- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

2025 Complete Guide to Alipay and PayPal International Remittance Process

Image Source: pexels

In 2025, you cannot directly transfer funds from Alipay to PayPal; you must use a bank card or third-party platform for fund transfers. China has over 1 billion digital payment users, with a growing demand for international remittances, particularly focusing on convenience and security. Mainstream options include bank cards, third-party payment tools, and professional remittance companies, with significant differences in fees and transfer speeds. You should focus on process details and information security when choosing.

Key Highlights

- Alipay and PayPal cannot directly transfer funds; you must use a bank card or third-party platforms like Wise for fund transfers.

- The bank card transfer process is simple, withdrawing to a bank card before linking to PayPal, but fees are higher and transfer times are longer.

- Wise offers low-fee and fast international remittance services, supporting multi-currency accounts, but registration and verification require materials like a passport.

- When choosing a remittance method, focus on fees, transfer speed, and security, ensuring accurate information to avoid transfer failures.

- Prevent fraud risks by prioritizing legitimate channels and contacting banks or customer service promptly for issues to ensure fund safety.

International Remittance Feasibility

Image Source: pexels

Direct Transfer Status

You may want to transfer money directly from Alipay to a PayPal account, but this is currently not possible. Alipay and PayPal operate under different payment systems. Alipay primarily serves Chinese users, relying on China’s local banking and digital wallet systems. PayPal operates in over 200 countries and regions globally, mainly depending on bank cards and third-party clearing institutions. There is no unified technical interface or payment protocol between them, so you cannot directly complete international remittances. Even if you try using third-party platforms like Wise, you will find that direct transfers between Alipay and PayPal are not possible. This situation makes international remittances inconvenient for many users.

Main Restrictions

When attempting international remittances with Alipay and PayPal, you will encounter several restrictions. First, technical barriers are significant. The payment systems and clearing mechanisms of Alipay and PayPal are incompatible, preventing direct fund transfers. Second, policy restrictions are prominent. PayPal’s global operations incur high compliance and anti-money laundering costs. Chinese users often face higher fees when receiving or transferring funds via PayPal. For example, recharging PayPal from a Hong Kong bank account typically incurs fees of 2%–4%, varying based on exchange rate fluctuations. Additionally, international remittances are affected by limits, currencies, and regulatory policies. You need to understand relevant regulations in advance to avoid transfer failures due to incomplete information.

Tip: Before making international remittances, consult bank or third-party platform customer service to confirm the latest policies and fee standards to minimize unnecessary losses.

Option 1: Bank Card Transfer

Image Source: pexels

Bank card transfer is a common method to facilitate fund flow between Alipay and PayPal. You can first withdraw Alipay balance to your bank card and then use this card to recharge your PayPal account. The process consists of two main steps:

Alipay Withdrawal to Bank Card

You can transfer your Alipay balance to your bank card with the following steps:

- Open the Alipay app, ensuring you have registered and completed real-name authentication.

- Go to the “My” page and click the “Balance” option.

- Select the “Withdraw” button, enter the amount you wish to withdraw, and ensure sufficient balance.

- Choose the withdrawal method as your linked bank card. If not yet linked, add a bank card in “Account Settings” or “Bank Card Management,” entering the card number, cardholder name, and bank details, and verify identity via SMS.

- Confirm withdrawal details, including amount and bank card information.

- Enter your payment password for security verification.

- Submit the withdrawal request and wait for system processing.

During withdrawal, note the fees and transfer times. According to Alipay’s official policy, withdrawals or transfers within a cumulative limit of $20,000 (USD) are fee-free; amounts exceeding this incur a 0.1% fee, with a minimum of $0.01 (USD) per transaction. Transfer times include real-time (requires express payment activation), 2-hour fast withdrawal, and standard mode (within 2 days). If you operate between 8:00 and 15:00, funds typically arrive within 2 hours; other times may delay beyond 24 hours.

| Withdrawal Method | Fee Details | Transfer Time Details |

|---|---|---|

| Within $20,000 (USD) | No fees | Real-time/Within 2 hours/Within 2 days |

| Over $20,000 (USD) | 0.1% on excess, minimum $0.01 (USD)/transaction | 8:00–15:00 typically within 2 hours, other times may delay |

Your linked bank card must be real-name registered and under your name. Ensure account security by setting a strong password.

Bank Card Recharge to PayPal

After completing the withdrawal, you can use this bank card to recharge or link your PayPal account. Follow these steps:

- Log into your PayPal account and go to the “Wallet” page.

- Select “Link a bank card or credit card” and enter the bank card details. PayPal supports Visa, Mastercard, and UnionPay-branded cards.

- Confirm recharge details and submit after verification.

- Complete verification steps as prompted, such as entering a verification code.

- Upon successful recharge, you can use PayPal for international remittances or online payments.

When linking a bank card, you may encounter common issues. For example, if PayPal and bank systems are not synchronized, wait one or two days before retrying. You can also try clearing browser cache, logging out and back in, or switching browsers. If using a VPN, disable it before proceeding. If issues persist, contact PayPal’s Chinese customer service (400-921-1000) for assistance.

| Error Code or Prompt | Failure Reason | Solution |

|---|---|---|

| INSTRUMENT_DECLINED | Bank card linking issues, e.g., unconfirmed billing address or transaction limit exceeded | Contact issuing bank to verify billing address and transaction |

| PAYEE_ACCOUNT_RESTRICTED | Recipient account restricted | Recipient contacts PayPal customer service |

| PAYEE_ACCOUNT_NOT_VERIFIED | Recipient account unverified | Complete account verification as prompted |

| RECEIVING_PREFERENCE_MANDATES_MANUAL_ACTION | Recipient account lacks the currency type | Manually confirm amount and add currency type |

| L_ERRORCODE0:10422 | Payment source cannot complete transaction | Select a different payment source |

| L_ERRORCODE0:10485 | User did not authorize payment | Ensure you click the payment authorization button |

| L_ERRORCODE0:10725/10736/10728 | Incorrect address information (country, city, zip code, etc.) | Enter correct address details |

When selecting a bank card, consider supported currencies. For example, ICBC’s “Global Quick Transfer” supports AUD, CAD, NZD, HKD, USD, JPY, EUR. HSBC Hong Kong Global Transfers support USD, EUR, HKD, JPY, GBP, AUD, SGD, CAD, CHF, NZD. Use a foreign currency remittance savings account, not a cash savings account. Common supported currencies include:

- USD

- EUR

- HKD

- JPY

- GBP

- AUD

- SGD

- CAD

- CHF

- NZD

Before making international remittances, understand the bank card’s limits and currency support. Limits vary by bank and card type, so consult bank customer service for the latest information.

Tip: Throughout the bank card transfer process, ensure all account information is accurate to avoid transfer failures due to errors. Contact the bank or PayPal customer service promptly to reduce fund risks.

Option 2: Wise Transfer

Wise, a globally recognized third-party international remittance platform, helps you achieve efficient and secure cross-border fund flows. You can transfer funds from Alipay or a bank card to a Wise account, then to PayPal, completing the international remittance process. Below, I detail each step and precaution.

Wise Account Registration

You need to register a Wise account, and the process is clear. Follow these steps:

- Visit the Wise website or download the Wise mobile app and click the “Register” button.

- You can register using an email, Facebook, Apple, or Google account.

- Choose a personal or business account and enter your residency information.

- Provide a phone number and complete SMS verification, ensuring the information is valid.

- Set a login password, complete account registration, and check for Wise’s activation email to activate the account.

- Log into the Wise account and go to the profile page to complete your personal information.

- For your first international transfer, Wise will require you to upload a passport photo (Chinese ID cards are not supported), ensuring the passport details (name, number, validity) are clear.

- You also need to upload a clear selfie, sometimes holding your passport.

- In some cases, Wise may require proof of address, such as a bank statement, utility bill, or government-issued address proof from the past three months (in English or with a translation).

- Wise typically takes 2–3 business days to review materials, with results notified via email and the app.

Tip: Ensure all information is valid during registration to avoid verification failures. Wise supports China mainland +86 phone numbers, and the email must be long-term accessible.

Funding Wise

After registering, you can transfer funds to your Wise account. Wise supports multiple payment methods and currencies, allowing flexible choices based on your needs:

- Bank Transfer: You can transfer USD or other foreign currencies from a Hong Kong bank account to Wise, with fast speeds and low fees.

- Credit/Debit Card Payment: Wise supports Visa, Mastercard, and other international cards, suitable for small transfers.

- Wise Account Balance Payment: You can use your Wise account balance for payments and conversions.

- Supported Currencies: Wise allows up to 10 currency account balances, including USD, GBP, CAD, EUR, SGD, AUD, and more. You can freely convert over 50 currencies to meet various international remittance needs.

- Transfer Channels: You can enter an Alipay ID, WeChat ID, or UnionPay card number as the receiving account. Wise uses local bank networks for transfers, with funds typically arriving within 24 hours.

| Payment Method | Example Supported Currencies | Transfer Speed | Remarks |

|---|---|---|---|

| Bank Transfer | USD, EUR, GBP, etc. | 1–2 business days | Suitable for large transfers |

| Credit/Debit Card | USD, EUR, AUD, etc. | Instant | Slightly higher fees |

| Wise Account Balance Payment | 40+ currencies | Instant | Suitable for multi-currency conversions |

You can flexibly choose payment channels during transfers. Wise supports over 20 currencies for fee payments, including USD, EUR, AUD, CAD, and currencies from Turkey, Brazil, Indonesia, and more. Choose the most suitable method based on your needs.

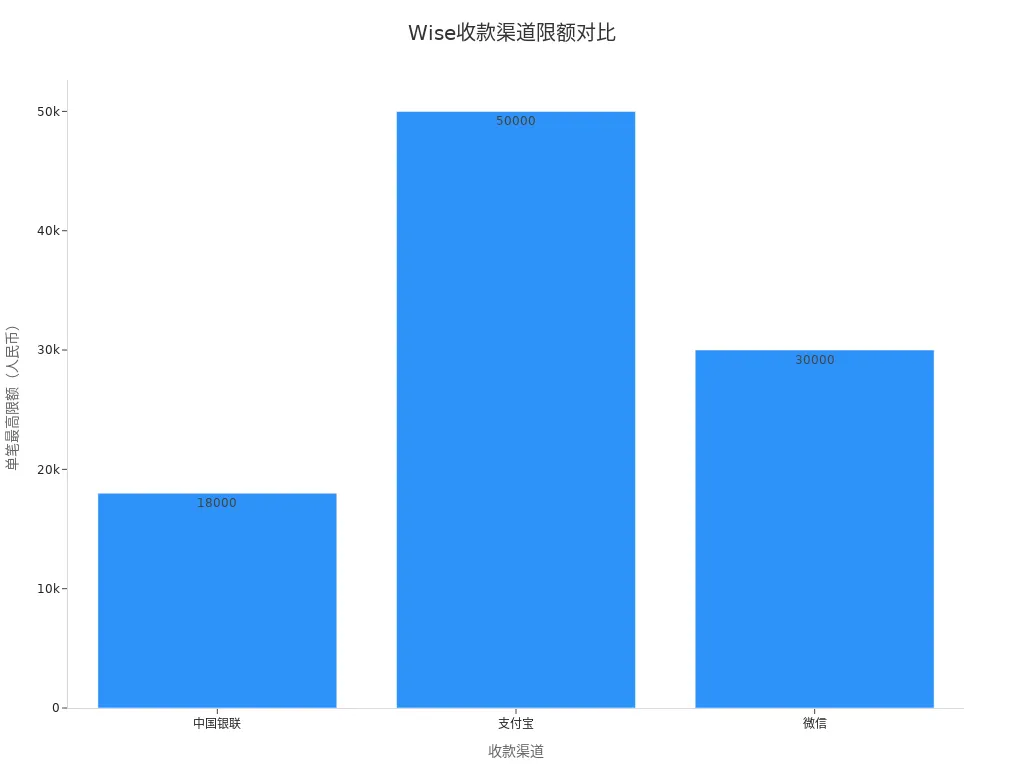

Note: Wise accounts have no monthly fees or minimum balance requirements. You only need to consider single transaction limits and receipt channel restrictions. For example, Hong Kong banks have a $50,000 (USD) single transaction limit, Alipay $50,000 (USD), and WeChat $30,000 (USD).

Wise Transfer to PayPal

After funding your Wise account, you can transfer funds to a PayPal account. The process is as follows:

- Link your Wise USD account to PayPal. In your PayPal account, select “Link a bank account,” choose a U.S. bank account type, and enter the Wise USD account’s Routing Number and Account Number.

- PayPal will verify your identity via phone code, and linking is complete upon success, allowing withdrawal operations.

- Log into PayPal, click “Transfer” under the balance on the homepage, select “Withdraw to bank account,” choose the linked Wise USD account, enter the withdrawal amount, and submit after confirming details.

- Wise transfers typically arrive within 1 business day, with possible delays on weekends.

- Some users report that Wise USD accounts may not link to PayPal due to PayPal account or Wise account bank issues. Contact Wise and PayPal customer service in advance to ensure accurate account details.

- Withdrawal amounts should ideally exceed $800 (USD) to effectively reduce fee costs.

- Monitor withdrawal fees and exchange rate costs; Wise uses mid-market rates with transparent, low fees.

| Transfer Method | Fee (Example: $1,000) | Transfer Time | Remarks |

|---|---|---|---|

| ACH Debit Payment | ~$21.83 (USD) | 1–2 business days | Suitable for U.S. bank accounts |

| Wise Balance Payment | ~$18.63 (USD) | Instant | Suitable for multi-currency conversions |

| Local Receipt Transfer | Free | Within 24 hours | Suitable for local receipts |

| USD Wire Transfer | $6.11 (USD) | 1–2 business days | Suitable for large transfers |

Tip: Wise fees consist of fixed costs and variable currency conversion costs, with popular currencies typically under 1%. You can use the fee calculator on the Wise website or app to check expected transfer times and fees in real-time, no registration required.

Throughout the Wise transfer process, you benefit from mid-market rates and low fees, with fast fund transfers, ideal for users needing frequent international remittances. Wise supports over 40 currency account balances with high single transaction limits, meeting diverse funding needs.

Option Comparison

Fees

When choosing an international remittance method, fees directly impact costs. Bank card transfers typically have higher fees, especially for SWIFT international wires through Hong Kong banks, where fees vary by amount and bank policy. You may find that traditional bank card cross-border remittances suit large or first-time transfers, but overall costs are higher, and the process is more complex.

Wise transfers have more transparent fees, typically 1.26% to 1.35%. For example, transferring $3,000 (USD) via Wise incurs about $40.74 (USD) in fees, and $4,500 (USD) about $56.91 (USD). Wise supports multi-currency virtual bank accounts, ideal for cross-border e-commerce receipts, but withdrawing directly to Chinese bank cards increases fees and has single transaction limits.

In summary, Wise offers advantages in fee transparency, but the withdrawal process and material requirements are more extensive. Bank card transfers are traditionally secure but have higher fees.

Transfer Speed

Transfer speed directly affects your fund usage efficiency. When using Hong Kong banks for SWIFT international wires, it typically takes 1–3 business days, with delays up to 5+ business days if intermediary banks are involved. About 72% of cross-border USD withdrawals use SWIFT channels, and 15% experience delays exceeding 3 business days.

Wise uses local bank account connections, with funds transferring between local banks, avoiding multiple intermediaries and significantly improving speed. When transferring via Wise, funds typically arrive within 1–2 business days, sometimes even same-day.

- Bank Card Transfer: 1–5 business days

- Wise Transfer: 1–2 business days, some currencies same-day

If you prioritize fast transfers, Wise better suits your needs.

Risks and Security

Security is equally critical during international remittances. Bank card transfers have a long history and high security, suitable for large fund transfers. When using Hong Kong banks, strict verification of transfer materials ensures fund safety.

Third-party platforms like Wise use multiple encryption and compliance regulations, with transparent transfer processes and clear fees and rates. Note that withdrawing to Chinese bank cards via Wise may require proof of funds, making the process complex. Ensure recipient information is accurate to avoid fund freezes or refunds.

It’s recommended to prioritize legitimate channels, ensure accurate account information, and prevent fraud risks when choosing a method.

International Remittance Precautions

Information Entry

When making international remittances, the accuracy of entered information is crucial. You must ensure the recipient’s name, bank account number, bank name, and address are correct. Verify against the recipient’s bank proof documents to avoid errors in a single letter or number causing transfer failure. Also, pay attention to entering the transfer amount, currency (e.g., USD), and purpose. Many Hong Kong banks require detailed transfer reasons and recipient addresses, which must match actual details.

Tip: Prepare all relevant documents in advance and verify each item to reduce risks from incorrect information.

Failure Reasons

Common reasons for international remittance failures include:

- Incorrect account information. Inaccurate bank account details can lead to refunds.

- Exchange rate fluctuations. Significant rate changes may cause abnormal received amounts; choose stable rate periods for transfers.

- Restricted payment methods. Some countries or regions limit certain payment methods; check destination policies in advance.

- Slow bank processing. Some banks have low efficiency, causing delays.

- Insufficient account balance. Low recipient account balance can cause failures.

- High fees. High fees increase costs; choose lower-fee channels.

- Network issues. Unstable networks can disrupt transfer instructions.

- Policy restrictions. Forex controls may directly impact transfer progress.

You can reduce failure risks by verifying information, choosing efficient banks, monitoring rates, and managing fees.

Risk Prevention

During international remittances, you must prioritize fund security. Common fraud tactics include impersonating judicial authorities, fake investment platforms, online shopping scams, and QR code fraud. Scammers often induce transfers to “safe accounts” or fake accounts. Be cautious of requests for sensitive personal information or scanning unknown QR codes.

Banks and payment platforms ensure fund safety through identity verification, transaction monitoring, and risk alerts. Choose reputable Hong Kong banks or professional remittance services, accurately entering all information to avoid freezes due to errors. If funds are frozen, contact the bank promptly and seek legal assistance if needed.

Avoid trusting unfamiliar transfer requests, regularly monitor remittance policies and fee changes, and ensure every international transfer is compliant.

When choosing an international remittance method, consider your needs and scenarios. The table below shows applicable scenarios for different methods:

| Remittance Method | Applicable Scenarios | User Types |

|---|---|---|

| SWIFT Code | International trade, forex transactions | Businesses and individuals |

| IBAN | Cross-border payments, account verification | Users in Europe and related regions |

| FedWire | Large payments within the U.S. | U.S. business clients |

| Sort Code | Domestic transfers in the UK | UK recipients |

Prioritize legitimate channels and ensure compliant operations to prevent fraud risks and secure funds. In 2025, policies continue to evolve; monitor remittance limits and anti-money laundering reviews. Control amounts and enter information accurately to reduce fees and delays. Choose the best method based on speed, fees, and receipt channels.

FAQ

Can I transfer directly between Alipay and PayPal?

You cannot transfer directly from Alipay to PayPal. You need to use a bank card or third-party platforms like Wise for transfers.

What materials are needed when transferring to PayPal via Wise?

You need to prepare a passport, selfie, and proof of address. Wise typically takes 2–3 business days to review materials. Ensure information is valid.

Which currencies do Hong Kong banks support for international remittances?

Hong Kong banks commonly support USD, EUR, HKD, JPY, GBP, AUD, SGD, CAD, CHF, and NZD.

Will funds be refunded if an international transfer fails?

If information is incorrect or policies restrict the transfer, funds are typically refunded. Wait patiently for bank processing and contact customer service promptly.

How can I reduce remittance fees?

Choose third-party platforms like Wise for transparent fees. Monitor rate changes and transfer during low-fee periods.

After a deep dive into the Hong Kong stock investment options with Tiger Brokers and BOC International, it’s clear that while both platforms have their own strengths, you still face numerous challenges in practice, such as complex cross-border fund transfers, opaque exchange rate fluctuations, and high transaction costs. These issues can significantly impact your investment returns and overall experience. BiyaPay was created to solve these pain points by offering a more comprehensive and efficient cross-border financial solution. On our BiyaPay platform, you can complete a simple digital identity verification and remit funds to most countries and regions worldwide with a fee as low as 0.5%, achieving same-day delivery. This allows you to completely bypass the cumbersome processes and long waits of traditional banking. We also provide a real-time exchange rate converter and support the conversion between various fiat and digital currencies, enabling you to easily manage your funds and seize investment opportunities on a single platform. Say goodbye to complexity, and register now to make your Hong Kong stock investment journey smoother.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.