- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Is Harley Davidson Stock a Value Play or a Warning Sign for 2025?

Image Source: pexels

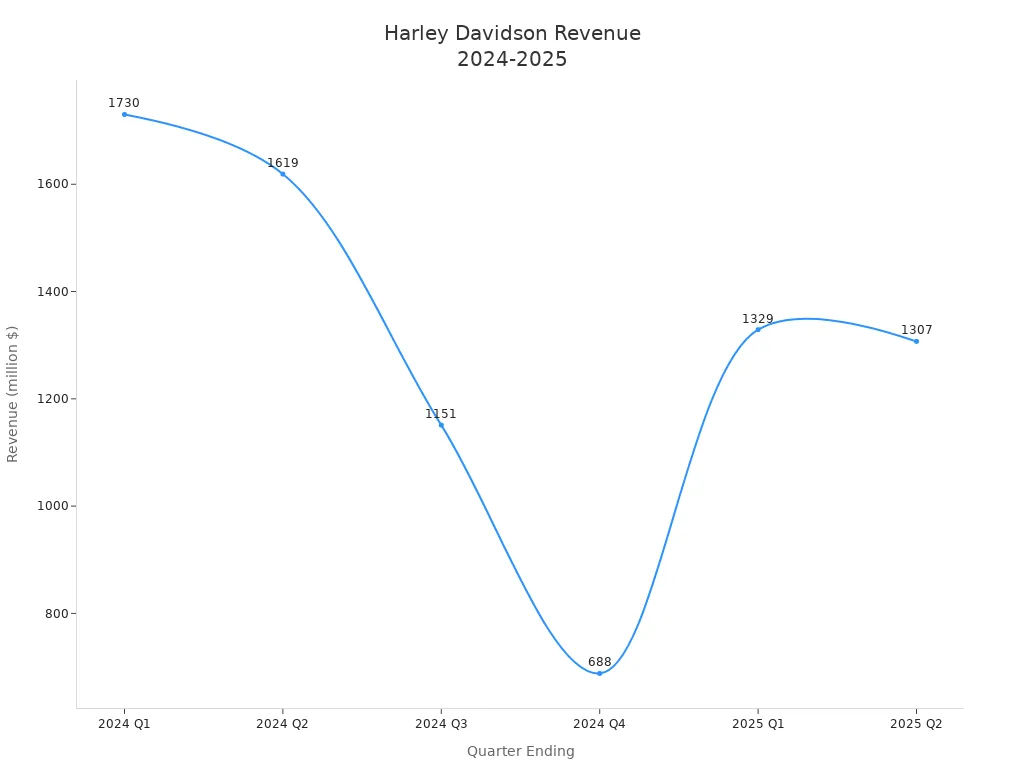

Harley davidson stock faces mounting scrutiny as sharp declines in revenue and profits raise concerns for 2025. The company reported a 15% drop in global retail motorcycle sales and a 47% decrease in Q4 2024 revenue, as seen in the table below.

| Metric | Q4 2024 | Q4 2023 | Change |

|---|---|---|---|

| Global Motorcycle Shipments (thousands) | 14.0 | 29.5 | -53% |

| HDMC Revenue (million $) | 420 | 792 | -47% |

| HDMC Operating Income (million $) | (214) | (44) | NM |

| Global Retail Motorcycle Sales (thousands) | 25.7 | 30.2 | -15% |

Investor interest remains mixed. Major investors such as Vanguard and BlackRock show both caution and optimism, reflecting a split between those who view the stock’s low price as a value play and those who see it as a warning sign. Harley-davidson’s recent performance and shifting investor interest signal a pivotal moment for the brand.

Key Takeaways

- Harley-Davidson’s stock price has dropped significantly due to falling sales and profits, raising concerns for 2025.

- The company faces challenges like high debt, tariffs, and changing customer preferences, which impact its financial health.

- Despite struggles, Harley-Davidson’s strong brand and loyal customer base offer a foundation for potential recovery.

- Management is taking steps to improve performance through cost cuts, share buybacks, and focusing on core markets.

- Investors who accept risk may see value in the stock’s low price, while cautious investors should wait for clearer signs of improvement.

Harley Davidson Stock Performance

Image Source: pexels

Recent Price Trends

Harley davidson stock has experienced a significant recent drawdown, capturing market attention. Since September 2024, the share price has dropped by 35%. In 2025, the year-to-date decline stands at 25%. This performance places harley-davidson among the most volatile names in the motorcycle industry. The current price of $25.59 USD (see exchange rate) sits much closer to its 52-week low than its high.

| Metric | Value | Relative Position to Current Price |

|---|---|---|

| Current Price | $25.59 | - |

| 52-Week Low | $20.46 | Current price is ~25.07% above low |

| 52-Week High | $39.92 | Current price is ~64.10% below high |

Shares now trade near their lowest levels in a year. Many investors see this as a warning sign, while others believe the low price could offer a buying opportunity if harley-davidson can recover.

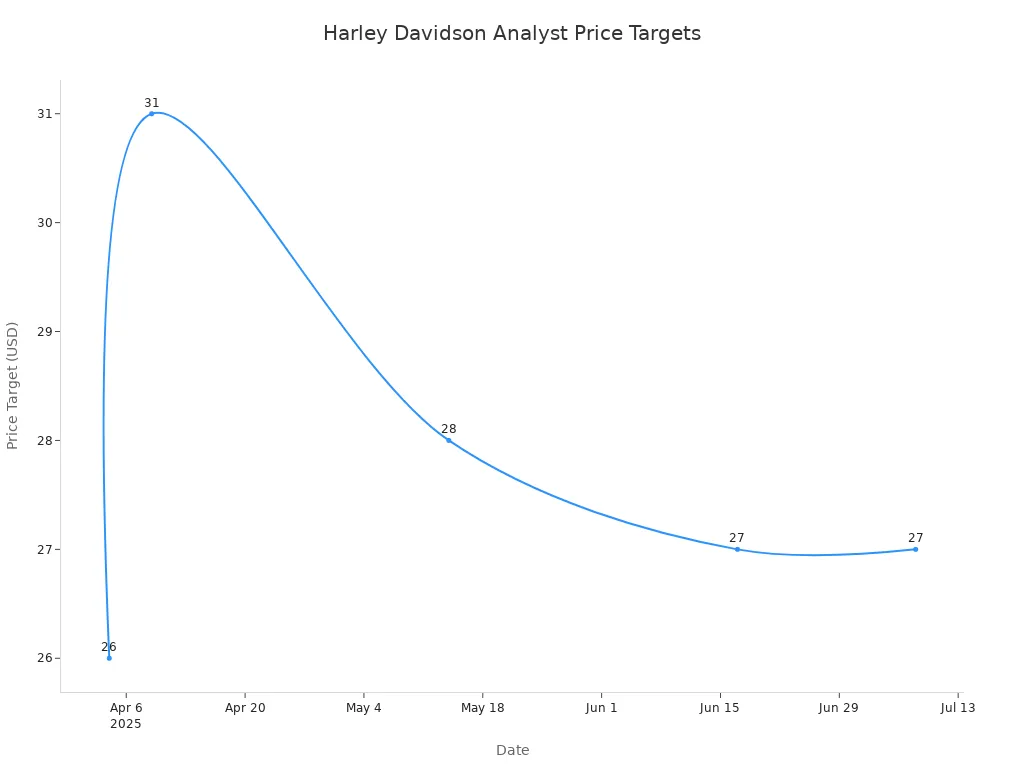

Analyst Targets

Wall Street analysts continue to monitor harley-davidson closely. As of August 12, 2025, the stock trades near resistance levels at $25.94 to $26.02 USD. Technical analysis suggests a potential buy signal if the price breaks above these points. The consensus one-year price target stands at $29 USD, which implies a possible upside of about 13.4% from the current level (see exchange rate).

Analyst forecasts have shifted throughout the past year. Some firms have raised their targets after tariff relief, while others have lowered them due to weak sales and policy risks. The table below summarizes recent analyst actions:

| Analyst Firm | Analyst Name | Date | Rating | Price Target Change | Reason Summary |

|---|---|---|---|---|---|

| UBS | Robin Farley | 2025-07-08 | Neutral (maintain) | $28 → $27 | Lowered target due to Q2 retail sales decline (~13-15%), no sequential improvement in sales months. |

| Citi | James Hardiman | 2025-06-17 | Neutral (maintain) | $24 → $27 | Raised target after tariff relief improved outlook; leisure stocks bounced back, but some risks remain. |

| Baird | N/A | 2025-05-14 | Neutral (maintain) | $26 → $28 | Raised target reflecting lower tariffs in updated model. |

| DA Davidson | Brandon Rolle | 2025-04-09 | Strong Buy (initiate) | Initiated at $31 | Initiated strong buy rating with a high price target. |

| Baird | Craig Kennison | 2025-04-04 | Hold (maintain) | $32 → $26 | Lowered target due to trade policy uncertainty and tariff risks impacting powersports ecosystem. |

Forecasts remain cautious. Most analysts maintain neutral ratings, reflecting uncertainty about harley-davidson’s ability to reverse its sales decline. The stock’s low valuation and potential upside keep it on many watchlists, but risks remain high.

Financial Results

Revenue and Sales Decline

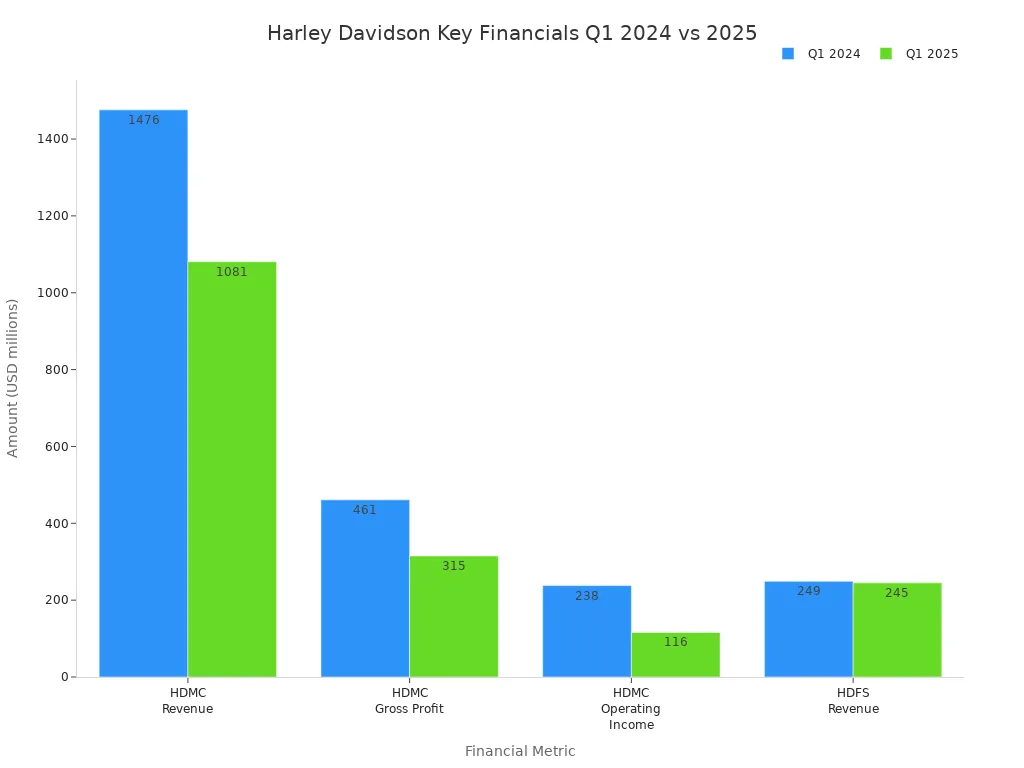

Harley-Davidson reported a sharp drop in revenue and sales during Q2 2025. The company’s consolidated revenue fell by 19% globally, with HDMC-specific revenue declining by 23% to $1,044 million USD (see exchange rate). Global motorcycle shipments decreased by 28%, and global retail motorcycle sales dropped by 15% compared to Q2 2024. The decline in motorcycles sold reflects ongoing challenges in the market.

| Metric | Q2 2025 Value | Q2 2024 Value | % Change |

|---|---|---|---|

| Consolidated Revenue (HDMC) | $1,044 million | $1,349 million | -23% |

| Global Motorcycle Shipments | 35.8 thousand | 49.7 thousand | -28% |

| Global Retail Motorcycle Sales | 42.3 thousand | 50.0 thousand | -15% |

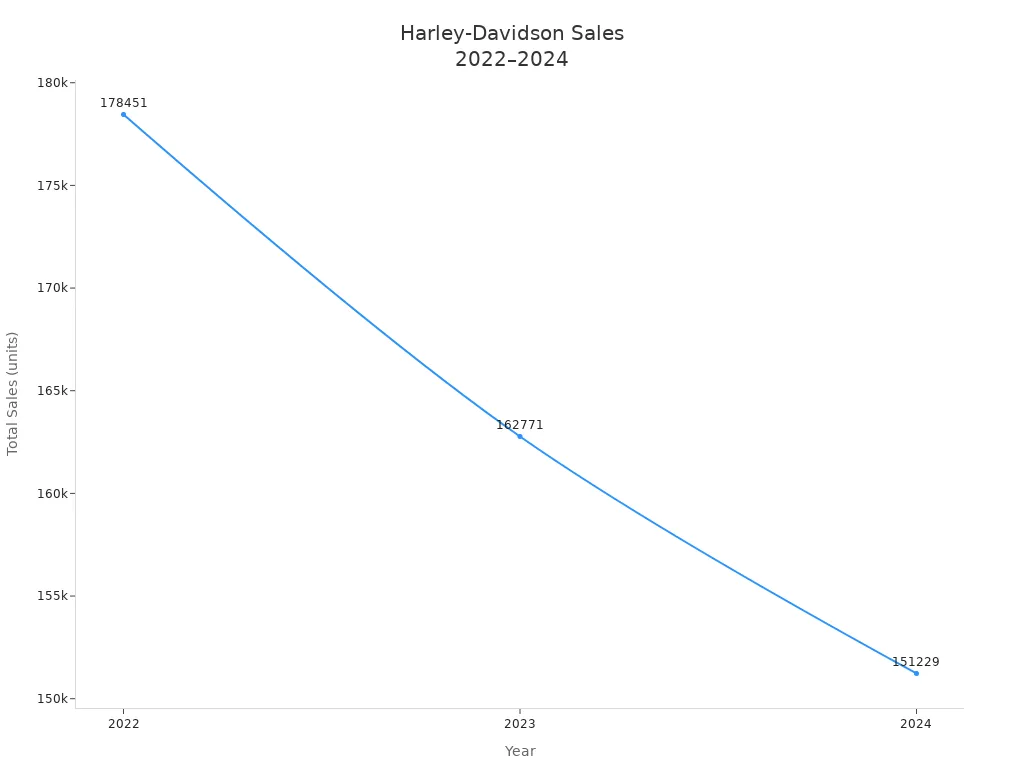

Harley-Davidson’s revenue growth has remained negative for two years. The company experienced an average annual sales decline of 22.2% in motorcycle units, with revenue dropping by 16.4% annually. The table below shows the consistent decrease in sales volume.

| Year | Total Sales (units) | Year-on-Year Decline (%) |

|---|---|---|

| 2022 | 178,451 | N/A |

| 2023 | 162,771 | 8.8% |

| 2024 | 151,229 | 7.0% |

Weak demand, high interest rates, and shifting consumer preferences have contributed to these results. Sales in North America fell by 24%, while Asia Pacific saw a 28% decrease, especially in China and Japan. The company withdrew its full-year 2025 financial outlook due to uncertain macroeconomic and tariff conditions.

Profit and Cash Flow Trends

Harley-Davidson’s profits have faced significant pressure. Gross profit margin declined from an average of 30.7% (2020-2024) to 26.6% in 2024. Operating margin dropped to 6.7%, down 6.9 points from the previous year. Net profit margin fell from 12% in 2023 to 8.8% in 2024. In Q4 2024, Harley-Davidson reported a net loss of $116.892 million USD and an operating loss of $193.349 million USD (see exchange rate).

| Metric | 2023 Value | 2024 Value | Change |

|---|---|---|---|

| Gross Profit Margin | 30.7% | 26.6% | -4.1% |

| Operating Margin | 13.6% | 6.7% | -6.9% |

| Net Profit Margin | 12% | 8.8% | -3.2% |

Despite declining profits, Harley-Davidson improved its operating cash flow by 39% to $1.1 billion USD in 2024. This increase shows effective cash management, even as profitability weakened. The company’s financial performance highlights the impact of high interest rates and changing consumer behavior, especially in regions like China and Japan.

Risks for Harley-Davidson

Image Source: pexels

Debt and ROIC

Harley-davidson faces significant financial risk due to its high debt levels. At the end of 2023, the company reported total long-term debt of about $5.2 billion. Its debt-to-equity ratio ranged from 2.22 to 2.31, which stands much higher than the average for the motorcycle industry. This means harley-davidson relies more on borrowed money than most of its competitors. High leverage can help a company grow during strong economic times, but it also increases risk when sales decline or the economy slows. Financial analysts have noted that this elevated debt-to-equity ratio could make it harder for harley-davidson to manage its obligations if market conditions worsen. Investors should pay close attention to future financial reports and any changes in the company’s credit rating. High debt levels can limit flexibility and put pressure on returns on invested capital (ROIC), especially if profits continue to fall.

Market Share and Brand

Harley-davidson’s brand remains iconic, but recent years have brought new challenges. The company has seen a steady decline in motorcycle sales, with over 162,800 units sold in 2023. Revenue reached about $5.8 billion, but these numbers reflect ongoing struggles to maintain market share. H Partners, a major activist shareholder, has criticized the company’s leadership for focusing too much on electric motorcycles and new markets. They argue that this strategy risks alienating loyal customers who value harley-davidson’s heritage of craftsmanship and quality. The company’s aging customer base and weaker sales in North America have raised concerns among investors. Despite these issues, harley-davidson still benefits from strong merchandise sales and a positive community image through its foundation’s support for health, education, and environmental causes. However, decisions like moving production overseas to avoid tariffs have drawn criticism from both consumers and political figures. These factors show that while the brand remains strong, its market position is under pressure from both internal and external forces.

Industry Headwinds

Harley-davidson operates in a challenging industry environment. Several major headwinds affect the company’s outlook:

- Tariff pressures continue, with new U.S. tariffs on Chinese components potentially costing harley-davidson $75–$100 million each year.

- Even though 75% of parts come from the United States, inflation and tariffs still drive up costs.

- High interest rates and inflation reduce consumer spending on motorcycles and parts.

- Electric vehicle sales dropped 72% in Q1 2025, showing weak demand for harley-davidson’s EV offerings.

- Dealer inventory increased from 48,000 to 56,000 units globally, which could lead to discounting and lower profit margins.

- Parts and accessories revenue fell 14% year-over-year, and motorcycle shipments dropped 33%, highlighting broader demand challenges.

- The company faces rising tariffs on steel, aluminum, and components, as well as retaliatory tariffs from the EU and trade tensions.

- Harley-davidson absorbed up to $40 million in extra costs in one year without raising prices, putting pressure on margins.

- Regulatory changes, such as stricter emissions standards, require costly updates to motorcycle designs.

- Economic downturns and shifts in consumer preferences reduce demand for traditional harley-davidson products.

- Operational risks include supply chain disruptions, product liability claims, labor relations, and brand reputation.

Harley-davidson has responded by diversifying suppliers, cutting costs, and expanding its product line to reach new customers. However, high debt levels and ongoing industry challenges make the company vulnerable if trade wars escalate or if a recession occurs. The company’s ability to manage these risks will play a key role in its future performance.

Value Factors

Brand Strength

Harley-davidson stands as one of the most recognized names in the motorcycle industry. The company’s reputation stretches over a century, with a legacy built on quality and tradition. Harley-davidson holds the top market share in the United States, selling motorcycles in more than 100 countries. The Harley Owners Group (HOG) boasts over a million members, creating a unique community that supports brand loyalty through events like Harleyfest. The company has diversified its business, expanding into merchandise, parts, electric motorcycles, and financing services. Harley-davidson leverages retro styling and American cultural mystique in its marketing, which appeals to younger buyers and maintains a strong social media presence.

| Evidence Aspect | Supporting Details |

|---|---|

| Rich History & Reputation | Over 100 years of operation; iconic and trusted brand globally recognized for quality |

| Market Position | Top motorcycle manufacturer in the US with over 30% market share; products sold in 100 countries |

| Brand Culture | Harley Owners Group (HOG) with over a million members; unique community and events like Harleyfest |

| Diversification | Expansion into merchandise, parts, electric motorcycles, and financing services |

| Marketing Strategy | Leveraging retro and American cultural mystique; strong social media presence targeting younger buyers |

| Customer Loyalty & Resale Value | High resale values; loyal customer base despite production challenges |

| Financial Strength | Significant revenue streams including financing ($394 million in early 2020) |

Harley-davidson’s brand loyalty surpasses competitors. Customers form emotional bonds with the brand, often becoming lifelong advocates. The repeat purchase rate reaches 64%, and the customer retention rate stands at 57%. The Harley Owners Group includes 1.2 million members, reinforcing a sense of belonging. Harley-davidson’s brand recognition is rooted in American culture and the image of freedom. Events like the Sturgis Motorcycle Rally and the HOG community strengthen this connection, setting the company apart from rivals such as Honda and Yamaha.

Turnaround Moves

Harley-davidson has taken bold steps to address recent financial and operational challenges. In Q2 2025, the company faced a 19% revenue decline. Management responded by selling a 4.9% stake in its financial services division for $1.25 billion. The company allocated $500 million to accelerate a $1 billion share repurchase program, aiming to boost earnings per share by 3-5% annually. Another $450 million went toward debt reduction, improving financial leverage. Harley-davidson reserved $300 million for growth investments, including expansion of the LiveWire electric motorcycle segment.

The company launched the ‘Hardwire’ five-year plan in 2020. This strategy focuses on overhauling the operating model, optimizing dealer networks, and streamlining product lines. Harley-davidson concentrated on core markets and improved inventory management. The plan led to a 41% increase in apparel sales and a 26% rise in licensing revenue, strengthening the lifestyle brand. In Q3 2022, revenues grew 23.8% year-over-year, and global motorcycle shipments increased by 19%. Dealer inventories improved, helping meet strong demand. Harley-davidson spun off its electric motorcycle division, LiveWire, to focus on electrification. The company’s shares outperformed the S&P 500 in 2022, reflecting positive market response to these turnaround efforts.

Harley-davidson’s valuation metrics suggest the stock may be undervalued. The trailing P/E ratio is about 6.8, with a forward P/E of 6.6 and a price-to-book ratio below 1.0. Operational success in Q1 2025 included a 32% EPS beat and a strong operating margin of 10.8%, despite a 23% revenue decline. The financial services segment showed resilience, with a 19% increase in operating income. Management repurchased $450 million in shares in 2024, signaling confidence in the company’s valuation. High institutional ownership and increased investor watchlist activity reflect significant market attention.

Contrarian Case

Contrarian investors see harley-davidson as a potential value play. The stock trades at a forward P/E ratio between 8.5x and 9x, which is low compared to higher-quality stocks. Harley-davidson maintains a strong free cash flow margin, reaching 31.8% in Q2 and averaging 15.1% over the last two years. This performance exceeds the sector average. Earnings per share grew at a compound annual rate of 31.5% over five years, showing management’s ability to adapt costs. The company’s five-year average return on invested capital stands at 18.6%, indicating efficient use of capital.

| Argument Aspect | Evidence Detail |

|---|---|

| Valuation | Forward P/E ratio around 8.5x to 9x, indicating cheap valuation compared to higher-quality stocks. |

| Free Cash Flow | Strong free cash flow margin of 31.8% in Q2; average free cash flow margin of 15.1% over last 2 years, better than sector average. |

| EPS Growth | 31.5% CAGR over five years despite revenue declines, showing management’s cost adaptation. |

| Return on Invested Capital | Historically high 5-year average ROIC of 18.6%, indicating past capital efficiency. |

| Projected Growth | Expected revenue growth of 14.5% and EPS growth of 46.8% over next 12 months, suggesting potential catalyst for stock re-rating. |

| Risks | High leverage (18x net-debt-to-EBITDA) and weakening fundamentals pose downside risks. |

Harley-davidson’s operational success in the U.S. Touring segment, driven by new Street Glide and Road Glide models, signals market share gains. The Hardwire strategy aims to streamline operations and invest in capital projects, showing early positive results. Despite challenges such as CEO transition and tariff uncertainties, the brand’s enduring strength and loyal customer base provide a foundation for recovery. Significant short interest introduces volatility but also creates a potential short squeeze opportunity if positive news emerges. Contrarian investors believe that easing tariff pressures, new product launches, and improved performance in the electric motorcycle division could act as catalysts for a stock re-rating.

Harley-Davidson vs Alternatives

Motorcycle Industry

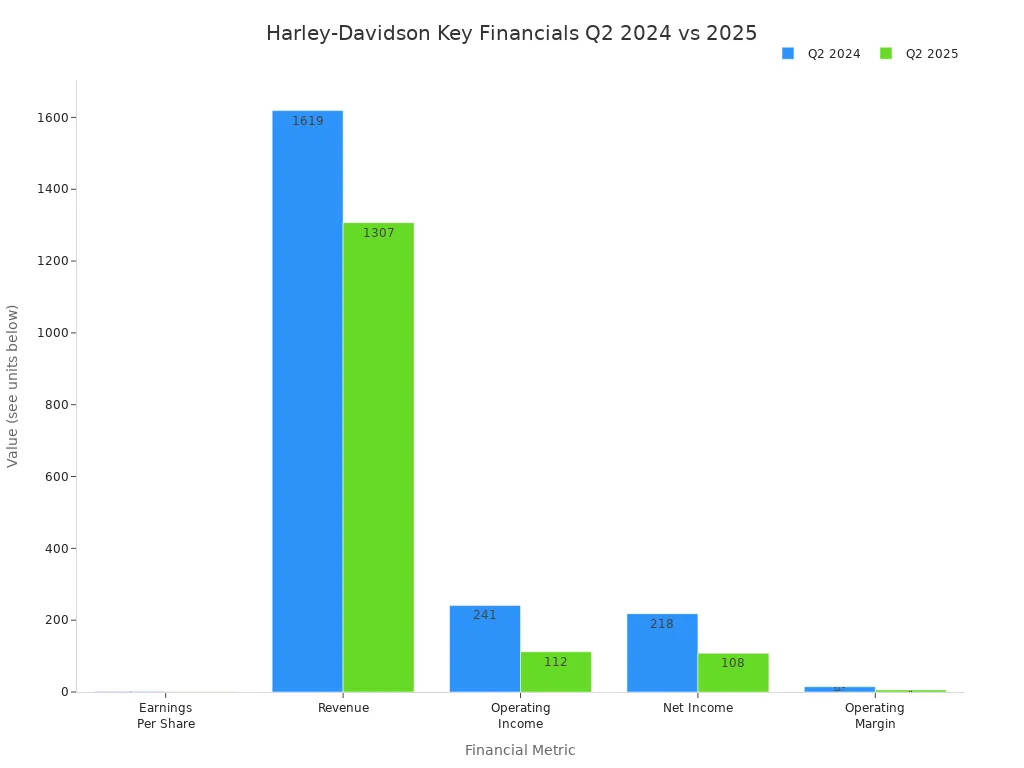

Harley-davidson faces strong competition in the motorcycle industry. The company’s financial results in 2024 and 2025 show significant declines. Revenue dropped by 19.3% year-over-year to $1,307 million USD (see exchange rate). Earnings per share fell 46% to $0.88. Operating income decreased by 53.5%. Net income dropped by 50.5%. Operating margin contracted by 8.8 percentage points. These numbers reflect challenges from tariffs, weak demand, and slow electric motorcycle adoption.

| Metric | Q2 2025 Value | Q2 2024 Value | Year-over-Year Change |

|---|---|---|---|

| Earnings Per Share (GAAP) | $0.88 | $1.63 | -46.0% |

| Revenue (GAAP) | $1,307 million | $1,619 million | -19.3% |

| Operating Income (GAAP) | $112 million | $241 million | -53.5% |

| Net Income Attributable to HOG | $108 million | $218 million | -50.5% |

| Operating Margin (HDMC) | 5.9% | 14.7% | -8.8 percentage points |

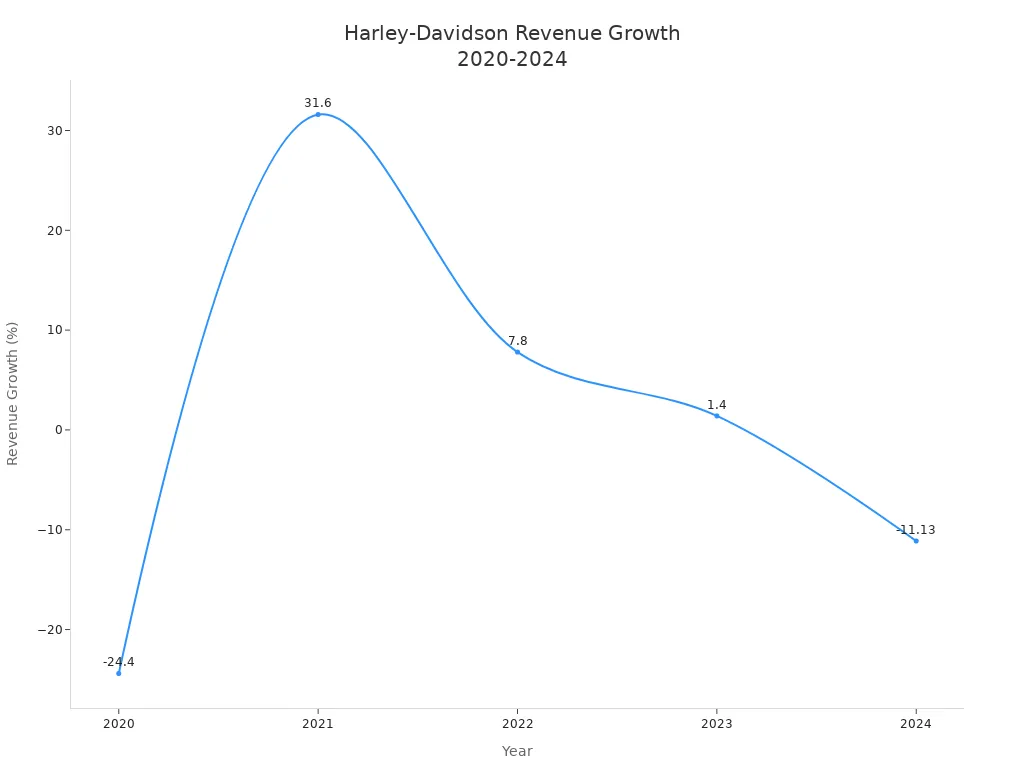

The broader motorcycle industry also faces pressure. Revenue growth trends show volatility. Harley-davidson’s total revenue in 2024 reached $5.19 billion USD, an 11.13% decrease from the previous year. Global motorcycle shipments fell 17%. The electric motorcycle segment saw a 32% revenue decrease in Q4 2024. Gross profit margin dropped to 26.6%. These trends mirror industry-wide challenges, including competition, regulatory changes, and shifting consumer preferences.

| Metric | Details |

|---|---|

| 2024 Total Revenue | $5.19 billion (11.13% decrease YoY) |

| Revenue Growth Trend (2020-2024) | 2020: -24.4%, 2021: +31.6%, 2022: +7.8%, 2023: +1.4%, 2024: -11.13% |

| Average Revenue Growth (2020-2024) | Approximately 1.1% |

| Global Motorcycle Shipments (2024) | 148,862 units (down 17%) |

| Segment Revenue Contributions (2024) | HDMC: $4.12 billion, Financial Services: $1.0 billion |

| Gross Profit (2024) | $1.4 billion |

| Gross Profit Margin (2024) | 26.6% (down 4.3 points from 2023) |

Industry competition remains intense. Harley-davidson’s strong brand and dealer network provide advantages. The company targets new customer segments, including women and younger riders. Regulatory pressures and green technology trends push innovation. Harley-davidson’s focus on touring motorcycles and financial services helps stabilize revenue.

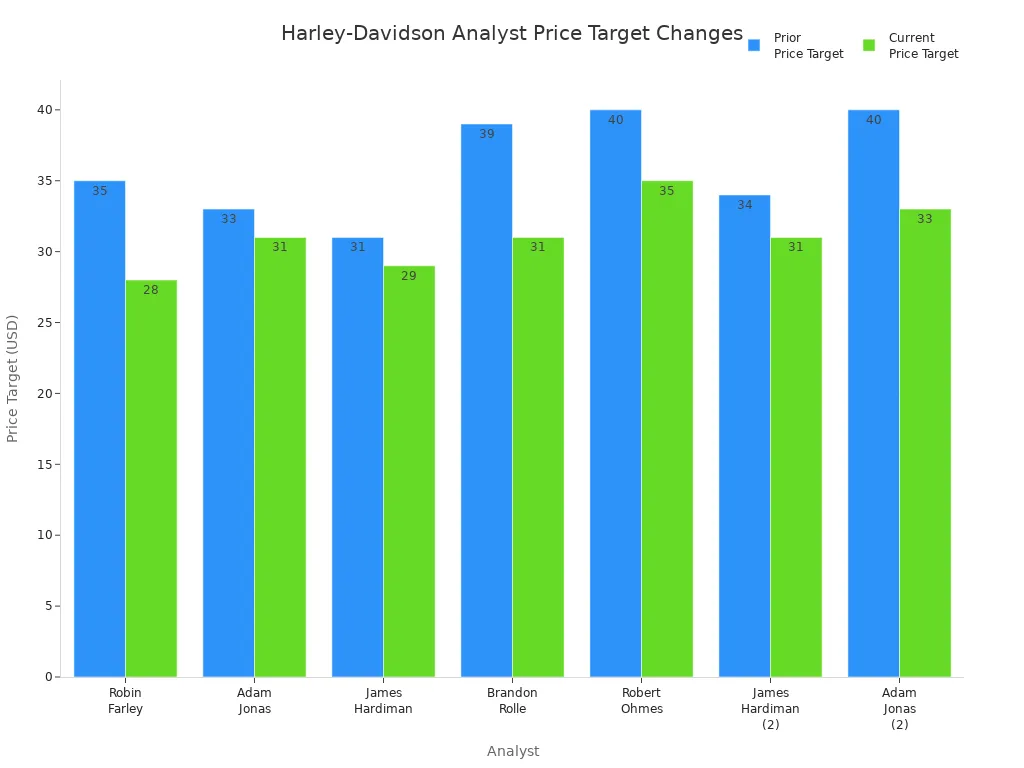

Broader Market

Harley-davidson’s stock valuation compares to the broader market with mixed results. Analysts have lowered price targets by about 13.5% on average. Ratings range from Neutral to Buy. The company’s market capitalization stands above the industry average, but recent revenue growth is negative. Profitability metrics such as net margin and return on equity show average performance. Harley-davidson carries a high debt-to-equity ratio, increasing financial risk.

| Analyst | Firm | Action Taken | Rating | Current Price Target | Prior Price Target |

|---|---|---|---|---|---|

| Robin Farley | UBS | Lowers | Neutral | $28.00 | $35.00 |

| Adam Jonas | Morgan Stanley | Lowers | Equal-Weight | $31.00 | $33.00 |

| James Hardiman | Citigroup | Lowers | Neutral | $29.00 | $31.00 |

| Brandon Rolle | DA Davidson | Lowers | Buy | $31.00 | $39.00 |

| Robert Ohmes | B of A | Lowers | Buy | $35.00 | $40.00 |

| James Hardiman | Citigroup | Lowers | Neutral | $31.00 | $34.00 |

| Adam Jonas | Morgan Stanley | Lowers | Equal-Weight | $33.00 | $40.00 |

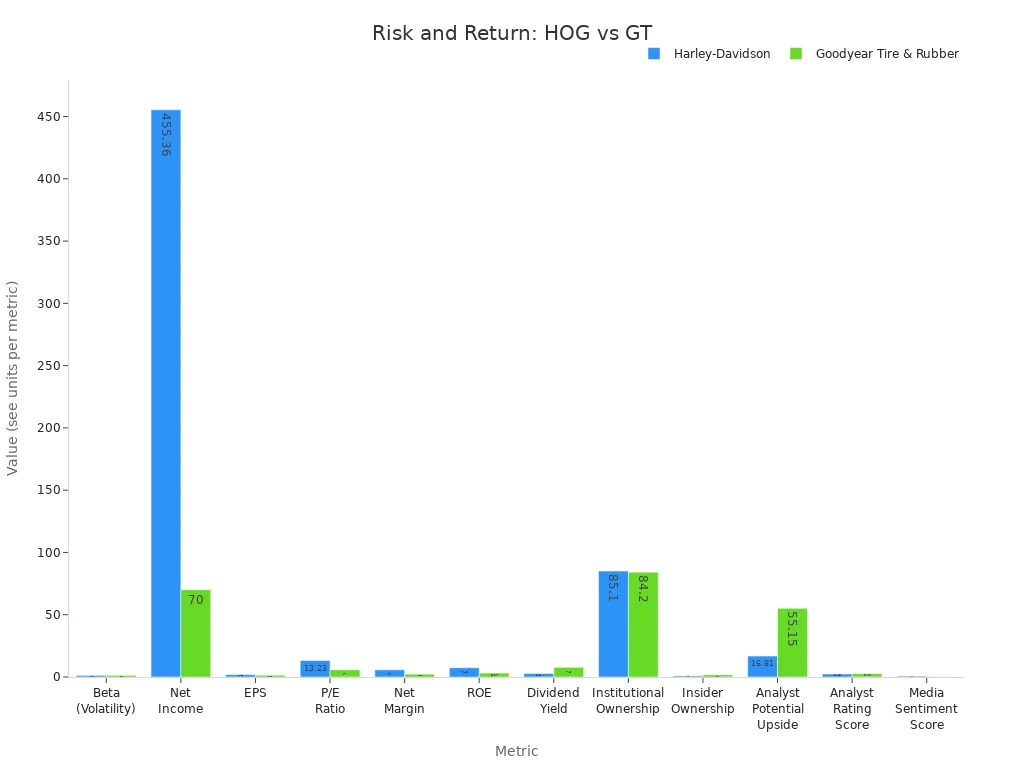

Comparing risk and return, Harley-davidson shows lower volatility than some alternatives, such as Goodyear Tire & Rubber. Harley-davidson’s net income and earnings per share are higher, but Goodyear offers a greater dividend yield and analyst upside. Harley-davidson’s institutional ownership remains strong at 85.1%. The company’s media sentiment score is positive.

| Metric | Harley-Davidson (HOG) | Goodyear Tire & Rubber (GT) |

|---|---|---|

| Beta (Volatility) | 1.29 (29% more volatile than S&P 500) | 1.37 (37% more volatile than S&P 500) |

| Net Income | $455.36 million | $70 million |

| Earnings Per Share (EPS) | $1.93 | $1.42 |

| Price-to-Earnings (P/E) Ratio | 13.23 | 5.81 |

| Net Margin | 5.76% | 2.22% |

| Return on Equity (ROE) | 7.43% | 3.17% |

| Dividend Yield | 2.8% | 7.8% |

| Dividend Growth | Increased dividends for 5 consecutive years | N/A |

| Institutional Ownership | 85.1% | 84.2% |

| Insider Ownership | 0.9% | 1.7% |

| Analyst Potential Upside | 16.81% | 55.15% |

| Analyst Rating Score | 2.43 | 2.71 |

| Media Sentiment Score | 0.68 (Positive) | 0.11 (Neutral) |

Harley-davidson’s stock offers moderate risk and stable profitability. Investors should weigh these factors against alternatives in the sector and broader market indices.

Investor Takeaways

Who Might Buy

Some investors may see opportunity in harley-davidson stock despite recent challenges. Value-oriented investors often look for companies trading at low price-to-earnings ratios and strong free cash flow. Harley-davidson currently trades at a forward P/E ratio below industry averages, which can attract those seeking undervalued assets. Contrarian investors might also consider the stock. They may believe that the market has overreacted to recent earnings misses and revenue declines. These investors often look for signs of a turnaround, such as management’s cost-cutting moves and share repurchase programs.

Long-term investors who trust in harley-davidson’s brand strength and loyal customer base may also find appeal. The company’s global presence and strong community support can provide a foundation for recovery. Some institutional investors, including large asset managers, continue to hold significant positions, suggesting confidence in the company’s ability to navigate industry headwinds.

Note: Investors who can tolerate volatility and have a long investment horizon may benefit if harley-davidson successfully executes its turnaround strategy.

Who Should Wait

Other investors should approach harley-davidson with caution. Recent financial reports show missed earnings estimates and falling revenues year-over-year. Tariffs have reduced profits, and leadership changes have added uncertainty. Investors who prefer stable financial performance or predictable growth may want to wait for clearer signs of recovery.

The following investor profiles may need to exercise caution:

- Investors sensitive to corporate governance issues, due to management engagement concerns.

- Those wary of strategic missteps, as harley-davidson faces pressure to overhaul its business model.

- Investors focused on market reputation and dealer relations, since production shifts have caused friction.

- Risk-averse investors or those seeking consistent growth, given recent earnings misses and tariff impacts.

- Investors who value brand heritage may worry about the company’s shift away from its core values.

A table summarizing investor profiles:

| Investor Profile | Suggested Action |

|---|---|

| Value/Contrarian | Consider buying |

| Long-term/Brand-focused | Monitor closely |

| Risk-averse/Stability-seeking | Wait or avoid |

| Governance/Strategy-sensitive | Exercise caution |

Harley-Davidson stock presents both value and warning signs for 2025. The company’s low P/E ratio, strong brand, and improved cash flow suggest potential upside, especially with analyst price targets indicating room for growth. However, risks remain high due to declining revenue, intense competition, and leverage concerns.

| Key Financial Metrics | Value |

|---|---|

| Stock Price Decline | ~40.50% (12 months) |

| Dividend Yield | 3.2% |

| P/E Ratio | 4.49–6.64 |

| Revenue Change (2024) | -11.13% |

Investors should monitor new product launches, efficiency measures, and upcoming earnings reports. Value and contrarian investors may find opportunity, while risk-averse individuals should wait for clearer signs of recovery.

FAQ

What caused Harley-Davidson’s recent stock decline?

Harley-Davidson’s stock fell due to lower sales, shrinking profits, and higher costs. Weak demand in key markets and rising tariffs also hurt performance. Investors reacted to these challenges by selling shares.

Is Harley-Davidson’s dividend at risk?

Harley-Davidson continues to pay dividends. However, falling profits and high debt levels could pressure future payouts. Investors should monitor earnings reports for any changes to the dividend policy.

How does Harley-Davidson compare to other motorcycle companies?

Harley-Davidson leads in brand recognition and U.S. market share. However, it faces tough competition from global brands like Honda and Yamaha. These rivals often show stronger sales growth and more stable financial results.

What are the main risks for investors?

Key risks include high debt, declining sales, and industry headwinds such as tariffs and changing consumer preferences. Management changes and regulatory pressures also add uncertainty for shareholders.

Can Harley-Davidson recover in 2025?

Harley-Davidson has a strong brand and loyal customers. Management has launched turnaround plans and cost-cutting measures. Recovery depends on improved sales, successful new products, and easing industry challenges.

Harley-Davidson stock presents a classic dilemma: a potential value play for those who believe in its turnaround, but a clear warning sign for those who are wary of its financial struggles. Regardless of your investment thesis, accessing the U.S. market from a different country can be a logistical challenge, with high fees and complex currency conversions eating into your returns. BiyaPay simplifies this process, providing a unified global financial platform. You can invest in US and Hong Kong stocks without needing an overseas bank account. Our real-time exchange rate converter and low remittance fees ensure you get the best value and transparency on every transaction. With a single, easy-to-use account, you can focus on analyzing the fundamentals of companies like Harley-Davidson, not the friction of global finance. Ready to take control of your cross-border investments? Register today.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.