- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How to Quickly Enter the U.S. Stock Market? Easily Choose the Brokerage Platform That Suits You Best!

Recently, Xiao Li noticed that Microsoft’s stock price had risen for seven consecutive days. Seeing this upward trend, he was also tempted and planned to take the opportunity to invest in some U.S. stocks. After all, the strong performance of the U.S. stock market is hard to ignore, and it seems like it might be a good opportunity now. However, when he thought about opening an account and registering with a brokerage firm, he began to hesitate. The complicated procedures and complex registration requirements gave him a headache, and he was afraid of missing out on a good opportunity.

In fact, not only Xiao Li, but many friends may also have similar confusion: they want to participate in U.S. stock investment but are not sure how to start. Perhaps they have already tried to register with brokerage platforms, but the process was so cumbersome and troublesome that it gave them a headache. Watching people around them enter the market one after another while not knowing where to start themselves is really frustrating.

In this article, we will briefly introduce several common ways to open brokerage accounts and their advantages and disadvantages to help you take this step and smoothly invest in U.S. stocks like Microsoft.

How to Choose a Brokerage Platform?

Actually, when choosing a brokerage platform, several core factors need to be considered: commission fees, account opening thresholds, platform functions, and fund security.

Next, we will take several well-known brokerage firms as examples to look at their advantages and disadvantages and compare the account opening steps of different platforms to help everyone make a wiser choice.

Futu Securities - Feature-rich but Troublesome to Register

As a popular trading platform for U.S. and Hong Kong stocks among investors, Futu Securities has powerful investment tools and data analysis functions. Whether you are an investor interested in technology stocks like Microsoft or a friend who hopes to diversify investments, Futu is a good choice. Especially in providing real-time market quotes and stock market dynamics, Futu performs very well.

However, Futu’s registration process is relatively troublesome, especially for mainland investors. You need to provide a large number of identity documents, proof of the source of funds, and some steps may even require you to go to Hong Kong in person. This process may make many novice investors feel confused and uneasy.

Futu Securities Account Opening Steps:

Online Appointment and Witnessing: First, make an online appointment for a designated location in Hong Kong to witness the account opening with Futu staff.

Direct Visit to the Headquarters: You can directly go to Futu Securities Hong Kong Headquarters at Room C1 - 2, 13th Floor, United Centre, 95 Queensway, Hong Kong, without an appointment. Phone: +852 - 2523 3588.

Documents Required for Hong Kong Residents:

Hong Kong Permanent Resident Identity Card + Proof of Address Issued within Three Months.

Or Hong Kong Resident Identity Card + Hong Kong Visa Identity Document + Proof of Address Issued within Three Months.

Or Hong Kong Resident Identity Card + Local Passport + Proof of Address Issued within Three Months.

Third-Party Witness Account Opening

For customers who do not have a Hong Kong Resident Identity Card or a Hong Kong bank account, they can download and fill out the account opening form, find a qualified witness for third-party witnessing, and then mail the materials to Futu for account opening.

Although the registration process is a bit cumbersome, Futu, with its support for global stock market trading and rich investment tools, is still the first choice for many investors. Especially for friends with certain investment experience, the diversified choices and powerful data analysis tools provided by Futu are undoubtedly very attractive.

Tiger Securities - Quick and Convenient but with Some Obstacles for New Mainland Customers to Register

Compared with Futu, the registration process of Tiger Securities is relatively simple and does not have such complicated material requirements as Futu. Tiger Securities not only supports trading in multiple markets such as U.S. and Hong Kong stocks but also has good investment tools and analysis functions, and the user experience is also excellent. However, recently, Tiger Securities has stopped accepting new account opening applications from mainland investors, which has made many mainland users lose the most convenient account opening channel.

Tiger Securities Account Opening Steps:

Be at least 18 years old, prepare identity documents such as an identity card or passport, mobile phone number, email address, and bank account information. Some platforms may also require proof of residence address.

Log in to the official website of the account opening platform, ask the customer service for the account opening link, and upload the materials as required. Note that you need to upload the stock balance proof before May 19, 2023: Hong Kong account statements or statements/account opening certificates of other overseas brokerage firms, and complete face verification, and then wait for the review.

After submission, wait for 1 - 2 working days for the review, and keep the communication channels unblocked during this period.

After the review is passed, activate the account and complete the deposit according to the instructions.

Although Tiger Securities has obvious advantages in user experience and trading fees, the obstacles in registration make it not suitable for everyone.

BiyaPay - A More Convenient and Secure Multi-Asset Trading Wallet

For those investors who hope to quickly enter the U.S. stock market and don’t want to be bothered by the cumbersome account opening process, the multi-asset wallet BiyaPay is undoubtedly a more convenient choice. BiyaPay not only supports trading in U.S. and Hong Kong stocks but also has no limit on the withdrawal amount.

Through BiyaPay, you can quickly register an account and easily invest in the U.S. and Hong Kong stock markets, avoiding cumbersome document preparation and complicated procedures. You don’t even need an overseas bank account.

BiyaPay Registration Steps:

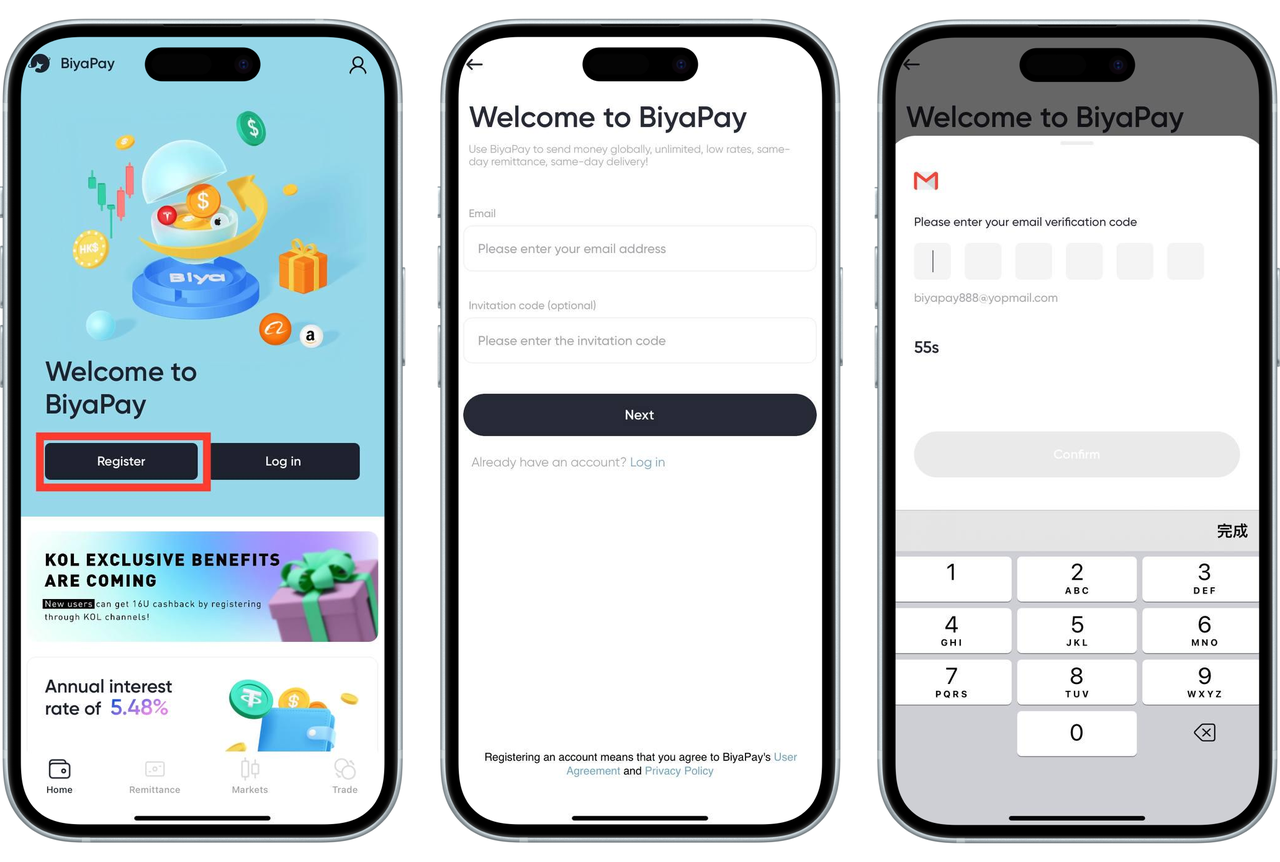

Step 1: Download the BiyaPay App and register a new account with zero threshold.

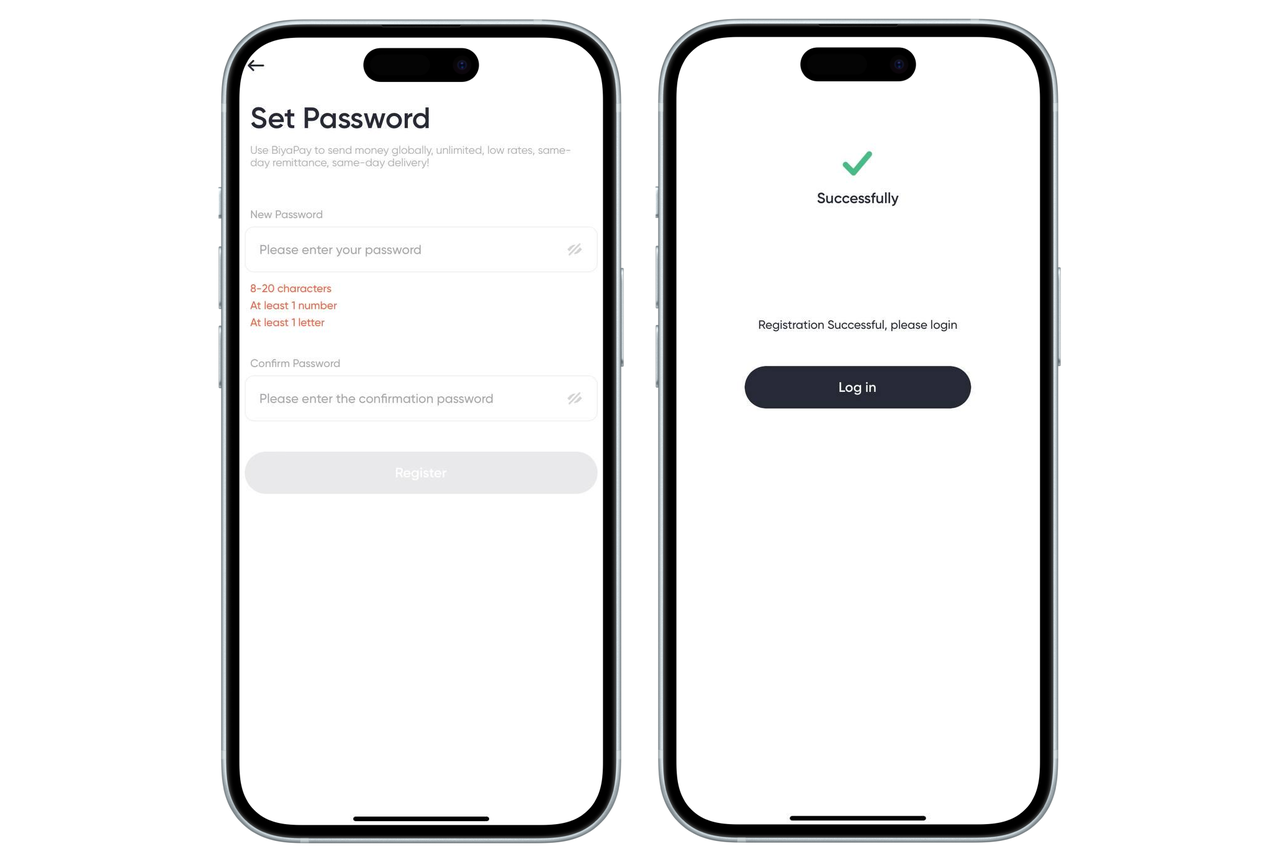

Step 2: Complete identity verification, upload your identity card or passport as required, and conduct face recognition.

Registering BiyaPay is particularly simple. [Enter your email address] → [Email verification code] → [Set password]. You can register successfully in just a few seconds.

The registration process of BiyaPay is simple and does not have so many troublesome registration restrictions. In addition, BiyaPay supports USDT deposit and withdrawal, which can help users conduct international remittances or fund operations, and there is no withdrawal limit. It can be used as a safe and professional deposit and withdrawal tool. You only need to enter the personal center to bind your bank account, recharge digital currency to BiyaPay and convert it into US dollars/Hong Kong dollars. Select remittance and specify the bound account as the payee, and the funds will arrive on the same day during U.S. working hours.

Finally, bind your BiyaPay account to brokerage firms such as Interactive Brokers and Futu to complete the deposit. It is recommended to bind the same account for smooth operation. This is especially attractive to investors who hope to handle funds conveniently.

Through the above introduction, everyone may have a clearer understanding of different brokerage platforms. Each platform has its own unique advantages and disadvantages, and choosing the platform that suits you best is crucial. For novice investors, platforms with simple registration processes and transparent commission fees are the first choice. For experienced investors, they can choose brokerage platforms that provide more investment tools and data analysis.

For those investors who hope to enter the market quickly, especially those facing cumbersome account opening processes, BiyaPay is undoubtedly an option worth considering. BiyaPay not only allows you to easily enter the U.S. and Hong Kong stock markets but also enables you to participate in digital currency trading, and there is no withdrawal limit. It is really a very convenient and flexible financial platform. If you are still hesitating about choosing a simple and secure investment platform, BiyaPay may be exactly what you need.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.