- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Hong Kong Stock Trading Platform Fees and Services Comparison: How Beginners Choose

Image Source: pexels

When choosing a Hong Kong stock trading platform, you need to focus on fees and services as two core factors. In terms of fees, trading commissions and premium feature subscription fees are the most common. On the service side, platform stability, security, feature comprehensiveness, user experience, customer service, real-time market data, investment education resources, and community interaction are all worth your careful consideration. The table below outlines the key items beginner investors commonly focus on:

| Concern | Details |

|---|---|

| Fees | Trading commissions, additional fees for premium features |

| Services | Platform stability and security, feature comprehensiveness, user experience (user-friendly interface, ease of operation), customer service quality, real-time market data and analysis capabilities, investment education resources, community interaction features |

You can make a comprehensive judgment based on your investment habits and needs, avoiding a focus on a single metric.

Core Points

- When choosing a Hong Kong stock trading platform, focus on trading commissions, platform fees, and hidden costs, avoiding reliance solely on “zero commission” promotions.

- Platforms with convenient account opening processes and low funding thresholds are more suitable for beginners, with many supporting online account opening and no requirement for a Hong Kong bank card.

- Rich trading tools and high-quality customer service can enhance the investment experience, and platforms with high user ratings offer greater assurance.

- Fund security is critical; prioritize platforms regulated by the Hong Kong Securities and Futures Commission (SFC) that use multiple encryption and segregated fund management.

- Rationally compare fees, services, and learning resources, and use demo accounts to find the most suitable Hong Kong stock trading platform.

Hong Kong Stock Trading Platform Fees Comparison

Image Source: unsplash

Commissions and Platform Fees

When choosing a Hong Kong stock trading platform, you should first focus on commissions and platform fees. Fee structures vary significantly across platforms. The table below lists the basic fee details of several mainstream platforms (using an exchange rate of approximately 1 USD = 7.8 HKD, subject to real-time exchange rates):

| Brokerage Platform | Commission Details | Platform Fee Details | Remarks |

|---|---|---|---|

| Longbridge Securities | Lifetime free commissions for HK and US stocks | Low trading and financing fees | Suitable for frequent, small-amount trading, saving ~50% in fees |

| Futu Securities | Suitable for large, infrequent trades, specific commissions not detailed | Not specified | Trusted brand, suitable for well-funded users |

| Tiger Brokers | Not specified | Not specified | Offers promotions, but no specific commission rates provided |

| Webull Securities | Not specified | Not specified | Offers promotions, but no specific commission rates provided |

| Vantage Securities | Not specified | Not specified | Sina-affiliated licensed broker, offers one-stop digital services |

You can see that commission and platform fee information for Hong Kong stock trading platforms is not always fully transparent. On average, Hong Kong brokers’ commission rates range from 0.03% to 0.25%, with internet brokers generally lower and traditional institutions like Hong Kong banks higher. Platform fees are typically around $1.92 (15 HKD) per trade. Some platforms offer “zero commission” or “lifetime free” promotions, but you need to pay attention to the validity period and scope of these offers.

Tip: When choosing a platform, don’t focus only on “zero commission” promotions. In practice, platforms may charge fees through other means, such as higher platform fees or additional service charges.

Hidden Fees

In addition to explicit commissions and platform fees, Hong Kong stock trading platforms may have hidden fees. You should pay special attention to the following types:

- Account Inactivity Fees: If your account remains inactive for a long period, some platforms may charge management fees.

- Deposit/Withdrawal Fees: Platforms or banks may charge fees for depositing or withdrawing funds, especially for cross-border transfers.

- Overnight Interest: If you use margin trading, holding positions overnight incurs interest fees.

- Commission Standards: Some platforms use variable commissions, and actual fees may exceed advertised rates.

These hidden fees can affect your actual returns. Before opening an account, thoroughly review the platform’s fee disclosures to avoid increased costs due to opaque charges.

Regulatory and Settlement Fees

Regulatory and settlement fees for Hong Kong stock trading platforms also impact your trading costs. Regulatory fees, charged by Hong Kong Securities Clearing Company Limited, are set at 0.0042% of the transaction amount starting June 30, 2025. For example, for a $1,000 trade (approximately 7,800 HKD), the regulatory fee is about $0.33 (0.0042% × 7,800 HKD, based on 1 USD = 7.8 HKD). Fees for small trades decrease, while those for large trades increase accordingly.

For settlement fees, specific rates are not clearly disclosed by platforms, but you must also bear stamp duty (0.1% of transaction amount), trading fees (0.00565%), and transaction levies (0.0027%). These fees are uniformly charged by Hong Kong authorities and apply to all Hong Kong stock trading platforms.

Note: When choosing a Hong Kong stock trading platform, prioritize those regulated by authoritative bodies like the Hong Kong SFC to reduce losses from opaque fees or settlement risks.

Hong Kong Stock Trading Platform Services Comparison

Account Opening Process

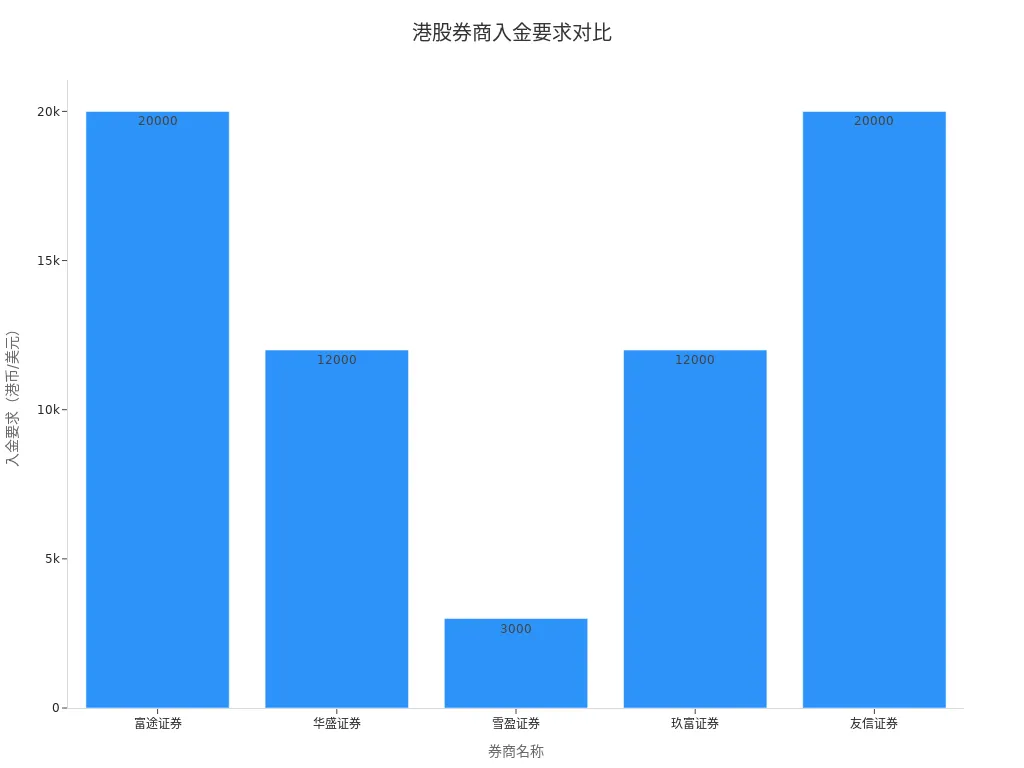

When choosing a Hong Kong stock trading platform, the convenience of the account opening process is crucial. Many mainstream platforms now support online account opening, eliminating the need to visit Hong Kong in person. You only need to prepare your ID, bank card, and other documents, uploading them via mobile or computer to complete identity verification. Some platforms also support account opening without a Hong Kong bank card and assist with obtaining one for free. The table below shows the account opening thresholds and related services of several mainstream platforms:

| Broker Name | Supports No HK Bank Card | HK Bank Card Assistance | Minimum Deposit (USD, ~1 USD=7.8 HKD) | Main Promotions |

|---|---|---|---|---|

| Futu Securities | Yes | Free assistance | ~2,564 | Free HK card + 180 days commission-free + lucky draw |

| Vantage Securities | Yes | Free assistance | ~1,538 | ~$115 commission-free card + IPO coupon |

| Snowball Securities | Yes | Free assistance | 3,000 | Free HK card + ~$38 |

| Jiufu Securities | Yes | Free assistance | ~1,538 | Free HK card + 90 days commission-free + stock gift |

| Uxin Securities | Yes | Free assistance | ~2,564 | Free HK card + lifetime commission-free + stock gift + cash reward |

You can see that most mainstream Hong Kong stock trading platforms support account opening without a Hong Kong bank card, with minimum deposit thresholds ranging from $1,538 to $3,000. Platforms also offer account opening rewards and commission-free promotions to reduce your initial investment burden.

The account opening process typically involves a few steps: registering an account, uploading documents, video verification, and awaiting approval. You don’t need to worry about operational complexity, as most platforms have user-friendly interfaces and clear guidance, making them easy for beginners to get started.

Trading Tools

The richness of trading tools directly impacts your investment experience. Mainstream Hong Kong stock trading platforms offer diverse tools, including quantitative trading, quick trading, portfolio trading, smart rebalancing, grid trading, and more. You can select tools based on your needs to enhance trading efficiency. The table below compares the main trading tools and supported account types of some platforms:

| Platform Name | Main Trading Tools and Features | Supported Products and Account Types |

|---|---|---|

| Guotou Securities OneQuant Platform | Quantitative trading, quick trading, portfolio trading, algorithmic trading, smart rebalancing, grid trading, programmatic T+0 trading | Centralized trading accounts, standard margin accounts, Jinzheng high-speed stock accounts, Huarui high-speed stock accounts; stocks, funds, bonds, HK Stock Connect, futures, options, etc. |

| ACT High-Speed Strategy Terminal | Quantitative strategy research and coding, arbitrage trading, basket trading, portfolio trading | Standard trading, margin trading, options trading, HK Stock Connect trading |

| Cheetah High-Speed Edition | Fast standard and margin trading, one-click treasury bond reverse repo, bulk IPO subscriptions, high-speed market data viewer, split-order series, basket and portfolio trading, debt-to-equity conversion, rights issues | Jinzheng high-speed, Huarui high-speed, FPGA high-speed counter users’ standard and margin accounts |

| Anyi Financial Terminal V8/V9 | L2 high-speed market data, multi-stock multi-market data, stop-loss/stop-profit conditional orders, F10 graphic information, smart stock selection, smart monitoring, lightning-fast orders, smart wealth management trading tools | Stocks, IPO subscriptions, open-end funds, ETFs, New Third Board trading, HK Stock Connect, options, margin trading, and full-service trading |

| Guotou Securities App | High-speed market data, smart monitoring, lightning-fast orders, one-click IPO subscriptions, smart stock selection, rich information, scientific trading support, smart wealth management trading, high-speed account opening, asset account management | Shanghai, Shenzhen, and HK market data, HK Stock Connect, margin trading applications, online permission activation, and more |

On platforms like Futu Niuniu and Longbridge Securities, you can access one-stop market data, smart monitoring, conditional orders, and bulk subscriptions. These tools help you manage investment portfolios more efficiently, ideal for beginners to gradually improve trading skills.

Customer Support

The quality of customer support directly affects your user experience. Internet brokers like Futu and Longbridge perform excellently in app ratings, scoring as high as 4.8 out of 5, with high user satisfaction. When you encounter issues, you can get help via online customer service, phone, or email. Traditional brokers like Xiangcai Securities excel in complaint handling, with a 100% response rate and fast, effective resolutions.

- Internet Brokers: Convenient operations and good user experience, ideal for beginners to get started quickly, though customer service response times may vary.

- Traditional Brokers: More robust complaint handling and high system stability, but interfaces are relatively traditional.

When choosing a Hong Kong stock trading platform, prioritize those with high user ratings and fast customer service responses. The platform’s ability to handle system failures or complaints is also critical.

Tip: Pay attention to platforms’ app ratings and user reviews to understand real customer service experiences.

Investment Products

Hong Kong stock trading platforms offer a wide range of investment products to meet diverse risk preferences and return needs. You can choose from equity investments, fixed-income products, cash management, and alternative investments. The table below shows common investment product types and their characteristics:

| Investment Product Type | Example Products | Term | Return Level | Risk Level |

|---|---|---|---|---|

| Alternative Investments | REITs, overseas private funds, public commodity funds, QDII, China-HK mutual recognition funds, FOFs | Customized | Customized | Customized |

| Equity Investments | Public equity funds, equity-biased hybrid funds, private funds, fund accounts, asset management plans, securities trusts | Open-ended or with lock-up periods | Low to high | Low to high |

| Floating Income-Linked | Income certificates, structured guaranteed and non-guaranteed income certificates | Fixed term | Medium-low to high | Medium-low to high |

| Fixed Income | Pure bond net-value products, net-value fixed-income+, public bond funds, bond-biased hybrid funds | Lock-up periods or open-ended | Moderate to high | Low to medium-high |

| Cash Management | Daily profit wealth, cash appreciation, money market funds, Xingjinbao | Short-term | Low to moderate | Low to moderate |

You can flexibly allocate different product types based on your risk tolerance and investment goals. Some platforms also offer portfolio recommendations and wealth planning services to help you diversify risks scientifically.

Platform Security

Fund security and data protection are critical when choosing a Hong Kong stock trading platform. Mainstream platforms are regulated by the Hong Kong Securities and Futures Commission (SFC), holding relevant licenses to ensure compliant operations. Platforms generally use multiple authentication and encryption technologies to secure accounts. Your funds are managed in segregated accounts to prevent misappropriation. Platforms also monitor transactions in real time to prevent unusual activities and fraud.

- Regulatory Authority: The Hong Kong SFC oversees platforms, requiring them to hold Type 1 licenses or virtual asset trading platform licenses.

- Technical Protection: Multiple encryption, hot-cold wallet separation, cold storage, multi-signature, MPC wallet architecture, 2FA, etc.

- Fund Management: Client funds are segregated with transparent transaction records, allowing you to verify anytime.

- Risk Education: Platforms regularly provide risk education content to enhance your security awareness.

When choosing a Hong Kong stock trading platform, prioritize licensed institutions and focus on their security technologies and compliance credentials to maximize the safety of your funds and personal information.

Tips for Beginners Choosing a Platform

Image Source: pexels

Low-Frequency Trading

If you trade infrequently, focus on basic fees when choosing a Hong Kong stock trading platform. You can refer to the table below to understand how different fees affect low-frequency trading:

| Fee Item | Description | Focus for Low-Frequency Traders |

|---|---|---|

| Trading Commission | Charged as a percentage of transaction amount | Choose platforms with low commission rates and no minimum commission |

| Stamp Duty | Charged on sales based on transaction amount | Mandatory, include in cost budgeting |

| Transfer Fee | Fee for transferring stock ownership | Small proportion but part of trading costs |

| Fund Account Management Fee | Charged by some platforms, many now waived or free | Prefer platforms with no management fees |

| Other Value-Added Service Fees | Fees for advisory, quantitative tools, etc. | Regular investors can avoid, focus on basic fees |

You should also consider the platform’s user experience and service quality. Internet brokers typically have lower commissions, making them suitable for low-frequency traders.

Low-Threshold Account Opening

With limited funds, choose Hong Kong stock trading platforms with low account opening thresholds to reduce trial-and-error costs and quickly experience investing. There are two main account opening methods:

- Direct account opening with Hong Kong brokers, requiring ID, proof of address, bank card, and a simple process.

- Opening a Hong Kong Stock Connect account through Chinese brokers, with a high funding threshold requiring daily assets of over 500,000 CNY, limited to trading certain Hong Kong stocks.

You can prioritize platforms with low minimum deposit thresholds. For example, some platforms require only $70 to open an account, also supporting demo accounts and 24/7 customer service, ideal for beginners.

Learning Resources

Choosing platforms with rich learning resources can help you grow quickly. Many Hong Kong stock trading platforms provide real-time market data, technical analysis, investment guides, expert insights, and community interaction. You can learn Hong Kong stock knowledge through text, video, and live courses. Platforms also offer IPO sections, investment training camps, and experience-sharing communities to support you before, during, and after investing.

You can use demo trading features to gain experience, understand market rules, and build investment confidence.

Comprehensive Consideration

When choosing a Hong Kong stock trading platform, don’t focus on a single factor. Compare fees, services, account opening thresholds, and learning resources comprehensively. Avoid focusing only on “zero commission” or short-term promotions. You can use demo accounts to test platform features and select one suitable for long-term use. Stay rational, keep learning, and progress steadily in the Hong Kong stock market.

When selecting an investment platform, focus on fees and services as key criteria. Many platforms advertise zero commissions but may charge platform or service fees. Carefully compare fee terms, watch for hidden costs and short-term promotions, and value investment tools and information services. Rational selection and continuous learning help manage investment risks better.

FAQ

What documents are needed to open a Hong Kong stock trading platform account?

You need to prepare an ID, bank card, and proof of address. Some platforms support online document uploads. During account opening, platforms guide you through identity verification and document submission.

Are zero-commission platforms truly free?

You should note that zero-commission platforms often charge platform or other service fees. Carefully review fee disclosures to avoid overlooking hidden costs.

What is the minimum deposit requirement for Hong Kong stock trading?

Minimum deposit thresholds vary by platform. Some require as little as ~$70 (1 USD = 7.8 HKD), while others have higher requirements. Choose based on your funding capacity.

How to ensure fund safety?

Choose platforms regulated by the Hong Kong SFC. Licensed platforms use multiple encryption and segregated fund measures. You can check account transactions anytime to ensure fund safety.

Can I use a Chinese bank card for deposits?

Most platforms support Chinese bank card deposits. You should monitor exchange rates and cross-border transfer fees. Some platforms assist with obtaining Hong Kong bank cards for easier fund management.

After a deep dive into Hong Kong stock trading platforms, it’s clear that while many claim “zero commission,” hidden platform fees, cumbersome deposit processes, and opaque exchange rate spreads remain common pain points for new investors. These issues not only impact your trading experience but also silently inflate your investment costs. BiyaPay was created to solve these challenges, offering you a more comprehensive and efficient cross-border financial solution. We break down traditional barriers, allowing you to invest in both U.S. and Hong Kong stocks on a single platform without the need for a complex overseas bank account, making asset allocation simple. With our real-time exchange rate query feature, you can always seize the optimal conversion opportunities and ensure every transaction is worthwhile with a remittance fee as low as 0.5%. Say goodbye to tedious processes and non-transparent fees, and register with BiyaPay today to begin your smart investment journey.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.