- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Guide to Overseas Study Remittances for Chinese Users: Common Methods and Practical Tips

Image Source: pexels

When you prepare to send remittances to overseas schools, you often use bank wire transfers, Alipay, WeChat, or third-party platforms. Each method varies in processing speed, handling fees, amount limits, and remittance support. For example, you can choose Hong Kong bank wire transfers or use Alipay for international remittances. It’s recommended to verify recipient information in advance and plan your account to ensure fund security. If a school only accepts specific channels, you should confirm the most suitable remittance method beforehand.

Key Points

- When choosing a remittance method, first confirm the channels supported by the school, with common options including bank wire transfers, Alipay, WeChat, and third-party platforms, each with different processing speeds and fees.

- Large tuition payments are suitable for bank wire transfers, which are cost-effective and secure; living expenses and small fees can use Alipay, WeChat, or third-party platforms, which are convenient and fast.

- Before remitting, always verify recipient information to ensure accuracy, avoiding delays or fund freezes due to errors.

- Note the annual personal overseas remittance limit of 50,000 USD; amounts exceeding this require supporting documents, so plan remittance amounts carefully.

- Be cautious of remittance scams; if you receive suspicious calls or requests to transfer funds, verify information first and avoid trusting or transferring money easily.

Common Methods and Remittance Support

Image Source: unsplash

Bank Wire Transfers

When you choose bank wire transfers, you can consider banks like Bank of China, China Merchants Bank, Agricultural Bank of China, or HSBC China. Bank wire transfers have extensive remittance support, covering 179 countries and regions globally. You can process transfers through bank counters, online banking, or self-service terminals, supporting multiple currencies such as USD, GBP, EUR, JPY, HKD, AUD, and CAD. The table below helps you quickly understand bank services for major study destinations:

| Country | Key Study Advantages | Bank of China Service Highlights |

|---|---|---|

| Japan | Numerous scholarships, cultural proximity | Branches available, student accounts, multi-currency remittance support |

| Australia | High education standards, lenient immigration policies | Flexible branch accounts, multi-currency remittance support, easy account opening |

| Canada | High-quality education, excellent living standards | Branches support student accounts and remittances, diverse financial services |

| UK | Wealth management, study concierge services | Branches offer comprehensive wealth management and study-specific services |

| USA | Major study destination | Branches with dedicated student accounts and remittance services |

When processing, you can enjoy multi-currency options and flexible remittance support, suitable for large tuition and living expense payments.

Alipay and WeChat

If you want simpler operations, you can try Alipay or WeChat. Alipay’s study payment function supports most schools in popular study destinations like the UK, USA, Canada, and Australia, and it also covers one-stop cross-border remittance services for 186 countries and regions. You can directly remit RMB to over 40 countries and regions, supporting currencies like HKD, EUR, JPY, and KRW. WeChat’s “WeRemit” mini-program also supports hundreds of institutions in the USA, UK, and Canada, with funds arriving as fast as one business day. When using WeChat for payments, it does not count toward the personal 50,000 USD foreign exchange limit, offering broad remittance support suitable for quick tuition and living expense payments.

Tip: Alipay and WeChat are mainly designed for students and parents, with convenient operations and fast processing, ideal for urgent payments.

Third-Party Platforms

You can also choose third-party platforms like Flywire, Wise, EasyTransfer, Panda Remit, or Western Union. These platforms offer extensive remittance support, with Flywire covering over 240 countries and regions and supporting 140+ currencies, primarily serving educational institutions and students. Wise supports over 200 countries and regions, offering multi-currency accounts and debit card services, suitable for individual and business cross-border remittances. PayPal is also common, with high security for large transfers, but both you and the recipient need PayPal accounts. Third-party platforms typically support online payments and transaction tracking, reducing errors from incorrect information.

Credit Card Payments

You can also use credit cards to pay tuition or deposits. Credit card payments are suitable for deposits and partial tuition, especially for institutions in the USA, UK, and Australia partnering with platforms like peerTransfer. Credit card payments are convenient and fast, ideal for urgent payments, but fees are higher (2%-4% in USD), increasing costs for large payments. When using credit cards, pay attention to exchange rate fluctuations and supported payment channels, as some schools and platforms may not accept China-issued cards.

Fees and Processing

Image Source: unsplash

Fee Comparison

When choosing a remittance method, fees are the most direct cost. Fees vary significantly across channels. The table below helps you quickly understand the fees and cost structures of main methods:

| Remittance Method | Fee Standard | Cost Structure Features |

|---|---|---|

| Bank | 30-50 USD per transaction, some banks charge proportional intermediary fees | Higher fees, longer processing times |

| Telecom Companies | Fees vary by amount and destination, ranging from a few to tens of USD | Flexible fees but with hidden costs |

| Online Payment Platforms | PayPal charges ~3-5% transaction fees, Wise charges lower fixed fees | Lower fees, fast processing, high cost-effectiveness |

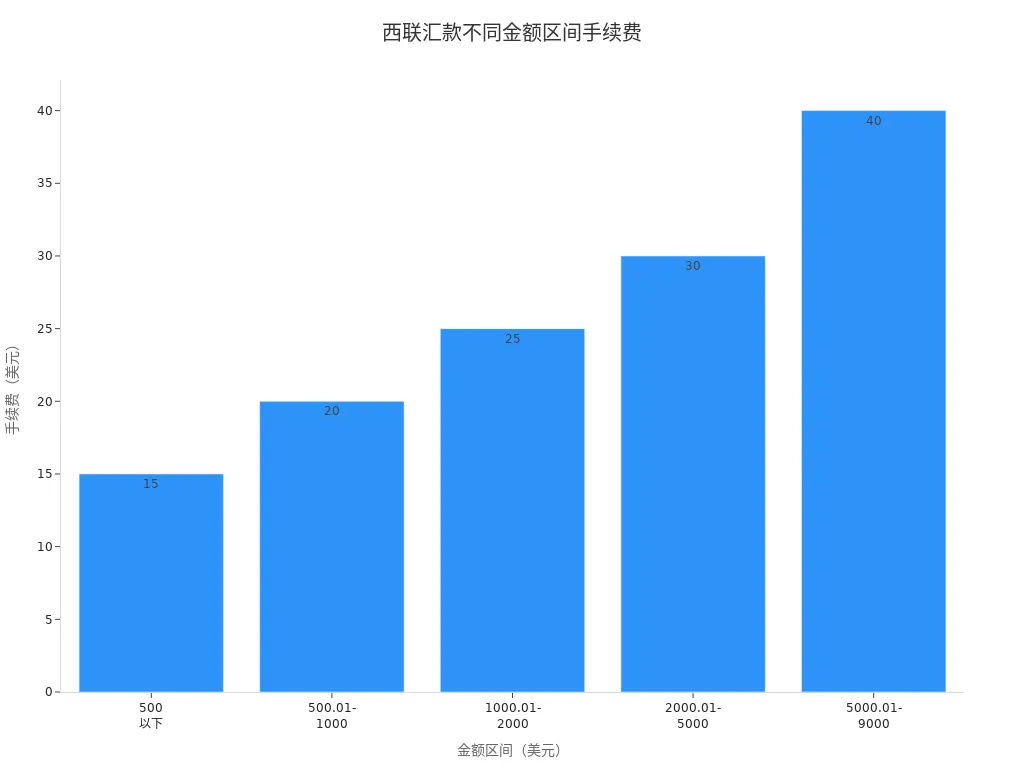

For small remittances, Western Union’s remittance fees start at 15 USD, suitable for emergencies and small payments. For large remittances, bank wire transfers are more cost-effective, but watch for intermediary bank fees.

Processing Time

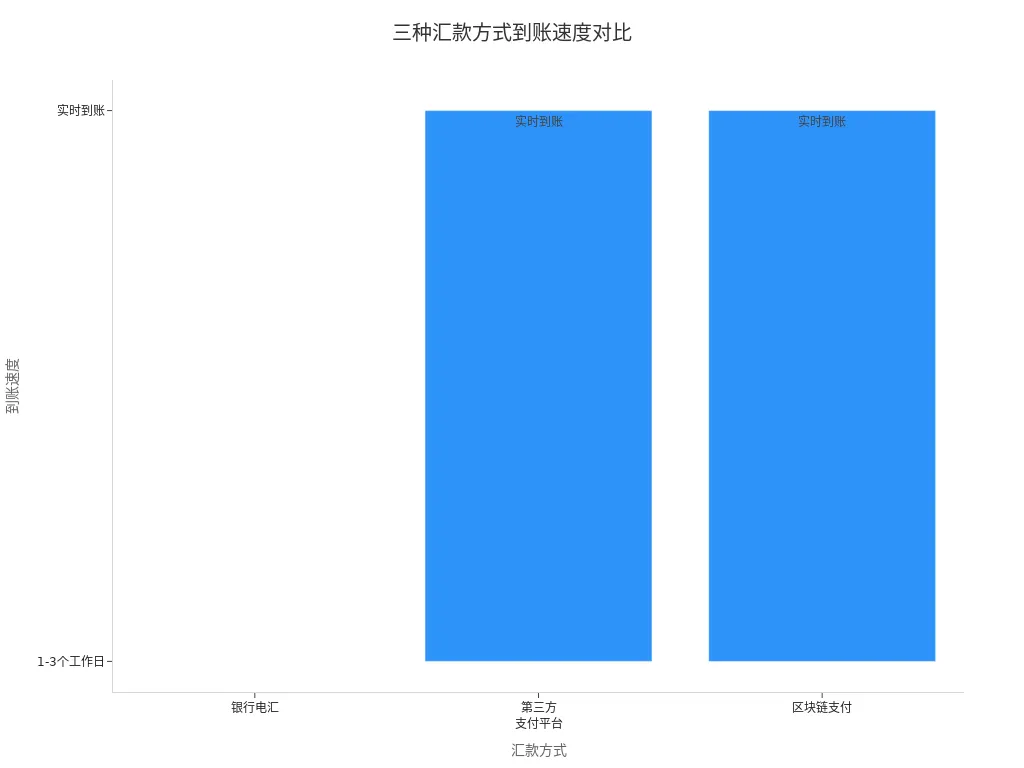

Processing speed directly affects your study and living arrangements. Bank wire transfers typically take 1-3 business days, delayed by holidays. Alipay and WeChat transfers to linked bank cards can arrive within 2 hours, with cross-border transfers taking 1-5 business days. Third-party platforms like Wise can process in as fast as 40 minutes, and Flywire offers expedited services. Refer to the table below:

| Method | Processing Time |

|---|---|

| Bank Wire Transfer (Large Amount) | Same-bank real-time, cross-bank 1-2 hours, non-business days delayed |

| Bank Wire Transfer (Small Amount) | Same-bank real-time, cross-bank 1-2 business days |

| Alipay/WeChat Transfer | 2 hours to 1 business day |

| Third-Party Platforms | 40 minutes to 3 business days |

Processing times are also affected by the remittance method, amount, bank system, time zones, and information accuracy. You should plan ahead to avoid delays impacting your studies.

Amount Limits

China has clear limits on personal overseas study remittances. Each person can remit up to 50,000 USD annually. For single transactions exceeding 50,000 USD, you need to provide admission letters, payment notices, or other supporting documents. Banks and platforms also have their own limits; for example, Alipay’s single transaction limit is 41,000 USD, and Western Union charges different fees based on amount tiers. The chart below shows fee variations across amount tiers:

Before remitting, confirm your limit and the school’s payment requirements to avoid returns due to exceeding limits.

School/Platform Remittance Support

Different schools and platforms have varying remittance requirements. Some schools only accept bank wire transfers, while others support Alipay, WeChat, or third-party platforms. You can check supported methods via the school’s website or payment notice. For example, Hong Kong bank wire transfers are secure, reliable, and fast, ideal for large tuition payments. Alipay and third-party platforms are simple to operate with low fees, suitable for living expenses and small fees. Choose the appropriate channel based on the school’s remittance policies to ensure smooth fund delivery.

Tip: Check the school’s or platform’s remittance support in advance to avoid repetitive operations and unnecessary losses.

Selection Advice

Urgent vs. Regular Needs

When studying abroad, you often encounter varying levels of remittance urgency. Sometimes, schools demand urgent tuition payments, or living expenses run low, requiring fast processing. Other times, with ample payment time, you can choose lower-cost channels.

The table below helps you compare the processing speeds and cost structures of different remittance methods:

| Remittance Method | Processing Speed | Cost Structure | Case Example |

|---|---|---|---|

| Bank Wire Transfer | 1-3 business days | 0.1%-1% handling fee, 1%-3% exchange rate spread | Student remits 100,000 USD for tuition, incurs 200 USD fee, ~2,000 USD exchange loss |

| Third-Party Payment Platforms | Real-time via mobile, withdrawal delays | 2%-4% conversion fee, 35 USD withdrawal fee | E-commerce seller receives 10,000 USD via PayPal, incurs 35 USD withdrawal fee, ~300 USD exchange loss |

| Blockchain Payment | Real-time | Very low fees (1/10 of traditional banks) | Business remits 1 million USD via Ripple, incurs 100 USD fee, fast and low-cost |

For urgent remittances, prioritize third-party payment platforms or blockchain payments, which are fast and suitable for emergencies. For regular needs, bank wire transfers, though slower, are highly secure and suitable for large, planned remittances.

Tip: In urgent cases, communicate with the school’s finance office in advance to confirm acceptable remittance methods, avoiding delays affecting registration or course selection.

Large vs. Small Remittances

When choosing a remittance method, the amount matters. Large and small remittances suit different channels:

- Large remittances (e.g., tuition, deposits) are suitable for wire transfers (T/T) and letters of credit. These methods are highly secure, ideal for large transactions. Hong Kong bank wire transfers offer broad coverage, multi-currency support, and reliable delivery.

- Small remittances (e.g., living expenses, miscellaneous fees) are suitable for third-party payment platforms (e.g., PayPal, Alipay) and Western Union. These are convenient, fast, and ideal for small or urgent payments.

- Emerging platforms like PhotonPay offer support for various payment scenarios, balancing efficiency and cost, suitable for different-sized cross-border payment needs.

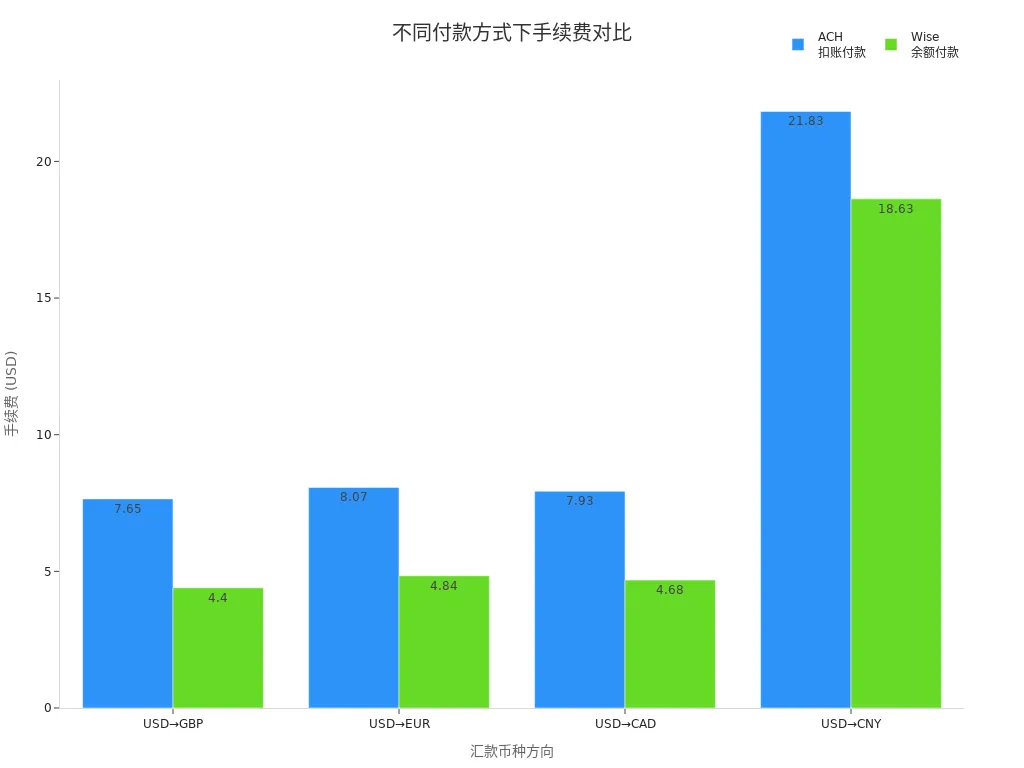

For large remittances, fees and exchange rates significantly impact total costs. Refer to the table below for fee and exchange rate differences:

| Payment Method | USD→GBP Fee | USD→EUR Fee | USD→CAD Fee | USD→CNY Fee |

|---|---|---|---|---|

| ACH Debit Payment | 7.65 USD | 8.07 USD | 7.93 USD | 21.83 USD |

| Wise Balance Payment | 4.40 USD | 4.84 USD | 4.68 USD | 18.63 USD |

Wise uses the market mid-rate, with fees typically below 1%. For example, remitting 1,000 USD to CNY via Wise yields 7,246.3 CNY (1 USD = 7.2463 CNY), while a U.S. bank yields 6,788.9 CNY (1 USD = 6.7889 CNY), saving significant costs.

Advice: For large remittances, prioritize platforms with low fees and transparent exchange rates. For small remittances, focus on processing speed and operational convenience.

Fee-Sensitive Users

If you’re particularly sensitive to fees, carefully compare each platform’s fee structure when choosing a remittance method. For example, PayPal’s fees are typically 4.4% of the transaction amount plus a fixed fee, while Stripe charges 2.9% plus a fixed fee. Some platforms also charge monthly or account opening fees.

Fee-sensitive users can choose platforms with lower fees and better exchange rates to effectively reduce remittance costs.

Many platforms and banks offer promotions for fee-sensitive users:

- New user benefits: Fee waivers for first withdrawals or transfers.

- Limited-time fee exemptions during holidays or platform events.

- VIP privileges: Premium users enjoy fee waivers, with some high-tier VIPs receiving year-long exemptions.

- Following official announcements, completing specific tasks, or upgrading membership levels can unlock more discounts.

- Most users report that fees can be fully waived during promotional periods, boosting satisfaction.

Reminder: Families with long-term or frequent remittances can monitor bank and platform promotions, plan remittance timing, and enjoy more discounts.

School Requirements and Platform Support

Before remitting, you must understand the school’s specific requirements. Some schools only accept bank wire transfers, while others support Alipay, WeChat, or third-party platforms. The remittance support and processing times vary across platforms.

In practice, you may encounter these issues:

- Transfers have amount and transaction limits, with amounts exceeding limits requiring in-person bank processing.

- Regular transfers typically arrive in 1-2 business days, delayed by holidays.

- Real-time cross-bank transfers have a 50,000 USD single-transaction limit, while regular transfers have no limit but are slower.

- Scheduled transfers may fail; contact bank customer service promptly if issues arise.

- Real-time cross-bank transfer functions require enabling online banking transfer features.

If you process remittances through Hong Kong banks and encounter issues, you can directly contact bank customer service or account managers for one-on-one remittance support.

Advice: Check the school’s website or payment notice in advance to confirm supported remittance methods and platforms, avoiding returns or delays due to mismatched channels.

Practical Tips

Information Accuracy

When filling out overseas study remittance information, you must be extremely careful. Common errors include inaccurate payer information, mismatched recipient names and IDs, incorrect bank account numbers, unclear income sources or amounts, incorrect transaction codes, wrong declaration dates, or missing special circumstance notes.

These errors can have serious consequences: banks may reject or freeze your funds, potentially affecting your credit record. According to regulations, incorrect filings may also incur fines or legal liabilities. You must strictly follow requirements to ensure all information is accurate.

Exchange Rate Selection

When choosing a remittance platform, exchange rates directly affect the received amount. Platforms use different rate types; some use real-time rates, while others use fixed rates. Rate differences between platforms affect the actual amount received. For large remittances, platforms often offer better rates. Some platforms also provide rate-locking services to mitigate exchange rate fluctuation risks. If you have multi-currency accounts, you can flexibly choose exchange timing to maximize received amounts.

Fraud Prevention

When remitting, beware of various scams. Common scams include calls impersonating embassies or law enforcement, threatening you with alleged crimes to trick you into transferring funds to “safe accounts.” Others pose as part-time job recruiters for cross-border purchases, inducing you to participate in money laundering, leading to frozen bank cards. Fraud groups are often highly organized, spanning multiple countries, making recovery difficult. Remember, any call claiming to be official and requesting transfers is a scam. Verify information first and never transfer money lightly.

Status Tracking

After completing a remittance, regularly monitor the fund status. Most platforms and Hong Kong banks offer online status tracking services. You can track remittance progress in real-time via mobile apps, websites, or customer service hotlines. If you notice anomalies or delays, promptly contact the bank or platform’s customer service, providing remittance vouchers and relevant information. This ensures fund security and avoids unnecessary losses.

When choosing a remittance method, consider your needs, such as processing speed, fees, and remittance support. Each channel has unique advantages. Ensure information accuracy, prioritize fund security, and maintain compliance. If you have questions, consult Hong Kong banks, schools, or third-party platforms anytime.

Reminder: Rationally choose the most suitable remittance channel and plan each fund transfer carefully.

FAQ

1. What methods can you use to remit to overseas schools?

You can choose Hong Kong bank wire transfers, Alipay, WeChat, third-party platforms (e.g., Wise, Flywire), or credit cards. Each method varies in processing speed, fees, and amount limits.

2. What information is needed for remittances?

You need the recipient’s name, bank account number, SWIFT code, school address, and remittance purpose. Accurate information ensures smooth fund delivery.

3. What’s the difference between Hong Kong bank wire transfers and third-party platforms?

| Method | Processing Speed | Fees (USD) |

|---|---|---|

| Hong Kong Bank Wire Transfer | 1-3 business days | 30-50 |

| Third-Party Platforms | As fast as 40 minutes | 10-30 |

You can choose based on your needs.

4. How long does it take for remittances to arrive?

Most Hong Kong bank wire transfers take 1-3 business days. Alipay, WeChat, and Wise can arrive on the same day. Holidays may cause delays.

5. What to do if a remittance fails?

Contact the remitting bank or platform’s customer service first, providing remittance vouchers. The bank will help identify the issue and assist with fund returns if necessary.

After a deep dive into the various channels for international remittance for Chinese users, it’s clear that each method has its unique advantages and corresponding pain points. Traditional bank transfers are secure but come with high fees and slow speeds; third-party payment platforms are convenient but have limited quotas and non-transparent exchange rates; and digital banks are flexible but might involve complex cross-border account management. These challenges can all affect the efficiency and experience of your fund transfers. BiyaPay was created to solve these pain points, offering a safer and more efficient cross-border financial solution.

We have significantly simplified the traditional KYC process with one-stop digital identity verification, allowing you to remit with a fee as low as 0.5% and achieve same-day delivery, completely eliminating opaque exchange spreads and long waits. Moreover, our platform supports the conversion between various fiat and digital currencies, so you don’t need a complex overseas account to invest in both U.S. and Hong Kong stocks on one platform, easily diversifying your assets. Say goodbye to cumbersome processes and non-transparent fees, and register with BiyaPay today to start your smart remittance journey.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.