- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Western Union Transfer Guide for Recipients in China

Image Source: pexels

You can receive Western Union transfers in China through four methods: cash pickup, bank account deposit, Alipay, and WeChat wallet. Cash pickup is suitable for those who want to receive USD cash directly, typically requiring a visit to a designated location. Bank account deposits are ideal for users with Hong Kong bank accounts, with a simple process and funds directly credited to the account. Alipay and WeChat wallet are suitable for mobile operations with fast transfers. When receiving funds, you need to prepare the MTCN, ID, and sender’s name. You also need to pay attention to transfer times, fees (e.g., $2–$10 per transaction, based on real-time exchange rates), and receiving limits to ensure smooth receipt of funds.

Key Highlights

- Western Union in China supports cash pickup, bank account deposits, Alipay, and WeChat wallet, meeting diverse user needs.

- When receiving funds, you must prepare an accurate MTCN, ID, and sender’s name to ensure error-free receipt of funds.

- Cash pickup and mobile wallet methods are the fastest, ideal for urgent cash needs; bank account deposits suit users with Hong Kong bank accounts who prefer direct crediting.

- Fees vary by method and amount; Alipay and WeChat wallet have lower fees, while cash pickup has higher fees; check the latest standards in advance.

- Transfers are valid for 35 days; unclaimed funds will be refunded, and you can contact Western Union customer service for assistance with issues.

Western Union Transfer Receiving Methods

Image Source: unsplash

You can choose different Western Union transfer receiving methods based on your needs. Each method suits different scenarios with distinct processes. Below is a detailed explanation:

Cash Pickup

Cash pickup is suitable when you don’t have a bank account or need cash urgently. You can collect USD cash directly at partner bank locations in China. Common partner banks include China Everbright Bank, Shanghai Pudong Development Bank, China Post Savings Bank, Bank of China, and China Construction Bank. You only need to bring a valid ID, sender information, and MTCN to collect funds. Cash pickup has no additional fees and offers fast transfers, ideal for small urgent transfers, such as sample fees or shipping costs.

| Transfer Method | Fees | Transfer Time | Applicable Scenarios |

|---|---|---|---|

| Cash Pickup | No additional fees | Instant | No bank account or urgent cash needs |

Tip: Cash pickup is globally available, supporting cross-border businesses and convenient for those without bank accounts.

Bank Account Deposit

If you have a Hong Kong bank account, you can choose bank account deposits. You need to provide your name (in pinyin), city, and country to the sender. After the sender completes the Western Union transfer, you will receive an MTCN. You can check the transfer status via the Western Union website or customer service hotline. Once the funds arrive, bring your ID and bank card to a partner bank to withdraw, or in some cases, the bank will credit USD to your dual-currency debit card. The process is simple, suitable for those with bank accounts who want funds credited directly.

Alipay Receipt

Alipay receipt is suitable for cross-border e-commerce sellers and frequent cross-border shoppers. You can operate directly on your phone without visiting offline locations. Alipay supports personal and business cross-border payments with fast transfers and convenient operations. You only need to link your payment details in Alipay, enter the MTCN, and relevant information to receive funds. Alipay is ideal for large payments, commonly used in cross-border e-commerce and personal transfers.

- Alipay receipt advantages:

- Convenient operation, no need for offline handling

- Supports cross-border shopping and transfers

- Suitable for individuals and businesses

WeChat Wallet Receipt

WeChat wallet receipt is suitable for small sample fee collections. You can complete receipt via the WeChat app’s micro-transfer mini-program. Each transfer is limited to about $3,000, with an annual limit of about $50,000. You need to provide the MTCN, sender’s full name (correct pinyin order), currency, and amount. Upon successful receipt, USD funds will be credited directly to your WeChat wallet. The operation is simple with a good user experience. Note that the sender must select “Cash pick up” mode, otherwise, you can only collect at a bank.

When choosing a receipt method, consider transfer speed, fees, limits, and convenience. Different methods suit different needs, such as cash pickup for urgent cash, bank account deposits for Hong Kong bank account holders, and Alipay/WeChat wallet for mobile operations and cross-border e-commerce.

Receipt Process and Required Information

Cash Pickup Process

When choosing Western Union cash pickup, you need to prepare the necessary documents in advance. The process is as follows:

- Find the nearest Western Union agent location. You can check via the Western Union website or partner banks, such as China Everbright Bank, Shanghai Pudong Development Bank, or China Post Savings Bank.

- Prepare a valid ID, such as an ID card, passport, or driver’s license, for identity verification.

- Prepare transfer details, including sender’s name, transfer amount, and MTCN. These help staff quickly locate the transfer record.

- Visit the agent location and inform staff you’re collecting cash.

- Fill out the required forms and present your ID for verification.

- Once verified, you can collect USD cash.

Tip: In some cases, staff may require your contact details for identity confirmation. All information must be accurate to avoid issues collecting cash.

Bank Account Receipt Process

If you have a Hong Kong bank account, you can choose bank account receipt. Western Union transfers support multiple banks, including China Everbright Bank, Pudong Development Bank, and China Post Savings Bank, covering locations nationwide. The process is as follows:

- Provide your name (in pinyin), city, and country to the sender.

- After the sender completes the Western Union transfer, you will receive an MTCN.

- You can check the transfer status via partner bank locations, online banking, or mobile banking. For example, Pudong Development Bank supports app operations, allowing users to purchase forex, enter recipient details, confirm payment, and obtain the MTCN.

- Once funds arrive, bring your ID and bank card to a bank location to withdraw, or transfer funds out via electronic channels.

- WeChat users can use the “micro-transfer” mini-program, enter the MTCN, and have funds credited to a bank account in real-time, up to $3,000.

Note: The bank account receipt process is simple, with funds credited directly, ideal for Hong Kong bank account holders wanting quick receipt. You can check nearby locations via the [WesternUnion西联] WeChat official account.

Alipay Receipt Process

If you prefer mobile operations, you can choose Alipay receipt. The steps for receiving Western Union transfers via Alipay are as follows:

- Open the Alipay app and search for the “Cross-Border Transfer” mini-program.

- Go to “I Want to Receive” and select “Transfer Number Receipt.”

- Enter the Western Union MTCN provided by the sender.

- Select a linked bank card as the receiving account. First-time receipt requires signing a China Bank service agreement and real-name authentication.

- Confirm receipt, and funds will be settled in RMB based on real-time rates, expected to arrive within 2 hours.

- Supports receipt to non-China Bank accounts as long as they’re linked to Alipay.

- Single transfer limit is $1,000, with an annual limit of $10,000.

Alipay receipt requires no offline handling, is convenient, and suits cross-border e-commerce and personal transfers. Ensure identity verification and bank card details are accurate.

WeChat Wallet Receipt Process

You can receive Western Union transfers via WeChat wallet, ideal for small amounts. The process is as follows:

- Open the WeChat app and access the “micro-transfer” mini-program.

- Enter the MTCN, sender’s full name (correct pinyin order), currency, and amount.

- For first-time receipt, submit your ID number and name for verification, and upload front and back photos of your ID and proof of address (e.g., utility bill).

- After verification, USD funds will be credited directly to your WeChat wallet.

- Each transfer is limited to about $3,000, with an annual limit of about $50,000.

The WeChat wallet receipt process is simple with a good user experience. You must select “Cash pick up” mode, or you’ll need to collect at a bank. Identity verification is critical for receiving larger amounts.

Required Information and Identity Verification

When receiving Western Union transfers, you must ensure all key information is accurate. This includes:

- MTCN: The unique identifier for collecting funds, must be entered correctly.

- ID Document: You need to bring a valid ID, such as a Chinese ID card or passport.

- Sender’s Name: Must match the name on the transfer form, with the first name before the last name, in correct order.

- Transfer Amount and Currency: Must match the actual transfer details.

- Contact Details and Proof of Address: Some methods require proof of address, like utility bills.

Errors in information entry may lead to the following consequences:

- Funds held, unable to be released, preventing collection.

- If information doesn’t match, banks cannot release funds, and the transfer will be refunded.

- Issues unresolved within 15 days may result in order cancellation.

- You need to promptly notify the sender to correct information, or receipt will fail.

Tip: Senders can update information before withdrawal, but unupdated changes may cause withdrawal failure. Verify all details before receiving to ensure accuracy.

Fees and Transfer Times

Image Source: unsplash

Fees by Method

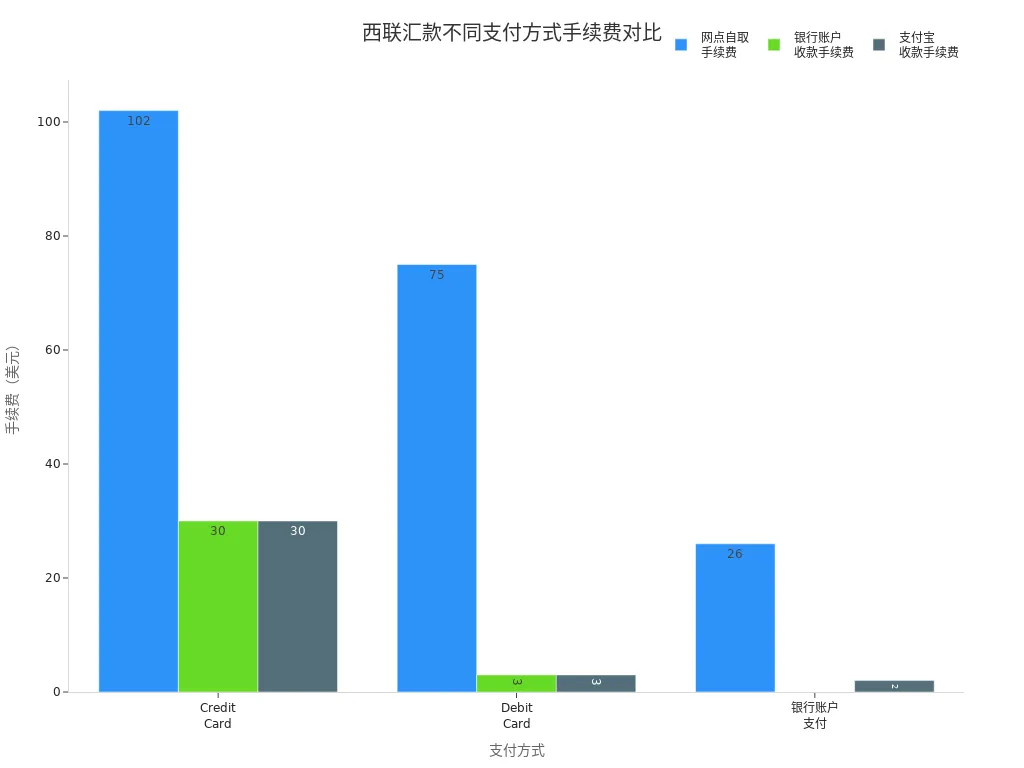

When choosing a Western Union transfer receiving method, fees are a key consideration. The fee standards for different methods are as follows:

- Cash pickup fees are typically higher than bank transfers.

- Online transfers have a limit of about $7,000, with fees varying by amount and payment method.

- Receiving via Hong Kong bank accounts may have lower fees, with some channels offering discounts.

- Alipay and WeChat wallet receipts have lower fees, with some new users eligible for fee waivers.

| Transfer Amount Range | Cash Pickup Fee | Bank Account Receipt Fee | Alipay Receipt Fee |

|---|---|---|---|

| 0–$5,000 | $15 | $0–$3 | $2–$3 |

| $5,001–$10,000 | $20 | $0–$30 | $2–$30 |

You can check the latest fee standards on the Western Union website or at partner locations. Some channels support point deductions to offset fees, helping you save costs.

Transfer Speed

Transfer speed directly affects your fund usage efficiency. Refer to the table below:

| Receipt Method | Transfer Time |

|---|---|

| Cash Pickup | Within minutes |

| Alipay/WeChat Wallet | Within minutes |

| Bank Account Receipt | 0–4 business days |

Cash pickup and mobile wallet methods are the fastest, ideal for emergency receipts. Bank account receipt speed depends on bank processing, typically 0–4 business days.

Exchange Rate Differences

When receiving funds, you also need to consider exchange rates. Western Union transfers are settled based on real-time rates, with slight differences between cash pickup and mobile wallet receipts. Bank account receipts typically use the bank’s daily rate. You can check rates on the website or app before receiving to choose the most favorable method.

Rate fluctuations affect the actual USD amount received. It’s recommended to receive funds when rates are higher to maximize returns.

Receipt Limits

Receipt limits are influenced by multiple factors. You need to note:

- Single online transfer limits are about $7,000; agent location limits require consultation with specific locations.

- Individuals in China cannot receive more than $50,000 annually.

- Cash pickup limits vary by location; Alipay and WeChat wallet limits also vary by bank and policy.

- Hong Kong bank account receipt limits are higher, suitable for large settlements.

Before receiving, consult the receiving bank or location to ensure the amount is within limits, avoiding receipt failure due to exceeding limits.

Western Union Transfer Common Issues

Validity Period and Handling Expired Transfers

You must complete receipt of Western Union transfers within 35 days. Transfers are valid for 35 days from the sending date. If you fail to collect within this period, the system will automatically refund the funds to the sender’s account. If you encounter a frozen transfer, contact Western Union customer service within 5 days and submit relevant documents to unfreeze the transfer. It’s recommended to act promptly upon receiving transfer details to avoid refunds due to expiration.

Reminder: When collecting funds, verify the MTCN and personal details to ensure smooth receipt.

Reasons for Receipt Failure

You may encounter the following common issues during receipt:

- Incorrect information, such as wrong pinyin order for names or mismatched amounts.

- Exceeding receipt limits, causing banks to reject crediting.

- Failed identity verification due to incomplete documents.

- Transfer expired, automatically refunded by the system.

- Sender selected the wrong receipt method.

If receipt fails, you can promptly contact the sender to correct information or call customer service for assistance. You can also visit a Hong Kong bank location to inquire about specific reasons.

Customer Service and Inquiry Methods

You can check transfer status or seek help through the following official channels:

- Western Union customer service hotline:

- 800 820 8668 (free from landlines)

- 021-6866 4610 (charges apply for mobile calls)

- Service hours: Monday to Sunday, 8:00–20:00

- Information needed for inquiries:

- MTCN

- Sender’s country and full name

- Transfer currency and amount

- Recipient’s full name

- Western Union China website: https://www.westernunion.com/cn/zh/home.html

- You can self-check transfer status, locate agent locations, or update delivery methods on the website.

- After obtaining the MTCN, log in to the transfer tracking page on the website.

- Enter the MTCN to check transfer status.

- This method applies to all official channel transfers.

Security Reminders

When receiving funds, beware of fraud. Common tactics include:

- Forged transaction vouchers, sending fake screenshots to induce transfers.

- Disappearing after receipt, with scammers vanishing.

- Using intermediaries to create a false sense of security.

- Requesting refunds of excess amounts, inducing further transfers.

You should verify the sender’s identity and avoid large one-time transactions. Western Union transfers use electronic security systems and password verification to protect your information. When receiving, safeguard personal details and avoid disclosing ID or transfer information.

You can choose different Western Union receipt methods based on your needs. The table below summarizes the main advantages and disadvantages:

| Advantages | Disadvantages |

|---|---|

| Fast transfers, high security, many global locations | High fees, cumbersome offline operations, complex settlement |

When choosing, consider transfer speed, fees, and convenience. Verify MTCN, name, and ID details during receipt to ensure fund security. For issues, call 8008208668 or visit the website for inquiries. Save the official customer service number and resources for future convenience.

FAQ

How long does it take for Western Union transfers to arrive?

If you choose cash pickup, Alipay, or WeChat wallet, funds typically arrive within minutes. For Hong Kong bank account receipts, funds arrive as fast as the same day or up to 4 business days, depending on bank processing.

What to do if receipt details are incorrect?

If you find errors, contact the sender immediately to correct them. Mismatched details may cause funds to be held or refunded. You can call Western Union customer service for assistance.

Are there amount limits for Western Union transfers?

Single online transfers are limited to about $7,000 (USD). Annual receipts cannot exceed $50,000 (USD). Hong Kong bank account receipts have higher limits, subject to bank regulations.

How to check transfer status?

After obtaining the MTCN, log in to the Western Union China website and enter the number to check progress. You can also call the official customer service hotline, providing the sender’s name and amount for quick status updates.

Do I need to pay fees when receiving?

Cash pickup has higher fees. Alipay and WeChat wallet receipts have lower fees. Hong Kong bank account receipts may have discounts on some channels. Check specific fees based on real-time rates and official announcements.

After learning about the various Western Union pickup methods in China, it’s clear that each option—cash pickup, bank account transfer, or via Alipay/WeChat Wallets—comes with its own unique processes and limitations. These can lead to cumbersome operations, exceeding limits, or information errors. To solve these pain points, BiyaPay offers a more comprehensive and efficient cross-border financial solution. We not only provide remittance fees as low as 0.5% but also support same-day delivery to most countries and regions worldwide, completely revolutionizing your cross-border remittance experience. Our platform supports the conversion between various fiat and digital currencies and provides a real-time exchange rate converter, allowing you to seize the best opportunities. Say goodbye to complicated steps and potential failure risks, and register now to start your new journey in smart finance.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.