- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

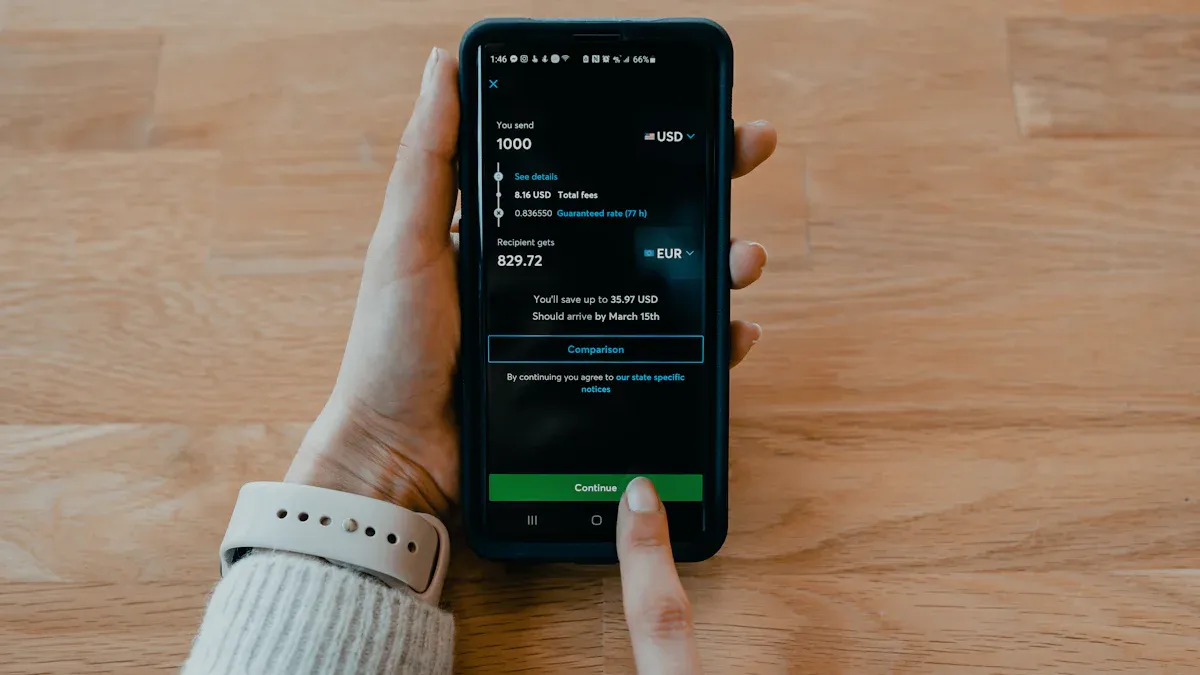

Common Issues and Solutions for WeChat Pay Cross-Border Transfers

Image Source: unsplash

Do you want to transfer money abroad using WeChat? Now, WeChat Pay cross-border transfers are very convenient. You can operate through the WeRemit mini-program, WeChat Pay HK App, or overseas credit cards. WeChat Pay’s cross-border service covers 74 countries and regions, supports 31 currency settlements, and collaborates with over 1,000 institutions. During actual operations, you may encounter issues with limits, fees, transfer times, identity verification, and compliance requirements.

Key Points

- WeChat Pay cross-border transfers are simple to operate, mainly through the WeRemit mini-program and WeChat Pay HK App, requiring pre-prepared recipient information and identity proof.

- Supports multiple mainstream currencies and payment methods, with the system automatically converting foreign currencies, making it convenient and fast for scenarios like tuition, salaries, and living expenses.

- Recipients must complete real-name verification, submitting authentic ID and bank card information to ensure account security and smooth receipt.

- Verified users enjoy higher transfer limits, with fees varying by channel and amount; comparing options helps choose the most cost-effective method.

- Transfer times range from real-time to 2 business days, with delays possible during holidays or for large transfers; check information and contact official customer service for delays.

WeChat Pay Cross-Border Transfer Process

Image Source: pexels

Operation Steps

Do you want to transfer money to other countries using WeChat? It’s actually very simple. The two most common entry points are the WeRemit mini-program and WeChat Pay HK App. You can search for “WeRemit” in WeChat, open the mini-program, follow prompts to fill in recipient information, select the destination country and amount, and complete payment via WeChat Pay. This process is especially suitable for sending money to family or friends in places like China, the Philippines, or Indonesia, or paying tuition. The WeRemit mini-program offers fast transfers and doesn’t use your personal foreign exchange quota.

If you’re in Hong Kong, the WeChat Pay HK App is more convenient. Just open the app, confirm the recipient is your WeChat contact, select the “cross-border remittance” service, enter the amount, and the system will display fees. If the amount exceeds the limit, the system will prompt for additional verification. You’ll also need to select the recipient and purpose (e.g., salary or family support) and enter your payment password to complete. After remitting, the recipient receives a notification and can collect funds via the WeRemit mini-program. Both methods require you and the recipient to complete real-name verification. While both the WeRemit mini-program and WeChat Pay HK App support cross-border transfers, their account systems and details differ, such as non-interoperable funds, limits, and fee standards.

Tip: Before starting, prepare the recipient’s name, account details, and identity proof to save time.

Supported Currencies

When using WeChat Pay for cross-border transfers, you’re likely most concerned about supported currencies. Currently, WeChat Pay supports 9 mainstream currencies, including GBP, HKD, USD, JPY, CAD, AUD, EUR, NZD, and KRW. During transfers, the system automatically converts RMB to the target currency, with exchange rates provided in real-time by partner financial institutions like Hong Kong banks. You don’t need to exchange currencies yourself; the system handles it, making it hassle-free.

WeChat Pay cross-border transfers cover over 49 countries and regions, supporting direct transactions in 16 currencies. For example, in Hong Kong, you can remit HKD directly to China, with the system converting to RMB. Policies jointly promoted by the People’s Bank of China and the Hong Kong Monetary Authority make remittances and payments between these regions more efficient and secure. You can use WeChat Pay for cross-border remittances for tuition, salaries, living expenses, and more.

Payment Methods

When making WeChat Pay cross-border transfers, payment methods are highly flexible. You can use WeChat wallet balance, linked bank cards (including Hong Kong bank cards), or overseas credit cards. For example, in Hong Kong, you can use WeChat Pay HK wallet balance or link a local bank card for direct payment. In the US, Canada, or Europe, you can initiate cross-border transfers via Xoom or PayPal, with funds arriving directly in the recipient’s WeChat wallet or linked bank card.

WeChat Pay also supports QR code payments, mini-program payments, and in-app payments. Outside China, you can link overseas bank cards for QR code scanning, passive scanning, or password-free deductions. This makes cross-border transfers and daily consumption easy for studying, traveling, or working abroad.

Reminder: Different payment methods may vary in transfer speed and fees; choose the best option based on your needs.

Recipient Eligibility

Verification Requirements

Want your family or friends to receive cross-border transfers via WeChat? You need to ensure the recipient meets WeChat Pay’s verification requirements. Currently, recipients must hold a Chinese second-generation ID or a Mainland Travel Permit for Hong Kong and Macau Residents. During remittance, recipients must complete initial identity verification in the WeChat cross-border remittance mini-program. This includes entering real name, ID number, phone number, and bank card details. WeChat Pay uses tiered verification based on transfer amounts. If a single or cumulative amount exceeds a threshold, such as approximately 7,000 USD (based on real-time exchange rates), the system may require additional documents like ID, passport, or visa. You’ll also need to pass facial recognition or security password verification to ensure account safety.

Tip: If the recipient hasn’t completed real-name verification, WeChat Pay will restrict receiving functions or suspend services until verification is complete.

Document Preparation

Before starting, prepare the following documents to ensure a smooth verification process:

- Recipient’s real name and ID number

- Valid Chinese second-generation ID or Mainland Travel Permit for Hong Kong and Macau Residents

- Recipient’s bank card details (e.g., issuing bank, account number)

- Recipient’s phone number

- Additional documents like passport or visa (for larger amounts)

If you’re a merchant, prepare a business license and legal representative’s ID. You can scan a channel QR code via WeChat to follow the “WeChat Pay Merchant Assistant” official account, then upload documents via the mini-program. The system verifies documents automatically, requiring minimal wait time.

Common Verification Issues

You may encounter these issues during verification:

- Incorrect ID information, leading to verification failure

- Unbound or unverifiable phone number

- Blurry or incomplete uploaded document photos

- Bank card details inconsistent with ID information

- Reaching annual receipt limits (e.g., 50,000 USD, based on real-time exchange rates), triggering system restrictions

If issues arise, double-check documents for accuracy. If verification still fails, contact WeChat Pay’s official customer service for one-on-one guidance to resolve issues quickly and complete cross-border transfer receipts.

Limits and Fees

Image Source: unsplash

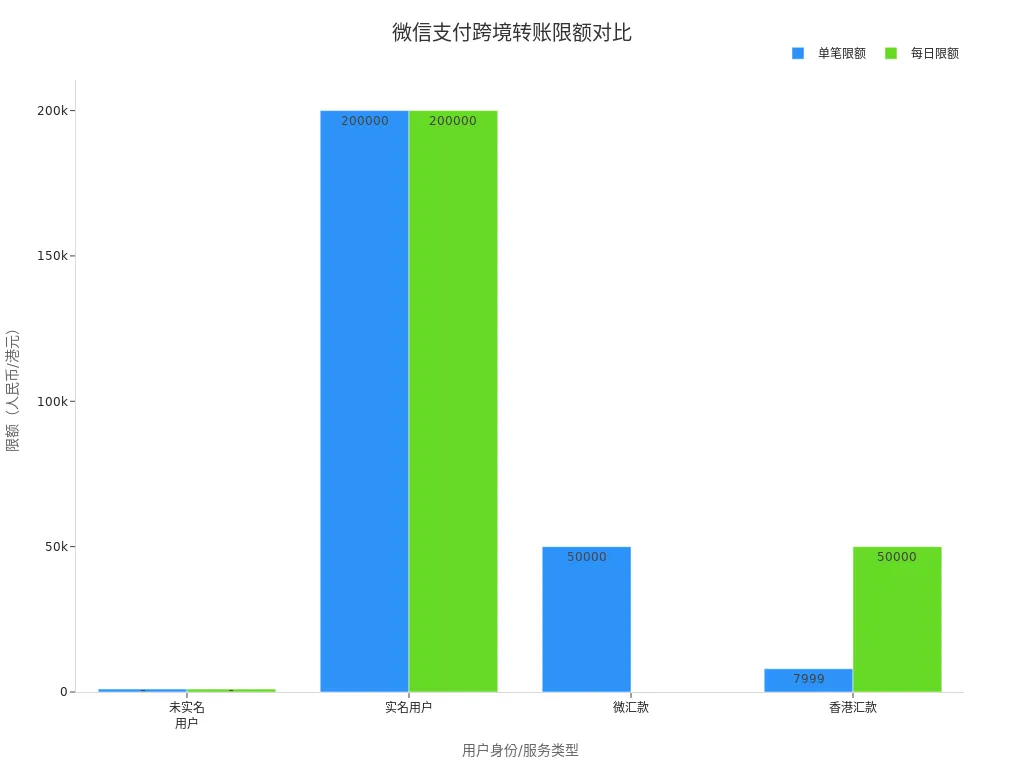

Single and Daily Limits

When using WeChat Pay for cross-border transfers, limits are a key concern. In November 2024, WeChat Pay raised the single-transaction limit for verified users to approximately 27,400 USD (based on 1 USD = 7.3 CNY). This allows more flexibility for large transfers. Unverified users have a single and daily limit of about 137 USD, with a monthly cap of 274 USD. The WeRemit mini-program has a single-transaction limit of 6,850 USD and an annual cap of 27,400 USD. Hong Kong remittance services have a single-transaction limit of 1,095 USD and a daily cap of 6,850 USD. Limits vary significantly by identity and service type, as shown below:

| User Identity/Service Type | Single-Transaction Limit (USD) | Daily Limit (USD) | Notes |

|---|---|---|---|

| Unverified Users (Wallet Payment) | 137 | 137 | Monthly limit 274 USD |

| Verified Users (WeChat Transfer) | 27,400 | 27,400 | Up to 100 transfers daily, no monthly limit |

| WeRemit Cross-Border Remittance | 6,850 | N/A | Annual cumulative limit 27,400 USD |

| WeChat Hong Kong Remittance | 1,095 | 6,850 | Monthly limit applies |

Reminder: Complete real-name verification before large transfers to enjoy higher limits and a smoother experience.

Fee Standards

Fees are a critical consideration during transfers. WeChat Pay cross-border transfer fees vary by service type, amount, and partner institutions (e.g., Hong Kong banks). Generally, WeRemit mini-program fees range from 0.3% to 1%, with a minimum of about 3 USD. Hong Kong remittance service fees are typically within 1%, with waivers during some promotional periods. Third-party platforms like xtransfer charge around 0.4% for settlement withdrawals, about 10 USD for regular withdrawals or transfers, and 20 USD for cross-border remittances. Choose the most suitable channel based on your needs.

Tips to Reduce Fees

Want to save money? Here are ways to lower fees:

- Apply for a 0.2% low-fee merchant account via “Smart Merchant Service Assistant”, uploading business license and representative ID for official approval.

- Choose cost-effective third-party platforms like xtransfer, offering free account opening and lower fees, ideal for businesses and large transfers.

- Watch for WeChat Pay and Hong Kong bank promotions, which may offer fee waivers or cashback.

Tip: Compare fees and transfer speeds across channels before transferring to choose the most cost-effective option.

Transfer Times

Normal Transfer Times

When using WeChat Pay for cross-border transfers, you’re likely most concerned about when funds will arrive. Generally, WeChat Pay cross-border transfers support real-time arrivals, with many cases arriving within 1–2 business days. Using the WeRemit mini-program, funds typically arrive the same day or next day. Channels partnered with Hong Kong banks also offer fast transfers. Wire transfers may take 1–3 business days. Transfers initiated on weekends or holidays may be delayed, with Saturday transfers typically taking 3–5 business days. Large transfers requiring risk reviews may take longer. Reference transfer times:

- Real-time: Some small transfers and fast channels

- 1–2 business days: Most WeChat Pay cross-border transfers

- 3–5 business days: Weekends, holidays, or large transfers

Tip: Check with the recipient bank, such as Hong Kong banks, to confirm specific transfer times before remitting.

Factors Affecting Transfers

Transfer times aren’t fixed, sometimes arriving quickly, other times taking days. Key factors include:

- Bank type: International and Hong Kong banks process faster; smaller banks may be slower.

- Intermediary banks: More intermediaries extend transfer times.

- Transfer method: Regular, fast, and electronic transfers vary in speed.

- Transfer amount: Large transfers require additional reviews, lengthening times.

- Transfer timing: Business days process faster; holidays and weekends delay transfers.

- Recipient information accuracy: Errors cause delays.

- Destination country/region: Policy restrictions in some regions extend transfer times.

Choose fast or electronic transfer methods for quicker arrivals.

Delay Handling Tips

If funds are delayed, don’t panic. Try these steps:

- Verify recipient details, ensuring name, account, and bank information are correct.

- Check transfer timing to see if holidays or weekends caused delays.

- Consult the recipient bank, such as Hong Kong banks, to understand intermediary or special review processes.

- Use the WeChat Pay mini-program or app’s progress tracking feature to monitor status.

- If delays exceed normal times, contact WeChat Pay’s official customer service with transfer receipts and details for assistance.

Reminder: Plan large transfers or those near holidays in advance to avoid delays impacting fund availability.

Compliance and Regulation

Key Regulations

When using WeChat Pay for cross-border transfers, compliance is critical. In June 2024, nine ministries issued “Opinions on Expanding Cross-Border E-Commerce Exports and Promoting Overseas Warehouse Construction”, supporting banks and payment institutions to provide efficient, low-cost cross-border settlement services. This policy makes WeChat Pay cross-border transfers safer and more reliable. On September 20, 2024, WeChat Pay’s user service agreement was revised, emphasizing compliance with agreement terms to ensure transaction legality and compliance.

Reminder: Review the latest policies and agreement terms before transferring to avoid issues from policy changes.

Document Requirements

To complete cross-border transfers smoothly, prepare these documents:

- Valid ID, such as a Chinese second-generation ID or Mainland Travel Permit for Hong Kong and Macau Residents

- Recipient bank card details (e.g., Hong Kong bank account)

- Phone number and recipient name

- Original ID for large transactions, mandatory verification for amounts over 50,000 USD

Merchants need a business license and legal representative ID. Ensure all documents are authentic and clear for quick system verification.

Review Issues

You may face challenges during reviews. Different countries have specific compliance restrictions; for example, Taiwan, Australia, and the US only support institutional modes, and some regions don’t support all modes. You need to submit pre-approval forms and formal review documents, with the process taking 1–2 months. Under the service provider model, special merchant documents must also be submitted, with fees ranging from 1%–2.5%, shared via SHA method. The review includes document submission, official review, agreement filing, and appid binding, requiring communication with WeChat Pay’s business manager.

Tip: Consult WeChat Pay’s official customer service before preparing documents to ensure a smooth process and reduce wait times.

Common Failure Reasons

Account Issues

Account issues are among the most common reasons for cross-border transfer failures. For example, insufficient account balance will cause the system to reject the transfer. Frequent receipts or suspicious operations may trigger system restrictions on receiving functions. Expired or frozen linked bank cards can also cause receipt failures. To prevent fraud and money laundering, payment institutions may freeze accounts or block cards. You may encounter transfers intercepted, withdrawals failing, or funds returned. To resolve:

- Check account balance and bank card status to ensure they aren’t frozen.

- If flagged as a risk account, submit documents to lift restrictions.

- Contact Hong Kong banks or WeChat Pay customer service for specific reasons.

Reminder: Keep account information authentic and compliant, avoiding frequent suspicious operations.

Information Errors

Incorrect information can cause transfer failures. For example, inaccurate recipient name, bank account, or SWIFT code can lead to returns or delays. Different countries’ financial regulations may require additional documents, and errors or missing documents can worsen delays or freeze funds. Be meticulous when entering information to ensure accuracy.

- Verify recipient name, account, and bank details match ID.

- Promptly upload clear, authentic documents if additional materials are required.

Tip: Confirm information with the recipient beforehand to reduce errors.

System Failures

System issues can also disrupt transfers. Unstable networks, bank system maintenance, or security vulnerabilities in third-party platforms can interrupt or fail payment processes. You may encounter incomplete payment processes, expired transactions, or 3D verification failures. For system failures:

- Check network stability.

- Restart the transfer if the process is interrupted.

- If failures persist, contact WeChat Pay or Hong Kong bank customer service for help.

Avoid peak periods or system maintenance times to improve success rates.

Other Questions

Foreign Currency Receipts

Can WeChat Pay directly receive foreign currencies? Currently, WeChat Pay automatically converts foreign currencies to RMB or HKD during cross-border transfers. You don’t need to exchange currencies yourself; the system settles based on real-time rates. Just monitor the received amount and rate changes to ensure fund safety.

Non-Friend Transfers

Want to transfer without adding someone as a WeChat contact? WeChat Pay introduced the “transfer to phone number” feature in 2019. Enter the recipient’s phone number, and if they’ve enabled “allow transfers via phone number,” the transfer can proceed. While not explicitly confirmed for cross-border scenarios, this feature is common in mainland China. Confirm settings with the recipient before proceeding.

Progress Tracking

Want to monitor transfer progress? WeChat Pay and the WeRemit mini-program offer progress tracking. Check statuses like “processing,” “received,” or “returned” in the mini-program or app. Delays trigger system prompts. Save transfer receipts for inquiries and communication.

Customer Support

For issues, contact WeChat Pay customer service via multiple official channels:

- Access [Consumer Protection] in the WeChat wallet and select [Contact Customer Service].

- Go to WeChat [Me] - [Settings] - [Help & Feedback] - [Online Consultation].

- Find WeChat customer service via video accounts, official accounts, or mini-programs.

- Click [Contact Merchant] in WeChat Pay receipts.

Customer service can address cross-border payment, rate, and transfer issues. Use official channels for faster, safer resolutions.

When using WeChat Pay for cross-border transfers, understand each step. Accurately enter recipient information, choose suitable Hong Kong banks, and monitor fees and transfer times. Comply with foreign exchange regulations, save receipts, and avoid holiday transfers. For unresolved issues, contact WeChat Pay’s official customer service promptly. Understanding policies and processes beforehand ensures safer funds and avoids unnecessary hassle.

FAQ

Is WeChat Pay cross-border transfer safe?

WeChat Pay cross-border transfers are secure. WeChat encrypts your information and uses multi-factor authentication. Protect your account and password to avoid fund risks.

Can I cancel a submitted cross-border transfer?

Once submitted, transfers are processed immediately and generally can’t be canceled. If information is incorrect, contact WeChat Pay customer service immediately to check processing status.

Can I add a note for the transfer purpose?

When entering transfer details, you can add notes like “tuition” or “living expenses.” This helps recipients and banks understand the purpose, aiding smooth reviews.

Which countries and regions support WeChat Pay cross-border transfers?

You can transfer to 74 countries and regions, including China, the Philippines, Indonesia, the US, and Canada. Check the full list in the WeRemit mini-program.

Will funds be returned if a transfer fails?

If a transfer fails, WeChat Pay automatically refunds your account, typically within 1–3 business days. For special cases, contact WeChat Pay customer service.

This guide to common issues with WeChat Pay’s cross-border transfers shows that despite its convenience, it has many pain points, such as limits, delays, and cumbersome authentication, especially for large transfers or complex business scenarios. If you’re looking for a more flexible, efficient, and comprehensive solution, BiyaPay is your ideal choice. We not only provide remittance fees as low as 0.5% and a lightning-fast same-day delivery experience, but we also integrate the ability to convert between various fiat and digital currencies within a single account, fundamentally simplifying your cross-border financial management. Say goodbye to switching between platforms and non-transparent fees. Register now and use our real-time exchange rate converter to control every dollar, making your global financial life simpler and more efficient.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.