- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Hong Kong Stock Platform Review for Chinese Users: In-Depth Analysis of Tiger Brokers and Valuable Capital Services

Image Source: pexels

When choosing a Hong Kong stock investment platform, Tiger Brokers is popular for its user-friendly operation and tech-driven experience, suitable for those seeking an efficient trading experience. Valuable Capital, with its extensive Hong Kong stock services and professional support, is ideal for investors who value localized services. Platforms like Futu, Longbridge, VSTAR, Webull, and moomoo each have unique features, with fierce market competition. A Hong Kong stock platform review helps you quickly find the right investment entry based on your needs.

Key Points

- When selecting a Hong Kong stock platform, prioritize those with a Hong Kong Securities and Futures Commission (SFC) license to effectively ensure fund safety and compliance.

- Tiger Brokers is suitable for users seeking efficient account opening and multi-market investments, with transparent fees and support for various investment tools.

- Valuable Capital offers localized services and professional support, with strong compliance, ideal for investors prioritizing fund safety and local expertise.

- Preparing identity documents and related materials during account opening can speed up the review process, with some platforms offering fully online operations for added convenience.

- Pay attention to platform commissions, margin rates, and fund transfer speeds, and choose the most suitable platform based on your trading habits to avoid hidden fees impacting returns.

Hong Kong Stock Platform Review: Background and Regulation

Image Source: pexels

Tiger Brokers Background and Regulation

When choosing a Hong Kong stock platform, Tiger Brokers often catches your attention. Tiger Brokers was founded in 2014, with its headquarters in Hong Kong. The company holds financial licenses in multiple regions globally and is regulated by several authoritative bodies. You can quickly understand Tiger Brokers’ basic information through the table below:

| Item | Details |

|---|---|

| Company Name | Tiger Brokers |

| Founded | 2014 |

| Registered Region | Hong Kong |

| Main Regulatory Bodies | US Financial Industry Regulatory Authority (FINRA), Australian Securities and Investments Commission (ASIC), Hong Kong Securities and Futures Commission (SFC), US Securities and Exchange Commission (SEC), Monetary Authority of Singapore (MAS) |

These regulatory bodies require Tiger Brokers to comply with strict financial standards, ensuring your trading safety. When using Tiger Brokers, you can feel the platform’s efforts in fund segregation, identity verification, and risk control. However, you should note that in 2022, the China Securities Regulatory Commission identified Tiger Brokers as engaging in “illegal securities business operations” and required it to stop onboarding new Chinese clients. Although Tiger Brokers denied any violations, regulatory authorities have repeatedly emphasized that securities trading services for Chinese investors require approval. When using Tiger Brokers, you need to pay attention to its compliance and policy risks, especially in the gray area of cross-border business. While Tiger Brokers emphasizes compliance, the market and regulators still question its cross-border operations, with greater fund safety and compliance risks. When conducting a Hong Kong stock platform review, you must consider these factors.

Valuable Capital Background and Regulation

Valuable Capital is a well-established Hong Kong-based brokerage. If you value localized services and compliance, you should focus on Valuable Capital. Below is the key background and regulatory information for Valuable Capital:

- Valuable Capital was founded in 1995 by Yeung Mau-lam, with its headquarters in Hong Kong.

- In 2010, Valuable Capital listed on the main board of the Hong Kong Stock Exchange, becoming a well-known listed brokerage.

- Its business scope is extensive, including securities brokerage, margin financing, commodity and futures brokerage, precious metals trading, forex trading, IPO subscriptions, and automated trading services.

- Holds Hong Kong SFC licenses 1, 2, 4, 5, 6, and 9, covering securities trading, futures contract consulting, asset management, and more.

- The primary regulatory body is the Hong Kong Securities and Futures Commission (SFC).

When choosing Valuable Capital, you can feel its commitment to compliance and fund safety measures. The Hong Kong SFC imposes strict requirements on licensed institutions, including reserve assets, anti-money laundering, risk management, and technological security. Valuable Capital must submit regular compliance plans and commit to meeting regulatory requirements. If it fails to meet standards, regulators will arrange a wind-down period to protect investor interests. During a Hong Kong stock platform review, Valuable Capital’s compliance and local regulatory advantages are worth noting.

Tip: When choosing a Hong Kong stock platform, prioritize those with an SFC license to effectively reduce policy risks and fund safety concerns.

Overview of Other Major Platforms

In a Hong Kong stock platform review, you will also encounter major platforms like Futu, Longbridge, VSTAR, Webull, and moomoo. These platforms are mostly registered in Hong Kong or Singapore and hold financial licenses in multiple regions. Futu and moomoo, both under Futu Holdings, hold SFC licenses with high compliance. Longbridge, VSTAR, and Webull are also licensed in Hong Kong, Singapore, and other regions. When using these platforms, your funds are typically held in Hong Kong banks, with platforms implementing customer identity verification and fund flow monitoring to form a closed-loop risk control system in collaboration with regulators.

However, you should note that cross-border brokers may face compliance reviews by Hong Kong banks during deposit and withdrawal processes. Brokers do not bear liability for guaranteeing fund safety, so you need to invest through legitimate channels to mitigate risks. The US, EU, and Hong Kong have strict capital adequacy, liquidity, and anti-money laundering requirements for brokers. The Hong Kong Monetary Authority and SFC jointly regulate to ensure user fund safety, but the complexity and policy risks of cross-border operations remain.

When choosing a Hong Kong stock platform, you must focus on the platform’s licensing status, regulatory compliance, and fund safety measures. Only then can you invest with confidence in the Hong Kong stock market and minimize unnecessary risks.

Account Opening Process Comparison

Image Source: pexels

Tiger Brokers Account Opening

When opening an account with Tiger Brokers, the process is very clear. You can follow these steps:

- Visit the Tiger Brokers website, register an account, and enter your phone number, verification code, and password.

- Confirm registration.

- Fill in personal information.

- Select the account type, with a margin account recommended.

- Provide investment information and activate relevant permissions.

- Read the client agreement and complete the W-8BEN tax form.

- Upload identity verification documents, including clear photos of both sides of your ID and a handwritten signature.

- Submit documents and await platform review.

You only need to prepare clear photos of your identity documents and basic personal information. The review time is generally quick, but the exact duration depends on the completeness of your documents and the platform’s review progress.

Valuable Capital Account Opening

When opening an account with Valuable Capital, the process is also straightforward. You can submit an account opening application via the website or app. You need to provide personal details, investment experience, and a risk tolerance assessment. You also need to upload identity proof and address proof (e.g., a Hong Kong bank statement or utility bill). Valuable Capital will arrange video witnessing or a phone call to verify your identity. Once approved, you will receive account details and can start investing.

Overview of Other Platforms’ Account Opening

When opening accounts with platforms like Futu, Longbridge, or VSTAR, the process is similar. You need to prepare basic documents like an ID, phone number, and Hong Kong bank card. Platforms streamline the experience with digital processes. The table below shows the account opening requirements and features of major platforms:

| Platform | Account Opening Requirements | Convenience and User Experience | Unique Features and Services |

|---|---|---|---|

| Futu Securities | ID, phone, bank card, and other basic documents | Streamlined investment process via the “Futu Niuniu” digital platform, excellent user experience | Rich investment analysis tools, social interaction features, supports US, Hong Kong, and A-share trading |

| Longbridge Securities | ID, phone, bank card, and other basic documents | Focuses on technological innovation and user experience, secure and stable platform, offers cross-border investment services | Cross-border investments, real-time market insights, professional research reports, social interaction features |

| VSTAR Securities | ID, phone, bank card, and other basic documents | Streamlined investment process via the “VSTAR” digital platform, user-friendly interface | Real-time market data, professional investment analysis tools, supports US, Hong Kong, and A-share trading |

Convenience and Document Requirements

When choosing an account opening platform, convenience and document requirements are key considerations. Platforms like Tiger Brokers and Futu support fully online operations, requiring mainly identity proof and a Hong Kong bank card. Valuable Capital emphasizes compliance and may require additional address proof. When opening an account, preparing all documents in advance can significantly improve review efficiency. Most platforms complete reviews quickly, typically within 1-3 business days. During a Hong Kong stock platform review, you can choose the most suitable platform based on your document preparation and convenience needs.

Hong Kong Stock Platform Review: Fee Comparison

When choosing a Hong Kong stock investment platform, the fee structure directly impacts your investment returns. During a Hong Kong stock platform review, you need to focus on core components like commissions, platform fees, and margin rates. Different platforms have varying fee standards and discount policies, with some including hidden costs. You should learn to compare and find the most suitable Hong Kong stock investment entry.

Tiger Brokers Fees

Tiger Brokers offers a relatively transparent fee structure. After opening an account, Hong Kong stock trading commissions do not exceed 0.3% of the transaction amount, with a minimum of $5 (approximately HK$39 at an exchange rate of 1 USD to 7.8 HKD). The default commission for Stock Connect is about 0.03%, and you can negotiate lower rates with your account manager. Margin rates are discounted to 4.5%, suitable for those with financing needs. Options fees are $1.7 per contract, with ETF and convertible bond trading rates as low as 0.05%. When selling Hong Kong stocks, you need to pay a stamp duty (0.05% of the sale amount, charged unilaterally) and a transfer fee (0.01%, borne by both buyer and seller). Tiger Brokers supports multiple trading software, with transaction fees significantly reduced, and some fees negotiable.

| Fee Type | Details |

|---|---|

| Commission | Up to 0.3% of transaction amount, minimum $5; Stock Connect ~0.03%, negotiable |

| Margin Rate | 4.5% |

| Options Fee | $1.7 per contract |

| ETF/Convertible Bond Rate | 0.05% |

| Stamp Duty | 0.05% of sale amount (unilateral) |

| Transfer Fee | 0.01%, borne by both parties |

| Platform Support | Supports multiple mainstream trading software |

During a Hong Kong stock platform review, pay attention to Tiger Brokers’ commission discounts and margin rates, especially for large transactions or high-frequency trading, where negotiation room is greater.

Valuable Capital Fees

Valuable Capital also offers commissions at near-cost levels. Commissions are typically charged bilaterally, with a cap of 0.3% and a minimum of $5. Stock Connect commissions are as low as 0.05%. Options fees are $1.7 per contract (all-inclusive), and ETF and convertible bond trading commissions are also 0.05%. Treasury bond reverse repo rates start at a 90% discount, with margin financing rates at a special 4.5%. You can obtain further exclusive discounts through your account manager. Valuable Capital’s fee structure is similar to Tiger Brokers but has a pricing advantage for certain products like Stock Connect and ETFs.

| Fee Type | Details |

|---|---|

| Commission | Near-cost, bilateral, up to 0.3%, minimum $5 |

| Stock Connect Commission | 0.05% |

| Options Fee | $1.7 per contract (all-inclusive) |

| ETF/Convertible Bond Commission | 0.05% |

| Treasury Bond Reverse Repo Rate | 90% discount |

| Margin Financing Rate | 4.5% |

When choosing Valuable Capital, you can benefit from special discounts on multiple products, suitable for diversified investment needs.

Overview of Other Platforms’ Fees

During a Hong Kong stock platform review, you will also consider fees for mainstream platforms like Futu (moomoo), Interactive Brokers, and Huatai. For example, Futu’s Hong Kong stock commission is 0.03%, with a minimum of HK$15 (~$1.92). Interactive Brokers has a minimum of HK$3 + HK$15 platform fee (~$2.3). Tiger Brokers has a minimum of HK$18 (~$2.3). Some platforms also charge platform usage or settlement fees. When choosing, note whether these additional fees impact your overall trading costs.

| Trading Product | Futu (moomoo) | Interactive Brokers | Tiger Brokers |

|---|---|---|---|

| Hong Kong Stock Commission | 0.03%, minimum $1.92 | 0.03%, minimum $2.3 | 0.05%, minimum $2.3 |

| Other Fees | - | Platform fee, transaction activity fee | Platform fee, settlement fee |

In practice, read each platform’s fee details carefully to avoid hidden costs impacting investment returns.

Fee Comparison

During a Hong Kong stock platform review, the most critical aspect is a direct comparison of platform fees. The table below summarizes the standard commission rates, ETF/options rates, and minimum charges for major Hong Kong stock platforms to help you understand at a glance:

| Broker | Hong Kong Stock Commission Rate (Standard) | ETF/Options Rate | Minimum Charge | Notes |

|---|---|---|---|---|

| Tiger Brokers | Up to 0.3%, minimum $5 | ETF 0.05%, options $1.7/contract | $5 | Negotiable, lower for some products |

| Valuable Capital | Up to 0.3%, minimum $5 | ETF 0.05%, options $1.7/contract | $5 | More advantageous for Stock Connect, ETFs |

| Futu (moomoo) | 0.03%, minimum $1.92 | ETF 0.05%, options $1.7/contract | $1.92 | Platform fee applies |

| Interactive Brokers | 0.03%, minimum $2.3 | ETF 0.05%, options $1.7/contract | $2.3 | Platform fee, transaction activity fee |

| Huatai Securities | 0.085%, minimum $5 | - | $5 | Requires commission negotiation |

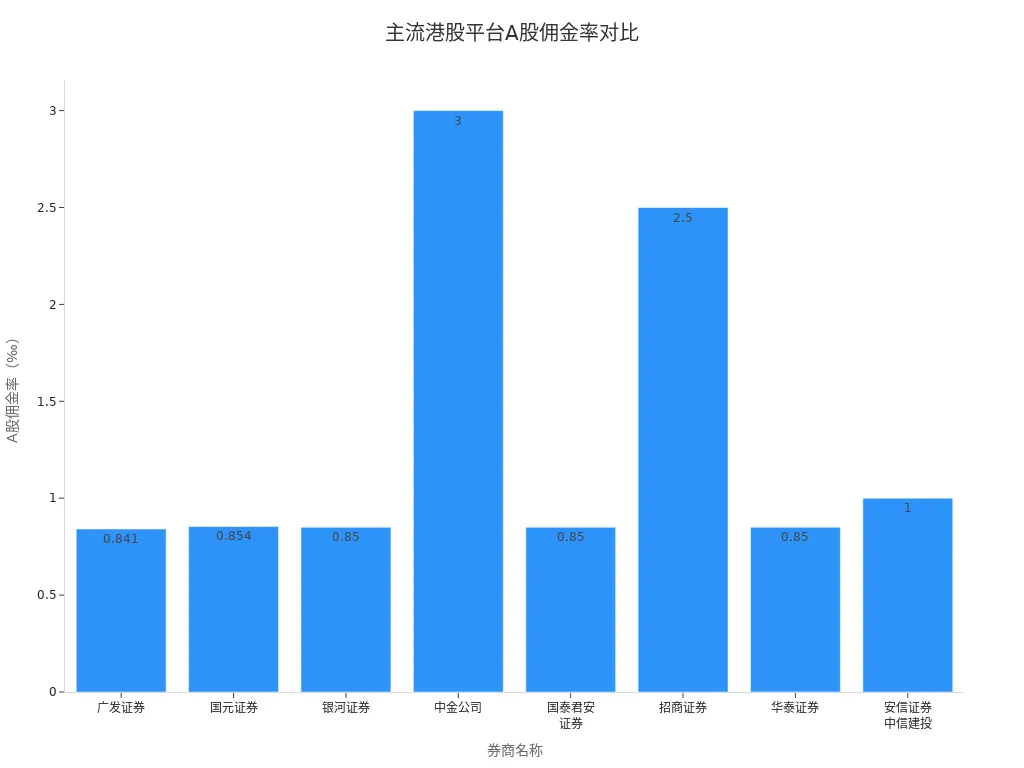

You can visually compare the commission rate differences of major Hong Kong stock platforms through the bar chart below:

When choosing a Hong Kong stock platform, consider your trading frequency, capital size, and investment products, weighing commissions, platform fees, and margin rates. Large investors or high-frequency traders can negotiate lower rates with account managers. Pay attention to fee transparency to avoid hidden costs impacting returns.

Investment Products and Features

Supported Markets and Products

When choosing a Hong Kong stock investment platform, you first need to check which markets and products the platform supports. Both Tiger Brokers and Valuable Capital support mainstream markets like Hong Kong, US, and A-shares. You can invest in multiple markets within a single account, making fund management convenient. Tiger Brokers also supports US options, ETFs, and convertible bonds. Valuable Capital has a stronger presence in the Hong Kong market, offering a wide range of local stocks, ETFs, warrants, and callable bull/bear contracts. If you want to invest in global markets, prioritize platforms supporting multiple markets.

| Platform | Supported Markets | Main Product Types |

|---|---|---|

| Tiger Brokers | Hong Kong, US, A-shares | Stocks, ETFs, options, convertible bonds |

| Valuable Capital | Hong Kong, US, A-shares | Stocks, ETFs, warrants, callable bull/bear contracts |

Before opening an account, check the platform’s supported markets and products to ensure they meet your investment needs.

IPO Subscriptions and Fractional Shares

If you’re interested in IPO subscriptions, both Tiger Brokers and Valuable Capital offer convenient services. Tiger Brokers supports one-click Hong Kong IPO subscriptions with a simple process and a low subscription fee of $1 per application (based on 1 USD = 7.8 HKD). Valuable Capital has a dedicated IPO channel, supporting margin-financed subscriptions with flexible minimum amounts. You can also trade fractional shares on some platforms. Tiger Brokers allows you to buy US stocks in increments as low as 0.01 shares, lowering the investment threshold. Valuable Capital currently focuses on whole-share trading but has an edge in Hong Kong IPO subscriptions.

Tip: When subscribing to IPOs, pay attention to subscription fees and allocation rates, and plan your funds accordingly.

Investment Tools and Unique Services

During investing, you often need professional tools and unique services. Tiger Brokers offers real-time market data, in-depth analysis, smart watchlists, and automated stop-loss features. You can use the app or website to track global market trends anytime. Valuable Capital focuses on localized services, providing real-time Hong Kong stock insights, professional research reports, and phone-based customer support. You can also attend investment seminars through Valuable Capital to enhance your skills. Some platforms offer simulated trading to help you familiarize yourself with the process.

- Tiger Brokers’ Unique Tools:

- Real-time market data push

- Smart watchlists and alerts

- Automated take-profit and stop-loss

- Valuable Capital’s Unique Services:

- In-depth Hong Kong stock insights

- Professional investment seminars

- One-on-one account manager

When choosing a platform, prioritize those with robust tools and attentive services based on your investment habits and needs.

Deposits and Withdrawals Convenience

Tiger Brokers Deposits and Withdrawals

When depositing or withdrawing with Tiger Brokers, you can choose from multiple methods. You can transfer funds via Hong Kong bank transfers, international wire transfers, or third-party payment platforms. Tiger Brokers supports multi-currency accounts, including USD and HKD. For withdrawals, you need to link a Hong Kong bank account. After submitting a withdrawal request, the platform typically processes it within 1-2 business days. Note that bank wire transfers incur fees of approximately $15-25, depending on the Hong Kong bank and exchange rate (1 USD = 7.8 HKD). Tiger Brokers does not charge additional deposit or withdrawal fees, but you bear the bank fees.

Valuable Capital Deposits and Withdrawals

When depositing or withdrawing with Valuable Capital, you primarily use Hong Kong bank accounts. You can choose local bank transfers or check deposits. Valuable Capital supports USD and HKD accounts. For withdrawals, you need to submit a withdrawal form to the platform. After review, withdrawals are typically completed within 1 business day. If using interbank transfers, Hong Kong banks charge $10-20 in fees. Valuable Capital itself does not charge deposit or withdrawal fees. You can expect a good experience in terms of fund arrival speed and security.

Other Platforms’ Deposits and Withdrawals

When depositing or withdrawing with platforms like Futu, Longbridge, or VSTAR, the process is also convenient. You can use Hong Kong bank transfers, FPS (Faster Payment System), or international wire transfers to fund your account. Some platforms support third-party payment tools. For withdrawals, you need to link a Hong Kong bank account. Most platforms do not charge deposit or withdrawal fees, but Hong Kong banks charge $10-30 depending on the transfer method. Before operating, check the platform and bank fee standards.

Speed and Cost

When choosing a Hong Kong stock investment platform, deposit and withdrawal speed and costs are critical. With Hong Kong bank transfers, funds typically arrive within 1-2 business days. International wire transfers may take 2-3 business days. For withdrawals, bank fees are the main cost, ranging from $10-30. If you operate frequently, choose platforms supporting local Hong Kong bank transfers to save time and costs. During a Hong Kong stock platform review, deposit and withdrawal convenience and costs are key factors to consider.

Customer Service and Experience

Customer Support Response

When using Tiger Brokers, you can get help via in-app online chat, email, or phone. The platform typically responds to inquiries within minutes during business hours. For complex issues, customer service will escalate to a dedicated account manager to assist with account opening, deposits, or withdrawals. Valuable Capital offers localized phone support and online inquiries. Calling the hotline during Hong Kong business hours usually connects quickly. The platform also assigns a one-on-one account manager to help with investment questions. If you value service efficiency, prioritize platforms with fast response times.

App and Web Experience

When operating on Tiger Brokers’ app or website, the interface is clean, with clearly organized functions. You can check market data, place orders, and manage funds with one click. The platform supports multi-language switching, suitable for users from different backgrounds. Valuable Capital’s app focuses on localized experience, displaying Hong Kong stock insights and watchlists on the homepage. Its website offers professional trading tools for in-depth analysis. If you prefer mobile operations, prioritize testing app functionality.

User Reputation and Unique Features

In investment communities and social platforms, you often see user reviews of Tiger Brokers and Valuable Capital. Tiger Brooks is popular among younger investors for its ease of use and transparent fees. Valuable Capital is praised for its localized services and professional research reports. When choosing a platform, refer to other users’ real feedback. You can also check if the platform offers investment seminars or simulated trading, which enhance your investment experience. During a Hong Kong stock platform review, combine your needs and user reputation to make an informed choice.

Pros, Cons, and Selection Recommendations

Tiger Brokers Pros and Cons

When using Tiger Brokers, you can experience a user-friendly interface and efficient account opening process. You only need identity proof and basic information to open an account quickly. Tiger Brokers supports multi-market investments, including Hong Kong, US, and A-shares. You can manage multiple assets in one account. The platform’s fees are transparent, with negotiable commissions and margin rates. You also get access to rich investment tools like real-time market data and smart watchlists. However, note Tiger Brokers’ compliance risks, as Chinese regulators have questioned its cross-border operations. You may face compliance reviews by Hong Kong banks during fund transfers. The platform relies mainly on online support, with complex issues requiring dedicated manager responses.

Valuable Capital Pros and Cons

When choosing Valuable Capital, you benefit from localized services and professional support. The platform holds multiple SFC licenses, ensuring high compliance. You have greater assurance of fund safety. Valuable Capital has extensive experience in the Hong Kong market, offering diverse products and dedicated IPO channels. You can get help via phone or a one-on-one account manager. The fee structure is clear, with competitive rates for products like Stock Connect and ETFs. However, you may need to provide additional address proof during account opening. The online experience is slightly less intuitive than Tiger Brokers, and some features are better suited for experienced investors.

User Recommendations

If you prioritize efficient account opening and multi-market investments, consider Tiger Brokers first. If you value localized services and fund safety, choose Valuable Capital. If you have large capital or financing needs, negotiate lower rates with the platform. When choosing, consider your investment habits, capital size, and service needs. Pay attention to compliance and policy risks to ensure investment safety. Try multiple platforms to find the best fit.

When selecting a Hong Kong stock platform, combine data from the platform review. Focus on compliance, fee structures, and deposit/withdrawal convenience. Make decisions based on your investment needs, trading habits, and capital size. Be mindful of policy risks and prioritize SFC-regulated platforms for safety. Compare multiple platforms to make a rational decision.

FAQ

What Documents Are Needed to Open Accounts with Tiger Brokers and Valuable Capital?

You need to prepare identity proof documents. Tiger Brokers typically requires only ID photos. Valuable Capital also requires address proof, such as a Hong Kong bank statement. Prepare documents in advance to speed up the review process.

How Fast Are Deposits and Withdrawals on Hong Kong Stock Platforms?

With Hong Kong bank transfers, funds typically arrive within 1-2 business days. International wire transfers may take 2-3 business days. Platform processing is fast, mainly depending on bank procedures.

What Are the Main Fees for Hong Kong Stock Trading?

You need to pay commissions, stamp duty, and transfer fees. For Tiger Brokers, the minimum commission is $5 (~HK$39 at 1 USD = 7.8 HKD). Check the platform’s fee details for specifics.

Can I Invest in Hong Kong Stocks Directly with RMB?

You cannot invest in Hong Kong stocks directly with RMB. You need to exchange RMB into USD or HKD and transfer it to the investment platform via a Hong Kong bank.

Are Hong Kong Stock Platforms Safe? How Is Fund Safety Ensured?

Choosing a platform with an SFC license offers higher fund safety. Platforms segregate client funds from their own. Pay attention to compliance to avoid policy risks.

Choosing a reliable Hong Kong stock platform is just the first step; the real challenge for many investors lies in finding an efficient and low-cost way to fund their accounts. High bank wire fees and lengthy transfer times can impact your investment efficiency and overall returns. BiyaPay is dedicated to solving these cross-border financial issues by providing a smoother, more cost-effective investment channel. We support the conversion between various fiat and digital currencies, allowing you to complete global remittances with a remittance fee as low as 0.5% and same-day delivery. Say goodbye to complex overseas bank accounts and opaque exchange rate losses. With our platform, you can invest in both U.S. and Hong Kong stocks without needing a separate overseas account. Use our real-time exchange rate query to lock in the best rates. Register with BiyaPay today to start your global investment journey.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.