- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Detailed Comparison of Wise and PayPal/Xoom International Remittance Fees

Image Source: unsplash

When choosing an international remittance service, the fee structures of Wise and PayPal/Xoom differ significantly. Wise uses a percentage-based fee, with fees varying by amount and high transparency. PayPal/Xoom primarily charges fixed or tiered fixed fees, with additional currency conversion fees for some payment methods. The table below shows the international remittance fee structures for different services:

| Remittance Service | Fee Structure | Specific Fee Details |

|---|---|---|

| Wise | Percentage-based fee | Lower and transparent fees, with real-time exchange rate and fee details |

| Xoom (PayPal) | Fixed/tiered fixed fees | Higher fees, some payment methods incur currency conversion fees, lower exchange rate transparency |

You usually get a higher received amount with Wise, and actual costs are easier to manage. It’s recommended to focus on each fee component and the received amount rather than just the apparent handling fee.

Key Points

- Wise’s international remittance fees are transparent, using a fixed plus percentage-based fee structure, with exchange rates close to the market mid-rate and no hidden fees.

- PayPal/Xoom fees are higher and more complex, with exchange rate markups and intermediary bank deductions, often resulting in lower-than-expected received amounts.

- Bank international remittance fees are numerous and complex, including multiple handling fees and telegraph fees, with longer transfer times and less transparency.

- When choosing an international remittance channel, focus on all fees and exchange rates, prioritizing the received amount over apparent handling fees.

- For small remittances, Wise is recommended to save on fees; for large remittances, Wise’s percentage fees are lower, while PayPal/Xoom is suitable for urgent transfer needs.

International Remittance Fee Structure

International remittance fees typically consist of three main components: remittance handling fees, telegraph fees, and intermediary bank fees. When choosing different remittance methods, the structure and transparency of these fees directly affect your actual received amount. Below, I will detail the fee components of Wise, PayPal/Xoom, and banks, using tables for comparison to help you clearly understand their advantages and disadvantages.

Wise Fee Components

When you use Wise for international remittances, the fee structure is highly transparent. Wise primarily charges two types of fees:

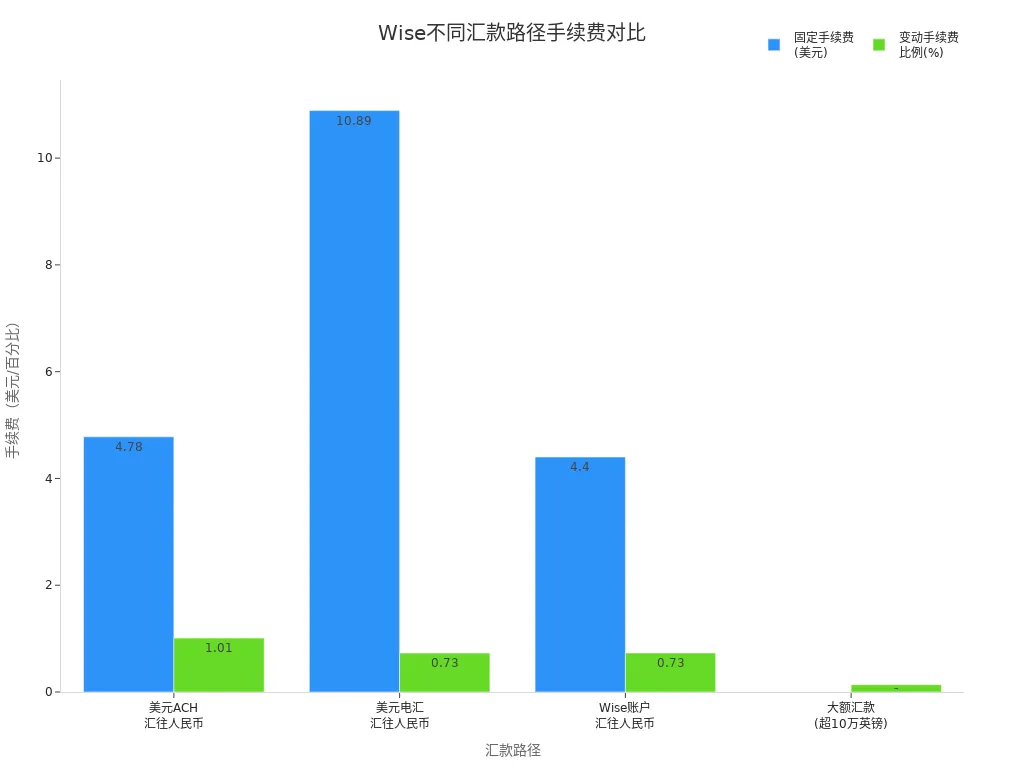

- Fixed fee: A fixed amount is charged per remittance. For example, when remitting USD (ACH payment) to RMB, the fixed fee is 4.78 USD. If you choose wire transfer payment, the fixed fee is 10.89 USD.

- Percentage fee: A proportional fee is charged based on the remittance amount. For instance, when remitting USD to RMB, the variable fee for ACH payment is 1.01%, and for wire transfer, it’s 0.73%.

- Exchange rate transparency: Wise uses the real-time mid-market rate without markups. You can see all fees and the final received amount clearly before remitting via Wise’s fee calculator on their website.

| Remittance Path | Fixed Fee | Variable Fee Percentage | Notes |

|---|---|---|---|

| USD (ACH payment) to RMB | 4.78 USD | 1.01% | Suitable for small remittances |

| USD (Wire transfer) to RMB | 10.89 USD | 0.73% | Fees vary by payment method |

| Wise account payment to RMB | 4.40 USD | 0.73% | Lower fees |

| Large remittances (over 100,000 GBP/month) | N/A | 0.1%-0.17% | Automatic discounts apply |

On Wise, you can check the fees for each international remittance at any time; the fee structure is simple, with no hidden fees, and the received amount is clear.

PayPal/Xoom Fee Components

When you choose PayPal or Xoom for international remittances, the fee structure is relatively complex. It mainly includes:

- Fixed or tiered fixed fees: PayPal/Xoom typically charges fixed fees based on remittance amount ranges. For example, a 1000 USD remittance may incur a 10-30 USD fee.

- Percentage fees: In some cases, PayPal/Xoom also charges a proportional fee based on the amount, especially for credit or debit card payments.

- Exchange rate markup: PayPal/Xoom adds a markup to the real-time exchange rate, reducing the actual received amount.

- Other fees: If intermediary or receiving banks are involved, additional fees may apply, which are often not fully predictable before remitting.

When using PayPal/Xoom, the actual received amount may be reduced due to exchange rate markups and intermediary bank deductions, with lower fee transparency.

Bank Fee Components

When you remit through a bank, the fee structure is the most complex. Bank international remittance fees generally include the following:

- Originating bank remittance fee: Banks charge a percentage of the remittance amount, typically 0.1%-0.2%, with minimum and maximum fee limits. For example, Bank of China charges 1‰, with a minimum of 50 USD and a maximum of 1000 USD.

- Telegraph fee: Banks charge for processing telegraph services, usually 10-25 USD, with some charging per transaction.

- Intermediary bank fee: When there’s no direct account relationship between the originating and receiving banks, intermediary banks charge 8-25 USD.

- Receiving bank fee: The receiving bank may also charge a fee upon receipt of funds.

- Fee-sharing method: You can choose OUR (all fees borne by you), SHA (shared between you and the recipient), or BEN (all fees borne by the recipient).

| Bank Name | Fee Item | Fee Standard | Minimum Fee | Maximum Fee | Notes |

|---|---|---|---|---|---|

| Bank of China | Remittance fee | 1‰ of remittance amount | 50 RMB/transaction | 1000 RMB/transaction | Plus telegraph fee of 10-25 USD |

| Postal Savings Bank | Remittance fee | 0.8‰ of remittance amount | 20 RMB/transaction | 200 RMB/transaction | Telegraph fee of 10 USD/transaction |

| Hangzhou United Bank | Remittance fee | 1‰ of remittance amount | 20 RMB/transaction | 250 RMB/transaction | Telegraph fee charged separately |

Bank international remittance fee structures are complex, with additional telegraph fees, intermediary bank fees, and exchange rate markups. The total fees you actually pay are often higher than expected, and the received amount may be reduced due to multiple deductions.

Comparison of International Remittance Fee Structures Across Channels

| Channel | Fee Structure | Transparency | Hidden Fee Risk |

|---|---|---|---|

| Wise | Fixed + percentage fees | High | Low |

| PayPal/Xoom | Fixed/tiered + percentage | Medium | Medium-High |

| Bank | Multiple fees + percentage | Low | High |

When choosing an international remittance channel, it’s recommended to focus on fee structure transparency and hidden fees. Wise’s fee structure is the clearest, while PayPal/Xoom and banks may have multiple hidden costs affecting your actual received amount.

Wise Fee Details

Image Source: unsplash

Fixed Fees

When you use Wise for international remittances, you first encounter fixed fees. These fees are closely tied to the payment method. For example, with USD wire transfer payments, the fixed fee is 6.11 USD. If you choose credit card payment, Wise charges a proportional fee of 7.32%, and for debit card, it’s 2.42%. For ACH debit, the fee is 0.28%. You can refer to the table below for fixed fee standards for different payment methods:

| Payment Currency | Payment Method | Fixed Fee Standard |

|---|---|---|

| USD | Wire transfer | 6.11 USD |

| USD | Credit card | 7.32% |

| USD | Debit card | 2.42% |

| USD | ACH debit | 0.28% |

Wise accounts have no maintenance fees, and opening an account is free. Holding multiple currencies incurs no additional fees. Each time you remit, the system automatically calculates the fixed fee, making the fee structure clear.

Percentage Fees

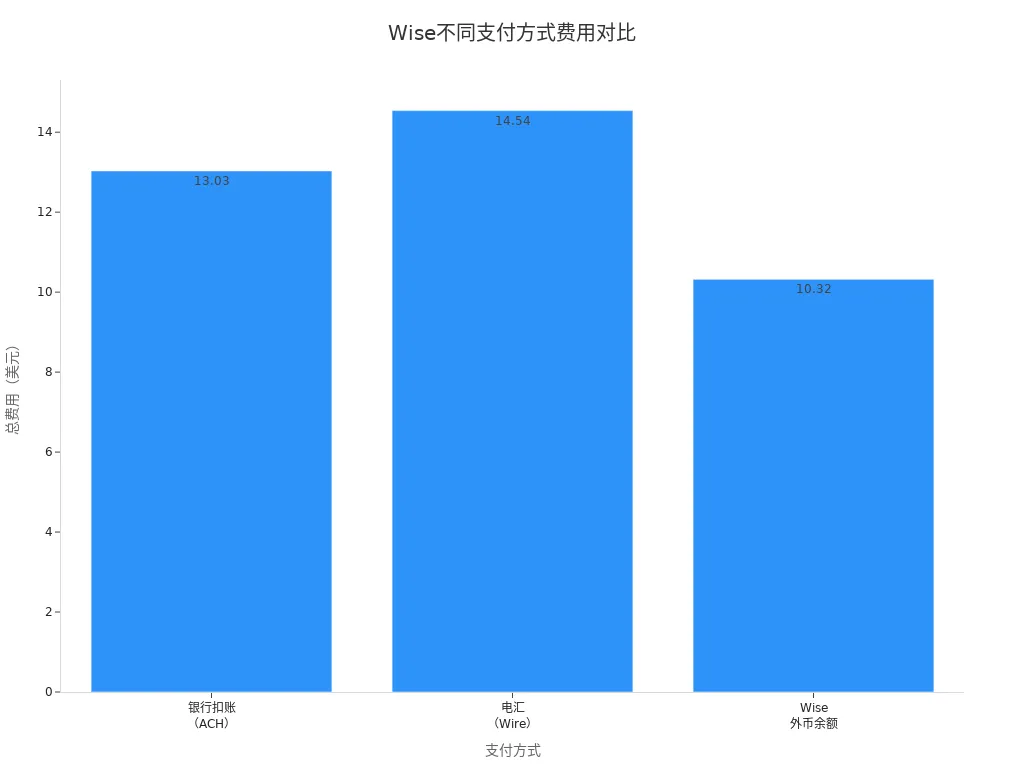

In addition to fixed fees, Wise charges percentage fees. These mainly include exchange rate conversion fees and service fees. Wise charges a proportional fee based on the currency pair and amount. For example, remitting 1000 USD via bank ACH debit incurs a fixed fee of 0.94 USD and a percentage fee of 1.22%, totaling approximately 13.03 USD. For wire transfer, the fixed fee is 4.46 USD, and the percentage fee is 1.02%, totaling about 14.54 USD. You can compare the fees for different payment methods in the table below:

| Payment Method | Fee Calculation | Example Fee (1000 USD Remittance) |

|---|---|---|

| Bank ACH debit | Fixed fee 0.94 USD + 1.22% | ~13.03 USD |

| Wire transfer | Fixed fee 4.46 USD + 1.02% | ~14.54 USD |

| Wise foreign currency balance | Fixed fee 0.6 USD + 0.98% | ~10.32 USD |

After entering the amount on Wise’s website, the system automatically displays all fees and the estimated received amount. Wise’s percentage fees are typically below 1%, with only some less common currencies exceeding 1%. This fee structure gives you greater control over international remittance fees.

Exchange Rate Transparency

Wise uses the market mid-rate without any hidden markups. When initiating a remittance, you can see the real-time exchange rate and all fees directly. Unlike traditional banks that add 2-3% markups, Wise only charges a single fee, and you don’t need to worry about additional costs. You can experience Wise’s exchange rate transparency through the following steps:

- Wise’s exchange rate follows the real-time market rate, with no hidden markups.

- After entering the amount on Wise’s website, the system automatically calculates fees, exchange rates, and the estimated received amount.

- Wise’s fee structure is transparent, with all fees clearly displayed before the transfer.

- Your actual received amount is maximized, avoiding losses due to exchange rate markups and hidden fees.

Wise’s international remittance fee structure is simple and transparent, with no hidden fees. You can easily manage each fee and the received amount, ensuring secure and efficient fund transfers.

PayPal/Xoom Fee Details

Fixed Fees

When you use PayPal or Xoom for international remittances, you first encounter fixed fees. Fee standards vary by remittance method and amount. You can refer to the table below for common fixed fee standards:

| Fee Type | Fee Standard (USD) | Notes |

|---|---|---|

| Withdrawal to Chinese bank | 35 | 15 USD refunded if withdrawal fails |

| Withdrawal via Hong Kong bank | Free for ≥128 USD, 4.5 USD for <128 USD | 2.6 USD refunded if withdrawal fails |

| Commercial payment fixed fee | 0.31 | Applies to China region |

| Small payment fixed fee | 0.05 | Applies to China region |

| Currency conversion fee | 0.2% for USD, 2.5% for other currencies | Exchange rate-related |

You can see some fees before remitting, but the actual received amount is also affected by other factors.

Percentage Fees

In addition to fixed fees, PayPal and Xoom charge percentage-based fees. For cross-border transfers, you typically pay 2.9% plus 0.3 USD. If you’re the recipient, the fee is about 4.4% plus 0.3 USD. When withdrawing to a Chinese bank account, the fee is 4.4% of the transfer amount plus 0.3 USD. For large remittances, the overall fee percentage is higher, especially when currency conversion is involved.

When using PayPal/Xoom for international remittances, percentage fees increase with the amount, significantly impacting large transactions.

Exchange Rate Markup

PayPal and Xoom’s exchange rates are typically below the market mid-rate. When remitting, the system automatically converts USD to the target currency, but the actual rate includes a 5%-9% markup. You may lose money due to exchange rate differences during conversion. User feedback indicates that overall conversion losses (including exchange rate differences and fees) are about 9%. When remitting on non-business days, Xoom’s fees and exchange rate markups are higher, potentially resulting in lower-than-expected received amounts.

- PayPal withdrawal fees are 4.4% of the transfer amount plus 0.3 USD.

- Cross-regional transfer fees are 2.9% plus 0.3 USD.

- Exchange rate markups typically range from 5%-9%, varying by amount and currency.

- Overall costs are higher for large conversions.

When using Xoom, exchange rates are not transparent, and the final rate may differ from the displayed rate after payment. Intermediary bank deductions also affect the actual received amount. When choosing PayPal/Xoom for international remittances, it’s recommended to calculate all fees in advance, paying attention to exchange rate changes and hidden costs.

Although PayPal and Xoom support multiple payment methods and offer fast transfer speeds with good user experience, you should pay attention to the international remittance fee structure and hidden fees during actual operations to ensure secure fund transfers.

Real-World Case Comparison

Image Source: unsplash

Fee Comparison for a 1000 USD Remittance

You want to remit 1000 USD from the U.S. to China. You can choose Wise, PayPal/Xoom, or a Hong Kong bank. Each method has a different fee structure, resulting in varying actual costs. The table below helps you compare the main fees for the three channels:

| Channel | Fixed Fee (USD) | Percentage Fee | Exchange Rate Markup | Other Potential Fees | Estimated Total Fee (USD) |

|---|---|---|---|---|---|

| Wise | 4.78 | 1.01% | None | None | 14.79 |

| PayPal/Xoom | 10-30 | 2.9%-4.4% | 5%-9% | Intermediary bank deductions | 60-90 |

| Hong Kong Bank | 20-50 | 0.1%-0.2% | 2%-3% | Telegraph fee, intermediary bank fee | 40-80 |

You can see that Wise’s fee structure is the simplest, with all fees visible before remitting. PayPal/Xoom and Hong Kong banks have higher fees and hidden costs. Pay special attention to the components of international remittance fees when choosing.

Received Amount Comparison

Your main concern is likely how much the recipient will actually receive. The received amounts vary significantly across channels. Below, I analyze this with a list:

- Wise Received Amount

- You remit 1000 USD, with total fees of approximately 14.79 USD.

- Wise uses the real-time mid-market rate without markups.

- The recipient actually receives about 985.21 USD equivalent in RMB.

- PayPal/Xoom Received Amount

- You remit 1000 USD; after fees and exchange rate markups, the actual received amount is significantly reduced.

- Assuming total fees of 70 USD, the recipient actually receives about 930 USD equivalent in RMB.

- If intermediary bank deductions occur, the received amount will be even lower.

- Hong Kong Bank Received Amount

- You remit 1000 USD; after fees and exchange rate markups, the recipient actually receives about 940-960 USD equivalent in RMB.

- If intermediary and receiving banks charge additional fees, the received amount may fall below 940 USD.

In actual operations, Wise offers the highest received amount with the most transparent fees. PayPal/Xoom and Hong Kong banks’ actual received amounts are affected by multiple fees, often lower than expected.

Tip:

When choosing an international remittance channel, don’t focus only on apparent handling fees. Consider all fees and exchange rates, focusing on how much the recipient will actually receive. This way, you can truly reduce international remittance fees and improve fund utilization efficiency.

Scenario Recommendations

Small Remittances

When making small international remittances, fees and transfer speed are the most important factors. Wise and PayPal/Xoom perform differently in this regard. You can refer to the table below to quickly understand their main differences:

| Remittance Service | Fee Details | Exchange Rate | Transfer Time | Other Features |

|---|---|---|---|---|

| Wise | Lower and transparent fees, free for first remittance up to 600 USD | Close to mid-market rate | Typically ~2 business days | Suitable for small remittances, slower transfer time |

| Xoom (PayPal) | ~30 USD for debit/credit card remittances, free for bank account transfers with limits | Converted at daily rate | As fast as 1 minute | Offers Chinese language support, fast transfers, higher fees |

If you’re remitting just a few hundred USD, Wise can save on fees and provide a higher received amount. If you need urgent transfers, choose Xoom, but watch out for fees and exchange rate markups.

Large Remittances

For large remittances, fee percentages and exchange rate markups impact actual costs. Wise typically has lower costs than PayPal/Xoom on most remittance routes. You can make choices based on the following points:

- Wise’s large remittance fee percentage is low, with exchange rates close to the market mid-rate, suitable for remittances over 1000 USD.

- PayPal/Xoom’s large remittance fees are higher, with significant exchange rate markups, reducing the actual received amount.

- Hong Kong banks have lower fees but include telegraph and intermediary bank fees, making received amounts uncertain.

If you aim to maximize the received amount, Wise is the better choice. If you prioritize transfer speed, consider PayPal/Xoom, but calculate all fees in advance.

Transfer Speed

When choosing an international remittance channel, transfer speed is also a key factor. Wise typically takes 2 business days, suitable for non-urgent scenarios. PayPal/Xoom can transfer as fast as 1 minute, ideal for urgent remittances. Hong Kong banks take longer, usually 2-5 business days.

In actual operations, choose channels flexibly based on remittance amount and transfer needs. For low costs and high transparency, Wise is more suitable. For urgent transfers, prioritize PayPal/Xoom, but watch out for fees and exchange rate markups.

When choosing an international remittance service, the fee structures and actual costs of Wise and PayPal/Xoom differ significantly. Although PayPal/Xoom has fixed fees, its exchange rates are below the daily interbank mid-rate, leading to higher actual costs. Wise uses near mid-market rates with a transparent fee structure, effectively reducing international remittance fees. When evaluating services, compare fees and exchange rates across platforms, prioritizing those with rate locking and transparent fees. You should also thoroughly understand potential hidden fees to avoid extra costs from intermediary banks. Overall, Wise is suitable for those seeking low costs and high transparency, while PayPal/Xoom fits scenarios requiring extremely fast transfers. In actual operations, it’s recommended to regularly monitor fee policy changes, choosing cost-effective and regulated platforms to ensure fund safety.

FAQ

Do Wise and PayPal/Xoom fees vary with the amount?

When you remit with Wise, fees are charged as a percentage of the amount. PayPal/Xoom has some fixed fees and some percentage-based fees. The larger the amount, the higher PayPal/Xoom’s total fees typically are.

Which method is fastest for remittances to China?

PayPal/Xoom remittances can arrive in as little as a few minutes. Wise typically takes 1-2 business days. Hong Kong bank remittances take longer, usually 2-5 business days.

How does Wise’s exchange rate differ from banks?

Wise uses the market mid-rate without markups. Hong Kong banks typically add 2%-3% markups. You get a higher received amount with Wise.

Does PayPal/Xoom have hidden fees?

When remitting with PayPal/Xoom, you may encounter exchange rate markups and intermediary bank deductions. These fees are hard to see before remitting. Calculate total costs in advance.

Are fees refunded if a remittance fails?

If a Wise remittance fails, fees are fully refunded. PayPal/Xoom may refund some fees but sometimes deducts a portion. Read platform rules carefully.

After a detailed analysis of the fee differences between Wise and PayPal/Xoom, you’ll find that although each has its strengths, you still have to compromise between fee transparency and delivery speed. Wise is transparent but can lack speed, while PayPal/Xoom is fast but has exchange rate markups and hidden costs. To solve this dilemma, BiyaPay offers a superior solution. We not only provide remittance fees as low as 0.5%, significantly reducing your costs, but also support same-day delivery to most countries and regions worldwide, completely revolutionizing your cross-border remittance experience. Our platform supports the conversion between various fiat and digital currencies and provides a real-time exchange rate converter, allowing you to easily manage your global assets on a single platform. Say goodbye to the difficult choice, and register now to start your new journey in smart finance.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.