- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Is SMCX Stock Worth the Volatility for Investors in 2025

Image Source: unsplash

Many investors question if smcx stock is worth the volatility in 2025. Super micro computer stands out for both risk and reward. The stock’s recent performance shows both strong gains and sharp swings, making investing challenging but potentially rewarding.

- SMCX stock has a beta of 5.56, showing very high sensitivity to market movements.

- The daily price often moves between $33.29 and $40.73, with a 67% chance of staying in this range.

- Its correlation with the broader market stays low, so smcx stock does not always follow other technology stocks.

- As of August 12, 2025, the price reached $38.95, with over 1.6 million shares traded each day.

Super micro computer has delivered an annualized share price return of about 7% over the past five years, with total shareholder returns reaching 49% when including dividends. While the company’s earnings growth outpaced its share price, investing in smcx stock still involves significant swings. Anyone considering investing should weigh these trends, competitive pressures, and the company’s position in AI and cloud computing.

Key Takeaways

- SMCX stock offers high growth potential driven by strong demand for AI servers and cloud computing, with impressive past returns beating major benchmarks.

- The stock shows high volatility due to its sensitivity to market swings and risks from competition, financial reporting, and margin pressures.

- Investors need a high risk tolerance and should consider SMCX as part of a diversified portfolio to balance potential gains and losses.

- Using technical analysis and multi-timeframe strategies helps improve entry timing and manage the stock’s price swings effectively.

- SMCX suits short-term traders more than long-term investors because daily leverage can reduce returns over time.

SMCX Stock Rewards

Image Source: pexels

High Return Potential

Super micro computer has delivered impressive results for investors who focus on stock performance. The company’s shares have outpaced major benchmarks and technology portfolios over several years. The table below shows how smcx stock compares to the S&P 500 Index and a leading tech portfolio.

| Metric | Return Since Start of 2024 | Return Feb 2025 MTD | Cumulative Return 2017-Early 2025 |

|---|---|---|---|

| SMCI Stock | 96% | 96% | 1889% |

| S&P 500 Index | 28% | 1% | 173% |

| Trefis Reinforced Value Portfolio | 21% | -2% | 719% |

Investors who chose smcx stock saw nearly 19 times the cumulative return of the S&P 500 from 2017 to early 2025. This outperformance highlights the high-reward nature of investing in super micro computer, even with periods of volatility and selloffs.

Growth Catalysts

Super micro computer continues to benefit from several strong growth drivers. The company’s sales in AI server systems have tripled in recent quarters, with over half of recent sales coming from this segment. Revenue reached $7.12 billion in fiscal 2023, marking a 37% year-over-year increase. Preliminary results for Q2 FY2025 show revenue between $5.6 and $5.7 billion, up 54% from the previous year. Management expects revenue to reach $23.5 to $25 billion in FY2025 and projects $40 billion for FY2026.

Key growth catalysts include:

- Increased demand for AI-driven servers.

- Strategic partnerships, such as Digi Power X using Nvidia-powered systems supplied by super micro computer.

- Industry-first immersion cooling certification for the BigTwin Server, supporting sustainable data centers.

- Expansion plans for a third campus in Silicon Valley focused on liquid-cooled solutions.

- Strong presence in cloud and telecom sectors, which account for 70% of sales.

- Financial discipline and regained Nasdaq compliance, boosting investor confidence.

- Analyst price targets raised by Citi and Loop Capital, with projections as high as $70.

- Revenue growth outlooks of 40% in 2025 and over 70% in 2026.

These factors show why many investors consider investing in smcx stock for exposure to AI and cloud computing growth.

Market Position

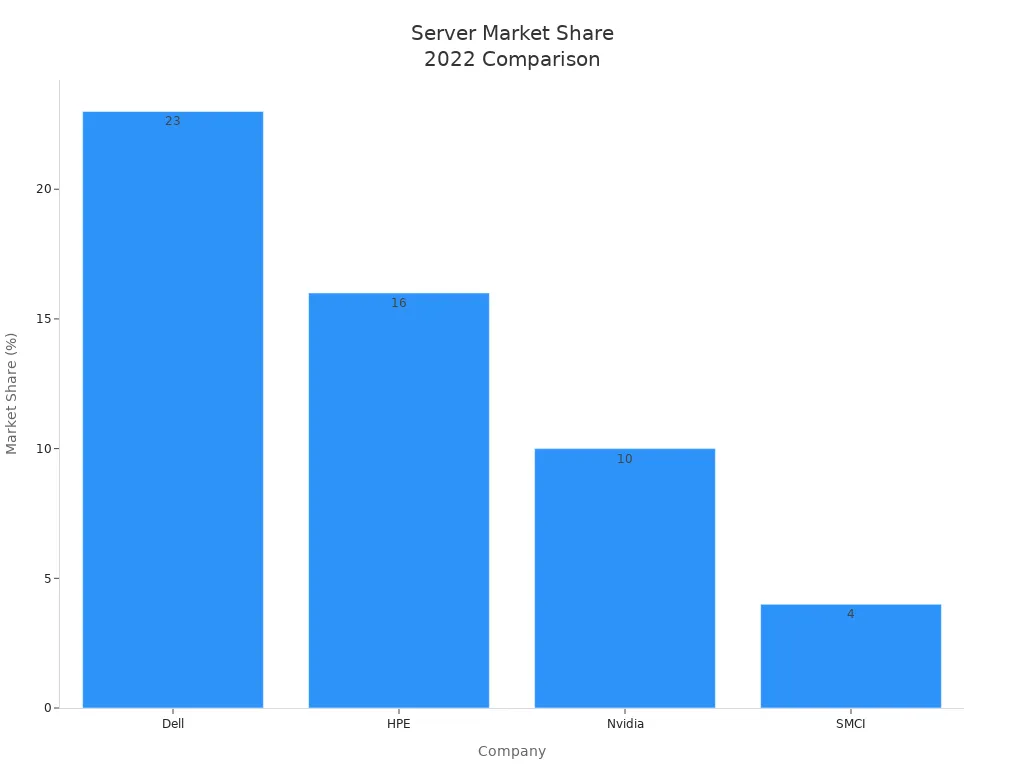

Super micro computer holds a unique spot in the server and cloud infrastructure market. The company ranks as the eighth-largest in data center server market share, with 4% as of 2022. While Dell and Hewlett Packard Enterprise lead with 23% and 16% respectively, super micro computer stands out for its rapid revenue growth. The chart below compares market share and growth rates among top competitors.

Super micro computer posted a 201% year-over-year revenue increase, far above Dell and HPE. Nvidia’s growth rate was higher, but super micro computer acts as a system builder, often integrating Nvidia chips into its products. The company’s focus on advanced server solutions and partnerships with leading chipmakers helps it compete in a crowded market. This strong market position supports future gains for those investing in smcx stock.

SMCX Stock Risk

Image Source: pexels

Volatility Factors

Investors face several risks when considering smcx stock. The price of this stock often moves sharply because it tracks the NASDAQ-100 Index, which includes many technology and communication companies. These sectors experience frequent price swings. The top holdings in the index, such as NVIDIA, Microsoft, Apple, Amazon, Meta, Netflix, Tesla, and Alphabet, have shown large changes in value this year. Growth stocks like these tend to be more volatile because their prices depend on future earnings and growth expectations. They usually do not pay dividends, so investors do not have a cushion during downturns.

Other factors add to the volatility:

- Changes in the NASDAQ-100 Index, such as rebalancing, can cause sudden price movements.

- Interest rate changes affect the performance and volatility of the stock.

- The market price of smcx stock can move away from its net asset value, creating more price swings.

- The focus on large growth companies in fast-growing industries means higher risk and more frequent price changes.

Analysts have also raised concerns about financial reporting. They point to issues with timely disclosures and fear that these problems could lead to a Nasdaq 100 delisting. The next earnings report is important for restoring investor confidence. Investors expect the company to show better financial controls and clearer communication about its financials.

Note: Investors should watch for updates on financial reporting practices. Improved transparency can help reduce uncertainty and restore trust.

Margin Pressure

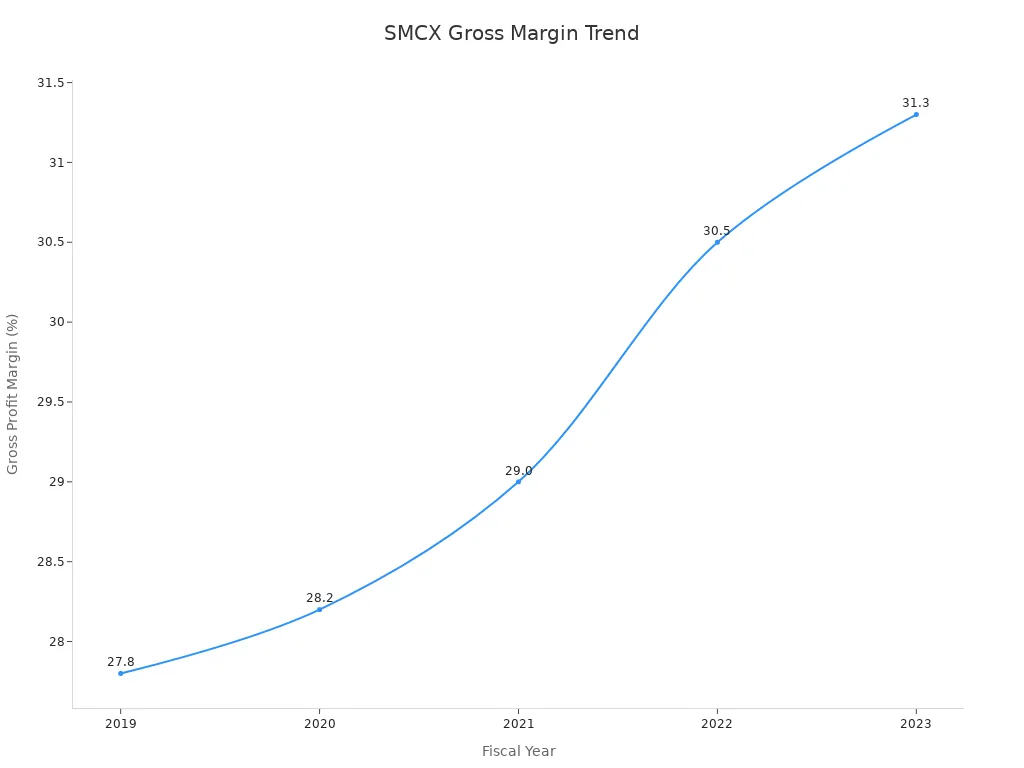

Gross profit margins show how much money a company keeps after paying for the cost of goods sold. Over the past five years, SMC Corporation has improved its gross margins. The table below shows this trend:

| Fiscal Year | Gross Profit Margin (%) |

|---|---|

| 2019 | 27.8 |

| 2020 | 28.2 |

| 2021 | 29.0 |

| 2022 | 30.5 |

| 2023 | 31.3 |

For the quarter ending June 30, 2025, the gross profit margin reached 44.29%. This is much higher than previous years and shows a positive short-term trend. However, margin pressure remains a risk. The cost of goods sold has risen faster than revenue, which can hurt profits. The server market is becoming more competitive, and many products are now seen as commodities. This reduces pricing power and can squeeze margins.

Some customers have reported high hardware and firmware failure rates. These problems can lead to lost sales and higher costs for repairs and support. Major competitors like Dell, Hewlett Packard, Lenovo, and Foxconn offer aggressive pricing and better service, making it harder for SMC Corporation to maintain its margins.

Competition and Regulation

SMC Corporation faces strong competition in the server and AI hardware markets. Dell Technologies, Hewlett Packard, Lenovo, and Foxconn have large enterprise networks and offer extensive services. They often use aggressive pricing, sometimes selling at near-zero margins. Dell has won big AI server deals from CoreWeave and Tesla, which has reduced SMC Corporation’s market share. Some customers have switched to competitors because of hardware failures and better after-sales support.

The company relies on Nvidia for AI chips, which creates supply and contract risks. Geopolitical and economic changes also add to competitive pressures. Former employees and industry experts say that poor after-sales service has led to lost deals.

Regulatory changes could impact SMC Corporation’s business in 2025. New rules in the European Union and the United Kingdom may change listing requirements, disclosure obligations, and ESG compliance. For example:

- The EU may allow smaller companies to use short-form prospectuses, lowering listing costs.

- New rules could simplify sustainability disclosures and introduce product labeling for ESG compliance.

- The UK is reviewing rules for asset management firms, which could increase reporting and governance requirements.

- Changes to international tax rules may raise tax liabilities for companies operating in the UK.

These changes could affect how SMC Corporation manages its operations, reporting, and compliance.

Analysts have a mixed outlook on smcx stock. Four recommend buying, five suggest holding, and one advises selling. They point to risks such as supply chain disruptions, intense competition, and higher compliance costs. Global economic factors, like currency changes, have caused a decline in international revenue. The company has a moderate debt-to-equity ratio and holds investment-grade debt, which lowers financial risk. SMC Corporation is working to manage risks through technology upgrades and supply chain improvements.

Tip: Investors should review analyst recommendations and company updates before investing. A balanced approach can help manage risk.

Super Micro Computer Investor Fit

Suitable Investor Profiles

Super micro computer attracts different types of investors. Growth investors often look for companies with strong sales and expanding markets. They may choose super micro computer because of its rapid revenue increases and leadership in AI server technology. People who want quick gains may find the stock appealing, but they must understand the swings in price. Some investors prefer stable returns and low risk. They may not feel comfortable with the sharp ups and downs seen in super micro computer shares.

Risk Tolerance

Investing in super micro computer requires a high level of risk tolerance. The stock price can change quickly, sometimes in a single day. Investors who can handle these changes may benefit from the company’s growth. Those who worry about losing money or dislike uncertainty may want to avoid this stock. It is important for each person to know how much risk they can accept before buying shares.

Note: People should review their own financial goals and comfort with risk before investing in super micro computer.

Diversification

Diversification helps reduce risk in a portfolio. Investors should not put all their money into one stock, even if it shows strong growth. Adding super micro computer to a mix of other stocks, bonds, or funds can help balance gains and losses. This approach protects investors if one company or sector faces problems. Many experts suggest spreading investments across different industries and regions. This strategy can help investors manage risk while still seeking growth.

Managing Volatility

Entry Timing

Investors often seek the best moment to enter volatile stocks like SMCX. Multi-timeframe analysis helps improve entry timing. Traders use weekly and daily charts to spot the main trend. They then switch to 4-hour or hourly charts to select trades and use 15-minute or 5-minute charts for precise entries. This method reduces noise and increases the chance of success.

| Strategy Type | Market Context & Setup | Entry Timing & Confirmation | Risk Management & Outcome | Key Lessons |

|---|---|---|---|---|

| Multi-Timeframe Alignment | Weekly/daily for trend, 4-hour/hourly for trade selection, 15-min/5-min for entry | Wait for confirmation signals before entry | Place stops beyond invalidation points | Aligning timeframes increases probability; confirmation reduces false signals |

| Counter-Trend Liquidity Grab | Downtrend on daily; price near resistance with stop orders | Enter after bearish reversal candlestick post-fake breakout | Stop above liquidity grab extreme; target previous structure low | Recognize liquidity grabs; defined risk; trade with trend after counter-trend move |

| Range Breakout with Fair Value Gap | Sideways range with failed breakouts | Enter on price return to fair value gap with continuation signal | Stop below fair value gap; target based on range height | Fair value gaps provide precise entries; clear stops |

Technical indicators also guide entry points. Moving average crossovers, such as the Golden Cross and Dead Cross, signal trend changes. Candlestick patterns like Doji, Hammer, and Marubozu show possible buy or sell moments. Traders wait for confirmation before entering to avoid false signals.

Tip: Using higher timeframes for trend and lower timeframes for entry helps investors manage volatility and improve timing.

Risk Management

Managing risk is vital for investors in SMCX stock. Setting stop-loss orders at key price levels limits losses. Position sizing ensures that no single trade risks too much capital. Beginners often risk 0.25%-0.5% per trade, while experienced traders may risk up to 2% on strong setups. Daily loss limits, such as 1-2%, help control exposure and prevent large drawdowns.

- Stop-loss orders exit trades automatically at set prices.

- Position sizing matches risk to account size and tolerance.

- Daily loss limits and trade limits protect capital.

- Partial profit-taking secures gains and reduces risk.

Smart Money Concepts trading combines technical analysis and price action. Investors identify market structures, such as order blocks and breaks of structure, to make informed decisions. Continuous practice and backtesting improve risk management skills.

Note: Capital preservation allows investors to survive losses and continue trading for long-term success.

Investment Horizon

SMCX stock suits short-term traders more than long-term investors. The fund provides 2x daily exposure to Super Micro Computer, which means it amplifies daily moves. Holding SMCX for more than one day often leads to performance decay because of compounding effects. Experts recommend using SMCX for tactical trades rather than long-term investment. Short-term traders benefit from daily leveraged moves, while long-term holders may see worse outcomes.

Investors should match their investment horizon to the nature of SMCX. Short-term strategies work best for this volatile stock.

SMCX stock offers strong growth potential and recent technical signals suggest possible upward movement. However, high volatility and risks remain, especially for those seeking stable returns. Investors with higher risk tolerance and a tactical approach may find SMCX suitable as a small part of a diversified portfolio. Those preferring steady growth should consider alternatives. Financial advisors recommend careful research and professional guidance before investing. Each investor should review personal goals and risk comfort before making decisions about SMCX.

FAQ

What makes SMCX stock so volatile?

SMCX stock shows large price swings because it tracks fast-moving technology companies. Investors react quickly to news about AI, earnings, and market changes. This causes the price to move up or down sharply.

Is SMCX suitable for long-term investment?

SMCX works best for short-term trades. The stock uses daily leverage, which can reduce returns over time. Long-term investors may see performance decay. Experts suggest using SMCX for tactical moves instead.

How do investors manage risk with SMCX?

Investors use stop-loss orders and position sizing to control risk. They set limits on how much money they risk per trade. Diversifying with other stocks and bonds helps protect their portfolios from big losses.

What are the main growth drivers for SMCX?

SMCX benefits from rising demand for AI servers and cloud computing. The company forms partnerships with top chipmakers and expands into new markets. Revenue growth and new products support future gains.

Where can investors find current USD exchange rates?

Investors can check USD exchange rates online. These rates help compare prices and fees in different currencies. Reliable sources update rates daily for accurate information.

SMCX stock offers a high-stakes opportunity for investors with a strong risk tolerance and a focus on tactical trading. Its extreme volatility and a beta of 5.56 mean that managing risk and timing your entries are more critical than ever. However, a successful strategy also requires a financial platform that can keep up with the market’s pace and handle cross-border transactions efficiently. This is where BiyaPay comes in. We offer a unified global financial account that allows you to directly trade in US and Hong Kong stocks, bypassing the complexities of overseas banking. With a real-time exchange rate converter and ultra-low remittance fees, you can move funds and manage your investments with speed and transparency. Let us handle the financial logistics so you can focus on mastering your strategy and capitalizing on the market’s swings. Ready to take control? Register today.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.