- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Investor Guide to BeiGene Stock’s Recent Gains and Future Outlook

Image Source: pexels

BeiGene stock has captured attention with a recent surge, as shares gained 32% in the past month, driven largely by European Commission approval. The table below highlights key performance figures:

| Time Period | Percentage Change | Notes |

|---|---|---|

| Past 1 month | +32% | European Commission approval |

| Year-to-date (YTD) | -4.2% | Industry decline of 4.9% |

Several factors have fueled BeiGene’s momentum:

- Promising cancer treatment results and expansion into Europe.

- Increased investments in artificial intelligence and machine learning.

- A new partnership with a leading pharmaceutical company.

- Commitment to sustainable technologies.

- Strategic acquisitions strengthening market position.

Analysts note that investor interest in BeiGene stock remains high, with shares showing resilience and attracting both institutional and individual investors.

Key Takeaways

- BeiGene’s stock surged 32% recently due to strong clinical results and European approval, showing strong momentum in the biotech sector.

- The company’s key products, Brukinsa and Tislelizumab, drive revenue growth with global sales and approvals in many countries.

- BeiGene’s financial health is solid, with growing profits, strong cash reserves, and manageable debt supporting future investments.

- Strategic partnerships and global clinical trials help BeiGene expand its market reach and develop new cancer treatments.

- Analysts remain optimistic, expecting further stock gains, but investors should watch risks like competition, regulations, and geopolitical issues.

BeiGene Stock Surge

Image Source: pexels

Recent Performance

BeiGene stock has demonstrated strong performance in recent months. Shares climbed 26% over the past six months, surged 32% in just one month, and jumped 7.36% in a single day. By late February 2025, the year-to-date gain reached 50.7%. This momentum stands out in the biotech sector, where many peers have struggled to match such growth.

Note: BeiGene, now trading under the ticker ONC, saw a 40% surge in price following positive clinical trial results. The company also achieved a $1 billion sales milestone, with earnings expected to triple. These achievements have fueled investor enthusiasm and contributed to the stock’s outperformance.

The table below compares BeiGene’s stock performance to the broader biotech sector and major indices:

| Metric | BeiGene (BGNE/ONC) | Biotech Sector Average | Major Indices |

|---|---|---|---|

| Relative Strength (RS) Rating | 84 | ~70 | N/A |

| 52-Week Stock Price Change | +14.71% | Lower (implied) | Lower (implied) |

| Recent Surge | +40% (post clinical trial) | N/A | N/A |

BeiGene’s RS Rating of 84 signals strong price momentum compared to the sector average of about 70. The 52-week price increase of 14.71% and the recent 40% surge highlight the company’s ability to outperform both biotech peers and major indices.

BeiGene’s market capitalization reached approximately $27.6 billion during the surge. The stock price hovered around $215, reflecting a 4.29% increase on the day of the report. Trading volume spiked to 258,492 shares, and the company experienced a 16% gain over four consecutive days. The surge coincided with regulatory acceptance of BeiGene’s DLL3/CD3 bispecific antibody, tarlatamab, which attracted significant investor interest.

Analyst Targets

Analysts remain optimistic about BeiGene stock. The consensus 12-month price target stands at $293 per share, suggesting further upside potential. This target reflects strong buy recommendations from leading analysts who cite the company’s robust pipeline and recent regulatory successes.

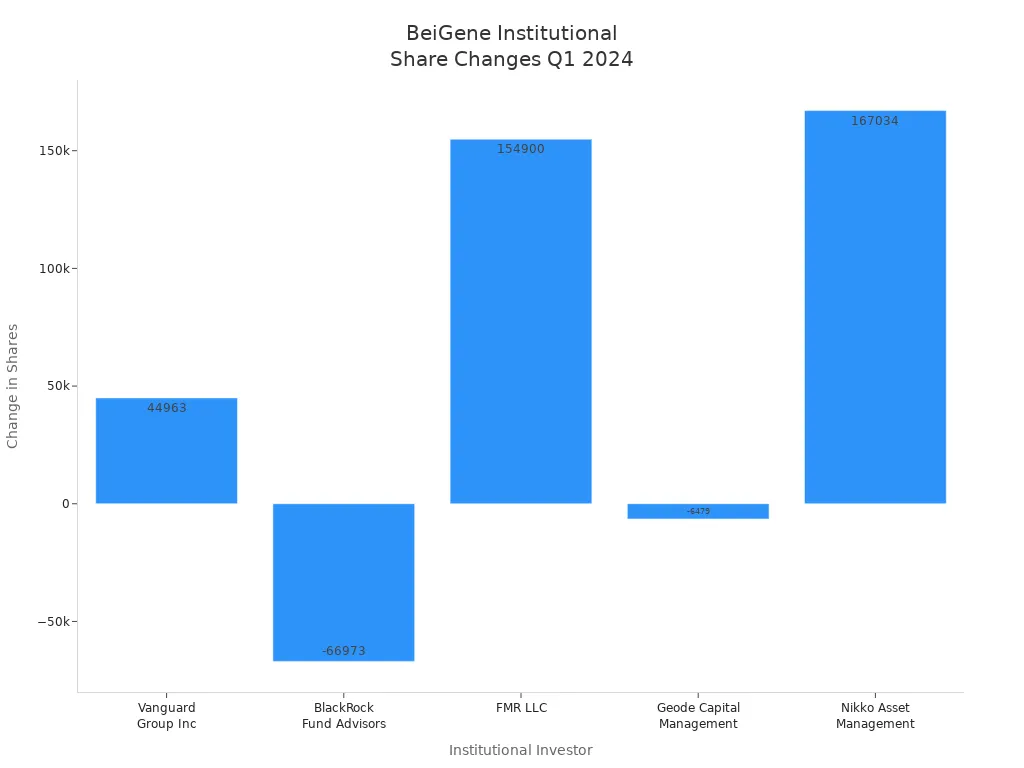

Institutional buying trends have played a key role in supporting BeiGene’s stock price. Several major institutional investors increased their holdings in early 2024, signaling confidence in the company’s future. The following chart illustrates changes in share ownership among top institutional investors:

The table below provides more detail on institutional ownership:

| Institutional Investor | Shares Held (Dec 31, 2023) | % Ownership | Change in Shares (Q1 2024) |

|---|---|---|---|

| Vanguard Group Inc | 3,988,990 | 3.05% | Increased by 44,963 |

| BlackRock Fund Advisors | 2,631,362 | 2.01% | Decreased by 66,973 |

| FMR LLC | 2,329,501 | 1.78% | Increased by 154,900 |

| Geode Capital Management LLC | 1,079,533 | 0.82% | Decreased by 6,479 |

| Nikko Asset Management Americas, Inc. | 846,986 | 0.65% | Increased by 167,034 |

Some institutional investors, such as Vanguard Group Inc, FMR LLC, and Nikko Asset Management Americas, Inc., increased their holdings, while others, including BlackRock Fund Advisors and Geode Capital Management LLC, reduced their stakes. This mixed pattern reflects nuanced sentiment, but overall, individual and institutional investors continue to show strong interest in BeiGene stock.

Surge Drivers

Regulatory Approvals

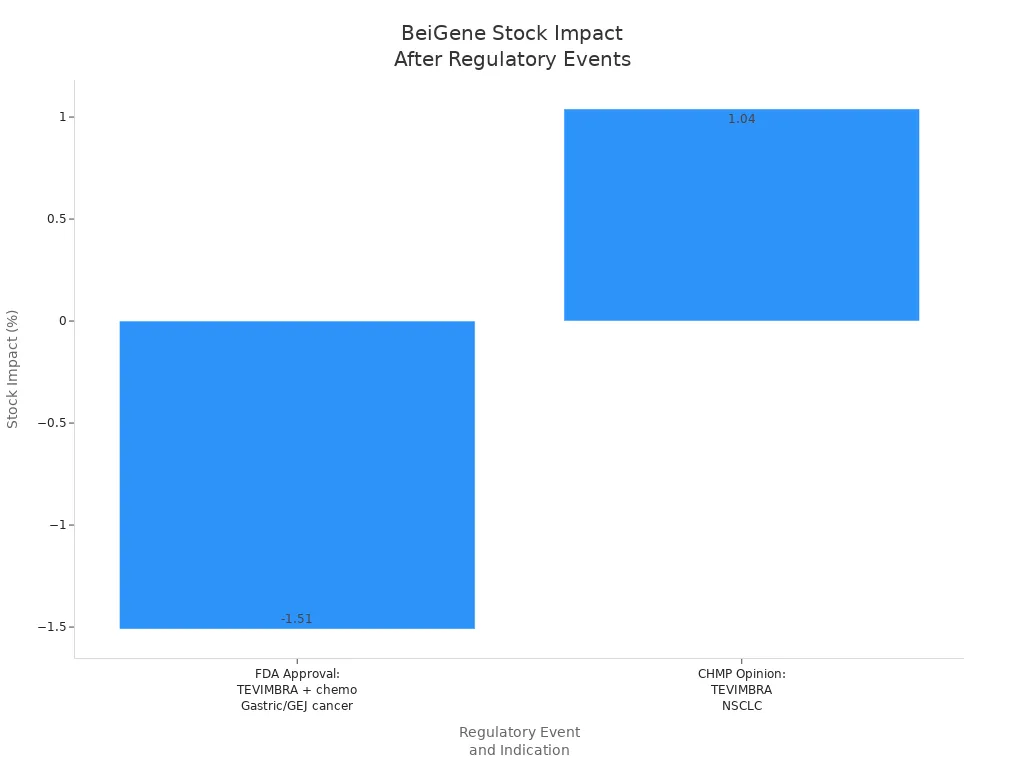

Regulatory approvals have played a major role in BeiGene’s recent developments. The FDA’s Oncologic Drugs Advisory Committee endorsed TEVIMBRA for treating advanced esophageal squamous cell carcinoma and gastric cancers with PD-L1 expression. This decision relied on strong clinical data from the RATIONALE-305 and RATIONALE-306 trials, which showed significant survival benefits. The committee set a PD-L1 expression cut-off to guide treatment. BeiGene also received FDA Fast Track Designation for BGB-16673, targeting relapsed or refractory CLL/SLL, and FDA approval for BLINCYTO in treating relapsed or refractory B-cell precursor ALL. These approvals have expanded BeiGene’s reach in oncology and improved its competitive position.

| Regulatory Event | Drug | Indication | Approval Date | Clinical Trial Basis | Stock Impact |

|---|---|---|---|---|---|

| FDA Approval | TEVIMBRA + chemotherapy | Gastric or gastroesophageal junction adenocarcinoma (PD-L1 ≥1) | Dec 2024 | RATIONALE-305 Phase 3 | -1.51% |

| FDA Approval | TEVIMBRA | Esophageal squamous cell carcinoma | Prior to 2024 | Clinical data | N/A |

| FDA Fast Track | BGB-16673 | Relapsed/refractory CLL/SLL | 2024 | Phase 1/2 data | N/A |

| EMA PRIME | BGB-16673 | Waldenstrom’s macroglobulinemia | July 2025 | Anti-tumor activity | N/A |

| FDA Approval | BLINCYTO | B-cell precursor ALL | 2024 | Improved survival | N/A |

| Positive CHMP | TEVIMBRA | NSCLC (neoadjuvant/adjuvant) | July 2025 | RATIONALE-315 Phase 3 | +1.04% |

Regulatory milestones have helped BeiGene expand its market share in China, the US, and Europe. The company’s integrated clinical development and commercial operations have accelerated its growth in oncology.

Product Launches

Product launches have driven BeiGene’s revenue growth and global expansion. Brukinsa, a BTK inhibitor, achieved global sales of 12.9 billion RMB in the first three quarters of 2024. Q3 revenue reached nearly 5 billion RMB, marking a 91.1% year-over-year increase. Brukinsa is now approved in over 70 markets, with 90% of sales coming from international regions such as Europe and North America. Tislelizumab, a PD-1 inhibitor, gained approval in 42 countries, supporting BeiGene’s market penetration in China and abroad. Pamiparib capsules, a PARP inhibitor, also contributed to revenue growth.

| Product Name | Type | Sales Performance & Market Approval | Projected Market Impact |

|---|---|---|---|

| Brukinsa (Zanubrutinib) | BTK inhibitor | Global sales exceeded 12.9 billion RMB in first 3 quarters of 2024; Q3 revenue nearly 5 billion RMB with 91.1% YoY growth; approved in 70+ markets worldwide; 90% sales from international markets | Expected to surpass $2 billion in annual sales in 2025 |

| Tislelizumab | PD-1 inhibitor | Approved in 42 countries including U.S., Europe, U.K., Brazil, Singapore; 11 of 14 approved indications included in China’s national medical insurance catalog | Supports domestic market penetration and international growth |

| Pamiparib capsules | PARP inhibitor | Self-developed Class 1.1 new drug contributing to revenue growth alongside Brukinsa and Tislelizumab | Supports BeiGene’s overall revenue growth and product portfolio expansion |

BeiGene’s new industrial bases in Suzhou and Guangzhou support future product launches and global supply needs. The company’s internationalization strategy, including its new English name, aims to boost global brand recognition.

Partnerships

Strategic partnerships have strengthened BeiGene’s market position and supported its latest partnership initiatives. The company collaborates with leading pharmaceutical firms to expand its product portfolio and accelerate clinical development. These alliances help BeiGene access new markets and technologies, driving innovation in cancer treatment. Partnerships also enable the company to maximize sales opportunities for key products like Brukinsa and Tislelizumab. By working with global leaders, BeiGene continues to build a strong foundation for future growth.

BeiGene Financials

Earnings & Revenue

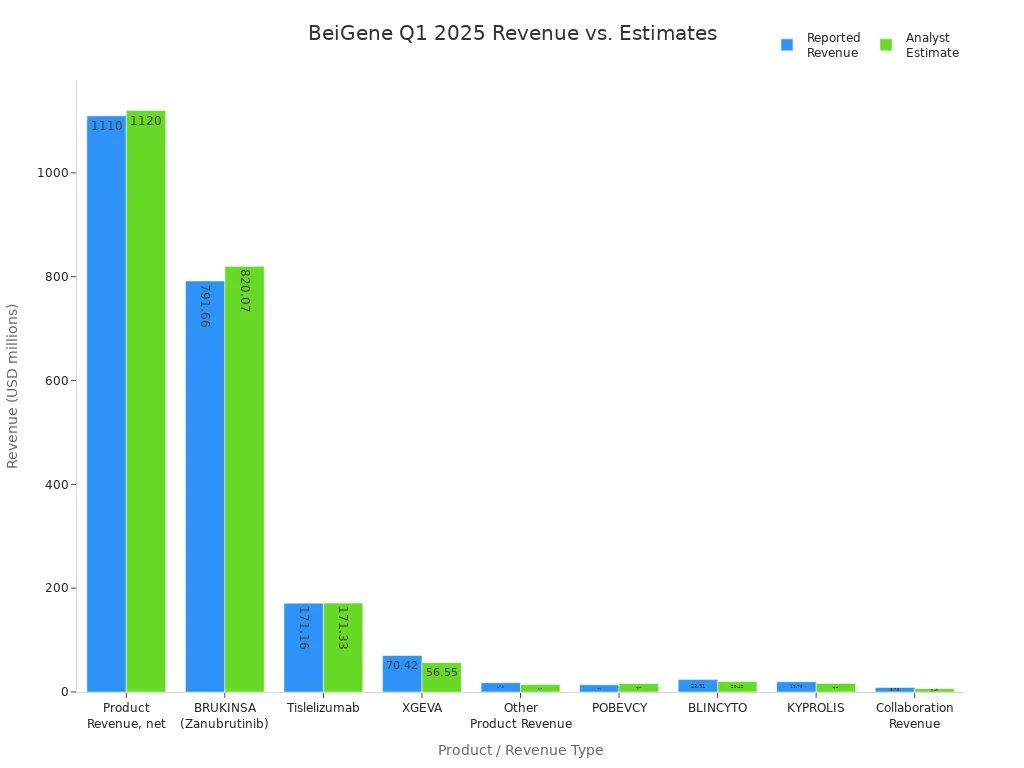

BeiGene delivered a standout earnings report for the first quarter of 2025. The company achieved its first quarter of GAAP profitability, a significant milestone in its financial performance. Net product revenues reached $1.12 billion USD, representing a 48% increase compared to the same period in 2024. This strong revenue growth reflects the success of key products such as BRUKINSA (zanubrutinib) and Tislelizumab, which continue to drive sales in China, Europe, and North America.

The table below summarizes BeiGene’s quarterly earnings and revenue results compared to analyst estimates:

| Metric | Reported Value | Analyst Estimate | Comparison / Surprise |

|---|---|---|---|

| EPS (Q1 2025) | $1.22 | -$0.71 | +271.83% EPS surprise |

| Revenue (Q1 2025) | $1.12 billion | $1.12 billion | -0.65% revenue surprise |

| Product Revenue, net | $1.11 billion | $1.12 billion | Slightly below estimate |

| BRUKINSA (Zanubrutinib) | $791.66 million | $820.07 million | Slightly below estimate |

| Tislelizumab | $171.16 million | $171.33 million | Nearly on estimate |

| XGEVA | $70.42 million | $56.55 million | Above estimate |

| Other Product Revenue | $17.90 million | $14.28 million | Above estimate |

| POBEVCY | $13.75 million | $16.11 million | Below estimate |

| BLINCYTO | $23.91 million | $20.42 million | Above estimate |

| KYPROLIS | $19.73 million | $16.51 million | Above estimate |

| Collaboration Revenue | $8.75 million | $6.49 million | Above estimate |

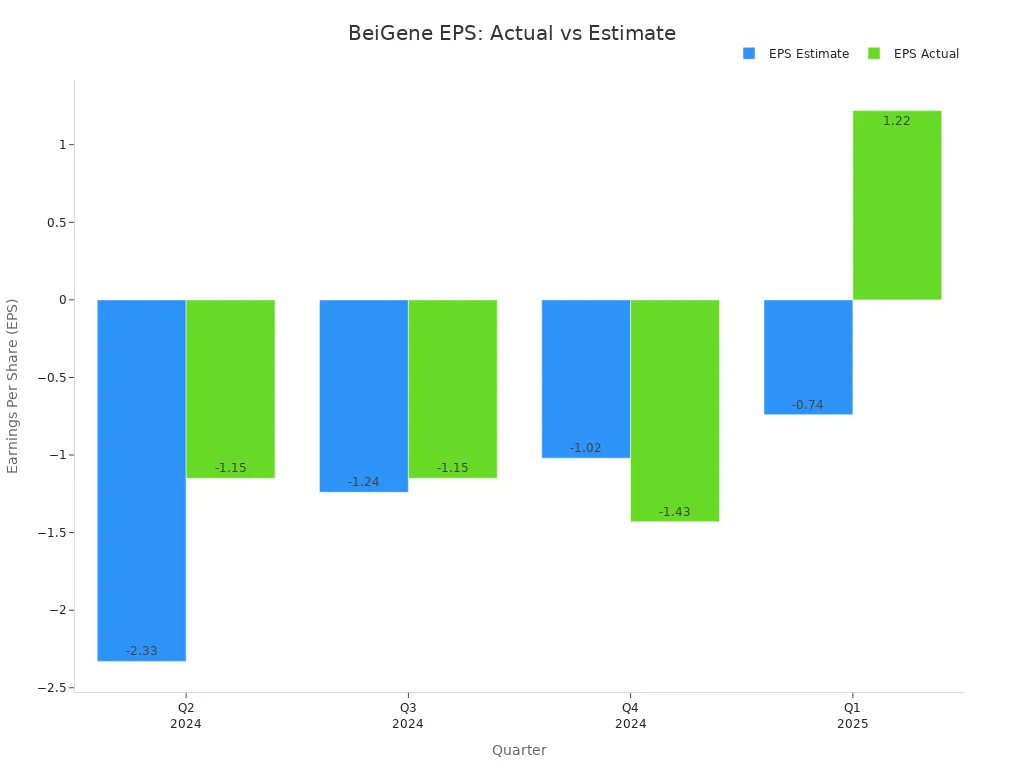

BeiGene’s Q1 2025 EPS reached $1.22, far exceeding the analyst estimate of -$0.71. This positive surprise marked a 271.83% outperformance. The company’s quarterly earnings have shown improvement over the past year, as seen in the table below:

| Quarter | EPS Estimate | EPS Actual | Price Change % |

|---|---|---|---|

| Q1 2025 | -0.74 | 1.22 | +2.0% |

| Q4 2024 | -1.02 | -1.43 | -2.0% |

| Q3 2024 | -1.24 | -1.15 | +1.0% |

| Q2 2024 | -2.33 | -1.15 | +4.0% |

The company’s earnings trajectory demonstrates a clear turnaround, with Q1 2025 marking the first positive EPS after several quarters of losses. This improvement signals robust operational momentum and effective cost management.

R&D spending also increased, rising from $460.6 million in Q1 2024 to $481.9 million in Q1 2025, a 5% increase. BeiGene continues to invest in advancing its preclinical and clinical programs, supporting future revenue growth and innovation.

Note: All monetary values are presented in USD. For the latest exchange rates, refer to XE.com.

Cash & Debt

BeiGene’s cash position strengthened significantly over the past year. The company reported $2.63 billion USD in cash as of June 30, 2025, following a successful IPO on the Shanghai Stock Exchange’s STAR Market. This influx of capital places BeiGene among the top biotech firms in terms of liquidity, enabling continued investment in research, development, and global expansion.

The company’s total debt stands at $1.02 billion USD. The cash-to-debt ratio is 1.25, which exceeds the industry benchmark of 1.0. This ratio indicates that BeiGene holds more cash than debt, reflecting a strong liquidity position. The current ratio is 1.95, just below the ideal benchmark of 2.0, but still suggests nearly twice as many current assets as current liabilities. The debt-to-equity ratio is 0.27, considered favorable and indicating low leverage compared to equity.

| Ratio | Value | Evaluation | Benchmark / Interpretation |

|---|---|---|---|

| Cash Ratio (cash to debt) | 1.25 | Good | Above 1.0 indicates strong liquidity; BeiGene surpasses this benchmark |

| Debt | $1.03B | N/A | Total liabilities $2.53B; cash ratio uses total liabilities as denominator |

| Debt to Equity Ratio | 0.27 | Good | Low debt relative to equity, considered favorable |

| Current Ratio | 1.95 | Slightly below ideal | Benchmark is 2.0 or greater; BeiGene is close but slightly below ideal liquidity threshold |

BeiGene’s financial stability is further supported by its first quarter of GAAP profitability and a 104% improvement in GAAP income from operations. The company’s RMB-denominated cash is restricted to RMB expenditures, but this does not limit its ability to fund those expenses in China. Debt agreements include covenants that could accelerate loan repayments in the event of default, which introduces some financial risk. However, the overall financial position remains solid due to strong cash reserves and positive operational results.

Tip: Investors should monitor interest expenses, as higher rates have increased costs on outstanding debt. BeiGene’s capital commitments remain manageable, with $6.7 million USD to be paid over the investment period.

BeiGene’s financial performance demonstrates resilience and adaptability. The company’s strong cash position, manageable debt, and improving earnings provide a foundation for continued growth and innovation in the global biotech sector.

Pipeline & Expansion

Image Source: pexels

Clinical Trials

BeiGene continues to advance its pipeline through a broad network of clinical trials. The company conducts studies in more than 45 countries across five continents. This global approach allows BeiGene to gather diverse data and accelerate the development of new therapies. Clinical programs include over 35 trials for BRUKINSA and 66 trials for TEVIMBRA, with nearly 14,000 patients enrolled worldwide. These trials focus on improving cancer treatment results and expanding options for patients with difficult-to-treat diseases.

Regulatory hurdles remain a significant challenge for BeiGene. The company faces complex requirements in multiple jurisdictions, which can delay drug development and approval. Changes in regulations or unexpected delays may impact commercialization timelines and financial stability. Forward-looking statements from BeiGene highlight regulatory challenges as a key risk, emphasizing the importance of navigating these landscapes to achieve commercial success.

Note: BeiGene’s ability to manage regulatory risks will determine the speed at which new therapies reach patients and influence future growth.

Global Reach

BeiGene has established a strong global presence through product approvals and market expansion. The table below summarizes the company’s reach:

| Aspect | Details |

|---|---|

| Product Approvals | Approved in US, China; expanding in Europe |

| Flagship Products | BRUKINSA approved in 70+ markets; TEVIMBRA approved in 42 countries |

| Patient Reach | BRUKINSA: 100,000+ patients treated globally; TEVIMBRA: 1.3 million+ patients treated |

| Sales Teams | US: 300+ oncology reps; China: 1,200+ personnel; Europe: expanding footprint |

| Market Presence | Commercial presence in 30+ countries; distribution across Asia-Pacific, North America, Europe |

| Strategic Partnerships | Novartis (2019) for oncology drug distribution; Merck (2021) for co-development and commercialization |

| Clinical Trials | Conducted in 45+ countries across 5 continents |

BRUKINSA sales in Q3 2024 reached $504 million in the US and $97 million in Europe, showing strong market penetration. TEVIMBRA has treated over 1.3 million patients worldwide. Recent approvals in the US, China, Europe, Brazil, Singapore, Thailand, and Israel reflect BeiGene’s expanding footprint. Strategic partnerships with Novartis and Merck support distribution and co-development, strengthening the company’s position in oncology markets.

Investor Sentiment

Analyst Ratings

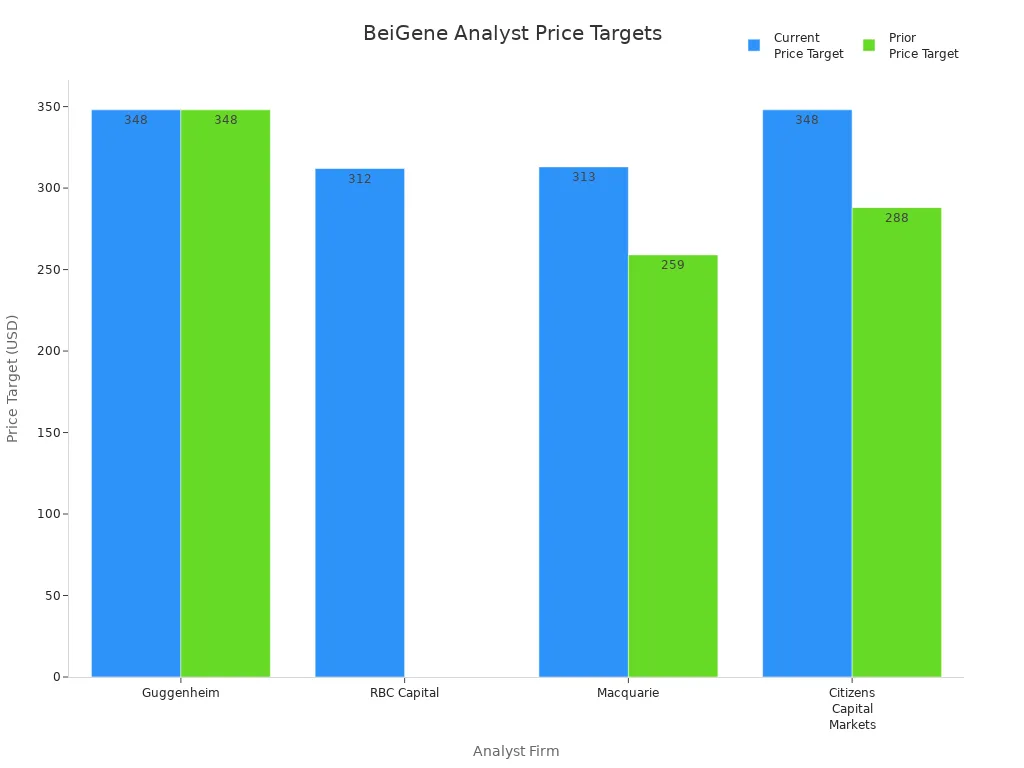

Analyst ratings for BeiGene have shown a clear shift toward a more bullish outlook over the past six months. Several major firms, including Guggenheim and Macquarie, have either maintained or raised their positive ratings. The table below summarizes recent analyst actions and price targets:

| Analyst Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|

| Guggenheim | Maintains | Buy | $348.00 | $348.00 |

| RBC Capital | Initiates Coverage | Outperform | $312.00 | N/A |

| Macquarie | Raises | Outperform | $313.00 | $259.00 |

| Citizens Capital Markets | Raises | Market Outperform | $348.00 | $288.00 |

Over the last 30 days, analysts have issued one bullish and three somewhat bullish ratings, with no bearish or neutral opinions. The average 12-month price target has climbed by 10.7%, rising from $298.33 to $330.25. This trend signals growing analyst confidence and strong investor enthusiasm.

Currently, BeiGene trades near $184.71 per share. Analyst price targets range from $152.5 to $348, with an average target of $244.37. This suggests a potential upside of about 32.3%. Most analysts rate the stock as Buy, and institutional ownership remains high at 48.55%. These factors reflect positive market sentiment and support the view that shares could see further gains.

Peer Comparison

BeiGene stands out among biotech peers for its rapid revenue growth and strong share price performance. The company reported a 48.64% increase in revenue over the past three months, ranking at the top among competitors. Over the last 52 weeks, shares have climbed 61.78%, outpacing many industry rivals.

| Metric | BeiGene Value | Peer Comparison / Industry Benchmark |

|---|---|---|

| Revenue Growth (3 months) | 48.64% | Top among peers |

| Share Price Increase (52 weeks) | 61.78% | Strong positive performance |

| Gross Profit Ranking | Middle | Median among peers |

| Return on Equity (ROE) | 0.04% | Below most peers but exceeds industry average |

| Net Margin | 0.11% | Exceeds industry average |

| Return on Assets (ROA) | 0.02% | Below industry average |

| Debt-to-Equity Ratio | 0.28 | Lower than industry average (conservative debt) |

| Market Capitalization | Below industry benchmarks | Smaller than peers, possibly due to growth expectations or operational capacity |

| Analyst Consensus | Outperform (7 analysts) | Average 1-year price target $340.71, 14.13% upside |

BeiGene’s core product, Brukinsa, generates over 60% of total revenue, supporting strong earnings growth. The company’s conservative debt-to-equity ratio and improving net margin highlight its financial health. While some efficiency metrics lag behind peers, BeiGene’s global strategy and focus on oncology therapeutics set it apart. The combination of robust earnings, rising analyst targets, and positive market sentiment positions BeiGene as a compelling choice for the investor seeking growth in the biotech sector.

Outlook & Risks

Growth Prospects

BeiGene stands at a turning point in the biotech industry. The company’s strong financials, expanding product pipeline, and global reach position it for significant upside growth. Analysts expect continued momentum as BeiGene launches new therapies and enters more international markets. The company’s focus on oncology and rare diseases gives it a competitive edge. Recent regulatory approvals in the United States, Europe, and China have opened new revenue streams. BeiGene’s investment in research and development supports innovation and helps bring new medicines to patients faster. The company’s partnerships with leading pharmaceutical firms also provide access to advanced technologies and wider distribution networks. These factors suggest that BeiGene could maintain its leadership in the sector and deliver value to shareholders.

Key Risks

Despite strong prospects, BeiGene faces several risks that could affect its future performance:

- Potential failure of BeiGene’s medicines to gain market acceptance in key regions

- Intense competition in the pharmaceutical industry from both established and emerging companies

- Challenges in navigating complex regulatory environments across multiple regions

- Limited experience in marketing its products on a global scale

- Reliance on third-party manufacturers for production and supply chain stability

- Geopolitical tensions, especially between China and other countries, which may impact growth, expansion strategies, and the value of its securities

Investors should monitor these risks closely. Changes in regulations, market dynamics, or international relations could influence BeiGene’s growth trajectory. The company’s ability to adapt and respond to these challenges will play a key role in its long-term success.

BeiGene’s recent gains reflect its strong global expansion, robust oncology pipeline, and strategic operational model. The company stands out by managing clinical trials in-house, maintaining control over key assets, and focusing on innovative cancer therapies.

- Key factors to watch include:

- The opening of a $700 million R&D facility in the US

- Continued approvals for drugs like Tevimbra

- Strong gross margins and positive operating cash flow

Investors should monitor upcoming earnings, regulatory decisions, and market trends that may shape BeiGene’s future.

FAQ

What caused BeiGene’s recent stock surge?

Strong clinical trial results, regulatory approvals in the United States and Europe, and increased institutional investment drove BeiGene’s stock higher. The company’s expanding product pipeline and global partnerships also contributed to investor confidence.

How does BeiGene’s financial health compare to other biotech firms?

BeiGene holds $2.63 billion in cash and maintains a low debt-to-equity ratio. The company’s liquidity and profitability place it among the stronger biotech firms, supporting ongoing research and international expansion.

Which products generate the most revenue for BeiGene?

Brukinsa, a BTK inhibitor, and Tislelizumab, a PD-1 inhibitor, lead BeiGene’s sales. Brukinsa achieved global sales growth, especially outside China, while Tislelizumab supports both China and international markets.

What risks should investors consider with BeiGene stock?

Investors face risks from regulatory changes, competition, and geopolitical tensions involving China. Supply chain challenges and market acceptance of new drugs also present uncertainties for future growth.

How does BeiGene expand its global reach?

BeiGene conducts clinical trials in over 45 countries and partners with major pharmaceutical companies. The company’s products have approvals in the United States, China, and Europe, helping it reach more patients worldwide.

BeiGene’s success story is a compelling example of a biotech company navigating complex global markets and regulatory landscapes to achieve impressive growth. However, for investors, a company’s global footprint, dual listings, and geopolitical risks present significant challenges in terms of currency conversion, fund transfers, and market access. Don’t let these complexities limit your investment potential. With BiyaPay, you can access a unified platform designed for global investors. Our service allows you to trade in US and Hong Kong stocks without needing a separate overseas bank account, simplifying your portfolio management. You can also benefit from our low fees, with remittance costs as low as 0.5%, and manage your international funds with a real-time exchange rate converter to ensure you’re always getting the best value. Ready to take control of your global investments? Register today and experience seamless, secure, and efficient financial services.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.