- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Smart Moves for Quantum Computing ETF Investors This Year

Image Source: pexels

Smart moves for quantum computing ETF investors in 2025 center on diversification, disciplined risk management, and a long-term investment approach. The quantum computing market reached $1.17 billion in 2024, expanding quickly as new technologies and major players drive growth. Investors gain advantages by choosing ETFs with broad exposure, monitoring technical indicators, and balancing allocations across tech giants, pure-play quantum firms, and hardware providers. The sector’s evolving landscape rewards patience and ongoing strategy review.

Key Takeaways

- Diversify your investments by choosing quantum computing ETFs that include both established tech giants and innovative startups to balance growth and risk.

- Manage risk carefully by limiting exposure to high-risk pure-play quantum stocks and regularly reviewing your portfolio to adjust for market changes.

- Adopt a long-term investment approach, staying patient and informed about new technologies, partnerships, and market developments in quantum computing.

- Understand that quantum computing ETFs can be volatile and speculative, so prepare for price swings and use strategies like active management and hedging to protect your portfolio.

- Stay updated on market trends, ETF features, and sector news to make smart investment decisions and position yourself for growth as quantum computing advances.

Top Quantum Computing ETF Strategies

Image Source: pexels

Immediate Moves

Investors looking at quantum computing ETF opportunities in 2025 should focus on diversification and risk management. Experts highlight the Defiance Quantum ETF (QTUM) as a strong choice. This ETF uses equal weighting and semi-annual rebalancing, which helps reduce risk and maintain balance. QTUM includes major technology companies such as IBM and Alphabet. These firms lead in quantum computing and provide stability to the fund.

The ETF also holds pure-play quantum companies like Rigetti Computing, D-Wave Quantum, and IonQ. These companies offer high growth potential but come with higher risk due to low revenues and high cash burn. IonQ stands out among pure-play stocks because it generates revenue and has partnerships with Amazon and Lockheed Martin. However, experts agree that quantum computing ETFs carry less risk than individual quantum stocks, especially at this early stage of the market.

Investors should prioritize diversified quantum computing ETFs over single pure-play stocks. Monitoring broader market trends and reviewing ETF holdings regularly can help manage risk and capture growth.

Some analysts suggest looking at other top technology stock picks, but most do not include pure-play quantum companies yet. For now, a diversified quantum computing ETF remains the preferred immediate move.

Long-Term Positioning

The quantum computing sector continues to evolve rapidly. Investors who adopt a long-term approach can benefit from the sector’s growth as the quantum computing revolution unfolds. Patience is key. The market remains in its early stages, and many companies are still developing their technologies.

Long-term strategies should include:

- Balancing exposure: Allocate investments between established technology leaders and emerging quantum computing firms. Established companies provide stability, while startups offer higher growth potential.

- Ongoing risk management: Rebalance portfolios regularly to adjust for changes in company performance and market conditions.

- Staying informed: Follow news about quantum computing breakthroughs, new partnerships, and regulatory changes. These factors can impact ETF performance and sector growth.

A long-term perspective allows investors to ride out short-term volatility and benefit from the sector’s potential for high returns.

Investors who remain patient and disciplined can position themselves to capture gains as quantum computing technology matures and adoption increases. The right mix of diversification, risk management, and ongoing research forms the foundation of successful investment strategies in this space.

Quantum Computing ETF Landscape

Key ETFs

Investors can choose from several quantum computing ETF options in 2025. The Defiance Quantum Computing ETF (QTUM) stands out as the largest fund in this sector. By December 2024, QTUM surpassed $400 million in assets under management (AUM), and by early 2025, it exceeded $1 billion USD. The VanEck Quantum Computing ETF launched in May 2025 with about $1 million USD in AUM. The Grayscale Quantum Computing ETF also entered the market, but its AUM remains much lower than QTUM.

| ETF Name | Assets Under Management (AUM) | Date/Period |

|---|---|---|

| Defiance Quantum Computing ETF (QTUM) | Surpassed $400 million USD | December 2024 |

| Defiance Quantum Computing ETF (QTUM) | Surpassed $1 billion USD | Jan-Feb 2025 |

| VanEck Quantum Computing ETF | About $1 million USD | May 21, 2025 |

QTUM leads the quantum computing ETF market in AUM, showing strong investor confidence and sector growth.

ETF Features

Quantum computing ETFs differ in their structure and holdings. QTUM tracks the BlueStar Quantum Computing and Machine Learning Index. It holds about 71 to 73 stocks, focusing on quantum computing and machine learning. The fund provides global exposure, with a tilt toward the U.S. market and significant holdings in Japan. Most of its allocation sits in information technology, including semiconductors and software. QTUM includes large and mid-cap companies, with small caps making up around 10% of the portfolio.

The VanEck Quantum Computing UCITS ETF offers a newer option for investors. Its holdings and sector allocations are less established, but it aims to provide exposure to quantum technology firms.

Quantum computing ETFs balance exposure between startups and established technology companies in several ways:

- QTUM requires at least 50% of revenue or activity from quantum computing or machine learning.

- Top holdings include established tech giants like IBM, Lockheed Martin, and NVIDIA, alongside quantum-focused startups such as D-Wave and Rigetti.

- Established companies offer revenue stability and fund quantum research.

- Startups contribute innovation and pure-play quantum exposure.

- The ETF holds companies across hardware, software, semiconductors, and defense sectors.

- This balanced approach reduces risk and volatility compared to investing in individual quantum stocks.

The quantum computing landscape continues to evolve. Investors benefit from understanding ETF features and differences before making decisions. A diversified quantum computing ETF can help manage risk and capture growth as quantum technology advances.

Investment Strategies

Diversification

Diversification stands as a core principle for quantum computing investors. The Defiance Quantum ETF (QTUM) demonstrates this approach by holding over 70 positions in quantum computing and related technologies. D-Wave Quantum, its largest holding, makes up less than 7% of the portfolio. This broad spread helps reduce risk compared to investing in a single high-risk stock. Investors can limit quantum computing stocks to no more than 5% of their total portfolio. Using ETFs like QTUM provides instant diversification across multiple companies and technological approaches. Focusing on firms with strong cash positions, strategic partnerships, and unique technology further lowers risk. Dividend income and lower volatility make diversified ETFs an effective tool for quantum computing investments.

Risk Management

Risk management remains essential in the volatile quantum computing sector. Many successful investors use a layered approach. They allocate capital across foundation companies, growth-stage firms, and innovative startups. Limiting high-risk pure-play quantum stocks to 1-5% of the technology allocation helps control downside. Maintaining cash reserves allows flexibility during market swings. Setting long-term horizons of five to ten years prepares investors for sector volatility. Regular portfolio reviews track technical progress and company milestones. Stop-loss orders and careful position sizing help cap losses and preserve capital. These tools support disciplined, emotion-free trading. Portfolio managers also monitor patent activity, government funding, and technical delays to adjust strategies as needed.

Portfolio Balance

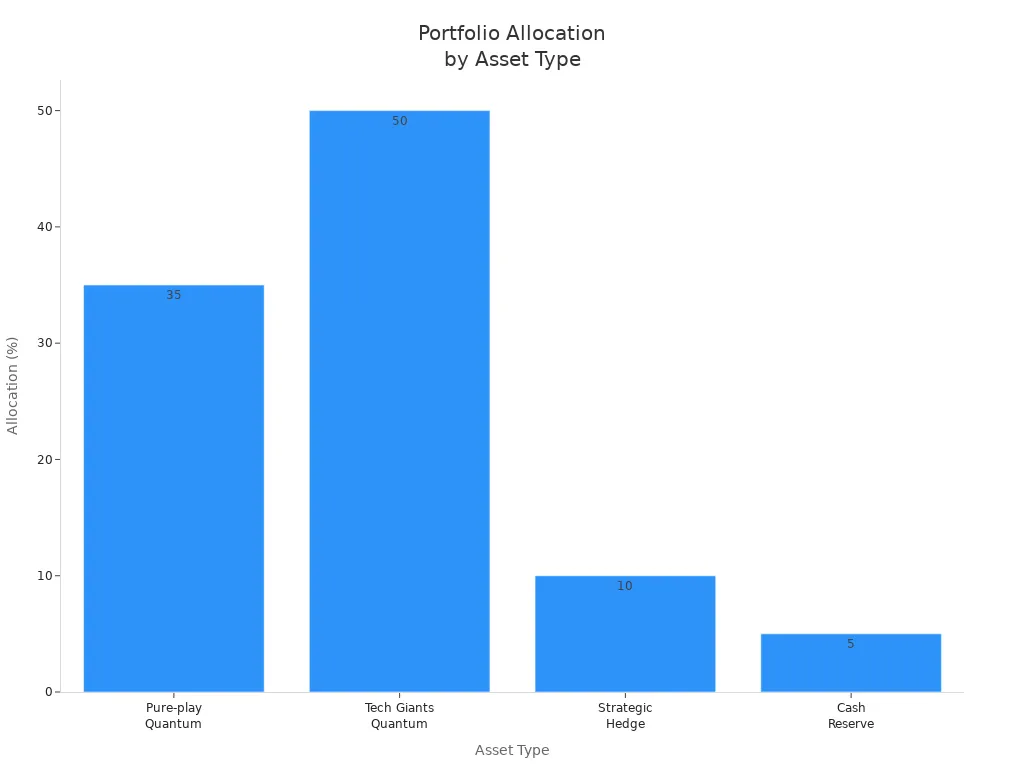

A balanced portfolio blends quantum computing exposure with stable technology and strategic assets. The following table shows a sample allocation:

| Asset Type | Example Companies / ETFs | Portfolio Allocation (%) | Rationale |

|---|---|---|---|

| Pure-play Quantum Companies | IonQ, Rigetti, D-Wave Quantum | 35% (15% IonQ, 10% Rigetti, 10% D-Wave) | Direct exposure to quantum tech with high growth potential but higher risk. |

| Technology Giants with Quantum Initiatives | Alphabet, IBM, Taiwan Semiconductor | 50% (20% Alphabet, 15% IBM, 15% Taiwan Semiconductor) | Stable companies funding quantum research, providing balance and reduced risk. |

| Strategic Hedge | Palo Alto Networks | 10% | Quantum-resistant cybersecurity solutions to protect portfolio regardless of quantum timeline. |

| Cash Reserve | N/A | 5% | Flexibility to capitalize on market opportunities and industry developments. |

Nvidia serves as a strong infrastructure play, offering essential quantum computing hardware with less technical risk. Conservative investors may prefer technology giants like Alphabet and Microsoft for stability. This balanced approach helps manage risk while capturing growth in the quantum computing market.

Quantum Computing Market Trends

Image Source: pexels

Growth Outlook

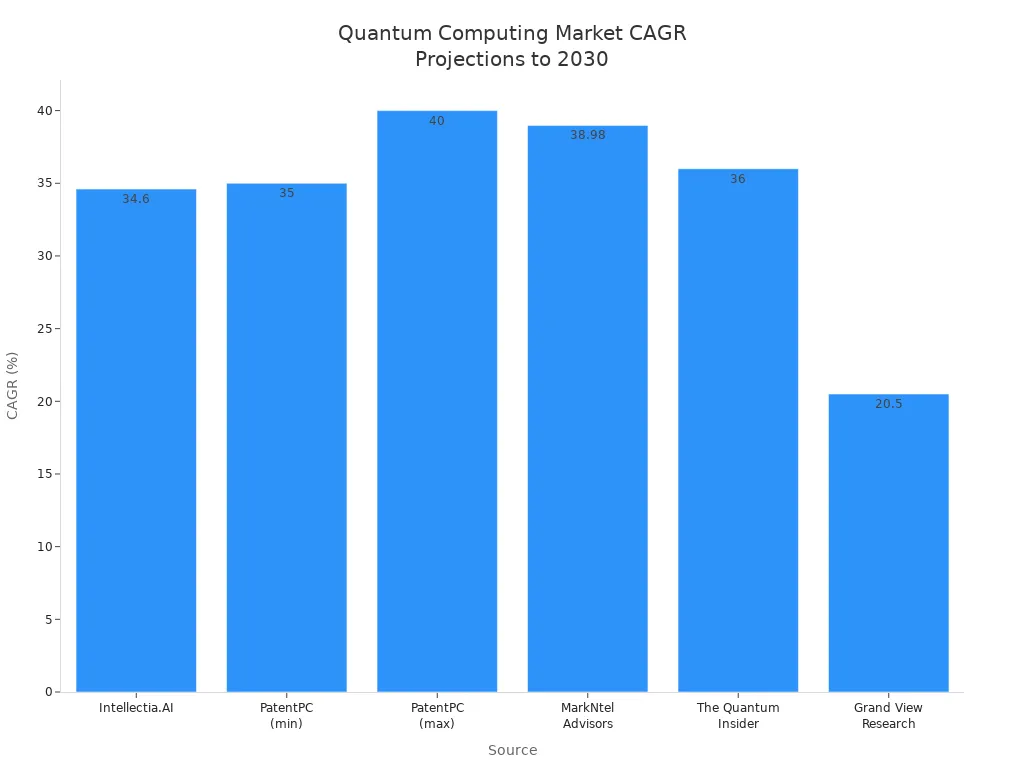

The quantum computing market shows strong growth potential through 2030. Analysts project compound annual growth rates (CAGR) ranging from 20.5% to nearly 40%. The following table compares forecasts from leading sources:

| Source | CAGR (%) | Forecast Period | Market Size Growth Example |

|---|---|---|---|

| Intellectia.AI | 34.6 | 2025 to 2030 | From $1.6B in 2025 to $7.3B by 2030 |

| PatentPC | 35 to 40 | 2024 to 2030 | - |

| MarkNtel Advisors | 38.98 | 2024 to 2030 | - |

| The Quantum Insider | 36 (base case) | 2024 to 2030 | From $1B in 2024 to ~$5B by 2030 |

| Grand View Research | 20.5 | 2025 to 2030 | To reach $4.24B by 2030 |

Recent market research estimates the quantum computing market could reach $173 billion by 2040. The sector may generate global economic value between $450 and $850 billion. Venture capital funding reached $1.2 billion in 2023, while government investments are expected to total $10 billion soon. Hardware improvements, such as qubit counts doubling every one to two years, highlight rapid progress.

Performance Drivers

Several factors drive the performance of quantum computing ETFs:

- Advancements in quantum computing technology make commercial use more practical.

- Public and private sector funding supports research and development.

- Quantum Computing-as-a-Service (QCaaS) increases scalability and accessibility for businesses.

- Demand for processing power grows in cryptography, optimization, and simulation.

- Major companies like IBM, Google, and Microsoft develop accessible quantum platforms.

- Government initiatives, including the U.S. National Quantum Initiative and investments by China, accelerate innovation.

- Quantum cloud services expand market reach and reduce infrastructure costs.

- Applications emerge in drug discovery, supply chain optimization, and quantum machine learning.

Technological breakthroughs also influence ETF performance. Trapped-ion technology, led by IonQ and Quantinuum, improves scalability and accuracy. Quantum annealing, advanced by D-Wave Quantum, solves complex optimization problems. Error correction and scalable processors from IBM and Google push the sector forward. Amazon AWS introduced the Ocelot chip in 2025, reducing error correction overhead. Cloud-based access and software tools like Qatalyst help developers build quantum-ready applications.

Government and private funding play a key role. Programs in the U.S., European Union, and China support research and nurture startups. Venture capital and private equity drive innovation in early-stage companies. Monitoring these trends helps investors understand the momentum behind quantum computing ETFs.

Risks and Challenges

Volatility

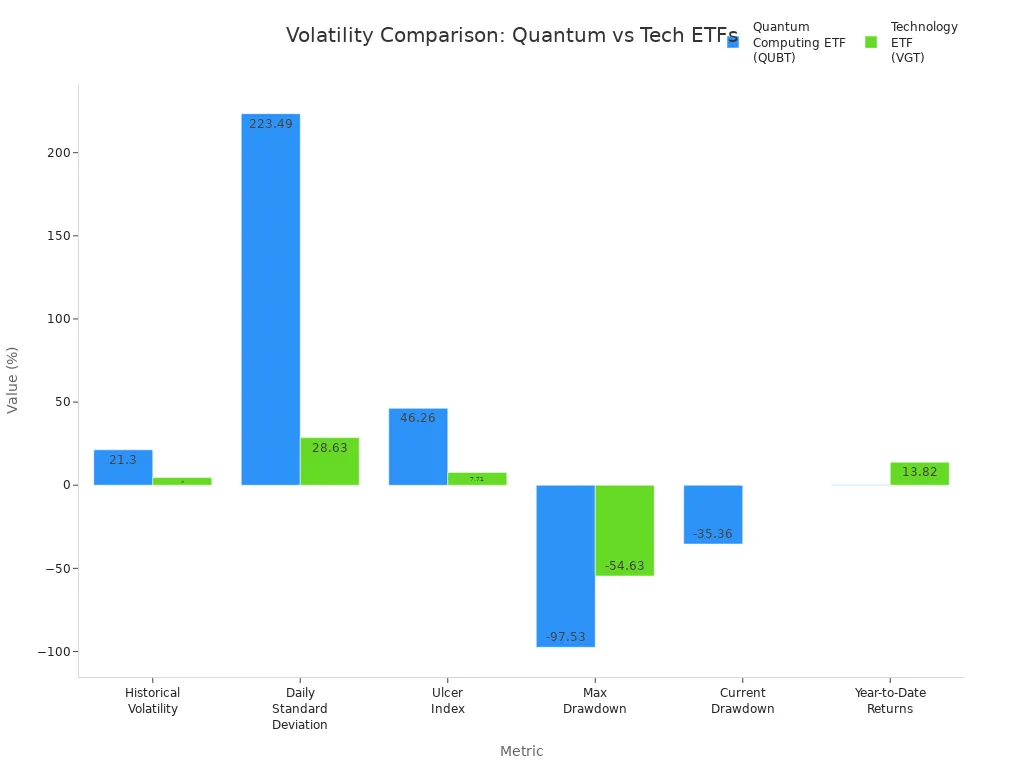

Quantum computing ETFs show much higher volatility than traditional technology ETFs. Investors often see large price swings in these funds. The table below compares key volatility metrics between a quantum computing ETF (QUBT) and a broad technology ETF (VGT):

| Metric | Quantum Computing ETF (QUBT) | Technology ETF (VGT) |

|---|---|---|

| Historical Volatility | 21.30% | 4.56% |

| Daily Standard Deviation | 223.49% | 28.63% |

| Ulcer Index | 46.26% | 7.71% |

| Max Drawdown | -97.53% | -54.63% |

| Current Drawdown | -35.36% | 0.00% |

| Year-to-Date Returns | 0.30% | 13.82% |

Quantum computing ETFs experience these swings for several reasons:

- The technology hardware sector faces intense competition and rapid changes.

- Complex supply chains and resource shortages can disrupt operations.

- Leveraged ETFs, which try to multiply daily returns, add more risk through frequent rebalancing.

- High transaction costs and tax impacts from active trading increase price fluctuations.

Quantum computing stocks often trade at high valuations. Investors expect fast progress and perfect execution. The sector remains speculative, and even small setbacks can cause sharp price drops.

Investors should prepare for large price movements and consider volatility when building their portfolios.

Early-Stage Risks

Most quantum computing companies remain in the early stages of development. These firms often do not make profits yet and rely on outside funding. The path to building reliable, fault-tolerant quantum computers may take five to ten years or more. This long timeline makes investments in the sector highly speculative.

Key risks for early-stage quantum companies include:

- High failure rates due to technical and financial challenges.

- Difficulty scaling up from research to commercial products.

- Uncertainty about which companies will become leaders.

- Sensitivity to small changes in technology or market demand.

ETFs like the Defiance Quantum ETF (QTUM) help reduce single-stock risk by spreading investments across many companies. However, the underlying firms still face the same long-term risks. Many ETFs also include companies from related fields, such as artificial intelligence, to provide broader exposure.

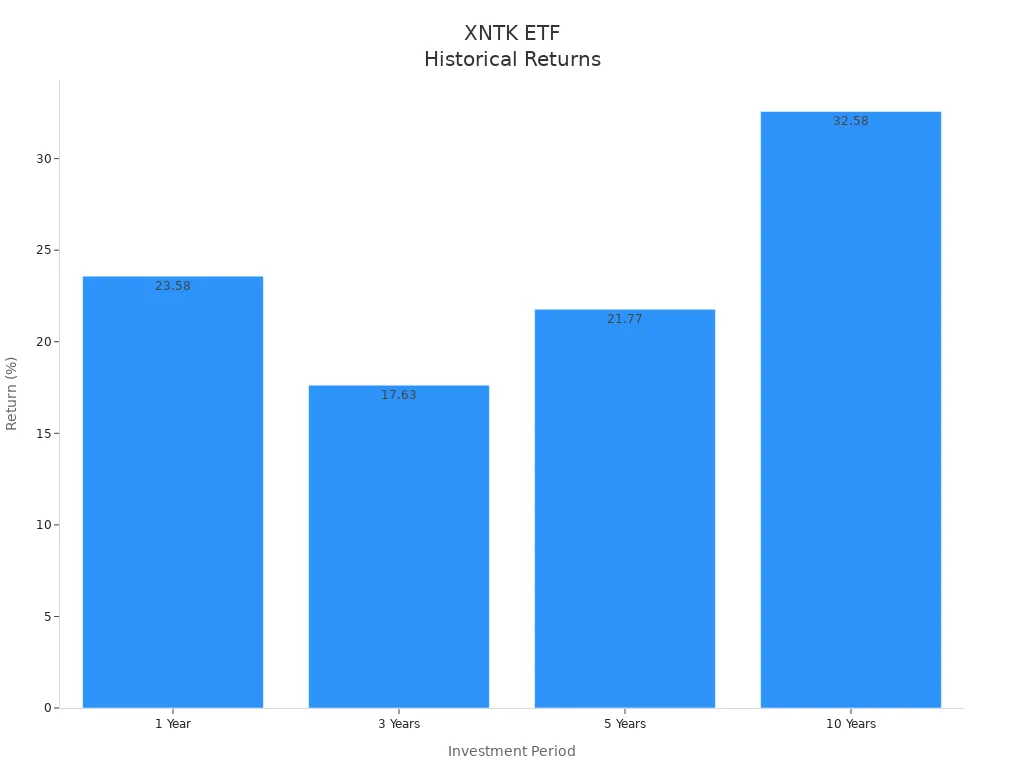

The table below shows how early-stage technology ETFs have performed:

| Period | Return (%) |

|---|---|

| 1 Year | 23.58% |

| 3 Years | 17.63% |

| 5 Years | 21.77% |

| 10 Years | 32.58% |

These returns show strong growth potential but also highlight the risks. Early-stage technology ETFs can deliver high rewards, but they come with greater uncertainty and price swings. Investors should understand these risks before committing capital to quantum computing ETFs.

Portfolio Recommendations

Building Resilience

Investors can build resilience in quantum computing ETF portfolios by using several proven techniques. Active management allows for dynamic allocation, focusing on companies with strong growth prospects. This approach helps reduce exposure to sector downturns. Equal-weighting methods prevent overconcentration in large-cap technology firms, spreading risk across both established leaders and smaller, innovative quantum companies.

Thematic ETFs that include quantum computing, artificial intelligence, and cybersecurity offer another layer of protection. These funds capture opportunities in related fields and help smooth out volatility. Overweighting growth areas such as AI infrastructure and semiconductor firms can further support portfolio stability. These sectors often benefit from advances in quantum technology and provide diversification.

Investors who shift from passive to active ETF strategies can better navigate sector-specific risks and improve risk-adjusted returns.

Adjusting for Risk

Managing risk in quantum computing ETF portfolios requires careful planning. Options-based strategies, such as protective puts, give investors the right to sell shares at a set price. This method limits losses during market downturns. Covered calls generate extra income by selling call options on owned shares, which can offset some declines. Collar strategies combine both approaches, offering cost-effective downside protection.

Alternative hedging methods also play a key role. Inverse or volatility-linked ETFs gain value when markets fall, providing broad protection. Allocating a portion of the portfolio to fixed income securities, like Treasury bonds or TIPS, cushions against equity market stress. Structured notes and cross-asset hedging, such as investing in gold, can further balance risk and return.

Investors should monitor hedge effectiveness and adjust strategies as market conditions change. Regular reviews ensure that the investment approach remains aligned with risk tolerance and market developments.

Quantum computing ETF investors in 2025 benefit most from a diversified approach, careful risk management, and a medium to long-term investment horizon. The VanEck Quantum Computing UCITS ETF stands out by tracking companies with strong quantum revenue and patent ownership, using strict eligibility criteria to manage concentration risk. Key risks include liquidity and volatility, especially among smaller companies.

Investors should regularly review fund documents and sector news to stay informed. Resources such as Investor’s Business Daily and expert analyses on companies like Microsoft, Nvidia, and IBM help track market trends. Applying these strategies positions investors to adapt and thrive as quantum computing evolves.

FAQ

What makes quantum computing ETFs different from traditional tech ETFs?

Quantum computing ETFs focus on companies developing quantum hardware, software, and related technologies. Traditional tech ETFs invest in a broader range of technology firms. Quantum ETFs offer higher growth potential but also carry greater risk and volatility.

How often should investors review their quantum computing ETF holdings?

Investors should review holdings at least twice a year. Regular reviews help track sector changes, company performance, and new technology developments. This approach supports better risk management and portfolio alignment.

Are quantum computing ETFs suitable for conservative investors?

Quantum computing ETFs may not suit conservative investors. These funds show high volatility and include early-stage companies. Conservative investors may prefer large technology firms with quantum initiatives for more stability.

What are the main risks of investing in quantum computing ETFs?

Key risks include high volatility, early-stage company failures, and uncertain timelines for commercial quantum breakthroughs. Investors may face sharp price swings and long periods without significant returns.

Can quantum computing ETFs provide diversification benefits?

Yes. Quantum computing ETFs hold a mix of startups and established technology leaders. This structure spreads risk across multiple companies and sectors, reducing the impact of any single stock’s poor performance.

Investing in quantum computing ETFs requires a forward-looking strategy that embraces diversification, discipline, and a long-term horizon. While funds like QTUM offer a great way to enter this high-growth sector, the practical challenges for global investors can be significant. Navigating cross-border transactions, managing currency risk, and dealing with high fees can undermine even the most well-researched strategy. This is where BiyaPay provides the perfect solution. Our unified global financial account makes it easy to access US-listed ETFs and stocks, enabling you to participate in the quantum computing revolution without friction. With our low fees and a transparent real-time exchange rate converter, you can efficiently fund your account and focus on your investment strategy, not on banking logistics. Take control of your portfolio and position yourself for growth in the next era of technology. Register with BiyaPay today to get started.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.