- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Comparison of Batch Transactions and Liquidity Functions for Cross-Border Business Accounts

Image Source: unsplash

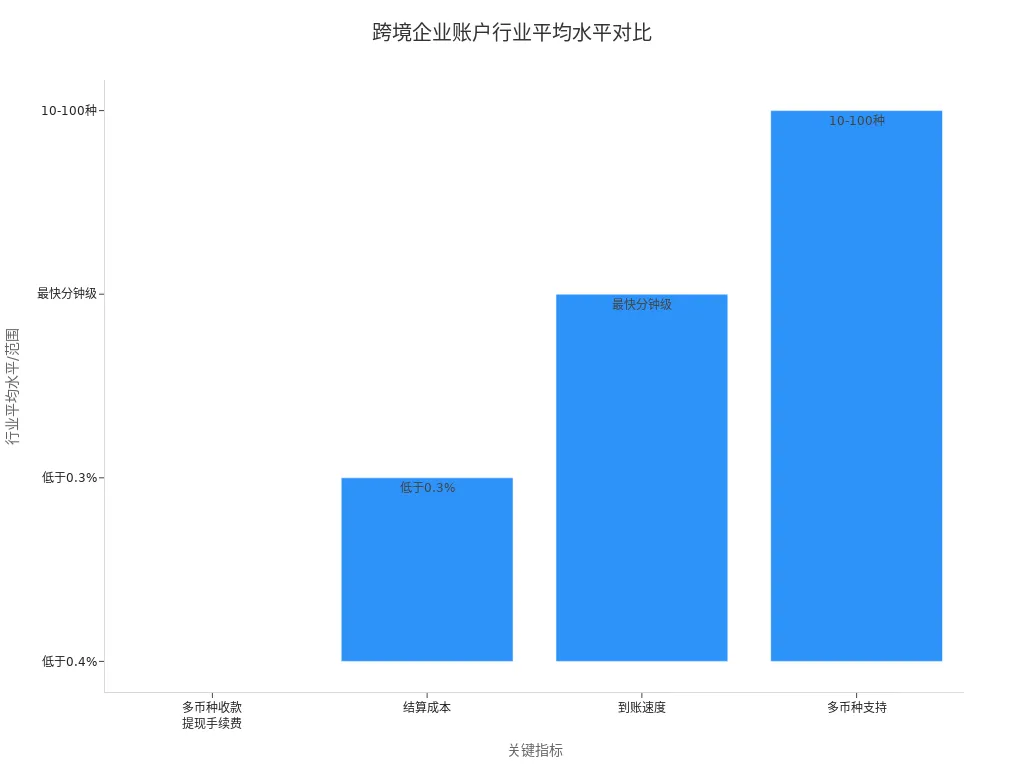

Cross-border business accounts vary in their performance in batch transactions and liquidity. Enterprises typically focus on multi-currency collection, settlement costs, exchange fees, and transfer speed. Data shows that mainstream platforms such as PingPong, PayPal, WorldFirst, Payoneer, and Lianlian International support 10 to over 100 currencies, with withdrawal fees generally below 0.4%, and settlement costs as low as below 0.3%. Transfer speeds can reach minutes in some cases, and certain platforms reduce exchange costs through smart currency conversion strategies.

| Metric | PingPong | PayPal | WorldFirst | Payoneer | Lianlian International |

|---|---|---|---|---|---|

| Transfer Speed | Fast withdrawal, funds arrive in a short time | Same-day arrival on business days | As fast as 1 minute | RMB arrives in as fast as 1 business day | Fast withdrawal processing |

| Multi-Currency Support | 50+ mainstream and emerging market currencies | 100+ currencies | 10 major currencies | 70+ currencies | Global multi-currency collection |

Key Points

- Cross-border business accounts support multi-currency collection and settlement, with fast transfer speeds and low fees, helping enterprises reduce cross-border transaction costs.

- Batch transaction functions vary significantly, and enterprises should choose platforms based on the number of batch payments, supported currencies, and transfer speed to enhance fund management efficiency.

- Automation technology and intelligent risk control improve the security and success rate of batch transactions, supporting large-amount and high-frequency payments to ensure smooth fund flow.

- Multiple fund transfer methods meet diverse needs, with automated systems and virtual accounts enhancing fund flexibility, shortening transfer times, and reducing risks.

- Enterprises should select compliant, user-friendly platforms with multi-currency support and fast transfers based on their business scale and needs to ensure fund safety and efficient flow.

Comparison of Batch Transactions for Cross-Border Business Accounts

Image Source: unsplash

Batch Payment Support

Different cross-border business accounts perform variably in batch payment support. Airwallex supports multiple e-commerce platforms like Amazon, Shopify, and eBay, covering payments in 23 currencies with fast withdrawal speeds. Instructions submitted before 3 PM on business days can arrive the same day. Payoneer primarily supports batch payments to U.S. bank accounts, handling up to 200 transactions at a time. PayPal supports international batch payments, handling up to 15,000 transactions at once, covering 24 currencies and 156 countries. The table below shows the batch payment capabilities of mainstream platforms:

| Platform | Batch Payment Support Range | Maximum Batch Payment Transactions | Number of Supported Currencies | Number of Supported Countries/Regions |

|---|---|---|---|---|

| Airwallex | Multi-platform, multi-currency payments | Not disclosed | 23 | Multiple countries |

| Payoneer | U.S. bank batch payments | 200 | N/A | USA |

| PayPal | International batch payments | 15,000 | 24 | 156 |

Enterprises should focus on the platform’s batch payment transaction limit, supported currency range, and transfer speed when selecting a cross-border business account. PayPal is suitable for enterprises needing large-scale international batch payments, while Airwallex is ideal for cross-border e-commerce with multi-platform and multi-currency operations.

Automation and Limits

Mainstream cross-border business accounts continuously enhance automation capabilities. Many platforms expand free trade account functions, supporting delay-free cross-border payments and collections, improving fund settlement efficiency. Financial institutions use blockchain technology to optimize electronic document verification, ensuring transaction security. The Cross-Border Interbank Payment System (CIPS) continues to improve, encouraging more banks to join and expanding global network coverage. Banks and financial institutions promote digital service upgrades, supporting real-time global fund transfers and enterprise group fund pool management.

Automation technology is applied in several areas:

- Real-Time Payment (RTP) networks operate 24/7, enabling instant initiation and settlement, significantly enhancing batch transaction automation levels.

- The ISO 20022 standard unifies payment instruction formats, improving interoperability between systems.

- Blockchain technology supports faster, more secure transactions, reducing costs and risks.

- Artificial intelligence optimizes payment paths, improves payment efficiency, and is widely used for anti-fraud and automated compliance management.

Regarding limits, cross-border business accounts support single transaction limits up to $500,000, with enterprises able to apply in phases to ensure stable large-amount batch transactions. Batch payment interfaces support tens of thousands of concurrent transactions, meeting high-frequency transaction needs. Large-amount transaction success rates have increased by 30%-50%, thanks to customized risk management and machine learning for identifying trusted transaction patterns. Intelligent routing technology boosts payment success rates by 12%-18% by automatically selecting the optimal clearing path.

Operational Convenience

Operational convenience is a key consideration for enterprises choosing cross-border business accounts. Mainstream platforms generally offer user-friendly interfaces and multilingual support. Enterprises can quickly complete large batch payment instructions by importing recipient information in bulk, using template management, and automating approval processes. Platforms like PayPal and Airwallex support API integration, allowing enterprises to embed batch payment functions into their ERP or financial systems for automated operations.

Many platforms also provide real-time transaction status queries and batch transaction progress tracking, helping enterprises monitor fund flows in real time. Dispute resolution cycles have been significantly reduced from 45 days to within 14 days, improving fund recovery efficiency. Some platforms support real-time settlement in over 135 currencies, with exchange rate discounts ranging from 0.5% to 1.2%, further reducing cross-border costs.

Tip: For high-frequency, large-amount batch transaction scenarios, enterprises should prioritize accounts with automated processing, high limits, and operational convenience to improve fund management efficiency and reduce operational risks.

Liquidity Comparison

Image Source: pexels

Transfer Speed

Transfer speed directly affects enterprise fund turnover efficiency. Different platforms show significant differences in transfer times and fees. Payoneer and Airwallex typically have transfer speeds of 3-5 business days, with withdrawal fees of $35 per transaction and settlement fees of about 1%. Wise offers faster transfers, completing within 2-3 business days, with fees around 1%, supporting quick settlement into RMB. Bank of East Asia, as a U.S. offshore bank, has slower transfer speeds, requiring account activation and no direct RMB settlement, with uncertain arrival cycles. The table below compares transfer speeds and fees of mainstream platforms:

| Platform | Transfer Speed | Withdrawal Fee | Settlement Fee | Notes |

|---|---|---|---|---|

| Payoneer | 3-5 business days | $35/transaction (charged by PayPal) | ~1% | Mainly for PayPal withdrawals in cross-border e-commerce, fast arrival |

| Airwallex | 3-5 business days | $35/transaction (charged by PayPal) | ~1% | Similar to Payoneer, third-party payment platform |

| Wise | 2-3 business days | ~1% | ~1% | Competitive exchange rates, supports quick RMB settlement |

| Bank of East Asia | Traditional bank speed, slower | Requires $2,500 fund activation | No direct RMB settlement | U.S. offshore bank, uncertain arrival time, limited settlement |

Bank of East Asia has a low account opening threshold but uncertain transfer cycles, suitable for enterprises with less stringent speed requirements. Wise is ideal for enterprises seeking quick settlement and low costs. Payoneer and Airwallex are widely used in cross-border e-commerce, with balanced transfer speeds and fees.

Fund Transfer Flexibility

Fund transfer flexibility is critical for enterprises operating globally. Mainstream cross-border business accounts support multiple transfer methods, including international third-party payment platforms, direct bank channels, and bank-enterprise direct connection systems. The transfer times and fees for different methods are as follows:

| Fund Transfer Method | Transfer Time | Fee Details |

|---|---|---|

| International Third-Party Payment Platforms | 1-3 business days, some platforms offer same-day arrival | Fees typically 0.5%-1.2%, with tiered rates for high-frequency large transactions, overall costs as low as below 0.3% |

| Direct Bank Channels (e.g., HSBC Hong Kong) | Affected by bank processing, typically 1-3 business days | Cross-border transfer fees of 100-125 HKD per transaction |

| Heshi Bank-Enterprise Direct Connection | Real-time automatic transfers, shorter transfer times | Reduces labor costs and risks, specific fees not disclosed |

Heshi’s bank-enterprise direct connection system monitors account fund status in real time, automatically completing fund transfers, enhancing fund usage flexibility, shortening transfer times, and reducing manual intervention and risks. International third-party payment platforms are suitable for high-frequency, large-amount cross-border fund transfers, with transparent fees and fast arrival. Hong Kong bank direct channels are ideal for large single transactions, with lower fees but transfer speeds affected by bank processing.

Tip: Enterprises should choose appropriate fund transfer methods based on business needs. High-frequency transfers should prioritize automated systems, while large single remittances can use Hong Kong bank direct channels.

Multi-Currency Management

Multi-currency management capabilities determine the efficiency of enterprises’ global fund operations. Heshi’s financial budgeting system supports real-time exchange rate synchronization, automatically handling multi-currency conversions and consolidated reports, covering major currencies like USD, RMB, and EUR. The system integrates with mainstream exchange rate platforms to ensure accurate and timely rate data, reducing exchange rate risks. Multinational manufacturing enterprises use this system for multi-currency budgeting and automatic consolidation into the group’s primary currency, improving financial settlement efficiency. International logistics companies simplify cross-border expense management with multi-currency reimbursement functions.

| System Name | Currency Management Flexibility | Exchange Rate Management | Multi-Currency Report Support | Applicable Enterprise Types |

|---|---|---|---|---|

| Qinsi Inventory/Cashier System | High, supports multi-currency addition and custom symbol names | Automatic or manual rate updates | Supports categorized multi-currency reports | Cross-border e-commerce, trade, chain stores |

| Yonyou T+ | Relatively high, supports multi-currency settings | Manual rate updates | Supports multi-currency reports | Medium to large manufacturing and trade enterprises |

| Kingdee Cloud Star | High, supports multi-currency and customization | Automatic/manual rate management | Supports multi-currency reports | Large groups and international enterprises |

| Suda V5 | Moderate, supports basic multi-currency settings | Manual rate management | Partial multi-currency report support | Small to medium enterprises |

Enterprises can flexibly choose currency settlement in procurement, sales, and payments, converting multi-currency balances into the base currency at period-end to meet multi-country and multi-region business needs.

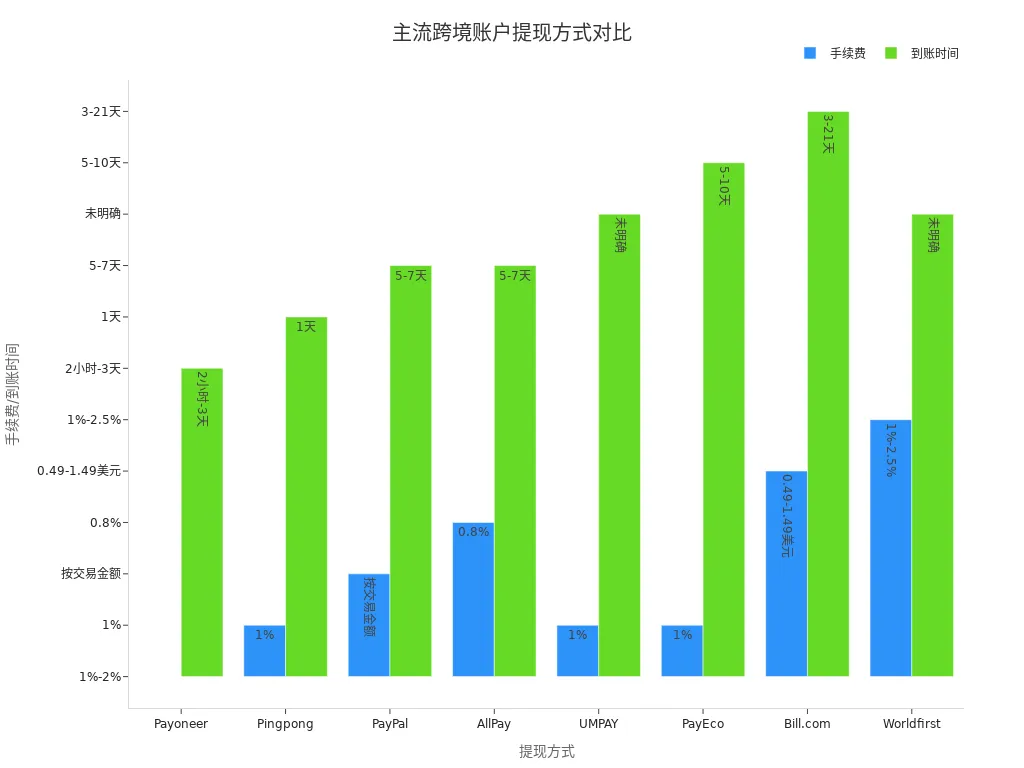

Withdrawal Methods

The diversity and speed of withdrawal methods directly impact enterprise fund flow. Mainstream cross-border business accounts support various withdrawal methods, including RMB settlement, foreign currency wire transfers, electronic transfers, and paper checks. The withdrawal fees and transfer times for different platforms are as follows:

| Withdrawal Method | Fee | Transfer Time | Notes |

|---|---|---|---|

| Payoneer | Up to 1%, RMB settlement and foreign currency wire transfers 1%-2% | As fast as 2 hours, typically 1-3 business days | Multi-currency support, lower fees with higher cumulative deposits |

| Pingpong | 1% | Typically within 1 business day | No exchange loss, no hidden fees |

| PayPal | Based on transaction amount | 5-7 business days | Recommended for transactions below $3,000 |

| AllPay | 0.8% | 5-7 days | Direct deposit to Chinese banks, no additional fees |

| UMPAY | 1% | Time not specified | No need to reopen accounts, no currency conversion fees |

| PayEco | 1% | 5-10 business days | Time depends on bank processing |

| Bill.com | Electronic transfer $0.49/transaction, check $1.49/transaction | Electronic transfer 3-5 business days, check 5-21 business days | Electronic transfers limited to U.S. individuals |

| Worldfirst | No withdrawal limit, 1%-2.5% exchange loss | Time not specified | No other fees |

| Wanlihui | Settlement fee capped at 0.3%, as low as zero | Time not specified | Supports withdrawals to Alipay, various promotions |

Enterprises can flexibly choose withdrawal methods based on amount, transfer speed, and fees. Payoneer and Pingpong are suitable for enterprises seeking fast transfers and multi-currency support. PayPal is ideal for small-amount withdrawals, while AllPay and Wanlihui offer more localized options for the Chinese market.

Fund Pooling, Virtual Accounts, and Supply Chain Finance Integration

- Fund Pooling Capabilities: PingPong integrates multi-site funds through a global account system, using a Singapore fund pool to reduce forex losses. Worldfirst has some limitations in fund pooling efficiency.

- Virtual Account Applications: Some platforms create dedicated settlement channels for distributors, with virtual bank account technology supporting localized fund processing, enhancing management flexibility and compliance.

- Supply Chain Finance Integration: Some platforms support supply chain payments and trade asset tokenization, using blockchain and smart contracts to automate goods delivery and payment settlement, streamlining trade processes.

Liquidity has become a core competitive advantage for cross-border business accounts. Enterprises should select account systems based on transfer speed, transfer flexibility, multi-currency management, and withdrawal methods to suit their business models.

Advantages and Disadvantages Comparison

Batch Transaction Advantages and Disadvantages

Mainstream platforms perform differently in batch transactions. Payoneer supports e-commerce platform batch payments with a simple registration process but has higher exchange and cross-border fees and limited embedded financial functions. Airwallex offers multi-currency accounts, no-fee Visa cards, and strong API integration, ideal for automated batch transactions, though some local payment methods may incur additional fees. Third-party platforms like PayPal and World First offer simple collection and settlement withdrawals, suitable for small-amount batch collections, but have account freeze risks and higher fees. Credit card collections have no transaction fees and support various online payment methods but are complex to integrate and costly. Wire transfers are fast, protecting seller interests, but have high fees and a limited customer base.

| Platform/Method | Main Advantages | Main Disadvantages | Applicable Scenarios |

|---|---|---|---|

| Payoneer | Supports batch payments, easy registration | High exchange and cross-border fees | E-commerce batch collections |

| Airwallex | Multi-currency accounts, strong API integration | Additional fees for some local payments | Automated batch transactions |

| PayPal | Wide international channels, high user trust | High fees, account freeze risks | Small-amount batch collections |

| Credit Card Collection | No transaction fees, multiple payment methods | Complex integration, high costs, chargeback risks | B2C retail |

| Wire Transfer (T/T) | Fast collection, protects seller interests | High fees, limited customer base | B2B large transactions |

Technical measures like environment isolation and permission-based management enhance batch transaction compliance and security, with industry recognition for automated compliance and multi-currency support.

Liquidity Advantages and Disadvantages

Cross-border business accounts also differ significantly in liquidity. Payoneer offers easy registration, multi-currency collection, low settlement fees (≤2%), and fast transfers, suitable for sellers with dispersed customers and small-amount transactions. Hong Kong offshore bank accounts have no remittance limits and support free multi-currency conversions, ideal for large-scale enterprises, but transferring funds to Chinese accounts is cumbersome and carries legal and financial risks. Credit card collections have a large user base, popular in Europe and the U.S., but are complex and costly to integrate. Airwallex offers mostly free local transfers, cross-border (SWIFT) transfers cost $15-25, with forex rates of 0.2%-0.5%, lower than traditional banks. On-chain stablecoin payments have minimal transaction fees but incur hidden costs when converting to fiat. Heshi’s expense control enhances batch settlement efficiency through automated reconciliation and settlement and intelligent exchange rate management, reducing financial risks.

| Account/Payment Method | Liquidity Advantages | Liquidity Disadvantages | Applicable Scope |

|---|---|---|---|

| Payoneer | Easy registration, multi-currency collection, low settlement fees, fast transfers | Small single transaction amounts | Cross-border e-commerce sellers |

| Hong Kong Offshore Bank Accounts | No remittance limits, free multi-currency conversion | Cumbersome fund transfers, legal risks | Traditional trade and large transactions |

| Credit Card Collection | Large user base, popular in Europe and U.S. | Complex integration, high costs, chargeback risks | B2C retail |

| Airwallex | Free local transfers, low forex rates | Fixed SWIFT transfer fees | Automated batch settlements |

| On-Chain Stablecoin Payments | Minimal transaction fees, strong global liquidity | Hidden costs for fiat conversion | Digital asset settlements |

Platforms like Heshi gain high user and industry recognition for intelligent digital technology and automated compliance assurance. Automated processes and real-time compliance checks help enterprises reduce non-compliance risks and optimize compliance operations.

Application Scenario Recommendations

High-Frequency Batch Transactions

For cross-border e-commerce enterprises in high-frequency batch transaction scenarios, consider the following factors when selecting accounts:

- Policy Compliance: Enterprises should choose account types compliant with Chinese customs clearance regulations, such as 9610 or 1210 models, to ensure legal transaction and settlement processes and reduce non-compliance risks.

- Settlement Efficiency: Prioritize Hong Kong banks or third-party payment institutions with foreign exchange qualifications to leverage electronic transaction information for fast settlements, improving fund recovery speed.

- Fund Security and Risk Management: Ensure fund safety through authenticity audits and compliance management to mitigate forex risks.

- Fee Costs: Compare fee levels across platforms to select solutions balancing cost and service efficiency.

- E-Commerce Platform Integration: Choose financial institutions that directly integrate with mainstream e-commerce platforms to simplify collection and settlement processes.

SMEs in Jiangxi Province have used the B2B model to target small-batch, high-frequency overseas order markets, increasing profitability and brand influence. RCEP policies promote enterprise digital transformation and overseas warehouse construction, further optimizing batch transaction efficiency.

Multi-Currency Management Needs

Enterprises with high multi-currency management needs typically choose the following types of cross-border business accounts:

| Account Type | Applicable Enterprise Types | Main Features |

|---|---|---|

| Free Trade Accounts | Enterprises registered in free trade zones | High fund flexibility, no traditional forex restrictions |

| Yiwu Individual Settlement Accounts | Small and micro trade enterprises | Low threshold, high settlement efficiency, simplified collection |

| Offshore Bank Accounts | Enterprises needing large cross-border transactions | Stable financial environment, robust legal systems, convenient services |

| Third-Party Payment Platform Accounts | Small to medium trade and e-commerce sellers | Multi-currency settlement, fast transfers, convenient online payments |

Mainstream platforms like PanPay and Heshi support multi-currency account systems, intelligent fund pools, and automated compliance approvals, enhancing fund management efficiency and user experience.

Different Enterprise Scales

Enterprises of different scales have distinct needs when selecting cross-border business accounts:

- Large enterprises with complex fund flows prefer cross-border fund pool business models, such as “cross-border centralized fund operations,” but face strict entry conditions and long approval cycles.

- SMEs prioritize financial service convenience and flexibility, with embedded financial services as a preferred choice, supporting global collections, multi-currency account management, and fast payments to reduce exchange costs.

- Supply chain enterprises and their upstream/downstream partners have growing needs for batch transactions and liquidity, with transaction banking services optimizing fund flow efficiency and enhancing customer retention.

Enterprises should select platforms based on trade paths, primary currencies, and compliance requirements, prioritizing reputable, compliant platforms to ensure fund safety and flow efficiency.

In the globalization process, batch transaction and liquidity function differences are significant. Multi-currency management and transfer speed directly impact fund turnover, with fintech platforms leveraging local collection accounts and real-time exchange rates to help enterprises shorten transfer times from 3-5 days to same-day or real-time, reducing costs by over 90%. Virtual accounts and API technology enhance fund management flexibility, supporting multi-currency local transactions and automated settlements. Enterprises can use bank-enterprise direct connections and AI data analytics to stay updated on account function upgrades and industry trends. Automated management and compliance mechanisms continuously optimize, helping enterprises improve cross-border fund management efficiency and security.

FAQ

Do cross-border business account batch transactions have minimum or maximum amount limits?

Most platforms have minimum and maximum amount limits. For example, single batch transactions can reach up to $500,000 (USD), subject to platform rules and exchange rates.

How can enterprises reduce cross-border fund flow fees?

Enterprises can choose low-fee platforms like PingPong or Airwallex. For large batch transactions, some platforms offer tiered rates, with overall costs as low as 0.3% (USD).

How do multi-currency accounts help enterprises manage global funds?

Multi-currency accounts support USD, EUR, RMB, and other currencies. Enterprises can collect and pay in different currencies within one account, reducing exchange losses and improving fund management efficiency.

How long does it take to withdraw to a Chinese bank account?

Mainstream platforms like Payoneer and PingPong can deposit to Chinese bank accounts as fast as 2 hours, typically within 1-3 business days. Transfer times are affected by bank processing and exchange rates.

How do enterprise accounts ensure fund safety and compliance?

Platforms use multi-factor authentication, permission-based management, and automated compliance audits. Enterprises can reduce freeze and non-compliance risks through authentic trade backgrounds and compliant materials.

This in-depth comparison of cross-border business accounts shows that while different platforms have their strengths, no single one meets all needs simultaneously. You might use Airwallex or PayPal for high-frequency batch transactions, PingPong for fast settlements, and bank transfers for large trades. This multi-platform approach is inefficient and complicates financial management. To solve this problem, BiyaPay was created to provide cross-border businesses with a comprehensive solution.

We not only offer remittance fees as low as 0.5% and a lightning-fast same-day delivery experience, but also integrate the ability to convert between various fiat and digital currencies within a single account. Say goodbye to cumbersome multi-account management. Register a BiyaPay account to easily manage your global funds and use our real-time exchange rate converter to control the cost of every transaction. Choose BiyaPay and make your cross-border operations simpler and more efficient.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.