- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Wise International Remittance Guide for Beginners: Essential Handbook for Chinese Users

Image Source: unsplash

Do you want to send USD worldwide at a lower cost? Wise international remittance lets you complete transfers with a single transparent fee, showing real-time mid-market exchange rates. You don’t need to worry about hidden fees. Delivery is fast, with instant transfers available in some countries. The operation process is simple and supports a Chinese interface. Compared to Hong Kong banks, Wise offers more transparent fees, faster delivery, and a better experience.

| Aspect | Wise Advantages | Common Disadvantages of Hong Kong Banks |

|---|---|---|

| Fees | Single transparent fee, mid-market exchange rate | Hidden exchange rate markups, multiple and opaque fees |

| Delivery Speed | Instant delivery in some countries, fully trackable | Typically 2-3 business days, hard to track |

Key Points

- Wise international remittance offers transparent fees, using mid-market exchange rates, low fees, and no hidden costs, helping you save on remittance expenses.

- Registering a Wise account is straightforward, with a Chinese interface, strict but convenient identity verification, ensuring account security and compliance.

- Wise supports multiple funding and payment methods, with fast delivery, including instant transfers in some countries, meeting diverse user needs.

- You can manage over 50 currencies through a Wise account, easily receiving and converting funds, facilitating multi-currency management for individuals and businesses.

- The Wise platform is secure and reliable, regulated by multiple countries’ financial authorities, employing robust security measures to protect your funds and information.

Wise Overview

Image Source: unsplash

Platform Features

You can enjoy global financial services through Wise international remittance. The Wise platform covers multiple countries and regions in the Americas, Europe, Asia, the Middle East, and Africa. The table below lists some representative countries:

| Coverage Region | Representative Countries/Regions |

|---|---|

| Americas | United States, Canada, Brazil, Mexico, Argentina |

| Europe | United Kingdom, France, Germany, Italy, Spain |

| Asia | China, Japan, Singapore, Malaysia |

| Middle East | UAE, Saudi Arabia, Israel |

| Africa | South Africa, Nigeria, Egypt |

As of 2018, Wise had over 25 million registered users. You can experience the platform’s high stability and data security. Wise adopts a multi-layer technical architecture, integrating various large models, supporting computing optimization and data compliance, suitable for multiple industries and sensitive scenarios.

Suitable Users

You can choose Wise international remittance based on your needs. The following user groups are best suited for Wise:

- Individual Users: If you frequently travel abroad, shop overseas, or need to send money to China, Wise helps you save costs with fast delivery and transparent exchange rates.

- Business Users: If you manage cross-border business funds, Wise supports efficient, low-cost international transfers, facilitating multi-currency management.

- Multi-Currency Management Needs: You can hold over 50 currencies in a Wise account, easily receiving and managing foreign currencies.

- Users Needing Convenient, Fast Remittances: You can directly transfer to Alipay or WeChat accounts in China, with fast delivery and transparent fees.

Note: The Wise debit card is not currently available for Chinese users, but you can use personal and business account features normally.

Main Functions

Wise offers you diverse financial services:

- Multi-Currency Account: You can open an account for free, holding and converting over 50 currencies, with bank account details provided for some currencies.

- International Remittance: Supports transfers to over 160 countries and regions, using real mid-market exchange rates with low fees, no hidden charges.

- Multiple Payment Methods: You can choose bank transfers, credit cards, debit cards, or account balance payments.

- Business Features: Supports recurring payments and bulk payments, suitable for business users.

- Security Assurance: Wise uses two-step authentication, real-time transaction notifications, and multi-country regulatory compliance to ensure your funds’ safety.

You can experience global, low-cost, and efficient cross-border financial services through Wise international remittance.

Wise International Remittance Registration Process

Image Source: unsplash

Account Registration

You can start the registration process on the Wise international remittance website or mobile app. First, enter your commonly used email address and set a secure password. The system will ask you to choose an account type, either personal or business. After registration, you will receive a verification email. Check your inbox promptly and click the link in the email to complete email verification. If you don’t receive the email, check your spam folder or resend it. It’s recommended to use a frequently accessed email for receiving future notifications.

Identity Verification

After email verification, you need to complete identity verification. Wise international remittance has strict identity checks. You typically need to upload a passport photo, though in some cases, an ID card or driver’s license may be attempted. When uploading, it’s recommended to use the mobile web version to take photos, trying multiple times to ensure clarity. Some users have found that the front of an ID card may not be recognized by the system, in which case you can switch to a passport. During verification, you also need to scan a QR code and take photos of your ID and a selfie using your phone. You don’t need to hold a sign or record a video. Be cautious when selecting an address, avoiding Hong Kong addresses, as this may lead to account closure. For Chinese users, address proof requirements are low, typically not requiring additional documents.

Tip: Virtual credit cards or other non-standard channels carry risks; it’s recommended to use only your authentic information and accounts for registration and verification.

Account Activation

After identity verification is approved, your Wise account will be automatically activated. You can log in to your account and start using multi-currency management and international remittance services. During the first deposit, the system requires you to use an account with the same name as your registered Wise account. Note that Wise international remittance does not currently support direct deposits from Chinese bank cards. You can use a Hong Kong bank account, credit card, or debit card for deposits. Some banks do not support corporate wire transfers, so it’s recommended to consult bank customer service in advance. After account activation, you can add recipients and make global transfers anytime.

Wise International Remittance Operation Process

Funding and Deposit Methods

Before using Wise international remittance, you need to complete account funding and deposits. Wise supports multiple funding methods to suit different user needs. You can choose from the following methods:

- Bank Transfer from China: You can purchase foreign currency through banks like Bank of China and wire it to your Wise account. Fees are higher, and delivery speed is unstable.

- Hong Kong Bank Account Wire Transfer: Some users choose Hong Kong bank accounts for wire transfers, with fees and minimum amount requirements.

- U.S. Bank Account Wire Transfer/ACH: If you have a U.S. bank account, you can fund via ACH or wire transfer, suitable for opening accounts in other currencies.

- Digital/Online Bank Debit Cards: Such as Passbook Debit Card or Sable Debit Card, some users choose these for funding.

- Virtual or Physical Credit Cards: Such as PokePay physical cards, which supported Wise account activation in 2024, though some virtual cards are restricted.

When funding, you must ensure the funding account name matches your registered Wise account name, or it may trigger account risks. Typically, the first deposit requires $20 to activate the account and verify identity. When funding, it’s recommended to select “Transfer the money from your bank account,” then choose “All Other Banks” and transfer the specified amount to the account provided by Wise via online banking.

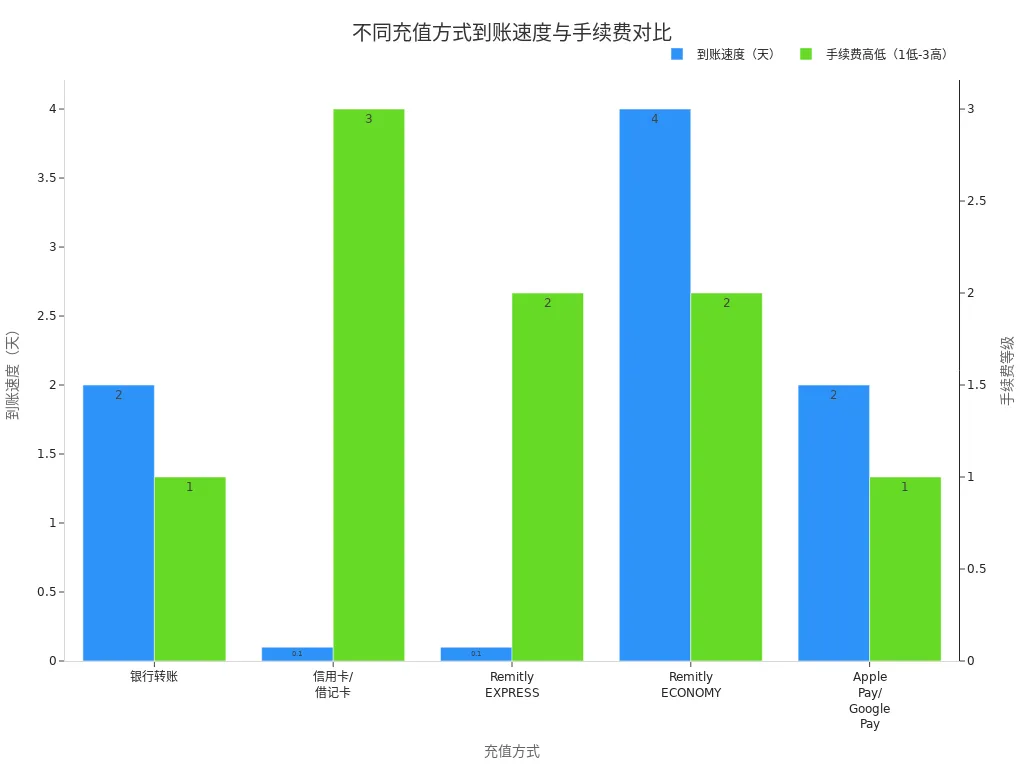

Fees and delivery speeds vary significantly by funding method. You can refer to the table below to choose the most suitable method:

| Funding Method | Fee Characteristics | Delivery Speed | Notes |

|---|---|---|---|

| Bank Transfer | Lower fees | Typically 2 business days | Suitable for large deposits, slower delivery |

| Credit/Debit Card | Higher fees | Within minutes | Suitable for small, fast deposits |

| Remitly EXPRESS | Reasonable fees | Within minutes | Suitable for urgent remittances |

| Remitly ECONOMY | Reasonable fees | 3-5 business days | Suitable for non-urgent remittances |

| Apple Pay/Google Pay | Lower fees | About 2 business days | Delivery time varies by platform |

| WeChat Mini-Program | Information not specified | N/A | No specific data available |

You can also refer to the chart below for a visual comparison of delivery speeds and fees for different funding methods:

Tip: When funding, double-check the account name to avoid restrictions due to mismatched information.

Adding Recipients

In Wise international remittance operations, adding a recipient is a key step. You can follow this process:

- Go to the recipient page in your Wise account.

- Select “Add Recipient.”

- You can search for friends via the recipient’s email to simplify operations or manually enter detailed information.

- Enter the recipient’s full name (in English or Chinese pinyin), bank card number, or Alipay ID (phone number or email).

- Provide the recipient’s address, including country, city, detailed address, and postal code.

- The recipient’s email is optional.

- After adding, you can edit recipient information anytime; to modify, you must delete and re-add.

When transferring to a Chinese bank card, you need to provide the recipient’s name (in English or pinyin), card number, and detailed address. For transfers to Alipay accounts, provide the recipient’s name, Alipay ID, and address details. The more accurate your information, the faster the delivery.

Filling Out Transfer Details

After adding a recipient, you need to fill out transfer details. You need to enter the transfer amount, select the currency, and specify the transfer purpose. Wise international remittance supports multi-currency operations, allowing you to choose currencies like USD, EUR, or GBP based on your needs. You also need to select the transfer purpose, such as “family expenses,” “tuition,” or “salary.” Specifying the transfer purpose helps improve approval rates and reduce delays.

Note: The transfer amount you enter will be converted based on the real-time exchange rate, and the system will display the estimated delivery amount and fees.

Choosing Payment Methods

After filling out transfer details, you need to choose a payment method. Wise international remittance supports multiple payment methods:

- Bank Account Transfer (ACH, wire transfer)

- Credit or Debit Card Payment

- Wise Account Balance Payment

- Wise Debit Card (not currently supported for Chinese users)

- Apple Pay, Google Pay (supported in some regions)

Different payment methods have varying fees and delivery times. Bank transfers have the lowest fees but slower delivery. Credit and debit card payments have higher fees but faster delivery. You can choose flexibly based on your needs.

When transferring to a Chinese bank card or Alipay account, reconfirm the recipient’s name, card number or Alipay ID, and address to ensure accuracy.

Submitting and Tracking

After confirming all information is correct, you can submit the transfer. The Wise international remittance system automatically calculates fees, exchange rates, and estimated delivery times. After reviewing transfer details and completing payment, Wise will process your transfer promptly.

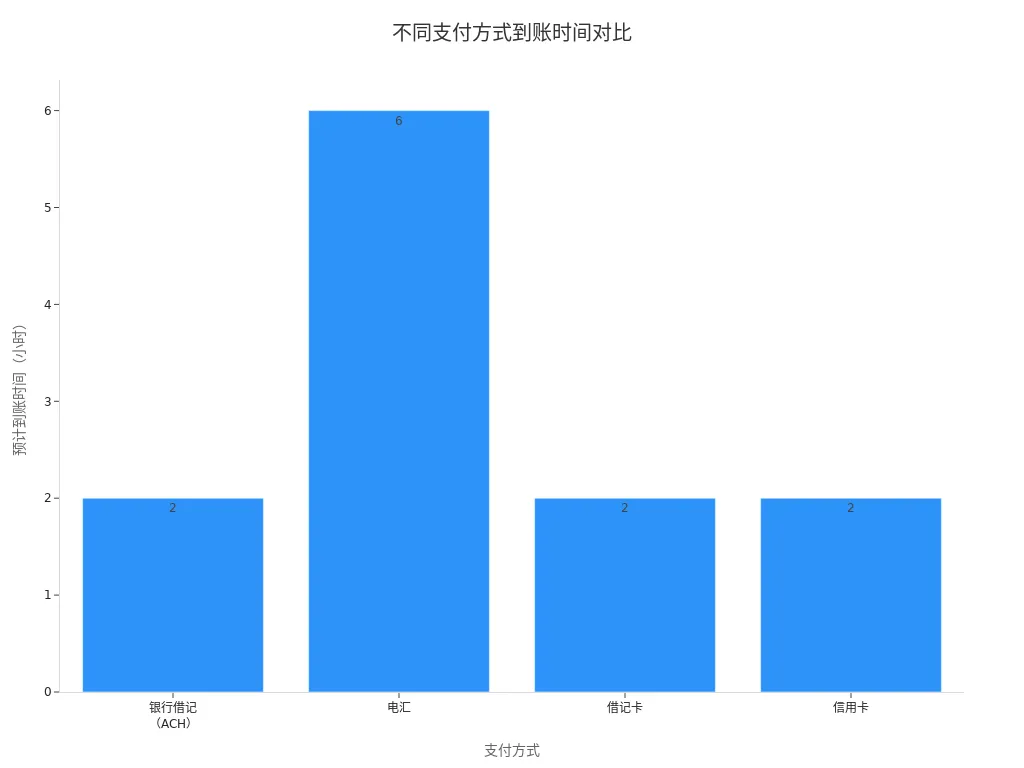

You can track transfer progress in real-time via the Wise app or website. The system displays transfer statuses, such as “Processing,” “Sent,” or “Delivered.” In most cases, Wise international remittances are delivered within 8 hours, with regular transfers typically arriving within 24 hours, the fastest in 1-2 hours, and up to 1-2 days at most. Delivery times are affected by payment methods and bank operating hours. For example, payments via bank debit (ACH), debit card, or credit card typically arrive within 2 hours; wire transfers take about 6 hours; transfers to Alipay in China can arrive as fast as 2 hours.

Reminder: You can download transfer receipts from your Wise account for record-keeping or reimbursement purposes.

Receiving and Multi-Currency Accounts

Wise Receiving Methods

You can easily receive funds through a Wise account. Wise supports opening accounts for over 50 currencies, including GBP, EUR, USD, AUD, SGD, and more. Each currency account provides local bank account details, such as wire transfer routing numbers, ACH routing numbers, SWIFT codes, and account numbers. You simply share these details with the payer, who can transfer funds to your Wise account via bank transfer, credit card, or debit card.

You can view and copy account details in the Wise app or website, making it quick and convenient to receive payments globally.

Supported Currencies and Receiving Channels

| Currency Example | Available Receiving Channels | Account Detail Types |

|---|---|---|

| USD | Bank transfer, ACH, wire transfer | Routing number, account number, SWIFT |

| EUR | SEPA transfer | IBAN, BIC |

| GBP | Faster Payments | Sort Code, account number |

| AUD | Local bank transfer | BSB, account number |

Multi-Currency Account Management

You can hold over 50 currencies simultaneously in a Wise account. Managing multi-currency balances is highly flexible:

- You can add different currency wallets via the Wise website or app.

- Up to 10 currencies have local bank details, facilitating local receipts and value-added services.

- You can fund different currency wallets via bank transfer, credit card, or debit card.

- You can freely convert currencies within the app, with the system displaying real-time exchange rates and fees, helping you understand the cost of each conversion clearly.

- Transfers between Wise accounts are free and convenient, requiring only the recipient’s phone number or email.

- You can sync phone contacts to transfer directly to other Wise users, simplifying multi-currency management.

- Wise multi-currency accounts can be used in over 70 countries and regions globally, allowing you to manage and use multiple currency balances anytime, anywhere.

You can check currency balances anytime and convert them flexibly to meet various scenario needs.

Non-Wise Account Receipts

You can also transfer funds to non-Wise accounts, such as Hong Kong bank accounts or third-party payment platforms. You need to note the following:

- China’s individual annual cross-border remittance limit is $50,000, with excess amounts requiring batch operations. Educational expenses can apply for additional limits but require documents like admission letters.

- Transfers require identity proof, recipient information, bank account number, SWIFT code, and transaction purpose.

- Delivery times vary by channel. Bank wire transfers typically take 3-5 business days, while third-party payment platforms may deliver instantly.

- Transfer limits are subject to China’s foreign exchange regulations, with daily cumulative limits of $50,000 for third-party overseas accounts and $200,000 for same-name accounts.

- Holidays may affect delivery times, so avoid operations during holidays.

- You should focus on account security and privacy protection to prevent fund misuse.

It’s recommended to understand relevant policies and limits in advance, plan fund flows rationally, and ensure smooth receipt.

Fees, Security, and Common Questions

Fees and Exchange Rates

When using Wise international remittance, you can enjoy a transparent fee structure. Wise’s fees consist of fixed and variable costs. Fixed costs depend on the payment method, such as ACH or wire transfer. Variable costs are related to currency conversion, using mid-market exchange rates without hidden margins. The table below shows fee examples for transferring to RMB:

| Payment Currency | Receiving Currency | Fee Example for $1,000 Transfer |

|---|---|---|

| USD (ACH Payment) | RMB | Fixed fee ~$4.78 + 1.01% variable fee, total ~$14.81 |

| GBP (Bank Transfer) | RMB | Fixed fee ~£3.64 + 0.72% variable fee, total ~£10.81 |

| EUR (Bank Transfer) | RMB | Fixed fee ~€4.58 + 0.83% variable fee, total ~€12.83 |

You can check specific fees in real-time on the Wise website. Large transfers also receive automatic discounts without additional applications.

Delivery Time

Wise international remittance delivers much faster than traditional banks. In most cases, your transfer can arrive within 1-2 hours, with a maximum of 2 days. Delivery time is affected by payment methods. The table below summarizes delivery times and fees for different payment methods:

| Payment Method | Estimated Delivery Time | Fee Details |

|---|---|---|

| Bank Debit (ACH) | Within 2 hours | 0.3% fee |

| Wire Transfer | ~6 hours | ~$5 fee |

| Debit Card | Within 2 hours | 1.15% fee |

| Credit Card | Within 2 hours | 3.7% fee |

You can refer to the chart below for a visual comparison of delivery times:

Security and Compliance

The Wise platform prioritizes your fund security. When using it, the platform employs multiple security measures:

- Wise is approved by financial regulators in multiple countries, operating legally and compliantly.

- The platform uses advanced encryption to protect your transaction data and personal information.

- Wise partners with banks like Citibank and Barclays, segregating user funds for safety.

- The platform enforces strict real-name verification and anti-money laundering policies, with a risk control team monitoring unusual transactions.

You can use Wise international remittance with confidence, as the platform is regulated by authorities like the UK’s FCA and U.S. FinCEN.

Common Questions

When opening an account, transferring, or receiving funds, you may encounter the following issues:

- Wise transfer limits vary by payment method and currency. Bank transfers can reach up to $1 million per transaction, but channels like Alipay or WeChat have single and annual limits.

- For Chinese users, single transfer limits are generally up to 31,000 RMB, with an annual total of about $50,000.

- Some banks (e.g., Agricultural Bank of China, China Merchants Bank) do not support Wise receipts, so confirm with the receiving bank in advance.

- First-time transfers require identity verification, uploading ID and a selfie, typically completed within 1 day.

- When withdrawing to Alipay, you may need to declare the fund source, which could affect delivery speed.

- Personal accounts cannot directly transfer RMB to business accounts but can transfer USD.

It’s recommended to prepare relevant documents in advance, plan transfer amounts rationally, and contact customer service promptly for issues.

By choosing Wise international remittance, you can enjoy low costs, fast transfers, and global coverage. You should complete identity verification for your first operation and prepare ID and recipient information in advance. Wise clearly displays all fees, helping you avoid financial losses. Recently, Wise partnered with LianLian Pay, enabling direct PayPal fund transfers to Alipay accounts, improving fund flow efficiency. When registering, stay updated on official new features and use the platform safely and compliantly.

FAQ

Which banks does Wise support for receiving funds?

You can choose banks like Hong Kong banks, China Merchants Bank, or Bank of Communications. Some banks may not support Wise receipts. You need to consult the receiving bank’s customer service in advance to confirm smooth delivery.

What should I do if a transfer fails?

If you encounter a transfer failure, first check if the recipient information is correct. You can also contact Wise customer service for detailed reasons. Most issues can be resolved by providing additional documents or correcting information.

Is there a minimum deposit amount for a Wise account?

For your first deposit, the system typically requires at least $20 (USD). Subsequent deposits can be based on your actual needs. You need to ensure account information consistency to avoid deposit failures.

How do I obtain a transfer receipt?

After completing a transfer, you can download an electronic receipt from the Wise account page. You can save the receipt for reimbursement or proof of fund source. Wise supports multiple download formats for your convenience.

Are there limits for transfers to Alipay in China?

When transferring to Alipay accounts in China via Wise, the single transfer limit is up to $31,000 (USD). Your annual cumulative limit is $50,000 (USD). You need to plan transfer frequency and amounts rationally.

After a deep dive into the advantages of Wise for international remittance, you may also find that it still has some limitations for Chinese users, such as the inability to top up directly with mainland Chinese bank cards, lack of support from some banks, and a gap in handling digital currency assets. To solve these pain points, BiyaPay offers a more comprehensive and flexible financial solution. We not only provide remittance fees as low as 0.5%, significantly reducing your costs, but also support same-day delivery to most countries and regions worldwide, ensuring a smooth and efficient cash flow. BiyaPay’s core advantage lies in its support for the conversion between various fiat and digital currencies and its real-time exchange rate converter, allowing you to easily manage your global assets on a single platform. Say goodbye to cumbersome account management and inconveniences, and register now to start your new journey in smart finance.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.