- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

In-Depth Review of International Remittance User Experience: Fees, Speed, and Security Compared

Image Source: pexels

| Metric | Traditional SWIFT Cross-Border Platforms | Central Bank Digital Currency (CBDC) Platforms |

|---|---|---|

| Fees | Global average cost of 6.3%, approximately USD 440 billion per transfer | Low cost, still in pilot phase |

| Speed | 89% arrive within 1 hour, some take days to a month | Fast arrival, synchronized forex settlement |

| Security | Multiple intermediary nodes, complex process, vulnerable to attacks | High transparency, low risk, regulatory and technical aspects still developing |

When choosing an international remittance platform, users prioritize fee structure, transfer speed, and security. Digital platforms currently offer lower fees, faster arrivals, and significantly improved security. Traditional platforms have advantages in compliance and fund protection. The following sections will break down each metric in detail.

Key Points

- Digital platforms like Wise and Paysend offer low and transparent fees, ideal for cost-conscious users.

- Digital platforms provide fast transfer speeds, with many supporting real-time arrivals, meeting urgent remittance needs.

- Platforms regulated by authoritative bodies ensure fund security, and users should prioritize these.

- Digital platforms are user-friendly, supporting multiple languages and mobile apps, enhancing user experience.

- Choose a platform based on transfer amount and needs: digital platforms for small, frequent transfers; bank wire transfers for large, urgent ones.

International Remittance Fee Comparison

Image Source: pexels

Handling Fees

Different international remittance platforms show significant differences in fee structures. Digital platforms like Wise, Paysend, and Remitly typically adopt transparent, low-cost fee models. Traditional banks such as ICBC, Bank of China, and HSBC have more complex fee structures, with users often facing higher-than-expected costs. Wise charges fees proportionally, starting as low as 0.33%, with no account opening or monthly fees. Users can clearly see all fees before transferring, ensuring transparent final amounts. Traditional banks (e.g., ICBC, Bank of China, HSBC) process transfers via the SWIFT network, potentially incurring telegraph fees, intermediary bank fees, and OUR fees. Fees are often hidden in exchange rate margins, making total costs hard to predict. Digital platforms like Paysend, Remitly, and Azimo also emphasize low handling fees and transparency, with some supporting multi-currency accounts for easier fund management. Western Union and Xoom charge varying fees based on payment method and transfer amount, with higher fees for credit card payments and lower fees for debit cards or bank account transfers.

Users should prioritize platforms with transparent fee structures and check for hidden costs like account opening or management fees. Use the platform’s fee calculator to estimate total costs in advance.

Exchange Rates and Hidden Fees

Exchange rates and hidden fees are critical factors affecting the total cost of international remittances. Digital platforms and traditional banks differ significantly in exchange rate policies and fee transparency.

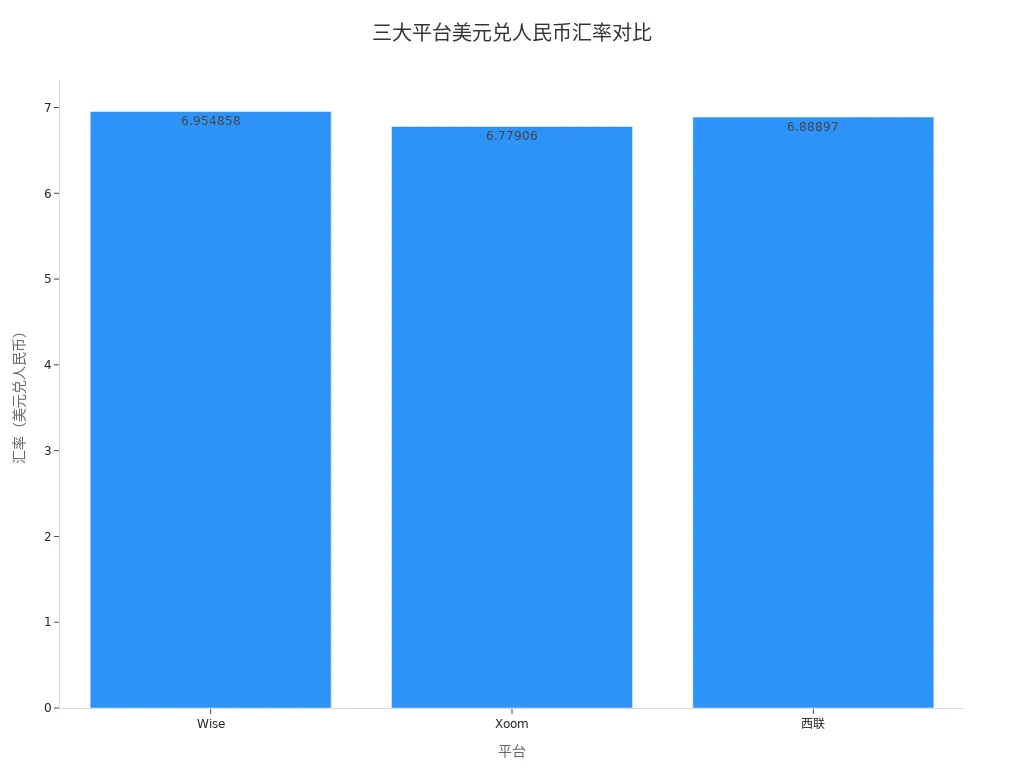

| Platform | Exchange Rate (USD to CNY) | Transfer Fee (USD) | Arrival Time |

|---|---|---|---|

| Wise | 6.954858 | 12.34 | Within seconds |

| Xoom | 6.77906 | 30 | 30 minutes |

| Western Union | 6.88897 | Debit card: 0, Credit card: 25 | Real-time |

Wise uses the mid-market exchange rate without hidden markups, offering a clear fee structure. Users can see all costs before transferring. Xoom and Western Union offer slightly lower exchange rates than Wise, with higher handling fees and additional costs for certain payment methods. Traditional banks’ exchange rates often include markups and lack transparency, making actual costs unpredictable. Common hidden fees include:

- Currency exchange fees: Hidden costs from exchange rate margins.

- Service fees: Additional charges for processing transfers.

- Intermediary bank fees: Extra costs when multiple banks are involved in the transfer.

Some platforms may also charge hidden costs like account opening or management fees. For example, PayPal and Stripe may include account management or subscription fees alongside payment fees. Users should carefully review service terms to understand all applicable fees before using international remittance services. Digital platforms like Wise and Airwallex offer transparent fee structures, real-time fee visibility, rates close to the market rate, and service fees as low as 0.2%. Traditional banks often have hidden fees and exchange rate markups, resulting in higher, less transparent costs.

Digital platforms generally offer lower international remittance fees with transparent structures, ideal for users seeking cost control and predictable arrival amounts. Traditional banks, with broader coverage, have higher and less transparent fees, suitable for scenarios prioritizing compliance and fund security.

Transfer Speed

Image Source: unsplash

Platform Arrival Times

International remittance platforms vary significantly in transfer speed. Digital platforms like Wise, Remitly, Azimo, Afriex, and Paysend are generally faster than traditional banks. Wise supports real-time transfers in some countries, achieving instant arrivals, with most transfers completed within hours. Remitly excels in speed, typically completing transfers in minutes, ideal for users with high time sensitivity. Azimo and Afriex also emphasize fast arrivals, though times vary by country and currency. Paysend’s exact arrival times are unspecified, but user feedback indicates faster performance than traditional banks. Traditional banks like ICBC, Bank of China, and HSBC typically use wire transfers, averaging 2–3 business days, with longer times for less common currencies or cross-border clearing. Transfers via the SWIFT network generally take 3–5 business days. Some major banks, like HSBC Hong Kong, offer expedited transfer services, arriving in 10–15 minutes, but require additional fees.

| Platform/Bank | Average Arrival Time Description |

|---|---|

| Wise | Real-time in some countries, instant in some cases, typically hours, faster than traditional banks |

| Remitly | Very fast processing, typically instant within minutes |

| Azimo | Unspecified exact time, user feedback indicates fast |

| Afriex | Unspecified exact time, user feedback indicates fast |

| Paysend | Unspecified exact time, user feedback indicates fast |

| ICBC/Bank of China/HSBC | Wire transfers typically take 2–3 business days, longer for uncommon currencies |

Users should weigh arrival time and their needs when choosing a platform. Digital platforms suit individuals and businesses seeking efficiency, while traditional banks are better for scenarios requiring high compliance and fund security.

Speed Variations by Scenario

Transfer speed depends not only on the platform but also on the remittance scenario. Urgent transfers, regular transfers, and transfers across different currencies or countries show significant speed differences.

- PayPal is ideal for small online transactions, with fast arrivals, secure and convenient but with higher fees.

- Alipay’s international transfers arrive quickly, suitable for daily small transfers, but have amount limits.

- Western Union and MoneyGram support fast arrivals, with medium-sized transfers under $10,000 completing in about ten minutes, ideal for urgent fund needs.

- Wise can arrive in as little as 1 minute, suitable for small, rapid transfers with real-time exchange rate conversions, but has single-transaction limits.

- Platforms like ClickandBuy take longer, with regular transfers requiring 3–4 business days.

- Traditional wire transfers are complex and slower, suitable for large regular transfers.

| Platform Name | Arrival Speed | Applicable Scenario | Notes |

|---|---|---|---|

| Western Union | Fast arrival | Medium transfers under $10,000 | Requires offline operations, higher fees |

| MoneyGram | About ten minutes | Fast transfers | Simple process, no bank account needed |

| Wise | As fast as 1 minute | Small, rapid transfers | Real-time rate conversion, single-transaction limits |

| ClickandBuy | 3–4 business days | Regular transfers | Longer arrival times |

| Traditional Wire Transfer | Slower | Regular transfers | Complex process |

International transfer speeds also vary significantly by currency and country. Transfers from the U.S. to China, using debit cards or bank transfers, range from instant to 2 days. Wise is typically the fastest, while Remitly’s USD transfers take up to 2 days. Different currencies involve different clearing systems—USD via the U.S. system, JPY via Japan’s system—causing cross-currency, cross-border transfers to pass through multiple systems, with unpredictable and potentially extended times. Arrival speed is also affected by:

- Transfer method: Wire transfers take 2–3 business days, expedited transfers about 10–15 minutes, SWIFT transfers 3–5 business days.

- Bank business days: Non-business day transfers may extend arrival times.

- Bank differences: Large banks are typically faster; smaller or foreign banks are slower.

- Fees and charges can impact arrival times.

- Accurate and complete recipient information is critical for fast arrivals; errors cause delays.

For urgent transfers, prioritize digital platforms like Remitly, Wise, or Western Union that support real-time arrivals. For regular large transfers, consider traditional banks but plan for potential delays due to holidays or errors.

Security Comparison

Regulation and Fund Protection

Regulatory bodies play a decisive role in the security of international remittance platforms. Yaben Express and its partners hold financial licenses from the European Central Bank and the UK Financial Conduct Authority (FCA). These platforms must comply with strict financial regulations when operating in the EU and EEA, with every transaction regulated by European authorities, ensuring legal and compliant fund flows. Users enjoy high fund protection on these platforms.

Digital platforms like Paysend and Wise typically use segregated account management, separating user funds from operational funds, protecting user funds even if the platform faces operational risks. Hong Kong banks like HSBC have extensive experience in fund security, using multi-factor authentication and real-time monitoring to prevent fund misuse.

Some platforms do not clearly disclose their regulators, posing risks of fund misappropriation or freezing. User reviews indicate that platforms regulated by authoritative bodies are more trusted, offering higher fund security.

Users should prioritize platforms regulated by authorities like the European Central Bank or FCA to ensure fund safety.

User Privacy Protection

User privacy protection is a critical component of international remittance services. Digital platforms like Wise and Paysend use encryption to protect personal and transaction data, storing all data securely to prevent leaks. Hong Kong banks like HSBC also employ multiple encryption and authentication measures to ensure client data security.

Some users report that smaller platforms lack robust privacy protections, risking data leaks. Mainstream platforms conduct regular security audits to fix vulnerabilities promptly. Users should review the platform’s privacy policy to understand data usage and protection methods when registering and using remittance services.

Platforms like Yaben Express excel in privacy protection, strictly adhering to EU GDPR and other data protection regulations, minimizing the risk of data misuse.

Users should choose platforms with transparent privacy policies and robust encryption to protect personal information.

User Experience

Operational Process

Major platforms differ significantly in account opening and transfer processes. Wise’s account registration process is secure, supporting multi-currency accounts, emphasizing two-step verification and instant notifications for account security. Users are limited to one account, and multiple accounts are discouraged. Paysend’s registration is quick, typically under 10 minutes, supporting 15 language interfaces, suitable for users from different countries. PayPal requires linking a credit card or bank account and verifying identity via email; transfers involve entering the recipient’s email, with recipients needing to register if they lack an account—convenient but less transparent in fees. MoneyGram and Western Union have low account-opening thresholds, requiring no bank account, ideal for users avoiding complex processes. Western Union offers mobile app operations, with a simple transfer process where the sender covers fees, leaving no cost for the recipient.

| Platform Name | Account Opening Process | Transfer Process | Interface Usability & User Feedback |

|---|---|---|---|

| PayPal | Register and verify identity, link credit card or bank account | Enter recipient’s email, recipient needs to register | Intuitive process, limited fee transparency |

| MoneyGram | No bank account needed, low threshold | Completed in about ten minutes, simple | Convenient and fast, clean interface |

| Western Union | No bank account needed, mobile app operation | Fast transfers, sender covers fees | Easy to use, good experience |

| Wise | Secure registration, supports multi-currency accounts | Transparent fees, ~32-hour arrival | Emphasizes security and fee transparency |

Users often encounter issues like delayed arrivals, high fees, operational restrictions, and lack of transparency. Traditional banks like Hong Kong banks have complex account-opening processes, requiring supported banks and currencies, with transaction limits restricting large fund transfers. Users can print transaction receipts via online banking but struggle to track transfer status in real-time. Bank compliance audits are complex, with varying risk control mechanisms and slow audit speeds impacting arrival times.

Platform interface usability directly impacts user experience. Digital platforms like Wise and Paysend offer rich features and transparent fees, suitable for individuals and businesses. Traditional banks provide stable processes but are cumbersome with less transparent information.

Customer Service and Mobile Support

Paysend and Wise excel in customer service and mobile support. Paysend offers 24/7 customer support via live chat, email, phone, and social media, meeting users’ anytime transfer needs. Wise’s mobile app receives high user ratings, with FAQs easily accessible, though phone support is limited to weekdays, but overall customer experience is strong. Paysend is compatible with web, iOS, and Android, with a fast registration process and a Trustpilot rating of 4.5/5, with over 85% positive reviews. Wise maintains a 92% user satisfaction rate, with a 4.6/5 Trustpilot score based on over 200,000 reviews, praised for real-time rate quotes, low fees, fast arrivals, and responsive support.

Traditional banks like Hong Kong banks lag in customer service and mobile experience. Direct banking apps have short development histories, with weak brand impact and limited customer bases. Products and services are highly homogenized, reducing user loyalty, with overlapping mobile banking features causing resource waste and poor experiences. Customer service relies on offline branches and account managers, with limited resources and coverage. During the pandemic, branch closures reduced customer interactions, online services were less efficient, and risk control issues persisted. Mobile products lack innovation and operational efficiency, failing to meet diverse customer needs.

Users should consider customer service response speed and mobile support when choosing platforms. Digital platforms excel in multilingual support, mobile compatibility, and customer service, while traditional banks offer stability and compliance.

International Remittance Scenario Recommendations

Small and Frequent Transfers

Users making small, frequent transfers prioritize fees and speed. Fintech platforms like Wise and Payoneer use local collection accounts and real-time rates to significantly reduce handling and exchange rate costs. Traditional banks have high fees and slow arrivals, typically 1–3 business days. Wise’s exchange rate fees start at 0.43%, transfer fees as low as 0.13%, with 52% of transactions arriving in 20 seconds. Airwallex’s withdrawal fees range from 0.3%–0.6%, with 1–2 business day arrivals, ideal for frequent transactions. PingPong and Payoneer support multiple e-commerce platforms, with withdrawal fees of 1% and 1.2%, respectively. Cross-border sellers paying $5,000 monthly via Wise can save ~$1,259 annually. SWIFT gpi and blockchain technology further enhance speed and transparency, meeting small, frequent transfer needs.

| Platform | Exchange Rate Fee | Transfer Fee | Arrival Speed | Applicable Scenario |

|---|---|---|---|---|

| Wise | From 0.43% | As low as 0.13% (ACH) | 52% of transactions in 20 seconds | Small, frequent, multi-currency management |

| Traditional Banks | 1.5%–3% | $20–50 + 1%–2% | 3–5 business days | High fees, slow arrivals |

For small, frequent transfers, prioritize digital platforms like Wise and Airwallex to save costs and improve efficiency.

Urgent and Large Transfers

Users making urgent or large transfers prioritize speed and security. Bank wire transfers are suitable for large funds, offering high security and strict regulation. Wire transfers arrive same-day domestically, 1–5 business days internationally, with fees of $35–50. Blockchain-based payments like Ripple and SWIFT GPI have fees about one-tenth of traditional banks, with some offering real-time arrivals, though regulatory clarity varies by country, and stability needs improvement. A case study shows a business transferring $1 million to Singapore via Ripple incurred only $100 in fees, saving ~90%. Bank online and mobile banking support large transfers from millions to tens of billions USD, with bank-enterprise channels handling up to hundreds of billions or trillions USD. Different transfer methods correspond to varying limits, meeting diverse needs.

| Transfer Method | Applicable Scenario | Arrival Speed | Fee Range | Security |

|---|---|---|---|---|

| Wire Transfer | Urgent, large payments | Same-day domestically, 1–5 days internationally | $35–50 | High |

| Blockchain Payment | Large, fast payments | Real-time | ~10% of bank fees | High |

For large or urgent transfers, prioritize bank wire transfers or regulated blockchain platforms to ensure security and timely arrivals.

Individual vs. Business Users

Individual and business users have distinct remittance needs. Individual users focus on non-commercial payments like sending money to family, paying overseas bills, travel, or online shopping, prioritizing speed and fees. Business users require batch and scheduled transfers, streamlined payment processes, multi-currency accounts, and accounting software integration. Wise Business accounts suit SMEs and freelancers, supporting batch payments, API automation, and multi-user permissions. Some banks offer tailored cross-border services and discounts for businesses, such as flexible rates and lower fees. Business users also benefit from fast arrivals, flexible collection accounts, and dedicated support.

| Need/Feature | Individual Users | Business Users |

|---|---|---|

| Purpose | Sending to family, paying bills, shopping | Business collections, batch payments, financial management |

| Account Features | Multi-currency accounts, basic features | Multi-currency accounts, batch payments, API automation, permission management |

| Applicable Platforms | Wise, Payoneer, PingPong | Wise Business, Airwallex, bank business services |

Individual users should choose low-fee, fast platforms. Business users should prioritize commercial accounts with batch payment and automation features for financial efficiency.

Major international remittance platforms vary in fees, speed, and security. Users can refer to the table below to choose based on their needs:

| User Type | Recommended Method | Fee Characteristics | Speed Performance | Security |

|---|---|---|---|---|

| Large Fund Transfers | Bank Transfer | Lower fees | 1–5 days | High |

| Small Daily Expenses | Third-Party Payment Platforms | Higher fees | Usually instant | Moderate |

| Urgent Funds | International Remittance Services | Higher fees | Within 24 hours | Good |

In the future, the international remittance market will continue to grow, driven by non-bank operators and individual applications, with increasing business concentration and more diverse products.

FAQ

What are the main fees for international remittances?

Users typically pay handling fees, exchange rate margins, and potential intermediary bank fees. Digital platforms like Wise offer transparent fees, while traditional banks like Hong Kong banks may have hidden costs. All amounts are in USD, with rates fluctuating in real-time.

How long does it take for a remittance to arrive?

Digital platforms like Wise and Remitly can deliver in minutes. Traditional banks like Hong Kong banks typically take 2–5 business days. Arrival speed depends on the country, currency, and bank processing efficiency.

Are international remittances secure?

Regulated digital platforms and Hong Kong banks use encryption to protect funds and data. Platforms like Wise and Paysend, regulated by the European Central Bank or FCA, ensure fund safety. Avoid unregulated platforms.

Are there limits on transfer amounts or currencies?

Most platforms limit single and daily transfer amounts. Wise, Paysend, and others support multiple currencies like USD and EUR. Hong Kong banks offer higher limits for large transfers.

How to choose the right international remittance platform?

Consider fees, speed, security, and supported currencies. Choose Wise for small, frequent transfers and Hong Kong bank wire transfers for large, urgent ones. Compare fees and services in advance.

This in-depth review of international remittance user experience reveals that whether you prioritize the low cost of digital platforms or the security of traditional banks, you often face a “can’t have it all” dilemma. While platforms like Wise and Paysend are affordable and fast, some users still have doubts about their security and regulation. Conversely, while traditional banks are safe and compliant, their high fees and cumbersome processes deter many. To break this impasse, BiyaPay was created, offering users a comprehensive solution that combines low costs, high efficiency, and top-tier security. We not only provide remittance fees as low as 0.5%, but also support same-day delivery to most countries and regions worldwide. What’s more, our real-time exchange rate converter ensures that every dollar is spent with complete transparency. Register now to easily manage your various fiat and digital currencies all on one platform, and start your new smart finance journey.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.