- EasyCard

- Trade

- Help

- Announcement

- Academy

- SWIFT Code

- Iban Number

- Referral

- Customer Service

- Blog

- Creator

Understanding the Risks and Rewards of NVDX Stock and the T-Rex 2X ETF

Image Source: pexels

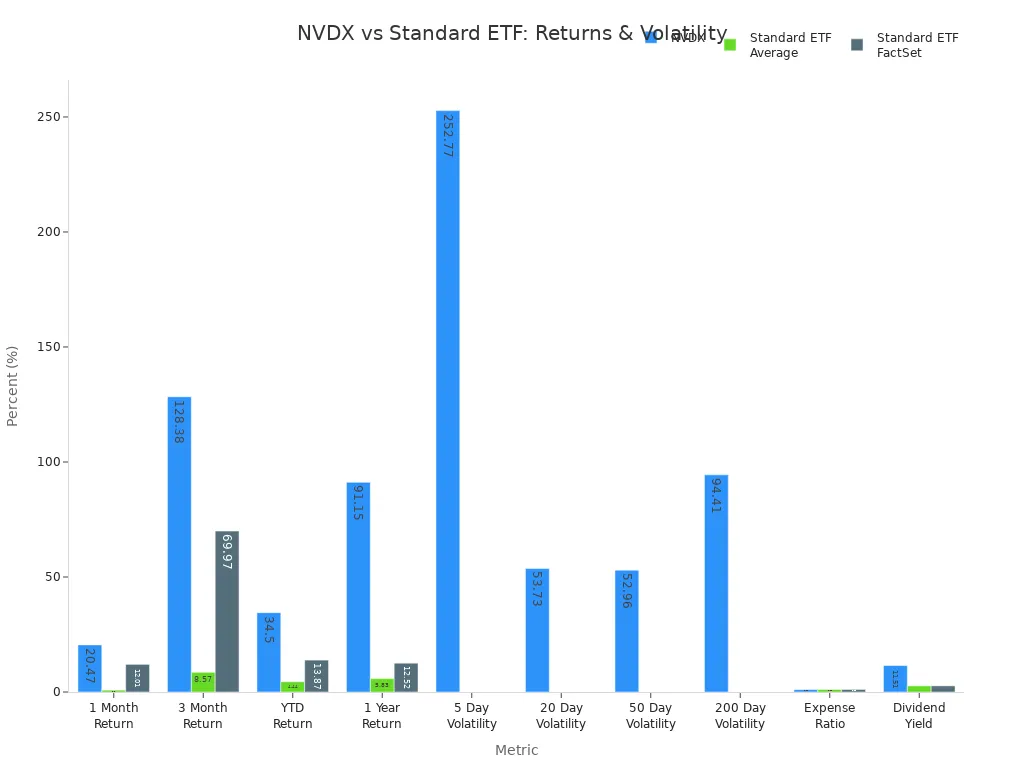

You can find both high rewards and high risks when trading nvdx stock or the t-rex 2x long nvidia daily target etf. These products aim to double the daily movement of NVIDIA’s stock, which can lead to strong gains in a short time. The table below shows that nvdx stock recently returned over 128% in three months, much higher than standard ETFs. However, the t-rex 2x long nvidia daily target etf also carries much higher volatility, ranking among the most volatile ETFs.

| Metric | NVDX | Standard ETF Averages |

|---|---|---|

| 1 Month Return | 20.47% | 0.80% / 12.01% |

| 3 Month Return | 128.38% | 8.57% / 69.97% |

| YTD Return | 34.50% | 4.44% / 13.87% |

| 1 Year Return | 91.15% | 5.83% / 12.52% |

| 5 Day Volatility | 252.77% | (much lower) |

| 20 Day Volatility | 53.73% | (lower) |

| 50 Day Volatility | 52.96% | (lower) |

| 200 Day Volatility | 94.41% | (lower) |

| Expense Ratio | 1.05% | 1.11% |

| Dividend Yield | 11.51% | 2.66% |

You should know that the t-rex 2x long nvidia daily target etf works best for short-term trades. If you hold it longer, daily resets and compounding can cause results to drift away from your expectations. You could even lose all your money if NVIDIA drops sharply. Always check how leverage and volatility could impact your returns before you trade.

Key Takeaways

- The T-Rex 2X Long NVIDIA Daily Target ETF (NVDX) aims to double NVIDIA’s daily stock moves, making it best for short-term trades.

- Daily resets and compounding can cause your returns to differ from expectations, especially if you hold NVDX longer than one day.

- NVDX carries high risks like volatility, leverage, and sector concentration, so only experienced investors should trade it.

- You can achieve amplified gains with NVDX during strong NVIDIA rallies, but losses can also be magnified quickly.

- Active monitoring and strict risk management are essential to protect your investment when trading NVDX.

What Is NVDX Stock?

Fund Structure

You may wonder what sets the t-rex 2x long nvidia daily target etf apart from other funds. This ETF, also known as nvdx stock, is designed to deliver 200% of the daily performance of NVIDIA’s stock before fees and expenses. The fund uses a leveraged daily structure, which means it rebalances every day to keep its 2X leverage target. The t-rex 2x long nvidia daily target etf is actively managed and listed on the BATS exchange. You will find that it is non-diversified, focusing mainly on the technology and semiconductor sectors, especially NVIDIA. This focus increases both the potential for high returns and the risk of large losses.

Note: The t-rex 2x long nvidia daily target etf aims to achieve its objective only for a single trading day. If you hold it longer, your results may differ from what you expect.

Here is a summary of the key features and objectives:

| Feature / Objective | Description |

|---|---|

| Fund Name | T-REX 2X Long NVIDIA Daily Target ETF (NVDX) |

| Investment Objective | Seeks daily leveraged investment results of 200% of the daily performance of NVIDIA Corp. stock (NVDA) |

| Leverage | Uses leverage to magnify daily returns (2x) |

| Investment Horizon | Designed for short-term trading; not suitable for long-term holding due to daily compounding and volatility effects |

| Use of Derivatives | Employs derivatives to achieve leverage, increasing risk exposure |

| Risk Factors | Includes leverage risk, derivatives risk, volatility risk, counterparty risk, liquidity risk, non-diversification risk, semiconductor and technology sector risks |

| Concentration | Non-diversified; concentrated in technology and semiconductor sectors, specifically related to NVIDIA |

| Target Investors | Sophisticated investors who actively monitor and manage their investments |

| Performance Note | Fund performance over periods longer than one day will differ from 2x NVDA performance due to daily compounding and volatility |

| Additional Risks | New fund risk, shorting risk, industry concentration risk, and risks specific to NVIDIA Corporation |

| Operational Details | Fund does not seek to achieve its objective over periods other than a single trading day |

| Suitability | Not appropriate for investors who do not intend to actively manage their portfolios |

Leverage and Daily Reset

The t-rex 2x long nvidia daily target etf uses leverage to amplify your daily returns. Each day, the fund resets its exposure to maintain the 2X target. This daily reset means that the fund’s performance over longer periods can be very different from simply doubling NVIDIA’s return. For example, if NVIDIA rises 10% one day and falls 9% the next, your return from the t-rex 2x long nvidia daily target etf will not be a simple multiple of NVIDIA’s two-day return. Compounding effects can work for or against you, depending on the market’s direction and volatility. You must monitor your investment closely, as holding nvdx stock for more than one day can lead to unexpected results.

Trading and Liquidity

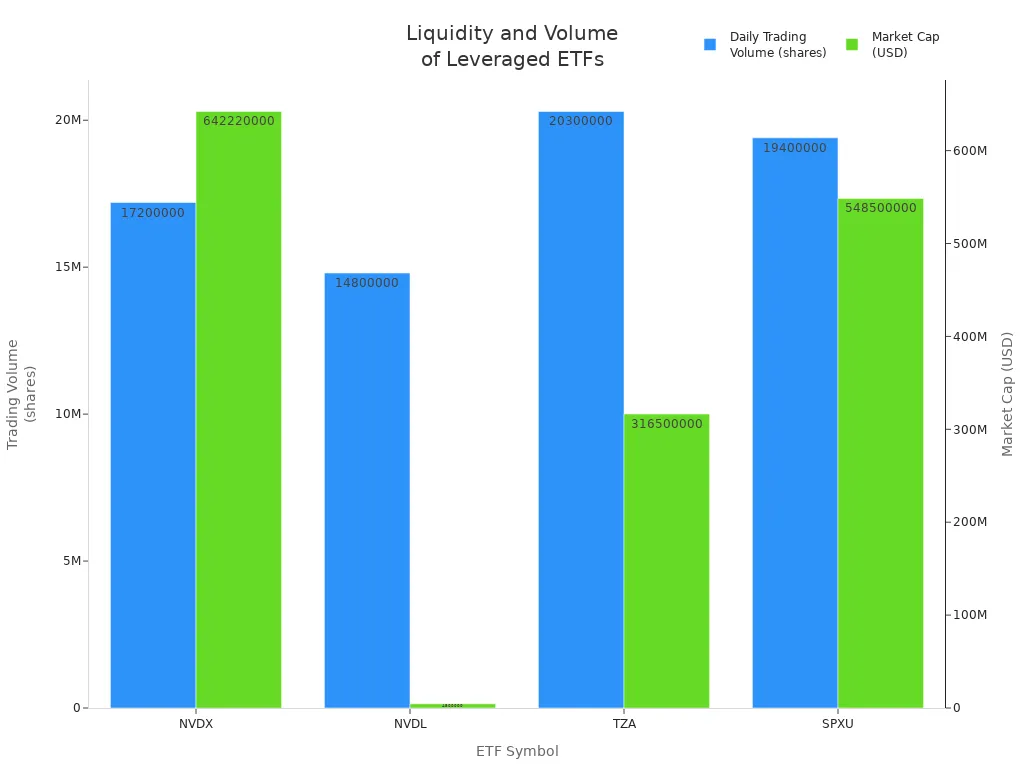

You will find that the t-rex 2x long nvidia daily target etf trades with strong liquidity. Its daily trading volume is higher than many other leveraged etfs in the technology sector. This high volume makes it easier for you to enter or exit positions quickly. The table below compares the trading volume and market cap of nvdx stock with similar funds:

| ETF Symbol | ETF Name | Approximate Daily Trading Volume | Market Cap (USD) |

|---|---|---|---|

| NVDX | T-Rex 2X Long NVIDIA Daily Target ETF | ~17.2 million shares | $642.22 million |

| NVDL | GraniteShares 2x Long NVDA Daily ETF | ~14.8 million shares | $4.5 million |

| TZA | (Leveraged ETF in same sector) | ~20.3 million shares | $316.5 million |

| SPXU | (Leveraged ETF in same sector) | ~19.4 million shares | $548.5 million |

You can see that nvdx stock offers solid liquidity, making it a practical choice for active traders who want to move in and out of positions with ease.

How the T-Rex 2X Long NVIDIA Daily Target ETF Works

Image Source: pexels

Swap Agreements

You may wonder how the t-rex 2x long nvidia daily target etf achieves its 2x daily exposure to NVIDIA stock. The fund uses swap agreements with major global financial institutions. In these agreements, two parties agree to exchange returns based on a notional amount linked to NVIDIA stock. These swaps are usually over-the-counter contracts, which means they do not have the same regulatory protections as standard exchanges. This setup allows the t-rex 2x long nvidia daily target etf to control a position much larger than its actual assets. However, you should know that swaps introduce several risks:

- Leverage risk: Losses can be much larger than with regular ETFs.

- Derivatives risk: Swaps can make the fund more volatile.

- Counterparty risk: If the other party in the swap fails to pay, you could lose money.

- Lack of regulation: Over-the-counter swaps may not offer full investor protection.

If you research t-rex 2x long nvidia daily target etf, you will see that these risks make it important to monitor your investment closely.

Portfolio Turnover

The t-rex 2x long nvidia daily target etf must rebalance daily to keep its 2x exposure. This process leads to high portfolio turnover. High turnover means the fund buys and sells positions often. As a result, trading costs increase, which can reduce your net returns over time. The fund’s expense ratio is 1.05%, which covers management and operating costs. However, frequent trading can add extra costs that are not always clear. When you research t-rex 2x long nvidia daily target etf, pay attention to how these costs might affect your returns.

Note: High turnover can make the fund less efficient, especially if market conditions change quickly.

Daily Compounding

Daily compounding is a key feature of the t-rex 2x long nvidia daily target etf. The fund resets its leverage every day, so your returns depend on the path of NVIDIA’s price, not just the start and end points. In a steady rising market, compounding can boost your gains. In a volatile or choppy market, compounding can cause your returns to fall short of what you expect. The table below shows how daily compounding affects performance:

| Market Scenario | Index Return | 2X ETF Return | Explanation |

|---|---|---|---|

| 10 days up 10% daily | +159% | +519% | Compounding boosts gains in a strong uptrend |

| 10 days down 10% daily | -65% | -89% | Losses are magnified, but not exactly 2x |

| 5 up, 5 down (volatile) | 0% | -19% | Volatility drag reduces returns |

You should use the t-rex 2x long nvidia daily target etf for short-term trades. Holding it longer can lead to unexpected results due to compounding and volatility.

Rewards

Amplified Gains

You can achieve amplified gains with the T-Rex 2X Long NVIDIA Daily Target ETF (NVDX) when NVIDIA stock rallies. This ETF aims to double the daily movement of NVIDIA, so your returns can grow much faster than with regular shares. When NVIDIA rises, NVDX can deliver impressive results in a short time.

- Nvidia saw huge Q1 stock returns during major rallies: +83% in 2023 and +90% in 2024. NVDX amplified these gains, giving traders the chance for even higher profits.

- The stock price of NVIDIA increased more than 12 times from the March 2020 pandemic low. This growth came from strong demand for artificial intelligence and data centers, which also boosted NVDX returns.

- NVIDIA completed two major stock splits: a 4-for-1 split in 2021 and a 10-for-1 split in 2024. Each split was followed by a 20–40% price rally, which helped NVDX deliver even greater gains and improved trading liquidity.

- Earnings per share (EPS) for NVIDIA jumped from $5.12 in fiscal year 2022 to over $15 in fiscal year 2025. This strong growth supported big rallies in the stock and amplified returns for NVDX holders.

- After earnings announcements, NVIDIA’s stock often moves 6–8% in a single day. NVDX can double these swings, giving you more chances for quick profits during these events.

Note: Amplified gains also mean amplified losses. You should always watch your positions closely and understand the risks before trading leveraged ETFs.

Short-Term Opportunities

NVDX gives you a tool for short-term trading. You can use it to take advantage of quick moves in NVIDIA’s stock price. If you expect NVIDIA to rise in the next day or two, NVDX can help you try to double those gains. Many traders use NVDX around key events, such as earnings releases or product launches, when NVIDIA’s price often moves sharply.

NVDX is not designed for long-term holding. The daily reset and compounding effects can make your returns drift away from what you expect if you hold the ETF for more than a few days. You should use NVDX for tactical trades, not as a buy-and-hold investment.

Performance Highlights

NVDX stands out for its ability to deliver strong returns over short periods. When you compare NVDX to unleveraged NVIDIA stock, you see that NVDX is built to give you about twice the daily return of NVIDIA. Over short-term trading windows, this means your gains and losses can be roughly double those of NVIDIA stock. However, the daily reset of leverage and the effect of volatility decay can cause NVDX’s returns to differ from exactly twice NVIDIA’s returns, especially in choppy or sideways markets.

NVDX is much more volatile and riskier than holding regular NVIDIA shares. You can use NVDX for short-term trades, such as intraday moves or trades lasting a few days. If you hold NVDX for longer, compounding and fees can reduce your returns. In contrast, holding NVIDIA stock gives you direct exposure without leverage decay or extra fees, plus benefits like voting rights and dividends.

Tip: Use NVDX when you want to try to double your gains over a short period, but always remember the risks. If you want steady exposure to NVIDIA, consider holding the stock itself.

Risks

Image Source: pexels

Volatility

You face significant volatility when you trade the T-Rex 2X Long NVIDIA Daily Target ETF (NVDX). This ETF magnifies the daily price changes of NVIDIA stock. If NVIDIA moves up or down by 5% in a day, NVDX aims to move about 10%. This means your gains can be large, but your losses can be just as big.

- NVDX responds to both market risk and company-specific risk. If NVIDIA’s price swings sharply, your investment in NVDX will swing even more.

- You must watch out for emotional risk. Quick price changes can lead you to make hasty decisions.

- Lack of diversification increases your exposure. NVDX focuses on one company and one sector, so you do not get the safety of a broad portfolio.

- You should consider using stop-loss orders to help limit your downside.

Note: Volatility decay can erode your returns over time. Even if NVIDIA rises over several months, NVDX may not deliver twice the gain you expect. Real-world data shows that leveraged ETFs like TQQQ have underperformed their underlying indexes during volatile periods. For example, TQQQ dropped 55% in 2018 and 80% in 2022, while the Nasdaq-100 index performed much better.

| Risk Type | Explanation |

|---|---|

| Leverage Risk | The fund uses leverage to magnify daily returns (2x), increasing potential losses when the underlying asset declines. |

| Effects of Compounding and Market Volatility Risk | Daily rebalancing and compounding cause returns over longer periods to deviate significantly from the expected multiple, with volatility decay potentially eroding returns even if the underlying asset appreciates. |

| Industry Concentration Risk | Concentrated exposure to the information technology sector (NVIDIA’s sector) increases risk compared to diversified portfolios. |

| Liquidity Risk | Difficulty in buying or selling holdings during market turmoil can affect valuation and execution. |

You need to understand and apply risk management when trading NVDX. Monitoring your positions and setting clear rules for when to exit can help you avoid large losses.

Compounding Effects

Daily compounding is a key feature of NVDX. The fund resets its leverage every day, so your returns depend on the path of NVIDIA’s price, not just the start and end points. In a steady uptrend, compounding can boost your gains. In a choppy or sideways market, compounding can cause your returns to fall short of what you expect.

- NVDX targets 2x the daily performance of NVIDIA through derivatives and daily rebalancing.

- Over longer periods, the fund’s returns can deviate from 2x the cumulative return of NVIDIA due to compounding.

- In trending markets, you may see amplified gains over short periods.

- In volatile markets, beta-slippage and path dependency can erode your returns. For example, if NVIDIA rises 10% one day and falls 9% the next, your NVDX return will not be a simple double of NVIDIA’s two-day return.

- Compounding effects can cause performance decay, especially in volatile or sideways markets.

Tip: Leveraged ETFs like NVDX are designed for short-term trading. They are not suitable for long-term holding because compounding can lead to significant underperformance over time. You should understand and apply risk management strategies to protect your investment from compounding losses.

Suitability

NVDX is not suitable for every investor. Financial advisors recommend that only sophisticated investors use leveraged ETFs. You need to understand how leverage, daily resets, and compounding work. You also need to monitor your investment closely and be ready to act quickly if the market moves against you.

| Suitability Criteria / Risk Factor | Description |

|---|---|

| Investor Sophistication | Suitable only for sophisticated investors who understand leverage risk and daily leveraged investment consequences. |

| Active Monitoring | Investors should intend to actively monitor and manage their investments. |

| High Degree of Risk | There is a significant risk of losing all or part of the investment. |

| Effects of Compounding and Market Volatility | Daily leveraged objectives cause performance to compound, which can differ significantly over periods longer than one day. |

| Leverage Risk | Use of leverage can lead to greater losses in adverse market conditions compared to non-leveraged funds. |

| Derivatives Risk | Exposure to derivatives can increase risk and potential losses beyond direct investment in underlying assets. |

| Sector Concentration Risk | Underlying securities may be highly volatile and subject to wide price fluctuations. |

| Liquidity Risk | Some securities, including options, may be difficult to sell, especially during market turmoil. |

| High Portfolio Turnover Risk | Frequent trading increases transaction costs and fund expenses. |

Regulatory guidelines state that leveraged ETFs like NVDX are speculative and intended only for knowledgeable investors. You should consult a financial advisor before investing. If you do not fully understand the risks, you should avoid these products. You can lose your entire investment in a single day if the market moves sharply against you.

Who Should Trade NVDX Stock?

Ideal Users

You should consider trading nvdx stock if you have a high risk tolerance and want to pursue aggressive, short-term trading strategies. Market research and fund documentation show that the T-Rex 2X Long NVIDIA Daily Target ETF is designed for sophisticated investors who understand leverage and daily rebalancing. You need to actively manage your positions and stay alert to volatility risks. If you seek leveraged exposure to NVIDIA and can handle the possibility of total loss, you may fit the ideal user profile. You should not use this ETF for long-term investing or if you prefer stable returns.

When to Use

You can use the T-Rex 2X Long NVIDIA Daily Target ETF in specific market conditions.

- Use this ETF for short-term trades when you expect NVIDIA to move sharply in one direction.

- Avoid holding it during periods of high volatility or sideways movement, as daily resetting can cause decay and reduce returns.

- If you want to capture quick gains from earnings reports or major news, this ETF may help you achieve your goals.

- For long-term exposure, you should buy the underlying stock instead of using leveraged ETFs.

- Research t-rex 2x long nvidia daily target etf before trading to understand how daily rebalancing affects performance.

Key Considerations

Before you trade nvdx stock, you need to evaluate several important factors.

- Review the ETF’s current market position and rating. NVDX is in a strong rising trend but carries medium risk.

- Research t-rex 2x long nvidia daily target etf fundamentals, including revenue, net income, EPS, debt-to-equity ratio, ROE, and P/E ratio.

- Compare NVDX with competitors and analyze broader market conditions and industry trends.

- Learn how to choose broker and open account with a trusted platform. Decide your investment amount based on your financial goals and risk tolerance.

- Select order types such as market, limit, or stop-loss to match your strategy.

- Monitor your investment regularly and set alerts for earnings or news.

- Apply risk management strategies like diversification and stop-loss orders.

- Consider fees, taxes, and liquidity before trading. Make sure you have emergency funds available.

Tip: Always research t-rex 2x long nvidia daily target etf and learn how to choose broker and open account before you invest. Stay disciplined and informed to protect your capital.

You have seen that the t-rex 2x long nvidia daily target etf offers both high rewards and high risks. Before you trade, remember these key points:

- The t-rex 2x long nvidia daily target etf aims for double the daily return of Nvidia, but it is built for short-term trades.

- Daily resets and compounding can cause your results to differ from expectations, especially if you hold the t-rex 2x long nvidia daily target etf for more than one day.

- Only experienced traders who use strict risk management should consider this ETF.

Always review your risk tolerance and learn how leveraged ETFs work. Speak with a financial advisor before you invest.

FAQ

What is the main goal of the T-Rex 2X Long NVIDIA Daily Target ETF (NVDX)?

You use NVDX to try to double NVIDIA’s daily stock movement. The ETF aims for 2x daily returns, not long-term gains. You should use it for short-term trades, not for holding over weeks or months.

Can you lose more than your initial investment with NVDX?

You cannot lose more than what you invest in NVDX. However, you can lose your entire investment quickly if NVIDIA’s price drops sharply. Always use risk controls like stop-loss orders to help protect your money.

How does daily compounding affect your returns?

Daily compounding means NVDX resets its leverage every day. If NVIDIA’s price moves up or down a lot, your returns can drift from what you expect. In volatile markets, you may see lower gains or bigger losses over time.

Is NVDX suitable for long-term investors?

NVDX does not suit long-term investors. You should only use it if you plan to trade actively and watch your positions closely. Long-term holding can lead to unexpected results because of daily resets and compounding.

What fees do you pay when trading NVDX?

You pay an expense ratio of about 1.05% per year. You may also pay trading fees to your broker. All costs are in USD. Check the latest exchange rates if you use a Hong Kong bank or trade from outside the United States.

NVDX is a powerful tool for a specific type of trader: one who is experienced, risk-tolerant, and has a clear, short-term strategy. The amplified returns it offers during strong market rallies can be tempting, but they come with significant risks that require active management and a deep understanding of market mechanics. For a global trader, an additional layer of complexity lies in the logistics of accessing the US market. A reliable and cost-effective financial platform is not a luxury—it’s a necessity. BiyaPay addresses these challenges directly. Our platform provides a seamless way to fund your brokerage account and trade US-listed stocks and ETFs like NVDX. With transparent, low fees and a built-in real-time exchange rate converter, you can minimize costs and focus on your trading strategy. By simplifying the process of moving funds and trading internationally, BiyaPay empowers you to capitalize on market opportunities with speed and precision. Take control of your trading. Register with BiyaPay today.

*This article is provided for general information purposes and does not constitute legal, tax or other professional advice from BiyaPay or its subsidiaries and its affiliates, and it is not intended as a substitute for obtaining advice from a financial advisor or any other professional.

We make no representations, warranties or warranties, express or implied, as to the accuracy, completeness or timeliness of the contents of this publication.

Contact Us

Company and Team

BiyaPay Products

Customer Services

is a broker-dealer registered with the U.S. Securities and Exchange Commission (SEC) (No.: 802-127417), member of the Financial Industry Regulatory Authority (FINRA) (CRD: 325027), member of the Securities Investor Protection Corporation (SIPC), and regulated by FINRA and SEC.

registered with the US Financial Crimes Enforcement Network (FinCEN), as a Money Services Business (MSB), registration number: 31000218637349, and regulated by FinCEN.

registered as Financial Service Provider (FSP number: FSP1007221) in New Zealand, and is a member of the Financial Dispute Resolution Scheme, a New Zealand independent dispute resolution service provider.