- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

PayPal Remittance Limit Trends and Coping Strategies

Image Source: pexels

When using PayPal for remittances, you’ll notice that single, daily, and monthly limits differ. Verified accounts can typically transfer up to $10,000 to $60,000 per transaction, while unverified accounts have lower limits. Automatic transfers have a single limit of $10,000, and manual transfers have a daily limit of $500. Limits also vary by country and currency; for example, withdrawals to Chinese banks incur a $35 fee per transaction, while Hong Kong banks waive fees for withdrawals over HKD 1,000.

Key Points

- After completing PayPal account verification, remittance and withdrawal limits significantly increase, with a single transaction limit up to $10,000, no monthly cap, and more flexible withdrawals.

- Withdrawal fees and limits vary significantly by account type and region; business accounts have higher limits, and Hong Kong bank withdrawals over $1,000 are fee-free for fees.

- PayPal’s remittance fees and exchange rate policies are constantly adjusted, with compliance and anti-money laundering requirements being the main reasons for limit changes; focus on account security and transaction compliance.

- Individual users should plan foreign exchange quotas wisely, using third-party platforms like Payoneer or Coral Global to bypass forex restrictions and improve withdrawal efficiency.

- In case of account risks or restrictions, promptly provide compliance documents, maintain good transaction records, avoid frequent large transactions, and reduce the risk of account freezes.

PayPal Remittance Limits

Image Source: unsplash

Account Type Limits

When using PayPal for remittances, the account type directly affects your remittance and withdrawal limits. The limits for different account types are as follows:

| Account Type | Remittance & Withdrawal Limits | Notes |

|---|---|---|

| Personal Account (Unverified) | Withdrawals to US/Hong Kong bank accounts: $500 monthly, $3,000 cumulative; check withdrawals: $500 monthly, $2,000 cumulative | Cannot accept credit card payments, has receipt limits |

| Personal Account (Verified) | Withdrawals to US/Hong Kong bank accounts: no withdrawal limit; check withdrawals: $2,500 monthly | Single payment limit up to $10,000 |

| Business Account | Withdrawals to US bank accounts free, check withdrawals incur $5 fee, Hong Kong bank withdrawals over $1,000 free | Can accept credit card payments, no receipt limit |

If you choose a business account, you can enjoy higher receipt and withdrawal limits and support credit card payments. After verifying a personal account, the single remittance limit increases, and withdrawals become more flexible. When withdrawing to a Hong Kong bank account, verified accounts have no withdrawal limit, and business accounts get free withdrawals for amounts over $1,000.

Verified vs. Unverified Differences

If you haven’t completed PayPal account verification, your remittance limits will be significantly restricted. After completing the verification process, limits increase noticeably. The specific differences are as follows:

- Unverified accounts have a monthly receipt limit of $500, with a cumulative cap of $3,000.

- Verified accounts have no withdrawal limit and no monthly receipt cap.

- Verified accounts have a maximum single transaction limit of up to $10,000.

- Verified accounts can pay up to $60,000, with no total payment cap.

After verification, you can link a bank card for direct withdrawals. You can also link a Payoneer account to withdraw funds to a Hong Kong bank account, bypassing personal foreign exchange quota limits. For your first withdrawal, it’s recommended not to exceed $5,000 to avoid triggering risk controls. PayPal processes withdrawals only on business days, so you can avoid weekends and holidays to reduce waiting time.

Tip: If you’re an individual user, you face an annual foreign exchange quota limit of $50,000. After exceeding this, consider withdrawing through third-party platforms like Payoneer, which don’t use personal forex quotas and typically arrive in 1–2 days.

Transfer Method Differences

When using PayPal for remittances, the transfer method also affects limits and fees. Common methods include automatic and manual transfers, with variations by currency and region. Below are the limits and fees for major regions:

| Region | Remittance Limits & Withdrawal Fees | Other Restrictions & Features |

|---|---|---|

| China PayPal | $35 withdrawal fee per transaction; $50,000 annual forex quota limit; failed withdrawals still incur fees | Can only transfer to non-China accounts; some banks don’t support forex withdrawals; strict risk controls, prone to freezes |

| US PayPal | Free withdrawals to US bank accounts | Fewer transfer restrictions, low withdrawal fees |

| Hong Kong PayPal | Free withdrawals to Hong Kong bank accounts; non-HKD balance withdrawals require mandatory conversion to HKD with a 2.5% conversion fee | Uses PayPal exchange rates, potential exchange loss |

If you choose automatic transfers to a Visa credit card, the single limit is $10,000. Manual transfers have a daily limit of $500. When withdrawing to a Hong Kong bank account, amounts over $1,000 are fee-free. For China PayPal accounts, each withdrawal incurs a $35 fee, with an annual forex quota of $50,000. US PayPal accounts withdraw to US banks for free, with fewer restrictions. Hong Kong PayPal accounts withdraw for free, but non-HKD balances require mandatory conversion with a 2.5% fee.

When choosing a remittance method, you can plan the amount and withdrawal method based on your needs and regional policies to avoid unnecessary fees and exchange losses.

Limit Change Trends

Image Source: unsplash

Recent Adjustments

When monitoring PayPal remittances, you’ll notice significant changes in limit policies in recent years. PayPal no longer uses a uniform fee rate but adopts variable rates based on transaction amounts, with a fee rate of 5%, minimum $0.99, maximum $4.99. The currency exchange spread has also been adjusted to 3.25%. These changes mean your actual fees and exchange losses vary by transaction amount and currency. PayPal also dynamically adjusts remittance limits based on regulatory requirements in different countries. For example, when using PayPal in China, the annual forex quota is $50,000, with a $35 fee per withdrawal. Withdrawals to Hong Kong bank accounts are free for amounts over $1,000. PayPal adjusts single, daily, and monthly limits for personal and business accounts based on verification status, transaction history, and risk levels.

Reasons for Changes

The adjustment of PayPal’s remittance limits is driven by multiple factors. You’ll find that compliance and anti-money laundering policies are the main drivers. PayPal must comply with local laws and regulations to prevent money laundering, terrorist financing, and violations of sanctions. When using PayPal, the platform screens your transactions. If suspicious activity is detected, PayPal may take the following actions:

- Freeze account funds or restrict transaction functions.

- Reject fund requests, delay, or cancel transactions.

- Close accounts or require additional identity and transaction information.

- Report suspicious transactions to regulatory authorities.

- Freeze or restrict account funds under court orders.

These measures directly affect your remittance limits and fund liquidity. PayPal also prohibits transactions involving sanctioned entities, investigates payment details, and may block or delay transactions if necessary. If your account poses risks or violates rules, PayPal will restrict access until you provide compliance documents. Through these measures, PayPal enhances risk control and ensures compliant operations.

Future Outlook

When using PayPal for remittances in the future, you may encounter more flexible but granular limit management. PayPal will continue to adjust remittance limits and fees based on global regulatory policies and market demands. You may see the following trends:

- Remittance limits will become more personalized, tied to your account verification, transaction history, and risk level.

- Fee and exchange rate policies will be tiered by country, currency, and amount, balancing platform revenue with user experience.

- Compliance and anti-money laundering measures will strengthen, with increased screening of suspicious transactions to ensure fund safety.

- If you’re a business user, you may enjoy higher limits and more flexible fund management tools but must comply with stricter audits.

When using PayPal for remittances, you should closely monitor platform announcements and policy updates, complete account verification promptly, and plan fund flows wisely. This ensures effective responses to limit changes, securing your funds and transactions.

User Impact

Individual Users

When using PayPal for remittances, you often encounter practical issues.

- Your annual USD exchange quota is limited, exceeding $50,000 prevents direct withdrawals or exchanges.

- Banks have strict controls on forex inflows, and Hong Kong banks may return funds, incurring a $15 return fee.

- You could previously use the fast RMB withdrawal service, but since July 1, 2018, this channel has been closed, limiting withdrawal options.

- Withdrawal fees are high, and the process is complex, potentially requiring additional bank forms.

- Personal accounts cannot directly transfer USD funds to some third-party accounts, requiring platforms like Payoneer to address withdrawal and exchange issues.

Tip: When withdrawing with PayPal, understand Hong Kong bank forex policies in advance to avoid fund returns and extra fees due to policy changes.

Business Users

As a business user, PayPal’s remittance limit changes bring more compliance and tax pressures.

- The US IRS has lowered the 1099-K reporting threshold yearly, set at $5,000 in 2024, dropping to $2,500 in 2025, and $600 in 2026 and beyond. Your goods and services transaction amounts are more likely to require reporting.

- You need to distinguish between goods/services transactions and personal repayments, or you may receive more tax forms, increasing compliance burdens.

- Some states (e.g., Maryland, Massachusetts) have lower reporting thresholds, requiring you to monitor local requirements.

- PayPal submits reports based on transaction labels, and even incorrect labels require you to address tax implications.

- When accounts are audited or restricted, you should prepare purchase receipts, invoices, and sales records to handle audits and appeals promptly.

Recommendation: Maintain compliant operations, regularly organize contracts and invoices, and choose remittance channels suited to your business scale, such as PayPal for small amounts and SWIFT for large ones.

Risk Warnings

When using PayPal for remittances, you should be aware of the following risks:

- Accounts may be restricted or frozen for suspected violations, lasting up to 180 days, affecting fund liquidity.

- PayPal strictly audits your identity and transaction details, and failure to provide documents may lead to account freezes.

- When receiving funds from unknown sources, you must promptly explain their origin, or your account may be restricted.

- Account unfreezing is lengthy, requiring extensive private documents, increasing operational burdens.

- Receipt fees are high, international transaction rates are higher, and withdrawal methods are limited with return risks.

- In case of returns or chargebacks, fund recovery is slow, impacting business cash flow.

Recommendation: You should complete account verification, maintain clear transaction records, and control transaction frequency, avoiding unusual large transactions to reduce the risk of account restrictions.

Coping Strategies

Increasing Limits

If you want to increase PayPal remittance limits, you can use third-party cross-border payment platforms. For example, Coral Global offers solutions to bypass personal forex quota limits. You only need to register and verify a Coral Global account, submitting ID, bank card, and PayPal account screenshots. After binding, initiate a withdrawal request with a minimum of $150 per transaction. You can choose automatic or manual exchange; manual exchange locks in rates to reduce losses. Withdrawal fees are about $35 per transaction, with service fees ranging from 0.6%–1.2% based on transaction volume. Increasing transaction volume further lowers service fees. Consolidating withdrawals can also spread fixed fees. In 2025, Coral Global withdrawals are preferred for large or frequent withdrawals, offering fast arrivals and multi-currency support, effectively bypassing the $50,000 annual exchange limit.

Risk Mitigation

When operating PayPal remittances, you should focus on compliance and account security. You should complete real-name verification and keep transaction records clear. Avoid frequent large transactions to prevent triggering risk controls. After receiving funds, promptly explain their source to avoid account freezes. You should also monitor Hong Kong bank forex policies and prepare relevant proof documents in advance. During account audits, have purchase receipts, invoices, and sales records ready. You can regularly organize contracts and invoices to reduce the likelihood of risk controls. Choosing compliant third-party platforms for withdrawals also lowers the risk of rejections or returns.

Alternative Solutions

If PayPal remittance limits are restrictive, you can consider other cross-border remittance methods. Common options include:

- Wise account: Supports multi-currency exchange, fast local transfers, low fees, suitable for individuals and businesses.

- OFX: Offers international payment services for individuals and businesses, supporting currency risk management.

- Western Union: Extensive global agent network, ideal for users needing cash receipts.

- Bank wire transfers: Traditional method, high security but higher fees and longer arrival times.

- WeChat Pay and Alipay International: Support cross-border payments in some overseas markets, relying on partner banks and policies.

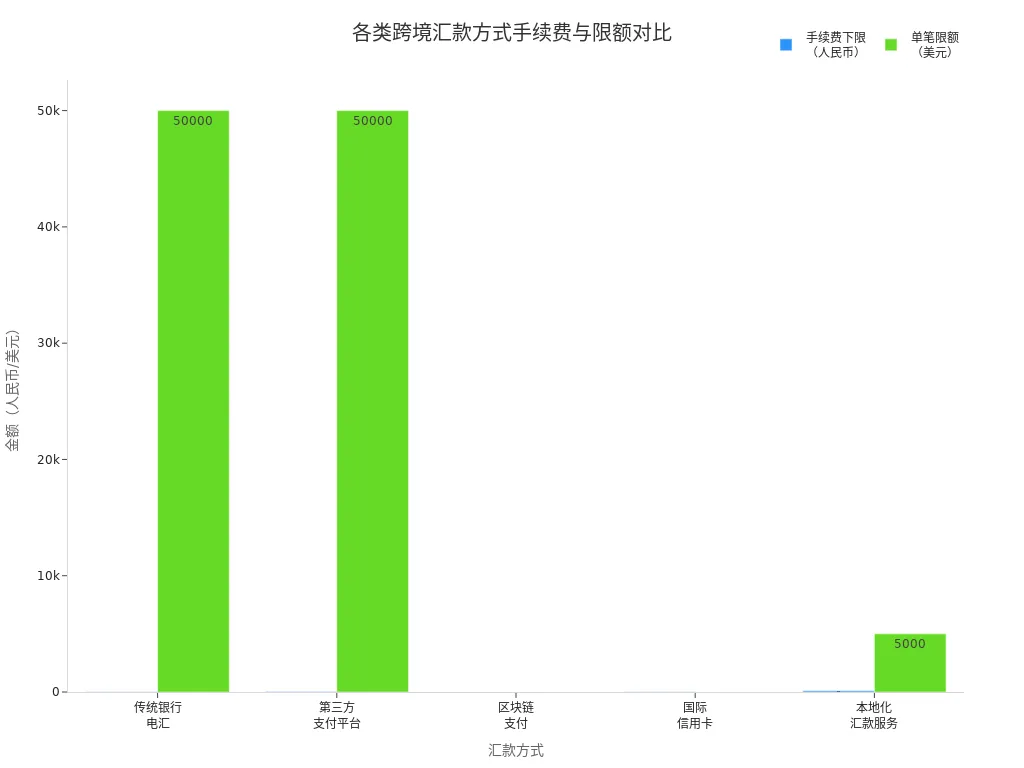

You can refer to the table below for fees and limits of different remittance methods:

| Remittance Method | Fee Range & Rates | Single Transaction Limit | Annual Limit | Other Fees & Notes |

|---|---|---|---|---|

| Bank Wire Transfer | 0.1%, min $20–50, max $300 | ~$40,000–$50,000 | $50,000 | Telegram fee $80–150 per transaction, intermediary fees $8–25 |

| Third-Party Payment Platforms | 2%–4% rate markup, $35 withdrawal fee | $50,000 per transaction | Subject to forex limits | Real-time arrivals, with rate spreads and withdrawal fees |

| Blockchain Payments | ~$100 fee per $1M | No clear limit | Less policy impact | Fast, no intermediary fees, regulatory risks pending |

| International Credit Cards | 3%–5% cash advance fee, min $15 per transaction | Subject to credit card limits | Included in forex quota | Dynamic currency conversion may cause rate losses |

| Localized Remittance Services | Fixed fees $15–50, 3%–5% rate markup | $5,000 per transaction | Policy-restricted | No bank account needed, suitable for non-card users |

When choosing alternatives, you should consider your needs, amount size, and arrival speed, prioritizing low-fee, fast, and compliant platforms.

When using cross-border remittances, limit and policy changes directly impact your fund liquidity. After completing account verification, you can increase remittance limits and reduce risks. Focusing on compliance requirements helps avoid account freezes. Choosing the right remittance method based on your needs and staying updated on policies ensures fund safety.

FAQ

How much do PayPal limits increase after verification?

After verification, you can remit up to $10,000 per transaction. Monthly receipt limits are unrestricted. You can also link a bank card for direct withdrawals to Hong Kong bank accounts.

How long does a PayPal withdrawal to a Hong Kong bank take?

After initiating a withdrawal, it typically arrives in 1–2 business days. Holidays or bank audits may extend the time. You can plan fund arrangements in advance.

Does PayPal charge fees for failed withdrawals?

When withdrawing to a Hong Kong bank account, if the withdrawal fails, PayPal still charges a $35 fee. You should ensure account information is accurate to avoid unnecessary losses.

What are the main PayPal remittance fees?

When remitting with PayPal, you pay a 5% fee (minimum $0.99, maximum $4.99). For currency exchange, PayPal charges a 3.25% rate spread.

How to avoid PayPal account freezes?

You should complete real-name verification and maintain clear transaction records. Avoid frequent large transactions. After receiving funds, promptly explain their source. This reduces the risk of freezes.

After a deep dive into PayPal’s remittance limits and strategies for managing them, it’s clear that complex account limits, high fees, and the constant risk of account freezes pose significant challenges to your financial management. From a withdrawal fee of up to $35 to the need for third-party platforms to bypass foreign exchange limits, a simple remittance can become an incredibly complicated process. To solve these pain points, BiyaPay offers a superior solution, allowing you to say goodbye to complex steps and opaque fees.

Our platform not only provides remittance fees as low as 0.5%, but also supports same-day delivery to most countries and regions worldwide, completely revolutionizing your cross-border remittance experience. We also provide a real-time exchange rate converter and support the conversion between various fiat and digital currencies, enabling you to easily manage your global assets on a single platform. Say goodbye to high costs and account risks, and register now to start your new journey in smart finance.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.