- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Complete Guide to Wise Registration, Activation, and Transfers to U.S. Accounts

Image Source: unsplash

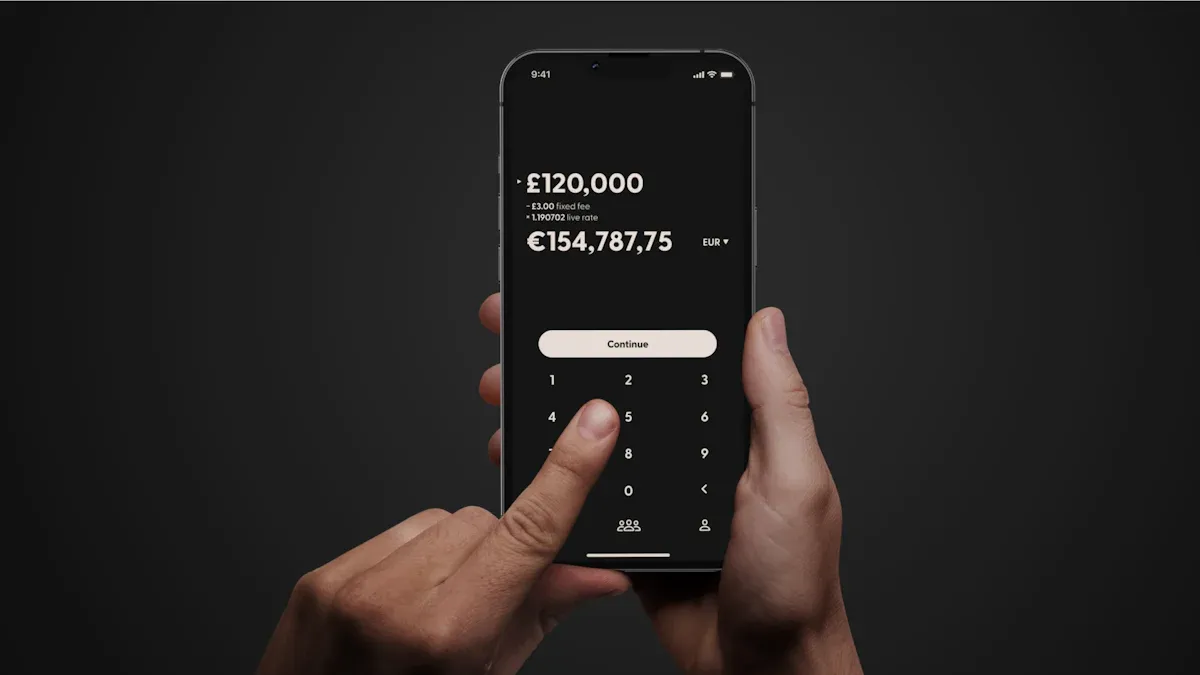

You can use Wise to transfer funds directly from China to U.S. bank accounts, with the recipient not needing to register, making the process highly convenient. Wise excels in transfer speed and fee transparency, leading the industry. The table below compares Wise with traditional banks (e.g., Hong Kong banks):

| Metric | Wise Performance | Traditional Bank Performance |

|---|---|---|

| Transfer Speed | Supports local real-time transfers, with some arriving instantly | Typically takes 2–3 business days, some banks longer |

| Fee Transparency | Uses mid-market exchange rate, transparent fees visible before transfer, no hidden costs | Rates include markups, various wire transfer fees, opaque costs, may result in shortfall |

| Fee Comparison | On average 3 times cheaper than U.S. banks | Higher fees with multiple charges |

You can choose from multiple payment methods, suitable for both individual and business users.

Key Highlights

- Wise transfer fees are low and transparent, with fees of only 0.5%–1%, using near mid-market exchange rates, avoiding hidden costs.

- Registering a Wise account is simple and fast, requiring only a passport, phone number, and email, with identity verification typically completed in 1–2 days.

- When transferring to the U.S., the recipient doesn’t need a Wise account, only accurate bank account details.

- Wise supports multiple payment methods with fast transfers, 50% of transfers arriving instantly and 90% within 24 hours.

- Wise prioritizes fund security, using encryption and two-step verification, with funds held in top global banks, ensuring user protection.

Wise Overview

Platform Advantages

Wise is a fintech company focused on cross-border remittances. You can enjoy fees as low as 0.5%–1% through Wise, significantly lower than traditional banks like Hong Kong banks. Wise uses real mid-market exchange rates, with transparent rates and no hidden fees. You can clearly see all fees and the final amount before transferring. Transfers are also fast, typically completing within hours to two days. Wise supports multi-currency account management, allowing you to manage USD, EUR, and other currencies simultaneously. You can directly obtain U.S. local bank account details (e.g., ACH), greatly enhancing collection convenience.

Wise ranked second in the 2025 U.S. third-party payment platform evaluation, demonstrating strong market recognition and competitiveness.

The table below compares Wise’s key advantages with traditional banks:

| Advantage Category | Wise Performance | Traditional Banks (e.g., Hong Kong Banks) Performance |

|---|---|---|

| Fees | 0.5%–1%, transparent fees | 2%–5%, with hidden fees |

| Exchange Rate | Uses real mid-market rate | Rates with markups, opaque fees |

| Transfer Speed | Hours to 2 days | Typically 2–5 business days |

| Multi-Currency Management | Supports one-click multi-currency account management | Limited to single currency or cumbersome operations |

| Local Account Details | Provides U.S. local account details (e.g., ACH) | Only supports international wires, complex procedures |

Applicable Scenarios

Wise is suitable for various users and scenarios. You can choose the appropriate account type and services based on your needs:

- If you need to make large transfers, Wise offers real-time exchange rates and transparent fees, effectively saving costs.

- If you prioritize transfer speed and fund security, Wise supports real-time transfers with high security.

- If you need to manage multi-currency accounts, Wise provides comprehensive currency accounts and debit cards, facilitating management of USD and other currencies.

- If you’re a business user, Wise business accounts support batch payments, team management, and API integration, ideal for cross-border e-commerce, freelancers, and international trade businesses.

- Wise services cover major markets like the U.S., UK, Australia, and Singapore, suitable for users with transfer needs in these regions.

Wise operates legally and compliantly in China, with partnership agreements with China UnionPay and Alipay. You need real-name authentication and should avoid frequent IP changes or large irregular transfers to ensure account security. Personal accounts cannot be used for commercial collections; business users should register business accounts for more stable services and additional features.

Registration and Activation

Image Source: unsplash

Registration Process

You can complete registration via the Wise website or mobile app. The process is very simple, typically requiring just a few steps:

- Open the Wise website or download the Wise app and click “Register.”

- Choose a personal or business account, and enter your email, Facebook, Apple, or Google ID.

- Enter your residency information, provide your phone number, and complete SMS verification.

- Set a login password, and after submission, you’ll receive an activation email; click the link to activate your account.

- After logging in, go to the profile page to complete details like name, date of birth, and address.

- For your first transfer, the system will prompt you to upload ID documents and a selfie for identity verification.

Registration and verification are generally completed within 1–2 business days. If additional documents are needed, Wise will notify you via the app and email. You can check verification progress anytime in the app.

Required Materials

To register a Wise account, you need to prepare the following materials:

- Valid passport (Chinese users should prioritize passports, as ID cards are typically not supported)

- Personal phone number

- Commonly used email

- Residency address details

Wise supports remote online registration without needing to visit a counter. You only need to prepare the above materials and upload them as guided. Business accounts also require company registration certificates, articles of association, and director/shareholder lists.

Identity Verification

Wise’s identity verification process is relatively strict, including the following steps:

- Upload a passport photo and a selfie. Chinese users must upload a passport, as ID cards are generally not accepted.

- Verification typically takes 1–2 business days, sometimes completing in minutes. Results are notified via the app and email.

- If the passport photo is unclear or unrecognizable, you can retry uploading multiple times. The system also has a manual review mechanism to ensure information authenticity.

- Generally, address proof is not required during registration. It may be needed only for large transfers or debit card applications.

For initial account activation, Wise usually requires a small deposit. Some users report that depositing $20 (USD) successfully activates the account. You can deposit via bank transfer, cryptocurrency transfer, or other methods. The deposit amount can be as low as $1 (USD), but follow system prompts. If you encounter risk control restrictions, try changing the deposit method or contact customer service for assistance.

Tip: Passport processing costs about 200 RMB; prepare it in advance. After the initial deposit, account features are enhanced, improving the transfer experience.

Wise Transfers to the U.S.

Image Source: pexels

Adding a Recipient

When transferring to the U.S. via Wise, you first need to add recipient information. The Wise platform guides you step-by-step to ensure accuracy. The steps are as follows:

- Enter the recipient’s name, preferably in English or pinyin full name.

- Provide the recipient’s bank account details, including the account holder’s full name and account number.

- Enter the recipient’s detailed address, including country, city, specific address, and zip code.

- The recipient’s email is optional; you can choose to fill it or skip it.

- After completing the above, click Continue to proceed.

- The system will require identity verification; verify using your phone, select the issuing country of your ID (Chinese users need a passport), and upload a passport photo and selfie to complete verification.

- Once verified, you can log in to Wise to confirm transfer details and make the payment.

Tip: The recipient doesn’t need a Wise account; they only need to provide bank details to receive funds. You can transfer to any major U.S. bank account, including those supporting ACH.

Entering Bank Details

You need to accurately enter the U.S. recipient’s bank details. Wise supports U.S. local bank accounts (ACH) and wire transfers. Pay attention to the following when filling out:

- Bank name and routing number

- Bank account number

- Recipient’s name (must match the bank account)

- Recipient’s address (for compliance review)

If the information is incorrect, the transfer may fail or be delayed. Wise will prompt you to double-check all details before submission.

Tip: U.S. bank account details typically include the Routing Number and Account Number. Request these from the recipient to ensure a smooth transfer.

Choosing Currency and Amount

Wise transfers support over 40 currencies for conversion to USD, allowing you to choose the transfer currency and amount based on your needs. Wise accounts let you hold multiple currency balances, which can be converted to USD anytime. The process is as follows:

- Select the payment currency on the Wise platform (e.g., RMB, HKD, EUR).

- Enter the transfer amount, and the system will display the convertible USD amount.

- Wise uses the mid-market exchange rate, updated in real-time, with no hidden markups.

- You can use the fee calculator on the Wise website or app to instantly check rates and fees.

- If you want to convert at a specific rate, you can set an auto-conversion feature, supporting 24 currencies.

Wise supports RMB-to-USD conversions with transparent rates and low fees. You can estimate the received amount in advance, avoiding losses from rate fluctuations.

Payment Methods

Wise transfers to the U.S. support multiple payment methods. You can choose the appropriate method based on your funding source and desired transfer speed. The table below compares payment methods’ transfer speeds and fees:

| Payment Method | Transfer Speed | Fee and Rate Details |

|---|---|---|

| Bank Transfer | 3–5 business days | Lowest fees, typically the cheapest option |

| Bank Card (Debit/Credit) | Faster, some transfers instant | Fees vary by method, starting at about 0.41% |

| SWIFT | Slower, requires intermediary banks | Higher fees, longer processing |

| Google Pay/Apple Pay | Fast, some transfers instant | Fees vary by method |

You can pay via bank transfer, Alipay, Wise account balance, credit, or debit card. Transfer speeds and fees vary slightly by method. Wise transfers are 50% instant and 90% within 24 hours, far faster than traditional channels like Hong Kong banks.

Fees and Exchange Rates

Wise transfers use a transparent fee structure and real-time mid-market rates. You can see all fees and the expected received amount before transferring. The table below outlines Wise’s main fees and rate mechanisms:

| Item | Description |

|---|---|

| Fee Rate | Personal transfers: 0.5%–1%; business clients with monthly transactions over $100,000 get 0.4% tiered rates, far lower than traditional banks like Hong Kong banks. |

| Exchange Rate Mechanism | Uses real-time interbank market rates, updated every 30 seconds, with a 0.3%–0.8% spread, supports 72-hour rate locking. |

| Rate Locking Service | Offers 24-hour rate locking (minimum $50,000) and 1–6 month forward locking for short- and long-term rate risk management. |

| Hidden Fees | Refund processing fee: $10/transfer; wire refund: $5/transfer; intermediary banks may charge 0.1%–0.4% transfer fees. |

| Regional Fee Variations | Southeast Asia: 0% intermediary fees; Europe: 0.1% VAT compliance fee; emerging markets: 0.5%–1% higher fees. |

| Official Fee Schedule | Details personal and business rates, hidden fees, and regional differences, meeting inquiry needs. |

You can use Wise’s online fee calculator, entering the amount and currency to see fees, rates, and expected received amounts. Wise’s fee structure includes fixed and percentage-based fees, typically under 1%, with no hidden costs and rate locking for cost savings.

Transfer Speed

Wise transfers to the U.S. are very fast. You can estimate transfer times based on the payment method and bank processing speed. Common transfer times include:

- Wise transfers to the U.S. generally arrive within 8 hours, with some in 1–2 hours.

- Bank debit (ACH) transfers typically arrive in 2 hours.

- Debit and credit card transfers can arrive in 2 hours, supporting fast transfers.

- Wire transfers are slower, requiring manual processing, taking an average of 1–3 business days.

- Wise does not always support real-time transfers; bank transfers are slower.

Wise transfers support U.S. banks’ ACH transfers, ideal for daily electronic payments with low, stable fees. Wire transfers suit large or urgent payments, being fast but more expensive. You can choose the appropriate method based on needs to ensure secure and efficient transfers.

When setting up a transfer on Wise, you can view the estimated arrival time, and after initiating, you can track progress in real-time via the app or website. Wise transfers go directly to the recipient’s bank account, avoiding intermediary fee risks of traditional banks.

Common Issues

Transfer Time

When using Wise to transfer to the U.S., funds typically arrive within hours. However, issues like account verification or incorrect details may cause delays. Common reasons include:

- Compliance reviews for new Wise accounts may result in rejected or held transfers.

- Incorrect account details or frozen accounts prevent funds from being credited.

- Slow customer service responses and complex processes may delay funds.

- Funds may be temporarily held by intermediary institutions (e.g., Synapse Financial Technologies).

- Lack of direct communication channels makes issue resolution challenging.

Some users report that errors in identity details and slow customer service responses can delay the process by nearly two months. Be extra careful when entering details and submitting materials, and follow up through multiple channels if issues arise.

Transfer Limits

Wise transfers have clear limits for single transactions, daily, and annual amounts. Refer to the table below for details on transfer limits:

| Funding Method | Single Transaction Limit (USD) | Daily Limit (USD) | Annual Limit (USD/RMB) | Remarks |

|---|---|---|---|---|

| Direct Bank Card Funding | 4,300 | 10,000 | 50,000 USD/year | Uses forex quota |

| Alipay to Bank Card | 7,000 | N/A | 70,000 USD/year | Does not use forex quota, max 5 transfers/month |

When using Wise in China, you have an annual forex quota of $50,000 (USD). Alipay transfers do not use the forex quota but are limited to 5 transfers per month. Some banks, like Hong Kong banks, also impose single-transaction limits; check in advance.

Security

Wise prioritizes fund security and user privacy. You can protect your account with the following measures:

- Enable two-step verification to prevent unauthorized access.

- Set up instant notifications to monitor account activity.

- Freeze or unfreeze your account anytime to ensure fund security.

- Wise uses encryption to protect transaction data, preventing leaks.

- Funds are held in top global banks, like Citibank and Barclays, strictly complying with regulations.

Wise also has 24/7 anti-fraud mechanisms and a risk control team, monitoring transactions in real-time to prevent financial risks. Keep your account details secure to avoid leaks.

Information Entry

When entering recipient details, ensure the name, bank account number, and Routing Number are accurate. Errors can lead to failed or delayed transfers. Verify all details with the recipient in advance, especially the U.S. bank’s Routing Number and Account Number. Wise’s customer service channels are limited, with slower response times. You can follow up via the app or email multiple times, seeking third-party assistance if needed.

Fee Structure

Wise’s transfer fee structure is transparent, mainly including transfer and conversion fees. The table below outlines key fee items:

| Fee Item | Wise Fee Details | Remarks and Examples |

|---|---|---|

| Transfer Fee | ACH: ~0.13%; debit/credit card: 1.56%–5.01%; wire: ~$3.52 (USD) fixed | $1,000 ACH: ~$4.22; wire: ~$6.44 |

| Conversion Fee | Starts at 0.43%, large conversions (>10,000 USD) discounted to 0.35%, special currencies add 0.2% | $100,000 conversion saves over $40 |

| Hidden Fees | Recipient fixed fees (e.g., $2.92), ATM withdrawal fees, expedited fees | ATM withdrawals over limit: 1.5% + $2; expedited fees increase rates |

| Exchange Rate Spread | Uses near mid-market rate, with 0.3%–0.7% hidden spread | USD/CNY buy rate 6.86, sell rate 6.90, with spread |

| Refund and Modification Fees | Modifications: +1.2%; refunds: original fees + 2% processing fee |

Wise’s overall fees are lower than traditional channels like Hong Kong banks. You can simulate fees on the website to estimate received amounts, avoiding losses from hidden fees or rate spreads.

Wise transfers make sending funds to U.S. bank accounts easy. You’ll find the platform offers transparent fees and fast transfers, earning high user ratings. Wise supports 170+ countries and 40+ currencies, with 90% of payments arriving within 24 hours, offering high security and a user-friendly interface. Whether for personal or business use, Wise provides fees as low as 0.4%–1% and an efficient transfer experience.

You can prepare your passport, address proof, U.S. phone number, and bank details in advance to significantly improve transfer efficiency and avoid delays due to incomplete materials.

FAQ

How long does it take for transfers to arrive?

When you use Wise to transfer to the U.S., funds typically arrive within hours. Some banks, like Hong Kong banks, may take 1–3 business days. You can check progress in real-time on the Wise platform.

What are the transfer limits?

You can transfer up to $50,000 (USD) annually, with single transaction limits typically at $4,300 (USD). Alipay transfers allow up to 5 transfers per month without using the forex quota. Choose the method based on your needs.

Is Wise secure?

You can enable two-step verification to protect your account. Wise uses encryption, with funds held in top global banks. You can freeze your account anytime to ensure fund security.

What to do if information is entered incorrectly?

You should carefully verify details when entering them. Errors may cause failed or delayed transfers. Contact Wise customer service to correct details and ensure funds arrive smoothly.

How are fees and exchange rates calculated?

After entering the amount on the Wise platform, the system automatically displays fees and rates. Fees are typically under 1%, with rates close to the mid-market rate. You can estimate the received amount in advance.

After a deep dive into the convenience of Wise, you may have also noted some details, such as the need for a passport for identity verification and the slow customer service response in some cases. If you’re looking for a more comprehensive solution, especially for managing digital currency, BiyaPay offers a more flexible and efficient option. We not only provide remittance fees as low as 0.5%, significantly reducing your costs, but also support same-day delivery to most countries and regions worldwide, completely revolutionizing your cross-border remittance experience. BiyaPay’s core advantage lies in its support for the conversion between various fiat and digital currencies and its real-time exchange rate converter, allowing you to easily manage your global assets on a single platform. Say goodbye to the limitations of traditional remittance models, and register now to start your new journey in smart finance.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.