- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Investing in QDTE Stock with the 0DTE Covered Call Approach

Image Source: pexels

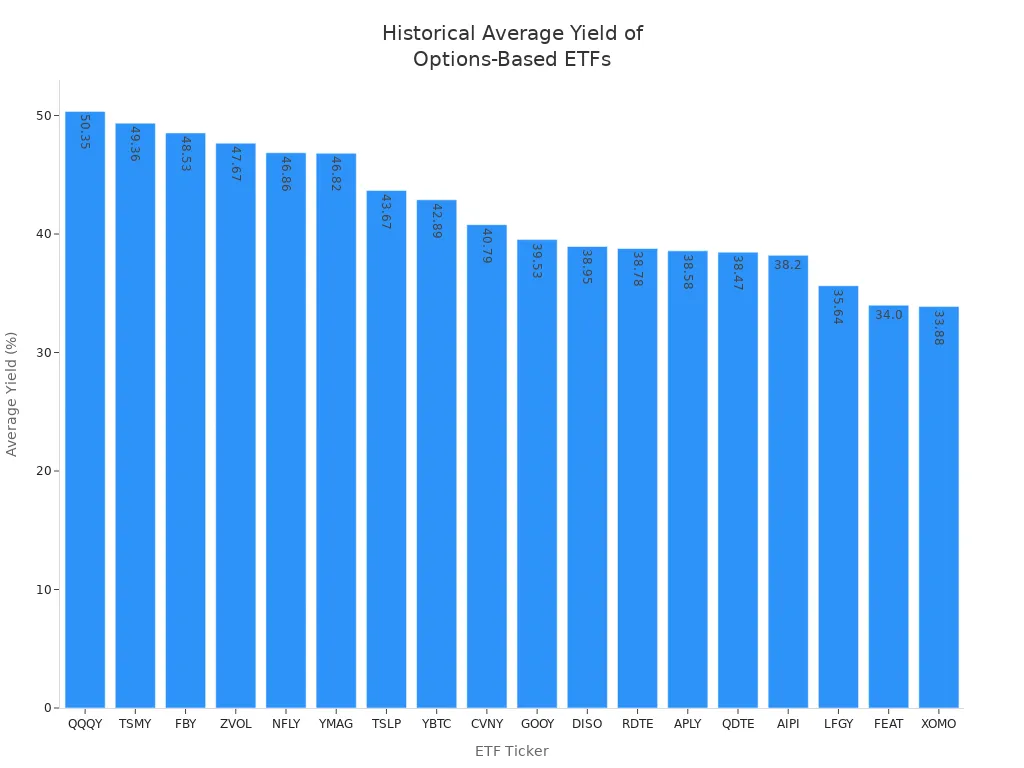

You may wonder if QDTE stock’s 0DTE covered call strategy offers a smart and steady way to earn income. Many investors find QDTE appealing because it uses a 0dte covered call strategy that targets high yields. The historical average yield for qdte stands at 38.47%, which places it among other high-yield, options-based ETFs.

| ETF Ticker | ETF Name | Historical Average Yield (%) |

|---|---|---|

| QDTE | Roundhill Innovation-100 0DTE Covered Call Strategy ETF | 38.47 |

| QQQY | Defiance Nasdaq 100 Enhanced Options & 0DTE Income ETF | 50.35 |

| TSMY | YieldMax TSM Option Income Strategy ETF | 49.36 |

| FBY | YieldMax META Option Income Strategy ETF | 48.53 |

QDTE has gained attention with assets under management of over $842 million, showing strong investor interest even though its price dropped by 13.66% in the past year. If you look for high income potential and want to explore a unique strategy, qdte could fit your investing goals.

Key Takeaways

- QDTE uses a daily 0DTE covered call strategy to generate high weekly income by selling options that expire the same day.

- The fund offers attractive yields but carries risks like net asset value erosion, high volatility sensitivity, and capped upside gains.

- Most distributions are return of capital and taxed as ordinary income, so holding QDTE in tax-advantaged accounts may help reduce taxes.

- QDTE fits income-focused investors who accept limited growth and higher risk, especially retirees seeking steady cash flow.

- Understanding market conditions and the strategy’s mechanics is crucial before investing, as sudden market moves can impact returns.

QDTE Stock: Is It a Smart Income Play?

Income and Growth Potential

You may look at qdte stock and see a strong source of income. The main way qdte generates income comes from selling out-of-the-money zero days to expiry (0DTE) call options on the Innovation-100 Index. This strategy lets you collect premiums every day. QDTE holds a synthetic long position by buying a deep in-the-money FLEX call option. At the same time, it sells short-term 0DTE call options. This approach aims to earn extra income from option premiums while keeping exposure to the Innovation-100 Index’s price movements. The fund pays out income to shareholders every week. Sometimes, these distributions may be higher than the actual income and count as a return of capital. The use of 0DTE options helps qdte capture premiums from options that expire the same day. This can take advantage of market volatility and small price changes.

When you compare qdte stock to other Nasdaq-100 options-based ETFs, you see some differences in growth potential. QDTE’s strategy creates frequent distributions, but most of these are return of capital. This reduces the fund’s net asset value over time and limits long-term growth. The strategy works best when markets are calm and rising. In these times, you benefit from premium income and the “night effect.” However, qdte is sensitive to sudden changes in the market. High expense ratios and capped gains also limit how much the fund can grow. In bear or volatile markets, qdte may perform worse than the Nasdaq-100 index. Return of capital distributions can speed up the drop in net asset value.

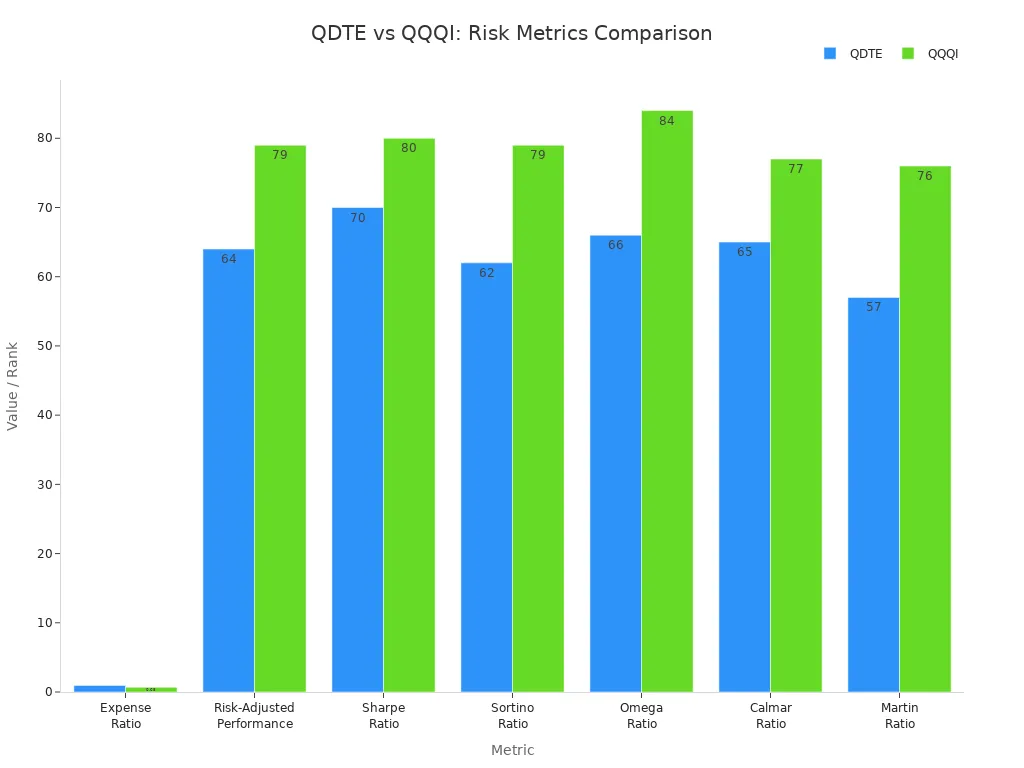

Here is a table comparing qdte and other Nasdaq-100 options-based ETFs on risk-adjusted performance and expenses:

| Metric | QDTE | QQQI |

|---|---|---|

| Expense Ratio | 0.95% | 0.68% |

| Risk-Adjusted Performance Rank | 64 | 79 |

| Sharpe Ratio Rank | 70 | 80 |

| Sortino Ratio Rank | 62 | 79 |

| Omega Ratio Rank | 66 | 84 |

| Calmar Ratio Rank | 65 | 77 |

| Martin Ratio Rank | 57 | 76 |

Note: QQQI outperforms qdte across all risk-adjusted metrics, showing stronger and more steady growth with lower expenses.

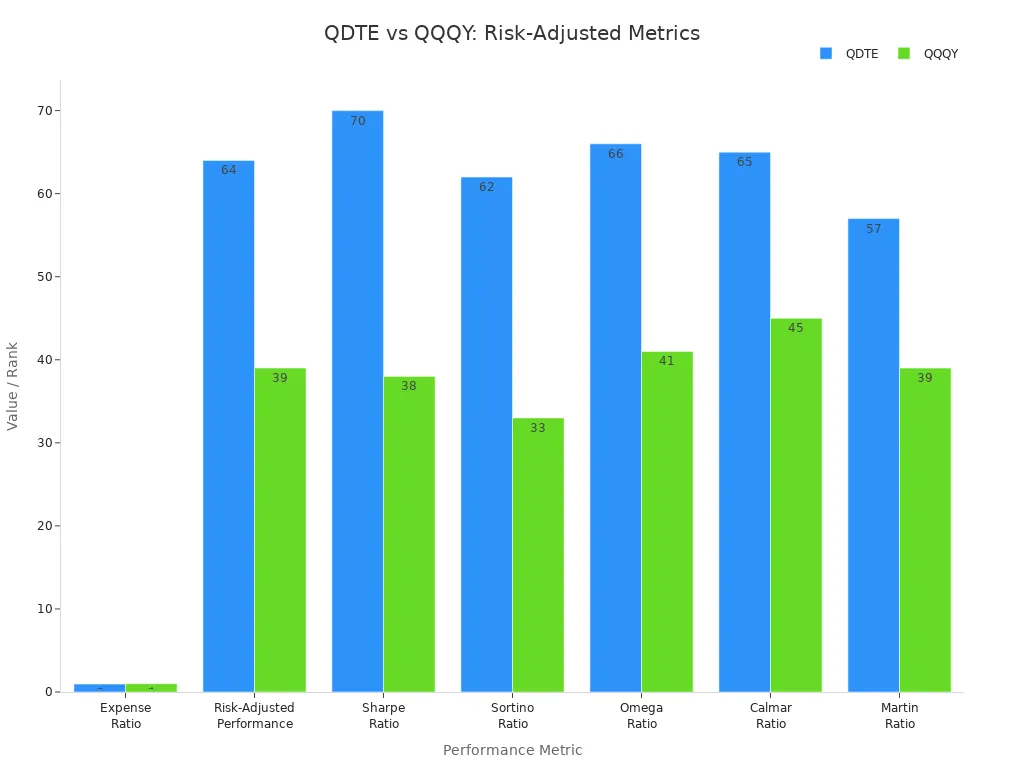

When you compare qdte to QQQY, qdte shows better risk-adjusted returns over the past year, even though both have high expense ratios.

| Metric | QDTE | QQQY |

|---|---|---|

| Expense Ratio | 0.95% | 0.99% |

| Risk-Adjusted Performance Rank | 64 | 39 |

| Sharpe Ratio Rank | 70 | 38 |

| Sortino Ratio Rank | 62 | 33 |

| Omega Ratio Rank | 66 | 41 |

| Calmar Ratio Rank | 65 | 45 |

| Martin Ratio Rank | 57 | 39 |

You should know that qdte stock’s growth potential depends on market conditions. The fund can deliver high income, but long-term growth may lag behind traditional Nasdaq-100 ETFs.

Who Should Consider QDTE

You may find qdte stock attractive if you want steady income and can accept capped total returns. Income-focused investors benefit most from this investment. If you value immediate income over capital gains, qdte may fit your needs. The fund’s high distribution yield, which is about 26.87%, appeals to those who want regular payouts.

Retirees and pre-retirees often choose qdte for its weekly income. This helps cover unexpected expenses and supports a steady cash flow. If you hold qdte in a tax-advantaged account, such as a Roth IRA, you may benefit even more. The distributions are mostly ordinary income and return of capital, so tax efficiency matters.

Tip: QDTE works best for investors who want high income, can handle some risk, and do not mind limited growth. If you seek long-term capital appreciation, you may want to look at other investment strategies.

You should always match your investment choices to your goals and risk tolerance. Qdte stock offers a unique way to generate income, but you need to understand the trade-offs before adding it to your portfolio.

How the 0DTE Covered Call Strategy Works

Image Source: unsplash

Mechanics of 0DTE in QDTE

You may wonder how the 0dte covered call strategy works in qdte. This approach uses options that expire the same day, known as zero days to expiry options. QDTE managers sell out-of-the-money call options on the Innovation-100 Index every trading day. These options expire at the end of the day. By selling these options, you collect premiums from buyers who want the right to buy the index at a higher price.

Here is how the daily process works:

- Sell out-of-the-money call options that expire the same day.

- Collect premium income from the rapid time decay of these 0dte options.

- Repeat the sale of 0dte options each day to generate steady income.

- Manage risk by using tight stops or hedging, since 0dte options can react quickly to market moves.

- Accept that your upside is capped. If the index rises above the strike price, you may have to sell at that price.

- QDTE managers handle this process for you, focusing on daily income while controlling risk.

This daily selling of 0dte options allows qdte to capture frequent premiums. The rapid time decay of these options means their value drops quickly as the day goes on. You benefit from this decay because you sold the option. The fund distributes this income to you each week. The 0dte covered call strategy can produce high yields, but it also brings high risk. Sudden market swings can cause losses if the index moves above the strike price. QDTE uses risk management tools like tight stops and hedging to help protect your investment.

Note: The 0dte covered call strategy in qdte aims to generate consistent income, but you must understand the risks. High volatility can lead to losses, and the fund’s expense ratio is higher than many traditional ETFs.

Synthetic and Poor Man’s Covered Calls

QDTE does not hold the actual stocks in the Innovation-100 Index. Instead, it uses a synthetic long position. This means the fund buys deep in-the-money FLEX call options to mimic owning the index. This method is sometimes called a “Poor Man’s Covered Call.” You get exposure to the index without buying all the stocks.

Let’s compare synthetic covered calls in qdte to traditional covered call strategies:

| Aspect | Synthetic Covered Calls (QDTE) | Traditional Covered Calls |

|---|---|---|

| Exposure | Uses options to create long exposure to the index, not actual stocks. | Holds the underlying asset directly. |

| Return Alignment | Returns may not match the index exactly due to option pricing. | Returns closely follow the asset, minus premiums. |

| Option Expiration | Uses zero days to expiry options for daily income. | Uses longer-dated options. |

| Risk Sensitivity | More sensitive to sudden price changes and volatility. | Less sensitive to daily swings. |

| Trade Execution | Timing is critical; delays can affect results. | Less timing pressure. |

| Liquidity & Costs | 0dte options may have low liquidity and higher costs. | Usually better liquidity and lower costs. |

| Derivative Risks | May lose money if options do not track the index well. | Fewer derivative risks. |

| Regulatory & Operational | May face new rules or challenges. | Fewer regulatory issues. |

You should know that synthetic covered calls can behave differently from traditional covered calls. The use of zero days to expiry options means you face more risk from sudden market moves. The premiums you collect may be higher, but so is the chance of loss. QDTE’s managers must act quickly each day to sell and manage these options. This high-frequency trading can increase costs and make the strategy more complex.

The poor man’s covered call approach lets you use less capital. You do not need to buy all the stocks in the index. Instead, you use options trading to create similar exposure. This can help you access the covered call strategy with less money, but it also adds complexity and risk.

Tip: If you want to use a covered call strategy but do not want to buy all the stocks, synthetic and poor man’s covered calls offer a way in. Make sure you understand how these options work and the risks involved.

The 0dte covered call strategy in qdte gives you a way to earn frequent premiums and weekly income. You trade off some upside for steady income, but you must watch for higher risk and costs. This strategy can fit your investment goals if you seek income and understand the mechanics of options.

Yields and Taxes with QDTE

Image Source: unsplash

Yield Potential and Sustainability

When you invest in QDTE, you see high yield potential. The fund reports a dividend yield of 42.26% over the last twelve months, with an annual dividend of $15.01 USD per share. The total return for the past year stands at 12.49%. You receive income every week, which can help you plan your cash flow. Here is a summary of QDTE’s recent performance:

| Metric | Value | Description |

|---|---|---|

| Total Return (1Y) | 12.49% | Annualized total return including price appreciation and dividends over the past 12 months |

| Dividend Yield | 42.26% | Dividend yield over the last twelve months |

| Annual Dividend | $15.01 USD | Annual payout per share |

You get weekly distributions, with an average amount of $0.514208 USD per share. The distribution rate is 1.20% per share each week. Most of these distributions are classified as a return of capital. This means you receive part of your original investment back, not just income from gains. Here is a table showing the distribution details:

| Attribute | Detail |

|---|---|

| Distribution Frequency | Weekly |

| Average Distribution | $0.514208 USD per share |

| Distribution Rate | 1.20% per share |

| Distribution Classification | 100% return of capital |

Note: You can check the current USD exchange rate here.

While the yield looks attractive, you need to consider sustainability. Most distributions come from your own capital, not from new profits. Over time, this can reduce the fund’s net asset value and affect future investment return. High yields may not last if market conditions change or if options premiums fall.

Tax Implications

You should understand the tax impact of QDTE’s options-based strategy. Most of the income you receive is classified as short-term capital gains. The frequent sale of short-dated options means these gains are taxed at ordinary income rates, which are higher than long-term capital gains rates. This can make your tax bill larger than you expect.

Most distributions from QDTE are also labeled as return of capital. This allows you to defer taxes until your cost basis is used up. However, this also means your investment return may shrink over time as the fund’s value drops. You need to watch for this effect when planning your long-term returns.

Tip: Many investors hold QDTE in tax-deferred accounts, such as IRAs, to delay taxes on income and returns. Always check your Form 1099-DIV for the final tax character of your distributions.

You should also know that regulatory changes or trading suspensions in the options market could affect your returns and tax reporting. QDTE’s strategy requires careful risk management and close attention to tax rules.

QDTE vs. Traditional Nasdaq-100 ETFs

Risk and Reward

When you compare qdte to traditional Nasdaq-100 ETFs, you notice big differences in risk and reward. Qdte uses a daily options strategy that sells zero-days-to-expiration calls. This approach creates high weekly income but also brings higher risk. You may see strong yields, but the fund’s net asset value can drop over time. Traditional Nasdaq-100 ETFs, like QQQ, follow a buy-and-hold investment strategy. These funds focus on long-term growth and stable returns. You get less income, but your investment faces less downside risk. Qdte works best if you expect the Nasdaq to keep rising. If the market turns, your investment could lose value quickly.

Note: Qdte’s aggressive options strategy can lead to NAV erosion, while traditional ETFs offer more consistent growth and lower risk.

Expense Ratios and Costs

You should always check the costs before making an investment. Qdte has a higher expense ratio of 0.95% (USD) compared to many traditional Nasdaq-100 ETFs. For example, QQQ’s expense ratio is only 0.20% (USD). Higher costs can eat into your returns over time. The active options trading in qdte also leads to more trading fees and possible slippage. Traditional ETFs keep costs low by using a passive investment approach. If you want to compare costs in your local currency, you can use the current USD exchange rate.

| ETF | Expense Ratio (USD) |

|---|---|

| QDTE | 0.95% |

| QQQ | 0.20% |

Upside Limits

You need to know that qdte’s options strategy caps your upside. When you sell call options, you give up gains above the strike price. This means your investment will not capture the full returns if the Nasdaq-100 index rises sharply. Traditional Nasdaq-100 ETFs do not have this limit. You get all the growth from the index, which can help your investment grow over the long term. Qdte focuses on income, but you trade away some potential returns for that steady cash flow.

Tip: If you want high income now and accept limited growth, qdte may fit your goals. If you want to maximize long-term returns, a traditional Nasdaq-100 ETF may suit you better.

Market Conditions and 0DTE Performance

Volatility Impact

You need to understand how market volatility affects the 0dte strategy in QDTE. When markets become more volatile, the prices of options can swing sharply. This means the premiums you collect from selling 0dte options may increase, but so does your risk. Sudden moves in the market can lead to losses if the index jumps above the strike price of the calls you sold. QDTE has experienced sharp price changes during periods of high volatility, such as in early September 2024. During these times, the fund’s premium income and distributions changed quickly, showing how sensitive the 0dte approach is to market stress.

The 0dte strategy exposes you to more pronounced short-term price swings compared to funds that use longer-duration options. This can lead to larger drawdowns and greater risk of loss. QDTE’s history shows that its share price can drop quickly when volatility spikes. You should always consider how much risk you are willing to take before investing in a fund that uses daily options trading.

Note: High volatility can boost income for a short time, but it also increases the chance of losses and net asset value erosion.

Bull and Bear Markets

The performance of QDTE’s 0dte strategy changes depending on whether the market is rising or falling. In a bull market, you may see steady premium income and positive returns, but your gains are capped because you sold call options. If the market rises sharply, you will not capture all the upside. In a bear market, the risk of loss grows. QDTE has seen about a 10% decline in market price over six months since its launch. This drop links to net asset value erosion, which often happens when distributions exceed earnings or when the underlying assets fall.

Unlike traditional funds, QDTE’s daily 0dte options make it more vulnerable to short-term market swings. During periods of market stress, the fund’s distributions may remain high, but these often come from your principal rather than new profits. This can reduce your future returns and increase your risk. You should watch for signs of market stress and understand that QDTE’s strategy may not protect you during major downturns.

Tip: If you want to use a 0dte strategy, always check how the fund performed during past volatile periods. This helps you judge if the risk matches your investment goals.

Practical Considerations for QDTE Investors

Diversification and Portfolio Fit

When you think about adding qdte to your portfolio, you should consider how it fits with your other investments. Qdte uses a specialized options-based strategy. This means it does not hold stocks or bonds directly. Instead, it invests mostly in options and cash. The table below shows the fund’s asset allocation and key features:

| Asset Allocation | Percentage | Notes |

|---|---|---|

| Other (Options) | 89.28% | Focus on call options tied to the Nasdaq 100 index |

| Cash | 10.72% | Used for liquidity and margin |

| Direct Stocks/Bonds | 0% | No direct stock or bond holdings |

| Number of Holdings | 5 | Highly concentrated, mostly options |

| Dividend Yield | 34.7% | High, with weekly distributions |

| Expense Ratio | 0.97% | Higher than many traditional ETFs |

| 1-Year Return | 23.3% | Strong recent performance |

| Year-to-Date Return | 8.7% | Reflects recent gains |

You should use qdte as part of a broader investment plan. This fund may help you boost income, but it also brings higher risk. The options strategy can lead to large swings in value. If you want stable returns, you may need to balance qdte with other investments like bonds or traditional ETFs. Diversification helps you manage risk and avoid putting too much money into one type of investment.

Tip: Always match your investment choices to your risk tolerance and income needs. Qdte may suit you if you want high income and can handle more risk, but it may not fit every portfolio.

Access and Suitability

You can buy qdte through many account types at Charles Schwab. These include:

- Brokerage accounts

- 401(k) Rollover accounts

- Individual Retirement Accounts (IRAs)

- Schwab Bank Checking accounts

- Small Business Retirement accounts

Qdte trades as an ETF, so you can buy shares during market hours. The price per share is about $35.79 USD. You need at least the price of one share to start your investment, unless your broker offers fractional shares. You can check the current USD exchange rate if you want to compare costs in another currency.

Qdte is best for investors who want frequent income and understand options strategies. The fund’s high yield and weekly payouts may look attractive, but you must accept higher risk and possible value swings. If you prefer stable income or have a low risk tolerance, you may want to look at other investment options. Always review your investment goals and risk profile before choosing qdte.

You can benefit from QDTE’s 0DTE covered call strategy if you want frequent income and exposure to the Nasdaq-100 Innovation-100 Index.

- Key benefits:

- Collect daily or weekly premiums

- Capture fast time decay

- Create synthetic dividend income

- Key risks:

- Net asset value erosion

- High volatility sensitivity

- Capped upside gains

- Higher expenses

If you seek steady income and accept principal erosion, QDTE may fit your goals. Compare it with other Nasdaq-100 ETFs and consider speaking with a financial advisor before investing.

FAQ

What is the main risk of investing in QDTE?

You face the risk of net asset value erosion. The fund pays high weekly income, but most distributions come from your own capital. If market volatility rises, you may see larger losses.

How often does QDTE pay distributions?

You receive distributions every week. The fund aims to provide steady income, but the amount can change. Most of the payout is classified as a return of capital.

Can you lose money with QDTE?

Yes, you can lose money. The fund’s strategy uses options, which can lead to losses if the market moves sharply. Your principal may decrease over time.

Are QDTE distributions taxed as ordinary income?

Most distributions are taxed as ordinary income or short-term capital gains. You may defer some taxes if the payout is a return of capital. Always check your Form 1099-DIV and consult a tax advisor.

Where can you check the current USD exchange rate?

You can check the current USD exchange rate at XE Currency Converter. This helps you compare costs if you invest from outside the United States.

Investing in a 0DTE covered call strategy like QDTE means you’re trading off growth for income, a trade-off that often comes with high complexity and risk, such as NAV erosion and capped upside. For those seeking a simpler, more powerful way to manage their global investments, BiyaPay offers a streamlined alternative. Our platform provides access to both US and Hong Kong stock markets without the need for an overseas account. You can easily manage your funds with a real-time exchange rate converter and seamless conversions for multiple fiat and digital currencies. With BiyaPay, you can participate in global markets with low fees, offering a solution to the pain point of high remittance costs and unreliable platforms. Learn more about our stocks trading services and start trading on our unified platform.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.