- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Global Remittance Networks vs. Business Accounts: Which Excels in Fees and Transfer Speed

Image Source: unsplash

Global remittance networks generally outperform traditional business accounts in terms of fees and transfer speed. Many businesses find that traditional bank cross-border wire transfers have high fees and take 3–5 days to arrive. In contrast, global remittance networks, through locked exchange rates and on-chain payments, offer fees as low as 0.7% and transfer times as fast as seconds or within 12 hours. Businesses are most concerned about transaction fees, exchange rate differences, and transfer speed. Fast transfers improve cash flow efficiency and reduce operational risks. More businesses are choosing highly automated, transparent-fee platforms to optimize their cross-border payment experience.

Key Highlights

- Global remittance networks offer low and transparent fees and fast transfer speeds, significantly outperforming traditional business bank accounts.

- Exchange rate differences and hidden fees are major costs in cross-border payments, and global remittance networks effectively reduce these expenses.

- Choosing global remittance platforms directly connected to local banks can significantly improve transfer speed and cash flow efficiency.

- Businesses should flexibly select suitable cross-border payment methods and multi-currency management tools based on transaction frequency, amount, and compliance needs.

- Global remittance networks have a streamlined account opening process, are secure and compliant, improve user experience, and help businesses manage funds efficiently.

Fee Comparison

Image Source: unsplash

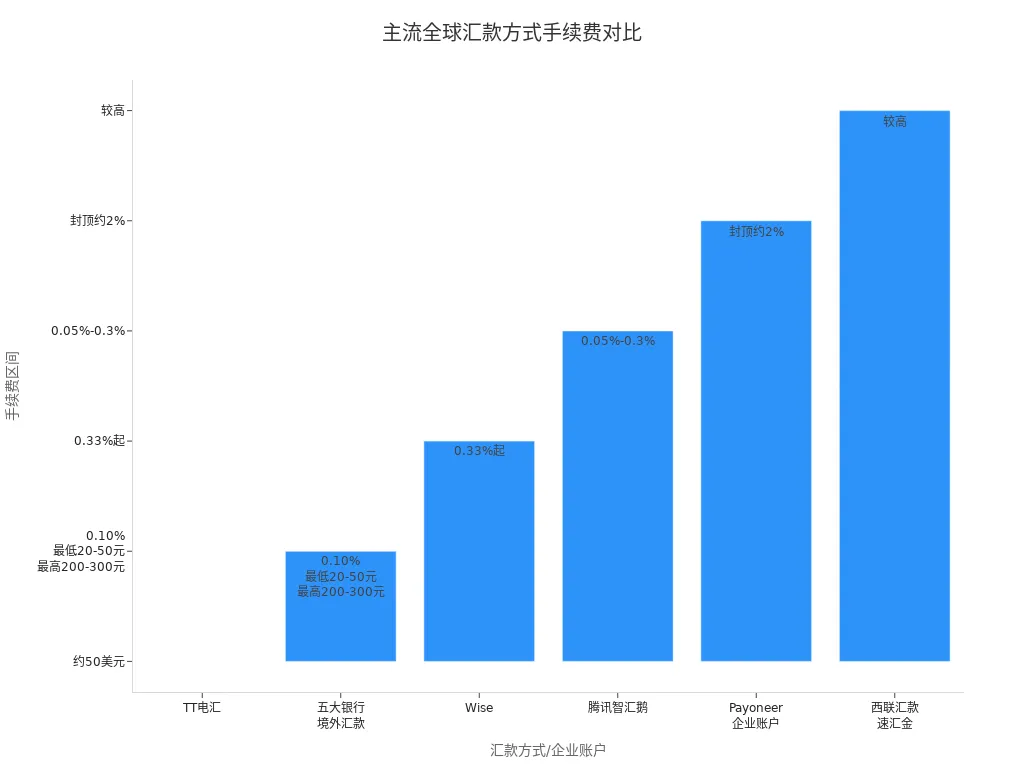

Transaction Fees

For businesses choosing cross-border payment methods, transaction fees are the most direct cost. Global remittance networks like Wise and Airwallex typically adopt transparent, low-cost fee models. For example, Wise’s currency conversion fees start at 0.33%, with no account opening or maintenance fees. In contrast, traditional banks (e.g., Hong Kong banks) charge higher wire transfer fees, typically including costs from the sending bank, intermediary banks, and receiving banks, totaling around $50 for a $1,000 transfer. Additionally, traditional banks may charge account maintenance fees, increasing operational costs for businesses.

The table below compares the transaction fees and exchange rate transparency of mainstream remittance services:

| Remittance Service | Transaction Fees | Exchange Rate Transparency | Exchange Rate Advantage | Transfer Speed | Payment and Receipt Methods |

|---|---|---|---|---|---|

| Wise | Low, charged separately and transparently | Uses mid-market exchange rate, no hidden markup | Significantly better than traditional banks | Within seconds | Multiple methods |

| Hong Kong Banks | High | Opaque exchange rates with hidden fees | Inferior to Wise | Slower | Bank accounts |

| Xoom | Around $30 | Less transparent than Wise | Inferior to Wise | About 30 minutes | PayPal, bank cards, etc. |

| Western Union | Varies by payment method | Opaque exchange rates | Inferior to Wise | Real-time | UnionPay cards, etc. |

Global remittance networks also support multi-currency accounts and batch payment functions, allowing businesses to process multiple cross-border payments at once, further reducing operational costs.

Exchange Rate Differences

Exchange rate differences are often overlooked hidden costs in cross-border payments for businesses. Global remittance networks like Airwallex and Wise use the mid-market rate, adding only a 0.2%–0.5% conversion fee. Mainstream currencies typically incur a 0.5% fee. In contrast, traditional banks (e.g., Hong Kong banks) have exchange rate spreads of 1%–3%, resulting in significantly higher actual costs compared to global remittance networks.

| Fee Type | Airwallex Approach and Fee Explanation | Traditional Banks or Other Comparisons | User Feedback and Actual Cost Differences |

|---|---|---|---|

| Exchange Rate Spread | Mid-market rate plus 0.2%–0.5% | Traditional bank spreads of 1%–3% | Significantly lower fees than traditional banks, saving costs |

For businesses conducting large or frequent transactions, savings from exchange rate differences are particularly significant. For example, a business with $100,000 in annual cross-border payments can save $1,000 directly by reducing the exchange rate spread by 1%.

Hidden Fees

Many businesses encounter various hidden fees when using traditional bank cross-border remittances. These include intermediary bank fees, additional recipient-end fees, expedited transfer fees, and exchange rate spreads. Global remittance networks reduce intermediary steps through technological innovation, offering a more transparent fee structure.

| Fee Category | Specific Fee Details | Explanation |

|---|---|---|

| Intermediary Bank Fees | Multiple agent banks charge commissions and fees | Common in traditional bank cross-border remittances, leading to accumulated fees |

| Recipient-End Fees | Fixed transfer fees, receiving fees, verification fees, etc. | Varies by country and bank standards |

| Special Scenario Fees | Expedited transfer fees, non-standard currency pair fees, refund or modification fees | Expedited transfers may incur an additional 1.5% |

| Exchange Rate Spread | Bid-ask spread results in hidden costs of about 0.3%–0.7% | Increases actual conversion costs |

| Third-Party Platform Advantages | Low rates, transparent fees, local account operations | Airwallex, Wise, etc., avoid multiple fees |

Global remittance networks leverage technologies like blockchain and stablecoins to further reduce hidden fees. For example, JD Group reduced cross-border payment costs by 90% using stablecoin conversions, with payment efficiency improved to within 10 seconds. World Bank data shows that global average remittance costs are around 6.94%, with hidden fees constituting a significant portion. By choosing transparent, automated global remittance networks, businesses can effectively control total costs and improve fund utilization efficiency.

Tip: When selecting cross-border payment solutions, businesses should focus on transaction fees, exchange rate differences, and hidden fees. Global remittance networks have clear advantages in these areas, making them suitable for businesses seeking efficiency and cost optimization.

Transfer Speed

Image Source: unsplash

Global Remittance Network Speed

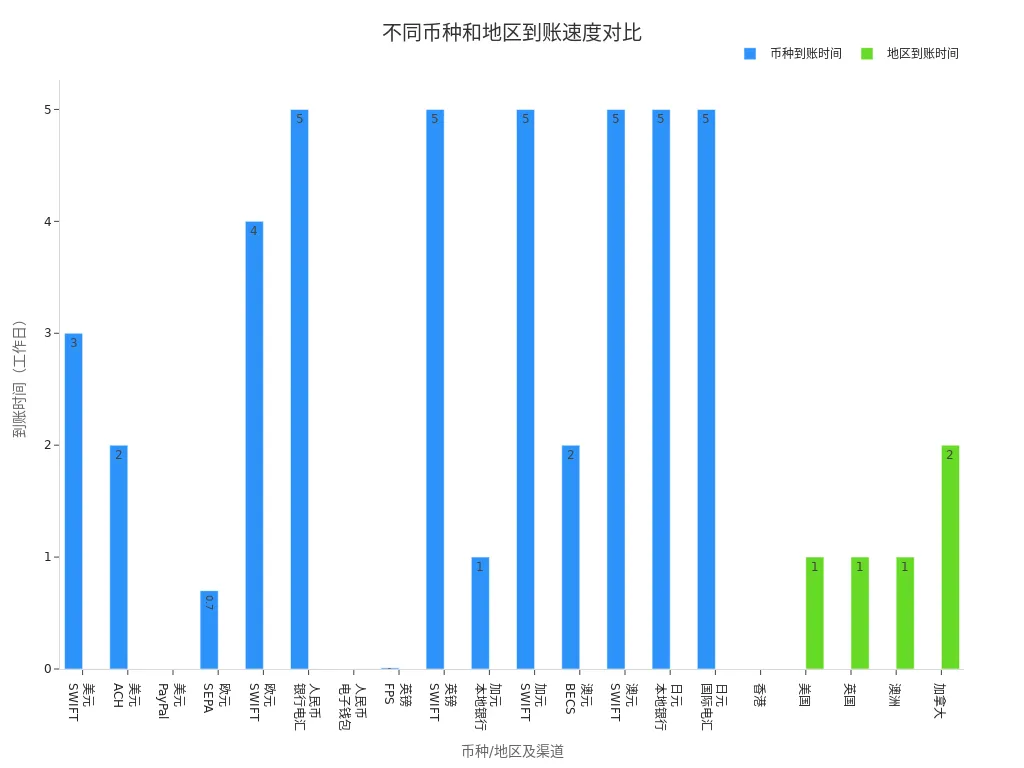

Global remittance networks excel in transfer speed. Many platforms significantly reduce the time it takes for funds to reach recipients by connecting directly to local banks and optimizing clearing processes. Below are the transfer speed differences for global remittance networks across countries and regions:

- Payment platforms in Asian markets (e.g., China, Japan, South Korea) have high direct connection rates with local banks, enabling funds to arrive in minutes.

- In European markets, due to financial regulations and payment system differences, some funds require intermediary bank clearing, potentially extending transfer times to 1–2 business days.

- Major currencies (e.g., USD, EUR) clear quickly, typically arriving on the same day or next day. Less common currencies take longer due to additional processing steps.

- Transfers through clearing systems are highly efficient, while multiple agent banks cause delays.

- Large transfers may face longer processing times due to strict compliance reviews.

- Bank operating hours and the accuracy of transfer details also affect transfer speed.

For example, Wise’s official data shows that major currencies like USD and EUR can arrive in 1–2 hours, with an average completion time of 8 hours. Some electronic remittance tools, like Panda Remit, can complete cross-border transfers in as little as 25 minutes. LianLian Cross-Border Payments achieve transfers in 5 minutes on business days, while iPayLinks supports transfers within 2 hours, available 24/7.

Tip: Businesses choosing global remittance networks should prioritize platforms directly connected to local banks to significantly improve transfer efficiency.

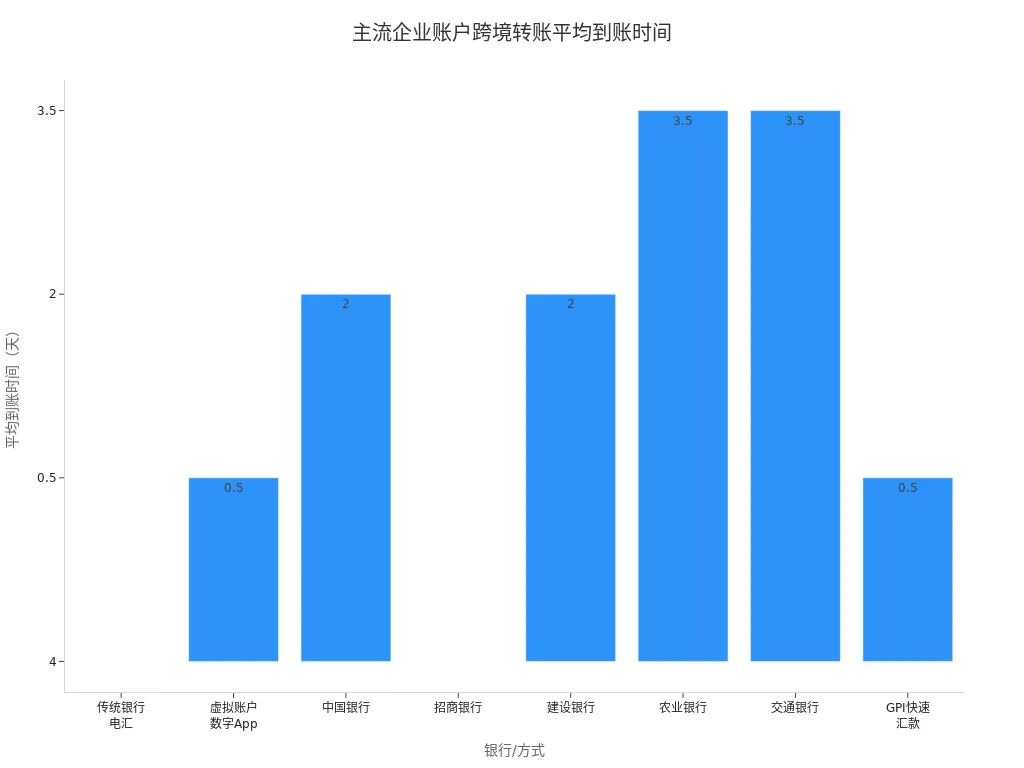

Business Account Speed

Business accounts include traditional bank accounts and virtual accounts. Traditional bank cross-border wire transfers are generally slower, typically requiring 1–3 business days for processing, with overall transfer times of 3–5 business days. Virtual accounts or digital payment apps are faster, with some achieving same-day or next-day transfers. Transfer times are affected by the completeness of transfer details, processing speeds of intermediary and recipient banks, transfer amounts, weekends, and holidays.

The table below shows transfer times for different banks and payment methods:

| Bank/Method | Cross-Border Transfer Time Range | Remarks |

|---|---|---|

| Traditional Bank Wire Transfer | 1–3 business days for processing, 3–5 business days overall | Can arrive in 24 hours in some cases, especially via electronic channels with accurate details |

| Virtual Accounts/Digital App Payments | Same-day or next-day arrival | Faster, with high security and ease of use |

| Bank of China | Counter: 1–2 business days; electronic channels: as fast as 24 hours | Affected by intermediary and recipient bank processing speeds, up to 3–7 business days |

| China Merchants Bank | 3–5 business days | Depends on overseas bank processing times |

| China Construction Bank | 1–3 business days | Requires processing at both counters |

| Agricultural Bank of China | 2–5 business days | |

| Bank of Communications | 2–5 business days | |

| GPI-Supported Fast Transfers | Generally same-day arrival | Transparent process, clear fees, with SMS notifications |

Transfer speeds also vary by currency and region. For example, USD transfers via SWIFT typically take 1–3 business days, SEPA transfers within the Eurozone can take as little as 0.7 business days, and GBP transfers via the FPS system can arrive in seconds to minutes. Some Hong Kong banks offer real-time transfers, while Canada and Australia have relatively longer transfer times.

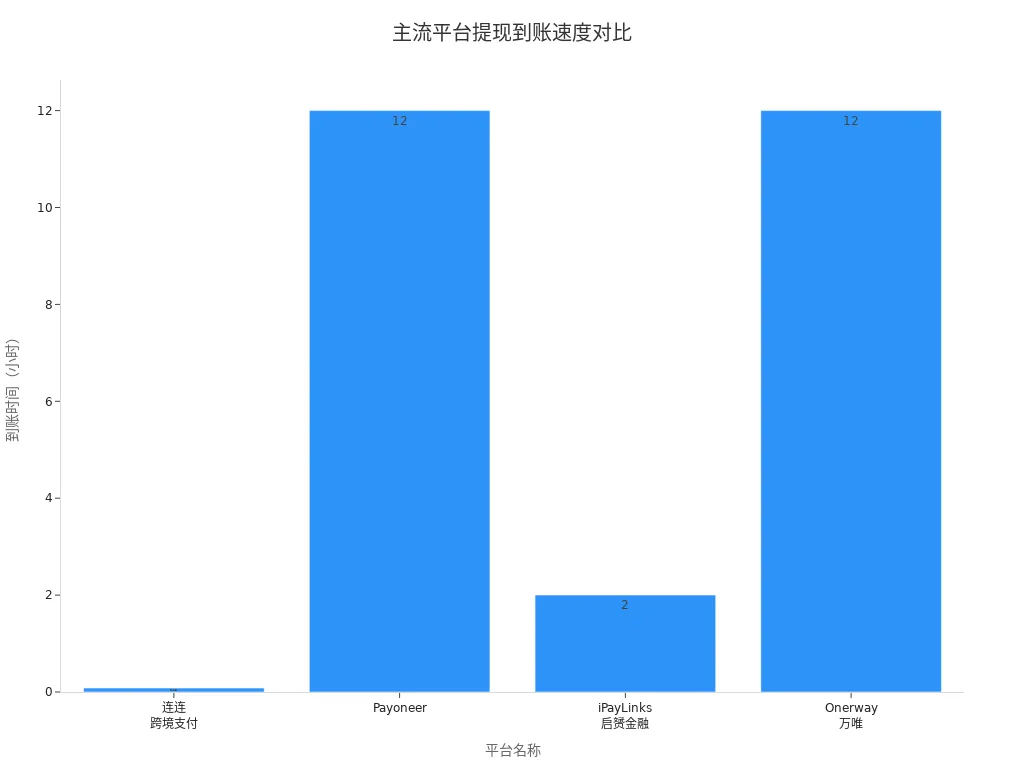

Real-Life Cases

In practice, the transfer speed advantage of global remittance networks is particularly evident. Below is a comparison of withdrawal times for mainstream platforms:

| Platform Name | Withdrawal Time | Withdrawal Fees | Supported Currencies | Remarks |

|---|---|---|---|---|

| LianLian Cross-Border Payments | Within 5 minutes (business days) | 0.7% cap | USD, GBP, EUR, CAD, AUD, JPY | Instant transfers as fast as 2 seconds, supports multiple currencies, free VAT payments |

| Payoneer | 1–2 business days | 1.2% cap | USD, GBP, EUR, CAD, AUD, JPY, etc. | Legally compliant, supports Mastercard, fast withdrawals, multi-platform support |

| iPayLinks | Within 2 hours (24/7) | 0.5% | USD, EUR, GBP, JPY, AUD | 24/7 withdrawals, value-added services include VAT payments, loans |

| Onerway | Same day at earliest, next day at latest | 0.5% | EUR, GBP, USD, JPY | Supports VAT and logistics payments |

Additionally, Wise supports multiple payment methods, with bank debits, debit cards, and credit cards achieving transfers within 2 hours, and wire transfers taking about 6 hours. Panda Remit completes transfers in as little as 25 minutes, and Alipay in as fast as 6 hours. Traditional bank SWIFT transfers generally take 1–3 business days, while bank counter transfers take about 3 days.

- PayPal withdrawals to local bank accounts take 1–2 business days, with a $35 fee per transaction.

- Ripple blockchain payments achieve real-time transfers with fees only one-tenth of traditional banks.

- A business transferring $1 million to Singapore via Ripple incurred only $100 in fees, saving 90% compared to traditional banks.

- A cross-border e-commerce seller withdrawing $10,000 via PayPal paid a $35 fee and lost about $300 due to exchange rate differences.

Summary: Global remittance networks significantly improve transfer speeds through technological innovation and local connections. Businesses can choose the optimal solution based on currency, region, and operational needs to enhance cash flow efficiency.

Applicable Scenarios

Business Types

Different types of businesses have varying considerations when choosing cross-border payment methods.

- Foreign trade companies typically require independent overseas bank accounts in the same name as the business to facilitate customs clearance and export tax rebates. Virtual account systems struggle to meet these compliance requirements.

- Cross-border B2B trade businesses involve large transaction amounts and complex processes, requiring robust KYC/KYB capabilities and risk control systems from payment services.

- Cross-border e-commerce businesses often use third-party e-wallets or platform collections, focusing on the convenience of online transactions and return risks.

- Service-oriented businesses prioritize cash flow efficiency and exchange rate management services. Banks like Hong Kong banks tend to support core businesses with complete financial data and larger scales. For example, Ping An Bank leverages blockchain and AI technologies to provide online accounts receivable transfers and financing services for core businesses and their SME supply chains, improving cash flow efficiency and risk management.

Transaction Needs

Transaction frequency and amount directly influence the choice of payment method. High-frequency transaction businesses often face challenges with traditional bank accounts due to cumbersome processes, slow transfers, and high fees.

- Traditional cross-border payments rely on the SWIFT system and multiple intermediary banks, suitable for large, low-frequency transactions with high security but low automation.

- Emerging payment networks like Airwallex connect to local clearing systems, enabling real-time exchange rate conversions with low fees and fast transfers, ideal for high-frequency, small transactions.

- Business accounts support batch management and multi-currency operations, meeting large and batch payment needs.

- Combining these methods enhances fund management efficiency and security for complex transaction scenarios.

Multi-Currency Management

Multi-currency management is critical for cross-border businesses to enhance competitiveness.

| Function Module | Description |

|---|---|

| Multi-Currency Accounting | Supports multi-currency account processing, automatically generating ledgers and detailed accounts by currency |

| Exchange Rate Management | Built-in real-time exchange rate interface, supports historical and custom rates, and automates accounting conversions |

| Report Consolidation | Automatically generates multi-currency consolidated reports, meeting international and local financial standards |

| Budgeting and Forecasting | Supports multi-currency budget allocation and rolling forecasts for global fund coordination and risk management |

| Fund Flow Analysis | Visualizes cross-border fund flows, supports multi-bank account integration |

| Compliance and Taxation | Automatically adapts to national tax and financial reporting standards, supports e-invoicing and declarations |

| Approval and Control | Multi-level approval processes ensure compliant and traceable fund operations |

In practice, cross-border e-commerce businesses use multi-currency management systems for unified accounting, real-time exchange rate management, and automated compliance reporting, significantly improving financial transparency and management efficiency. API integration with accounting systems allows businesses to automatically retrieve sales and shipping data, generate accounting vouchers and financial reports, reduce manual operations, and improve accounting accuracy and efficiency.

Tip: Businesses should select appropriate payment methods and multi-currency management tools based on their scale, business model, and transaction needs to enhance cash flow efficiency and risk control.

Operations and Security

Account Opening Process

Businesses often face practical issues when opening business accounts.

- System prompts like “user session timed out” during login are often due to unstable public IP addresses or improper LAN settings; businesses can contact network administrators to optimize the environment.

- For U-key issues, try removing unnecessary USB devices and disabling Bluetooth before retrying.

- Missing certificate information requires checking U-key insertion and driver installation.

- If driver installation fails, businesses should download the latest drivers from the bank’s official website.

- Login ID errors require confirming whether the bank received the certificate collection form and completed unfreezing.

- Online banking issues, such as password input fields not appearing, may require checking security control installations and disabling blocking software.

- If online banking transactions are unresponsive, businesses can adjust the network MTU value.

For online banking, businesses need to prepare materials such as business licenses, legal representative and operator IDs, authorization letters, and U-keys. Some accounts allow shared online banking permissions, subject to bank regulations. Businesses also need to select the appropriate company type, determine the company name, and prepare registration materials. In contrast, global remittance networks have a simpler account opening process, typically completed by submitting documents online, saving significant time and labor costs.

Compliance and Security

Traditional banks have significant advantages in compliance and security.

- Through digital transformation and technological innovation, banks have enhanced risk monitoring and early warning capabilities. For example, Beijing Rural Commercial Bank built a universal financial transmission system to strengthen information security.

- Using AI and digital signatures, banks improve compliance management and customer service.

- Robust risk control systems and compliance culture strengthen internal audits, ensuring accurate compliance reports.

- Banks strictly adhere to market access and operational regulations, establishing supply chain finance compliance systems to prevent false transactions and risk transmission.

- Multi-party collaboration with judicial, regulatory, and industry associations fosters a strong compliance environment.

Hong Kong banks and other institutions prioritize market access regulation, forming professional teams to apply for and maintain financial licenses, ensuring legal and compliant operations. Banks also enhance compliance systems to prevent facilitating false trade, supporting the stable development of financial institutions.

User Experience

Global remittance networks excel in convenience and multi-user management. Cross-border payment systems like SWIFT’s GPI project significantly reduce transfer times, allowing users to receive payment confirmations in minutes. Digital technology enhances transfer speed and transparency, enabling users to view real-time exchange rates and fees, avoiding hidden charges. Platforms like Cross-Border Payment Connect support multi-currency conversions and diverse payment methods, meeting the needs of businesses and individuals. A Shanghai electronics manufacturer completed a $100,000 order collection in 10 minutes, a Guangzhou consumer completed an e-commerce payment in seconds, and a Shenzhen tourist in Thailand received urgent funds from family quickly, demonstrating the system’s efficiency and flexibility. In the future, global remittance networks will further simplify processes, offer personalized services, and enhance multi-user management to help businesses improve fund management efficiency.

When choosing cross-border payment solutions, global remittance networks outperform in fees and transfer speed. Common decision factors include:

- Account management and payment/receipt efficiency

- Cash flow and bill management

- Corporate account overdraft limits

Many businesses leverage innovative technologies like SWIFT GPI and blockchain to enhance payment experiences. In the future, intelligent and real-time payments will continue to optimize global remittance networks, helping businesses efficiently address diverse operational scenarios.

FAQ

What are the main differences between global remittance networks and business accounts?

Global remittance networks typically offer lower fees and faster transfers. Business accounts, like those of Hong Kong banks, involve complex procedures, high fees, and slower transfers. Businesses can choose based on their operational needs.

Are business remittances via global remittance networks secure?

Global remittance networks use encryption and multi-factor authentication. Platforms like Wise and Airwallex are regulated, ensuring fund security. Businesses can use them with confidence.

How do businesses calculate the actual received amount for remittances?

Businesses should consider transaction fees, exchange rate differences, and potential hidden fees. Platforms display estimated received amounts. For a $1,000 transfer, the actual amount varies slightly due to rates and fees.

What documents are needed to open a business account?

Businesses need a business license, legal representative ID, authorization letter, etc. Hong Kong banks often require U-keys and registration documents. Global remittance networks have simpler processes, requiring only online document submission.

How does multi-currency management benefit businesses?

Multi-currency management allows businesses to handle USD, EUR, and other currencies simultaneously. It enables automatic rate conversions, unified accounting, improved financial efficiency, and reduced conversion losses.

Through an in-depth comparison of global remittance networks and traditional business accounts, you’ll see that while traditional banks are safe and compliant, they can’t meet the needs of modern businesses in terms of cost and speed. Emerging remittance networks, while efficient and transparent, still haven’t solved all the pain points, such as the complexity of managing multiple accounts and the fragmentation between fiat and digital assets. To help you overcome this challenge, BiyaPay offers a solution that combines cost-effectiveness, speed, and a forward-looking approach. We not only provide remittance fees as low as 0.5%, but our global network also enables funds to be delivered on the same day. Crucially, we offer the ability to manage multiple fiat and digital currencies from a single account, fundamentally simplifying your cross-border financial management. Register now, and with our real-time exchange rate converter, you can control the cost of every transaction while preparing for the future. Say goodbye to complex traditional methods and choose BiyaPay to make your cross-border cash flow more efficient and intelligent.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.