- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

How Much Do You Know About Alipay’s Low-Cost, High-Efficiency Cross-Border Remittance

Image Source: unsplash

When you choose Alipay for cross-border remittances, you can experience convenient operations and low fees. The platform, with over 800 million monthly active users, relies on Alibaba’s ecosystem, boasting strong market penetration and high cross-border payment activity.

- You need to submit documents such as business licenses and identification, and Alipay will conduct strict reviews.

- The platform manages transactions in compliance with local laws and regulations.

- For high-risk transactions, Alipay implements measures such as investigations or delayed settlements to ensure fund security.

Multi-currency support and technological innovation make your small-amount remittances more efficient, while compliance measures ensure peace of mind.

Key Highlights

- Alipay’s cross-border remittance fees are low, especially suitable for small remittances, offering more cost-effective rates compared to traditional banks and other platforms.

- Transfers are fast, with some remittances arriving in seconds, significantly reducing waiting times.

- The operation process is simple, requiring only a few steps on your phone, catering to various user needs.

- Supports multiple currencies, covering over 40 countries and regions, facilitating global remittances.

- Alipay prioritizes fund security and compliance, using blockchain technology and strict audits to protect your funds.

Alipay’s Cost Advantages

Image Source: pexels

Fees

When using Alipay for cross-border remittances, the fee structure is very transparent. The platform charges fees based on the remittance amount. For example, when your remittance is below $14,000 (approximately 100,000 RMB, calculated at 1 USD ≈ 7.1 CNY), the fee is 0.06%, with a minimum of $10 and a maximum of $17. If the amount exceeds $14,000, the fee is 0.08%, with a minimum of $20 and a maximum of $37. Fees vary by destination country, with specific costs displayed on the operation page.

Compared to the traditional SWIFT method, Alipay’s fee advantage is clear. When using Hong Kong banks or other traditional banks for SWIFT cross-border remittances, you typically pay $50–$43 in fees, plus $14–$21 for SWIFT telegraph fees. World Bank data shows that the average fee rate for traditional SWIFT remittances is as high as 7.68%, while Alipay’s fee rate is significantly lower. Third-party platforms like PayPal have even higher fees, typically including a 2% transaction fee, a 4.4% processing fee, and a $0.3 fixed fee, with additional charges for withdrawals. Western Union and MoneyGram fees start at $14–$21. By choosing Alipay, you can save more on small remittances.

Tip: When using Alipay for cross-border remittances, fees vary based on the amount, currency, and destination. It’s recommended to carefully review the fee details before transferring to avoid unnecessary expenses.

Exchange Rates

Alipay’s cross-border remittances use exchange rates from legitimate banking channels, typically slightly below the bank’s listed rates. You can choose between real-time exchange rates or locked rates. Real-time rates adjust instantly based on market fluctuations, while locked rates allow all transactions on the same day to settle at a fixed rate, reducing risks from exchange rate volatility. You can negotiate with payment providers to use buy, sell, or mid-market rates, flexibly adapting to market changes.

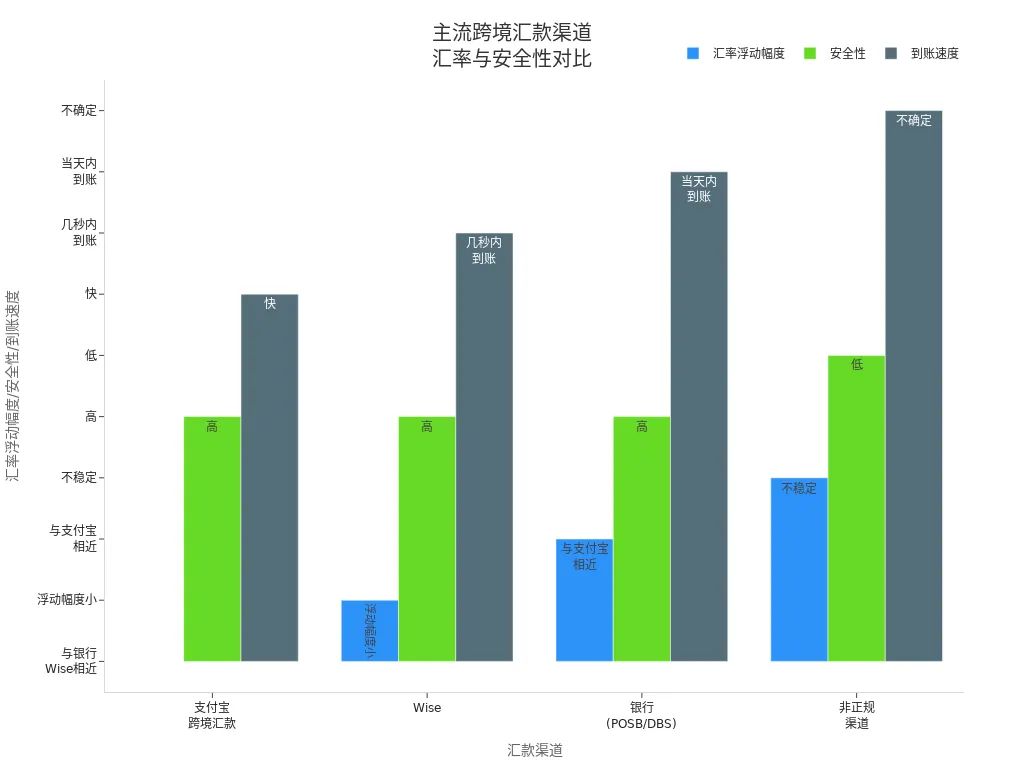

The table below compares the exchange rate policies and transfer speeds of mainstream cross-border remittance channels:

| Remittance Channel | Exchange Rate Policy | Rate Fluctuation | Fees | Security | Transfer Speed |

|---|---|---|---|---|---|

| Alipay Cross-Border Remittance | Legitimate banking channels, slightly below listed rates | Similar to banks and Wise | Low | High | Fast |

| Wise | Mid-market rate, locked for 47 hours | Small fluctuation, highly competitive | Transparent and low | High | Instant |

| Hong Kong Banks | Slightly below listed rates | Similar to Alipay | Not specified | High | Same-day arrival |

| Informal Channels | High rates, high risk | Unstable | High hidden fees | Low | Uncertain |

As you can see, Alipay’s exchange rate fluctuations are comparable to Hong Kong banks and Wise, with high security and fast transfer speeds. Wise’s rates are close to the mid-market rate with transparent fees, ideal for users prioritizing cost control. Informal channels may appear to offer better rates but carry significant security risks and are not recommended.

Hidden Fees

When using Alipay for cross-border remittances, besides explicit fees and exchange rates, you should also be aware of common hidden costs:

- Exchange rate conversion fees: Alipay typically adds a 2%–4% markup on the mid-market rate, which may reduce your actual received amount.

- Withdrawal fees: Withdrawing funds to a Chinese bank account may incur fixed fees (e.g., $35 per transaction), similar to PayPal’s withdrawal charges.

- Exchange rate fluctuation losses: If you choose real-time rates, market volatility may reduce the received amount.

- Intermediary bank fees: Some remittance routes may involve intermediary banks charging opaque fees, increasing your actual costs.

During operations, it’s recommended to carefully check each step’s fee details, especially exchange rates and withdrawals. User feedback indicates that these hidden fees are often not reflected in explicit charges but can affect your final received amount.

Note: While Alipay offers clear advantages in fees and exchange rates, you should still pay attention to all potential hidden costs to ensure fund security and maximize the received amount.

Efficiency Performance

Transfer Speed

When you choose Alipay for cross-border remittances, you can experience extremely fast transfer speeds. Many users report that funds arrive almost instantly when using Alipay’s cross-border payment system. For example, one user sending money to their daughter studying in Hong Kong saw the funds arrive in seconds, eliminating the hassle of currency conversion and half-day waits. Official data shows that on the first day of the cross-border payment system’s launch, approximately 6,900 northbound and 19,000 southbound transactions were processed, demonstrating the system’s efficiency and stability.

Alipay’s cross-border remittances connect directly to fast payment systems in China and Hong Kong, bypassing traditional intermediary agents. You no longer need to wait 1–3 business days, with average transfer times reaching “instant” levels. An Agricultural Bank of China representative stated that the cross-border payment system not only achieves instant transfers but also waived fees during the pilot phase, significantly reducing costs.

However, transfer speeds may vary by country and region due to factors such as remittance amount, recipient bank processing efficiency, compliance reviews, time zone differences, and local holidays. For instance, a $5,000 remittance to Romania may take 1–3 business days. Overall, Alipay offers faster transfer times than traditional banks in most major countries and regions.

Operation Process

Completing a cross-border remittance on the Alipay app is highly streamlined. Simply follow these steps:

- Open the Alipay app, go to “Transfer” - “Cross-Border Remittance” - “I Want to Send” interface.

- Select the remittance currency and enter the amount, then click Next.

- Fill in the sender and recipient information, then click Initiate Transfer.

- Provide the expected transfer time and purpose, read and agree to the terms, then click Submit.

- Review the “Personal Purchase Application,” confirm payment, and complete the remittance.

You can typically complete the entire process in just a few minutes. Alipay has optimized its interface and process for different user groups. For example, study-abroad users can split information entry between students and parents, addressing language and operational challenges. For users with strong financial capabilities, the interface highlights exchange rates, fees, and transfer times, while for less tech-savvy users, it simplifies the display to focus on fees and discounts. You can choose the operation method that best suits your needs.

Alipay has also invested heavily in technological innovation. Ant International uses its blockchain platform “AntChain” for multi-party real-time accounting, avoiding the cumbersome processes of traditional intermediary banks. Over one-third of transactions are completed via blockchain channels, supporting 24/7 real-time cross-border clearing, far surpassing traditional SWIFT transfers. Blockchain’s immutability also enhances transaction transparency, facilitating regulatory audits. You can initiate remittances anytime, anywhere, enjoying round-the-clock efficient service.

Multi-Currency Support

When using Alipay for cross-border remittances, you can choose from multiple currencies to meet the needs of various countries and regions. Currently, Alipay supports currencies such as HKD, EUR, JPY, KRW, and GBP, covering over 40 countries and regions. When paying in USD, the system automatically converts to the recipient’s local currency, eliminating the hassle and exchange rate risks of traditional secondary conversions.

Although currencies like USD, CAD, and AUD are not yet supported, you can meet most major countries’ remittance needs with the available currencies. Alipay also collaborates with overseas e-wallets to promote localized cross-border payments, further enhancing convenience. Whether for overseas living, studying, traveling, or business activities, you can enjoy seamless cross-border remittance services.

Through technological innovation, Alipay enhances cross-border payment and settlement efficiency, reducing fees and currency conversion costs. You can enjoy instant transfers, multi-currency support, and a safer, more transparent fund transfer process, making Alipay the preferred choice for many users.

Comparison of Methods

Image Source: pexels

With Traditional Banks

When using traditional banks (e.g., Hong Kong banks, Bank of China, ICBC) for cross-border remittances, you typically need to fill out multiple forms, making the process cumbersome. Fees are generally high, averaging $50–$43, with additional $14–$21 SWIFT telegraph fees. Transfers take 1–3 business days, potentially longer during holidays, and intermediary banks may charge extra fees, making the received amount uncertain.

In contrast, Alipay offers lower fees (approximately 0.5%–1%), a simple process, and fast transfers, with some remittances arriving instantly. You can complete the process in a few steps on your phone without visiting a bank counter. For sending living expenses to children studying in the U.S. or small transfers to friends, Alipay is more suitable.

With Third-Party Platforms

If you choose third-party platforms like Western Union or Wise, fees and transfer speeds vary. Wise uses the mid-market rate with transparent fees and fast transfers, ideal for cost-conscious users. Western Union has broad coverage, suitable for urgent large transfers, but fees are higher.

Alipay offers unique advantages for small U.S.-China personal transfers, with low fees and convenient operations, typically arriving instantly or within 1–2 business days. Blockchain-based cross-border payment exploration further enhances settlement efficiency and reduces costs. For daily expenses, tuition, or similar scenarios, Alipay provides greater convenience.

Advantages and Limitations

When using Alipay for cross-border remittances, you can enjoy the following advantages:

- Low fees, ideal for small remittances

- Fast transfers, some instant

- Simple operation process, completed via mobile

- Multi-currency support, covering over 40 countries and regions

Note: You should also be aware of some potential limitations:

- Transfer times may be affected by recipient bank processing or holidays, potentially causing delays.

- Only supports China mainland real-name verified accounts linked to specific bank cards.

- Remittance limits apply, requiring additional information to increase limits.

- Personal payment codes cannot be used overseas; use the “Cross-Border Remittance” function.

- Regulatory policies may restrict certain business scenarios, affecting fund flow efficiency.

- Alipay accounts can only transfer to the account holder’s same-name bank card, limiting transfers between relatives.

When choosing a remittance method, you can weigh these advantages and limitations to select the most suitable channel.

User Experience

Real-Life Cases

When using cross-border remittances, you’re likely most concerned about fund security and compliance. Many businesses and individuals have shared their experiences:

- A Dongguan mold manufacturing company exporting to London via the Shenzhen port strictly adhered to compliance requirements. The company ensured payment paths matched shipment details, successfully completing settlements and avoiding account freezes or fund risks.

- Trader Chen Wenting suggests using a company account for receiving payments and ensuring the company is registered in China to avoid freezes. Even with offshore companies, compliance is essential.

- In the Greater Bay Area “Cross-Border Wealth Management Connect” pilot, 31 banks served 43,600 investors with 18,600 cross-border transfers, totaling $376 million (at 1 USD ≈ 7.1 CNY). This demonstrates the widespread use of cross-border remittances in daily life and investments.

- Hong Kong users can transfer HKD to mainland China accounts via AlipayHK without fees, greatly facilitating cross-border fund flows.

You can also refer to Alipay’s safety guidelines to learn how to secure accounts, choose appropriate payment methods, and prevent transaction risks, ensuring peace of mind during remittances.

Common Issues

You may encounter some common issues during operations:

- Errors in filling out remittance details may lead to delayed or returned funds.

- Anti-money laundering compliance reviews may delay large or unclear-purpose transfers.

- Insufficient account balance can prevent successful transfers.

- Incorrect, closed, or frozen recipient accounts will result in returned funds.

- Abnormal transactions may be rejected by the platform to ensure security.

- Transfers exceeding platform or bank limits cannot proceed.

- Improperly filled transfer purposes without supporting documents may lead to returns.

- Regulatory restrictions may affect certain cross-border remittance scenarios.

- Abnormal account operations or reaching transfer limits may restrict receiving funds.

- Abnormal user location may affect cross-border payment code usage.

- Anti-fraud and risk control measures may cause rejections or delays.

You can reduce these issues by carefully verifying information, planning transfer amounts, and specifying purposes. Alipay’s strict risk control system, including real-time monitoring and anti-fraud mechanisms, ensures fund security.

You’ll find that users highly rate the service’s convenience. Many praise the intuitive interface and efficient design, especially for younger users. Satisfaction surveys show that overall ratings for cross-border remittance services have steadily risen, reaching 7/10 in 2025. Whether for daily life, studies, or investments, you can experience efficient and convenient cross-border remittance services.

When choosing a remittance method, prioritize low-cost, fast options. Alipay offers a streamlined process and fast transfers, ideal for small, frequent payments. In scenarios like cross-border e-commerce, travel spending, studying abroad, or international trade, you can enjoy convenient services. Be mindful of transfer limits, compliance requirements, and transfer times, and choose the best channel for your needs.

FAQ

Does Alipay’s cross-border remittance have minimum and maximum amount limits?

Each transfer has a minimum of $10 and a maximum of $14,000. Exceeding the limit requires additional identity and purpose verification.

Will funds be automatically refunded if a remittance fails?

If a remittance fails, funds are automatically returned to the original account. You can check the refund progress in the Alipay app.

Which currencies does Alipay support for cross-border remittances?

You can choose currencies like HKD, EUR, JPY, KRW, and GBP. USD is not yet supported, but the system automatically converts currencies.

How long does it take for a remittance to arrive?

Transfers to Hong Kong bank accounts typically arrive in seconds. Other countries take 1–3 business days, depending on the recipient bank’s processing speed.

How can I ensure fund security during remittances?

Enable account security settings and use real-name verification. Alipay employs blockchain technology and real-time risk control to safeguard your funds.

While Alipay’s cross-border remittance is excellent for small, high-frequency personal transfers, you’ve also noted its many limitations, including restricted transfer amounts, a lack of direct support for major currencies like USD, and a transfer limit to same-name bank cards only. If you need a more comprehensive solution to meet the demands of large business transactions, multi-currency management, or more flexible fund transfers, then BiyaPay is your ideal choice. We offer remittance fees as low as 0.5% and ensure same-day delivery. Most importantly, we enable the conversion between various fiat and digital currencies all within a single account, providing you with unprecedented flexibility and cost advantages. Say goodbye to the limitations of traditional platforms. Register now and use our real-time exchange rate converter to start your new era of efficient global fund management.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.