- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Is EDV Stock a Good Hedge Against Interest Rate Changes

Image Source: pexels

EDV stock offers a unique approach for investors who seek protection against interest rate changes. Many investors choose the Vanguard Extended Duration Treasury ETF because it tracks long-term U.S. Treasury securities. EDV focuses on zero-coupon bonds, which react strongly to shifts in interest rates. Vanguard designed EDV to provide exposure to these movements, making it different from other traditional investments. EDV stock stands out for its sensitivity to rate changes, and some investors use it to adjust risk in their portfolios.

Key Takeaways

- EDV is a Vanguard ETF that invests in long-term zero-coupon U.S. Treasury bonds, making it very sensitive to interest rate changes.

- EDV’s price can rise sharply when interest rates fall but can drop quickly if rates increase, so it carries high risk and volatility.

- Investors use EDV as a hedge to protect portfolios when they expect interest rates to stay low or decline, especially during economic uncertainty.

- EDV works best for investors with high risk tolerance who want to balance stock market risks or seek strong reactions to rate changes.

- While EDV offers low costs and potential gains, investors should understand its risks and use it as part of a diversified portfolio, not alone.

EDV Stock Basics

What Is EDV Stock

EDV stock refers to the Vanguard Extended Duration Treasury ETF. This ETF tracks the Bloomberg 20-30 Year Treasury STRIPS index. Investors use EDV to gain exposure to long-dated U.S. Treasury STRIPS with maturities between 20 and 30 years. Vanguard launched this ETF on December 6, 2007. The fund is classified under the Fixed Income: U.S. - Government, Treasury Investment Grade Long-Term segment. EDV holds about 80 different Treasury STRIPS, focusing on securities that mature between 2045 and 2055. The ETF has a low expense ratio of 0.05%. As of the most recent fiscal year, the total net asset value stands at approximately CAD 11.00 billion, which is about USD 8.1 billion (see current exchange rate). EDV offers commission-free trading for Vanguard account holders, making it attractive for cost-conscious investors.

How EDV Tracks Treasuries

The Vanguard Extended Duration Treasury ETF uses a passive management strategy. The fund holds securities that match the Bloomberg U.S. Treasury STRIPS 20–30 Year Equal Par Bond Index. This approach means EDV aims to mirror the performance of the index rather than trying to outperform it. The ETF’s portfolio closely follows the index’s composition, which helps ensure that returns align with the broader market for long-term U.S. Treasury securities. Vanguard’s passive replication strategy provides transparency and consistency for investors seeking exposure to extended maturity Treasuries.

Zero-Coupon Bond Focus

EDV invests primarily in zero-coupon U.S. Treasury securities, also known as STRIPS. At least 80% of the fund’s assets are in these zero-coupon bonds. These securities pay no periodic interest. Instead, investors receive a single payment at maturity. The focus on zero-coupon bonds makes EDV highly sensitive to changes in yield. When interest rates fall, the price of these bonds can rise sharply. However, when rates increase, the value of EDV can drop quickly. Zero-coupon bonds tend to show more volatility than traditional coupon bonds or stocks. They can provide strong returns during periods of falling yields, but they also carry higher interest rate and inflation risks. EDV’s structure gives investors straightforward access to this unique segment of the Treasury market.

Interest Rate Sensitivity

Image Source: pexels

Why Duration Matters

Duration measures how much a bond or bond fund reacts to changes in interest rates. EDV has a very high duration because it invests in long-term treasury STRIPS with maturities between 20 and 30 years. This means EDV’s price can change sharply when interest rates move. Investors use duration to estimate how much a fund’s value will rise or fall if rates shift by one percent. For example, EDV’s effective duration is about 25 years. If interest rates drop by 1%, EDV’s price could jump by roughly 25%. If rates rise by 1%, EDV’s price could fall by the same amount. The table below shows how duration affects price sensitivity:

| Duration (Years) | Price Change for 1% Interest Rate Drop | Explanation |

|---|---|---|

| 2 | ~2% | Short-duration bonds have low sensitivity to interest rate changes. |

| 25 (EDV) | ~25% | Long-duration bonds like EDV react strongly to rate changes. |

EDV’s long duration makes it much more volatile than most other treasury funds. Over the past decade, EDV’s volatility reached 4.39%, while the broader bond market ETF, BND, had only 1.25%. EDV also saw a maximum drawdown of nearly 60%, compared to BND’s 18.58%. This shows that EDV’s price can swing much more than typical bond funds.

EDV Stock and Rate Changes

EDV stock benefits most when interest rates fall or remain stable. During periods of economic slowdown or recession fears, inflation expectations often drop. Lower inflation leads to lower long-term treasury yields, which helps EDV’s performance. Investors who expect rates to decline may choose EDV for its strong price response. However, EDV suffers when inflation expectations rise. Since early 2020, EDV lost half its value as inflation pushed long-term rates higher. Rising yields hurt EDV’s performance because its long duration amplifies losses. Economic factors such as inflationary policies and fiscal deficits can also drive rates up, increasing risk for EDV holders. EDV works best for investors who believe rates will stay low or fall, but it carries high risk if rates climb.

Hedging with EDV Stock

Image Source: pexels

When EDV Works as a Hedge

Investors often look for ways to protect their portfolios from interest rate risk. EDV can serve as a hedge in specific scenarios. When investors expect long-term interest rates to fall, EDV provides strong price appreciation. This happens because the value of zero-coupon bonds rises sharply when yields drop. Investors who hold assets that lose value when rates fall, such as bank stocks or certain real estate investments, may use EDV to offset those losses.

EDV also helps balance portfolios that have high exposure to equities. During periods of economic uncertainty, investors often move money into long-term U.S. Treasuries. This shift can cause EDV to rise when stocks decline. Some investors use EDV as a tactical tool. They add it to their portfolios when they believe the Federal Reserve will cut rates or when inflation expectations decrease.

Tip: EDV works best as a hedge when interest rates are expected to decline or remain stable for an extended period.

Limitations and Risks

EDV does not provide a perfect hedge in all situations. The ETF carries significant interest-rate risk because of its long duration. If interest rates rise, EDV can lose value quickly. This risk makes EDV unsuitable for investors who cannot tolerate large swings in portfolio value.

The ETF also faces inflation risk. Rising inflation often leads to higher interest rates, which can hurt EDV’s performance. Investors who expect inflation to increase should consider this risk before adding EDV to their portfolios.

Below is a table that summarizes the main risks and limitations of using EDV as a hedge:

| Limitation | Description |

|---|---|

| High Volatility | EDV’s price can swing sharply with small changes in interest rates. |

| Inflation Sensitivity | Rising inflation can lead to losses in EDV. |

| Not a Short-Term Tool | EDV may not perform well during short-term rate spikes or unexpected events. |

| Limited Diversification | EDV focuses on one segment of the bond market, reducing diversification. |

Investors should also consider liquidity. While EDV trades on major exchanges, large trades can still impact the price. The ETF may not always track its index perfectly during periods of market stress.

Note: EDV stock can amplify both gains and losses. Investors should use it with caution and understand the risks involved.

Benefits and Drawbacks

Potential Upside

EDV offers investors a unique opportunity to benefit from changes in interest rates. The ETF focuses on long-term U.S. Treasury STRIPS, which can deliver strong price appreciation when yields fall. Investors seeking to hedge against equity downturns may find EDV useful, as its performance often improves during periods of economic uncertainty. The ETF’s structure, which emphasizes zero-coupon bonds, increases its sensitivity to rate movements. This feature allows for significant gains if the Federal Reserve lowers rates or if inflation expectations decrease.

EDV’s 30-day SEC yield provides a transparent measure of current income potential. Investors can review this yield to assess the ETF’s income-generating ability. The fund’s low expense ratio of 0.05% helps maximize returns, especially for cost-conscious investors. EDV trades in USD, and investors can check the current exchange rate if needed. The ETF’s passive management ensures that performance closely tracks the underlying index, providing clarity and predictability.

Key Risks

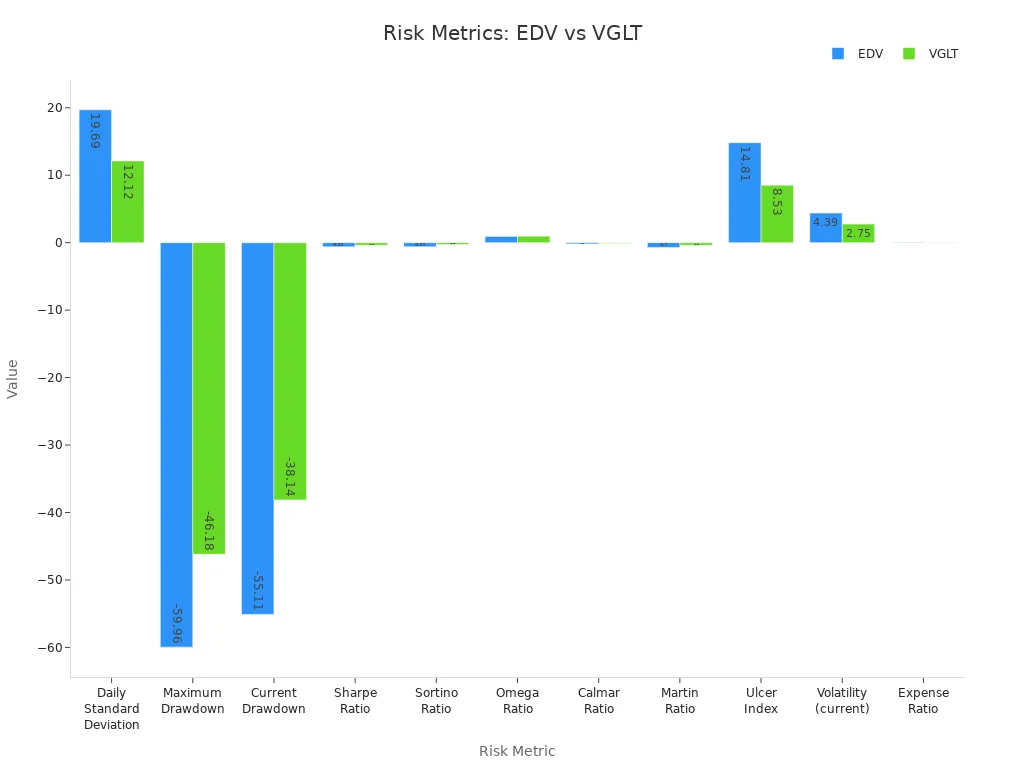

EDV carries significant risks that investors must consider. The ETF’s extended duration makes it highly sensitive to interest rate increases. Even a small rise in yields can lead to sharp declines in performance. The table below compares EDV to VGLT, another long-duration Treasury ETF:

| Metric | EDV (Vanguard Extended Duration Treasury ETF) | VGLT (Vanguard Long-Term Treasury ETF) |

|---|---|---|

| Daily Standard Deviation | 19.69% | 12.12% |

| Maximum Drawdown | -59.96% | -46.18% |

| Current Drawdown | -55.11% | -38.14% |

| Sharpe Ratio | -0.62 | -0.37 |

| Sortino Ratio | -0.62 | -0.28 |

| Omega Ratio | 0.93 | 0.97 |

| Calmar Ratio | -0.18 | -0.08 |

| Martin Ratio | -0.70 | -0.37 |

| Ulcer Index | 14.81% | 8.53% |

| Volatility (current) | 4.39% | 2.75% |

| Expense Ratio | 0.06% | 0.04% |

| Correlation (EDV vs VGLT) | 0.97 (high correlation) | 0.97 (high correlation) |

EDV’s higher volatility and larger drawdowns show that it reacts more strongly to market changes than other ETFs. Inflation risk also threatens performance, as rising prices often push yields higher. Investors should understand that EDV’s focus on long-term bonds can amplify both gains and losses.

EDV Stock vs. Other ETFs

Duration Differences

Investors often compare the Vanguard Extended Duration Treasury ETF (EDV) to other long-duration treasury ETFs. Duration measures how much an ETF’s price changes when interest rates move. EDV targets longer duration bonds than most competitors. The table below shows the duration for three popular treasury ETFs:

| ETF | Duration (years) | Notes |

|---|---|---|

| EDV | 18.60 | Targets longer duration bonds than TLT but shorter than ZROZ |

| TLT | 15.66 (approx.) | Typical duration for 20+ year Treasury bonds |

| ZROZ | 21.00 | Focuses on zero-coupon bonds with the longest duration |

EDV’s focus on zero-coupon treasury bonds increases its sensitivity to interest rate changes. ZROZ has the highest duration, making it even more reactive than EDV. TLT offers a lower duration, which means less price movement when rates shift.

Cost and Liquidity

Cost plays a key role when choosing an ETF. EDV has a low expense ratio, which helps investors keep more of their returns. Vanguard sets the expense ratio for EDV at 0.05%. TLT and ZROZ also offer competitive fees, but EDV stands out for its cost efficiency. All three ETFs trade in USD. Investors can check the current exchange rate if needed.

Liquidity matters for investors who want to buy or sell quickly. EDV trades on major exchanges and usually has tight bid-ask spreads. TLT has higher trading volume, which can make large trades easier. ZROZ has lower volume, so investors may see wider spreads during market stress.

Note: Most treasury ETFs, including EDV, follow similar tax rules. Investors pay taxes on income and capital gains. There is no special tax treatment for EDV compared to other treasury ETFs.

Risk Comparison

Risk varies across treasury ETFs. EDV’s long duration makes it highly sensitive to interest rate changes. In a portfolio with 20% EDV, the standard deviation reached 15.03%, and the maximum drawdown was 34.65%. These numbers show that EDV can add significant risk to a portfolio. ZROZ, with its even longer duration, may expose investors to greater swings. TLT’s lower duration reduces risk, but it still reacts strongly to rate changes.

The Sharpe ratio helps investors measure risk-adjusted returns. EDV’s Sharpe ratio over the past five years was -0.63, and over ten years was -0.12. These negative values show that EDV struggled to deliver returns compared to its risk. Investors should consider these metrics before adding EDV or similar ETFs to their portfolios.

Who Should Consider EDV

Investor Suitability

The Vanguard Extended Duration Treasury ETF attracts investors who seek strong reactions to interest rate changes. This etf holds Treasury STRIPS with an average duration of over 24 years. Such a long duration means the etf can swing sharply in value when rates move. Investors who have historically benefited most from holding EDV during periods of interest rate volatility are those with a high risk tolerance. These individuals often look for high returns and can handle large price swings. For example, during the March 2020 market crash, EDV delivered strong gains as investors rushed to safe assets. In 2011, the etf returned about 55%, showing its potential for large profits in the right environment. However, the same features can lead to steep losses if rates rise quickly. Speculative or tactical traders, rather than conservative buy-and-hold investors, usually find EDV more suitable for their strategies.

Portfolio Fit

EDV can play a unique role in a diversified portfolio. Many investors use it as a hedge against equity downturns or to balance risk in a traditional 60% stock and 40% bond portfolio. The etf provides exposure to long-term Treasury STRIPS, which can help offset losses in stocks during market stress. Common reasons for choosing EDV as a hedge include its pure interest rate exposure, potential for price appreciation when rates fall, and its ability to reduce overall portfolio volatility. Some risk parity strategies allocate as much as 75% to EDV and 25% to equities, using the etf as an “insurance parachute” during market downturns. While EDV can diversify and buffer a portfolio, investors should tailor allocations based on their own risk tolerance and market outlook. The etf is not expected to drive returns but to support investments by reducing risk during crashes.

Recent studies show several key points about EDV stock as an interest rate hedge:

- EDV remains an effective diversifier and risk reducer within a portfolio, even when interest rates rise.

- Bonds like EDV do not always lose value in rising rate environments unless rates increase rapidly.

- Long bonds have outperformed stocks over the past 20 years and offer asymmetric upside due to bond convexity.

- Volatility in long-term bonds helps counterbalance stock market downturns, making EDV a superior diversifier.

Financial advisors recommend that investors align EDV with their risk tolerance and investment timeline. Younger investors may accept more volatility, while those nearing retirement should focus on capital preservation. Advisors suggest using EDV as part of a diversified portfolio, not as a sole investment. Mixed analyst opinions reflect both caution and recognition of EDV’s benefits in volatile markets.

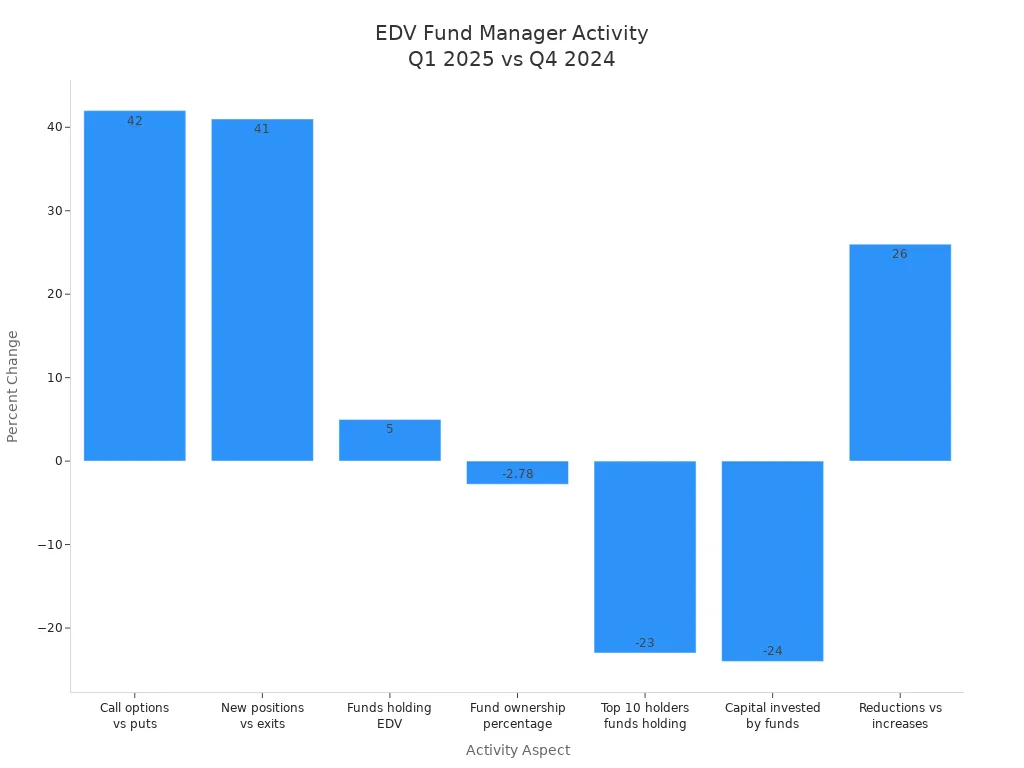

| Aspect | Summary |

|---|---|

| Analyst Opinions | Mixed: Some downgrade EDV due to risks from rising rates; others highlight yield, low fees, and diversification benefits |

| Fund Manager Activity | Increased call options and new positions, but overall fund ownership and capital invested have decreased |

Investors should weigh EDV’s risks and benefits in the context of their own portfolio goals. Regular monitoring and diversification remain essential for effective risk management.

FAQ

What makes EDV stock different from other Treasury ETFs?

EDV stock invests in zero-coupon U.S. Treasury STRIPS with long maturities. This focus gives EDV higher sensitivity to interest rate changes compared to most other Treasury ETFs.

Can investors in China or Hong Kong buy EDV stock?

Investors in China or Hong Kong can access EDV stock through international brokerage accounts. Many Hong Kong banks offer platforms that allow trading of U.S.-listed ETFs like EDV.

How does EDV perform during rising interest rates?

EDV usually loses value when interest rates rise. Its long duration means even small increases in rates can cause large price drops. Investors should monitor rate trends closely.

Is EDV suitable for conservative investors?

EDV stock carries high volatility and risk. Conservative investors may find its price swings uncomfortable. They should consider shorter-duration bond funds for lower risk.

Does EDV pay regular income?

EDV does not pay regular interest. It holds zero-coupon bonds, which pay out only at maturity. Investors seeking steady income may prefer traditional bond ETFs.

EDV is a powerful tool, but its high volatility and extreme sensitivity to interest rates make it suitable only for specific investors. For a global investor, beyond understanding the complexity of this strategy, a key challenge is efficiently and affordably getting funds into the U.S. market. BiyaPay offers a solution that helps you easily overcome this hurdle. We provide an integrated global financial account, allowing you to trade US and Hong Kong stocks directly without needing an overseas bank account. Through our platform, you can get access to a real-time exchange rate converter and transfer funds with fees as low as 0.5%, ensuring every transaction is efficient and transparent. Register now to simplify your global investment journey and focus on your investment strategy itself.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.