- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

2025 Guide to Investing in Hong Kong Stocks with HSBC Bank

Image Source: pexels

If you want to invest in Hong Kong stocks through HSBC Bank, you can follow the following operation process:

- You need to open a securities account with HSBC Bank, choosing appropriate handling fees and a convenient trading platform.

- You can conduct stock selection analysis based on financial reports, industry information, and market news.

- You should pay attention to Hong Kong stock trading hours, select suitable order types, and monitor related taxes and fees.

- You can manage risks through diversified investments and setting stop-loss points.

Key Points

- Opening a Hong Kong stock account with HSBC Bank requires you to visit Hong Kong in person, prepare identification and proof of address, and meet the 18+ age requirement.

- Transferring funds to a Hong Kong account can be quickly completed via HSBC online banking or mobile app, supporting fee-free cross-border transfers.

- Choosing a suitable trading platform (mobile app or online wealth management) for Hong Kong stock trading is simple, with orders typically executed within minutes.

- Pay attention to account management fees and trading commissions; young investors can apply for the Trade25 plan to enjoy 25 commission-free trades per month.

- To ensure account security, enable two-factor authentication, regularly change passwords, and contact bank customer service promptly if anomalies are detected.

Account Opening Requirements and Documents

Eligibility Requirements

To invest in Hong Kong stocks through a Hong Kong bank, you first need to meet basic account opening eligibility requirements.

- You must be at least 18 years old to open a securities account independently.

- You need to use a valid identification document, such as a resident ID card. During account opening, the bank will verify your identity, and using someone else’s information is not allowed.

- If you are a minor, you can perform limited operations with a legal guardian present but cannot open an account independently.

- You also need a valid bank account for fund transfers and regulatory purposes.

- If you are not a Chinese citizen, you must comply with relevant legal regulations during account opening, which may vary by region.

Tip: If you are aged 18-35, you can apply for the Trade25 plan to enjoy lower trading commissions.

Required Documents

When preparing to open an account, you need to gather the following documents in advance:

- A valid Chinese resident ID card, Hong Kong/Macau pass, or passport.

- Proof of address, such as utility bills, credit card statements, or property deeds. If your work and residence address match your ID address, additional proof may not be required.

- You need to visit Hong Kong in person to complete account opening procedures. Per regulations, you must physically travel to open an overseas account.

- Fill out the bank application form, ensuring all information is accurate and complete, as the bank will conduct a review.

It’s recommended to prepare all documents in advance to save time during the process.

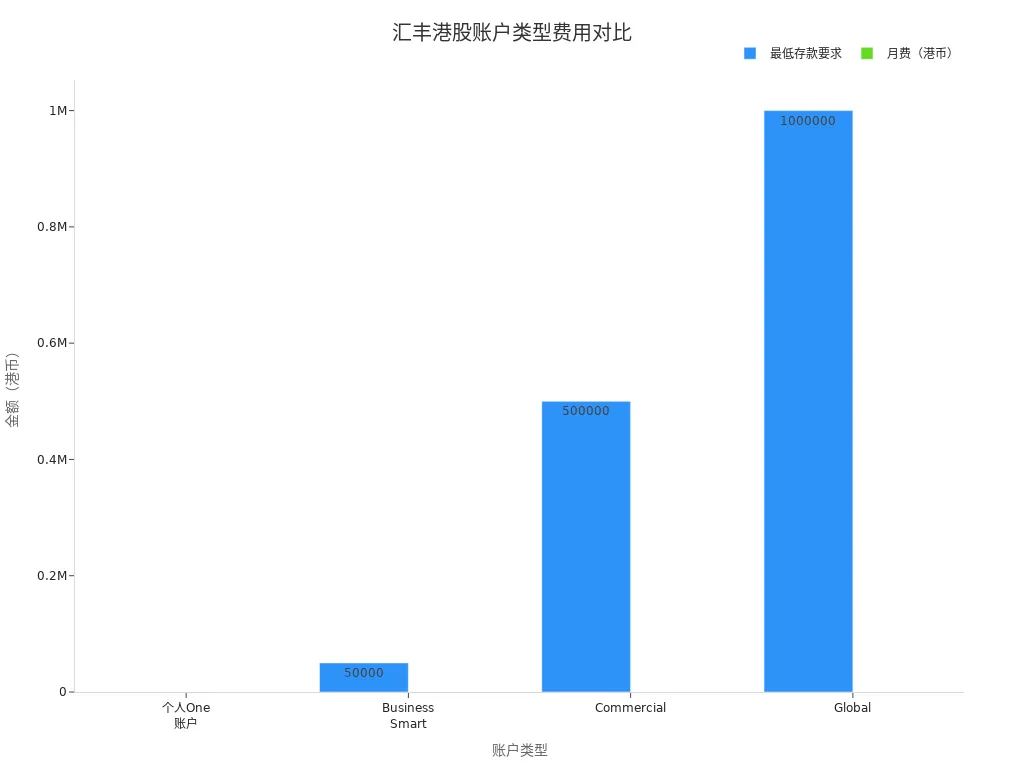

Account Types

Hong Kong banks offer various Hong Kong stock investment accounts tailored to different investor needs. You can choose the appropriate account type based on your situation:

| Account Type | Key Features and Target Users | Minimum Deposit Requirement (USD) | Monthly Fee Status |

|---|---|---|---|

| Personal One Account | Suitable for general individual investors, supports multi-currency, young clients can opt for low-threshold accounts | No minimum balance fee (requires monthly deposits) | First 6 months free, then ~8 USD/month if below ~6,400 USD |

| Business Smart | Suitable for startups or businesses with annual revenue below 640,000 USD | ~6,400 USD | ~15 USD/month |

| Commercial | Suitable for medium-sized enterprises | ~64,000 USD | Waived |

| Global | Suitable for multinational businesses | ~128,000 USD | Waived |

- Personal accounts, mainly the “HSBC One Account,” are suitable for most individual investors, with low-threshold accounts available for clients aged 18-24.

- Business accounts include “Business Smart,” “Commercial,” and “Global,” catering to businesses of different scales.

- All accounts support multi-currency operations, facilitating cross-border Hong Kong stock investments.

Hong Kong Stock Investment Account Opening Process

Image Source: pexels

Online Account Opening

You can open an HSBC Hong Kong stock investment account online. You can submit an application through the “HSBC InvestExpress” app or online wealth management platform by uploading identification and proof of address. After submitting, the bank will conduct a review. Due to high application volumes, the review process may require waiting. Once approved, the bank will send a physical bank card and password letter via regular mail within one month. You should store these securely upon receipt. After opening an account online, you cannot opt for in-person processing.

Tip: After opening an account online, you must visit Hong Kong in person within 90 days to activate the account. During activation, you need to upload entry/exit records, typically taking 30 minutes to 1 hour to complete.

Branch Account Opening

You can also visit an HSBC Bank branch counter in Hong Kong to open an account. You need to bring identification and proof of address. The in-person process is straightforward, typically taking 30 to 40 minutes. You can receive a physical bank card on the spot. During in-person account opening, you can discuss your account opening purpose with the account manager, such as investing in Hong Kong stocks. You can also set a password on-site to avoid forgetting it.

Review and Activation

Whether you choose online or in-person account opening, you need to complete account activation. After receiving the physical card and password letter, you can activate the account via phone or online banking. During activation, ensure you securely store your account number and password to avoid leaks. If you enter the wrong password multiple times, the account will be locked, requiring an in-person reset. Once activated, you can log in to your account anytime to start Hong Kong stock investment operations.

Investment Operation Process

Image Source: pexels

Fund Transfers

When preparing to invest in Hong Kong stocks, you first need to transfer funds from a Chinese RMB account to a Hong Kong HKD account. HSBC Bank offers multiple convenient fund transfer methods:

- You can use HSBC’s personal online banking or mobile banking global transfer service to transfer RMB funds from a China HSBC account to a Hong Kong HSBC HKD account. As long as the account names match, cross-border foreign currency transfers are convenient.

- When using electronic channels for RMB remittances, you can enjoy fee-free benefits. Fund transfers between Hong Kong and China are also fee-free, with transfers typically arriving within minutes.

- You can use the HSBC mobile banking app or online banking for account upgrades and transfer operations. The entire process is simple and fast.

- After funds arrive, you can transfer HKD to a brokerage account via the Faster Payment System (FPS) or Electronic Direct Debit Authorization (EDDA) to prepare for Hong Kong stock investments.

- HSBC One and HSBC Premier accounts both support HKD accounts and Hong Kong stock investments. You need to visit Hong Kong in person to open an account, bringing identification, entry/exit proof, and a KYC questionnaire.

Tip: HSBC supports high-value FPS transfers with flexible fund turnover and favorable exchange rates for international foreign exchange services, keeping costs low. You can calculate fund exchange costs based on real-time exchange rates (e.g., 1 USD ≈ 7.8 HKD).

Trading Platform Selection

When choosing a trading platform, you can select based on your operating habits and needs from the following channels:

- HSBC Mobile Wealth Management App: You can trade Hong Kong stocks, transfer funds, and manage accounts anytime, anywhere via your phone. The app has a simple interface and is user-friendly, ideal for frequent travelers or those needing mobile operations.

- HSBC Online Wealth Management: You can log into online banking from a computer to trade Hong Kong stocks, view market data, and manage funds. The online platform offers comprehensive features, suitable for investors needing detailed analysis and management.

- Telephone Wealth Management Service: You can place orders via phone, suitable for situations where internet access is unavailable or when you need human assistance.

It’s recommended to prioritize the “HSBC InvestExpress” app, which supports real-time quotes, fast order placement, and various order types, significantly enhancing your trading efficiency.

Hong Kong Stock Trading Process

After transferring funds, you can follow these steps to trade Hong Kong stocks:

- In a brokerage app (e.g., Vantage or Interactive Brokers), apply for EDDA authorization, fill in bank account and identification details, and wait for approval. Once authorized, you can directly input the deposit amount, and funds will be debited from your HSBC account in real-time, arriving quickly with no fees (transactions below 100 USD incur ~1.3 USD fee).

- You can also use FPS transfers. After obtaining HSBC’s FPS recipient information in the brokerage app, log into the HSBC app, go to the “Transfer and Pay” section’s “FPS” page, and enter the brokerage’s recipient account and amount. It’s recommended to add a unique suffix to the amount to speed up processing. Save a screenshot of the transfer receipt and upload it to the brokerage app to notify receipt.

- If you prefer online banking, you can transfer via the web. After obtaining recipient information from the brokerage app, log into HSBC online banking, select “Banking Services” – “Transfer,” and input the recipient details to complete the transfer. After a successful transfer, save the receipt screenshot and upload it to the brokerage app.

- Once funds arrive, you can select Hong Kong stocks in the app or online wealth management platform, input buy or sell quantities and prices, and submit the order. Most orders are executed within 5 minutes, though transactions exceeding 1,280,000 USD may take up to 2 hours to settle.

Note: Different brokerages may have slightly different interfaces, but the overall process is similar. You can choose the most suitable method based on your needs.

Order Tracking and Fund Management

After completing Hong Kong stock trades, you need to promptly track order status and manage funds. HSBC Bank provides multiple convenient tools for tracking and management:

- You can view order execution details, position information, and fund balances in real-time via the HSBC Mobile Wealth Management App or online platform.

- You can set fund alerts to stay informed of account changes and avoid fund losses or anomalies.

- You can perform fund transfers, foreign currency exchanges, and account management via the app or online banking, flexibly arranging investment plans.

- You can download transaction statements for investment analysis and tax reporting.

It’s recommended to regularly check account security settings and enable two-factor authentication to protect funds.

Fees and Promotions

Account Management Fees

When opening an investment account with HSBC Hong Kong, you need to pay attention to account management fees. Generally, if your account assets fall below the minimum threshold (typically ~128,000 USD, at 1 USD ≈ 7.8 HKD), the bank will charge a monthly management fee. The standard service fee is approximately 38 USD per month. If you maintain assets above the threshold, the bank waives the fee. You can also enjoy a 12-month fee waiver by opening a new HSBC Premier account and completing Greater Bay Area Wealth Connect service pairing within 30 days. The specific fee standards and waiver policies are as follows:

| Fee Item | Fee Standard and Conditions | Waiver Policy Details |

|---|---|---|

| Account Management Fee | 38 USD/month if assets below 128,000 USD | Waived if assets meet threshold or through promotional plans |

| Service Monthly Fee | ~38 USD/month if conditions not met | Waived for 12 months if conditions met |

| Dynamic Fee Adjustments | Adjusted based on assets and service usage | Consult wealth advisors for personalized policies |

Tip: You can consult your dedicated wealth advisor to learn about the latest fee policies and promotions.

Trading Commissions

When trading Hong Kong stocks, you need to pay trading commissions. HSBC Bank uses a tiered commission structure, with rates varying based on transaction size and account type, typically at 0.25%, 0.18%, or 0.08%. For example, larger transaction amounts incur lower commission rates. You can check specific commission rates before trading via the app or online platform. Commissions are automatically deducted upon trade execution, requiring no manual action.

Trade25 Plan

If you are aged 18 to 35, you can apply for the Trade25 plan. Under this plan, you enjoy $0 commission on the first 25 Hong Kong stock trades each month. Beyond 25 trades, standard commissions apply. You simply select the Trade25 plan option during account opening, and the system will automatically verify your age and eligibility. This plan is ideal for young investors, significantly reducing trading costs.

Note: The Trade25 plan is only available for personal accounts, not business accounts.

Other Fees

During the investment process, you also need to consider exchange rates and other fund conversion fees. When transferring funds from China to a Hong Kong account, the bank converts funds based on real-time exchange rates. Generally, HSBC offers competitive exchange rates, keeping conversion costs low. For FPS or EDDA transfers, transactions below 100 USD may incur a ~1.3 USD fee, while those above are free. Additional services, such as paper statements or telephone support, may also incur extra charges. You can check detailed fee descriptions on the bank’s website or app.

It’s recommended to review related fees before each fund operation to plan investment costs effectively.

Common Issues

Account Opening Queries

When opening a Hong Kong stock account with HSBC Bank, you may encounter some common issues. Below are the most frequent account opening queries to help you complete the process smoothly:

- How should you state your account opening purpose? It’s recommended to avoid directly mentioning “investing in Hong Kong stocks” and instead use terms like “asset allocation” or “wealth management needs” to increase approval chances.

- Can someone else open an account on your behalf? Bank regulations require you to open the account in person; any proxy attempts will be rejected.

- What documents do you need? You must provide identification and proof of address, ensuring all documents are valid and authentic.

- How do you explain fund usage and income? You should provide truthful information and prepare supporting documents to gain the bank’s trust.

- What should you note during fund transfers? Avoid mentioning “frequent large transfers” to prevent triggering bank risk controls.

Reminder: Prepare all documents in advance to avoid delays due to incomplete materials.

Trading Issues

When trading Hong Kong stocks, you may encounter the following issues:

- If your account information is missing or expired, the bank may restrict your trading functions. You need to promptly update identification and contact details.

- If you encounter trading anomalies or system failures, you can contact customer service via the app or phone, and the bank will assist in resolving them.

- Conducting multiple small test transactions in a short period or sudden large fund movements may trigger the bank’s risk control system, potentially leading to temporary account freezes.

- If you exceed foreign exchange limits, the bank will require additional supporting documents. You can consult a wealth advisor in advance to plan fund flows.

- If there are compliance or international sanction risks, the bank may suspend related account functions.

It’s recommended to regularly check account information, comply with trading rules, and proactively communicate with the bank if issues arise.

Fund Security

When investing in Hong Kong stocks with HSBC Bank, fund security is critical. You can protect your account with the following measures:

- Enable two-factor authentication in the app to prevent unauthorized access.

- Regularly change your login password and securely store your physical bank card and password letter.

- If you detect unusual transactions, immediately contact bank customer service to freeze the account.

- Set fund movement alerts to stay informed of account activities in real-time.

- For complex issues, seek assistance from professional financial advisors or lawyers.

| Security Measure | Purpose |

|---|---|

| Two-Factor Authentication | Enhances login security |

| Fund Movement Alerts | Tracks account fund changes in real-time |

| Customer Service Assistance | Promptly addresses account anomalies |

| Professional Advisor Consultation | Resolves complex compliance or legal issues |

As long as you comply with bank regulations and cooperate with information verification, your account funds are generally well-protected.

Notes and Recommendations

Account Security

When managing your Hong Kong bank account, you must prioritize account security. You can enable two-factor authentication in the app to enhance login security. You should regularly change your password and securely store your physical bank card and password letter. When transferring funds or investing, never disclose account information to third parties. You can also book account opening through the HSBC Bank website to prevent information leaks. If you detect account anomalies, immediately contact bank customer service to freeze the account. You should set fund movement alerts to stay informed of account activities instantly. Staying vigilant can effectively mitigate fund risks.

Risk Warning

Before investing, you need to understand your risk tolerance. HSBC Bank requires you to complete a risk assessment questionnaire, guiding you to choose suitable products based on your financial situation, investment experience, and goals. You can refer to the table below to understand fund risk levels corresponding to different risk tolerances:

| Investment Risk Tolerance | Corresponding Fund Risk Level |

|---|---|

| Cautious | Level 1 Risk |

| Conservative | Level 1-2 Risk |

| Balanced | Level 1-3 Risk |

| Growth | Level 1-4 Risk |

| Aggressive | Level 1-5 Risk |

You should carefully read fund contracts and disclosures to understand that investments carry risks. Past performance does not guarantee future results. You also need to monitor risks like exchange rate fluctuations. The bank does not bear responsibility for investment losses, so you must make cautious decisions based on your situation.

Trading Hours

When trading Hong Kong stocks, you need to note the market’s open hours. The Hong Kong stock market is open from 09:30 to 12:00 in the morning and 13:00 to 16:00 in the afternoon. Hong Kong stock market holidays differ from Chinese A-shares. You’ll notice that during holidays like Labor Day, National Day, and Chinese New Year, Hong Kong’s market closure periods are typically shorter than China’s. Holidays like Christmas, Buddha’s Birthday, Chung Yeung Festival, and Mid-Autumn Festival also result in closures. You can check the annual holiday schedule on the HKEX website (www.hkex.com.hk). Planning trading times accordingly helps you better seize market opportunities.

Customer Support

During account opening and investing, you may encounter various issues. HSBC Bank offers multiple customer and technical support channels:

- You can book account opening through the HSBC Bank website to ensure information security.

- You can contact an account manager for assistance with account opening, identity verification, and fund witnessing.

- Some third-party service companies offer support with document preparation, booking guidance, and online verification to improve account opening efficiency.

You should note that the bank will not proactively request sensitive information. When in doubt, prioritize assistance through the official website or account managers to ensure account security and smooth operations.

You now understand the main process for investing in Hong Kong stocks with HSBC Bank. You need to prepare account opening documents, complete account activation, and focus on account security. You should plan investments rationally, monitor management fees, and take advantage of promotional policies. You can stay updated on the latest Hong Kong stock investment services by joining Hong Kong card discussion groups, following relevant WeChat accounts, and visiting HSBC Bank’s dedicated pages. Continuously learning and staying informed will help you better seize investment opportunities.

FAQ

Is in-person presence required for account opening?

You must visit an HSBC Bank branch in Hong Kong to open an account. The bank will verify your identification and proof of address. You cannot delegate someone else to open the account.

Are there limits on fund transfers to Hong Kong accounts?

You can transfer up to 50,000 USD annually (~390,000 HKD at 1 USD ≈ 7.8 HKD) through personal foreign exchange quotas. You need to plan fund flows carefully.

Are Hong Kong stock trading hours the same as Chinese A-shares?

The Hong Kong stock market is open from 09:30-12:00 and 13:00-16:00. Holiday schedules differ from A-shares. You can check the HKEX website in advance.

How is account security ensured?

You can enable two-factor authentication in the app. You should regularly change passwords. If unusual transactions are detected, contact HSBC customer service promptly to secure funds.

How to apply for the Trade25 plan?

If you are aged 18-35, select the Trade25 plan during account opening. The system will automatically verify eligibility. You can enjoy $0 commission on the first 25 Hong Kong stock trades monthly.

After a deep dive into the process for Chinese users to invest in Hong Kong stocks through HSBC, it’s clear that while the process is straightforward, there are still many pain points you need to handle yourself. For example, opening an account requires an in-person visit to Hong Kong, which is a significant challenge in terms of time and effort for many users. Moreover, fund transfers, transaction fees, compliance checks, and complex account management can all affect your investment efficiency and experience. BiyaPay was created to solve these pain points, offering a more comprehensive and efficient cross-border financial solution.

We have significantly simplified the traditional KYC process with one-stop digital identity verification, allowing you to remit with a fee as low as 0.5% and achieve same-day delivery, completely eliminating opaque exchange spreads and long waits. Moreover, our platform supports the conversion between various fiat and digital currencies, so you don’t need a complex overseas account to invest in both U.S. and Hong Kong stocks on one platform, easily diversifying your assets. Say goodbye to cumbersome processes and opaque fees, and register with BiyaPay today to start your smart investment journey.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.