- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Marqeta and the Transformation of Card Issuing Platforms

Image Source: unsplash

Marqeta has redefined the modern card issuing landscape by leveraging open API technology, cloud infrastructure, and real-time controls. Traditional card issuing platforms often fail to deliver the speed and flexibility that today’s fintech and financial services companies demand. Marqeta’s card issuing platform enables instant payment solutions, dynamic spend management, and seamless integration with financial solutions. The modern card issuing market, valued at USD 5.2 billion in 2024, continues to expand, with Marqeta holding significant growth potential despite holding less than 1% of the vast U.S. and global card markets.

| Metric | Value/Estimate |

|---|---|

| Modern Card Issuing Market Size | USD 5.2 billion (2024) |

| Projected Market Size | USD 11.2 billion (2033) |

| CAGR (2026-2033) | 9.1% |

| Global Card Issuance Market Size | USD 43.09 billion (2026) |

| CAGR (2021-2026) | 5.5% |

| Regional Revenue Share (2023) | North America: 40% |

| Asia Pacific: 30% | |

| Europe: 20% | |

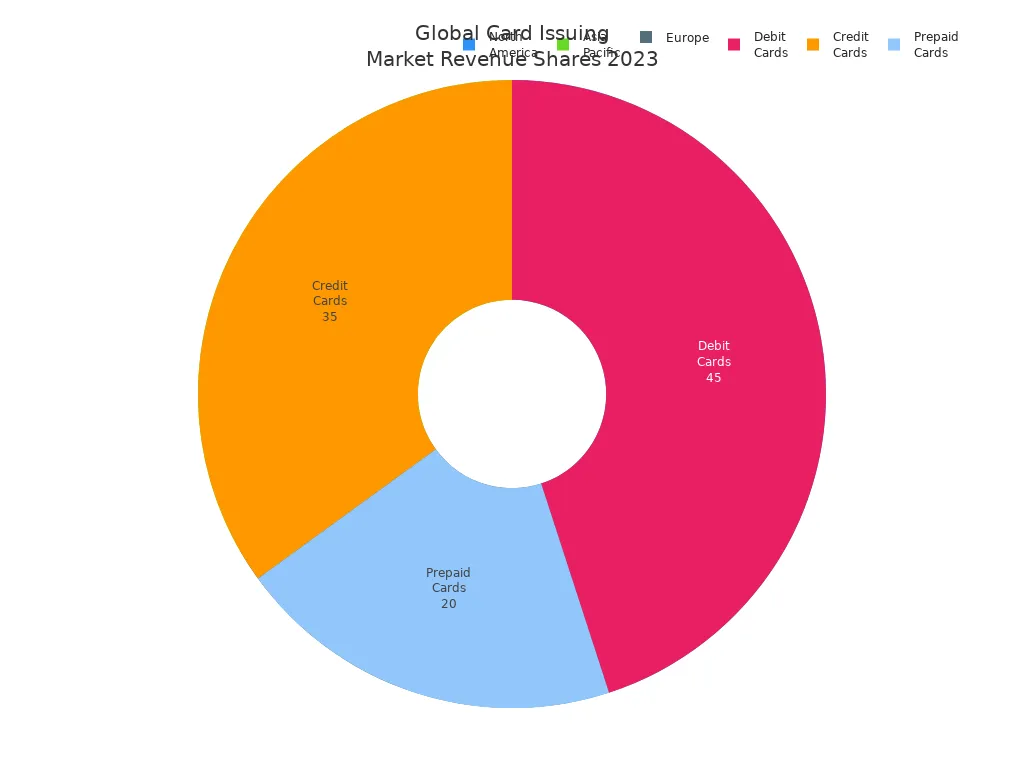

| Card Type Revenue Share (2023) | Debit Cards: 45% |

| Credit Cards: 35% | |

| Prepaid Cards: 20% |

By offering open API access and robust fintech tools, Marqeta bridges the gap between legacy systems and the needs of modern financial services, empowering rapid innovation across the industry.

Key Takeaways

- Marqeta uses open APIs and cloud technology to offer fast, flexible card issuing that meets modern fintech needs.

- Real-time controls help prevent fraud instantly and give businesses detailed spending rules for better security.

- The cloud platform ensures high reliability and easy scaling, supporting millions of transactions daily worldwide.

- Marqeta speeds up card program launches with instant issuance, easy management tools, and smooth migration from old systems.

- Strong partnerships and ongoing innovation position Marqeta as a leader in digital payments and embedded finance.

Marqeta Innovations

Image Source: pexels

Open API

Marqeta’s open API stands at the core of its card issuing platform, driving rapid transformation in the fintech sector. The open API enables instant account funding and transaction approvals, removing the multi-day delays that traditional platforms impose. Businesses can manage expenses and on-demand payments efficiently, thanks to real-time funding capabilities. Marqeta processed over $60 billion in transaction volume in 2022, which highlights its ability to scale and support accelerated card issuing and payment solutions.

The open API breaks the traditional linear payment flow into modular components. This design allows businesses to customize authorization rules dynamically, based on spending limits, merchant categories, geolocation, and risk profiles. Unlike legacy systems that rely on the ISO 8583 standard, Marqeta translates transaction data into a readable JSON format. This approach enables real-time data validation and control, reducing delays and empowering businesses to launch integrated payment solutions faster. For example, DoorDash uses Marqeta’s API to tightly control transactions by limiting card use to specific dollar amounts and merchant categories, a capability not possible with traditional cards.

| Feature Category | Distinguishing Technical Features of Marqeta’s Open API |

|---|---|

| Real-time Authorization | Just-in-Time Funding enabling real-time authorization decisions |

| Card Issuance | Instant virtual card issuance |

| Security | Tokenization support for mobile wallets |

| Card Controls | Advanced spending rules and granular restrictions |

| Program Management | Comprehensive reporting and administrative tools |

| Developer Experience | Extensive documentation, SDKs, sandbox environments, and advanced testing capabilities |

| Testing Support | End-to-end test flows and mock servers for simulating card lifecycle and authorizations |

Marqeta’s open API platform enables rapid launch of customized credit card products. Businesses can adjust account parameters such as rewards, APR, and credit lines in real time. The intuitive dashboard allows instant cardholder activation and direct provisioning into digital wallets. Marqeta integrates program management services, including underwriting, compliance, and risk management, through partner ecosystems. This flexibility and speed to market set Marqeta apart from legacy systems.

Real-Time Controls

Marqeta’s real-time controls provide a significant advantage for fintech companies seeking secure and efficient payment solutions. These controls enable fraud detection and prevention as transactions occur, rather than relying on post-transaction reviews. The platform uses machine learning and behavioral analytics to predict and manage fraud across application, card, payment fraud, merchant monitoring, and anti-money laundering.

- Card programs define their own fraud rules and receive real-time notifications of breaches, allowing immediate response to threats.

- Dynamic spend and velocity controls can be configured at the individual card level, restricting usage by country, merchant type, transaction frequency, and amount.

- Just In Time (JIT) gateway functionality allows program owners to participate directly in authorization decisions using real-time business logic.

- Marqeta simplifies integration by converting complex ISO 8583 messaging into user-friendly JSON format, reducing developer burden and enabling faster deployment of fraud controls.

- The platform supports webhooks and allows up to three seconds for authorizations, enabling real-time actions such as in-app notifications for declined transactions.

- Proprietary 3DS solutions combined with rules-based fraud decisioning and transaction monitoring tools further strengthen fraud prevention.

Compared to legacy systems, Marqeta offers greater agility, transparency, and proactive fraud management. Legacy platforms often rely on post-transaction review and less flexible rule management, which can delay response and increase risk.

Companies using Marqeta’s real-time controls experience measurable business outcomes:

- Enhanced fraud prevention through intelligent, real-time risk controls that protect revenue and build customer trust.

- Operational efficiencies by reducing internal complexities and streamlining disbursement processes.

- Improved cash flow management for end users, fostering trust and reducing churn.

- Increased customer loyalty driven by features such as earned wage access and instant expense reimbursement.

- Automation that reduces support demand, allowing payment teams to focus on growth and innovation.

- Real-time payments as a competitive differentiator in B2B sectors, improving operational efficiency and reducing churn.

Cloud Infrastructure

Marqeta’s cloud infrastructure delivers reliability, scalability, and cost efficiency for fintech companies. The cloud-native platform supports over 2 million transactions per day with 99.99% uptime, enabling rapid customization and deployment of payment solutions. This reliability ensures continuous availability for businesses and their customers.

| Advantage Aspect | Supporting Evidence |

|---|---|

| Uptime | Marqeta guarantees 99.99% uptime, ensuring high platform reliability and continuous availability for payment solutions. |

| Scalability | The platform follows a ‘build once, deploy anywhere’ model, enabling global scalability without costly reimplementations; supports over 2 million transactions daily; certified in over 40 countries; modular, API-first design allows rapid customization and stress-free scaling. |

| Cost Efficiency | Automation features like IVR reduce support costs by minimizing human intervention; integrated ecosystem reduces operational complexity; eliminating legacy reimplementation costs; operational heavy lifting by Marqeta allows clients to focus on growth and innovation. |

Marqeta’s cloud infrastructure allows instant issuance and processing of payment cards. Users can start within three clicks using the instantly issued sandbox, which demonstrates a fast deployment process. This streamlined setup contrasts with traditional on-premises solutions that require extensive infrastructure setup and maintenance.

- On-premises solutions require full responsibility for infrastructure setup, ongoing maintenance, updates, backups, and security, which can be time-consuming and costly.

- Cloud-hosted solutions reduce the need to maintain physical infrastructure, shifting maintenance responsibilities such as backups and updates to the provider.

- Cloud hosting generally offers faster deployment since there is no need to procure and configure hardware.

- Maintenance overhead is lower with cloud solutions because the provider manages infrastructure, allowing users to focus on software usage rather than hardware upkeep.

- On-premises solutions provide more control but at the cost of higher upfront investment and continuous maintenance effort.

Marqeta’s cloud infrastructure enables fintech companies to scale globally, launch integrated payment solutions quickly, and minimize operational complexity. The platform’s modular, API-first design supports rapid customization and stress-free scaling, making it a preferred choice for businesses seeking innovation and growth.

Benefits

Image Source: unsplash

Speed

Marqeta accelerates the launch of customized payment card programs for businesses. Companies can issue cards instantly, skipping the delays of traditional card issuing platforms. The Marqeta Dashboard provides a single place to manage tasks like onboarding cardholders, issuing cards, and monitoring transactions. This centralized approach saves time and reduces complexity. The UX Toolkit offers pre-approved, regulatory-compliant UI components, so fintech teams can build branded experiences quickly. Portfolio Migration services help businesses move existing payment card programs from other providers with less effort. Ramp, a leading fintech, launched its first transaction in under 70 days using Marqeta. These features allow businesses to reach the consumer faster and adapt to market changes with ease.

- Marqeta Dashboard streamlines issuing, onboarding, and risk management.

- UX Toolkit reduces front-end development time.

- Portfolio Migration ensures smooth transitions from legacy systems.

- Dedicated compliance support removes regulatory roadblocks.

Security

Security remains a top priority for Marqeta. The platform holds PCI DSS Level 1 and SSAE-18 certifications, meeting the highest standards for card data protection. Marqeta uses bank-grade encryption to secure sensitive information during storage and transmission. All communication with the platform requires TLS 1.2 or higher. PCI-compliant JavaScript libraries and widgets allow clients to display sensitive card data securely, without storing it on their own servers. This approach reduces the risk of data breaches and helps businesses maintain compliance. Marqeta’s security tools protect both the business and the consumer, ensuring trust in every transaction.

Note: Marqeta’s compliance team manages regulatory risk, so businesses can focus on growth instead of legal hurdles.

Customization

Marqeta offers extensive customization options for payment card programs. Businesses can design cards with their own logos, graphics, and signatures. The platform supports physical, virtual, and tokenized cards, including NFC and EMV-chip features. Open APIs allow fintech companies to integrate card issuing into their existing systems, creating tailored payment experiences for the consumer. Just-In-Time funding and dynamic spend controls give businesses real-time control over transactions. Marqeta’s platform enables brands to build loyalty through personalized rewards and seamless customer engagement. These features support a wide range of business models, from gig economy platforms to e-commerce and SaaS companies.

- Branded card design and flexible card types

- Real-time spend controls and funding models

- Integration with digital wallets for added convenience

Scalability

Marqeta’s card issuing platform scales with growing enterprises. In Q1 2025, Marqeta processed $84 billion in total payment volume, showing strong growth across fintech, marketplaces, and new verticals. The platform supports clients as they expand globally, with certifications in over 40 countries. Marqeta’s acquisition of TransactPay improved scalability and compliance in the UK and EU. The platform handles nearly $300 billion in annual payments, proving its ability to manage high transaction volumes. Marqeta’s white-label app platform lets clients launch card programs without building their own infrastructure, making it easier to grow and serve more consumers.

- Processes high transaction volumes efficiently

- Supports global expansion and compliance

- Enables rapid scaling for fast-growing businesses

Impact

Industry Adoption

Marqeta has become a trusted partner for leading companies in the financial services industry. Square, Uber, and DoorDash rely on Marqeta’s open API platform to power their payment card programs. These companies use Marqeta to create both virtual and physical cards with advanced controls, such as spending limits and merchant restrictions. Marqeta’s platform supports gig economy payouts and digital marketplace needs by enabling real-time Just-in-Time Funding. This feature authorizes and funds transactions instantly, which improves the consumer experience. Marqeta also integrates with mobile wallets, allowing instant virtual card provisioning. This capability helps clients onboard consumers quickly and retain them longer. Full card lifecycle management through APIs lets clients automate card activation, suspension, and reissuance. Deep transaction-level reporting helps optimize financial performance and meet regulatory requirements. Marqeta’s programmable infrastructure supports embedded finance, allowing partners to offer integrated payment solutions that set them apart in the market.

Use Cases

Marqeta’s platform supports a wide range of use cases across the fintech landscape. In the Buy Now, Pay Later (BNPL) sector, companies like Klarna use Marqeta to deliver seamless payment experiences with real-time authorization and fraud management. On-demand services, such as Instacart, benefit from flexible payment solutions that enhance convenience for the consumer. In digital banking, Marqeta enables card issuance integrated with digital wallets, providing enhanced security, spend controls, and fast time to market for both fintech startups and established banks. The platform’s modern card issuing API supports real-time payment authorization and fraud prevention, which are critical for financial solutions that serve today’s consumer. Marqeta’s support for embedded finance allows businesses to embed financial services directly into their platforms, creating new ways to engage and serve consumers.

Partnerships

Marqeta’s growth and reputation stem from its strategic partnerships and its usage-based business model. The company acts as the payment processor for major platforms, helping them develop modern card programs tailored to their business models. Marqeta’s acquisition of TransactPay expanded its presence in Europe and improved its ability to support multinational clients. The usage-based pricing model aligns Marqeta’s revenue with client transaction volume growth. As clients process more transactions, Marqeta’s revenue increases. The table below highlights how this model supports both Marqeta and its partners:

| Metric | Explanation |

|---|---|

| Usage-based pricing model | Marqeta earns a portion of interchange fees from transactions processed. |

| Total Processing Volume Growth | Transaction volume grew 177% year-over-year, reaching $60 billion. |

| Net Revenue Retention | Over 200% in recent years, showing clients increase spending over time. |

| Revenue Growth | Revenue more than doubled year-over-year, scaling with client growth. |

| Take Rate Variability | Take rate changes with client and transaction mix, reflecting market trends. |

| Gross Margins | Margins remain strong as Marqeta scales with client transaction volumes. |

Marqeta’s alignment with client growth ensures that its payment processing services and embedded finance offerings continue to evolve with the needs of the financial services industry. This approach positions Marqeta as a leader among modern payment platforms.

Future

Ongoing Innovation

Marqeta continues to shape the digital payments landscape by transforming credit cards into dynamic digital platforms. The company moves beyond static cards, creating personalized experiences that act as financial homepages for users. Features such as interactive statements, spending insights, and targeted offers help users manage their finances more effectively. Marqeta’s platform supports instant issuance of prepaid, debit, and credit cards, giving fintech companies and banks the flexibility to launch new products quickly. The modular, API-first design allows for easy integration and customization, which appeals to digital-native generations. Marqeta also provides advanced risk management and program management tools, enabling clients to balance growth with compliance and security. These innovations position Marqeta as a leader in delivering engaging and secure payment experiences.

Note: Marqeta’s focus on personalization and real-time engagement sets a new standard for cardholder interaction, especially for Gen Z and younger users.

Market Trends

The card issuing industry faces rapid change, driven by demand for fast, seamless payment experiences and the rise of embedded finance. Businesses outside traditional banking now offer financial services, integrating payments into everyday platforms. Marqeta supports this shift by partnering with fintechs and non-financial brands, helping them navigate regulatory and technical challenges. The company’s tools enable embedded finance solutions that break down barriers and improve access to financial services.

Key trends include the growth of real-time payments, the use of AI for fraud detection, and the adoption of blockchain for borderless transactions. The digital payments market is expected to grow strongly, especially in Asia Pacific and Europe, with sectors like retail and e-commerce leading the way. Marqeta’s acquisition of TransactPay strengthens its presence in Europe, supporting global expansion. Analysts recognize Marqeta’s strong revenue growth and leadership in modern card issuing, though they note ongoing challenges in profitability. As automation, AI, and alternative payment methods become more important, Marqeta’s commitment to innovation and embedded finance will help it remain at the forefront of the industry.

Marqeta has transformed card issuing by delivering a flexible, API-driven platform that supports real-time payments and over 300 card configurations. The company’s partnerships with leading brands and its cloud-native technology have set new standards for reliability and scalability.

| Aspect | Supporting Details |

|---|---|

| Innovative Platform | API-driven card issuing and payment processing enabling real-time transaction authorization and over 300 card configurations |

| Strategic Partnerships | Collaborations with major tech companies such as Square, DoorDash, and Instacart |

| Market Impact | Processed $167.4 billion in payment volume in 2022; $456.8 million revenue in 2022; served 605 customers with 95% retention |

| Technological Strength | Cloud-native platform with 99.99% uptime, supporting over 2 million daily transactions and instant card configuration |

| Industry Position | Positioned to capitalize on embedded finance growth, real-time programmable payments, and digital wallet adoption |

Marqeta’s solutions enable instant card issuing, dynamic spend controls, and fast reconciliation. As fintech continues to evolve, Marqeta stands ready to drive the next wave of payment innovation.

FAQ

What types of cards can Marqeta issue?

Marqeta supports physical, virtual, and tokenized cards. Clients can issue prepaid, debit, and credit cards. The platform also enables instant provisioning to digital wallets for fast access.

How does Marqeta help prevent fraud?

Marqeta uses real-time controls, machine learning, and behavioral analytics. The platform monitors transactions as they happen. Clients can set custom rules to block suspicious activity and receive instant alerts.

Can Marqeta support global card programs, including in China and Hong Kong?

Yes. Marqeta holds certifications in over 40 countries, including support for Hong Kong banks. The platform enables global card issuance and compliance. For current USD to HKD exchange rates, see XE.com.

What is Marqeta’s pricing model?

Marqeta uses a usage-based pricing model. Clients pay based on transaction volume. The company earns a portion of interchange fees. For more details, contact Marqeta or review their pricing FAQ.

How quickly can a business launch a card program with Marqeta?

Businesses can launch card programs in weeks, not months. The platform offers instant card issuance, a developer-friendly API, and migration support. Many clients, such as Ramp, have gone live in under 70 days.

Marqeta has proven to be a cornerstone of modern card issuing, providing the innovative platform that empowers businesses to build their own unique payment solutions. While Marqeta handles the complexities of issuing and processing, a global business still needs a streamlined way to manage its own cross-border finances and investment capital. This is where BiyaPay offers a perfect complement. Our integrated global financial account simplifies the process, allowing you to manage multiple currencies, transfer funds with low fees, and easily invest in US and Hong Kong stocks. With our real-time exchange rate converter and transparent pricing, you can ensure your financial operations are as efficient as your Marqeta-powered payment platform. BiyaPay removes the logistical headaches of global finance, letting you focus on scaling your business and innovating your offerings. Simplify your business’s financial operations. Register today.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.