and frequent remittances. Failure to declare accurately may result in frozen or returned funds.

Tip: When processing remittances from China to the USA, prepare all documents in advance, ensure information is accurate and complete, and avoid issues due to non-compliant declarations.

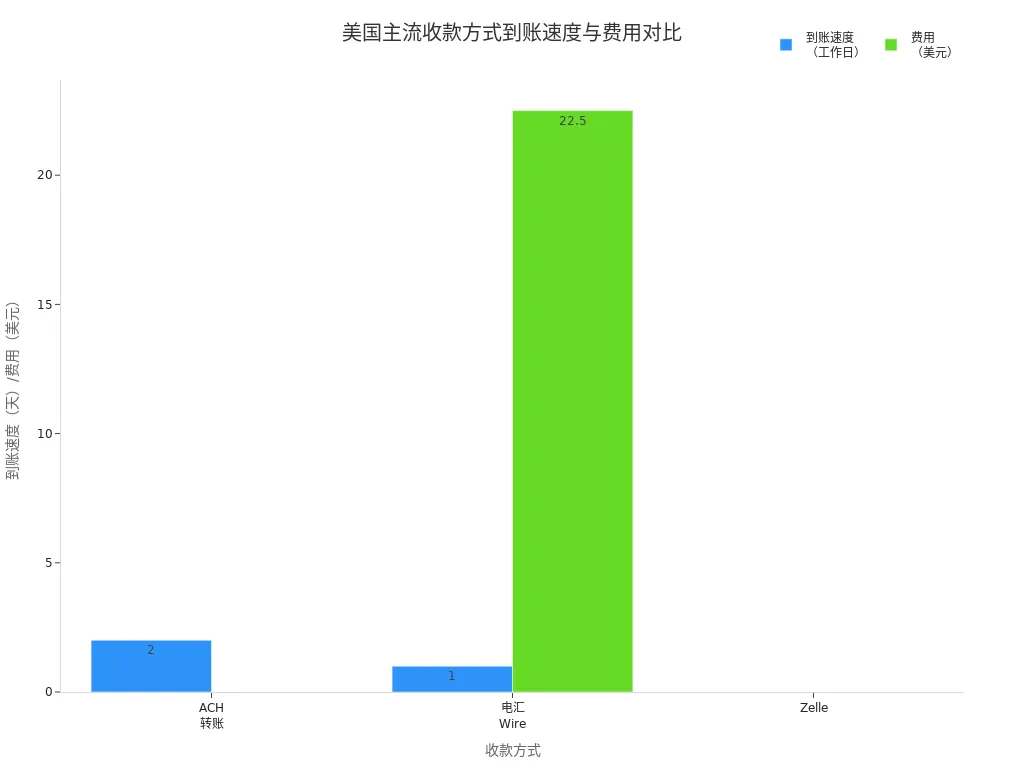

US Receipt Methods

When receiving funds in the USA, you can choose from multiple methods. Common options include ACH transfers, wire transfers, and Zelle. Each method varies in receipt speed and fees. You can refer to the table below to choose the most suitable receipt method:

| Receipt Method | Fees | Receipt Speed | Applicable Scenarios |

|---|---|---|---|

| ACH Transfer | Usually free | 1-3 business days | Daily payments, limited by amount and frequency |

| Wire Transfer | Domestic: $15-30, International: $35-50 | Domestic: same day, International: 3-5 business days | Urgent or large payments, fast but costly |

| Zelle | Free | Instant | Small personal transfers, single or daily limit ~$2,500 |

When choosing a receipt method, consider your specific needs. For fast receipt, choose Zelle or wire transfers. For cost savings, opt for ACH transfers. Post-policy changes, bank channels offer higher compliance and safety, making them a preferred choice.

- Starting January 1, 2026, the USA will impose a 1% tax on remittances via non-bank channels.

- This policy will increase costs for families relying on cross-border remittances, affecting fund flows.

- Remittances through formal bank accounts are exempt from this tax, making them a preferred compliant option.

- You may lean toward bank channels to avoid additional taxes and ensure fund safety.

Note: When processing remittances from China to the USA, stay informed about policy changes, choose compliant channels, and protect your financial interests.

Channel Selection Recommendations

Needs Matching

When choosing a remittance channel from China to the USA, you should first clarify your specific needs. Different remittance purposes suit different channels. For example, to pay tuition, you can consider drafts, wire transfers, third-party platforms, or dedicated tuition payment platforms. For living expenses or family support, opt for bank wire transfers, traveler’s checks, or transfers after opening a US account. For emergencies requiring fast remittances, choose Western Union or carry cash. The table below helps you quickly compare applicable scenarios and pros and cons of different channels:

| Remittance Channel | Applicable Needs | Advantages | Considerations |

|---|---|---|---|

| Drafts, Wire Transfers, Traveler’s Checks | Tuition, living expenses, family remittances | Traditional and formal, some banks support USD | Some banks don’t accept USD, monitor exchange rates and fees |

| Credit Card | Tuition payments | Convenient, supports auto-payments | High fees, some schools accept only US credit cards |

| Carrying Cash | Living expenses, urgent funds | Convenient, legal entry with amount proof | Amount limits, security risks |

| Transfers After US Account Opening | Tuition, living expenses | Easy fund management, builds credit history | Requires US account opening, higher fees |

| Hong Kong Bank Cross-border Transfers | Tuition, living expenses, family remittances | Easy online operations, fast receipt | Fees and telegraph costs, monitor rate changes |

| Third-party Payment Platforms | Tuition payments | Supports CNY payments, convenient | Higher rate costs, some platforms lack Chinese support |

You can select the most suitable remittance method based on your needs and the table’s content.

Cost Priority

If you prioritize remittance costs, compare fees and exchange rates across channels. Bank wire transfer fees are typically 0.1% of the amount, with minimum and maximum limits, plus telegraph fees. Third-party platforms like Wise have transparent fee structures and near-market mid-rates, offering lower overall costs. Western Union has high fees and less favorable rates. Calculate the actual received amount in advance to choose the lowest-cost channel.

Recommendation: Before remitting, use each platform’s fee calculator to avoid reduced received amounts due to hidden fees.

Safety Priority

If you prioritize fund safety, choose Hong Kong bank wire transfers or major third-party platforms. Bank wire transfers follow strict procedures and high compliance, suitable for large and long-term uses. Third-party platforms like Wise and Alipay International Remittance use bank-grade encryption to ensure fund safety. Avoid remitting through unknown channels or individual intermediaries to prevent fund or compliance risks.

Retain all remittance receipts and confirmations for quick issue resolution.

Common Pitfalls

When choosing a remittance channel, you may fall into pitfalls. Some focus only on fees, ignoring exchange rate differences and intermediary bank fees, reducing the received amount. Others choose informal channels for simplicity, overlooking compliance and safety risks. Some fail to prepare documents in advance, causing returns or delays.

- Consider fees, exchange rates, receipt speed, and safety comprehensively.

- Ensure all information is accurate and complete to avoid delays due to incomplete documents.

- Monitor policy changes and adjust remittance plans promptly.

Choosing the right channel ensures your funds arrive in the USA safely, quickly, and cost-effectively.

When selecting a remittance channel from China to the USA, focus on fees, receipt speed, safety, limits, and compliance requirements. Each method has its pros and cons. Choose based on amount, frequency, and purpose. Stay informed about policy changes to ensure compliant operations and avoid risks.

FAQ

What are the main methods for remitting from China to the USA?

You can choose bank wire transfers (e.g., Hong Kong banks), third-party platforms (e.g., Wise, Alipay International Remittance), or cash remittances (e.g., Western Union). Each suits different needs.

What documents are needed for remittances?

You need to provide identification, recipient information, and proof of remittance purpose. Banks typically require passports, tuition bills, or living expense proof. Third-party platforms require identity verification.

What happens if a single remittance exceeds $10,000 (USD)?

If you remit over $10,000 (USD) in a single transaction, banks automatically report to China’s State Administration of Foreign Exchange and US authorities. You must accurately declare the purpose to ensure compliance.

How long does it take for remittances to arrive?

Bank wire transfers take about 3 business days. Third-party platforms like Wise can be instant, up to 1 business day. Western Union cash remittances complete in minutes. Receipt times vary by channel and bank.

What to do if a remittance is returned?

Contact the remitting bank or platform’s customer service to verify information accuracy. Provide additional documents or correct errors. Banks will assist with reprocessing or refunding funds.

This article provides a comprehensive guide for users on remitting money from China to the United States, aiming to help them choose the most suitable method. The article offers a detailed comparison of three mainstream channels: bank wire transfers, third-party platforms, and cash remittances, analyzing their pros and cons in terms of fees and speed, security and compliance, and limits and required documents. The article highlights that bank wire transfers are secure and suitable for large amounts; third-party platforms like Wise, with their transparent fees and fast transfers, are ideal for frequent, small-amount remittances; and cash remittances are best for urgent, small-amount needs. The article also specifically emphasizes the latest foreign exchange policies and compliance requirements, reminding users to truthfully declare the purpose of their funds to avoid unnecessary risks.

However, despite the detailed content of the article, a core challenge for many Chinese investors remains: the flow of cross-border funds. Traditional funding methods, such as international bank wire transfers, are not only complex and time-consuming but also come with high fees and opaque exchange rate spreads. These issues can directly impact investment returns and increase transaction costs.

BiyaPay was created to solve these cross-border financial pain points. We offer a smoother, more cost-effective channel for your investments. We support the conversion between various fiat and digital currencies, allowing you to easily manage global assets, and provide a real-time exchange rate query feature to ensure you always get the best rates. What’s more, our remittance fees are as low as 0.5% with same-day delivery, significantly cutting down your transaction costs and time. Now, you don’t need a complex overseas account to invest in both U.S. and Hong Kong stocks on one platform. Say goodbye to the hassle of cross-border payments and start your efficient financial journey. Register with BiyaPay today to make fund management as smooth as trading.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.