- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Sending Money from China to Africa: A Comparison of Alipay and Western Union Scenarios

Image Source: pexels

When considering sending money from China to Africa, you often face the dilemma of choosing between Alipay and Western Union. Different methods suit different needs: if you prioritize small transfers, ease of operation, and lower fees, Alipay is more suitable for you; if you need medium to large transfers or the recipient lacks a bank card, Western Union is more appropriate. The table below outlines the main advantages and suitable users for both methods:

| Remittance Method | Main Advantages | Suitable Users | Fee Structure |

|---|---|---|---|

| Western Union | Many agent locations, no bank card required, convenient cash pickup | General users, rural and remote area users | Higher fees (USD-based) |

| Alipay | Technological innovation, online convenience, low fees | Small cross-border transfers, users prioritizing experience | Lower fees (USD-based) |

Key Points

- Alipay is suitable for small, frequent, and fast remittances from China to Africa, with simple operations, low fees, and the recipient only needing a mobile phone number to receive funds.

- Western Union is suitable for medium to large remittances or when the recipient has no bank card, supporting cash pickup with fast delivery but higher fees.

- Alipay operates entirely online, requiring no bank visits, with funds typically arriving in minutes, making it convenient for daily and urgent remittances.

- Western Union requires visiting designated locations, with more complex procedures and fees charged based on the amount, suitable for specific scenarios and cash needs.

- When choosing a remittance method, consider the transfer amount, receiving method, fees, and delivery speed to flexibly select the most suitable channel.

Alipay and China-to-Africa Remittance Scenarios

Image Source: unsplash

Suitable Users

If you frequently need to send money from China to Africa, Alipay offers significant convenience. Alipay’s remittance service is primarily aimed at users with cross-border fund transfer needs, especially those frequently traveling between China and Hong Kong or requiring convenient cross-border payments. You can use an AlipayHK account without linking a Chinese bank card to transfer HKD to an Alipay account in real-time. For users with limited budgets needing small, fast, and frequent remittances, Alipay is an ideal choice. With high mobile phone penetration in Africa and widespread acceptance of mobile payment technology, receiving funds in Africa becomes simpler.

Operation Process

You only need to select the “International Remittance” function in the Alipay app and fill in the recipient’s phone number and related information. The recipient does not need a bank card; a mobile phone number is sufficient to complete the receipt. You can pay directly in USD, and the system will automatically settle at the real-time exchange rate. The entire process is completed online, without needing to visit a bank or agent. For Hong Kong users, operating through an AlipayHK account is even more convenient, with real-time delivery.

Fees and Delivery Speed

Alipay’s remittance fees are low, typically a fixed fee per transaction. When sending money from China to Africa, the fee is generally below $10, with the exact amount depending on the exchange rate and partner policies. Delivery is fast, often completed within minutes. You don’t need to worry about high fees or long wait times, making it suitable for urgent fund needs.

Advantages and Limitations

Advantages:

- You can leverage Africa’s high mobile penetration and mobile payment technology to easily complete remittances from China.

- Alipay collaborates with South African payment companies, covering 10,000 merchants, facilitating consumption and receipt in Africa.

- You don’t need to link a bank card; operations can be completed with just a phone number, with low fees and a low entry barrier.

- Mobile payments drive Africa’s digital economy, promoting financial inclusion.

Limitations:

- Weak financial infrastructure in some African countries may result in cross-border remittance fees sometimes exceeding 10%.

- About 80% of African adults lack bank accounts, and low credit card penetration limits Alipay’s application scope.

- Local policies and financial environments may affect Alipay’s service promotion and usage.

- Blockchain and digital currencies are rapidly developing in Africa, and some users may prefer these emerging tools.

When choosing Alipay for remittances from China, you should consider whether the recipient has a mobile phone and mobile payment capabilities, as well as local policy support for Alipay.

Western Union and China-to-Africa Remittance Scenarios

Image Source: unsplash

Suitable Users

If you need to send money from China to Africa, Western Union offers multiple options. Western Union is suitable for the following users:

- You can process remittances and receipts through partner locations such as China Postal Savings Bank, Agricultural Bank of China, China Everbright Bank, Jilin Bank, Fujian Haixia Bank, Zhejiang Chouzhou Commercial Bank, Harbin Bank, and Yantai Bank.

- If you need to receive Google AdSense advertising fees, Western Union is a common channel.

- You can use the WeChat “Cross-Border Remittance” mini-program to link a bank card or WeChat wallet for receipt.

- If you don’t have a bank account, Western Union supports cash pickup, which is very convenient.

- If you are aged 16-65 and meet the remittance frequency and amount restrictions, you can use Western Union services.

Operation Process

When sending money from China to Africa, you can follow these steps:

- Bring identification to a nearby Western Union agent and fill out a remittance form.

- Alternatively, you can log in to the Western Union website, register an account, and enter the recipient’s information and remittance amount.

- After paying the remittance amount and fees, the system will generate a Money Transfer Control Number (MTCN).

- You share the MTCN with the recipient, who can use it along with identification to collect cash at a Western Union agent in Africa.

- Cash withdrawals and mobile wallet transfers are delivered within minutes, while bank transfers typically take 0-4 business days.

Fees and Delivery Speed

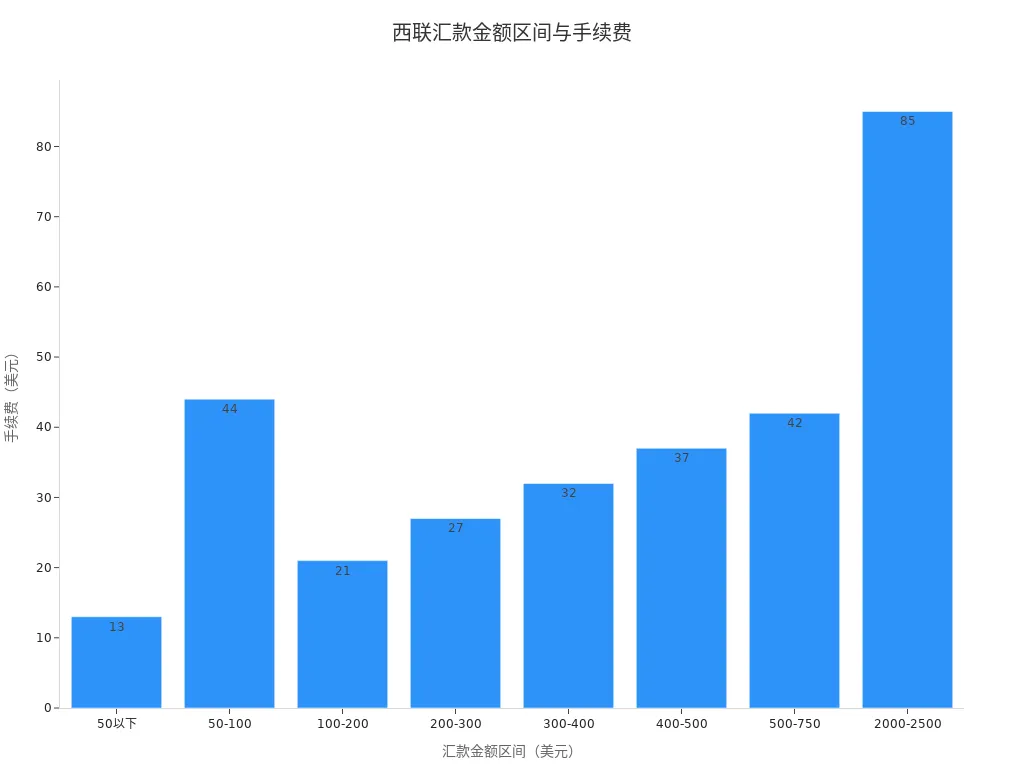

Western Union’s fees are charged based on the amount, making it suitable for medium to large remittances from China. Refer to the table below:

| Amount Range (USD) | Fee (USD) |

|---|---|

| Below 50 | 13 |

| 50-100 | 44 |

| 100-200 | 21 |

| 200-300 | 27 |

| 300-400 | 32 |

| 400-500 | 37 |

| 500-750 | 42 |

| 2000-2500 | 85 |

| Over 2500, per additional 500 | Add 20 |

In terms of delivery speed, Western Union typically delivers within minutes, much faster than traditional international transfers of 3-5 business days. The chart below illustrates fee variations for different amount ranges:

Advantages and Limitations

Advantages:

- You can enjoy a 15-minute delivery experience, ideal for urgent remittance needs from China.

- You don’t need a bank card, and cash pickup is flexible, suitable for users without bank accounts.

- After remitting, an MTCN is generated, and the recipient can collect funds with the number and ID, making operations simple.

- Fees are tiered, and some African regions offer discounts, saving costs.

Limitations:

- For small remittances, fees are high, creating a noticeable cost burden.

- Recipient information is strictly verified, and discrepancies may lead to funds being returned.

- In initial transactions, buyers may be reluctant to pay first due to trust issues.

- There are risks of identity information leakage and fraud, so caution is needed.

When choosing Western Union, you should weigh its advantages and limitations based on your needs, amount, and receiving method to ensure smooth and secure remittances from China.

Comparison and Recommendations for China-to-Africa Remittance Methods

Fee Comparison

When choosing a remittance method from China, fees are a primary consideration. Alipay and Western Union have distinct fee structures. Alipay’s international remittances typically use a fixed fee model, with transparent costs, deducted directly from the payer’s Alipay account. Your per-transaction fees are generally low, ideal for small, frequent cross-border transfers. Western Union charges per transaction, with fees varying by country and region. You should check specific fee standards with local Western Union banks in advance. Western Union is more accepted among European and American clients, but fees are generally higher, especially for cash pickups, where costs increase further.

The table below compares fees for different amount ranges:

| Payment Method/Amount Range | Western Union Fee (USD) | Alipay Receipt Fee (USD) |

|---|---|---|

| Bank Account Receipt | 1.99 - 8.00 | 0.99 - 8.00 |

| Alipay Receipt | 0.99 - 8.00 | 0.99 - 8.00 |

| Cash Pickup | 9.99 - 14.49 | N/A |

You can see that Alipay has lower fees for small remittances, while Western Union’s fees are higher for cash pickup scenarios. For large remittances, Western Union’s total fees increase with the amount, whereas Alipay maintains a more stable fee structure.

Tip: When choosing a remittance method, ensure you check for hidden fees and calculate total costs based on the actual amount.

Delivery Speed Comparison

Delivery speed directly impacts the recipient’s fund usage efficiency. Alipay’s international remittances are known for being “highly convenient and fast,” with user feedback indicating delivery within minutes, though specific times are not detailed. When you urgently need funds, Alipay can meet fast delivery needs.

Western Union’s delivery time is generally within 24 hours, with some cases requiring up to 4 business days, depending on bank processing speeds and local holidays. When using Western Union, the system displays the estimated delivery time. For cash pickups, Western Union typically delivers on the same day, but bank account receipts may face delays.

| Remittance Method | Delivery Time Description |

|---|---|

| Alipay International Remittance | Typically delivered within minutes, highly convenient |

| Western Union | Within 24 hours, some cases require 4 business days |

If you have high demands for delivery speed, Alipay is more suitable. If you’re not in a rush, Western Union can meet daily needs.

Convenience Comparison

You’ll experience different levels of convenience in operation and user experience. Alipay supports a fully online process, where you only need to enter information in the app to complete the remittance, without visiting a bank or agent. You can initiate remittances from China anytime, anywhere, ideal for frequent, fragmented fund transfers.

Western Union primarily involves offline processes, requiring you to bring identification to a partner bank or agent to fill out a remittance form. Procedures are relatively complex, affected by business hours and holidays. You also need to visit designated locations to collect cash, making it less convenient than Alipay.

Note: When choosing a remittance method, prioritize platforms with simple procedures and intuitive operations, especially in cross-border scenarios, where convenience directly impacts the remittance experience.

Recommendations for Applicable Scenarios

When choosing a remittance method from China, you should consider your needs, amount, and receiving method:

- If you need small, frequent, and fast remittances, Alipay is the top choice. You can enjoy low fees, convenient operations, and quick delivery, suitable for daily life, family transfers, or cross-border e-commerce.

- If you need medium to large remittances or the recipient lacks a bank account and can only receive cash, Western Union is more suitable. You can collect cash directly at Western Union agents, meeting specific scenario needs.

- When focusing on security, both Alipay and Western Union use encryption to ensure fund safety, but Western Union’s offline operations require caution to protect personal information and prevent fraud.

- You should also consider compliance and identity verification requirements to ensure the remittance process is legal and compliant.

Summary: You should flexibly choose a remittance method based on your actual needs. Fees, delivery speed, convenience, security, and compliance are key factors to consider. Only by aligning with your situation can you find the best remittance solution from China.

When choosing to send money from China to Africa, you can decide based on your needs. Alipay is suitable for small, fast, and frequent remittances with low fees and simple operations. Western Union is suitable for medium to large remittances or when the recipient has no bank card, supporting cash pickup.

Recommendation: First clarify the remittance amount and receiving method, then choose the most suitable channel.

FAQ

Does Alipay remittance to Africa require the recipient to have a bank card?

You don’t need the recipient to have a bank card. As long as the recipient has a mobile phone number, they can receive funds via Alipay, making remittances more convenient.

What receiving methods does Western Union support?

You can choose cash pickup, bank account receipt, or mobile wallet receipt. The recipient can select the most suitable method based on their situation.

How are fees calculated for Alipay and Western Union remittances?

When using Alipay, fees are typically a fixed amount per transaction, generally below $10. Western Union fees are tiered based on the amount, with higher amounts incurring higher fees.

How can I confirm a remittance has been successfully received?

You can check the remittance status in the Alipay or Western Union app. Once the recipient receives the funds, you’ll receive an SMS or app notification.

Which banks in China can process Western Union remittances?

You can process Western Union remittances through partner banks such as Hong Kong banks, China Postal Savings Bank, and Agricultural Bank of China. Simply bring valid identification to process the remittance.

This analysis of Alipay and Western Union shows that when you send money from China to Africa, you’re always faced with a choice: Alipay’s convenience or Western Union’s extensive coverage. This “either-or” model limits your flexibility. To help you overcome this limitation, BiyaPay offers a solution that combines cost-effectiveness, speed, and a forward-looking approach.

We not only provide remittance fees as low as 0.5%, but our global network also enables funds to be delivered on the same day. Crucially, we offer the ability to manage multiple fiat and digital currencies from a single account, fundamentally simplifying your cross-border financial management, especially in a continent with a booming digital economy. Register now, and with our real-time exchange rate converter, you can control the cost of every transaction while preparing for the future. Say goodbye to complex traditional methods and choose BiyaPay to make your cross-border cash flow more efficient and intelligent.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.