- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Popular Cross-Border Remittance Platforms for Chinese Users and Tips to Avoid Pitfalls

Image Source: unsplash

When choosing a cross-border remittance platform, you often come across PayPal, Wise, Western Union, WorldFirst, Airwallex, Payoneer, PingPong, Panda Remit, LianLian Global, HSBC China, and Alipay International Remittance. These platforms are favored by Chinese users for their low fees, fast transfer speeds, and high compliance. You can flexibly select the appropriate service based on your actual needs.

Key Points

- When selecting a cross-border remittance platform, you should consider fees, exchange rates, transfer speed, and safety compliance based on your needs and remittance amount.

- Platforms like Wise and LianLian Global offer transparent fees and exchange rates close to market rates, suitable for users seeking low costs and fast transfers.

- PayPal and Western Union have wide coverage, ideal for individual users and small remittances, but their fees and exchange rate costs are relatively high.

- Business users can prioritize WorldFirst, Airwallex, Payoneer, and PingPong to improve fund turnover efficiency and compliance assurance.

- Before using a cross-border remittance platform, it’s advisable to test with a small transfer, carefully check fees and exchange rates, avoid hidden costs and rate traps, and ensure fund safety.

Mainstream Cross-Border Remittance Platforms

Image Source: unsplash

PayPal

You can choose PayPal for global payments and receipts. PayPal is suitable for individual users, freelancers, and small businesses. You only need an email address to register an account. PayPal supports multi-currency transactions, commonly used for cross-border e-commerce and overseas service payments. When shopping or receiving payments, the platform automatically converts exchange rates, making it convenient and fast.

Wise

Wise offers you international remittance and receipt services. You can open a multi-currency account, enjoy mid-market exchange rates, and avoid hidden fees. Wise is suitable for individuals, freelancers, SMEs, and international business users. You can receive local transfers for free using local bank account numbers. Wise is often used for cross-border fund management and international payments.

- Wise’s main application scenarios:

- International remittances

- Cross-border receipts

- Multi-currency account management

Western Union

Western Union is a long-established cross-border remittance platform. You can send and receive remittances in over 200 countries and regions globally. Western Union is suitable for individual users needing cash withdrawals. You can complete remittances through offline branches or online operations, ideal for urgent remittances and family support.

WorldFirst

WorldFirst focuses on providing cross-border remittance services for Chinese micro-enterprises, international trade users, and online merchants. You can use WorldFirst for overseas trade settlements, supporting 71 global e-commerce platforms like Amazon and eBay. WorldFirst has helped over 50,000 Chinese clients conduct overseas business, primarily serving enterprises.

- Micro-enterprises

- International trade users

- Cross-border e-commerce merchants

Airwallex

Airwallex primarily serves SMEs and large enterprises. You can use Airwallex in industries like e-commerce, aviation, travel, internet, gaming, and live streaming. The platform enhances fund turnover efficiency through automated cross-border receipt processing, currency exchange, settlement, and remittances. Airwallex serves well-known enterprises like Tencent and JD.

- SMEs

- Large enterprises

- E-commerce and internet companies

Payoneer

Payoneer focuses on the cross-border B2B payment market. If you are a trading or cross-border e-commerce seller, you can use Payoneer to receive overseas payments and pay partners. Payoneer collaborates with platforms like Alibaba and JD, emphasizing compliance and multi-jurisdictional licenses to address inefficiencies in traditional B2B payments.

- Cross-border e-commerce sellers

- Trading enterprises

- B2B payment users

PingPong

PingPong mainly provides cross-border remittance services for mainland Chinese enterprises, Hong Kong enterprises, and individual businesses. If you are a B2B physical goods trading enterprise, you can use PingPong to receive overseas payments. PingPong strictly adheres to compliance requirements and does not support individual registrations or service trade.

- B2B physical goods trading enterprises

- Enterprises with Chinese resident legal representatives

Panda Remit

Panda Remit is suitable for individual users needing small, fast remittances. You can send money to multiple countries globally via mobile app or offline stores. Panda Remit supports various receipt methods, ideal for family remittances and tuition payments.

LianLian Global

LianLian Global serves cross-border e-commerce sellers, independent website merchants, B2B trading clients, and large enterprises. You can use LianLian Global to achieve full-chain fund flows, improving operational efficiency. The platform also offers auxiliary services like copywriting, image, and video processing for overseas merchants, helping you reduce costs and increase efficiency.

- Cross-border e-commerce sellers

- B2B trading clients

- Large enterprises

HSBC China

You can use HSBC China for international remittances and receipts. HSBC China is suitable for enterprises and high-net-worth individuals, supporting multi-currency accounts and global fund management. You can enjoy professional financial services and high fund safety assurance.

Alipay International Remittance

Alipay International Remittance is suitable for individual users and family remittances. You can send money directly to overseas bank accounts via the Alipay app. The platform supports multiple currencies, is easy to use, and has fast transfer speeds, ideal for daily life and tuition payments.

When choosing a cross-border remittance platform, you can flexibly select the most suitable platform based on your needs and target audience.

Platform Features and Use Cases

PayPal Advantages and Use Cases

When using PayPal, you can experience a globalized payment network. PayPal supports multi-currency transactions, suitable for individual users, freelancers, and small businesses. You only need an email to register an account, making it easy to use. PayPal’s strength lies in its wide coverage, supporting over 200 countries and regions. You can use it for cross-border shopping, receipts, and service payments.

PayPal’s drawback is relatively high fees, especially with exchange rate markups during currency conversion. Transfer speeds are generally instant, but withdrawals to Chinese bank cards may take 1-3 business days. PayPal is suitable for cross-border e-commerce, overseas service procurement, and small-scale payment/receipt scenarios.

Wise Advantages and Use Cases

Wise provides you with a low-cost, highly transparent cross-border remittance experience. You can enjoy real market exchange rates, with the platform charging only a transparent fee without hidden markups.

| Item | Wise Performance | Traditional Bank Performance |

|---|---|---|

| Fees | Uses real market exchange rates, charges only a transparent fee, no hidden markups or various wire transfer fees | Exchange rates include hidden markups, with multiple wire transfer-related fees |

| Transfer Speed | Some popular currencies arrive instantly, most transfers complete within 24 hours | Typically takes 1-5 business days, affected by multiple banks’ processing times |

You can use Wise’s local transfer network to ensure funds arrive in full. You can also track transfer progress anytime via the website or app. Wise is suitable for international remittances, cross-border receipts, and multi-currency account management, especially for users with high demands for low fees and fast transfers.

Western Union Advantages and Use Cases

Western Union is a highly compliant cross-border remittance platform. You can send and receive remittances in over 200 countries and regions, supporting over 130 currencies.

- Western Union has over 40 years of secure and reliable remittance experience, serving over 100 million customers.

- It is authorized by financial regulators in the US, Canada, Australia, Austria, the UK, Hong Kong, and other regions.

- You can choose bank accounts, mobile wallets, or cash receipt methods.

- In China, Western Union collaborates with multiple banks, supporting direct RMB remittances with fast transfer speeds and fees and exchange rates often better than traditional bank wires.

Western Union is suitable for urgent remittances, family support, and cash receipt scenarios. You can flexibly choose receipt methods globally to meet diverse needs.

WorldFirst Advantages and Use Cases

When choosing WorldFirst, you can experience extremely fast transfer speeds. Payments can arrive in as little as 1 minute, significantly improving fund turnover efficiency. WorldFirst also provides value-added services like forex risk management, helping businesses grow steadily.

WorldFirst is suitable for Chinese micro-enterprises, international trade users, and cross-border e-commerce merchants. You can use it for overseas trade settlements, supporting global e-commerce platforms like Amazon and eBay. WorldFirst’s advantages include fast transfers and professional services, ideal for business users with high demands for fund turnover efficiency.

Airwallex Advantages and Use Cases

Airwallex provides you with a one-stop global business account, supporting multi-currency management. You can have local bank codes and dedicated account numbers, facilitating receipt of overseas payments and reducing large transfer fees.

- You can make payments in 155 countries and regions, with local payments/receipts in over 80 countries.

- You can automate global receipt account creation, authorize deductions, generate statements, and perform cross-border payments, exchanges, and card issuances via API.

- You can use cross-border payments anytime in transactional internet platforms and other scenarios, automating fund flows and simplifying reconciliation.

- You can achieve 0-1 day local arrivals, significantly shortening transfer times.

- It is mainly suitable for SMEs expanding overseas, helping you address overseas financial service challenges, reduce cross-border trade costs, and improve operational efficiency.

Airwallex is suitable for global fund management and automated financial operations in e-commerce, internet, gaming, and live streaming industries.

Payoneer Advantages and Use Cases

Payoneer supports over 120 currencies, allowing overseas platforms and clients you work with to pay directly into your Payoneer account. You can benefit from global smart routing, ensuring payment success rates and timely receipt services.

Payoneer has 19 years of payment industry experience in security, compliance, and risk control, holding 58 compliance licenses and partnering with over 40 top global banks and financial institutions. You can enjoy high-level risk control assurance, ensuring fund safety. Payoneer also provides local dispute resolution teams to ensure secure and compliant transactions.

Payoneer is suitable for cross-border e-commerce sellers, trading enterprises, and B2B payment users. You can use it to receive overseas payments, pay suppliers, and support global business expansion.

PingPong Advantages and Use Cases

PingPong has a robust global payment network, supporting direct settlements in multiple major currencies, helping you reduce exchange rate conversion costs.

- You can collaborate with major global banks and payment institutions through PingPong, ensuring funds arrive quickly and securely, significantly shortening receipt cycles.

- PingPong uses big data and AI technologies to provide intelligent risk management, ensuring transaction safety.

- You can make payments in over 200 countries and regions, meeting local currency payment/receipt needs in over 40 countries, further reducing cross-border operational costs and improving transfer speed and fund efficiency.

PingPong is suitable for B2B physical goods trading enterprises and companies with Chinese resident legal representatives, especially for users with high demands for fund efficiency and safety.

Panda Remit Advantages and Use Cases

Panda Remit has a good reputation among students and overseas Chinese. You can enjoy a secure, fast, and convenient cross-border remittance experience, with transfers as fast as 2 minutes, comparable to domestic transfer speeds in China.

- Its main users are students and overseas workers; you can frequently make cross-border remittances, focusing on low fees and fast transfers.

- Panda Remit supports tuition payments and overseas living expenses, covering 28 countries globally.

- You can enjoy fee-free first transfers, greatly simplifying the fund transfer process.

- It supports multi-currency remittances, and you can complete payments via bank accounts or third-party platforms (like Alipay or WeChat).

- Exchange rates are updated in real-time, allowing you to choose the optimal timing for settlements.

Panda Remit is suitable for use in scenarios like studying abroad, overseas living, and family support, making it a benchmark platform for individual cross-border remittances.

LianLian Global Advantages and Use Cases

LianLian Global excels in compliance, holding over 60 global payment licenses, one of the few payment companies licensed in both China and overseas. You can benefit from its proprietary anti-money laundering and anti-fraud systems, ensuring every payment’s safety.

LianLian Global supports global payments/receipts in over 130 currencies, covering more than 100 countries and regions. You can obtain accounts in major currencies like USD, EUR, GBP, and local receipt accounts in the US, UK, Europe, Indonesia, and more, reducing intermediary bank fees.

You can open accounts with zero thresholds, completing in as fast as 1 business day, with withdrawal fees as low as 0.4%. LianLian Global is suitable for cross-border e-commerce sellers, B2B trading clients, and large enterprises, helping you improve cross-border payment/receipt efficiency and reduce operational costs.

HSBC China Advantages and Use Cases

You can use HSBC China for international remittances and receipts, enjoying multi-currency accounts and global fund management services. HSBC China is suitable for enterprises and high-net-worth individuals, offering professional financial services and high fund safety assurance. You can flexibly allocate funds globally to meet the needs of business internationalization. HSBC China is ideal for users with high demands for fund safety and professional services, particularly large enterprises and multinational companies.

Alipay International Remittance Advantages and Use Cases

You can enjoy transparent fees and a convenient process with Alipay International Remittance.

- For fees, Shanghai Bank charges $50 per transfer, collected by Alipay, with fixed and transparent costs.

- You can operate international remittances directly through the Alipay wallet, with a simple process requiring only recipient information, remittance amount, and purpose confirmation.

- It supports remittances in ten major currencies, including USD, EUR, HKD, CAD, and AUD.

- Transfers generally arrive in 1-5 business days, with relatively fast speeds.

- You can use Alipay for overseas QR code payments, convenient for spending abroad.

Alipay International Remittance is suitable for individual users and family remittances, especially for daily life, tuition payments, and small-scale cross-border fund transfers.

Cross-Border Remittance Platform Comparison

Image Source: unsplash

Fee Comparison

When choosing a cross-border remittance platform, fees are the most direct cost. Fee structures vary significantly across platforms. You can refer to the table below to understand the fee structures for mainstream remittance methods at different amounts:

| Remittance Method | Fee Structure and Description | Notes |

|---|---|---|

| MoneyGram | $15 for a $2,000 transfer; $10 for a $90 transfer | Tiered fees, lower than Western Union |

| Western Union | $25 for a $2,000 transfer; $15 for a $90 transfer | Mainly supports USD fast transfers, slightly higher fees than MoneyGram |

| Wire Transfer | 0.10% of the transfer amount, minimum $20-$50, maximum $200-$300; plus $80-$150 telegraph fee | Suitable for large transfers, with caps, but longer arrival times |

| Bank Draft | Lower fees than wire transfers, no telegraph fee, other fees same as wire transfers | Low fees butರ |

System: transfer, but long arrival times |

| LianLian Pay | 1% of transaction amount, minimum $2, maximum $50 | Holds multiple payment licenses, suitable for cross-border RMB settlements |

You can see that MoneyGram and Western Union are suitable for small, fast remittances with lower fees. Wire transfers and bank drafts are better for large fund transfers with capped fees but longer arrival times. LianLian Pay is suitable for cross-border RMB settlements with flexible fees.

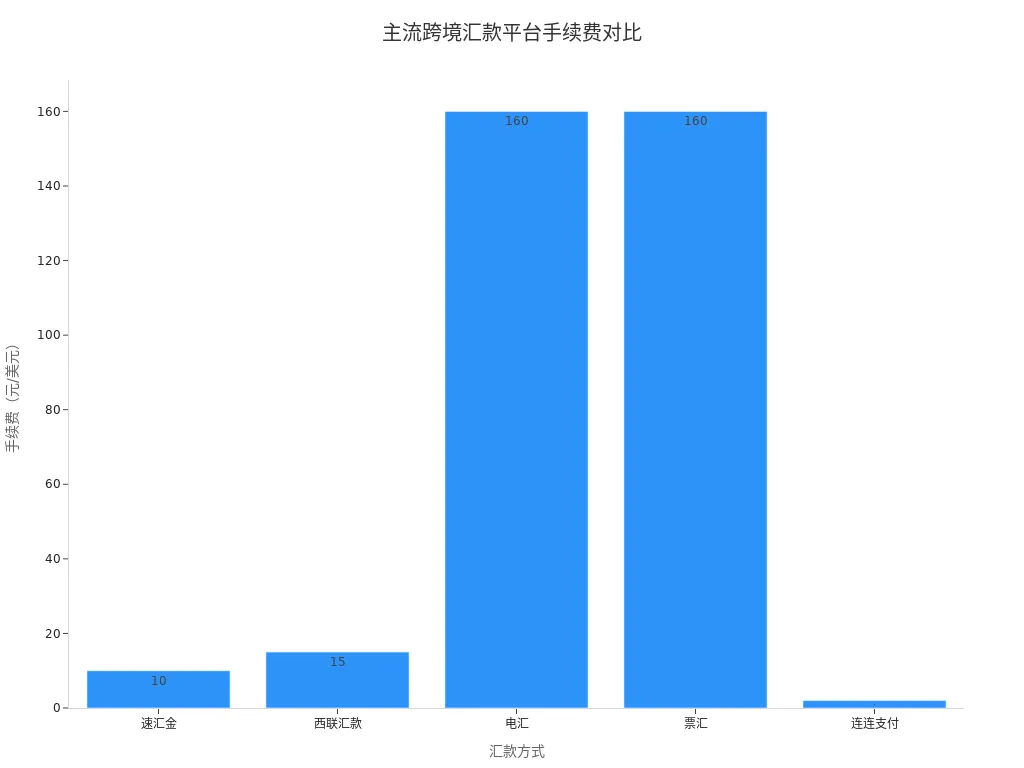

You can also view the bar chart below to compare fee differences for a $90 remittance:

Tip: Before remitting, you should carefully review the platform’s fee rules to avoid sudden fee increases due to tiered amounts.

Exchange Rate Comparison

When making cross-border remittances, exchange rates directly affect the received amount. Some platforms use real-time market rates, while others add a percentage fee to the rate. For example, Wise uses mid-market rates with no markups. PayPal and some traditional banks add a 1%-3% fee to the exchange rate. If you choose wire transfers or bank drafts, you often encounter bank rate markups.

You can understand it this way: for a $1,000 transfer, a 1% rate markup reduces the received amount by $10. When choosing a platform, you should prioritize those with transparent exchange rates, especially for large remittances.

Reminder: Before remitting, you can use the platform’s official exchange rate calculator to estimate the received amount to avoid excessive losses due to rates.

Transfer Speed Comparison

Transfer speed is a key consideration when choosing a cross-border remittance platform. If you choose MoneyGram or Western Union, transfers typically arrive within 10-15 minutes, ideal for urgent needs. Wire transfers and bank drafts take longer, usually 1-5 business days. According to Currencies Direct’s official statement, withdrawals generally take 0-2 business days, while SWIFT channels require 2-3 business days.

If you have high demands for transfer speed, you can prioritize MoneyGram, Western Union, or Wise. If you’re not in a rush, wire transfers or bank drafts can save on fees.

Suggestion: Transfer speeds may be delayed during holidays or non-working hours, so plan ahead.

Safety and Compliance

When making cross-border remittances, safety and compliance must be prioritized. Mainstream platforms typically have the following safety measures:

- Holding multiple international payment licenses to ensure legal operations.

- Establishing robust Know Your Customer (KYC) procedures to verify user identities.

- Implementing Anti-Money Laundering (AML) and Counter-Terrorism Financing (CFT) measures to monitor and report suspicious transactions.

- Complying with data protection regulations like EU GDPR and China PIPL, ensuring encrypted storage and secure data transmission.

- Setting up dedicated compliance management teams and data protection departments, conducting regular compliance audits and staff training.

- Adhering to consumer protection regulations, ensuring transparent transactions, fund safety, and effective complaint and dispute resolution mechanisms.

- Fulfilling tax compliance obligations, accurately reporting tax information to avoid legal risks.

You can refer to the table below to understand the compliance measures of mainstream platforms:

| Compliance Element | Specific Measures and Certifications | Platform Examples |

|---|---|---|

| Payment Licenses | Holding multiple international payment licenses and cross-border settlement permits | Many platforms hold licenses from the People’s Bank of China, Hong Kong Monetary Authority, and other regulators |

| Risk Control Systems | AI and big data risk control systems, real-time transaction monitoring, identity verification, and anomaly handling | Many platforms have proprietary risk control systems to identify high-risk activities automatically |

| Data Security and Privacy | Compliance with GDPR, ISO27001, and other international standards, encrypted data storage and transmission | Many platforms are certified internationally and have dedicated data protection departments |

| Compliance Management Team | Regular monitoring of regulatory changes, compliance reviews, and staff training | Many platforms have compliance specialist teams to assist with compliant operations |

| Compliance Reporting | Automated reporting of forex, tax, and AML compliance information | Many platforms support automated compliance reporting, reducing manual review risks |

| Consumer Protection | Transparent transactions, secure funds, robust complaint and dispute resolution mechanisms | Many platforms provide compliant cross-border payment services |

When choosing a platform, you must prioritize licensed, compliant platforms with robust risk control to ensure fund safety.

Usability Analysis

In actual operations, a platform’s usability directly impacts the remittance experience. Platforms like PayPal, Wise, and Alipay International Remittance support Chinese interfaces with simple processes, suitable for individuals and micro-enterprises. You only need to register an account and link a bank or credit card to complete remittances. Some platforms also support app operations, enabling fund management anytime, anywhere.

If you choose wire transfers or bank drafts, you typically need to fill out more information, making the process more cumbersome. MoneyGram and Western Union support both offline stores and online operations, suitable for users of different age groups. LianLian Global and Airwallex provide API interfaces and batch operation functions for business users, enhancing fund management efficiency.

Suggestion: When using a platform for the first time, you can start with a small test transfer to familiarize yourself with the process and avoid losses due to operational errors.

Tips to Avoid Pitfalls

Hidden Fees

When using cross-border remittance platforms, you often encounter hidden fees beyond handling charges. For example, some platforms add markups to exchange rates or charge additional recipient fees. You should carefully read the platform’s fee descriptions before remitting and use the official exchange rate calculator to estimate received amounts. You can also choose platforms with transparent fees to avoid reductions in received amounts due to hidden costs.

Exchange Rate Traps

Some platforms advertise low fees but offer exchange rates 1%-3% below market rates. If you focus only on fees, you may overlook exchange rate losses. You can compare real-time exchange rates across multiple platforms and prioritize those using mid-market rates. You can also lock in rates before remitting to reduce risks from exchange rate fluctuations.

Compliance Risks

When choosing a cross-border remittance platform, compliance is critical. Some platforms lack payment licenses in China or Hong Kong, risking fund freezes. You should prioritize platforms with multiple international payment licenses and robust risk control systems. You can also check if the platform has AML and anti-fraud measures to ensure fund safety.

Information Security

During remittances, you need to provide personal and recipient information. If a platform lacks encryption, information may be vulnerable to leaks. You can choose platforms with data encryption and privacy protection certifications. You should also regularly change passwords to prevent account theft. When encountering suspicious emails or texts, avoid clicking links to prevent information leaks.

Platform Selection Tips

When choosing a cross-border remittance platform, you can follow these tips:

- Diversify payment channels to avoid reliance on a single tool and spread risks.

- Choose platforms with integrated intelligent risk control systems to enhance anti-fraud capabilities.

- Optimize settlement cycles, set flexible terms, and collect partial payments in advance to reduce bad debt and exchange rate risks.

- Consider fees, exchange rates, transfer speed, and compliance based on your needs to select the most suitable platform.

In practice, you should start with a small test transfer to familiarize yourself with the process before making large remittances to effectively reduce risks.

When choosing a cross-border remittance platform, you should focus on fees, exchange rates, transfer speed, safety compliance, and supported currencies. You can flexibly select the right platform based on your remittance amount, transfer speed, and receipt method needs. You should also stay updated on policy changes and platform

FAQ

1. How do you determine if a cross-border money transfer platform is compliant and secure?

You can check if the platform holds payment licenses from regions such as Mainland China and Hong Kong. Additionally, you should pay attention to whether the platform has a sound risk control system and data encryption measures. Compliant platforms usually disclose such information publicly.

2. How do you avoid exchange rate losses when making cross-border money transfers?

You can choose a platform that uses the mid-market exchange rate, such as Wise. Before making a transfer, you can use the platform’s exchange rate calculator to lock in the exchange rate in advance and reduce losses.

3. Can you transfer money to a Hong Kong bank account using Alipay International Remittance?

Yes, you can transfer money to a Hong Kong bank account via Alipay International Remittance. Simply fill in the recipient’s information and bank account number, and the platform will automatically handle currency conversion and settlement.

4. What should you do if you encounter a delay in money transfer?

First, you can check the transfer progress on the platform. If the funds have not arrived within the promised time, you can contact the platform’s customer service. You should also keep the transfer receipt for easier follow-up inquiries.

5. How do you reduce fees for cross-border money transfers?

You can compare the fee standards of different platforms. Opt for platforms with transparent fees and no hidden charges. Furthermore, you can split the transfer into multiple batches and choose the optimal amount range to lower the total cost.

After a deep dive into the various channels for international remittance for Chinese users, it’s clear that each method has its unique advantages and corresponding pain points. Traditional bank transfers are secure but come with high fees and slow speeds; third-party payment platforms are convenient but have limited quotas and non-transparent exchange rates; and digital banks are flexible but might involve complex cross-border account management. These challenges can all affect the efficiency and experience of your fund transfers. BiyaPay was created to solve these pain points, offering a safer and more efficient cross-border financial solution.

We have significantly simplified the traditional KYC process with one-stop digital identity verification, allowing you to remit with a fee as low as 0.5% and achieve same-day delivery, completely eliminating opaque exchange spreads and long waits. Moreover, our platform supports the conversion between various fiat and digital currencies, so you don’t need a complex overseas account to invest in both U.S. and Hong Kong stocks on one platform, easily diversifying your assets. Say goodbye to cumbersome processes and non-transparent fees, and register with BiyaPay today to start your smart remittance journey.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.