- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Wise vs. China Construction Bank Personal Remittance Experience Comparison

Image Source: pexels

When choosing a remittance method, Wise and China Construction Bank each present distinct differences. Wise’s fees typically range from 0.3% to 3.7% of the transfer amount, with large transfers costing approximately $45.59–$61.89, and arrivals as fast as half an hour. China Construction Bank has a single transfer limit of $31,000, with a relatively complex process and higher fees. If you prioritize low costs and fast arrivals, Wise is better suited for personal small transfers. The table below highlights their key fees and speeds:

| Remittance Service | Fee Range | Specific Fee Example (USD) | Arrival Speed |

|---|---|---|---|

| Wise | 0.3%–3.7% | 45.59–61.89 | 30 minutes–32 hours |

| China Construction Bank | Varies by amount (higher) | N/A | 30 minutes–32 hours |

Key Points

- Wise offers low and transparent fees, using real market exchange rates, ideal for small and fast transfers.

- China Construction Bank has higher fees and longer arrival times, suitable for large and business transfers.

- Wise delivers fast, often within 30 minutes, convenient for urgent funding needs.

- Both are highly secure, with Wise regulated by multiple countries and CCB employing strict risk controls.

- Wise is user-friendly, supporting multiple currencies and payment methods, offering a better user experience.

Wise vs. China Construction Bank Fee Comparison

Image Source: pexels

Handling Fees

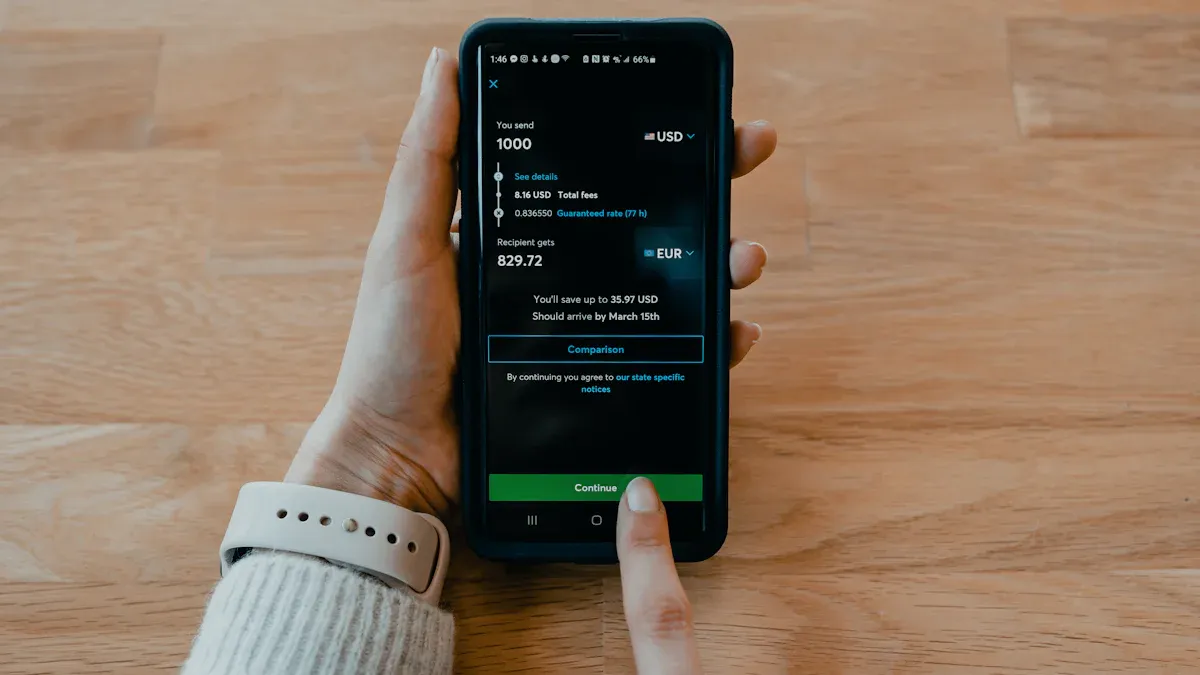

When selecting a remittance service, handling fees directly impact costs. Wise’s fee structure is highly transparent. You can use Wise’s website or app fee calculator to input the amount and payment method, seeing real-time fees. Wise’s fees typically include a fixed fee and a percentage-based fee. For example, using ACH for USD transfers to China, the fixed fee is $4.78 with a 1.01% percentage fee. For wire transfers, the fixed fee is $10.89 with a 0.73% percentage fee. For large transfers, Wise automatically offers discounts, reducing the percentage fee to as low as 0.1%–0.17%.

| Payment Method | Fixed Fee (USD) | Percentage Fee | Notes |

|---|---|---|---|

| ACH Payment | 4.78 | 1.01% | Bank automated clearing system |

| Wire Transfer | 10.89 | 0.73% | Traditional bank wire |

| Wise Account Payment | 4.40 | 0.73% | Direct deduction from Wise account |

| Large Transfer Discount | N/A | 0.1%–0.17% | For monthly totals exceeding $100,000 |

You can visually compare Wise’s fee differences across payment methods in the chart below:

In contrast, China Construction Bank’s international remittance fees are more complex. You need to pay forex fees, telegraph fees, and full-amount arrival fees. For example, transferring to Singapore incurs an RMB fee of 80 yuan and a foreign currency fee of 20 SGD, totaling about $25.5 (based on 1 USD = 7.3 CNY and 1 SGD = 0.74 USD). For larger amounts, fees can reach hundreds of dollars.

Exchange Rates

Wise uses the mid-market exchange rate, the real rate you can find on platforms like Google or Reuters. Wise does not add markups to the exchange rate or charge hidden fees. You can see the exchange rate and all fees clearly before transferring, ensuring the full amount arrives.

| Aspect | Wise | China Construction Bank |

|---|---|---|

| Exchange Rate Standard | Mid-market rate, no markup | Bank-set rate, typically with markup |

| Exchange Rate Markup | None | Yes, typically 0.5%–2% |

| Fee Transparency | Fees and rates displayed upfront | Rates and fees may lack transparency |

China Construction Bank uses its own exchange rate, typically adding a 0.5%–2% markup on the market rate. Your actual received amount is reduced as a result. The bank may also charge intermediary fees, further decreasing the arrival amount.

Total Cost

To clearly understand the total cost difference between Wise and China Construction Bank, consider this example. If you transfer $10,000 to China:

| Transfer Method | Fee Breakdown | Fee Amount (USD) | Notes |

|---|---|---|---|

| Wise | Handling fee from 0.43% | 43 | Uses mid-market rate, no other fees |

| China Construction Bank | RMB fee + foreign currency fee + exchange rate markup | 25.5 + markup | Higher actual cost due to markup |

When transferring via Wise, the fee is about $43 with no exchange rate markup. With China Construction Bank, the fee is around $25.5, but the exchange rate markup increases the total cost beyond Wise’s. The bank may also incur intermediary fees, reducing the final amount received.

When choosing a remittance service, the differences in fees, exchange rates, and total costs between Wise and China Construction Bank are stark. Wise’s transparent fee structure and real exchange rates make it ideal for cost-conscious and efficient personal users. China Construction Bank is better for scenarios requiring higher security for large or business transfers.

Wise vs. China Construction Bank Transfer Speed

Image Source: unsplash

Wise Arrival Time

When using Wise for international transfers, your primary concern is whether funds arrive quickly. Wise’s arrival speed is industry-leading. When transferring to a Hong Kong bank account, funds can arrive in seconds to minutes. In most cases, Wise transfers are completed within half an hour. If you transfer from Japan to Hong Kong, it typically arrives within 30 minutes. This speed is ideal for urgent funding needs.

| Transfer Time Type | Time Range |

|---|---|

| Fastest Arrival Time | Seconds to minutes |

| Average Arrival Time | Within 30 minutes or 24 hours |

During peak times or special circumstances, Wise maintains relatively fast arrival times. For example, using the U.S. ACH clearing network, arrival times are reduced to T+1, 2 business days faster than the industry average. Transfers to Malaysia or Chile typically arrive in 0.5–1 business days. Even during overseas holidays or system issues, Wise’s customer service responds within 24 hours and updates progress, keeping you informed about your transfer status.

Wise’s fast arrival times provide peace of mind for scenarios like tuition, living expenses, or urgent medical payments, eliminating concerns about long wait times.

China Construction Bank Arrival Time

If you choose China Construction Bank for international transfers, arrival times are noticeably slower than Wise. Depending on the situation, CCB’s international transfers typically take 1 to 3 business days to arrive. When initiating transfers during holidays or non-working hours, banks and clearing institutions usually do not process transactions, extending arrival times. Interbank clearing systems pause or delay during holidays, preventing real-time arrivals, with processing completed on the next business day.

| Bank Name | Average International Transfer Arrival Time | Longest Arrival Time |

|---|---|---|

| China Construction Bank | 1 to 3 business days | Unspecified |

For larger amounts or special cases, arrival times are further affected by bank clearing mechanisms and transaction types. To ensure faster arrivals, initiate transfers during business hours on workdays.

If you need fast transfers, Wise has a clear speed advantage. CCB is better for non-urgent or large, secure fund transfers.

Scenario Comparison

You can refer to the table below to compare Wise and China Construction Bank’s arrival times across scenarios:

| Scenario | Wise Arrival Time | CCB Arrival Time |

|---|---|---|

| Tuition/Living Expenses | Seconds to 30 minutes | 1–3 business days |

| Urgent Medical Transfers | Minutes to 24 hours | 1–3 business days, delayed by holidays |

| Large Business Transfers | 0.5–1 business day (some markets) | 1–3 business days |

When choosing a transfer method, the speed differences between Wise and CCB are clear. Wise suits urgent personal scenarios, while CCB is better for business or large fund transfers.

Security and Compliance

Wise Security Measures

When using Wise for international transfers, you benefit from robust security measures. As a globally compliant fintech company, Wise is regulated by multiple financial authorities. For example, Wise is regulated by the UK Financial Conduct Authority (FCA), registered as a Money Services Business with FinCEN in the U.S., licensed by ASIC in Australia, and regulated by the European Central Bank and the National Bank of Belgium (NBB) in Europe. The table below lists Wise’s main regulators:

| Country/Region | Regulatory Authority |

|---|---|

| UK | Financial Conduct Authority (FCA) |

| USA | Financial Crimes Enforcement Network (FinCEN) |

| Australia | Australian Securities and Investments Commission (ASIC) |

| Europe | European Central Bank & National Bank of Belgium (NBB) |

| Singapore | Monetary Authority of Singapore (MAS) |

| Hong Kong | Hong Kong Monetary Authority (HKMA) |

Wise implements several measures to ensure your fund security:

- Fund Segregation: Stores user funds in secure banks like Citibank and Barclays, separate from company operating accounts.

- Real-Name Verification: Requires your authentic identity information to prevent illicit fund flows.

- Data Encryption: Uses advanced encryption to protect your personal and transaction data.

- Risk Monitoring: Professional teams monitor transactions in real-time to prevent fraud and money laundering.

Wise faced anti-money laundering compliance scrutiny from the National Bank of Belgium in Europe but proactively rectified issues, demonstrating its commitment to compliance.

China Construction Bank Security Measures

When using China Construction Bank for international transfers, you experience high-level security. As a major Chinese commercial bank, CCB employs multiple risk controls and technical measures to protect your funds:

- Customer Identity Verification: Ensures every transfer undergoes strict identity checks to prevent account misuse.

- Transaction Monitoring and Risk Alerts: Systems monitor abnormal transactions in real-time, issuing timely risk warnings.

- Blacklist Screening: Screens accounts linked to illegal activities to prevent funds from reaching high-risk parties.

- Internal Compliance Checks: Strictly adheres to international financial standards for anti-money laundering, anti-corruption, and anti-terrorism.

- Technical Safeguards: Uses advanced technology to protect transaction data and account security.

If your funds are frozen during an international transfer, CCB assists you in preparing materials and coordinating with relevant authorities to unfreeze them, safeguarding your rights.

User Experience

Operational Process

When transferring with Wise, the process is very straightforward. You simply follow these steps:

- Log into your Wise account with your username and password.

- Select the transfer type, destination country, and currency.

- Enter the transfer amount, and the system displays the real-time exchange rate and fees.

- Add recipient details, including name, address, and bank account.

- Choose a payment method, such as bank transfer, credit card, or debit card.

- Confirm the details and click “Send” to complete the transfer.

You can also transfer directly to Chinese bank cards or Alipay accounts. Wise requires you to complete profile details and verify identity, uploading a passport photo and selfie, and transfers can proceed after verification. The entire process can be completed on your phone or computer without visiting a physical branch.

In contrast, when transferring with China Construction Bank, you must first open an account, submit identity and address proof, and fill out multiple forms, which are reviewed before transferring. The process is more complex, suitable for business or large fund transfers.

Supported Currencies

Wise supports over 80 countries and regions, covering more than 40 currencies. You can transfer USD, EUR, AUD, CAD, and other major currencies, as well as less common ones like TRY or BRL. Wise accounts allow you to hold over 40 currencies, with personal bank account details for 8 currencies, facilitating foreign currency receipts. When transferring to China, recipients receive CNY directly.

China Construction Bank mainly supports USD, EUR, HKD, and other common currencies. If you need to transfer less common currencies, options are limited. Bank accounts typically support a single currency, offering less flexibility.

Customer Service

Wise provides multi-channel customer service. You can get help via online chat, email, or phone. Wise uses chatbots and virtual agents for quick responses to simple issues. For complex problems, the system transfers you to human support, ensuring quality. You can track progress in real-time, with SMS or WeChat notifications at key stages. Ticket resolution times have been reduced to 12 hours on average, with high user satisfaction.

China Construction Bank’s customer service relies on phone and in-branch support. You need to call the hotline or visit a branch, with longer wait times. The bank’s efficiency and transparency lag behind Wise, making it suitable for face-to-face or large business needs.

Applicable Scenarios

Personal Transfers

If you need small, fast international transfers, Wise is an excellent choice. Wise supports over 50 currencies across 70+ countries. You only need the recipient’s email or phone number, and Wise users can receive funds instantly. Wise uses the mid-market exchange rate, with fees as low as 0.33% and no hidden costs. You pay no account opening or monthly fees and have no minimum balance requirements. The Wise app notifies you after each transaction, with a simple process. You can choose multiple payment methods, with most transfers arriving within 24 hours. Funds are secure, as Wise is regulated by multiple financial authorities. You can also use the auto-exchange feature to convert at ideal rates, further reducing costs. The Wise card supports payments and withdrawals in 150+ countries without overseas transaction fees, convenient for global fund use.

If you prioritize low costs, transparent fees, and efficiency, Wise excels in personal transfer scenarios. Compared to CCB, Wise outperforms in fees, speed, and ease of use for personal users.

Business/Large Transfers

If you’re a business user or need large transfers, Wise and China Construction Bank each have strengths. Wise offers business accounts supporting 40+ currencies. You can access batch payments, multi-user management, and accounting integrations. Business accounts charge a one-time $31 fee for receiving account details, with transfer fees starting at 0.33%. The table below compares Wise’s personal and business accounts:

| Feature/Fee | Personal Account | Business Account |

|---|---|---|

| Account Opening Fee | Free | Free |

| Supported Currencies | 40+ | 40+ |

| Receiving Account Details | Free | $31 |

| Batch Payments | Not supported | Supported |

| Multi-User Access | Not supported | Supported |

| Accounting Integration | Not supported | Supported |

When using Wise for large or business transfers, note restrictions like CNY transfer single and annual limits, and batch payments don’t support CNY as a target currency. For large transfers, you may need tax proof to raise limits. Recipients must verify within a set time, or transfers may be delayed or canceled.

If you prioritize fund security, network coverage, and stability, China Construction Bank is more suitable. Bank channels suit large fund transfers, with relatively stable rates but higher fees and 3–7 business day arrivals. You need more documentation, and the process is complex.

Choose based on your needs. For small, urgent personal transfers, Wise is more efficient. For business or large transfers, Wise and CCB each have strengths; weigh fees, speed, and compliance requirements.

When selecting an international remittance service, the differences between Wise and China Construction Bank are clear. Wise offers transparent fees, real market rates, fast transfers, and a user-friendly experience. China Construction Bank has higher fees and longer arrivals, suitable for large or business transfers. The table below summarizes their differences in fees, speed, and experience:

| Dimension | Wise | China Construction Bank |

|---|---|---|

| Fees | Low and transparent | High and complex |

| Speed | Fast and trackable | 2–3 business days |

| Experience | Simple and user-friendly | Complex process |

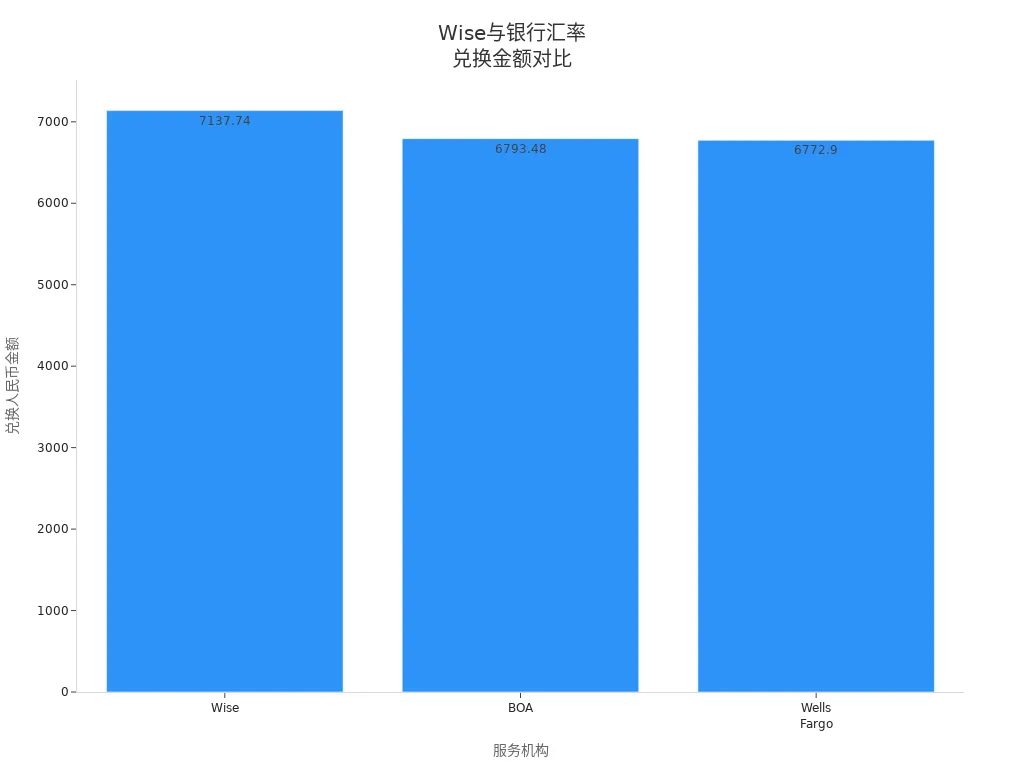

You can refer to the bar chart below, showing Wise’s CNY amount for $1,000 USD far exceeds traditional banks:

If you need small, fast transfers, Wise is ideal. If you prioritize fund security or business transfers, China Construction Bank is a safer choice. Choose based on your specific needs.

FAQ

How long does a Wise transfer to a Chinese bank card take?

You typically receive funds within 30 minutes to 24 hours. In most cases, it’s much faster than Hong Kong banks. You can track progress in real-time.

Does China Construction Bank have a limit for international transfers?

Your single transfer limit with CCB is $31,000. Large transfers require additional proof, with strict bank reviews.

Which is safer, Wise or China Construction Bank?

Both Wise and CCB offer high security. Wise is regulated by multiple countries with fund segregation. CCB has strict risk controls and compliance measures.

What payment methods does Wise support?

You can choose bank transfers, credit/debit cards, or Wise account balance. Fees and speeds vary by method.

How to choose the best transfer method?

Choose based on amount, speed, and fees. Use Wise for small, urgent transfers and CCB for large or business transfers.

After comparing remittance services from Wise and China Construction Bank, you’ll find that each has its focus: Wise excels at personal small-amount transfers, while CCB is more suited for large corporate transactions. However, this “either/or” choice often makes it difficult to balance low costs, high efficiency, and diverse needs. To solve this pain point, BiyaPay offers a more comprehensive and flexible financial solution.

We not only provide remittance fees as low as 0.5%, significantly reducing your costs, but also support same-day delivery to most countries and regions worldwide, completely revolutionizing your cross-border remittance experience. BiyaPay’s core advantage is its ability to manage both personal and corporate remittances from a single account, along with supporting the conversion between various fiat and digital currencies. Say goodbye to complex choices and non-transparent fees, and register now to start your new journey in smart finance.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.