- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Neuralink Stock Outlook for Investors in 2025 and Beyond

Image Source: pexels

Neuralink stock remains unavailable to the public, yet many investors seek ways to invest in this pioneering neurotechnology company. Neuralink stands out in a market projected to reach $17.39 billion in annual revenue by 2025, driven by rising demand for neurological disorder treatments and rapid technological progress. Investors recognize both the potential for breakthrough advancements and the challenges, such as strict FDA approval processes and ethical concerns over privacy. Investing in Neuralink stock means navigating risks while pursuing significant opportunities in a fast-growing sector.

Key Takeaways

- Neuralink is a private company, so its stock is not available on public markets and only accredited investors can buy shares through private channels.

- The company leads in neurotechnology with advanced brain-computer interface devices and strong funding, positioning it for growth in a rapidly expanding market.

- Investing in Neuralink carries risks like limited liquidity, regulatory hurdles, ethical concerns, and privacy issues related to brain data.

- Neuralink’s IPO timing is uncertain and depends on market conditions, regulatory approvals, and company progress in clinical trials.

- Retail investors can gain exposure to neurotechnology by investing in public companies and startups working on brain-related technologies.

Neuralink Stock Availability

Private vs. Public Status

Neuralink operates as a private company. It does not trade on public stock exchanges such as NYSE or Nasdaq. The company has no stock ticker symbol, and its shares remain in the hands of founders, management, employees, and private investors. Neuralink has not announced any official plans for an initial public offering (IPO). Any speculation about a public listing remains premature. Investors cannot find neuralink stock on public markets, and the company is not legally eligible for public trading at this time.

Note: Liquidity events, such as an IPO or acquisition, are uncertain and unpredictable for private companies like Neuralink. Investors should understand that access to neuralink stock depends on the company’s future decisions.

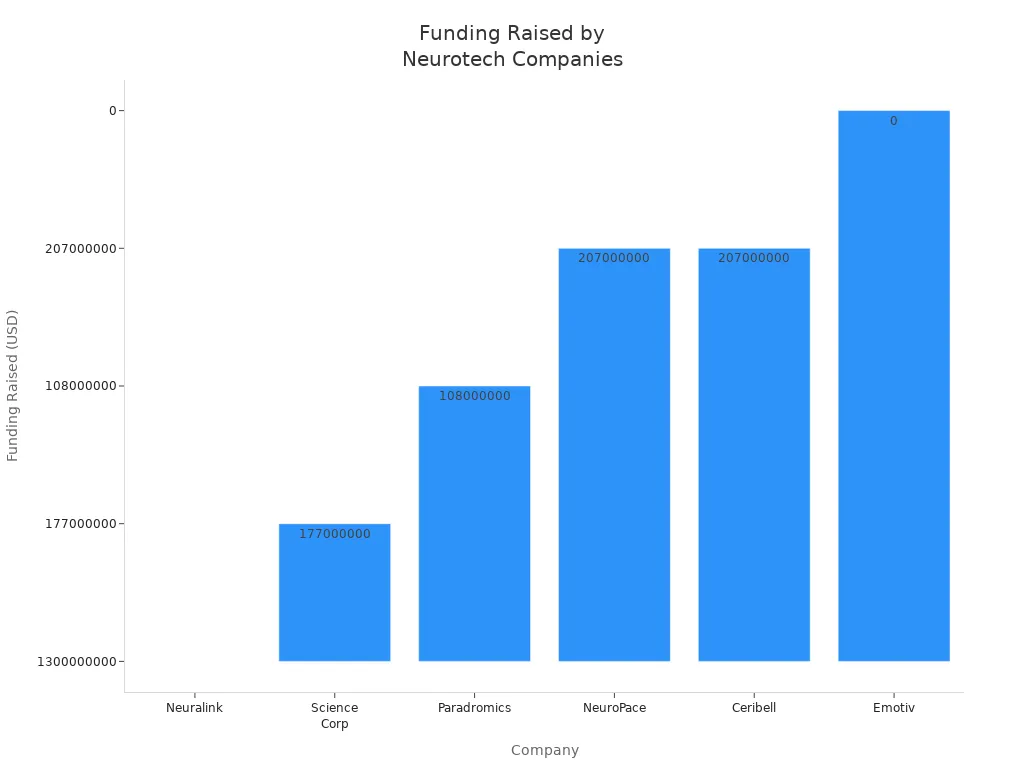

The following table compares Neuralink’s private status with other leading neurotech startups:

| Company | Founded | Funding Raised | Ownership Status | Notable Details |

|---|---|---|---|---|

| Neuralink | 2016 | ~$1.3 billion | Private | Most well-funded neurotech startup; Elon Musk invested >$100M early; FDA IDE approved for human trials |

| Science Corp | 2021 | ~$177 million | Private | Raised significantly less than Neuralink |

| Paradromics | N/A | ~$108 million | Private | Lower funding compared to Neuralink |

| NeuroPace | 1997 | Public | Public (NASDAQ: NPCE) | FDA approved implantable neurostimulators |

| Ceribell | 2014 | Public | Public (NASDAQ: CERB) | IPO raised $207M in 2024 |

| Emotiv | 2011 | Much smaller funding | Private | Seed/accelerator-backed, smaller scale |

This comparison highlights Neuralink’s unique position as a private company with significant funding and advanced research, while some competitors have already gone public.

Who Can Buy Neuralink Stock

Investors interested in neuralink stock face strict limitations. Only accredited investors and institutional investors can buy neuralink stock through private placements or secondary markets. Accredited investors must meet financial thresholds, such as an annual income over $200,000 (or $300,000 jointly) or a net worth exceeding $1 million, excluding their primary residence. Institutional investors include venture capital firms and private equity funds.

- Neuralink stock is not available to the public. Retail investors cannot buy neuralink stock through traditional brokerage accounts or public markets.

- Accredited investors may access neuralink stock through private placements or specialized investment platforms, such as Forge or Notice. These platforms require verification of investor status and often involve working with a Private Market Specialist.

- Transactions for neuralink stock typically require issuer approval, legal agreements, and may take 30-60 days to complete. Direct share transfers are rare and may involve special purpose vehicles (SPVs) or forward purchase contracts.

- Investments in neuralink stock carry higher risks than public equities. These risks include limited liquidity, lack of financial disclosure, regulatory challenges, and market competition.

- Retail investors who do not meet the accredited investor criteria cannot buy neuralink stock directly or through secondary markets.

Tip: Investors should carefully review eligibility requirements and understand the risks before attempting to invest in private companies like Neuralink.

Neuralink restricts share purchases to protect the company and comply with SEC regulations. Pre-IPO investment opportunities remain limited to high-net-worth individuals, institutional investors, and those with a strong interest in neurotechnology. For most investors, direct access to neuralink stock will only become possible if the company decides to go public in the future.

Neuralink Company Overview

Image Source: unsplash

Technology and Mission

Neuralink aims to revolutionize the way humans interact with technology. The company’s mission centers on developing a generalized brain interface that restores autonomy for people with unmet medical needs and unlocks human potential. Neuralink focuses first on medical applications, such as helping individuals with paralysis and vision loss. Over time, the company plans to expand into human enhancement and enable symbiosis with artificial intelligence.

Neuralink has developed several proprietary technologies:

- The N1 implant allows patients to control digital devices using their thoughts. In clinical trials, a quadriplegic patient used the N1 to move a computer cursor.

- The Blindsight chip targets vision restoration by stimulating the visual cortex. The U.S. Food and Drug Administration granted this device Breakthrough Device Designation.

- The R1 surgical robot performs precise implantation of neural devices, improving safety and accuracy.

Neuralink conducts clinical trials like the PRIME Study, which implants the N1 in patients with quadriplegia, and the CONVOY Study, which explores controlling assistive robotic arms. The company uses a vertically integrated approach, combining chip design, robotics, and manufacturing. Leadership, including Elon Musk, emphasizes innovation, patient safety, and ethical responsibility. Recent funding rounds, such as a $650 million Series E, support ongoing research and clinical expansion.

Market Potential

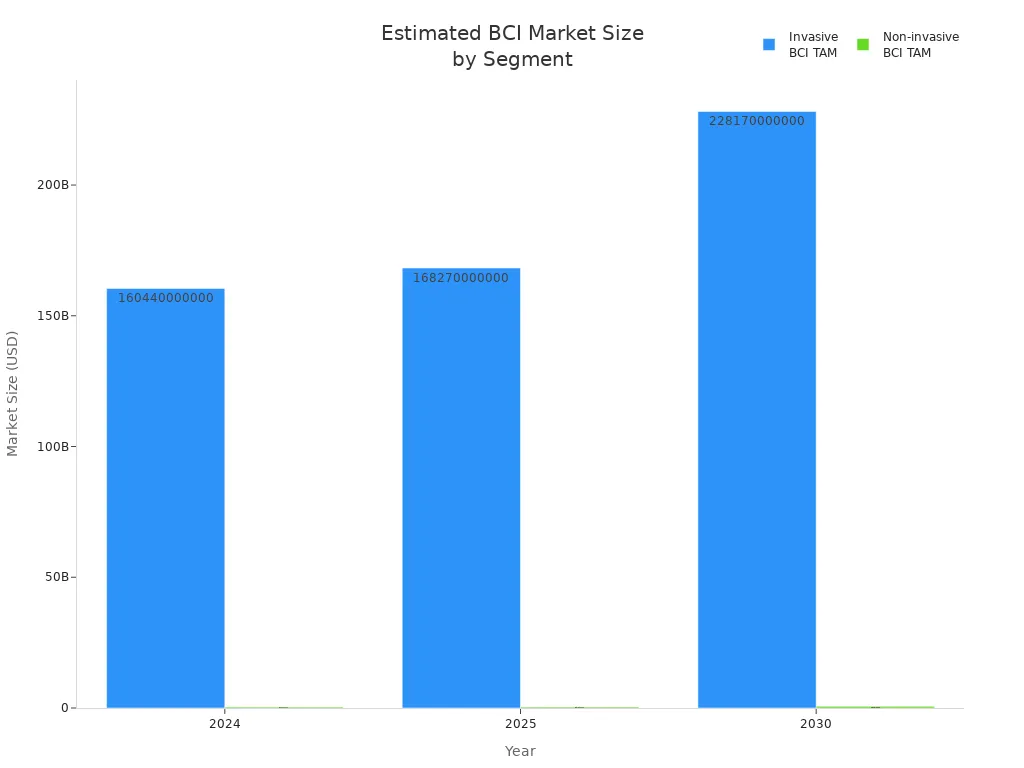

The brain-computer interface market shows strong growth prospects. In 2023, the market size reached about USD 2.05 billion. Projections estimate growth to USD 10.65 billion by 2033, with a compound annual growth rate (CAGR) of 17.9%. This expansion comes from advances in neuroscience, artificial intelligence, and increased demand for non-invasive solutions.

Neuralink targets both invasive and non-invasive brain-computer interface segments. The invasive segment, which includes technologies like the N1 implant, is expected to reach USD 168.27 billion in 2025. Non-invasive solutions will also grow, reaching USD 397.59 million in the same year.

| Market Segment | Year | Estimated Market Size (USD) | CAGR (%) |

|---|---|---|---|

| Invasive BCI TAM | 2024 | 160.44 billion | N/A |

| Invasive BCI TAM | 2025 | 168.27 billion | 1.49 (2025-30) |

| Invasive BCI TAM | 2030 | 228.17 billion | N/A |

| Non-invasive BCI TAM | 2024 | 368.60 million | N/A |

| Non-invasive BCI TAM | 2025 | 397.59 million | 9.35 (2025-30) |

| Non-invasive BCI TAM | 2030 | 621.57 million | N/A |

Neuralink stands at the forefront of the brain-computer interface and brain-machine interface industries. The company’s technology and mission position it to capture significant value as the market expands.

Neuralink Stock Price and Valuation

Image Source: pexels

Recent Funding Rounds

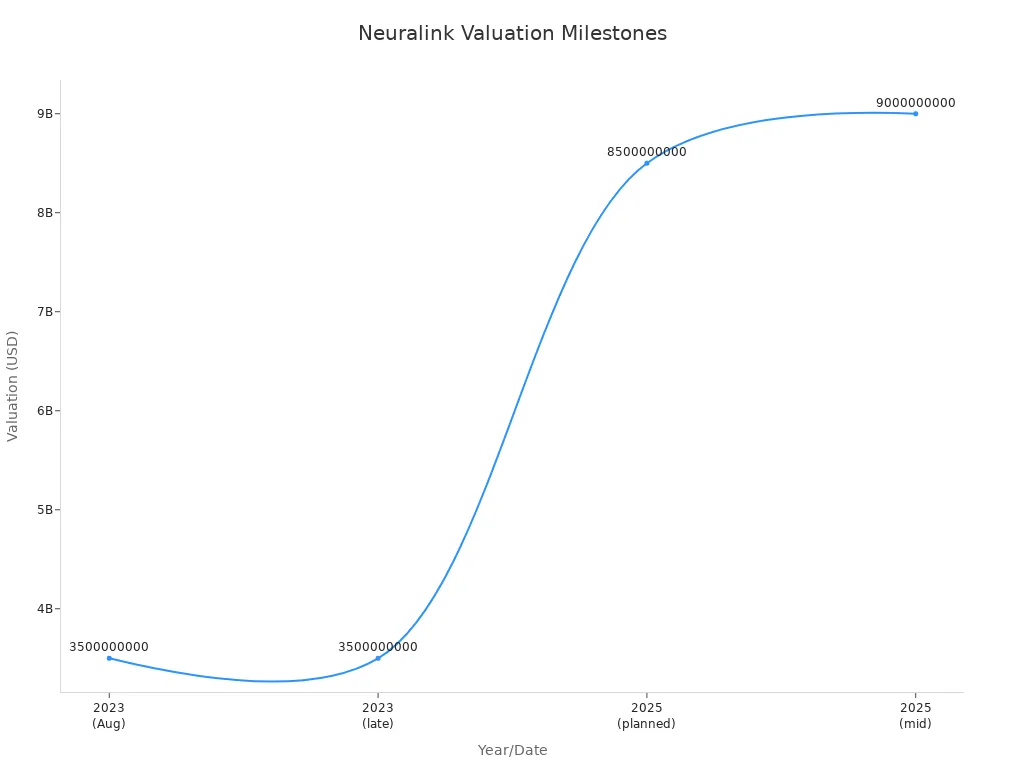

Neuralink has attracted significant attention from investors through multiple funding rounds. The company raised $280 million in August 2023, followed by an additional $43 million later that year. Early in 2025, Neuralink planned a $500 million round, and by mid-2025, the company closed a $650 million Series E round. Major investors in these rounds included Sequoia Capital, Lightspeed, and Thrive Capital. Thrive Capital also invests in OpenAI, showing strong interest in advanced technology sectors.

The following table summarizes key funding rounds and valuation milestones for Neuralink:

| Year/Date | Funding Amount | Valuation | Major Investors | Notes |

|---|---|---|---|---|

| 2023 (Aug) | $280 million | ~$3.5 billion | N/A | Initial large funding round |

| 2023 (Later) | $43 million | N/A | N/A | Additional funding round |

| Early 2025 | $500 million | $8.5 billion | N/A | Funding round eyed, not finalized |

| Mid 2025 (closed) | $650 million | $9 billion pre-money | Sequoia, Lightspeed, Thrive Capital, others | Series E round closed |

Valuation Growth

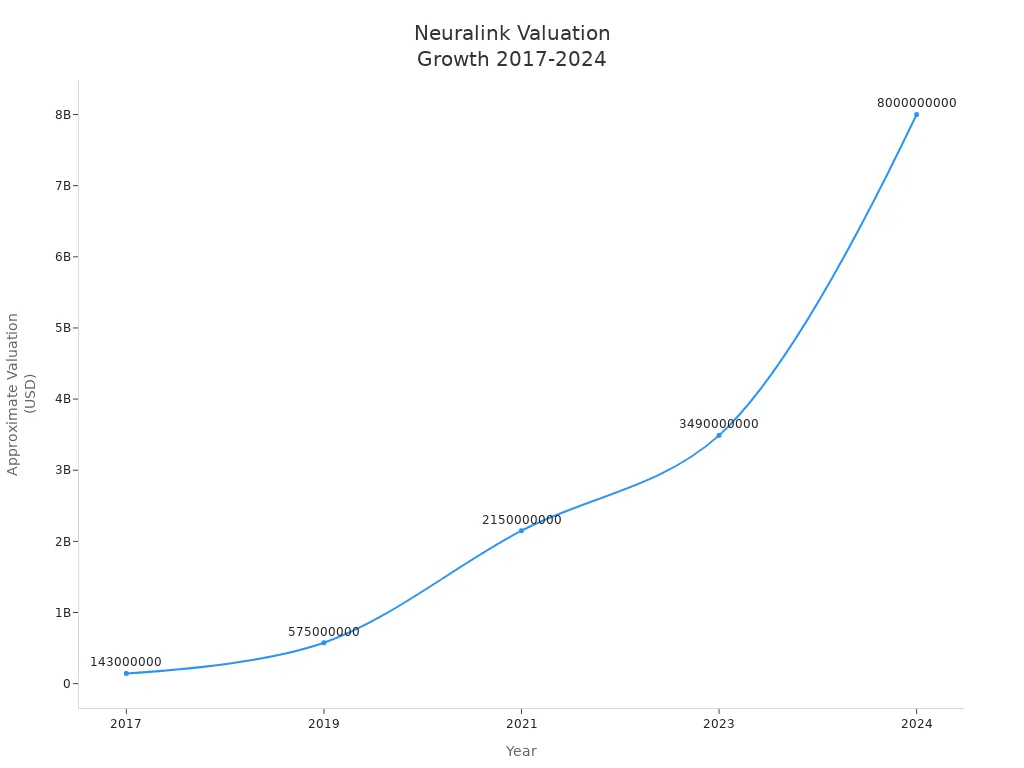

Neuralink valuation has grown rapidly since its founding. In 2017, the company raised $107 million at a valuation of about $143 million. By 2019, the valuation reached $575 million after a $51 million Series B round. In 2021, Neuralink raised $206 million, pushing the valuation to $2.15 billion. The Series D round in 2023 brought the valuation to $3.49 billion. Secondary market trades in 2024 suggested a valuation as high as $8 billion, and by mid-2025, the pre-money valuation reached $9 billion.

The chart below illustrates Neuralink’s valuation growth from 2017 to 2024:

Neuralink stock price remains unavailable to the public because the company is private. Investors cannot view a public neuralink stock price or trade shares on exchanges. Private market valuations reflect investor demand and company milestones, but these prices often trade at a premium due to scarcity. Neuralink stock continues to attract interest from venture capital firms and institutional investors, while retail investors must wait for a possible IPO.

Note: All monetary values are presented in USD. For current exchange rates, refer to XE.com.

Neuralink IPO Outlook

IPO Timeline

Neuralink IPO remains a topic of speculation among investors. The company has not announced an official date for its public offering. Neuralink continues to operate as a private entity, focusing on clinical trials and product development. The timeline for a neuralink ipo depends on several factors. Market volatility in early 2025 has led many tech companies to delay their IPO plans. Neuralink benefits from strong private funding, such as the $280 million Series D round, which reduces the urgency to go public. The company may wait for improved investor confidence and more stable market conditions before pursuing a neuralink ipo.

Regulatory changes also influence the neuralink ipo timeline. Increased scrutiny from the SEC has made the process more complex. The newly elected administration in the United States has promised to deregulate the IPO market, which could make it easier for neuralink to list shares. Neuralink will likely monitor these developments closely before making any decisions about a neuralink ipo.

What to Watch

Investors should pay attention to several key factors that could impact the neuralink ipo. These include:

- Market conditions: Investor confidence in technology stocks remains uncertain. Poor outcomes from recent tech IPOs and controversies around SPAC mergers have made investors cautious.

- Regulatory environment: The SEC has increased oversight of IPOs, especially after issues with SPACs. Changes in regulations could affect the timing and structure of a neuralink ipo.

- Company performance: Neuralink’s ability to advance clinical trials and secure FDA approvals will play a major role in its IPO prospects.

- Private funding: Neuralink’s success in raising large amounts of capital allows it to delay going public until conditions improve.

| Factor | Impact on Neuralink IPO |

|---|---|

| Market volatility | May delay IPO plans |

| SEC scrutiny | Increases complexity |

| Private capital raised | Reduces IPO urgency |

| Regulatory changes | Could ease IPO process |

Tip: Investors interested in neuralink ipo should follow news about regulatory reforms and market trends. Staying informed will help them anticipate when neuralink might go public.

How to Buy Neuralink Stock

Pre-IPO Access

Neuralink stock remains private, so most investors cannot buy neuralink stock through public exchanges. Accredited investors and institutions may gain access through private channels. One such channel is Hiive, a marketplace where private shares, including neuralink stock, can be listed and traded. Hiive allows users to view historical trading trends and place listings anonymously. However, the platform does not guarantee that neuralink shares are always available. Hiive also states that investing in private shares is speculative and illiquid. Only accredited investors can participate, and each transaction requires careful review and approval.

To invest in neuralink before an IPO, investors often use special purpose vehicles (SPVs) or private placement agreements. These methods pool funds from multiple accredited investors to purchase shares from early employees or existing shareholders. The process can take several weeks and involves legal agreements. Investors should understand that these shares remain highly illiquid until a liquidity event, such as an IPO or acquisition, occurs.

Note: Private investments in neuralink stock carry significant risks. Investors should consult with financial advisors and review all terms before making commitments.

Alternative Investment Options

Most retail investors cannot buy neuralink stock directly. However, they can gain exposure to the neurotechnology sector through public companies and other neurotech startups. The table below highlights several options across different sub-sectors:

| Sub-sector | Company Name | Ticker/Status | Description & Investment Thesis |

|---|---|---|---|

| Neurodiagnostics & Monitoring | Ceribell, Inc. | NASDAQ: CBLL | Portable EEG device for seizure detection; FDA-cleared; growing demand in critical care. |

| Hyperfine, Inc. | NASDAQ: HYPR | Portable MRI scanner; FDA-cleared; expanding hospital adoption. | |

| Neuromodulation & Neurostimulation | Neuronetics, Inc. | NASDAQ: STIM | Non-invasive TMS device for depression; expanding insurance coverage. |

| Medtronic plc | NYSE: MDT | Leader in deep brain stimulation; stable medical device portfolio. | |

| Brain-Computer Interfaces | NeuroOne | NASDAQ: NMTC | Flexible brain electrodes; enabling hardware for BCIs. |

| NeuroPace, Inc. | NASDAQ: NPCE | Implantable brain pacemaker for epilepsy; FDA-approved. | |

| ONWARD Medical | EBR: ONWD | BCI for paralysis recovery; clinical trials underway. | |

| Private Neurotech Startups | Synchron | Private | Minimally invasive BCI implant; breakthrough in implant technology. |

| Blackrock Neurotech | Private | Brain-signal-powered devices; established in BCI medical devices. |

Investors seeking to invest in neuralink indirectly may consider companies with significant investments in brain-computer interface technology. For example, Synchron and Blackrock Neurotech have attracted funding from notable investors such as Bill Gates and Jeff Bezos. These companies offer exposure to the growth of neurotechnology without the need to buy neuralink stock directly.

Tip: Investors should research each company’s financials and market position before making investments. For current USD exchange rates, refer to XE.com.

Risks and Opportunities

Key Risks

Investing in neuralink presents several important risks that anyone considering this company should understand.

- Reports have surfaced about rushed animal testing at neuralink, with nearly 1,500 animals killed since 2018. These incidents have raised ethical concerns and could impact regulatory approvals.

- Animal welfare issues and criticism from organizations may slow research progress and lead to regulatory investigations.

- Neuralink’s technology records neural signals, which creates privacy risks. Unauthorized access or misuse of brain data could harm users and damage the company’s reputation.

- The company remains private, with no public shares available. This creates financial and liquidity risks for those investing, as there is no guarantee of a future IPO or easy exit.

- Regulatory frameworks for neurotechnology continue to evolve. Unclear rules about data privacy and medical device approvals can delay commercialization and increase costs.

- Device safety, reliability, and long-term effects remain uncertain. Malfunctions or side effects could hinder adoption and lead to further scrutiny.

- Neuralink’s future depends on regulatory approvals, ethical oversight, and social acceptance. Any setbacks in these areas could delay or prevent commercial success.

Note: Transparency in safety data and strong ethical oversight are critical for maintaining public trust and supporting long-term growth.

Growth Potential

Despite these risks, neuralink offers significant growth potential. The company’s recent $650 million funding round has positioned it as a leader in the brain-computer interface market. Neuralink has implanted brain chips in patients with paralysis, including a non-verbal ALS patient who communicated using the device. These clinical milestones show real progress toward commercial applications.

Key breakthroughs that could increase neuralink’s market value include:

- FDA Breakthrough Device designations, which build regulatory trust.

- The Blindsight initiative, aiming to restore vision, with human trials planned by early 2026.

- The CONVOY trial, which targets robotic arm control for patients with severe disabilities.

- The R1 surgical robot, which automates implantation and could reduce costs.

The neurotechnology sector is expected to grow rapidly. The table below shows projected growth rates:

| Metric | Projection Period | CAGR | Market Size (USD Billion) |

|---|---|---|---|

| Global Neurotechnology Market | 2025 to 2034 | 13.19% | From 17.32 to 52.86 |

| Neurotechnology Device Market | 2026 to 2033 | 6.4% | From 8.5 to 14.6 |

| Brain-Computer Interfaces & Neurostimulators | Through 2033 | >12% | N/A |

Neuralink’s technical edge, strong funding, and first-mover advantage could help it capture a large share of this expanding market. For current USD exchange rates, see XE.com.

Neuralink remains a private company with no public stock available, and analysts expect an IPO only after it proves profitability and passes regulatory scrutiny. Investors face risks from complex brain disorder treatments and competition, such as Precision Neuroscience’s FDA-cleared device. To stay informed, investors should follow market trends, regulatory updates, and specialized reports. Many choose alternative exposure through venture funds, ETFs, or accelerators. Careful research and a long-term outlook help investors navigate the evolving neurotechnology sector.

For current USD exchange rates, visit XE.com.

FAQ

Can retail investors buy Neuralink stock now?

Retail investors cannot buy Neuralink stock. Only accredited investors and institutions have access through private placements or secondary markets. The company remains private, so shares do not trade on public exchanges.

When might Neuralink go public?

Neuralink has not announced an IPO date. The company continues to raise private capital and focus on clinical trials. An IPO may occur after regulatory milestones and market conditions improve.

How does Neuralink compare to other neurotech startups?

Neuralink leads in funding and technology among neurotech startups. The company focuses on invasive brain-computer interfaces, while others target non-invasive solutions or specific medical devices. Neuralink’s clinical progress sets it apart in the sector.

What are the main risks of investing in Neuralink?

Investors face risks such as regulatory delays, ethical concerns, and uncertain device safety. The private status of Neuralink also means limited liquidity and less financial transparency compared to public companies.

Are there alternative ways to invest in the neurotechnology sector?

Investors can consider public companies like Medtronic or NeuroPace, which develop neurotechnology devices. Some may also invest in funds or ETFs that include neurotech startups and related healthcare innovators.

While direct investment in Neuralink stock remains out of reach for most, the broader neurotechnology market offers compelling opportunities. The real challenge for global investors isn’t just finding the right stock, but having a seamless, reliable platform to act on those opportunities. BiyaPay empowers you to do just that. Our unified global financial account provides direct access to the US and Hong Kong stocks markets, allowing you to invest in publicly traded neurotech innovators like Medtronic and NeuroPace. With our real-time exchange rate converter and ultra-low remittance fees, you can efficiently manage your funds across borders without the typical hassle. Don’t wait for a potential IPO; you can start building a diversified portfolio in this high-growth sector today. BiyaPay simplifies the logistics, so you can focus on your investment strategy. Ready to get started? Register today.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.