- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Which is Better: Futu Securities or Yellowfin Securities? A Comprehensive Comparison for Beginner Hong Kong Stock Platforms

Image Source: unsplash

If you prioritize operational convenience and rich online features, Futu Securities is more suitable for you. It leverages social platforms like WeChat and QQ to attract a large number of young users, with a user-friendly interface ideal for beginners. Yellowfin Securities, with 587,072 clients and client assets reaching approximately $7.76 billion (calculated at 1 USD ≈ 7.8 HKD), focuses more on traditional services and a stable experience. If you prefer the services and security of a traditional broker, Yellowfin Securities is a good choice.

Key Points

- Futu Securities offers a simple and fast account opening process, supporting full mobile operations, ideal for beginners seeking efficiency and convenience.

- Yellowfin Securities has higher trading fees but is suitable for large transactions, offering traditional offline services, ideal for users valuing stability and face-to-face support.

- Futu Securities has a modern, user-friendly interface with rich features, providing smart tools and an active community to help beginners learn and invest quickly.

- Yellowfin Securities offers a stable and professional interface, suitable for experienced investors, supporting multi-window market data and technical analysis tools.

- When choosing a Hong Kong stock broker, you should focus on account opening convenience, trading costs, interface experience, and customer service to make rational choices that enhance investment efficiency.

Comparison Dimensions

When selecting a Hong Kong stock broker, you often consider multiple aspects. Whether the account opening process is convenient directly affects how quickly you can enter the market. Trading fees, including commissions, transfer fees, and margin financing rates, impact your investment costs. If you want to reduce costs, you should focus on comparing each platform’s fee structure. Interface experience is also crucial. A clear and easy-to-use interface helps you get started faster and reduces errors. For beginners, interface friendliness directly determines your learning curve.

You also need to consider the information and educational resources provided by the platform. Rich market insights and investment courses can help you understand changes in the Hong Kong stock market and enhance your investment skills. Customer service is another critical dimension. Timely and effective support makes you feel more secure during trading. The platform’s unique features, such as smart trading tools, automated conditional orders, and advisory services, also affect your overall experience. If you value efficient operations, these features will make your investments smoother.

The table below summarizes the key dimensions and their main considerations for beginner investors choosing a Hong Kong stock broker:

| Dimension | Main Considerations and Description |

|---|---|

| Trading Fees | Commissions, transfer fees, margin financing rates, etc. |

| Account Opening Process | Convenience, required documents, review speed |

| Interface Experience | Ease of operation, interface friendliness |

| Information and Education | Market insights, investment courses, market data |

| Customer Service | Response speed, service channels, professionalism |

| Unique Features | Smart trading tools, automated conditional orders, advisory services |

You can prioritize the dimensions most important to you based on your investment habits and needs. For example, if you value low costs, focus on comparing trading fees. If you prioritize operational experience and educational resources, choose a platform with a user-friendly interface and rich information. This way, you can efficiently find the Hong Kong stock broker that suits you best.

Account Opening Process

Image Source: pexels

Futu Securities Account Opening

If you choose to open an account with Futu Securities, you can experience a highly efficient process. You only need to download the Futu NiuNiu app and follow the instructions. The entire account opening process involves the following steps:

- You fill in personal information in the app, choosing to open a Hong Kong stock or A-share Connect account, which takes approximately 3 to 5 minutes.

- You need to read and submit trading risk disclosure documents, then proceed to the review stage, typically waiting 5 to 10 minutes.

- Once approved, the account is activated within 1 minute, with the entire process completed online without mailing physical documents.

Futu Securities’ account opening process is ideal for beginners seeking efficiency. You can complete all steps on your phone anytime, anywhere. The review process is fast, typically delivering results within 10 minutes. You don’t need to visit a physical branch or prepare complex documents. This allows you to enter the Hong Kong stock market quickly and seize investment opportunities.

Yellowfin Securities Account Opening

If you choose to open an account with Yellowfin Securities, the process is relatively traditional. You can apply online via their website or visit a physical branch in Hong Kong. For online applications, you need to upload identity and address proof documents. The review process generally takes 1 to 2 business days. If you opt for in-branch processing, staff will assist you in filling out forms and completing identity verification. The process is slightly slower than Futu Securities but suits investors who prefer face-to-face services. If you have questions during the process, you can consult staff directly for detailed guidance.

Trading Fees

Image Source: unsplash

Futu Securities Fees

When choosing a Hong Kong stock broker, trading fees are a key factor affecting your investment returns. Futu Securities adopts a transparent fee structure. You pay a 0.03% commission for each Hong Kong stock trade, plus a fixed $2 fee per trade (approximately 15 HKD, based on 1 USD = 7.8 HKD). New users can also enjoy exclusive promotions: within 180 days of registration, you can experience commission-free Hong Kong stock trading, significantly lowering the initial investment barrier and making it easier for you to get started.

| Broker | Trading Commission Rate | Platform Fees |

|---|---|---|

| Futu Securities | 0.03% | $2 per trade |

| Yellowfin Securities | 0.067% | N/A |

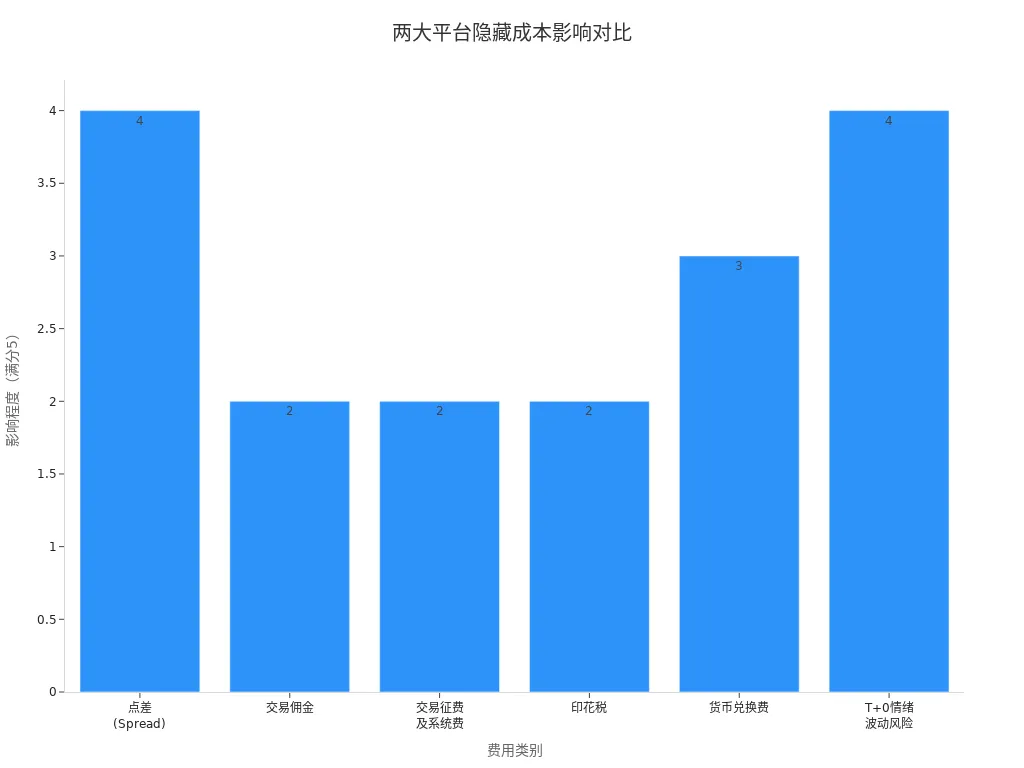

When trading, you also need to consider hidden costs. For example, the bid-ask spread can cause immediate losses upon buying, especially for less liquid stocks. The Hong Kong stock market also charges transaction levies, stamp duties, and currency conversion fees. The table below summarizes these common hidden fees and their impact:

| Fee Category | Description | Impact Level (Max 5) |

|---|---|---|

| Spread | Difference between bid and ask prices, larger for less liquid stocks, leading to immediate losses | 4 |

| Trading Commission | Broker commission, typically up to 0.25% of transaction amount, with minimum charges | 2 |

| Transaction Levy & System Fees | Includes HKEX trading fees, SFC levies, and trading system fees; small per trade but significant cumulatively | 2 |

| Stamp Duty | 0.1% of transaction amount charged on sales | 2 |

| Currency Conversion Fee | Exchange rate differences and fees for RMB to HKD conversion | 3 |

| T+0 Volatility Risk | Hong Kong stocks use T+0 trading, with short-term speculation causing sharp price swings | 4 |

Tip: When calculating investment costs, besides commissions and platform fees, you should also consider spreads, stamp duties, and currency conversion fees to more accurately assess actual returns.

Yellowfin Securities Fees

Yellowfin Securities’ fee structure is relatively traditional. You pay a 0.067% commission for each Hong Kong stock trade, with a minimum charge of $19.2 (approximately 150 HKD). Additionally, you bear stamp duty (0.1% of transaction amount, minimum $0.13), transaction levy (0.0027%), trading fee (0.005%), and settlement fee (0.006%, minimum $0.64). Yellowfin Securities does not charge fixed platform fees, which is attractive for large-transaction users.

| Fee Type | Rate or Amount | Minimum Charge |

|---|---|---|

| Trading Commission | 0.15% of transaction amount | $19.2 |

| Stamp Duty | 0.1% of transaction amount | $0.13 |

| Transaction Levy | 0.0027% of transaction amount | N/A |

| Trading Fee | 0.005% of transaction amount | N/A |

| Settlement Fee | 0.006% of transaction amount | $0.64 |

If your transaction amounts are small, the minimum commission threshold makes per-trade costs higher. Yellowfin Securities was among the first to reduce commissions from 0.25% to 0.05% in 2003, a pioneer in lowering fees. Currently, some Hong Kong local brokers have minimum commissions as low as 0.1%, but actual fees depend on official announcements.

Reminder: When choosing a broker, consider your trading frequency and transaction size, factoring in commission rates, minimum charges, and platform fees to avoid hidden costs impacting returns.

Interface Experience

Futu Securities Interface

When using Futu Securities, you’ll find the interface design highly user-centric. The platform’s operations are clear, with well-organized buttons, helping you quickly locate needed functions. According to a Hong Kong SFC survey, the convenience and flexibility of trading programs are key criteria for user platform selection. Futu Securities excels here, with a clean and intuitive interface ideal for beginners to get started quickly. You can view account assets, market trends, and the latest news at a glance on the homepage, reducing operational errors.

Futu Securities emphasizes “safety, accuracy, stability, speed, and usability,” and you’ll feel fast interface responses and timely data updates in practice. The platform also uses big data analytics to offer personalized asset allocation suggestions, easing investment decisions. If you like customizing interfaces, Futu Securities meets your needs. You can freely arrange quote components in the “toolbox”, adjusting positions of charts, order books, and more. The platform supports custom window colors, letting you tailor the interface style. Trading layout templates use a new UI, with elements auto-scaling based on window size, making it easy to create a personalized workspace.

In Futu Securities’ investment ecosystem, you can interact with other investors and analysts, enhancing engagement. Data shows the platform’s client retention rate is as high as 98%, indicating high user satisfaction with the interface experience.

Yellowfin Securities Interface

When using Yellowfin Securities, you’ll notice the interface leans toward traditional brokerage styles. The platform has clear functional sections, suitable for users with some investment experience. You can quickly access trading, fund management, and information modules via the main menu. While the interface lacks flashy designs, it’s stable and reliable. When placing orders, the system displays detailed confirmation windows, helping you verify trade details and reduce errors.

Yellowfin Securities’ market data page supports multi-window displays, allowing you to monitor multiple stocks’ real-time trends simultaneously. The platform provides rich technical analysis tools to meet advanced investors’ needs. If you prefer using the desktop client, Yellowfin Securities’ PC interface is clear, with comprehensive data displays. The mobile app focuses on core functions, ideal for checking market data and placing orders on the go.

Tip: If you value interface personalization and interactive experiences, prioritize Futu Securities. If you seek a stable and professional operating environment, Yellowfin Securities is also a solid choice.

Information and Education

Futu Securities Information

When using Futu Securities, you can access rich market insights and educational resources. The platform pushes daily financial news and stock updates, keeping you informed of market changes in real time. You can set price alerts, and the system will notify you automatically when stock prices hit your target, ensuring you don’t miss key trading opportunities.

Futu NiuNiu offers various smart tools to boost your investment efficiency. You can use the smart stock selection feature to quickly filter stocks meeting your criteria. Big data algorithms analyze market trends, aiding more informed decisions. If you want to learn investment knowledge, the platform provides industry-focused investment courses and practical tutorials, covering Hong Kong stock basics, technical analysis, and quantitative strategies. You can choose courses based on your interests and needs to gradually improve your skills.

Futu Securities supports programmatic trading with official API interfaces. If you have programming skills, you can develop and backtest quantitative trading strategies for automated operations, highly beneficial for users keen on deepening investment knowledge.

In the Futu NiuNiu community, you can exchange experiences and share insights with other investors. The platform’s interface is clean and simple, ideal for beginners to get started quickly. You can access information, learning, and trading tools in one place, making your investment experience more efficient.

Yellowfin Securities Information

With Yellowfin Securities, you can also access real-time Hong Kong stock market data and news. The platform provides basic stock quotes, announcement information, and market updates. You can view the latest market dynamics and key company news via the PC or app. Yellowfin Securities periodically releases investment reports and analytical articles, helping you understand industry trends and company fundamentals.

If you need educational resources, you can find beginner guides and occasional webinars on Yellowfin Securities’ website. The platform sometimes hosts online or offline investment seminars, inviting analysts to discuss market trends. You can enhance your investment knowledge through these events. However, Yellowfin Securities’ educational resources are less diverse and updated less frequently than Futu Securities, better suited for investors with some experience.

Tip: If you value the richness of information and diversity of educational resources, Futu Securities is more suitable. If you need only basic market data and periodic reports, Yellowfin Securities meets your needs.

Customer Service

Futu Securities Customer Service

When using Futu Securities, you can experience diverse customer service options. The platform offers 24/7 online support. You can consult on account opening, trading, or funding issues via the app’s live chat feature anytime. You can also send emails, typically receiving replies within 1 hour. Futu Securities provides a detailed FAQ section, helping you quickly find solutions. For urgent issues, you can get human assistance via customer service phone lines. The platform supports Mandarin, Cantonese, and English, catering to users from different regions. When transferring funds, customer service guides you on USD transfers via Hong Kong banks, ensuring a smooth process. You can also interact with other investors in the community to share experiences and get more help.

Tip: For technical or account issues, use the app’s live chat for faster responses and higher resolution efficiency.

Yellowfin Securities Customer Service

When opening an account or trading with Yellowfin Securities, you can access professional customer service. The platform offers phone, email, and online messaging channels. You can call customer service during business hours for one-on-one answers. Yellowfin Securities has multiple branches in Hong Kong, where you can get face-to-face support. Staff will guide you through each step of fund transfers or account operations. The platform also hosts periodic investment seminars, where you can consult analysts directly to address investment queries. If you prefer traditional service methods, Yellowfin Securities’ branch services will reassure you.

Reminder: When choosing customer service channels, select phone, email, or branch services based on your needs to enhance communication efficiency.

User Experience

Futu Securities Experience

When using Futu Securities, you’ll find the platform highly smooth. Whether opening an account, trading, or checking market data, operations are seamless. You can quickly place orders via the mobile app, with fast interface responses. Futu Securities offers rich customization options, allowing you to adjust the interface layout to your preferences. The platform’s push notifications and smart tools are practical, helping you seize market opportunities in real time. If you encounter issues, you can contact online support, typically receiving replies within minutes. You can also interact with other investors in the community to share experiences. Overall, Futu Securities suits you if you seek an efficient and convenient experience.

Yellowfin Securities Experience

When trading with Yellowfin Securities, you’ll notice the platform prioritizes system security and stability. The company invests heavily in improving trading system efficiency, conducting frequent high-volume stress tests to ensure stability most of the time. Yellowfin Securities has relocated its central computing equipment to the HKEX data center, enhancing system speed and reliability. After each trade, the platform notifies you via SMS or email, helping you detect anomalies. The platform also regularly engages cybersecurity firms to test systems, continuously improving protections. However, during peak periods, you may face the following experience issues:

- System login delays or failures may affect order placement speed.

- Lack of widespread two-factor authentication, relying only on dual passwords, poses some security risks.

- High system load during peak periods may slow some operations.

If you value security and traditional services, Yellowfin Securities offers a stable experience, but be mindful of system stress during peak times.

Suitable Audiences

Who Futu Securities Suits

If you seek an efficient and convenient investment experience, Futu Securities is more suitable for you. The platform’s interface is user-friendly and simple, ideal for beginners new to Hong Kong stocks. You can quickly open accounts and trade via the mobile app without complex processes. Futu Securities provides rich market insights and educational resources, helping you quickly learn about the Hong Kong stock market. If you enjoy smart tools and community interactions, the platform’s features will feel convenient.

You can also note Futu Securities’ performance in investor protection. The company actively complies with China’s SFC regulatory requirements, strictly halting new business while continuing to serve existing clients. You’ll feel the platform’s commitment to compliance and fund safety during use. The table below summarizes the user types suited for Futu Securities:

| User Type | Reasons for Suitability |

|---|---|

| Hong Kong Stock Beginners | Simple operations, fast account opening |

| Young Investors | Rich app features, modern interface |

| Self-Service Users | Abundant information, comprehensive smart tools |

| Compliance and Safety Focused | Actively responds to regulations, ensures fund safety |

If you want to complete account opening, trading, learning, and interactions with one phone, Futu Securities will save you time and effort.

Who Yellowfin Securities Suits

If you value the stable services of a traditional broker, Yellowfin Securities is your choice. The platform has years of Hong Kong stock service experience and a stable system, suitable for you if you have some investment experience. You can visit Hong Kong branches for face-to-face guidance. Yellowfin Securities takes a cautious approach to investor protection. The company paused new client onboarding due to regulatory policies, resuming only after policy clarity. This reflects its commitment to compliance and client rights.

If you prefer one-on-one services via phone or branches, Yellowfin Securities meets your needs. The table below helps you determine if Yellowfin Securities suits you:

| User Type | Reasons for Suitability |

|---|---|

| Experienced Investors | Stable system, professional features |

| Traditional Service Users | Branch services available, detailed support |

| Compliance and Safety Focused | Cautious regulatory compliance, protects client rights |

| Large Fund Users | Suitable for large transactions, favorable fee structure |

If you seek professional offline services and a stable investment environment, Yellowfin Securities will reassure you.

When choosing a Hong Kong stock broker, you should focus on company strength, interface simplicity, and information richness. Futu Securities earns praise for efficient account opening, rich market data, and active community, ideal for beginners seeking convenience. Yellowfin Securities emphasizes stable services, suitable for those valuing safety and offline support. Rationally selecting a platform based on your needs enhances your investment experience and avoids blind trend-following.

FAQ

What documents are needed to open accounts with Futu Securities and Yellowfin Securities?

You need to prepare identity and address proof. Futu Securities supports full online uploads. Yellowfin Securities supports online and Hong Kong branch applications. Prepare documents in advance to save review time.

How to fund Hong Kong stock trading accounts, and which banks are supported?

You can fund via Hong Kong bank transfers. Common banks include HSBC, Hang Seng Bank, and Bank of China Hong Kong. Some platforms support USD account funding, calculated at 1 USD = 7.8 HKD.

What are the minimum funding requirements for Futu Securities and Yellowfin Securities?

Futu Securities has no mandatory minimum funding amount. Yellowfin Securities recommends a minimum initial funding of $100 (approximately 780 HKD), subject to platform announcements.

What are the main fees for trading Hong Kong stocks?

You need to pay commissions, stamp duties, transaction levies, and platform fees. Futu Securities charges 0.03% commission plus $2 per trade. Yellowfin Securities charges 0.067% commission, minimum $19.2.

What risks should beginners note when investing in Hong Kong stocks?

You should be aware of exchange rate fluctuations, T+0 trading volatility, and spread costs. Start with a demo account to gradually learn Hong Kong stock market rules.

After a deep dive into the comprehensive comparison between Futu Securities and Bright Smart Securities, it’s clear that while both platforms have their own strengths, you still face some challenges. For example, you need to weigh Futu’s convenience against Bright Smart’s stability, while also independently handling complex cross-border fund transfers, exchange rate fluctuations, and transaction cost calculations. These challenges can all affect the efficiency of your fund transfers and your overall investment experience. BiyaPay was created to solve these pain points, offering a more comprehensive and efficient cross-border financial solution. We have significantly simplified the traditional KYC process with one-stop digital identity verification, allowing you to remit with a fee as low as 0.5% and achieve same-day delivery, completely eliminating opaque exchange spreads and long waits. Moreover, our platform supports the conversion between various fiat and digital currencies, so you don’t need a complex overseas account to invest in both U.S. and Hong Kong stocks on one platform, easily diversifying your assets. Say goodbye to cumbersome processes and opaque fees, and register with BiyaPay today to start your smart investment journey.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.