- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

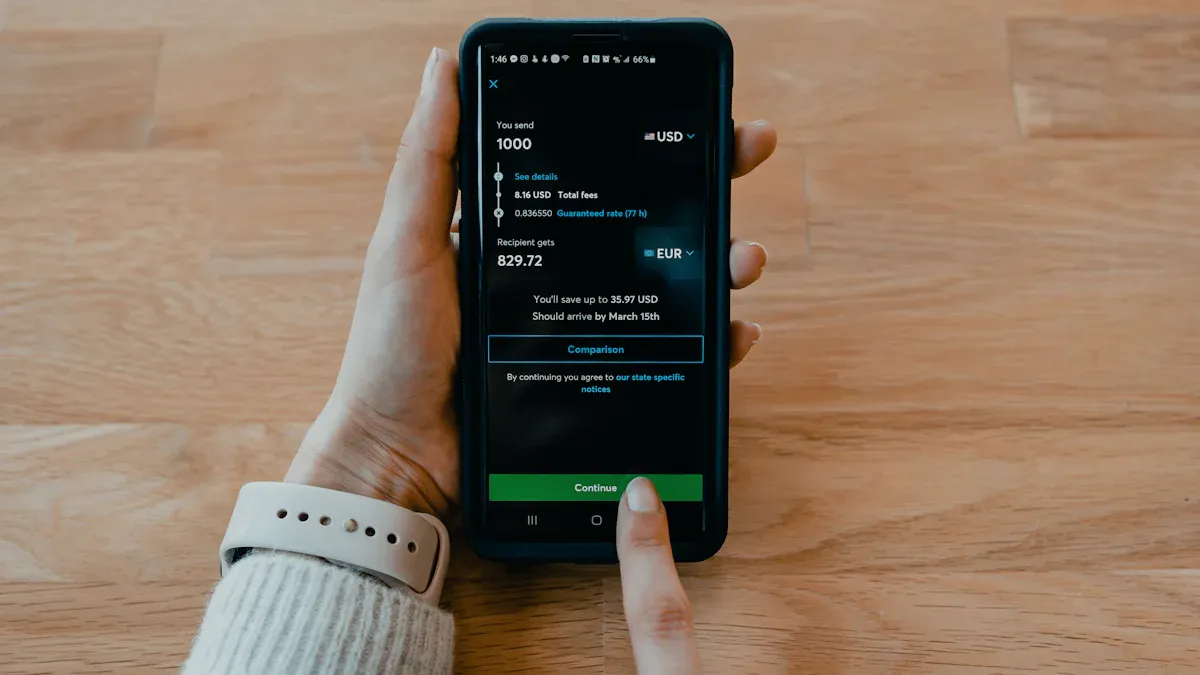

How Chinese Users Can Choose Between Wise and Western Union for International Remittances

Image Source: unsplash

When choosing an international remittance method, you often focus on delivery speed, fees, exchange rate transparency, and security. Wise is suitable for you if you prioritize low fees and transparent exchange rates, especially for cross-border e-commerce and scenarios requiring digital operations. Western Union is better for Chinese users needing cash pickup or offline service outlets, particularly in remote areas where it’s more convenient. Each method has unique advantages, and your choice should align with your specific needs.

Key Points

- Wise is ideal for users seeking low fees, transparent exchange rates, and digital operations, particularly for cross-border e-commerce, freelancers, and those needing multi-currency management.

- Western Union suits users requiring cash pickup or offline services, with fast delivery for small remittances and urgent fund needs.

- When choosing a remittance method, focus on delivery speed, fees, exchange rate transparency, and security, making a rational choice based on your needs.

- Wise offers multiple online payment and collection methods, with transparent fees; Western Union has extensive outlets, ideal for offline pickup and face-to-face services.

- For large remittances, Wise is recommended; Western Union suits small amounts and cash needs, with proper scenario matching enhancing efficiency and safety.

Recommendations for Chinese Users

Quick Recommendations

When choosing an international remittance service, you should first assess which method best suits your actual needs.

If you prioritize low fees, transparent exchange rates, and digital operations, Wise is your top choice. Wise supports multi-currency accounts and debit cards, ideal for individuals and businesses managing multi-currency funds or making global payments. If you’re a cross-border e-commerce seller, freelancer, or need batch payments and API automation, Wise offers higher efficiency and lower costs.

- Wise is suitable for:

- You, if you need cross-border transfers with fair, transparent fees.

- Individual users wanting cost-effective international fund management and simplified overseas bank account setup.

- Businesses and freelancers with international payment needs, requiring batch payments, API automation, and permission management.

- Users needing multi-currency management and global payments.

- Individuals and businesses prioritizing cost and efficiency.

If you value offline services or the recipient needs cash pickup, Western Union is more suitable. Western Union has service outlets in nearly 200 countries and regions, supporting small private remittances with simple operations; recipients only need to provide their name and nationality. You can complete cross-border collection in 10-15 minutes, ideal for small amounts needing quick delivery. For small sample fees, order collections, or transactions ensuring seller fund safety, Western Union also performs well.

- Western Union is suitable for:

- You, if you need cash pickup or offline service outlets.

- Small private remittances, with convenient operations and quick receipt for recipients.

- Small payments under $10,000 (USD), especially for sample fees or order collections.

- Users needing to receive funds before shipping to ensure transaction safety.

- Users wanting cost-free, simple operations for recipients.

Tip: When choosing, first clarify your remittance amount, collection method, and delivery speed requirements, then consider fees and exchange rates to quickly select the best service.

Key Considerations

Chinese users should focus on the following core factors when choosing an international remittance service:

- Remittance Speed: You need to understand the delivery times of different services. Professional remittance companies typically achieve T+1 delivery, with some scenarios even faster. Western Union can deliver in 10-15 minutes, while Wise’s delivery speed depends on the recipient’s bank (e.g., Hong Kong banks) and currency, with some currencies arriving same-day.

- Cost: You should compare fees and hidden costs. Wise is known for low rates and transparent fees, while Western Union’s fees are borne by the sender, with no cost to the recipient, but fees are relatively high. You also need to consider exchange rate differences, as they directly affect the received amount (in USD).

- Compliance and Risk Control: You should choose providers with global regulatory compliance and robust risk control systems to ensure fund safety. Both Wise and Western Union have strong compliance capabilities, meeting Chinese users’ high security standards.

- Exchange Rate Management: You can check if the provider offers digital currency exchange or rate-locking features to reduce exchange risks and costs. Wise excels in exchange rate transparency.

- Service Experience: You should consider whether the operation process is convenient, supports Chinese interfaces, and offers robust customer service. Both Wise and Western Union are improving user experience and service quality.

- Payment Network Coverage: You can choose based on the recipient’s location. Western Union’s global outlets suit offline pickup needs, while Wise leverages global banking and payment networks for digital collection.

- Business Process Understanding and Innovation: If you’re in cross-border e-commerce or trade, consider providers’ understanding of business processes and innovation capabilities, as these impact efficiency and experience.

- Digitalization, Online Operations, and Transparency: You can prioritize services offering online operations and transparent processes to enhance efficiency and security.

When making a choice, align these factors with your needs to find the best international remittance solution.

Comparison Overview

Main Dimensions

When choosing an international remittance service, you often focus on fees, exchange rates, delivery speed, collection methods, ease of use, security, and amount limits. The table below helps you quickly understand the main differences between Wise and Western Union:

| Item | Wise | Western Union |

|---|---|---|

| Fees | ~$12.34, transparent and separate | $0 for debit card, $25 for credit card, overall may be higher |

| Exchange Rate | Uses mid-market rate, no markup (e.g., 6.954858) | Lower rate (e.g., 6.88897) with ~1% markup |

| Delivery Speed | Seconds to same-day for some currencies | Real-time, cash pickup in 10-15 minutes |

| Collection Methods | Wise account, bank card, Alipay, WeChat, online methods | Cash pickup, bank card, Alipay, WeChat, many offline outlets |

| Payment Methods | Bank transfer, debit/credit card, Apple Pay, Google Pay | Online channels, agent outlets |

| Amount Limits | Varies by country and method, generally higher | Online transfer limit $7,000, annual receipt limit $50,000 |

| Security | Globally regulated, digital risk control | Regulated, many offline outlets, strict ID verification |

| Ease of Use | Fully online, user-friendly, multilingual | Online and offline, suits diverse needs |

| Unique Advantages | Low fees, transparent rates, fast delivery | Diverse collection methods, convenient offline pickup, ideal for cash users |

Based on your needs, use the table to quickly select the best remittance method. If you prioritize low cost and speed, Wise is better. If you need cash pickup or offline services, Western Union is more convenient.

Dimension Details

- Fees

You pay direct fees during remittances. Wise’s fees are typically low and transparent, ideal for cost-conscious scenarios. Western Union’s fees vary by payment method, with $0 for debit cards and up to $25 for credit cards. For small remittances, fees have a higher proportional impact. - Exchange Rate

The exchange rate determines your actual received amount. Wise uses the mid-market rate with no markup, offering better exchange ratios, e.g., USD to CNY at 6.954858. Western Union’s rates include a markup, reducing the received amount. - Delivery Speed

You want funds to arrive quickly. Wise uses local bank networks for near-instant transfers, with most completing within 24 hours. Western Union’s global electronic network supports real-time delivery, with cash pickup in 10-15 minutes. - Collection Methods

Wise supports bank accounts, Alipay, WeChat, and more, ideal for digital operations. Western Union offers cash and bank card collection, with extensive offline outlets for cash pickup scenarios. - Payment Methods

Wise supports bank transfers, debit/credit cards, Apple Pay, and Google Pay for flexible options. Western Union supports online channels and agent outlets, suiting varied scenarios. - Amount Limits

Western Union’s online transfer limit is $7,000, with a $50,000 annual receipt cap for Chinese users. Wise’s limits vary by country and method, generally higher for large remittances. - Security

Both Wise and Western Union are globally regulated with strong compliance. Wise uses digital risk control, while Western Union requires strict ID verification at offline outlets. - Ease of Use

Wise offers fully online operations with a clear, multilingual interface. Western Union combines online and offline options, catering to diverse user needs.

When choosing, prioritize fees, exchange rates, and delivery speed, as these directly impact costs and efficiency. If you or the recipient need cash, Western Union’s outlets are more convenient. For digital experience and low costs, Wise is better.

Remittance Fees

Image Source: pexels

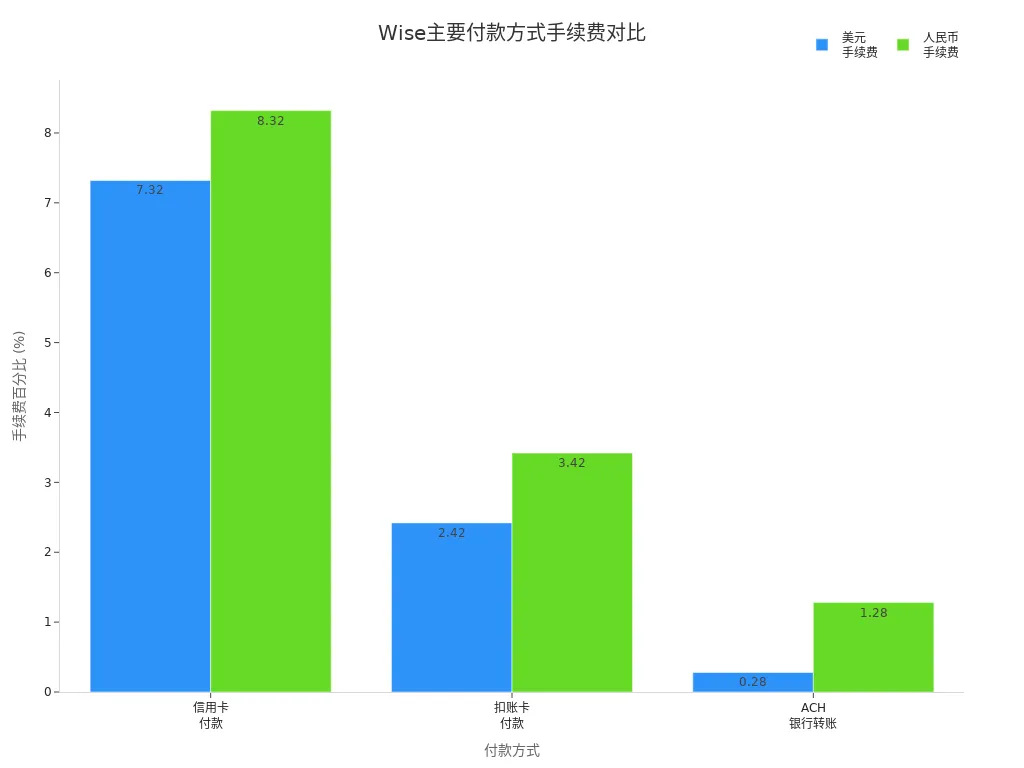

Wise Fees

When using Wise for international remittances, you enjoy transparent and low fees. Wise’s fees consist of a fixed fee and a currency conversion fee. Fees vary by payment method. For example, using a USD credit card incurs a 7.32% fee; a debit card is 2.42%; ACH bank transfer is 0.28%; and wire transfer is a fixed $6.11. For CNY payments, credit card fees are 8.32%, debit card 3.42%, bank transfer 1.28%, and wire transfer $6.11 plus 1%. Wise’s conversion fee starts at 0.33%, with lower rates for larger remittances.

| Payment Currency | Payment Method | Fee Example |

|---|---|---|

| USD | Credit Card | 7.32% |

| USD | Debit Card | 2.42% |

| USD | ACH Bank Transfer | 0.28% |

| USD | Wire Transfer | $6.11 |

| CNY | Credit Card | 8.32% |

| CNY | Debit Card | 3.42% |

| CNY | Bank Transfer | 1.28% |

| CNY | Wire Transfer | $6.11 + 1% |

With Wise, fees are clear regardless of amount. Small remittances have fees starting at ~0.43%, while large remittances (over $10,000) can drop to 0.35%. Wise has no hidden fees, ideal for transparent and efficient scenarios.

Western Union Fees

When choosing Western Union, the fee structure is relatively simple. Partner banks like SPDB charge no additional fees, with all costs displayed in real-time on Western Union’s system. For in-person remittances, the limit per transaction is $10,000, while online and mobile banking limits are $5,000. Fees vary by amount, starting at $15 for $0-$5,000 and $20 for $5,001-$10,000. You don’t need to worry about intermediary or cash-to-telegraphic fees, and recipients collect the full amount without extra charges.

| Amount Range | Fee Standard |

|---|---|

| $0 - $5,000 | $15 and up |

| $5,001 - $10,000 | $20 |

Western Union’s fees fluctuate based on amount, destination, and channel. For small remittances, fees have a higher proportional impact. Western Union suits cash pickup or offline service needs but is costlier than Wise. When choosing, weigh the fee structures based on your needs and collection method.

Exchange Rate Comparison

Wise Exchange Rate

When using Wise for international remittances, you benefit from the mid-market exchange rate. Wise does not add markups to the rate. You see the actual market rate. For example, converting $1,000 (USD) to CNY uses the mid-market rate. You can check rates in real-time on Wise’s website or app, with transparent data and no hidden costs. You know the exact amount received before sending. Wise updates rates multiple times daily, tracking global forex markets. If you choose a Hong Kong bank as the recipient account, Wise converts USD to HKD or CNY at the mid-market rate, minimizing your losses.

Wise’s exchange rate advantage lies in transparency and real-time updates. You don’t need to worry about extra costs from rate fluctuations. For large or frequent cross-border transactions, Wise’s rate policy saves significant costs.

Western Union Exchange Rate

When choosing Western Union, the exchange rate is slightly lower than the Bank of China’s mid-market rate. Western Union typically adds ~1% profit to the mid-market rate. For example, if the Bank of China’s USD-to-CNY mid-market rate is 6.95, Western Union’s rate might be ~6.88. Your received amount decreases due to this 1% difference. Western Union’s rates are relatively stable, suitable for quick cash pickups or offline collection. You don’t need to pay extra recipient fees, but note the actual cost from rate differences.

| Provider | Rate Type | Rate Markup | Transparency |

|---|---|---|---|

| Wise | Mid-Market Rate | No markup | High |

| Western Union | Mid-Market + 1% Profit | ~1% | Moderate |

When choosing, compare the real-time rates of both providers. If you prioritize the received amount, Wise’s mid-market rate is better. If you value cash pickup and offline services, Western Union’s slightly lower rate is more flexible.

Delivery Speed

Wise Delivery

When using Wise for international remittances, you typically experience very fast delivery. Wise has its own local bank account network, allowing you to transfer like a local payment. About half of remittances achieve instant delivery, with most arriving within 24 hours. If you send to a Hong Kong bank account, delivery is even faster. Wise supports transfers to Alipay and WeChat accounts, making collection more convenient. Compared to traditional banks’ SWIFT transfers, Wise is faster, avoiding 2-5 business days of waiting and potential intermediary fees. With Wise, delivery typically ranges from instant to 2 days.

Delivery speed depends on several factors:

- Sending and receiving country

- Currency type

- Sender and recipient bank processing

- Public holidays

- Verification or security steps

- Payment method (e.g., bank transfer, debit card)

- Need for additional ID or fund source verification

When operating, plan remittance timing based on these factors.

Western Union Delivery

When choosing Western Union, remittances typically complete in minutes. Western Union has the world’s largest electronic transaction network, supporting quick transfers in urgent cases. Most remittances arrive in 10-15 minutes, allowing recipients to collect cash instantly at global outlets. Western Union partners with Chinese banks, further improving delivery efficiency. If you need to send USD to family or friends quickly, Western Union is highly efficient. Delivery speed also depends on location, currency, bank processing, and ID verification. When choosing Western Union, plan flexibly based on your needs to ensure timely delivery.

Collection Methods

Wise Collection

When using Wise, you can choose multiple collection methods to suit different scenarios. Wise supports bank account transfers, Alipay, WeChat, Wise user-to-user transfers, and multi-currency collection accounts. You only need the recipient’s name, phone number, or email to complete collection. The table below shows Wise’s main collection methods and use cases:

| Collection Method | Details | Use Case |

|---|---|---|

| Bank Account Transfer | Requires recipient name, email, bank account, SWIFT/BIC code | Individual and business cross-border remittances |

| Alipay and WeChat | Needs recipient info and phone number | Convenient for Chinese users |

| Wise User-to-User Transfer | Needs phone, email, or Wisetag, free and instant | Fast transfers between Wise users |

| Multi-Currency Account | Provides local account details for 30+ countries, free collection | Multi-currency management, cross-border collection |

| Wise Card | Multi-currency smart exchange, supports overseas spending and withdrawals | Overseas spending, travel, account management |

If you need to manage multi-currency funds or frequently collect cross-border payments, Wise’s multi-currency accounts and flexible methods enhance efficiency. You can also use the Wise card for overseas spending with real-time rate conversion, saving costs.

Wise’s collection methods suit cross-border e-commerce, freelancers, businesses, and individuals, especially those prioritizing digital and multi-currency management.

Western Union Collection

When choosing Western Union, the collection process is straightforward. You only need to provide your name and nationality, with the sender covering all fees, so the recipient pays nothing. After receiving the payment reference (MTCN number), you can collect at a bank counter or via partner bank apps (e.g., SPDB app). Western Union supports global remittances and withdrawals, primarily through offline counters.

-

Western Union Advantages:

- Fast delivery, typically within 10-15 minutes for cash pickup.

- Sellers can collect funds before shipping, ensuring transaction safety.

- No cost to recipients, ideal for small private remittances.

-

Western Union Disadvantages:

- Higher risk for buyers, with lower acceptance among some users.

- Requires in-person counter visits, with more complex processes and potential queuing.

- Not ideal for large transactions due to higher fees.

If you need quick cash or the recipient lacks a bank account, Western Union is the top choice. It’s ideal for urgent remittances, family support, or small transactions.

Western Union suits cash pickup, offline services, and fast delivery but consider operation complexity and fee costs.

Ease of Use

Registration Process

When registering with Wise, you complete the process in a few steps. You visit the Wise website or app, entering your email and password. You choose an account type (personal or business) and fill in basic information. You upload ID documents, and the system auto-verifies. Once approved, you can start remitting. The fully digital process is simple, ideal for efficiency-focused users.

Western Union’s registration is also straightforward. You can follow these steps:

- Visit the Western Union website and click “Register.”

- Fill in personal details and set a login password.

- If your remittance exceeds $3,000 (USD), complete ID verification first.

- After verification, you can use the remittance service.

During registration, Western Union may require additional ID details based on the amount. Wise emphasizes automation and transparency. Both support online registration, making it easy to start international remittances.

Operation Experience

When using Wise, you’ll find the interface clean and clear. All key information—rates, fees, and delivery times—is prominently displayed. Wise prioritizes transparency and automation, with detailed prompts for each step. During remittances, the system shows real-time received amounts and expected delivery times. If you prefer digital operations, Wise is efficient and hassle-free.

Western Union offers diverse service channels. You can choose online self-service or visit nearby agents for assistance. Its interface suits users needing face-to-face interaction, especially seniors. If you encounter issues, offline customer support is readily available. Western Union balances online and offline options, ideal for personalized service needs.

When choosing, consider your operation habits and service channel needs. For digital efficiency, Wise is better. For offline assistance or face-to-face services, Western Union is more accommodating.

Security

Image Source: pexels

Compliance Assurance

When choosing an international remittance service, security is a top concern. Wise uses advanced encryption technology to protect your payment information and funds. When using Wise, the system requires ID verification to prevent identity theft and fraud. Wise monitors transactions in multiple ways to ensure authenticity and reliability. All data is encrypted during transmission, reducing the risk of leaks.

Western Union also prioritizes security. When using Western Union, the system conducts strict ID verification. With its global agent network, Western Union employs multiple security measures to ensure fund and transaction safety. When remitting through partner institutions like Hong Kong banks, staff verify your identity, ensuring compliance and legality. Both methods offer robust compliance and risk control to safeguard your funds.

When operating, always use official channels to avoid risks to your information and funds.

User Feedback

While focusing on security, you also care about other users’ experiences. As one of the world’s largest remittance companies, Western Union is valued for its wide coverage, especially in remote areas. Many Chinese users find Western Union fast, secure, and reliable. For urgent remittances or cash pickups, Western Union provides stable service.

Wise is favored for its low fees and transparent rates. You can manage remittances anytime via Wise’s mobile app, enjoying convenient digital services. While specific Chinese user feedback on security is limited, both Wise and Western Union are generally seen as safe and reliable. When choosing, use official channels to minimize fund security risks.

When remitting, stay vigilant, protect personal information, and choose reputable platforms to significantly reduce risks.

Scenario Recommendations

Family Remittances

When remitting to family, you focus on delivery speed, fees, and security. Wise and Western Union each have advantages for different needs.

- Wise is ideal for small daily remittances, with low fees, transparent rates, and high security. You can easily send USD to family Hong Kong bank accounts, with fees ~0.5%-2% and no hidden costs.

- Western Union suits urgent remittances or family cash pickup needs. With numerous global outlets, remittances arrive in 10-15 minutes, offering convenience.

| Dimension | Wise Advantages | Western Union Advantages |

|---|---|---|

| Fee Structure | Transparent, low fees (~0.5%-2%), no hidden costs | Fees vary by amount and destination, higher for small amounts, lower for online transfers |

| Exchange Rate | Real-time mid-market rate, more favorable | Traditional rate, less favorable than Wise |

| Delivery Speed | 1-2 business days, some instant | Typically instant, faster with credit card |

| Security | Two-factor authentication, high security | High security, offline ID verification |

| Use Case | Ideal for small transfers, up to ~$1M or equivalent | Wide outlet network, ideal for urgent remittances |

If you prioritize fees and security, choose Wise. If you need fast delivery or offline cash pickup, go with Western Union.

Tuition Payments

When paying overseas tuition, amounts are typically large. Wise supports large remittances with transparent fees and near mid-market rates. You can send USD directly to a school’s Hong Kong bank account, saving costs. Western Union also supports tuition payments, suitable for offline processing or specific school requirements. When choosing, prioritize delivery speed and fees to ensure timely, secure payments.

Overseas Shopping

For overseas shopping or service payments, Wise’s multi-currency account and card are highly practical. You can settle in USD or other currencies with real-time rates, avoiding extra conversion losses. Western Union suits payments to individual sellers or small merchants, especially for cash-only recipients. Choose based on the recipient’s needs.

Other Scenarios

For cross-border e-commerce, freelancing, or travel, select the right tool based on your needs. Wise is ideal for batch payments, API automation, or multi-currency management. Western Union suits remote areas, urgent aid, or recipients without bank accounts. When operating, consider amount, delivery speed, and collection method for the optimal solution.

When choosing an international remittance service, make flexible decisions based on your needs. Wise suits you if you prioritize low fees, transparent rates, and fast delivery, offering high received amounts for efficient transfers. Western Union is ideal if you’re fee-sensitive or need cash pickup, though delivery may take longer, with more service outlets.

- You should focus on remittance convenience, fund accessibility, delivery speed, and fees.

- Funds can be sent to prepaid cards or bank accounts, with prepaid cards suiting those without accounts or needing quick cash.

- Fully understand the features and limitations of each method to choose the best solution for your needs.

FAQ

Which is better for large remittances, Wise or Western Union?

If you need large remittances, Wise is better. Wise supports higher amounts with transparent fees and fast delivery. Western Union’s online transfer limit is $7,000 (USD), unsuitable for large transactions.

Can I use Wise or Western Union to send to Hong Kong bank accounts?

You can use Wise to send directly to Hong Kong bank accounts, with fast delivery and low fees. Western Union also supports Hong Kong bank transfers but focuses on cash pickup, with more complex processes.

What information is needed for remittances?

For Wise, you need the recipient’s name, bank account, and SWIFT/BIC code. For Western Union, provide the recipient’s name and nationality, with the MTCN number for pickup.

How long does delivery take after remitting?

With Wise, some currencies arrive in seconds, most within 24 hours. Western Union typically delivers in 10-15 minutes, ideal for fast scenarios.

How do I ensure fund safety during remittances?

Both Wise and Western Union require ID verification. Use official channels, protect personal information, and avoid risks to ensure fund safety.

In the complex world of international remittances, fees, exchange rates, and transfer speeds are always the core concerns for Chinese users. The cumbersome and high-cost nature of traditional bank wire transfers, along with Western Union’s lack of transparency in exchange rates, significantly reduces the efficiency of fund transfers. BiyaPay was created to solve these pain points, offering a more efficient and transparent cross-border financial solution. We support the conversion between various fiat and digital currencies, allowing you to easily complete global remittances with a remittance fee as low as 0.5% and same-day delivery. You don’t need a complex overseas bank account to invest in both U.S. and Hong Kong stocks on one platform, and you can use our real-time exchange rate query to seize the best conversion opportunities. Say goodbye to the hassle of traditional remittances, and register with BiyaPay today to start your smart investment journey.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.