- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How Beginners Can Buy Hong Kong Stock ETFs Through Futu Securities

Image Source: pexels

If you want to buy Hong Kong stock ETFs, you only need to complete four steps on Futu Securities: account opening, funding, ETF selection, and order placement. The process is simple, with a low entry barrier. Hong Kong stock ETFs cover themes like the Hang Seng Index, technology, and dividends, with management fees as low as 0.15% (based on 1 USD ≈ 7.8 HKD), and you can also benefit from lower tax rates. You can choose flexibly based on your risk preferences, suitable for those new to Hong Kong stock investments.

Key Points

- Opening an account with Futu Securities is simple and fast; you only need an ID and proof of overseas residence, completable in minutes.

- Funding methods are diverse; it’s recommended to use FPS for fast fund arrivals and zero fees, allowing flexible fund management.

- When selecting Hong Kong stock ETFs, focus on trading volume and turnover rate, prioritizing products with good liquidity and low management fees to reduce investment risks.

- Buying ETFs is convenient, supporting same-day buying and selling, ideal for flexibly adjusting investment portfolios.

- Understand fees and investment risks, invest rationally, diversify funds, and long-term holding can yield stable returns and tax benefits.

Platform and Account Opening

Image Source: pexels

Futu Securities Overview

You can easily enter the Hong Kong stock market through Futu Securities. Futu Securities is a platform focused on cross-border online brokerage, primarily serving international markets like Hong Kong and Singapore. The platform has over 790,000 paying users, with client assets reaching approximately $5.9 billion (based on 1 USD ≈ 7.8 HKD). Although its user base is smaller than some local major brokers, Futu excels in cross-border investments, with users mainly comprising post-90s finance and internet professionals, averaging $68,000 in assets per person.

Futu Securities offers many user-friendly features for beginner investors:

- Community and Information Features

You can post, watch live streams, and interact with other investors in the Futu Circle community, quickly learning investment knowledge. The platform also provides rich market information, including news, updates, and investment courses, helping you stay informed about market dynamics. - Fund Management and Trading Features

You can deposit, withdraw, and convert funds through various methods, with an intuitive interface. Trading features support multiple conditional orders, meeting diverse investment needs. - Simple Account Opening Process

Futu Securities’ account opening process is clear, with fast reviews, typically completed in minutes, making it ideal for beginners to get started quickly.

Tip: Futu’s advanced market data and technical analysis tools are better suited for experienced investors. Beginners can prioritize using community and information features to gradually improve investment skills.

Account Opening Process

You only need to prepare relevant documents to quickly complete account opening with Futu Securities. The specific process is as follows:

- Account Opening Conditions

- At least 18 years old

- Chinese residents working or living overseas

- Required Documents

- Valid Chinese ID card original

- Proof of overseas work or residence within the last three months (e.g., Hong Kong work visa, pay stubs, labor contract, employment certificate)

- Overseas utility bills, phone bills, bank statements, insurance policies, tax bills, overseas lease agreements, or overseas driver’s licenses

- Account Opening Steps

- Download and register for the Futu NiuNiu or moomoo app

- Upload photos of both sides of your ID card

- Provide address proof (e.g., bank statements or utility bills)

- Fill in occupation, financial status, and investment experience

- Read and confirm risk disclosure documents

- Complete identity verification via SMS

- Submit electronic signature and account opening application

- Transfer funds via a same-name Hong Kong bank account to complete funding verification (minimum $1,300 per transaction)

- Review and Precautions

- Review time is generally 1-2 business days, with the fastest completed in minutes

- Transfer remarks must include “FUTU + ID number” to avoid review failures

- Ensure the app version is v13.47.14108 or higher

After completing these steps, you can officially start your Hong Kong stock investment journey, including purchasing Hong Kong stock ETFs and other products.

Funding and Fund Management

Funding Methods

You can transfer funds to your Futu Securities account through multiple methods. The platform supports the following mainstream funding channels:

- Bank-to-Broker Transfer: You can transfer funds directly from a Hong Kong bank account to your securities account. Some banks may charge fees, and the method is relatively traditional.

- EDDA Funding: This method uses Hong Kong’s FPS system, is simple to operate, with funds typically arriving in 5 minutes and no fees. You only need to authorize on the platform without uploading transfer receipts.

- FPS (Fast Payment System): A commonly used real-time transfer system in Hong Kong, supporting 24-hour operations. You need to upload a transfer receipt for the first use, but subsequent transfers are automatically recognized, ideal for small and frequent transfers.

You can choose the appropriate method based on your fund size and transfer habits. The table below shows the arrival times for different funding methods to help you plan funds better:

| Funding Method | Description | Arrival Time |

|---|---|---|

| Overseas Bank Account Wire Transfer | Wire transfer from a Hong Kong bank account to Futu Securities | Typically 1-3 business days |

| Hong Kong Bank Account FPS | Hong Kong bank accounts supporting FPS | Real-time arrival |

Tip: When funding, you should prioritize currencies matching the trading contract (e.g., HKD or USD) to reduce losses from exchange rate fluctuations. The platform converts your assets based on real-time exchange rates, and mismatched currencies may incur additional interest costs due to rate changes.

Fund Management

Before investing, you should allocate funds reasonably, avoiding investing all funds in a single stock or ETF. Futu Securities provides diverse fund management tools. You can view real-time market data, analysis tools, and portfolio performance in the Futu NiuNiu app, adjusting asset allocations anytime. The platform suggests setting stop-loss and stop-profit points to help you control risks and lock in returns.

Futu Youpei also offers rich investment strategies and learning resources. You can use these to enhance your fund management skills and gradually build disciplined investment habits. Diversified investments and rational operations help you progress steadily in the Hong Kong stock market.

Buying Hong Kong Stock ETFs Process

Image Source: unsplash

ETF Selection

You can easily select suitable Hong Kong stock ETFs on the Futu Securities platform. The platform offers a wide range of ETF products, covering themes like the Hang Seng Index, technology, and dividends. You can choose different types of ETFs based on your investment goals and risk preferences. For example:

- Hang Seng Index ETF: Tracks the Hang Seng Index, suitable for investors wanting to follow the overall Hong Kong market performance.

- Technology ETF: Focuses on leading tech companies listed in Hong Kong, ideal for those interested in tech industry growth.

- High-Dividend ETF: Invests in high-dividend companies, suitable for investors seeking stable returns.

You can access the “Market” section in the Futu NiuNiu app, click the “ETF” category, and use the filtering function. You can filter by industry, theme, fund size, historical performance, and other dimensions. The platform also displays key data like net asset value, price, trading volume, and turnover rate for each ETF, helping you assess product liquidity and activity.

The table below shows liquidity metrics for some Hong Kong stock ETFs:

| Metric | Value | Description |

|---|---|---|

| Intraday Turnover Rate | 24.5% | Good liquidity, active trading |

| Intraday Trading Amount | $87.12 million | Active trading, sufficient funds |

| Average Daily Trading Amount (Past Year) | $186 million | Stable and high long-term trading volume |

When selecting ETFs, you should prioritize products with high trading volume and turnover rates, as these are easier to trade with smoother price fluctuations. You also need to focus on the difference between ETF prices and net asset values. Significant deviations between price and net value may impact your actual returns.

Tip: You should pay attention to ETFs’ historical performance and fund size. Larger-scale ETFs typically have better liquidity and lower management fees, suitable for beginners to hold long-term.

Order Placement

After selecting an ETF, you can place orders directly on the Futu Securities platform. You only need to search for the target ETF code in the app, go to the product details page, and click the “Buy” or “Sell” button. You can choose market or limit orders, enter the purchase quantity and price, and submit the order after confirming accuracy.

Futu Securities supports the Hong Kong stock market’s T+0 trading rule. You can sell ETFs bought on the same day, supporting multiple intraday trades. You can adjust holdings flexibly based on market conditions. Actual settlement occurs on T+2, meaning funds and stocks settle on the second business day after the trade. Before settlement, you cannot withdraw cash or transfer custody of stocks.

The Hong Kong stock market has no price fluctuation limits, and ETF trading units are set by issuers, commonly 200, 500, or 1,000 shares per lot. You need to note the minimum purchase unit when placing orders to avoid failures due to insufficient quantities.

The specific order placement process on the Futu Securities platform is as follows:

- Log into the Futu NiuNiu app and search for the target ETF code.

- Go to the ETF details page and click “Buy” or “Sell.”

- Choose market or limit order, enter purchase quantity and price.

- Confirm order details and submit the order.

- Await system transaction feedback; once completed, check ETF holdings on the portfolio page.

Note: When buying Hong Kong stock ETFs, you should focus on ETF liquidity and price volatility. Highly liquid ETFs trade more smoothly, with prices closer to net value. You can also use Futu’s dark pool system to enhance trading efficiency and seize more arbitrage opportunities.

By purchasing Hong Kong stock ETFs through the Futu Securities platform, you benefit from convenient operations, low commissions, and rich investment tools. You can adjust holdings flexibly based on your investment plan, achieving diversified asset allocation.

Fees and Precautions

Main Fees

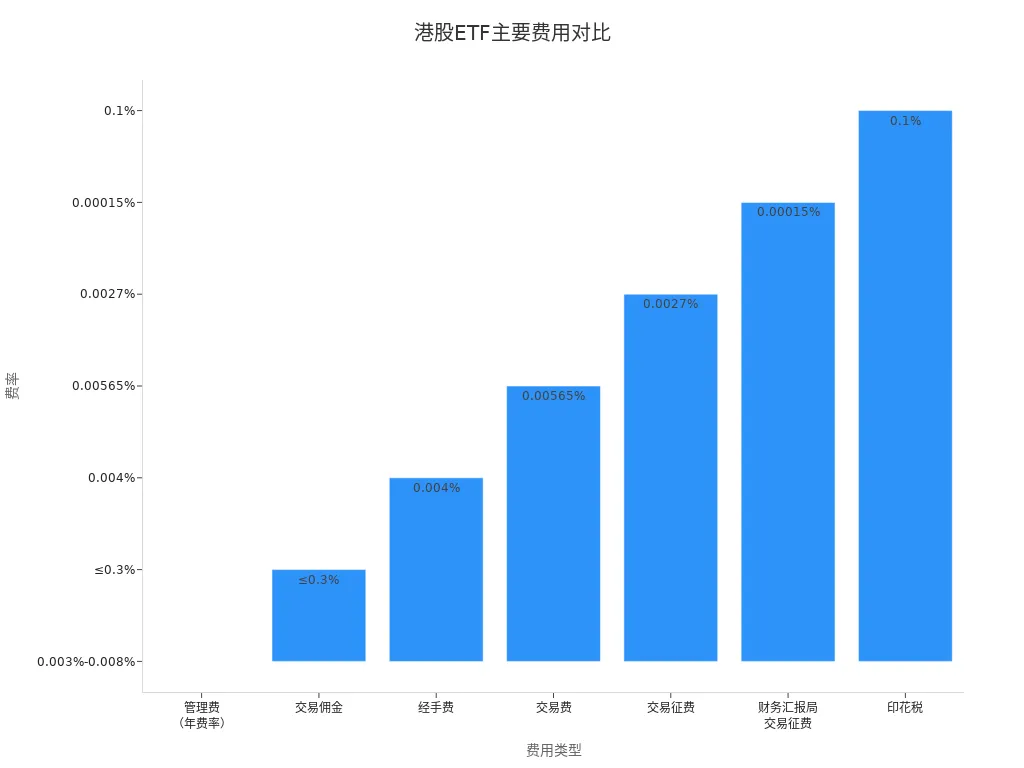

When investing in Hong Kong stock ETFs, you need to understand various fees. Main fees include management fees, trading commissions, handling fees, transaction fees, transaction levies, Financial Reporting Council transaction levies, and stamp duties. Different fees have varying standards. You can refer to the table below:

| Fee Type | Fee Standard | Remarks |

|---|---|---|

| Management Fee (Annual Rate) | 0.003% - 0.008% (tiered based on portfolio value) | Lower rates for larger portfolios, minimum 0.003% |

| Trading Commission | Up to 0.3% (3‰), minimum $5 if below | Charged both ways |

| Handling Fee | 0.04‰, waived for currency and bond ETFs | Charged both ways |

| Transaction Fee | 0.00565% | Charged both ways |

| Transaction Levy | 0.0027% | Charged both ways |

| Financial Reporting Council Transaction Levy | 0.00015% | Charged both ways |

| Stamp Duty | 0.1%, minimum $1 if below | Charged both ways |

You can view the fee rate distribution through the chart below:

Different brokers have varying fees. Futu Securities’ Hong Kong stock ETF trading fees are 0.03% plus $15, offering competitive rates. You can refer to the table below:

| Broker | Hong Kong Stock ETF Trading Fees (Commission + Fixed Fee) |

|---|---|

| Futu Securities | 0.03% + $15 |

| ZR Securities | 0.03% + $12 |

| Interactive Brokers | 0.08% |

Investment Risks

When investing in Hong Kong stock ETFs, you also need to note the following risks and details:

- Trading Hours: The Hong Kong stock market operates Monday to Friday, 9:30 AM-12:00 PM and 1:00 PM-4:00 PM (Hong Kong time). You need to complete trades within these hours.

- Minimum Investment Amount: Hong Kong stock ETFs are traded in lots. The minimum investment amount for each ETF is set by the manager, typically affordable for the public. You can check specific requirements on the product details page.

- Tracking Error: ETF performance may deviate from the tracked index. You need to focus on the fund’s tracking error and choose products with smaller errors.

- Leveraged ETF Risks: Leveraged ETFs carry higher risks, suitable for short-term trading. You need to pay special attention to the following:

- Leveraged ETFs are suitable for short-term holding, as long-term holding may lead to net value erosion due to market volatility.

- Daily rebalancing mechanisms may increase net value erosion risks.

- Trading costs and management fees are higher.

- Performance is better in trending markets, with increased risks in volatile markets.

- Issuers suggest only short-term trading or hedging, not suitable for long-term investment.

Tip: When investing, you should remain rational and avoid frequently switching ETFs to prevent chasing highs and selling lows. You can adjust regular investment amounts based on market trends, increasing investments during undervaluation. Persist in long-term investing, set profit-taking standards, and use a “core + satellite strategy” to diversify risks. Choose ETFs with good liquidity and low tracking errors, avoiding blind premium purchases. You should also monitor the gap between secondary market prices and net values to avoid return impacts from price deviations.

By understanding fees and risks, you can allocate assets more scientifically and enhance your investment experience.

You now understand the complete process of buying Hong Kong stock ETFs through Futu Securities. Choosing a reputable platform and diversifying funds can help you reduce risks. You can continuously monitor changes in the Hong Kong stock ETF market for the following benefits:

- Dividend ETFs use the QDII model, with dividend tax rates of only 10%, saving taxes over the long term.

- Dividend ETFs cover multiple industries, diversifying risks and enhancing return stability.

- Long-term capital and policy support boost market vitality, optimizing investment returns.

You can continue learning ETF knowledge through platforms like Cnblogs, mastering product classifications, trading methods, and disclosure mechanisms. Persist in rational investing, stay updated on market dynamics, and gradually improve your investment skills.

FAQ

1. Can you directly fund Futu Securities with a Chinese bank card?

You cannot directly fund with a Chinese bank card. You need to transfer via a Hong Kong bank account or supported international wire transfer channels to ensure smooth fund arrival.

2. How soon can you sell Hong Kong stock ETFs after buying?

You can buy and sell on the same day. Hong Kong stock ETFs support T+0 trading, offering high flexibility for short- and long-term investments.

3. How do you check real-time ETF prices and net values?

You can view real-time prices, net values, and trading volumes on the ETF details page in the Futu NiuNiu app. The platform syncs market data for easy monitoring.

4. What taxes and fees do you need to pay?

When trading Hong Kong stock ETFs, you mainly face trading commissions and management fees. Dividend ETFs under the QDII model have a 10% dividend tax rate. Check specific fees in platform announcements.

5. Can you directly buy Hong Kong stock ETFs with USD?

You can fund with USD and convert to HKD. Futu Securities supports multi-currency accounts, automatically converting at real-time rates (e.g., 1 USD ≈ 7.8 HKD) for convenient investing.

After learning the full process of buying Hong Kong stock ETFs through Futu Securities, it’s clear that while the platform offers convenient operations and rich tools, there are still some pain points you need to handle yourself, such as funding, account management, and risk control. For instance, you need to transfer funds from a mainland bank card to a Hong Kong bank account, a complex process that is not only time-consuming but may also incur extra fees due to exchange rate fluctuations. BiyaPay was created to solve these challenges, offering a safer and more efficient cross-border financial solution. We’ve significantly simplified the traditional KYC process with one-stop digital identity verification, so you don’t need a complex overseas bank account to invest in both U.S. and Hong Kong stocks on one platform, easily diversifying your assets. With our real-time exchange rate query feature, you can always seize the optimal conversion opportunities and ensure every transaction is worthwhile with a remittance fee as low as 0.5%. Say goodbye to cumbersome processes and non-transparent fees, and register with BiyaPay today to begin your new era of smart investing.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.