- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Pony AI Stock Sees Volatile Swings—Here’s What Investors Should Watch

Image Source: pexels

Pony AI stock saw a dramatic surge of over 70% in one week in 2024, reflecting heightened investor interest and significant volatility. Strong revenue growth to $75 million USD and a market cap near $4.56 billion USD show increasing confidence, but steep losses of $275 million USD highlight ongoing risks. Investor alert: focus on Pony AI’s financial health, regulatory scrutiny, and ambitious robotaxi targets before making any investment decisions.

Key Takeaways

- Pony AI stock shows big price swings due to earnings, partnerships, and regulatory news, so investors should expect volatility.

- The company has strong revenue growth but still faces losses as it invests in technology and fleet expansion.

- Regulatory actions and safety concerns in China and the US can quickly affect Pony AI’s operations and stock value.

- Pony AI’s partnerships and robotaxi production plans offer growth potential but come with operational challenges.

- Investors should watch key milestones like Gen-7 robotaxi mass production, fleet expansion, and regulatory updates to make informed decisions.

Pony AI Stock Movements

Image Source: unsplash

Recent Price Swings

Pony AI stock experienced significant volatility since its November 2024 IPO. The stock price jumped over 30% after the IPO, which was priced at $13 per share. This surge reflected strong initial investor demand. In 2025, the stock continued to show sharp movements. On August 12, 2025, the price dropped from $15.07 to $13.12, marking an 11.29% decrease in a single day. This intraday plunge followed concerns about the company’s rapid expansion and competitive pressures.

The table below summarizes the largest price swings for Pony AI stock during this period:

| Year | Event Description | Price Change Details | Percentage Change |

|---|---|---|---|

| 2024 | Post-IPO price rise after November | IPO price at $13, stock rose >30% | >30% increase |

| 2025 | Intraday plunge on August 12, 2025 | Price dropped from $15.07 to $13.12 | 11.29% decrease |

Between mid-April and mid-May 2025, Pony AI stock surged over 245%. However, the stock then faced a sharp 29.5% drop over the next 30 days. These swings highlight the unpredictable nature of stocks in the autonomous vehicle sector.

Main Catalysts

Several factors have driven the recent volatility in Pony AI stock. Strong second quarter earnings and revenue growth have attracted investor attention. UBS analyst Paul Gong initiated coverage with a buy rating and a $20 price target, causing a notable stock bump of 7.8% in one session. Strategic partnerships with companies like Toyota Motor and Uber Technologies have also boosted investor confidence.

Regulatory news and safety concerns have contributed to sharp declines. On August 12, 2025, negative sentiment grew after Pony AI announced further expansion into Europe. Investors worried about the sustainability of rapid growth and increased competition. Market corrections, regulatory scrutiny, and autonomous vehicle safety issues have all played roles in recent price swings.

Investors should monitor these catalysts closely, as they can lead to both rapid surges and sudden drops in Pony AI stocks.

Pony AI Financials

Image Source: pexels

Revenue Growth

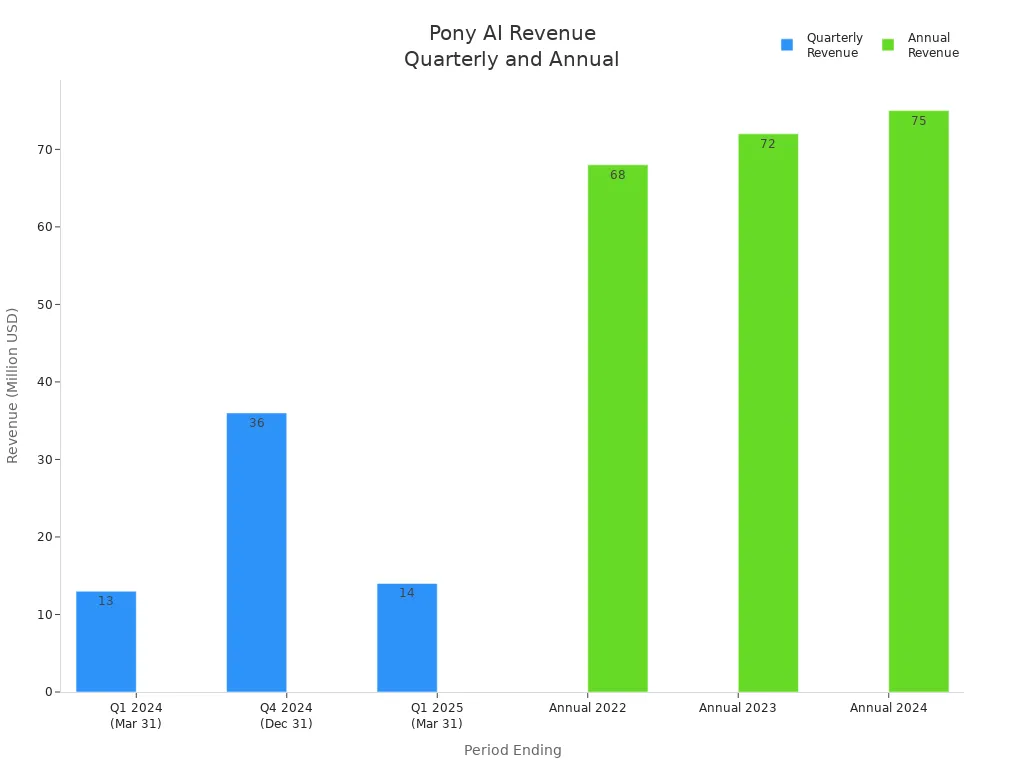

Pony AI has reported steady increases in revenue over the past three years. The company’s revenue leaped from $68 million in 2022 to $75 million in 2024, showing strong growth numbers despite some quarterly fluctuations. The most recent quarterly report for Q1 2025 shows revenue at $14 million, which matches the same period last year. However, the annual trend remains positive, with the last twelve months’ revenue reaching $85.74 million, a 1.67% increase year-over-year. The table below summarizes recent revenue performance:

| Period Ending | Revenue (Million USD) | Year-over-Year Change (%) |

|---|---|---|

| Q1 2025 (Mar 31) | 14 | 0% |

| Q4 2024 (Dec 31) | 36 | N/A |

| Q1 2024 (Mar 31) | 13 | N/A |

| Annual 2024 | 75 | +4.35% |

| Annual 2023 | 72 | +5.14% |

| Annual 2022 | 68 | 0% |

Investors should note that while quarterly revenue can fluctuate, the overall annual trend points upward.

Losses and Cash Position

Pony AI continues to operate at a loss as it invests in technology and fleet expansion. In Q1 2025, the company reported a net loss of $37.4 million, up from $20.8 million in Q1 2024. Increased spending on research and development and capital expenditures contributed to this higher loss. The cash position declined early in 2025, dropping from $536.2 million at the end of 2024 to $379.4 million by March 2025. However, by June 2025, the company’s liquidity improved, with total cash, cash equivalents, and short-term investments rising to $747.7 million. This improvement reflects capital raises and better operational efficiency. Pony AI has also started mass production of its Gen-7 Robotaxi vehicles, aiming to deploy 1,000 units by the end of 2025. Fare-charging revenue from Robotaxi services has more than tripled year-over-year, supporting the company’s move toward positive unit economics.

Analyst Expectations

Analysts remain optimistic about Pony AI’s future. Consensus forecasts show revenue could rise from $83.37 million to $118.44 million in the next fiscal year, representing about 42% growth. Despite this, analysts expect earnings per share to remain negative, with a slight decline from -0.46 to -0.54. Revenue growth estimates for 2025 average 11.1%, with some analysts predicting up to 21.2%. Most analysts rate the stock as a strong buy, with price targets near $19.4 to $20. This positive outlook reflects confidence in Pony AI’s ability to scale operations and capture market share, even as losses continue.

Drivers of Volatility

Technology and Robotaxi Targets

Pony AI stands out as a self-driving tech developer with a strong focus on autonomous technology advancement. The company has built proprietary full-stack systems for perception, prediction, planning, and control. These systems help Pony AI optimize performance and efficiency, giving it an edge in the self-driving car industry. The company operates in both China and the United States, collecting diverse data that improves its algorithms. Strategic partnerships with automotive leaders such as Toyota provide access to manufacturing expertise, which supports the mass production of robotaxis.

Pony AI has secured regulatory approvals for fully driverless operations in several Chinese cities and holds testing permits in California. These autonomous driving achievements position the company among the top-tier global developers. The company targets both passenger robotaxis and autonomous trucking, diversifying its business. As of early 2024, Pony AI operates about 250 robotaxis in China. The CEO expects per-vehicle profitability in 2025, which will support further fleet expansion. The company plans to begin supervised trials in 2025, launch full driverless operations in 2026, and start mass production of seventh-generation robotaxis in late 2025. Pony AI aims to scale its fleet to 1,000 vehicles by the end of 2025 and deploy robotaxis in Dubai through a partnership with the local RTA.

Pony AI’s technological foundation and ambitious fleet targets drive investor confidence, but rapid scaling introduces risks that can affect stock volatility.

Regulatory and Safety Concerns

Regulatory scrutiny remains a major factor in Pony AI’s volatility. On May 22, 2025, a robotaxi caught fire in Beijing, leading local authorities to suspend Pony AI’s testing and operations. The company’s app was disabled in affected areas, and regulators launched an investigation into the incident. This event caused a 10% drop in stock price the next day. The fire prompted discussions about revising safety regulations and increasing oversight for autonomous vehicles in China. Regulatory bodies may introduce stricter testing protocols, which could raise compliance costs and disrupt operations.

Pony AI responded quickly by activating emergency protocols and maintaining transparent communication. Partnerships with major automakers now face increased scrutiny due to potential safety issues. The incident highlights how regulatory actions can swiftly impact operations and investor sentiment. Regulatory risks in the autonomous vehicle sector affect all companies, not just Pony AI. Sector-wide scrutiny, competitive pressures, and macroeconomic volatility contribute to elevated default risk and stock swings.

Investors should monitor regulatory developments closely, as safety incidents and compliance changes can lead to sudden drops in stock value.

Market Sentiment

Market sentiment plays a critical role in Pony AI’s stock movements. After announcing a partnership to deploy over 1,000 robotaxis with Shenzhen Xihu Corporation, Pony AI shares dropped 17%. Retail investor sentiment on Stocktwits shifted from bearish to neutral, with increased message volume. Analysts continue to rate the stock as a ‘Buy’ or higher, with an average price target of $22, suggesting over 50% upside potential. Financial news outlets highlight Pony AI’s partnerships and technology but note the lack of a deployment deadline as a reason for caution.

The robotaxi market is growing rapidly, with Pony AI recognized as a key player in China. Analysts emphasize technology, partnerships, and market potential as important factors for stock attractiveness. However, regulatory issues and long investment cycles create cautious optimism among investors. Volatility in technology stocks often results from earnings reports, geopolitical risks, valuation concerns, supply chain changes, and growth projections. Pony AI’s recent performance reflects these factors, with sharp declines and rebounds in response to news and market sentiment.

| Factor Driving Volatility | Reflection in Pony AI’s Recent Performance |

|---|---|

| Earnings Reports | Revenue dropped nearly 30% YoY; robotaxi services revenue fell ~60%; gross profit declined; net loss expanded to $181 million. |

| Geopolitical Risks | U.S.-China tensions and tariffs contributed to bearish sentiment and stock price decline to a 52-week low near $4 per share. |

| Market Sentiment Swings | Stock price fell from over $20 to $4, then rebounded to about $10 after positive corporate updates and technology unveilings. |

| Valuation Concerns | Despite unprofitability, Pony AI maintains a high valuation (~$3.5 billion market cap), creating investor uncertainty. |

| Supply Chain and Cost Reductions | Announced 70% reduction in bill-of-materials costs and significant cuts in autonomous driving computation and LiDAR expenses. |

| Growth Projections and R&D | Investment in next-gen robotaxi platform with mass production expected mid-2025; ongoing R&D drives investor interest and risk. |

Market sentiment toward Pony AI stock remains cautiously optimistic, supported by technology and growth potential in the future of transportation technology.

Risks for Investors

Regulatory Risks

Pony AI faces significant regulatory risks that can impact both its operations and financial outlook. The company has achieved regulatory approvals in all four Tier-1 cities in China and expanded into international markets such as Dubai and South Korea. These approvals are essential for scaling robotaxi fleets and generating revenue. However, regulatory delays and public safety concerns remain major challenges. For example, a robotaxi fire in Beijing led to temporary suspension of operations and increased scrutiny from local authorities.

Geopolitical tensions also add uncertainty. Recent U.S. Congressional initiatives have urged the SEC to reconsider the listings of major Chinese companies, including those with alleged ties to China’s military. This pressure has caused sharp declines in Pony AI’s stock price, reflecting investor concerns about potential delisting and liquidity risks. If regulators in the United States or China change their stance, Pony AI could face severe impacts on its market valuation and access to capital.

China’s government continues to push for autonomous vehicle adoption, mandating that 30% of new vehicles sold by 2025 must have Level 3 or higher autonomy. However, after a fatal crash in March 2025, regulators tightened rules, requiring driver monitoring systems and restricting certain advertising claims. These changes can increase compliance costs and slow deployment. In the United States, the lack of consistent federal regulations creates a patchwork of state laws, making it difficult for Pony AI to operate smoothly across regions.

Investors should closely monitor regulatory developments in both China and the United States, as changes can quickly affect Pony AI’s growth prospects and stock performance.

Operational Challenges

Pony AI must overcome several operational challenges to achieve its ambitious targets. The company invests heavily in research and development, which led to a net loss of $53.3 million in Q2 2025. Although Pony AI holds $747.7 million in cash reserves, ongoing losses put pressure on the company to reach breakeven by 2026. Achieving this goal depends on successful regulatory navigation and efficient scaling of robotaxi fleets.

Operational risks include competition from established players like Waymo and Cruise, as well as the need to maintain high safety standards. The fragmented regulatory landscape in the United States adds complexity, with states like California requiring human drivers in autonomous vehicles for at least the next five years. This requirement limits Pony AI’s ability to deploy fully driverless vehicles and generate revenue in key markets.

The company also faces supply chain challenges and must manage partnerships with major automakers such as Toyota and Uber. Any disruption in these relationships could delay production or limit market expansion. For those considering an investment, understanding these operational hurdles is crucial. Pony AI’s future success relies on its ability to execute efficiently while adapting to evolving regulations and market demands.

Opportunities for Pony AI Stocks

Growth Potential

Pony AI stocks present a strong opportunity for investors who seek exposure to the autonomous vehicle sector. The company has shown impressive growth in both revenue and operational scale. In Q2 2025, Pony AI reported a 76% year-over-year revenue increase, rising from $12.2 million to $21.46 million. Robotaxi revenue grew by 158% in the same period, reaching about $1.5 million. Gross margin improved from -0.3% to 16.1%, which signals better unit economics and a path toward profitability. The company accelerated production of its Gen-7 robotaxi, aiming to reduce costs and improve fleet economics. Although net loss widened to $53.1 million, this reflects heavy investment in technology and expansion.

| Metric | Value | Description |

|---|---|---|

| Year-over-Year Revenue Growth | 76% | Revenue increased from $12.2M to $21.46M |

| Robotaxi Revenue Growth | 158% | Robotaxi revenue rose to about $1.5M |

| Gross Margin Improvement | 16.1% | Turned positive, indicating better unit economics |

| Gen-7 Robotaxi Production | Accelerated | Scale-up efforts to reduce costs |

| Net Loss | $53.1M | Reflects heavy investment despite growth |

Pony AI’s focus on scaling its robotaxi fleet and improving margins positions it well for future market expansion. The company targets high-demand corridors in Shenzhen, Dubai, and other international markets. With a goal to reach breakeven by 2026, Pony AI continues to invest in technology and operational efficiency.

Partnerships and Expansion

Strategic partnerships drive Pony AI’s expansion and strengthen its position in the global autonomous vehicle market. The company has partnered with GAC and BAIC to manufacture its seventh-generation robotaxi models, with production starting in mid-2025. This supports the goal to expand the fleet to 1,000 vehicles by the end of 2025. Pony AI also formed a partnership with Dubai’s Roads and Transport Authority to implement Level 4 autonomous mobility solutions, with supervised robotaxi trials planned for late 2025.

Other key partnerships include Tencent Cloud, Uber, and ComfortDelGro. These collaborations enhance Pony AI’s technology and operational capabilities. The company operates fully driverless robotaxi services in all four tier-one cities in China and has expanded internationally to Dubai, South Korea, and Luxembourg. The partnerships help reduce costs, scale production, and accelerate commercial deployment.

| Aspect | Details |

|---|---|

| Fleet Scale | 2,001 Gen-7 units produced since June 2025; targeting 1,000 vehicles by end of 2025 |

| Market Expansion | Focus on Shenzhen, Dubai, and other international markets |

| Regulatory Approvals | Fully driverless license in Shenzhen; agreements in Dubai, South Korea, and Luxembourg |

| Key Partnerships | GAC, BAIC, Tencent, Toyota, Uber, ComfortDelGro, Xihu Group |

| Deployment Timeline | Gradual ramp-up in second half of 2025; global deployment acceleration by 2026 |

Investors should watch for continued expansion and new partnerships, as these factors can drive revenue growth and improve the competitive position of Pony AI stocks in the evolving autonomous vehicle industry.

What Investors Should Watch

Key Metrics

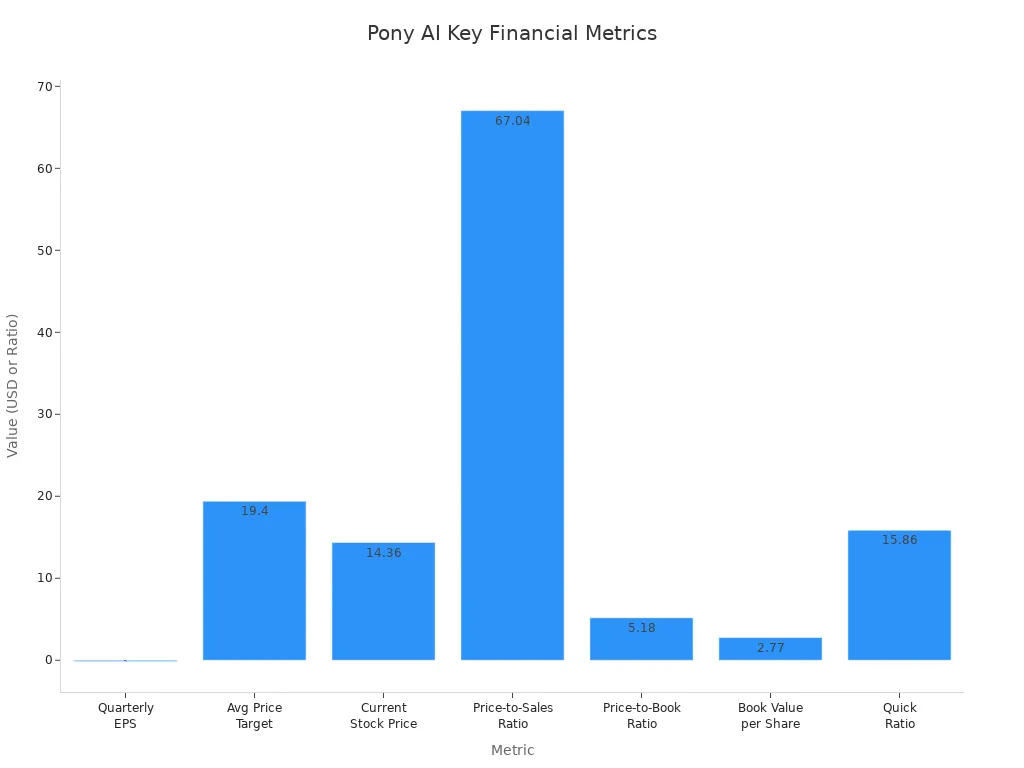

Investors should focus on several financial indicators to assess Pony AI’s position among the best stocks to buy in the autonomous vehicle sector. The table below highlights the most important metrics for evaluating Pony AI’s performance and valuation:

| Financial Metric | Value | Significance for Investors |

|---|---|---|

| Revenue | ~$75 million | Shows company sales size and growth potential |

| Enterprise Value | $6.85 billion | Reflects total company valuation |

| Price-to-Sales Ratio | 67.04 to 82.45 | Indicates high valuation, important for overvaluation risk |

| Cash Holdings | Over $745 million | Demonstrates liquidity strength |

| Quick Ratio | 15.86 | Signals strong liquidity |

| Leverage Ratio | 1.1 | Suggests manageable debt levels |

| Long-term Debt | Slightly above $1 million | Low debt burden |

| Return on Assets (ROA) | 0 | Indicates lack of profitability currently |

| Return on Equity (ROE) | 0 | Reflects no current returns to shareholders |

| EBIT Margin | Razor-thin | Shows tight profit margins, signaling competitive pressure |

| Price-to-Book Ratio | 5.18 | Important for valuation relative to book value |

| Book Value per Share | $2.77 | Provides asset value per share |

| Earnings Per Share (EPS) | -$0.14 (recent quarter) | Indicates recent losses, important for profitability analysis |

| Market Capitalization | $5.03 billion | Overall market value of the company |

Analysts from UBS have set a $20 price target, suggesting a possible upside from the current stock price. They highlight Pony AI’s unique position as the only robotaxi company operating driverless services in all four tier-one cities in China. The annual sales growth forecast of 96% through 2030 supports strong investor confidence, but the high price-to-sales ratio signals potential volatility in these stocks.

Upcoming Events

Several operational milestones will shape investor confidence in the coming months. Pony AI plans to mass-produce and road test its seventh-generation robotaxi models. The company targets a fleet expansion to over 1,000 vehicles by the end of 2025. This year marks a turning point for scalable commercial deployment. The Gen-7 system uses 100% automotive-grade components, which ensures high quality and reliability.

Key events to watch include:

- Completion of mass production for Gen-7 robotaxis.

- Expansion of the fleet to 1,000 vehicles by year-end.

- Achieving a 70% reduction in bill-of-materials costs for the autonomous driving kit.

- Strategic partnerships with Guangzhou Automobile Group and Beijing Automotive Industry Corporation for vehicle integration.

- Transition from closed-track validation to real-world road testing in cities like Guangzhou and Shenzhen.

These milestones will demonstrate Pony AI’s ability to scale operations and improve cost efficiency. Progress on these fronts will help determine if Pony AI remains one of the best stocks to buy in the autonomous driving sector.

Pony AI stock remains highly volatile, with sharp price swings driven by strategic partnerships, technological achievements, and inclusion in major indexes. Investors see strong growth potential as the company nears profitability and expands its market presence. Experts suggest starting with small investments to manage risk while pursuing returns. Investors should monitor financial results, regulatory changes, and operational milestones. Balancing optimism about innovation with caution regarding ongoing risks will help investors make informed decisions in this dynamic sector.

FAQ

What causes Pony AI stock to swing so much?

Pony AI stock often reacts to earnings reports, regulatory news, and new partnerships. Investors also respond to changes in market sentiment and technology updates. These factors can lead to sharp price increases or drops.

How does regulatory action in China affect Pony AI?

Regulatory changes in China can halt operations, increase compliance costs, or delay product launches. Safety incidents or new rules may cause sudden stock declines. Investors should track regulatory updates closely.

Is Pony AI profitable right now?

Pony AI currently operates at a loss. The company invests heavily in research and development. Analysts expect losses to continue until at least 2026, despite strong revenue growth.

What milestones should investors watch for in 2025?

Investors should monitor the mass production of Gen-7 robotaxis, expansion to 1,000 vehicles, and new partnerships. Progress in these areas may signal improved financial health and growth potential.

How do partnerships impact Pony AI’s growth?

Partnerships with companies like Toyota and Uber help Pony AI scale production and enter new markets. These alliances can boost revenue and support technology development, making the stock more attractive to investors.

Pony AI’s stock performance reflects a company at a critical inflection point: a promising future in a volatile and high-risk environment. For investors, success lies in having the right tools to navigate this complexity. A key part of that is a financial platform that can handle the specific challenges of investing in a global, fast-moving tech company. This is where BiyaPay excels. We offer a unified financial account that provides seamless access to a wide range of US and Hong Kong stocks. With our real-time exchange rate converter and low fees, you can efficiently move funds across borders, allowing you to react quickly to market swings and manage your portfolio with confidence. Instead of being held back by financial logistics, you can focus on tracking the key milestones that will define Pony AI’s journey, from regulatory approvals to fleet expansion. Ready to build a portfolio that can handle the future of mobility? Register today.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.