- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Overview and Scenario Analysis of International Remittance Channels for Chinese Users

Image Source: unsplash

When conducting international remittances, you often focus on service selection, fees, receipt speed, and exchange rate fluctuations. Many users prefer online banking operations, considering them convenient and secure. Some banks also offer fee waivers and multilingual services for overseas students, helping you reduce costs. You may also pay attention to fluctuations in currency conversion between RMB and USD, opting to lock in exchange rates to minimize risks. Banks can also provide visa-related documentation services to meet various scenario needs.

Core Points

- International remittance channels are diverse, including bank wire transfers, third-party platforms, digital banks, Alipay/WeChat, and cash remittances, allowing you to choose the appropriate method based on amount and needs.

- Fees and receipt speeds vary significantly; bank wire transfers are secure but costly, third-party platforms like Wise have low fees with some currencies arriving instantly, and cash remittances suit urgent situations.

- Exchange rate fluctuations affect the received amount; it’s recommended to monitor real-time exchange rates and lock rates for large remittances to avoid losses, while noting single transaction and annual remittance limits for proper fund planning.

- Fund security and compliance are critical; verify information multiple times when filling out forms and prepare proof of fund sources to avoid delays or failures due to errors.

- Different scenarios have distinct recommendations: large study abroad remittances prioritize bank transfers, small family remittances can use third-party platforms, overseas shopping suits third-party payments, and business remittances emphasize security and compliance.

International Remittance Channels

Image Source: pexels

Bank Wire Transfers

You can choose bank wire transfers for international remittances. Bank of China, ICBC, and Hong Kong banks all support this method. Bank wire transfers are suitable for large remittances, such as tuition fees, business collaborations, or family financial support. You need to provide the recipient’s account information and SWIFT Code. The advantage of bank wire transfers is high security, ideal for large international remittances. The downside is higher fees, typically $20-$50 per transaction, with receipt times generally 1-3 business days. If you need personal assistance, bank branches can provide detailed services.

Third-Party Platforms

You can also choose third-party platforms for international remittances. Wise and PayPal are common options. Wise supports over 50 currencies and remittances to more than 70 countries, with a simple process and Chinese interface. You only need to upload identification documents and a selfie to open an account. Wise’s exchange rates are close to the market mid-rate, with transparent fees, typically lower than banks. Some currencies can arrive instantly. The drawback is that Chinese users cannot directly remit from mainland China to overseas via Wise. PayPal is suitable for small shopping and cross-border e-commerce payments, with fast receipt but higher fees.

The table below compares Wise’s main advantages and limitations:

| Aspect | Wise Advantages | Wise Limitations |

|---|---|---|

| Account Opening and Operation | Simple process, supports Chinese | No physical branches, lacks offline services |

| Currency and Country Support | Supports over 50 currencies, 70+ countries | Chinese citizens cannot remit directly from mainland China to overseas |

| Exchange Rates and Fees | Transparent rates, low fees | Fees vary by currency and payment method |

| Remittance Speed | Some currencies arrive instantly | N/A |

| Fund Security | Regulated in multiple countries, segregated funds | N/A |

| User Experience | Trackable progress, multi-currency accounts | N/A |

Digital Banks

Digital banks, such as Hong Kong virtual banks and Revolut, also support international remittances. You can complete account opening and operations via a mobile app. Digital banks are suitable for users with frequent cross-border fund flows, such as overseas workers or freelancers. They typically offer lower fees and faster receipt times. You can check exchange rates and remittance progress anytime, enhancing the experience.

Alipay/WeChat

You can also use Alipay and WeChat for international remittances. WeChat’s micro-remittance service has a single transaction limit of 50,000 CNY (approximately $7,000 USD, based on current rates) and an annual cumulative limit of 200,000 CNY (about $28,000 USD). Alipay’s micro-remittance has a single transaction limit of 5,000 CNY (about $700 USD), with a monthly maximum of 50 transactions. You need real-name authentication to use these services. Alipay and WeChat are suitable for small family remittances or transfers to friends, but limits apply, and policies may change.

| Platform | Single Transaction Limit | Annual Cumulative Limit | Other Restrictions |

|---|---|---|---|

| ~$7,000 USD | ~$28,000 USD | Requires real-name authentication, transaction limits | |

| Alipay | ~$700 USD | N/A | Maximum 50 transactions per month |

Cash Remittances

You can choose cash remittance methods, such as Western Union and MoneyGram. You only need to bring identification and cash to a service outlet and fill in the recipient’s information. Cash remittances are suitable for urgent assistance or when the recipient lacks a bank account. Fees are generally $10-$30 per transaction, with fast receipt, and some countries allow instant cash withdrawal.

Other Methods

Some users opt for Hong Kong company account transfers or cryptocurrency for international remittances. These methods suit users with specific needs, such as cross-border e-commerce or asset allocation. You need to be aware of compliance and tax risks to ensure fund security.

Fees and Speed Comparison

Image Source: pexels

Fees

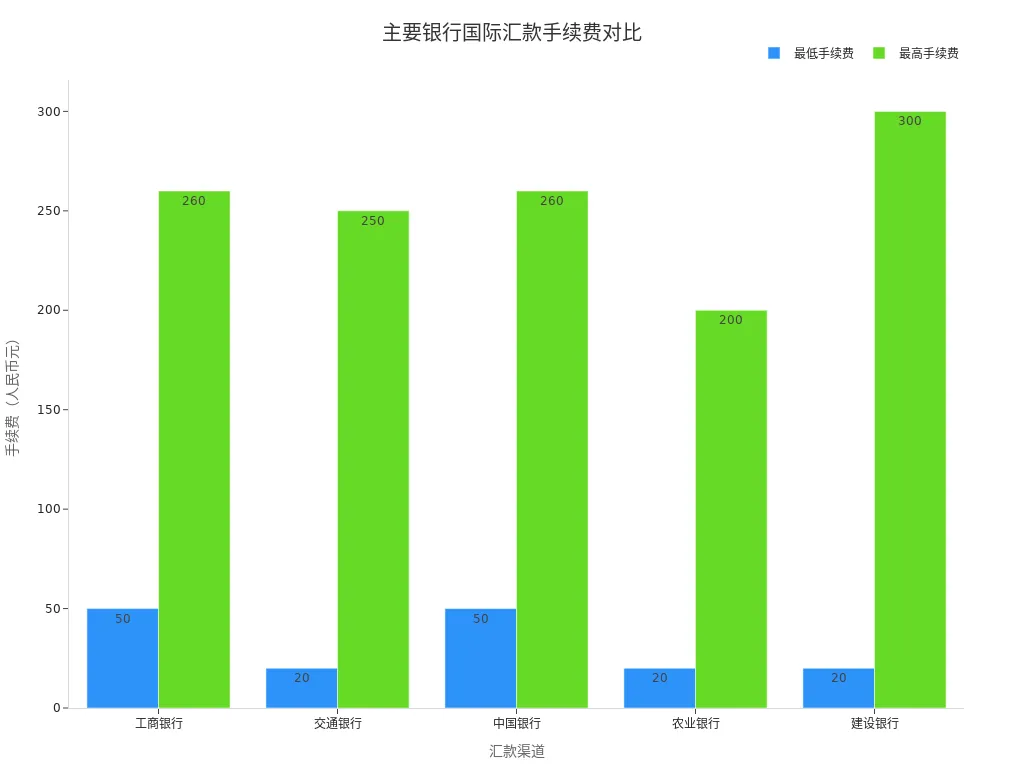

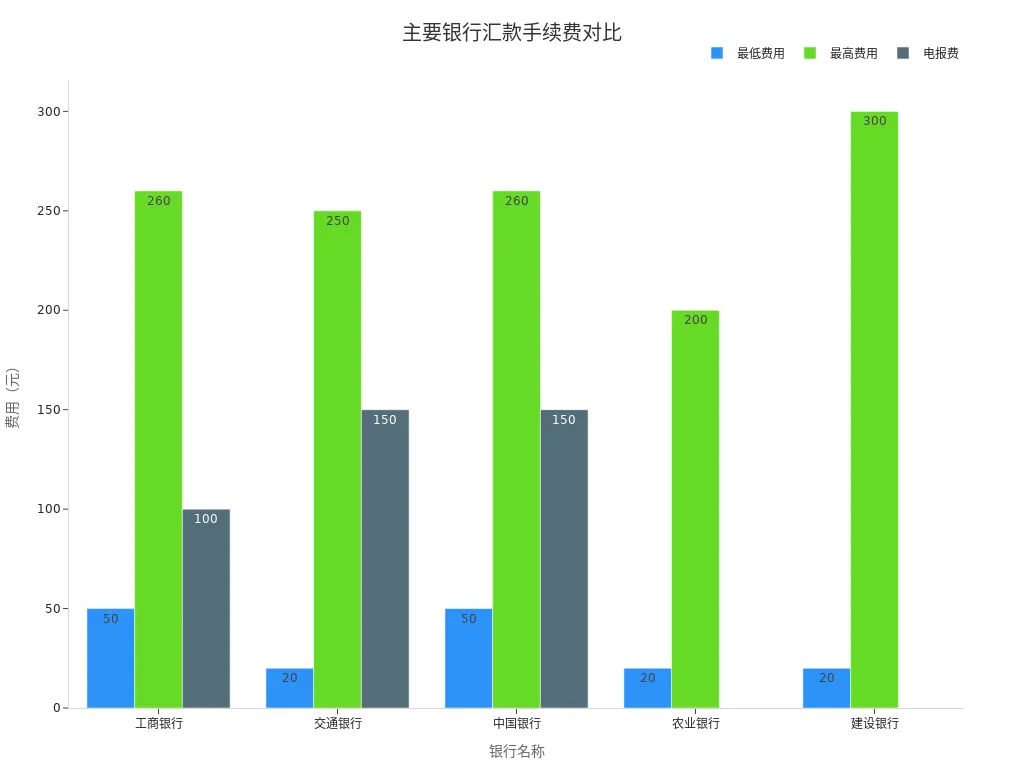

When choosing international remittance channels, fees are the most visible cost. Different channels have distinct fee standards and structures. Bank remittances typically charge 0.10% of the remittance amount, with minimum and maximum fee limits. For example, ICBC charges a minimum of $50 and a maximum of $260 per transaction, plus a $100 telegraph fee. Hong Kong banks have similar fee structures. Third-party platforms like Wise and PayPal have fees generally ranging from 0.5% to 3%, with Wise favored for its low fixed fees and transparent rates. Some digital banks, like AXOS Bank, waive remittance and wire transfer fees. You also need to note that telecom companies like Western Union charge fees ranging from a few dollars to tens of dollars, depending on the amount and destination.

| Remittance Channel | Fee Standard | Remarks |

|---|---|---|

| ICBC | 0.10%, ¥50-¥260 | Plus ¥100 telegraph fee |

| Bank of Communications | 0.10%, ¥20-¥250 | Plus ¥150 telegraph fee |

| Bank of China | 0.10%, ¥50-¥260 | Plus ¥150 telegraph fee |

| Agricultural Bank of China | 0.10%, ¥20-¥200 | |

| China Construction Bank | 0.10%, ¥20-¥300 | |

| Wise | 0.5%-1%, minimum ~$5 | Transparent fees, cost-effective |

| PayPal | 3%-5% | Suitable for small remittances |

| Western Union | $5-$30 | Varies by amount and country |

| AXOS Bank | $0 | Digital bank, fee-free |

Tip: When choosing a channel, besides fees, consider currency conversion fees and potential hidden costs. Third-party platforms like Wise typically offer lower overall costs, ideal for cost-conscious users.

Receipt Time

Receipt speed directly impacts your fund planning. Counter remittances generally take 1-2 business days, traditional wire transfers take 1-3 business days, and some large remittances may require 3-7 business days. Online channels like internet banking or mobile apps can deliver within 24 hours, with same-day receipt possible if information is accurate. Banks supporting GPI fast remittances enable same-day receipt with full tracking. Third-party platforms like Wise offer instant receipt for some currencies, and PayPal is also relatively fast. Telecom companies like Western Union typically enable same-day receipt, ideal for urgent needs.

| Channel/Method | Receipt Time | Description |

|---|---|---|

| Counter Remittance | 1-2 business days | Affected by bank processing speed and time zones |

| Online Channels | As fast as 24 hours | Same-day receipt possible with accurate information |

| Traditional Wire Transfer | 1-3 business days | Large remittances may take 3-7 business days |

| GPI Fast Remittance | Same-day receipt | Trackable process, SMS notification upon receipt |

| Wise | Instant for some currencies | Others take 1-2 business days |

| PayPal | 1-2 business days | Suitable for small remittances |

| Western Union | Instant receipt | Ideal for urgent remittances |

In practice, you’ll find that bank channel receipt times are heavily influenced by intermediary and receiving banks, with delays possible on weekends or holidays. Third-party platforms and telecom companies offer faster receipt, suitable for scenarios requiring quick delivery. You can flexibly choose the most appropriate international remittance method based on your needs.

Exchange Rates and Limits

Exchange Rate Differences

When conducting cross-border transfers, the choice of exchange rate directly affects the received amount. Banks and third-party platforms typically offer different rates. Bank rates are generally higher than the market mid-rate, reducing the received amount. Third-party platforms like Wise use rates close to the market mid-rate, offering better conversion results. When purchasing foreign currency, you can choose mainstream currencies like USD or EUR. Some digital banks and Hong Kong banks support real-time rate queries, helping you seize optimal timing. For large remittances, exchange rate fluctuations have a greater impact, so locking in rates in advance is recommended to reduce risks.

Remittance Limits

When remitting, you need to be aware of single transaction and annual limits. China has clear regulations on individual foreign exchange purchases and remittances. Your annual foreign exchange purchase limit is equivalent to $50,000 USD, with daily single remittances not exceeding $50,000 USD. For users with Hong Kong resident IDs, the daily limit for remitting RMB to China is approximately $11,000 USD (based on current rates). For remittances via MoneyGram, if the received amount exceeds $3,000, the recipient must confirm the transaction purpose via SMS, or the remittance may be returned.

Reminder: Large remittances may trigger bank risk controls. You need to provide proof of fund sources and purposes to ensure compliance.

In practice, you must understand each channel’s limit policies in advance and plan fund arrangements to avoid remittance failures due to exceeding limits.

Security Analysis

Fund Security

When conducting cross-border transfers, fund security is the most critical aspect. You need to ensure all information is accurate. When filling out the recipient’s name, account number, SWIFT Code, and receiving bank address, verify multiple times. Any error may lead to the bank returning the funds or delaying receipt. When using Hong Kong banks, ensure the correct Bank Code is provided to facilitate interbank transfers and overseas receipts. You should also note that some banks require proof of fund sources and purposes, especially for large remittances. You can operate through bank counters, mobile banking, or third-party platforms, but always save receipts for future reference.

Tip: When filling out information, use uppercase English letters to avoid delays due to spelling errors. If you have questions, consult bank customer service to ensure each step is compliant and secure.

Compliance and Taxation

When conducting cross-border transfers, compliance and tax issues are equally important. China has strict regulations on large fund flows. You need to note the following:

- When you make a single payment overseas equivalent to $50,000 USD or more, you must file with the local tax authority.

- Payment types requiring filing include service trade income, overseas personal work remuneration, dividends, profits, interest, guarantee fees, donations, compensation, taxes, and incidental income.

- You must ensure filing materials are authentic and legal, processed via tax service halls or e-tax bureaus, with no fees and instant processing.

- For contracts requiring multiple payments, you only need to file before the first payment.

- Certain types, such as overseas travel expenses, import/export trade commissions, insurance fees, and private overseas study/tourism expenses, do not require tax filing.

- You are responsible for the authenticity of submitted materials, with electronic signatures having legal effect, and copies must be marked “consistent with original” and signed.

If you transfer via a Hong Kong company account, note:

- Hong Kong, as an international financial hub, has relaxed foreign exchange controls, allowing companies to open offshore accounts for cross-border fund transfers.

- For large remittances, you need to provide economic purpose statements and supporting documents to prove fund legitimacy and prevent money laundering risks.

- Certain capital or trade-related remittances must be processed through trade settlement accounts approved by the SAFE to ensure compliance.

- Hong Kong companies must comply with relevant national tax laws during cross-border remittances, ensuring declarations and tax payments to avoid legal risks.

- During bank operations, the legal representative or authorized agent must provide identification and authorization documents to ensure compliance.

- When settling funds, the recipient’s country may have foreign exchange limits, so you need to arrange remittance methods reasonably.

Reminder: During cross-border fund operations, consult professionals or banks in advance to ensure compliance and avoid risks due to incomplete documents or operational errors.

Scenario-Based Recommendations

Study Abroad

When remitting for study abroad, you typically need to pay tuition and living expenses. You can choose bank transfers, third-party payment platforms, international remittance services, or cash remittances. Each channel has pros and cons. The table below helps you understand quickly:

| Remittance Channel | Advantages | Disadvantages |

|---|---|---|

| Bank Transfer | High security, suitable for large remittances | Complex procedures, longer time, requires form filling |

| Third-Party Payment Platform | Convenient operation, fast receipt | Higher fees, occasional receipt delays |

| International Remittance Service | Fast, flexible | Expensive, less cost-effective for small remittances |

| Cash Remittance | No fees | High risk, difficult to recover if lost, not recommended for frequent use |

If you need to remit large tuition fees, prioritize bank transfers, such as through Bank of China or Hong Kong banks, to ensure fund security and meet school requirements. If you prioritize receipt speed and convenience, consider third-party payment platforms, but note fees and receipt times. For emergencies, international remittance services are an option, but fees are higher. Cash remittances carry higher risks and are not recommended for frequent use.

Recommendation: When handling study abroad remittances, prepare recipient information and SWIFT Code in advance to avoid delays due to incomplete documents.

Family Remittances

In family remittance scenarios, you typically focus on fees, receipt speed, and security. You can refer to the following selection criteria:

- You can compare fees and receipt times of different banks and third-party platforms, noting exchange rate fluctuations and hidden fees, and choose platforms with lower total costs and transparency.

- You can select banks or payment platforms with faster receipt times, scheduling remittances to improve fund receipt efficiency.

- You need to ensure the use of legitimate channels, enable two-factor authentication, handle personal information cautiously, and regularly check account activity to prevent fraud.

- You can consider personal needs and circumstances, refer to others’ experiences, and weigh fees, speed, and security to choose the most suitable remittance channel.

For smaller amounts, use third-party platforms like Alipay or WeChat for convenience and fast receipt. For larger amounts, choose bank transfers for higher security. When selecting a channel, verify recipient information to ensure fund safety.

Overseas Shopping

When shopping overseas, you typically involve small, high-frequency transactions. Traditional bank wire transfers have high fees and slow receipt, unsuitable for this need. You can choose third-party cross-border payment channels like Qbit or PayPal. These platforms leverage internet and digital technology to offer instant payments, low fees, transparent rates, and convenient operations. You can complete payments via mobile apps, supporting multiple currencies with fast speed and low costs. Qbit supports over 180 countries and 40+ currencies, ideal for individuals and businesses with small, high-frequency international remittances. When shopping, choosing third-party payment channels significantly enhances the experience and saves costs.

Tip: For overseas shopping, prioritize third-party platforms supporting local payment networks for faster receipt and lower fees.

Business Remittances

In business remittance scenarios, you typically handle large fund flows, such as trade settlements, service procurement, or cross-border investments. You can choose bank wire transfers, especially Hong Kong banks, for high security, suitable for large and frequent international remittances. You need to prepare contracts, invoices, and other supporting documents to ensure compliance. You can also consider digital banks or professional international remittance services to improve receipt speed and fund flow efficiency. For small, high-frequency business needs, combine third-party payment platforms to reduce costs.

For business remittances, confirm account information with the recipient in advance and schedule remittances to avoid delays due to holidays or time differences.

Other Needs

For special needs, such as asset allocation, cross-border wealth management, or urgent assistance, choose channels flexibly based on circumstances. For fast receipt, opt for cash remittance services like Western Union, ideal for urgent assistance. If you focus on fund compliance and tax issues, choose Hong Kong company account transfers, ensuring relevant documentation is prepared. For large international remittances, consult banks or professionals in advance to ensure compliance and security.

Reminder: When choosing international remittance channels, consider your needs, focusing on fees, speed, security, and compliance for efficient and secure fund transfers.

International Remittance Process

Operation Steps

When handling international remittances, you can follow these steps:

- Fill in recipient information. You need to accurately provide the recipient’s name (use pinyin for Chinese users as per the account-opening document) and account number.

- Provide remittance bank information, including the receiving bank’s name, address, SWIFT Code, and correspondent bank details (if applicable).

- Determine the remittance currency and amount. You can choose USD or other mainstream currencies, ensuring the amount complies with regulations.

- Specify the fee bearer. You need to clarify who bears overseas bank fees; if unspecified, the recipient typically bears them.

- Comply with regulatory requirements. You must accurately provide your name, account, and address to ensure compliance.

- Follow bank guidance to complete the application form to avoid routing errors.

- If the recipient lacks an account, the bank will assist in opening one and notify the recipient to collect funds. 8. It’s recommended to choose wire transfers, typically arriving within 5 business days.

Tip: When filling out information, verify multiple times to avoid delays due to spelling errors.

Required Documents

You need to prepare the following documents:

- Valid identification (e.g., passport or ID card)

- Recipient’s name and account information

- Receiving bank’s name, address, and SWIFT Code

- Remittance purpose statement

- Proof of fund source (required for large remittances)

- Relevant contracts or invoices (required for business remittances)

Preparing these documents in advance significantly improves processing efficiency.

Common Issues

During remittances, you may encounter these issues:

- Funds frozen. US OFAC rules may intercept funds due to sanctions. You need to confirm the reason for freezing, communicate with the bank promptly, and seek legal assistance if necessary.

- Remittance delays. Multiple intermediary banks, incomplete information, or low bank processing efficiency can extend receipt times.

- Information errors. Long or incorrect company names or SWIFT Code errors may lead to pending or returned transactions.

- Unclear fees. Some fees borne by the recipient reduce the received amount.

You can reduce risks by communicating with the bank, preparing backup accounts, and saving remittance receipts.

Pitfall Avoidance Tips

| Operation Mistake/Risk | Description | Avoidance Tips |

|---|---|---|

| Improper Payment Method | PayPal has high fees, Western Union is costly for large amounts, T/T is slow | Understand fee structures and choose payment methods wisely |

| Inaccurate Information | Spelling errors, long company names, incorrect SWIFT Codes | Verify information multiple times, seek bank assistance if needed |

| Delivery Period Risks | Inaccurate factory delivery schedules affecting fund planning | Allow ample time, split shipments for urgent orders, communicate in advance |

| Incomplete Documentation | Missing contracts, invoices, or proof of fund sources | Prepare all documents in advance, consult banks for large remittances |

Recommendation: Save receipts after each remittance, contact the bank promptly for failed transactions, and seek professional assistance if needed.

When choosing remittance channels, refer to the table below to compare receipt speed, security, and fees. Each method has pros and cons; for example, Western Union is fast but less secure, while PayPal offers strong buyer protection but high fees. Consider your needs, focusing on fees, speed, and compliance to mitigate risks.

| Metric | Western Union | PayPal | Letter of Credit | Wire Transfer | Credit Card Payment |

|---|---|---|---|---|---|

| Receipt Speed | Minutes | Fast | Slow | Fast | Fast |

| Security | Moderate | High | High | Medium | Medium |

| Fees | Low | High | High | Low | Medium |

| Operational Convenience | Simple | Convenient | Complex | Simple | Convenient |

Tip: Before remitting, compare channels, prepare documents in advance, and consult Hong Kong banks or professionals for clarification.

FAQ

How do you determine if an international remittance channel is secure?

You can check if the channel holds financial regulatory licenses. You should verify if the platform uses multiple identity authentications. You can also review user feedback. Choosing legitimate institutions like Hong Kong banks offers greater assurance.

What should you do if account information is filled incorrectly?

You should immediately contact the remitting bank or platform’s customer service. You need to provide correct recipient information. The bank will assist in correcting or returning funds. You should save all remittance receipts.

How can you reduce international remittance fees?

You can compare fees across channels. Choosing third-party platforms like Wise is often more cost-effective. You can also monitor Hong Kong bank promotions. Planning remittances in advance avoids peak periods.

How long does it take for a remittance to arrive?

Bank wire transfers typically take 1-3 business days. Platforms like Wise and PayPal offer instant receipt for some currencies. Delays may occur during holidays or with incomplete information.

What documents are needed for smooth remittances?

You need valid identification, recipient’s name and account, receiving bank’s name and SWIFT Code. For large remittances, provide proof of fund sources. Preparing documents in advance improves efficiency.

After a deep dive into the various channels for international remittance for Chinese users, it’s clear that each method has its unique advantages and corresponding pain points. Traditional bank transfers are secure but come with high fees and slow speeds; third-party payment platforms are convenient but have limited quotas and non-transparent exchange rates; and digital banks are flexible but might involve complex cross-border account management. These challenges can all affect the efficiency and experience of your fund transfers. BiyaPay was created to solve these pain points, offering a safer and more efficient cross-border financial solution.

We have significantly simplified the traditional KYC process with one-stop digital identity verification, allowing you to remit with a fee as low as 0.5% and achieve same-day delivery, completely eliminating opaque exchange spreads and long waits. Moreover, our platform supports the conversion between various fiat and digital currencies, so you don’t need a complex overseas account to invest in both U.S. and Hong Kong stocks on one platform, easily diversifying your assets. Say goodbye to cumbersome processes and non-transparent fees, and register with BiyaPay today to start your smart remittance journey.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.