- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Materials and Precautions Chinese Users Must Prepare Before Using Wise for Transfers

Image Facet: pexels

When using Wise for transfers, you often need to prepare your ID, passport, phone number, and real home address in advance. Chinese users must provide information for a same-name overseas account, and in some cases, upload a selfie and ID photos. During registration, you need to select the account type and fill in detailed information. Account activation typically requires a deposit of 20 USD. You should also pay attention to fees, transfer arrival time, and risk control audits to avoid transfer failures due to incomplete or incorrect information.

Key Points

- Chinese users must prepare a valid Chinese passport, phone number, and real home address for Wise registration, ensuring the information matches the passport.

- Registering a Wise account requires uploading clear passport photos and a selfie, and in some cases, address proof and same-name overseas bank account information.

- Activating the account requires depositing at least 20 USD from a same-name overseas bank account, with accurate deposit information.

- When filling in recipient information for transfers, use pinyin and correct bank account details, SWIFT code, etc., to avoid transfer failures due to incorrect information.

- Wise transfer fees are transparent, with fast arrival times, most transfers arriving within 24 hours. Check policy changes and transfer limits before use.

Materials Preparation

Image Source: pexels

ID and Passport

When registering for Wise, you must prepare a Chinese passport. Wise currently does not support Chinese ID cards for identity verification. You need to select China as the passport-issuing country and upload a passport photo and a selfie as required. After uploading, click “I have completed verification” and wait for system review.

Tip: Ensure the passport photo is clear and complete to avoid audit failure due to blurry photos or missing information.

Sometimes, Wise’s risk control system may require additional documents like address proof or income proof. Failure to provide these may result in account suspension or closure. Ensure all materials are authentic and valid, avoiding false information.

Materials needed for Wise registration:

- Chinese passport (valid with complete information)

- Phone number (preferably matching the registration country)

- Address proof (e.g., credit card statement with name and address)

- Same-name overseas bank account information

Phone Number and Address

You need a phone number with the China country code +86. Wise will send an SMS verification code to your phone, and registration can only proceed after successful verification. The phone must receive SMS normally and cannot be a landline.

When filling in your home address, provide your real address in China accurately. It’s recommended to keep the address consistent with your passport to reduce risk control issues. You can fill in the address in Chinese. During registration, select “China” as the country and “personal account” as the account type. The name should be filled in pinyin as per the passport.

For some currency accounts (e.g., USD accounts), you may need to upload a bill from the past three months containing your name and address as proof. During registration, the system may ask you to complete a questionnaire, which should be filled out truthfully to avoid triggering risk controls.

Phone number and address precautions:

- Phone number must start with +86 and be able to receive SMS verification codes.

- The address must be real and valid, preferably matching the passport.

- The name should be in pinyin, consistent with the passport.

- Some accounts require uploading bills or other address proof.

Overseas Account Information

Chinese users must prepare a same-name overseas bank account for Wise registration. You must use your real information, including pinyin name, email, and phone number, to register. You need to select an overseas bank account (e.g., Hong Kong or UK bank) as the deposit account. To activate the Wise account, deposit at least 20 USD via bank wire or other methods, with the exact amount varying based on the day’s exchange rate. The deposit account must match the name on your Wise account and cannot be a friend or family member’s account.

You need to accurately fill in the overseas account’s IBAN number, amount, and memo details to ensure a smooth transfer. The Wise account can only be activated and used normally after a successful deposit.

Note: When registering for Wise, all materials must be authentic, legal, and compliant. Avoid using false addresses or multiple accounts, as this may trigger address verification or account suspension.

Key points for preparing overseas account information:

- Select a same-name overseas bank account (e.g., Hong Kong or UK bank).

- The deposit account must be in your name.

- The deposit amount must be at least 20 USD, based on the day’s exchange rate.

- Accurately fill in the IBAN number and related information.

Registration Verification

Account Registration Process

You can register an account via the Wise website or mobile app. The process is straightforward and suitable for Chinese users. Follow these steps to complete registration:

- Visit the Wise website or download the Wise app and click register.

- Choose to register with an email or third-party account (e.g., Apple, Google, Facebook).

- Select account type (personal or business) and fill in residency information.

- Enter your Chinese phone number and complete SMS verification.

- Set a login password to complete initial account registration.

- Log in and go to the profile page to fill in your name, date of birth, nationality, address, postal code, etc., all in pinyin.

- For the first transfer, the system will require uploading ID documents and a selfie for identity verification.

- Wait for Wise’s review, typically 1-3 business days. If materials are incomplete or questionable, Wise will notify you via app or email to provide additional documents.

Tip: Some users report issues with Chinese phone numbers not receiving verification codes. Try switching to another phone number or check SMS blocking settings. Avoid frequently changing login IPs during registration to ensure smooth phone verification.

Identity Verification Steps

You must complete identity verification to use Wise for transfers. The verification process includes:

- Fill in contact information, with the name in pinyin.

- Upload address proof. You can use a personal bill with your name and address in English or pinyin, not a company address or Google-translated address. The bill must include a traceable number (e.g., account or customer number).

- Upload two identity documents, such as a passport and driver’s license. Photos must be clear with complete information.

- Fill out a financial questionnaire and upload a bill (different from the address proof bill and not from the same bank).

- Sign a KYC declaration form, with the signature matching the ID document.

- Provide additional documents if needed, such as a translated driver’s license or a Google Maps link for remote addresses.

Wise completes identity verification within 2-3 business days. If issues arise, contact customer service via the Wise app or website for assistance.

Note: All materials must be authentic and valid. Uploaded photos must be clear, and information must match registration details. Prepare address proof and bills in advance to avoid delays due to mismatched materials.

Account Activation and Deposit

After identity verification, you need to activate your Wise account. The system requires a deposit of at least 20 USD to complete verification. You can deposit via:

- Wire transfer from your Hong Kong bank account, with a minimum of 50 USD, with excess amounts refunded.

- Wire transfer or ACH transfer from a U.S. bank account.

- Debit card via digital or online banks.

- Wire transfers from Chinese bank accounts have higher fees and lower success rates, so they are not recommended.

The 20 USD deposit is the minimum requirement for account activation. Once the deposit is successful, your Wise account can be used for global transfers and receipts.

Tip: The deposit account must match your Wise account name. Do not use others’ accounts or virtual cards for deposits, as this may lead to account suspension. The system automatically activates the account after a successful deposit, with no additional steps required.

Transfer Preparation

Recipient Information

When making a Wise transfer, you must accurately fill in recipient information. Requirements vary by currency account. For example, USD accounts require the recipient’s name, account number, and SWIFT code; EUR accounts require IBAN and SWIFT code; GBP accounts require IBAN and UK sort code. All information must be entered in English letters, as the Wise system does not support Chinese characters.

Follow these steps:

- Go to the recipient management page.

- Add your own or another’s bank account, either by searching with an email address or manually entering details.

- Confirm and save recipient information.

- To modify, delete and re-add the information.

Tip: Ensure the recipient bank, region, account number, and name match actual information to avoid transfer failures due to errors.

Transfer Limits

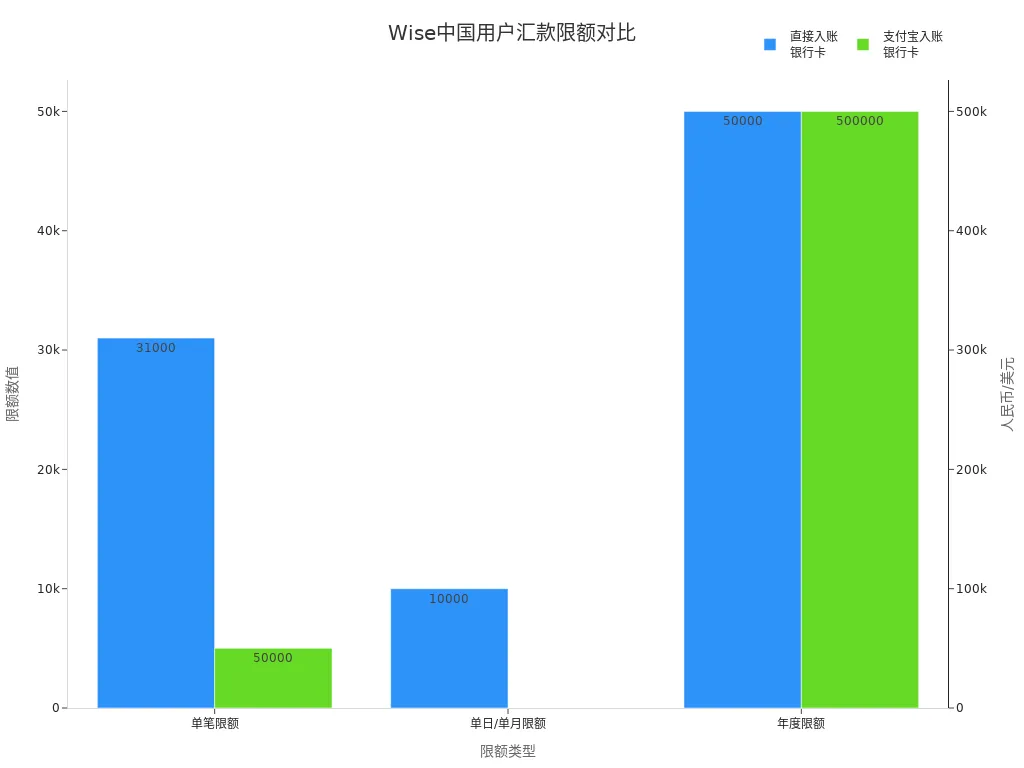

Wise has specific transfer limits for Chinese users. Pay attention to single transaction, daily, monthly, and annual limits. Limits vary by transfer method, as shown below:

| Transfer Method | Single Transaction Limit | Daily/Monthly Limit | Annual Limit | Notes |

|---|---|---|---|---|

| Direct Bank Card Deposit (Uses Forex Quota) | 31,000 CNY (~4,300 USD) | 10,000 USD per recipient daily | 50,000 USD per recipient annually | Uses $50,000 annual forex quota |

| Alipay Bank Card Deposit (No Forex Quota) | 50,000 CNY (~7,000 USD) | Up to 5 transactions per recipient monthly | 500,000 CNY (~70,000 USD) per recipient annually | Does not use forex quota |

Check your annual forex quota before transferring to avoid failures due to insufficient quotas.

Payment Method Selection

Wise supports multiple payment methods for flexibility. You can transfer USD directly from your Wise balance or use a Chinese local bank account for bank transfers. Use your mobile banking app to transfer from your own account to Wise’s dedicated ACS account.

Wise also supports UnionPay, Alipay, and WeChat accounts (requiring real-name authentication), though some banks and regions may have restrictions. The payment account name must match the Wise account name, or the system will automatically refund.

Arrival times and fees vary by payment method, as shown below:

| Payment Method | Arrival Time | Fee Characteristics |

|---|---|---|

| Wise Balance, Credit Card, Debit Card | Shortest processing time, potentially instant | Transparent fees, cheapest with Wise balance |

| Traditional Bank Wire | Typically 2-3 business days, longer for some currencies | May include wire and intermediary bank fees, higher costs |

Wise uses the mid-market exchange rate with low, transparent fees and no hidden costs. Choose the most suitable payment method based on your needs for efficient and secure transfers.

Risks and Common Issues

Image Source: unsplash

Risk Control Audits

When using Wise for transfers, you’ll face strict risk control audits. Wise has high requirements for fund sources and address proof. Incomplete or inauthentic documents may lead to application rejection or account closure. Common issues include:

- Failure to submit payslips or bank statements, leading to unclear fund sources.

- Using non-personal accounts or cards for deposits, triggering risk controls.

- Investment fund proof must come from legitimate stock platforms; cryptocurrency statements may occasionally work but are not recommended.

- In cases of same-name conflicts, manual identity confirmation is required.

- High-risk accounts require extra caution for large or non-matching name transactions.

Ensure all materials are authentic and valid to avoid issues affecting transfers.

Fees and Arrival Time

Wise’s fee structure for Chinese users is transparent. Refer to the table below for fee standards by currency:

| Payment Currency | Recipient Currency | Fee Example (Fixed + Percentage) |

|---|---|---|

| USD (ACH Payment) | CNY | $4.78 fixed + 1.01% percentage, ~$14.81 total |

| GBP (Bank Transfer) | CNY | £3.64 fixed + 0.72% percentage, ~£10.81 total |

| EUR (Bank Transfer) | CNY | €4.58 fixed + 0.83% percentage, ~€12.83 total |

Wise uses the mid-market exchange rate with no hidden fees. Large transfers may receive automatic discounts. Most transfers arrive within 24 hours, with popular currencies potentially instant. Wise’s local bank account network speeds up transfers to Alipay and WeChat, much faster than traditional banks.

Policy Change Reminders

When using Wise, stay updated on policy changes in China and Wise. Adjustments may affect transfer limits, activation thresholds, and fees. Recent changes and impacts are listed below:

| Policy Change | Details | Impact on Users |

|---|---|---|

| Alipay/WeChat Withdrawal Limits | Personal accounts: 50,000 CNY daily, 500,000 CNY annually; business accounts require extra authentication, limit raised to 1M CNY | Personal account withdrawals restricted, business account authentication requirements increased |

| New User Activation Threshold | Initial deposit raised from 100 CNY equivalent to 170 CNY equivalent | Higher entry barrier for new users, affecting first-time experience |

| Business User Expedited Transfer Fee | Rate reduced from 2.45% to 1.95% | Lower transfer costs for business users, improving cash flow efficiency |

| Case Study | Cross-border seller A pays $5,000 monthly to U.S. suppliers, saving ~$1,259.76 annually with Wise | Highlights cost and service advantages post-policy changes, significant savings for users |

Stay informed about Wise’s official announcements and Chinese policies to plan transfers and avoid failures due to policy changes.

As a Chinese user, preparing ID and address proof in advance can reduce verification delays and resubmission issues.

- Wise account opening typically requires only ID documents, with address proof needed only when necessary.

- Familiarize yourself with the process and prepare materials in advance to avoid transfer delays or failures.

| Topic | Key Information |

|---|---|

| Transfer Arrival Time | Most Wise transfers arrive within 24 hours, supporting Alipay and WeChat, faster than traditional banks. |

| Fund Security | Wise is a licensed institution with regulated client funds, ensuring safe withdrawals. |

For issues, check Wise’s official help or contact customer service to ensure smooth transfers.

FAQ

What to do if I don’t receive a verification code during Wise registration?

Check your phone’s SMS blocking settings. Try a different phone number that can receive SMS. If the issue persists, contact customer service for assistance.

What are common reasons for Wise account activation failure?

You may have uploaded blurry passport photos or used a deposit account with a different name. Ensure all materials are authentic and the deposit account is in your name.

What to note when filling in recipient information for transfers?

Use pinyin for the recipient’s name. Ensure bank account numbers, SWIFT codes, etc., are accurate. Verify details in advance to avoid transfer failures due to errors.

How long does a Wise transfer take to arrive?

Most transfers arrive within 24 hours. Some currencies or banks (e.g., Hong Kong banks) may take longer. Track progress in real-time via the app.

What payment methods does Wise support?

You can use bank transfers, debit/credit cards, or Wise balance. Using your own Hong Kong bank account is recommended for faster arrivals and lower fees.

While Wise offers transparent rates and low fees, its strict identity verification for Chinese users, mandatory requirements for a passport and an overseas bank account, and the risk of account freezes can make your remittance journey challenging. If you desire a simpler, more flexible, and more comprehensive cross-border financial solution without the hassle of tedious documentation and multi-account management, then BiyaPay is your ideal choice. We not only provide remittance fees as low as 0.5% and a lightning-fast same-day delivery, but also integrate the conversion between various fiat and digital currencies all within a single account. Say goodbye to complex authentication and multi-platform juggling. Register now and use our real-time exchange rate converter to make your global asset management simpler and more efficient than ever before.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.