- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Alipay International Remittance FAQs and Solutions

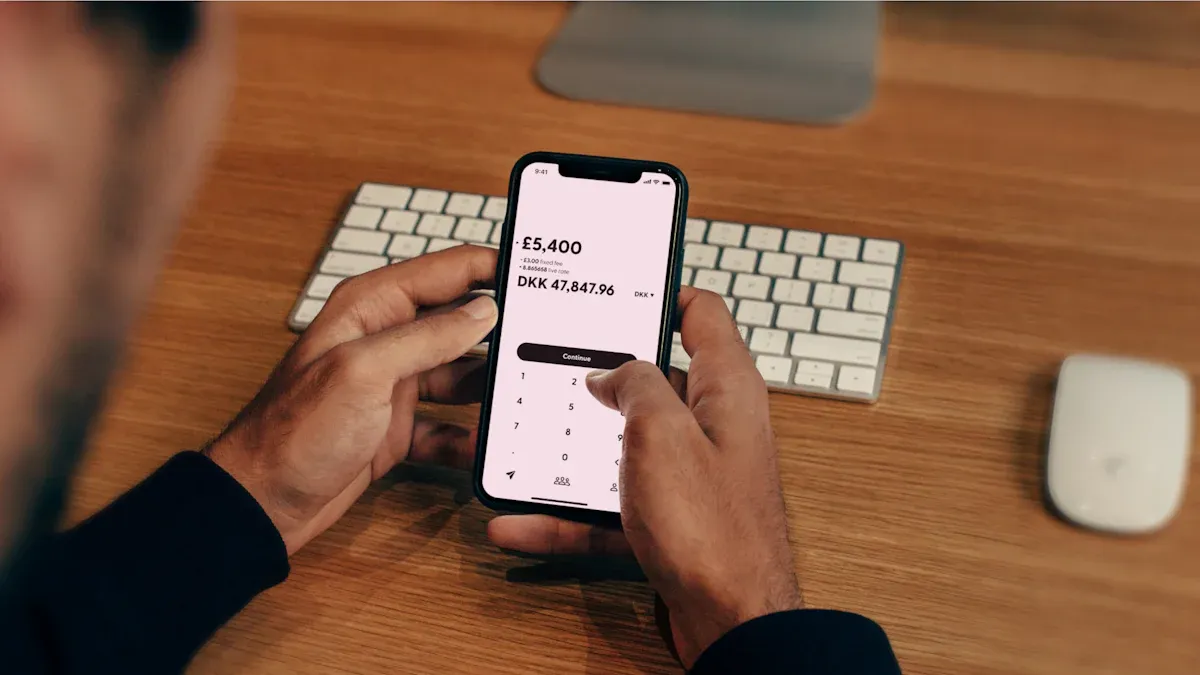

Image Source: pexels

You can use Alipay for international remittances. The operation process is simple, requiring only an Alipay account. During the process, you often encounter issues with information filling, fees, transfer time, limits, and information accuracy. The Alipay international remittance guide can help you understand each step. Compared to other mainstream platforms, Alipay offers advantages in convenience and fees, but you can only remit in RMB, and it is affected by daily limits. The table below shows the advantages and disadvantages of Alipay international remittance compared to other platforms:

| Aspect | Alipay International Remittance Advantages | Alipay International Remittance Disadvantages |

|---|---|---|

| Operation | Easy to use, requires only an Alipay account | Can only remit in RMB |

| Speed | 1-3 business days for arrival | Affected by daily bank card limits |

| Fees | Fixed fee of approximately $21 (based on exchange rate of 7.1) | Currency restrictions limit usage scope |

| Exchange Rate | Close to Hong Kong bank rates | N/A |

| Limit | Does not count toward the $50,000 annual foreign exchange quota | Restricted by daily bank card limits |

| Other | Offers discount coupons | Requires funds to be deposited into Alipay account in advance |

Key Points

- Alipay international remittance is simple to operate, requiring only an account, supporting 186 countries and regions, suitable for various currencies and account types.

- When filling out remittance information, you must use uppercase English letters, ensuring details such as name, bank account number, and SWIFT code are accurate to avoid remittance failure.

- Remittances generally arrive within 1 to 5 business days; choosing a Hong Kong bank for receipt can speed up the process, though holidays and large transfers may cause delays.

- Fees are charged by domestic and foreign banks, with three fee-bearing options; you should communicate with the recipient beforehand to avoid misunderstandings.

- If you encounter issues, you can seek help from Alipay’s official customer service, preparing your order number and relevant information to resolve problems quickly.

Coverage

Image Source: unsplash

Supported Countries and Regions

You can use Alipay’s international remittance service to send funds to 186 countries and regions worldwide. This service has wide coverage, meeting your diverse remittance needs. If you have relatives or friends studying in the UK, USA, Canada, or Australia, Alipay specifically supports most schools in these popular study destinations. You can directly use Alipay to pay their tuition, eliminating the cumbersome traditional bank processes. When selecting a remittance destination, it’s recommended to confirm in advance whether the recipient’s country or region is within Alipay’s supported range to avoid remittance failure due to unsupported regions.

Tip: You can check the latest list of supported countries and regions on Alipay’s international remittance page to ensure accurate information.

Currencies and Account Types

When using Alipay for international remittances, you can choose from multiple currencies and account types. Alipay supports both corporate and personal accounts. You can remit in USD, EUR, HKD, CAD, AUD, CHF, GBP, SGD, JPY, and NZD, totaling 10 mainstream currencies. You need to complete real-name authentication, upload ID photos, and link your phone and quick-access savings card number. For fees, Shanghai Bank charges 50 RMB per transaction (approximately $7, based on an exchange rate of 7.1), and overseas banks may also charge intermediary or receiving fees. After remitting, funds generally arrive within 1 to 5 business days via wire transfer.

| Supported Account Types | Supported Currencies | Usage Conditions | Fee Details | Settlement Method | Arrival Time |

|---|---|---|---|---|---|

| Corporate accounts, personal accounts | USD, EUR, HKD, CAD, AUD, CHF, GBP, SGD, JPY, NZD | Real-name authentication, ID upload, linked phone and savings card number | Shanghai Bank 50 RMB/transaction (approx. $7), overseas banks may charge intermediary or receiving fees | RMB settlement | Wire transfer, 1-5 business days |

When choosing a currency, you can adjust flexibly based on the recipient’s needs. For remittances to Hong Kong bank accounts, it’s recommended to prioritize HKD or USD for faster arrival and more transparent fees.

International Remittance Guide: Operation Process

Image Source: unsplash

Foreign Exchange Purchase and Settlement Steps

When using Alipay for international remittances, you first need to complete foreign exchange purchase and settlement. The international remittance guide will walk you through the following steps to complete the process:

- Open the Alipay app, go to the “Transfer” page, and select the “Cross-border Remittance” function. You can also search for “remittance” in the search bar to quickly find the entry.

- Select the “Remit to China” service and confirm you are the remitter.

- Choose the target country and currency, such as USD, EUR, or HKD. Enter the amount you wish to remit, and the system will automatically display the current exchange rate (e.g., 1 USD = 7.1 RMB).

- Compare exchange rates and fees across different partner platforms, choosing the one that suits you best. For example, some platforms charge $7, while others charge $21.

- Fill in the required information as prompted and confirm the remittance details.

- After submitting the application, the system will automatically complete the foreign exchange purchase and settlement. You can check the status in the “Remittance Progress” section.

The international remittance guide reminds you that only Chinese users who have completed real-name authentication can use this feature. The annual limit for foreign exchange purchase and settlement is equivalent to $50,000 per person. Ensure you have sufficient quota before remitting to avoid failure due to insufficient limits.

Tip: You can prioritize Hong Kong banks as the receiving bank for faster arrival and more transparent fees.

Filling in Remittance Information

In the international remittance guide, filling in remittance information is a critical step. You need to pay special attention to the following points:

- All information must be filled in uppercase English letters, and Chinese characters are not allowed. Inaccurate information will lead to remittance failure, and fees will not be refunded.

- You must accurately provide the recipient’s name, country or region, detailed address, bank SWIFT code, and bank account number (not the bank card number).

- The remittance currency, amount, purpose, and remarks must be filled in truthfully to avoid audit rejection.

- Personal information must be authentic, and the account must complete real-name authentication and link a phone and quick-access savings card.

- Remittances generally arrive within 1 to 5 days. You should confirm the information with the recipient in advance to avoid refund issues and deductions due to incorrect information.

- You should also monitor exchange rate fluctuations, as regulations in different countries and regions may affect arrival time.

Common errors include incorrect parameter entry, network issues, and system maintenance. For example, incorrect order number formats, unstable networks, or system upgrades may cause remittance failure. The international remittance guide recommends carefully reviewing all information before submission to ensure accuracy.

Note: When filling in information, avoid spaces, spelling errors, and improper formatting to significantly reduce the risk of remittance failure.

Common Issues and Solutions

Remittance Failure

When using Alipay for international remittances, you may encounter remittance failures. Common reasons include account limit restrictions, account abnormalities, location issues, incomplete identity information, system errors, incorrect recipient codes, and disabled cross-border receiving functions. Specifically:

- If your single transaction exceeds $10,000 USD or your monthly total exceeds $50,000 USD, Alipay will automatically restrict the operation.

- If your account has abnormal activities or has been reported, the system may freeze or restrict it, preventing remittances.

- If you enable virtual location or are physically overseas, Alipay will disable the receiving function.

- Incomplete ID information or account security risks may cause the system to reject remittance applications.

- During unstable networks or system maintenance, receiving may show abnormalities, leading to remittance failure.

- Incorrect or invalid recipient codes or links will prevent the system from recognizing recipient information.

- If you disable the cross-border receiving function, you cannot receive overseas transfers.

You can follow the self-check steps in the international remittance guide to review account status and information item by item. For system errors, try waiting and retrying later. If your account is restricted or frozen, contact Alipay customer service to appeal.

Tip: When filling in recipient information, use uppercase English letters and ensure all details are accurate to avoid remittance failure due to errors.

Arrival Delays

After completing a remittance, you typically want the funds to arrive quickly. Alipay international remittances generally take 3-5 business days to arrive, with the fastest being 1 day and no later than 3 days. Arrival time is affected by several factors:

- Different receiving banks have varying processing speeds. Hong Kong banks typically process faster.

- The remittance currency and amount also affect arrival time. Large remittances or special currencies may require longer review times.

- Holidays and weekends slow down bank processing.

- System maintenance or network issues may extend arrival time.

You can check the status in real-time on Alipay’s “Remittance Progress” page. If the funds do not arrive after 5 business days, contact the receiving bank or Alipay customer service to investigate.

Tip: Confirm bank information with the recipient in advance and choose a Hong Kong bank to effectively shorten arrival time.

Fees and Cost-Sharing

When making international remittances, fees consist of two parts: a fixed fee charged by domestic banks and potential additional fees from overseas banks. The specific standards are as follows:

| Remittance Amount Range | Fee Rate | Minimum Fee | Maximum Fee | Notes |

|---|---|---|---|---|

| Below 10,000 USD | 0.6‰ | 10 USD | 17 USD | Based on exchange rate of 7.1 |

| Above 10,000 USD | 0.8‰ | 20 USD | 37 USD | Based on exchange rate of 7.1 |

| Domestic Fee | Fixed 7 USD | N/A | N/A | Charged by Alipay on behalf of Hong Kong banks |

| Overseas Fee | Determined by overseas banks | N/A | N/A | May be deducted from the remittance amount |

| Remittance Limit | 7,000 USD per transaction | 28,000 USD daily | 42,000 USD annually | Subject to bank restrictions |

When choosing a fee-bearing method, you can select OUR, SHA, or BEN based on your needs:

- OUR: You bear all fees, and the recipient receives the full amount.

- SHA: You and the recipient share fees, reducing the recipient’s received amount by some fees.

- BEN: The recipient bears all fees, significantly reducing the received amount, typically by $20 to $60.

The international remittance guide explains the impact of each fee-bearing method, helping you choose the most suitable option.

Note: Communicate the fee-bearing method with the recipient beforehand to avoid misunderstandings due to fees.

Limit Issues

When using Alipay for international remittances, you must pay attention to remittance limits. The system imposes clear restrictions on single transactions, daily, monthly, and annual limits:

| Limit Type | Amount Restriction | Notes |

|---|---|---|

| Single Transaction Limit | 7,000 USD | Maximum per Alipay international remittance |

| Daily Limit | 7,000 USD | Maximum daily remittance, may vary by bank |

| Annual Cumulative Limit | 42,000 USD | Total annual remittance limit |

| Monthly Transaction Limit | Up to 5 transactions | Maximum monthly remittance transactions |

If you need to remit large amounts, you can split the transactions to avoid exceeding single or daily limits. Some banks may have stricter limits, so consult Hong Kong banks or Alipay customer service in advance to confirm specific limits.

Tip: Check the latest limit standards in the international remittance guide and plan remittance frequency and amounts to ensure smooth fund transfers.

Error Prevention and Self-Check

Information Filling Precautions

When filling out Alipay international remittance information, you must ensure all details are accurate. Many users face remittance failures or delays due to improper information entry. Common errors include:

- The uploaded ID photo does not match Alipay’s real-name authentication. For example, using a child’s ID instead of your own will cause verification failure. You should upload an ID photo matching your Alipay real-name authentication.

- Incorrect bank card number entry. Using a credit card number or a non-personal savings card number will fail system verification. Use a savings card number matching your Alipay real-name authentication, preferably from banks like ICBC, ABC, BOC, CCB, or BOCOM.

- The bank card does not support opening an electronic account. Replace it with a savings card that supports electronic accounts.

- Incorrect ID number entry. Verify and enter the correct ID number and name.

- Blurry uploaded ID photos. Retake clear photos of both sides of the ID.

- ID information does not match bank records. Update your identity information at a bank branch.

- The phone number does not match the bank’s registered number. Update the registered phone number at a bank counter.

When filling in information, use uppercase English letters and avoid Chinese characters. All bank codes (e.g., SWIFT, IBAN, FedWire, Sort Code) must be accurate. Different countries have varying bank code requirements, so verify carefully before filling.

Information Verification Checklist

Before submitting a remittance application, refer to the following checklist to ensure all key information is correct:

| Verification Item | Specific Content and Requirements | Check Suggestions |

|---|---|---|

| ID Information | Name and number match Alipay real-name authentication, clear photos | Double-check before uploading |

| Bank Card Information | Savings card number and bank name match Alipay real-name authentication | Use mainstream bank savings cards |

| Bank Codes | SWIFT, IBAN, etc., are accurate and meet the recipient country’s requirements | Confirm with the receiving bank in advance |

| Phone Number | Matches the bank’s registered phone number | Update if inconsistent |

| Recipient Information | Name, address, bank account number, bank name, SWIFT code, etc. | Fill in uppercase English |

| Remittance Amount and Currency | Matches recipient’s needs | Note exchange rate changes |

| Order and Transaction Number | Used to verify transaction information, ensuring remittance matches order | Keep relevant records |

Follow this checklist to review each item and make corrections as needed. This can significantly reduce the risk of remittance failure and delays, ensuring smooth fund transfers.

Reminder: If you have doubts about recipient information, contact the receiving bank or Alipay customer service in advance to avoid unnecessary losses due to errors.

Handling Special Issues

Official Customer Service Assistance

When using Alipay for international remittances, you may encounter issues that cannot be resolved through standard methods, such as prolonged non-arrival, account abnormalities, or system prompts indicating incorrect information. You can seek help through Alipay’s official customer service channels. Alipay offers multiple support options, including online and phone customer service. You can find the “Customer Service” entry in the Alipay app, select online consultation for quick answers, or call the customer service hotline for detailed assistance. You can also follow Alipay’s official announcements and customer service channels to stay updated on policy changes and service adjustments, ensuring you have the latest information to avoid operational errors.

Reminder: When contacting customer service, prepare your remittance order number, recipient information, and relevant screenshots to improve communication efficiency.

Process for Issues That Cannot Be Resolved Independently

Some special issues, such as system errors, frozen accounts, or returned remittances, may not be resolvable independently. Follow these steps to address them:

- Open the Alipay app, go to “My” - “Customer Service and Help,” and select issues related to “International Remittance.”

- Submit your issue description and relevant evidence, such as the order number and remittance screenshots.

- Wait for a customer service response, typically within 24 hours.

- For complex issues, customer service may assist with manual review or suggest providing additional materials to institutions like Hong Kong banks.

- Check the progress in the app or follow up via phone customer service.

When facing issues that cannot be resolved independently, remain patient and cooperate with customer service requirements to expedite resolution and ensure fund safety and successful remittance.

When using Alipay for international remittances, accurate information filling and verification directly affect success rates. Cross-border remittances involve complex account information, and errors may lead to fund loss. You can prepare in advance as follows:

- Create a remittance order, select the sending and receiving countries, and enter the amount (USD, based on real-time exchange rates).

- Fill in and confirm recipient information, link the receiving method, and ensure accuracy.

- Complete identity authentication and upload ID documents to secure the account.

For special issues, contact Alipay’s official customer service promptly to ensure fund safety.

FAQ

What currencies does Alipay international remittance support?

You can choose from 10 mainstream currencies, including USD, EUR, HKD, CAD, AUD, GBP, and others. The system automatically converts amounts based on real-time exchange rates.

How long does it take for a remittance to arrive?

You typically receive the funds within 1 to 5 business days. Choosing a Hong Kong bank as the recipient speeds up the process.

Will funds be refunded if a remittance fails?

If a remittance fails, the system will automatically refund the funds. You need to wait 1 to 3 business days for the funds to return to your account.

How can I check remittance progress?

You can view the status in real-time on the “Remittance Progress” page in the Alipay app. The system displays the processing status for each step, making it easy to track progress.

What should I do if I enter incorrect information during a remittance?

If you notice an error, cancel the order immediately and resubmit. If already submitted, contact Alipay customer service promptly to avoid fund loss.

This analysis of common Alipay international remittance issues shows that while it offers convenience, it still has pain points like cumbersome information entry, potential hidden fees, transfer delays, and a single-currency remittance limitation. If you want to say goodbye to these hassles and manage your global funds in a more efficient and transparent way, then BiyaPay is your ideal choice. We not only offer remittance fees as low as 0.5% and a guarantee of same-day delivery, but also provide the ability to manage multiple fiat and digital currencies from a single account, simplifying your cross-border financial life completely. No need to worry about complex forms and data entry errors. Register now and use our real-time exchange rate converter to make every remittance clear, transparent, and highly efficient.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.