- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Is Enstar Stock Positioned for Growth This Year

Image Source: pexels

Enstar group limited has delivered steady results in 2024. The company’s book value per ordinary share grew 4.5% year-to-date, reaching $358.74, while enstar group limited’s stock price rose 6.77% over the past 52 weeks. Enstar’s beta of 0.70 signals lower volatility compared to the broader market. Expert sentiment points to cautious optimism, with technical indicators favoring a hold or accumulate strategy. Institutional investors and institutional ownership, which now account for around 73%, play a major role in enstar group’s stability. Investor attention remains focused on enstar’s growth prospects, institutional dynamics, sector trends, and financial signals. Investors continue to weigh enstar group limited’s prospects against risk factors and market signals, as institutional investors shape price movements. Enstar’s financial performance and institutional ownership will guide investor sentiment about enstar group and enstar stock in the months ahead.

Key Takeaways

- Enstar’s stock showed steady growth in 2024 with a 6.77% price increase and strong financial health reflected in rising book value per share.

- High institutional ownership, around 73% to 81%, provides stability and reduces stock volatility, making Enstar attractive for long-term investors.

- The company offers a stable dividend yield near 7.5%, giving investors reliable income despite no recent dividend growth.

- Enstar manages risks well through diversification, disciplined underwriting, and strategic acquisitions, helping it navigate market and regulatory challenges.

- The recent acquisition by Sixth Street will make Enstar a private company, which may change its stock liquidity and investor dynamics going forward.

Enstar Stock Performance

Image Source: pexels

Price Trends

Enstar stock has shown resilience in 2024, with its price rising 6.77% over the past 52 weeks. The company’s book value per share also increased, reflecting steady financial health. Several factors drive recent price movements:

- Investor sentiment remains mixed, shaped by enstar’s financial results, strategic decisions, and the broader regulatory environment.

- Analyst perspectives and institutional investor confidence play a significant role in price dynamics.

- Market reactions to changes in ownership and large investor moves reveal how the investment community views enstar.

- Institutional investors often focus on long-term value and risk-adjusted portfolio allocation, which impacts stock price volatility.

- Insider trading trends, especially net selling, can influence market perception and price movements.

Enstar’s price trends reflect a balance between cautious optimism and ongoing scrutiny from both analysts and investors. The company’s ability to maintain stable growth, even during periods of market uncertainty, highlights the strength of its business model and management strategy.

Volatility Factors

Enstar typically experiences lower volatility compared to the broader market. The stock’s beta stands at 0.70, indicating that its price movements are less sensitive to market swings. Several elements contribute to this stability:

- High institutional ownership, which accounts for about 73% of shares, helps dampen short-term price fluctuations.

- Long-term investment strategies by institutional investors reduce the impact of speculative trading.

- Enstar’s focus on risk management and disciplined underwriting further supports stable performance.

- Regulatory changes and shifts in the insurance sector can introduce volatility, but enstar’s diversified portfolio helps mitigate these risks.

The company’s approach to managing risk and maintaining a strong capital position allows it to navigate market challenges effectively. This stability appeals to investors seeking consistent performance rather than high-risk, high-reward opportunities.

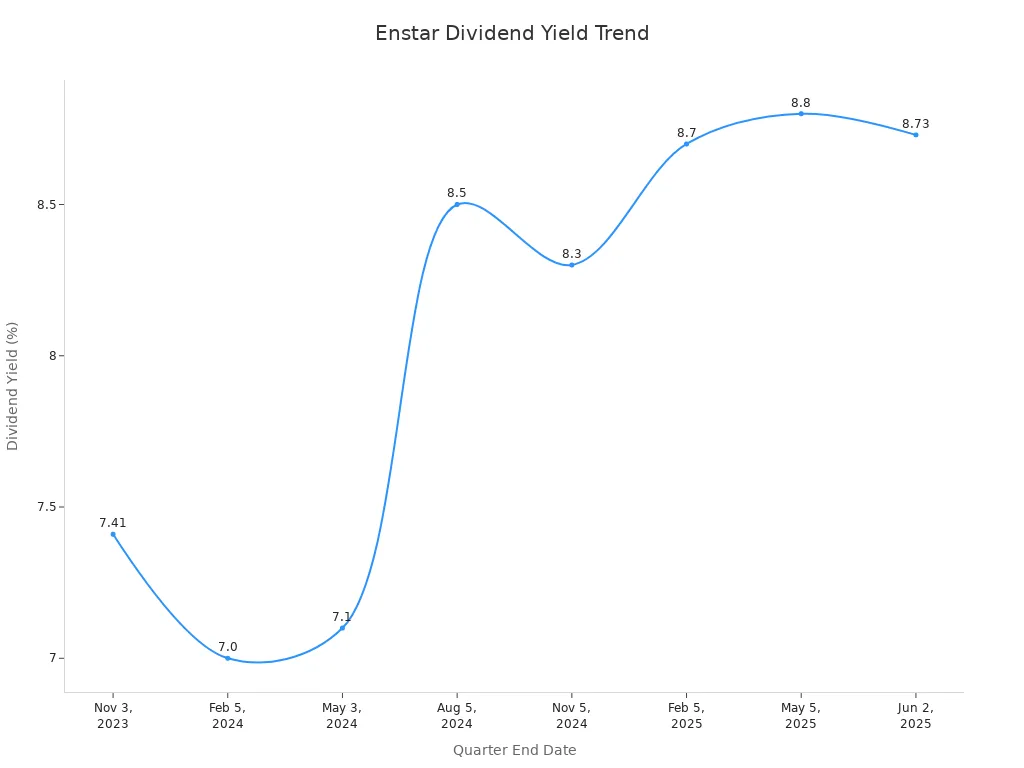

Dividend Yield

Enstar offers a stable dividend yield, which has become a key component of its overall performance. The company’s quarterly dividend payments have remained consistent at $0.4375 per share over the past several years. The dividend yield has fluctuated between 7.0% and 8.8% in recent quarters, reflecting changes in the stock price rather than the dividend amount.

| Date | Quarterly Dividend Payment | Dividend Yield (%) | Dividend Growth | Notes |

|---|---|---|---|---|

| Jun 2, 2025 | $0.4375 | 8.73 | 0.00% | Current dividend yield and payment |

| May 5, 2025 | $0.4375 | 8.8 | 0.00% | Recent quarterly yield high |

| Feb 5, 2025 | $0.4375 | 8.7 | 0.00% | Stable dividend amount |

| Nov 5, 2024 | $0.4375 | 8.3 | 0.00% | Slight yield fluctuation |

| Aug 5, 2024 | $0.4375 | 8.5 | 0.00% | No dividend growth |

| May 3, 2024 | $0.4375 | 7.1 | 0.00% | Lower yield earlier in year |

| Feb 5, 2024 | $0.4375 | 7.0 | 0.00% | Consistent dividend payment |

| Nov 3, 2023 | $0.4375 | 7.41 | 0.00% | No significant trend in dividend amount |

Compared to the insurance industry median, enstar’s dividend yield stands out. The company’s yield has reached a 13-year high of 7.59%, while the industry median remains generally lower. However, enstar has not increased its dividend in the past three years, while the industry median shows a 9.9% growth rate.

| Metric | Enstar Group (ESGRF.PFD) | Insurance Industry Median |

|---|---|---|

| Dividend Yield (%) | ~7.53% - 7.59% | Generally lower |

| 3-Year Dividend Growth Rate (%) | 0.00% | 9.9% |

| Historical Dividend Yield High | 7.59% (13-year high) | N/A |

Investors value enstar’s stable dividend payments, especially during periods of market uncertainty. The high yield provides attractive income, but the lack of dividend growth may limit long-term appeal for some investors. Overall, enstar’s dividend policy supports its reputation for steady performance and risk management.

Market Signals

Interest Rates

Interest rates play a critical role in shaping the performance of enstar and esgr. Rising rates often impact investment portfolios, which form a significant part of enstar group limited’s earnings. Higher rates can increase yields on fixed-income assets, benefiting esgr’s investment returns. However, they may also reduce the market value of existing bond holdings. Enstar group limited monitors these shifts closely, adjusting its asset allocation to manage risk and optimize returns. Market conditions, such as central bank policy changes, can create both challenges and opportunities for esgr. Investors watch for buy signals when interest rate trends align with enstar’s risk management strategies.

Sector Trends

The insurance sector, especially the re/insurance segment where enstar group limited operates, faces several prevailing trends:

- Intense competition continues to pressure premiums and transaction margins for esgr.

- Regulatory changes worldwide affect capital requirements and operational costs, requiring enstar to adapt quickly.

- Market volatility and economic downturns influence investment portfolios and financial stability for enstar group limited.

- Enstar mitigates risks through diversification, hedging, prudent underwriting, and active risk management.

- Growth opportunities arise from strategic acquisitions, market expansion, and investments in technology such as data analytics and AI.

- The pending merger with Sixth Street Partners, LLC, stands out as a significant growth catalyst for esgr.

- Challenges include reliance on the finite run-off business model and the need to attract and retain skilled employees.

Enstar’s expertise in run-off management and capital release solutions gives esgr a competitive edge. The company’s strong financial position, with a market capitalization of $3.4 billion, supports resilience and growth. However, regulatory uncertainties and increased competition require continuous innovation.

Relative Strength

Esgr demonstrates relative strength compared to many peers in the insurance sector. The company’s focus on risk management and innovation helps maintain stability during volatile market conditions. Enstar group limited’s diversified portfolio and disciplined underwriting support consistent performance. Analysts often highlight esgr’s ability to adapt to changing market conditions and regulatory environments. The company’s strong financials and strategic initiatives position enstar for potential outperformance, even as sector trends evolve.

Ownership Impact

Institutional Holdings

Institutional investors play a dominant role in shaping enstar’s stock performance. In November 2023, institutional investors controlled 73% of enstar shares. By August 2025, this figure climbed to 81.01%. This upward trend signals growing institutional confidence in esgr. The top eight institutional investors now hold more than half of enstar’s outstanding shares. Their decisions can move esgr’s price significantly. Over the past two years, institutional investors bought 2.22 million esgr shares valued at $721.39 million and sold 3.12 million shares worth $1.02 billion. Despite recent net selling, the overall increase in institutional ownership shows that large investors see long-term value in enstar. When institutional investors adjust their positions, esgr often experiences noticeable price swings.

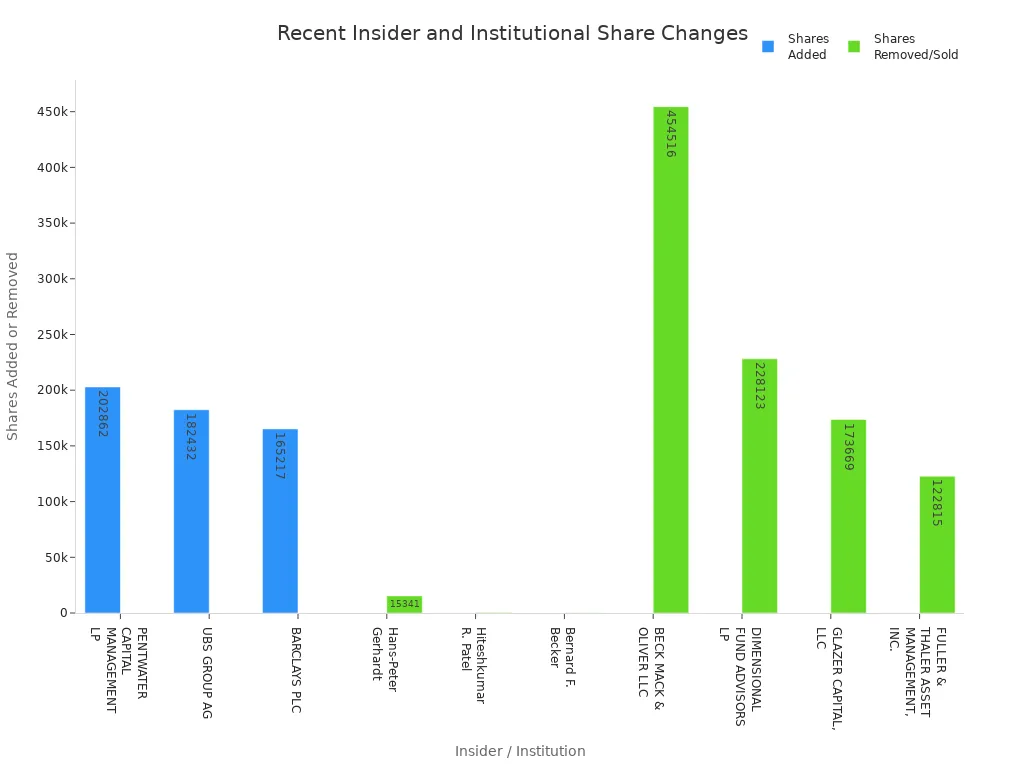

Insider Activity

Insider transactions provide important signals for investor confidence in enstar. Recent activity shows several key executives selling shares. For example, Hans-Peter Gerhardt sold 15,341 esgr shares for $5,094,075. Hiteshkumar R. Patel and Bernard F. Becker also sold shares, though in smaller amounts. Some institutional investors, such as BECK MACK & OLIVER LLC and DIMENSIONAL FUND ADVISORS LP, removed large positions, while others like PENTWATER CAPITAL MANAGEMENT LP and UBS GROUP AG added shares. These moves can influence investor sentiment and esgr’s volatility.

| Insider / Institution | Transaction Type | Shares Sold / Added | Estimated Value / % Change |

|---|---|---|---|

| Hans-Peter Gerhardt | Sale | 15,341 shares | $5,094,075 |

| Hiteshkumar R. Patel | Sale | 484 shares | $160,770 |

| Bernard F. Becker | Sale | 200 shares | $66,590 |

| BECK MACK & OLIVER LLC | Removed | 454,516 shares | $151,072,028 |

| DIMENSIONAL FUND ADVISORS LP | Removed | 228,123 shares | $75,823,522 |

| PENTWATER CAPITAL MANAGEMENT LP | Added | 202,862 shares | $67,427,271 |

| UBS GROUP AG | Added | 182,432 shares | $60,636,748 |

| GLAZER CAPITAL, LLC | Removed | 173,669 shares | $57,724,102 |

| BARCLAYS PLC | Added | 165,217 shares | $54,914,826 |

| FULLER & THALER ASSET MANAGEMENT, INC. | Removed | 122,815 shares | $40,821,249 |

Private Equity

Private equity involvement adds another layer of influence to enstar’s ownership structure. The recent $5.1 billion acquisition by Sixth Street affiliates, with support from other institutional investors, highlights strong financial backing for esgr. This transaction reassures investors about enstar’s access to capital and strategic direction. Private equity stakes can also increase esgr’s volatility, as these investors often seek to maximize returns over shorter time frames. Their actions can affect both investor confidence and the long-term outlook for enstar.

Investor Sentiment

News Events

Recent news events have shaped investor sentiment toward esgr. Several technical signals emerged on July 10, 2025, including a KDJ Death Cross and a bearish Marubozu candlestick pattern. These indicators pointed to a shift from bullish to bearish momentum for esgr. Narrowing Bollinger Bands reinforced the trend, suggesting reduced volatility but continued downward pressure.

Other significant events include:

- The announcement of fixed dividends for Series D and E preference shares, payable June 2, 2025, which provided steady income signals and supported positive investor sentiment.

- Cavello Bay Reinsurance, a subsidiary, received an ‘A’ Financial Strength and ‘a+’ Credit Rating from AM Best, enhancing confidence in esgr’s financial stability.

- The agreement with Atrium Syndicate 609 to transfer $196 million in net loss reserves to Enstar’s Syndicate 2008, a strategic move expected to improve claims handling.

- A cash tender offer for outstanding junior subordinated notes due 2040, which indicated active capital management.

The acquisition of Enstar Group Limited by Sixth Street and other investors in a $5.1 billion cash transaction at $338.00 per ordinary share, completed in early July 2025, led to esgr transitioning to a private entity and delisting from NASDAQ. This event significantly affected investor sentiment and stock price dynamics.

Market Trends

Investor sentiment toward esgr has responded to several market trends:

- The company’s financial performance, including profitability and revenue growth, has influenced investor confidence.

- Strategic decisions, such as mergers and acquisitions, have swayed opinions.

- Broader economic trends and the insurance sector’s performance have played a significant role.

- Regulatory changes have impacted investor views.

- Insider trading activity, especially net selling, has reflected changing confidence levels.

- The acquisition announcement in July 2024, with a $338 per share cash offer, signaled a transition to a private company, affecting stock liquidity and valuation.

- Market reactions to changes in institutional holdings have influenced price movements and investor confidence.

- Analyst perspectives, including buy ratings and price targets, have shaped sentiment.

- Different investor groups, such as institutional, retail, and insiders, have responded based on their investment horizons and focus areas.

Defensive Positioning

Many investors have adopted a defensive stance with esgr. Insider sales by key executives, such as Laurence Plumb, Hiteshkumar R. Patel, and Hanspeter Gerhardt, suggest a shift in confidence or repositioning ahead of the acquisition. The table below summarizes recent insider sales:

| Insider Name | Position | Shares Sold | Price per Share | Total Value (USD) |

|---|---|---|---|---|

| Laurence Plumb | Chief of Business Operations | 151 | $332.00 | $50,130 |

| Hiteshkumar R. Patel | Director | 484 | $332.17 | $160,770 |

| Hanspeter Gerhardt | Director | 4,934 | $332.01 | $1,640,000 |

Institutional investors have also emphasized long-term value investing and risk-adjusted portfolio allocation. The transition of esgr to a privately held company, with a cash buyout at $338 per share, has prompted cautious investor behavior. This defensive positioning reflects a focus on capital preservation and risk management as esgr moves into a new phase.

Enstar Group Limited Financials

Image Source: pexels

Return on Equity

Enstar group limited demonstrates a steady improvement in return on equity. Over recent years, enstar group limited increased its return on equity from negative averages to approximately 8%. This positive trend signals that enstar group limited uses shareholder capital more efficiently. Investors often view a rising return on equity as a sign of strong management and effective capital allocation. Enstar group limited’s focus on disciplined underwriting and risk management supports this upward movement. The company’s financial performance reflects its ability to generate profits from equity investments, which strengthens investor confidence in esgr.

Acquisition Costs

Acquisition costs play a significant role in enstar group limited’s financial strategy. Enstar group limited manages acquisition costs carefully to maintain profitability. The company often acquires insurance portfolios and run-off businesses, which can introduce short-term expenses. However, enstar group limited’s expertise in integrating new assets helps control these costs over time. By focusing on operational efficiency, enstar group limited reduces the impact of acquisition costs on overall financial performance. This approach allows esgr to expand its portfolio while protecting margins. Investors monitor acquisition costs closely, as they influence both short-term results and long-term growth for enstar group.

Profitability Metrics

Profitability metrics provide a clear view of enstar group limited’s financial health. Enstar group limited reports a net profit margin ranging from 38.06% to 63%, which marks a significant improvement from previous negative averages. The operating profit margin stands at approximately 41.84%, reflecting strong cost control and operational efficiency. These metrics indicate that enstar group limited manages expenses well and converts revenue into profit effectively. The table below summarizes key profitability metrics for esgr:

| Profitability Metric | Value |

|---|---|

| Net Profit Margin | 38.06% |

| Operating Profit Margin | 41.84% |

Stable or increasing margins suggest that enstar group limited continues to improve its financial performance. Investors use these figures to compare esgr with industry peers and to evaluate trends over time. Strong profitability metrics reinforce the company’s reputation for sound financial management and resilience.

Risks and Opportunities

Economic Downturns

Economic downturns present both risks and opportunities for Enstar Group Limited. The company faces challenges when market volatility increases, interest rates fluctuate, or credit spreads widen. These factors can reduce the value of investment portfolios and impact financial results. For example, Enstar reported a decline in net income attributable to shareholders from $119 million to $50 million year-over-year. This drop resulted from decreased total investment returns and adverse foreign currency exchange rates. However, the investment segment remained strong, generating $183 million in net income. Comprehensive income also grew to $125 million, driven by unrealized gains on investments.

Enstar’s run-off segment experienced a net loss of $1 million, highlighting the risks in this area. Despite these setbacks, institutional investors continue to show confidence. Over 92% of Enstar shares are held by institutions, including The Vanguard Group, BlackRock Inc., and Wellington Management Group. Institutional ownership increased by 3.5% in Q4 2023, with net purchases totaling $245 million. High institutional participation supports price stability and strong corporate governance. Active involvement from these investors suggests a positive outlook for Enstar, even during economic challenges.

| Aspect | Details |

|---|---|

| Negative Impact on Stock | Net income fell from $119M to $50M due to lower investment returns and currency losses. |

| Investment Segment Strength | Net income of $183M shows strong asset management. |

| Comprehensive Income Growth | Rose to $125M, driven by unrealized investment gains. |

| Run-off Segment Weakness | Net loss of $1M, reflecting segment challenges. |

| Economic Threats | Market volatility, interest rates, credit spreads, and equity prices threaten portfolio value. |

| Strategic Opportunities | Ability to use market volatility for acquisitions and diversification. |

| Risk Mitigation | Diversification, hedging, prudent underwriting, and active risk management sustain stability. |

| Regulatory Risks | Regulatory changes could disrupt operations or increase costs. |

Enstar uses diversification, hedging, and prudent underwriting to manage risk. The company’s ability to adapt and pursue strategic acquisitions helps it find value in turbulent markets. Investors who focus on value investing may see these downturns as opportunities to acquire shares at attractive prices.

Regulatory Factors

Regulatory factors play a major role in shaping Enstar’s future. The company operates under many regulatory frameworks worldwide. These rules affect capital requirements, reserving practices, and operational costs. Regulatory changes require constant monitoring and adaptation, which can increase expenses and impact financial performance.

The pending $5.1 billion acquisition by Sixth Street introduces new regulatory risks. The deal needs multiple regulatory approvals and shareholder consent. During this period, Enstar faces potential litigation, antitrust scrutiny, and restrictions that may limit business opportunities. The company’s management must focus on completing the transaction, which could divert attention from daily operations. If the transaction does not close, Enstar’s stock price may fluctuate or decline.

Note: After the acquisition closes, Enstar will become a private company and will no longer trade publicly. This change may alter its strategic direction and financial structure. Investors should monitor regulatory disclosures and updates for any material changes before the expected closing in 2025.

Regulatory developments remain a key risk factor for Enstar. Legislative changes, new compliance requirements, and economic shifts can all affect the company’s value. Investors who practice value investing should pay close attention to these factors, as they can influence both risk and reward.

Growth Catalysts

Enstar’s growth opportunities set it apart from many peers in the insurance sector. The company specializes in acquiring and managing run-off insurance portfolios. This niche focus gives Enstar a unique value proposition compared to companies that rely on active underwriting or traditional insurance lines. Strategic acquisitions, market expansion, and innovative solutions for complex insurance liabilities drive growth.

Key growth drivers include:

- Strategic partnerships and new product development.

- Investments in technology to improve efficiency and risk management.

- A strong financial position and experienced management team.

- Expertise in run-off management, which allows Enstar to unlock value from legacy insurance assets.

Enstar’s book value per share grew 4.5% year-to-date, and the company reported $2.4 billion in revenue for 2024. These results show solid performance and effective execution of its business model. Compared to other insurance companies, Enstar offers a distinct risk-return profile. Its focus on efficient management of run-off portfolios appeals to investors seeking value and stability rather than rapid growth from new policy writing.

Investors who use value investing strategies may find Enstar’s approach attractive. The company’s ability to generate value through disciplined acquisitions and operational excellence supports long-term growth. As the insurance sector evolves, Enstar’s unique strengths position it to capture new opportunities and deliver value to shareholders.

Enstar group limited enters this year with a strong foundation, supported by high institutional ownership and a history of stable performance. Enstar’s recent acquisition and delisting from NASDAQ introduce new risks, including reduced liquidity and uncertainty for preferred shareholders. The company faces moderate market risk, as shown by a beta of 1.05 and a market capitalization near $3.97 billion. Market volatility impacts enstar’s short-term price swings and long-term financial health, but enstar group limited manages these challenges through diversification and prudent risk controls. Investors should monitor valuation ratios, profitability, and sector trends to assess enstar’s prospects. Experts recommend using real-time data and professional guidance when evaluating enstar group limited. While short-term volatility may create trading opportunities, enstar’s growth prospects depend on its ability to adapt and leverage strategic acquisitions. Enstar group limited remains positioned for growth, but investors must stay alert to evolving risks and sector performance.

FAQ

What drives Enstar Group Limited’s stock price changes?

Institutional investor actions and strategic acquisitions influence Enstar’s stock price. Market signals, sector trends, and regulatory updates also play important roles. Investors monitor financial performance and news events for buy or sell signals.

Tip: Review quarterly reports for the latest price drivers.

How does institutional ownership affect Enstar’s volatility?

High institutional ownership stabilizes Enstar’s stock. Large investors often use long-term strategies, which reduce speculative trading. Sudden changes in institutional holdings can still cause price swings.

What risks should investors watch with Enstar stock?

Investors should watch for market volatility, regulatory changes, and economic downturns. Acquisition costs and insider activity may also impact risk. Monitoring sector trends helps identify new threats.

Does Enstar Group Limited pay dividends?

Enstar pays quarterly dividends. The amount remains stable at $0.4375 per share. Dividend yield fluctuates with stock price. Investors value consistent payments, but dividend growth has stalled.

| Date | Dividend Payment (USD) | Yield (%) |

|---|---|---|

| Jun 2, 2025 | $0.4375 | 8.73 |

What happens after Enstar’s acquisition by Sixth Street?

Enstar will become a private company after the acquisition. The stock will delist from NASDAQ. Investors will receive $338.00 per share in cash. Future updates will come from private disclosures.

Note: See USD exchange rates for conversion details.

Enstar’s journey as a publicly-traded company is coming to an end, with the acquisition by Sixth Street offering a clear exit at a fixed price. While this move removes the potential for future stock appreciation, it also presents an opportunity to re-evaluate your portfolio and find new growth avenues. If you’re looking for a platform that can smoothly transition you to your next investment, consider BiyaPay. We specialize in simplifying global finance, enabling you to invest in a wide range of U.S. and Hong Kong stocks without needing an overseas bank account. Manage your funds transparently with our real-time exchange rate converter and benefit from low remittance fees. With BiyaPay, you can quickly reallocate your capital and pursue new opportunities, ensuring your investment journey continues seamlessly. Register today and discover how simple and efficient global investing can be.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.